Imperial Ginseng Products Ltd. Announces Debt Settlement Completion

25 January 2014 - 9:18AM

Marketwired Canada

Imperial Ginseng Products Ltd. (TSX VENTURE:IGP)(TSX VENTURE:IGP.PRA.A) (the

"Company" or "Imperial") announces that, further to its press release of October

16, 2013, it has completed the transactions contemplated in the debt settlement

agreement (the "Debt Settlement Agreement") with certain officers, directors and

significant shareholders of the Company (the "Debt Holders"). As at June 30,

2013, the Company was indebted to the Debt Holders in the amount of $2,984,944

consisting of a current debt of $2,707,578 and unpaid dividends on Class "A"

preference shares of $277,366. Under the Debt Settlement Agreement, $1,114,944

of the indebtedness was settled by the issuance of 4,129,422 common shares of

the Company at the deemed price of $0.27 per share and the remaining $1,870,000

of the indebtedness will be repaid under the terms of loan agreements (the

"Loans") having a maturity date of January 1, 2021, and secured by all of the

assets of the Company (including the assets of its subsidiary). The Loans are

subordinate to the Company's indebtedness to its commercial bank. During the

first four years of the term of the Loans, they do not bear interest and no

repayments of principal are required. During the next four years of the term of

the Loans, principal shall be repayable as to 25% per annum each January 1,

commencing January 1, 2018, and shall bear interest thereafter at the rate of 9%

per annum. The Company has the right to pre-pay any amount of the Loans at any

time with a 5% prepayment fee.

In addition to the statutory 4 month hold period expiring on May 25, 2014, all

of the 4,129,422 shares issued pursuant to the Debt Settlement Agreement are

also subject to a negotiated long term hold period expiring as to one-third of

the shares at the end of each of the third, fourth and fifth years after their

issuance on January 24, 2014.

An Independent Committee of the Board of Directors was formed in 2011 to

negotiate the settlement of the indebtedness to the Debt Holders. The

Independent Committee recommended the Debt Settlement Agreement and believes it

is in the best interest of the Company and all shareholders as it (i) removes

uncertainty with respect to the debt by converting the cash settled portion of

the debt from a current liability to a long term liability with specific

repayment terms, (ii) reduces the Company's total debt from approximately $3

million to $1.87 million, (iii) conserves the Company's cash for the next four

years, and (iv) because the interest rate drops from 12% to 9% and no interest

is charged for the first four years, saves the Company over $3 million in

interest charges over the next eight years.

The transaction has been approved by 91% of the minority shareholders voted at

the Company's AGM and by the TSX Venture Exchange, which also changed the

Company's tier classification to Tier 2 effective January 23, 2014.

The Debt Holders include Trilogy Bancorp Ltd. ("Trilogy"), a private company,

and Stephen McCoach, Hugh Cartwright and Maurice Levesque (through MLTS Holdings

Inc.), all officers and directors of the Company. Trilogy, of 310 - 650 West

Georgia Street, Vancouver, BC, is owned and controlled equally by the family

trusts of Stephen McCoach, Hugh Cartwright and Maurice Levesque. Accordingly,

the following information is provided in relation to the shareholdings of each

of these Debt Holders.

Trilogy acquired 166,459 common shares (the "Trilogy Shares") of the Company,

representing 2.6% of the issued and outstanding shares of the Company calculated

as at January 24, 2014, at the deemed price of $0.27 per Trilogy Share.

Immediately prior to the closing, Trilogy owned 848,484 common shares of

Imperial, representing 35.6% of the issued and outstanding shares of Imperial

calculated as at January 23, 2014. After the acquisition of the Trilogy Shares,

Trilogy owns 1,014,943 common shares representing 15.6% of the issued and

outstanding common shares of the Company calculated as at January 24, 2014.

Trilogy has acquired the securities for investment purposes and may acquire

further common shares or dispose of its holdings of common shares of the Company

both as investment conditions warrant.

Stephen McCoach ("McCoach"), of Vancouver, BC, acquired 2,222,222 common shares

(the "McCoach Shares") of the Company, representing 34.1% of the issued and

outstanding shares of the Company calculated as at January 24, 2014, at the

deemed price of $0.27 per McCoach Share. Immediately prior to the closing,

McCoach owned 26,269 common shares of Imperial, representing 1.1% of the issued

and outstanding shares of Imperial calculated as at January 23, 2014. After the

acquisition of the McCoach Shares, McCoach owns 2,248,491 common shares

representing 34.5% of the issued and outstanding common shares of the Company

calculated as at January 24, 2014. In addition, McCoach's family trust holds its

one-third interest in Trilogy, which holds the number of shares set out above.

McCoach has acquired the securities for investment purposes and may acquire

further common shares or dispose of its holdings of common shares of the Company

both as investment conditions warrant.

Hugh Cartwright ("Cartwright"), of Vancouver, BC, acquired 851,852 common shares

(the "Cartwright Shares") of the Company, representing 13.1% of the issued and

outstanding shares of the Company calculated as at January 24, 2014, at the

deemed price of $0.27 per Cartwright Share. Immediately prior to the closing,

Cartwright owned 19,821 common shares of Imperial, representing 0.8% of the

issued and outstanding shares of Imperial calculated as at January 23, 2014.

After the acquisition of the Cartwright Shares, Cartwright owns 871,673 common

shares representing 13.4% of the issued and outstanding common shares of the

Company calculated as at January 24, 2014. In addition, Cartwright's family

trust holds its one-third interest in Trilogy, which holds the number of shares

set out above. Cartwright has acquired the securities for investment purposes

and may acquire further common shares or dispose of its holdings of common

shares of the Company both as investment conditions warrant.

Maurice Levesque, through MLTS Holdings Inc. ("Levesque"), of North Vancouver,

BC, acquired 888,889 common shares (the "Levesque Shares") of the Company,

representing 13.7% of the issued and outstanding shares of the Company

calculated as at January 24, 2014, at the deemed price of $0.27 per Levesque

Share. Immediately prior to the closing, Levesque owned 8,470 common shares of

Imperial, representing 0.4% of the issued and outstanding shares of Imperial

calculated as at January 23, 2014. After the acquisition of the Levesque Shares,

Levesque owns 897,359 common shares representing 13.8% of the issued and

outstanding common shares of the Company calculated as at January 24, 2014. In

addition, Levesque's family trust holds its one-third interest in Trilogy, which

holds the number of shares set out above. Levesque has acquired the securities

for investment purposes and may acquire further common shares or dispose of its

holdings of common shares of the Company both as investment conditions warrant.

ON BEHALF OF THE BOARD OF DIRECTORS

Stephen McCoach, Chief Executive Officer and Director

For additional information or for a copy of the early warning report, please

contact Stephen McCoach.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that

term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Imperial Ginseng Products Ltd.

Stephen McCoach

(604) 689-8863

info@imperialginseng.com

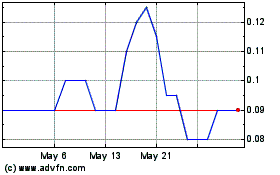

Imperial Ginseng Products (TSXV:IGP)

Historical Stock Chart

From May 2024 to Jun 2024

Imperial Ginseng Products (TSXV:IGP)

Historical Stock Chart

From Jun 2023 to Jun 2024