St. James Gold Corp.

(the

“Company”)

(TSXV: LORD) (OTCQB: LRDJF)

(FSE: BVU3) is pleased to announce that it has

entered into an agreement with Canaccord Genuity Corp. as lead

agent (the “

Lead Agent”) in connection with a

commercially reasonable efforts brokered private placement of: (i)

up to 931,667 units of the Company (each, a

“

Unit”) at a price of $3.22 per Unit; and (ii) up

to 259,067 flow-through units of the Company (each, a “

FT

Unit”) at a price of $3.86 per FT Unit, in any combination

and for aggregate gross proceeds to the Company of up to $4,000,000

(the “

Offering”).

Each Unit shall be comprised of one common share

in the capital of the Company (each, a “Common

Share”) and one Common Share purchase warrant (each, a

“Warrant”), with each Warrant entitling the holder

thereof to purchase one additional Common Share at an exercise

price of $4.18 for a period of three (3) years from the Closing

Date (as defined below).

Each FT Unit shall be comprised of one Common

Share (each, a “FT Share”) and one Warrant, each

of which will qualify as a “flow-through share” as defined in

subsection 66(15) of the Income Tax Act (Canada) (the “Tax

Act”), with each Warrant entitling the holder thereof to

purchase one additional Common Share, which will not qualify as a

“flow-through share”, at an exercise price of $4.18 for a period of

three (3) years from the Closing Date.

The Offering will be conducted pursuant to the

terms of an agency agreement to be entered into between the Company

and the Lead Agent on or prior to the Closing Date. The Company has

agreed to pay the Lead Agent a cash fee equal to 6.0% of the gross

proceeds of the Offering and to issue that number of broker

warrants equal to 6.0% of the combined number of Units and FT Units

sold under the Offering (each a “Broker Warrant”).

Each Broker Warrant will be exercisable to purchase one Unit for a

period of three (3) years from the Closing Date at an exercise

price of $3.22. In addition, the Company has agreed to pay the Lead

Agent a corporate finance fee payable in Units and equal to 2.0% of

the combined number of Units and FT Units sold under the

Offering.

The Company intends to use the net proceeds of

the Offering to conduct drilling on the Florin Gold Project,

exploration activities on the Company’s Newfoundland properties and

for general corporate purposes. The gross proceeds raised from the

sale of FT Units will only be used to incur “Canadian exploration

expenses” that are “flow-through mining expenditures” (as such

terms are defined in the Tax Act) on the Company’s options on the

Florin Gold Project and Newfoundland properties.

The Offering will be conducted in all provinces

of Canada and in the United States pursuant to private placement

exemptions and in such other jurisdictions as are agreed to by the

Company and the Lead Agent. The closing of the Offering is subject

to, among other things, the receipt of all necessary approvals from

the TSX Venture Exchange (the “TSXV”). Closing of

the Offering will occur on August 26, 2021 or such other date to be

agreed to by the Company and the Lead Agent (the “Closing

Date”). Pursuant to applicable Canadian securities laws,

all securities issued and issuable in connection with the Offering

will be subject to a four (4) month hold period commencing on the

Closing Date.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy securities in the

United States, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful. The securities to be offered have not been, and will not

be registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities

Act”) or under any U.S. state securities laws, and may not

be offered or sold in the United States or to, or for the account

or benefit of, U.S. persons, absent registration or an applicable

exemption from the registration requirements of the U.S. Securities

Act and applicable state securities laws.

About St. James Gold Corp.

St. James Gold Corp. is a publicly traded

company listed on the TSX Venture Exchange under the trading symbol

“LORD”, in the U.S. Market listed on OTCQB under "LRDJF" and on the

Frankfurt Stock Exchange under “BVU3”. The Company is focused on

creating shareholder value through the discovery and development of

economic mineral deposits by acquiring prospective exploration

projects with well-delineated geological theories; integrating all

available geological, geochemical, and geophysical datasets; and

financing efficient exploration programs. The Company currently

holds: (i) an option to acquire a 100-per-cent interest in 29

claims, covering 1,791 acres, in the Gander gold district in

north-central Newfoundland located adjacent to New Found Gold

Corp.'s Queensway North project; and (ii) an option to acquire a

100-per-cent interest in 28 claims, covering 1,730 acres, in

central Newfoundland located adjacent to Marathon Gold's Valentine

Lake property; and (iii) an option to acquire up to an 85-per-cent

interest in the Florin Gold Project, covering nearly 22,000

contiguous acres in the historical Tintina gold belt in Yukon.

For more corporate information please

visit: http://stjamesgold.com/

For further information, please contact:George Drazenovic, Chief

Executive OfficerTel: 1 (800)

278-2152Email: info@stjamesgold.com

Forward Looking Statements

This news release contains forward-looking

statements and forward-looking information within the meaning of

Canadian securities laws (collectively, “forward-looking

statements”). Forward looking statements in this news release

relate to, among other things: completion of the Offering; the

timing and size of the Offering; the timing and receipt of approval

from the TSXV for the Offering; the expected use of the net

proceeds of the Offering and all other statements that are not

historical facts, particularly statements that express, or involve

discussions as to, expectations, beliefs, plans, objectives,

assumptions or future events or performance of the Company. Often,

but not always, forward-looking statements can be identified

through the use of words or phrases such as “will likely result”,

“are expected to”, “expects”, “will continue”, “is anticipated”,

“anticipates”, “believes”, “estimated”, “intends”, “plans”,

“forecast”, “projection”, “strategy”, “objective” and “outlook”.

Forward-looking statements contained in this news release are made

based on reasonable estimates and assumptions made by management of

the Company at the relevant time in light of its experience and

perception of historical trends, current conditions and expected

future developments, as well as other factors that are believed to

be appropriate and reasonable in the circumstances. Forward-looking

statements contained in this news release are made as of the date

of this news release and the Company will not update any such

forward-looking statements as a result of new information or if

management’s beliefs, estimates, assumptions or opinions change,

except as required by law. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements.

Forward-looking statements involve known and

unknown risks, uncertainties, and other factors, many of which are

beyond the Company’s control, which could cause actual results,

performance, achievements, and events to differ materially from

those that are disclosed in or implied by such forward-looking

statements. Such risks and uncertainties include, but are not

limited to, the impact and progression of the COVID-19 pandemic and

other factors outlined in the Company’s Annual Information Form

dated July 26, 2021 (the “AIF”) filed under the

Company’s profile on SEDAR at www.sedar.com. The Company

cautions that the list of risk factors and uncertainties described

in its AIF on SEDAR are not exhaustive and other factors could

materially affect its results.

New factors emerge from time to time, and it is

not possible for the Company to consider all of them or assess the

impact of each such factor or the extent to which any factor, or

combination of factors, may cause results to differ materially from

those contained in any forward-looking statement. Any

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS

DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS

RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS

RELEASE.

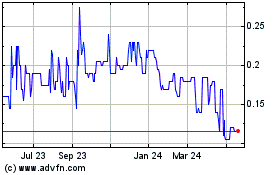

St James Gold (TSXV:LORD)

Historical Stock Chart

From Dec 2024 to Jan 2025

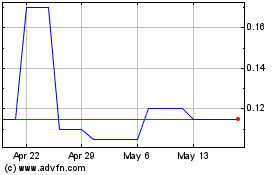

St James Gold (TSXV:LORD)

Historical Stock Chart

From Jan 2024 to Jan 2025