Independence Gold Increases Resource Estimate for 3Ts Project, BC

06 May 2014 - 10:00PM

Marketwired

Independence Gold Increases Resource Estimate for 3Ts Project, BC

VANCOUVER, BRITISH COLUMBIA--(Marketwired - May 6, 2014) -

Independence Gold Corp. (TSX-VENTURE:IGO) (the "Company") is

pleased to announce that the National Instrument ("NI") 43-101

compliant Inferred Resource estimate on its 100% owned 3Ts Project

has been increased by 12% for the contained ounces of gold* and by

27% for the contained ounces of silver*. This updated Inferred

Resource estimate for the Ted and Mint veins incorporates results

from the 2012 and 2013 diamond drilling programs (see the Company's

news releases dated January 29, 2013 and June 10, 2013).

The 3Ts Project is located approximately 120 kilometres

southwest of Vanderhoof and consists of fourteen mineral claims

covering approximately 4,934 hectares in the Nechako Plateau region

of central British Columbia. The 3Ts Project covers an epithermal

quartz-carbonate vein system within which more than a dozen

individual mineralized veins, ranging up to 900 metres ("m") in

strike length and up to 20 m in true width, have been

identified.

The current combined NI 43-101 compliant Inferred Resource

estimate including the Ted, Mint, and Tommy** veins is 5,452,000

tonnes grading 2.52 g/t gold and 71.5 g/t silver at a cut-off grade

of 1.0 g/t gold. This inferred resource is now estimated to contain

a total of 441,000 ounces of gold and 12,540,000 ounces of silver.

The updated inferred resource estimates for the Ted and Mint veins

and the current inferred resource estimate for the Tommy Vein are

set out in the following table and are reported at a series of

cut-off grades. These veins are open at depth and along strike.

3Ts Inferred Resource Estimates

| Gold Cut-off |

Tonnes |

|

Gold |

Silver |

|

Grade (g/t) |

Ounces |

Grade (g/t) |

Ounces |

| Tommy Vein** |

|

0.5 g/t |

1,615,000 |

|

3.99 |

207,000 |

39.7 |

2,059,000 |

|

1.0 g/t |

1,490,000 |

|

4.25 |

204,000 |

41.9 |

2,009,000 |

|

1.5 g/t |

1,371,000 |

|

4.52 |

199,000 |

44.3 |

1,953,000 |

|

2.0 g/t |

1,182,000 |

|

4.96 |

189,000 |

48.0 |

1,824,000 |

| Ted Vein |

|

0.5 g/t |

2,984,000 |

|

1.62 |

156,000 |

93.5 |

8,974,000 |

|

1.0 g/t |

2,942,000 |

|

1.64 |

155,000 |

94.7 |

8,955,000 |

|

1.5 g/t |

2,763,000 |

|

1.72 |

153,000 |

99.5 |

8,837,000 |

|

2.0 g/t |

2,484,000 |

|

1.83 |

146,000 |

107.4 |

8,575,000 |

| Mint Vein |

|

0.5 g/t |

1,036,000 |

|

2.47 |

82,000 |

47.5 |

1,581,000 |

|

1.0 g/t |

1,020,000 |

|

2.51 |

82,000 |

48.0 |

1,576,000 |

|

1.5 g/t |

957,000 |

|

2.63 |

81,000 |

50.4 |

1,552,000 |

|

2.0 g/t |

829,000 |

|

2.94 |

78,000 |

53.0 |

1,411,000 |

| TOTAL |

|

0.5 g/t |

5,635,000 |

|

2.46 |

445,000 |

69.6 |

12,614,000 |

|

1.0 g/t |

5,452,000 |

|

2.52 |

441,000 |

71.5 |

12,540,000 |

|

1.5 g/t |

5,091,000 |

|

2.61 |

433,000 |

75.4 |

12,342,000 |

|

2.0 g/t |

4,495,000 |

|

2.86 |

413,000 |

81.7 |

11,810,000 |

| * At a cut-off grade of 1.0 g/t gold |

| ** Tommy Vein Resource Estimate previously released

on January 20, 2012 |

|

|

|

| Resource Estimate Notes and Parameters: |

|

|

|

|

1. |

Values in the resource estimate table may differ due to

rounding. |

|

|

|

|

2. |

Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources

may be materially affected by environmental, permitting, legal,

title, taxation, socio-political, marketing, or other relevant

issues, although the Company is not aware of any such issues. |

|

|

|

|

3. |

The

quantity and grade of reported Inferred resources in this

estimation are uncertain in nature and there has been insufficient

exploration to define these Inferred resources as an Indicated or

Measured mineral resource and it is uncertain if further

exploration will result in upgrading them to an Indicated or

Measured mineral resource category. |

|

|

|

|

4. |

The

mineral resources in this news release were estimated using the

Canadian Institute of Mining, Metallurgy and Petroleum (CIM)

Standards on Mineral Resources and Reserves, Definitions and

Guidelines prepared by the CIM Standing Committee on Reserve

Definitions and adopted by the CIM Council. |

The current 3Ts mineral resource estimates are based on a

database of 205 drill holes (41,450 m) with 4,449 assay values.

Drill hole collar locations, down hole surveys and assay values

were verified against drill logs and assay certificates. The

mineral resources were estimated using 1.0 m composites of the

assay values, with zero grade inserted into intervals that were not

sampled.

Revised geological models were constructed of the mineralized

Ted and Mint veins. These models were used to constrain the

composite values chosen for interpolation, as well as to constrain

the resource blocks reported within each mineral resource. Block

models were constructed using 2 m x 10 m x 10 m blocks in the x, y

and z directions respectively. Grades for gold and silver were

interpolated into the blocks by the inverse distance squared method

using a minimum of 4 and a maximum of 20 composites to generate

block grades. A bulk density of 2.69 t/m3 was used for all tonnage

calculations.

Allan Armitage, Ph.D., P.Geo. of GeoVector Management Inc.

("Geovector"), a Qualified Person as defined by NI 43-101, prepared

the Inferred mineral resource estimates. GeoVector is an

Ontario-based consulting firm specializing in resource estimation,

project assessment and project management. Dr. Armitage is

independent of the Company and has reviewed and approved the

technical information pertaining to the resource estimate in this

news release.

An NI 43-101 technical report will be finalized and filed on

SEDAR within 45 days of the date of this news release.

Well-mineralized vein float boulders (as described in the

Company's NI 43-101 technical report filed on SEDAR December 23,

2011) indicate potential to discover new mineralized veins within

the 3Ts Project area. Targets generated from 2013 field work at the

Ringer Target area, and at other locales, will be tested by diamond

drilling during summer 2014.

David Pawliuk, P.Geo., the Company's Qualified Person, as

defined by NI 43-101, for the 3Ts Project has reviewed the

technical information in this news release.

INDEPENDENCE GOLD

CORP.

Randy Turner,

President

Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Independence Gold Corp.Sophie

Taylor604-687-3959604-687-1448info@ingold.ca

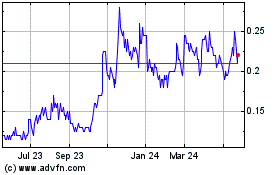

Independence Gold (TSXV:IGO)

Historical Stock Chart

From Oct 2024 to Nov 2024

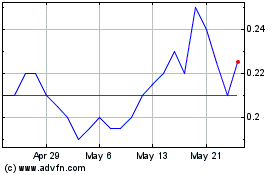

Independence Gold (TSXV:IGO)

Historical Stock Chart

From Nov 2023 to Nov 2024