Leonovus Inc., ("Leonovus or the

Company") (TSXV: LTV) (OTC: LVNSF) today announced

the signing of a Letter of Intent ("

LOI") on

February 27, 2020 to purchase PureColo Inc

("

PureColo"). PureColo is a Canadian colocation

(or "colo") company with headquarters at 390 March Road, Ottawa,

Ontario. As of fiscal year-end, December 31, 2019, PureColo

generated unaudited revenues of $265,439 and net losses of $241,298

with total net assets of $412.972. PureColo customers are typically

on three-year agreements. February 2020 monthly recurring revenues

were $32,000, and the Company expects a year over year growth rate

of 45% and MRR to exceed $50,000 per month by the end of 2020 along

with positive EBITDA.

Under the terms of the LOI, Leonovus will acquire all the issued

and outstanding shares of PureColo (the “Proposed

Transaction”). The targeted closing date of the Proposed

Transaction is May 1, 2019 (the “Closing

Date”).

The purchase price is $3,000,000 (the “Purchase

Price”) plus the assumption of debts of approximately

$500,000. The Purchase Price will be paid as follows:

|

|

(a) On the Closing date: |

| |

a. Cash in the amount of

$2,100,000; and |

| |

b. the issuance of $900,000 in

Units (as defined below); |

| |

|

| |

(b) a contingent equity payment

of 70% of the Units (as defined below) issued on closing and the

remaining 30% held in escrow by counsel to the Company, 50% of

which will be released upon PureColo achieving quarterly revenues

exceeding $300,000 and 50% of which will be released upon PureColo

reaching quarterly revenues exceeding $400,000 before December 31,

2021 (the “Contingent Equity”). |

Closing of the Proposed Transaction is conditional upon Leonovus

completing a concurrent private placement to raise a minimum of

$5,000,000 (the “Offering”). The Offering will be

a non-brokered private placement or rights offering of units (the

“Units”) issued at a price to be set based on

market conditions. Each Unit will consist of one common share in

the capital of the Company (a “Common Share”) and

one warrant. Each warrant will entitle the holder to acquire one

Common Share at an exercise price of $0.10 for eighteen (18) months

following the Closing Date. Once the price of the shares for the

private placement is finalized, the Company will issue a news

release with the Unit pricing details.

The Proposed Transaction is also conditional on the completion

of due diligence, approval of the TSXV, obtaining any necessary

consents, execution of employment agreements with key employees,

and other conditions typical for transactions of this nature. The

Proposed Transaction is not a Non-arm’s length Transaction. No

finder’s fee is payable on the closing of the Proposed

Transaction.

A colocation data centre, like the one operated by PureColo,

permits customers to co-locate their IT infrastructure alongside

those of other customers. It is considered a step between customers

managing their own servers on-premises and moving their apps and

data to the cloud. Adding Leonovus Vault and Smart Filer technology

further differentiates the services of the colo by allowing

customers to analyze their data and optimize where it is stored

while ensuring it remains both available and secure.

Why is Leonovus adding colocation to its business

strategy?

The advent of 5G wireless, Internet of Things and Artificial

Intelligence/Machine Learning is driving the need for Edge

Computing (the processing and storage of data close to where it is

generated and consumed). These activities are fundamentally

changing the location of data centres and introducing the need for

services in those data centres/colocation facilities. By adding

colocation services to the Company, Leonovus will benefit from new

streams of revenues. Additionally, it will own a distributed

network of facilities it can use to offer software and

infrastructure services for customers of the colo as well as third

parties.

Due to integration and connectivity, colocation and/or cloud

ecosystems will be critical for future corporate infrastructures.

All workloads are not equal, and proper placement is key to

unlocking their true potential to the business. Infrastructures are

dynamic and must be able to change quickly, as markets and

providers change Edge and IoT deployments that are stretching

infrastructures, shifting priorities and adding complexity.

“We believe that with transformative technological advancements

growing the need for Edge Computing, there is a compelling

opportunity for small, nimble colocation centres with value-added

services such as Leonovus Vault and Smart Filer

technology,” said Michael Gaffney, Leonovus Chair and

CEO.

"We have started discussions with potential lead/strategic

investors to finance this transaction and provide additional

working capital for the Company. The Company expects that it will

offer current shareholders a Rights Offering, which is then

followed by a Private Placement. PureColo not only offers Leonovus

immediate incremental revenues, but it also provides direct access

to many potential new customers, which should decrease the length

of the sales cycle and reduce selling expenses. Proceeds from the

financing will be used to complete the purchase of PureColo,

provide working capital and assist in the creation of a second

colocation facility,” said

Gaffney.

“Three years ago, PureColo made a strategic shift from building

yet another classical Data Center in a crowded market to addressing

the requirements of customers with specialized needs in secondary

markets,” said Rainer Paduch,

PureColo, President and CEO. “This shift showed us that

customers were dissatisfied with high network latency, too many

router hops and a high cost for basic

infrastructure.” Paduch also added

that “We at PureColo are excited to be working with

Leonovus to address another hurdle introduced by cloud computing.

This is the high cost of basic storage and transit fees. The

Leonovus products will give our customers greater architectural

flexibility and much lower infrastructure costs."

All dollar amounts in this news release are in Canadian

dollars.

About PureColoThe PureColo founders are data

centre experts who have built and managed hundreds of thousands of

square feet of white space across Canada. PureColo started

colocation operations in 2017, in a 5,000 sq. ft facility in Kanata

Ontario and it intends to disrupt the self-serve colocation market

with a no-frills, carrier-neutral, wholesale priced model combined

with decades of experience delivering to this industry. PureColo’s

vision is to be a leading supplier of carrier-neutral data centres

across Canada, starting with the Nation’s Capital. Currently, there

are twenty customers including, major telecom carriers, managed

service providers, multinational corporations and product

development companies.

About LeonovusLeonovus is a software provider

that offers storage solutions that allow organizations to embrace

cloud storage securely, simply and cost-effectively while giving

them the flexibility to deal with the ever-evolving cloud storage

landscape.

Designed with the IT manager in mind, Leonovus Vault uses

patented algorithms to analyze, classify, encrypt, shred and spread

data across a network of on-premises, hybrid or multi-cloud storage

nodes – allowing for the most secure yet internally accessible form

of object-based data storage across the entire solution. The

advanced geo-distributed architecture minimizes latency, optimizes

geo-availability, reduces remote backup costs and meets data

sovereignty requirements. With its software and hardware agnostic

design, Vault provides petabyte scalability. It allows the

enterprise to use its existing idle storage resources, extend the

useable lifespan of depreciated resources and improve the

enterprise's overall ROI.

Leonovus Smart Filer is an information lifecycle management

(ILM) solution that analyzes existing file storage and extends its

capacity automatically and transparently. According to

customer-defined policies, infrequently accessed files are

automatically removed from high-cost, high-performance primary

storage, and placed in secondary or cloud storage, without any

changes to how users and applications access them.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accept responsibility for the adequacy or accuracy of

this release.

This news release contains "forward-looking statements".

Forward-looking statements can be identified by words such as:

"anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely,"

"may," "should," "will" and similar references to future periods.

Examples of forward-looking statements include, among others,

statements we make regarding the anticipated closing of the

acquisition of PureColo or concurrent financing, potential benefits

to adding colocation business, potential growth for the market for

colocation.

Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on

our current beliefs, expectations and assumptions regarding the

future of our business, future plans and strategies, projections,

anticipated events and trends, the economy and other future

conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. There can be no assurance that

the Proposed Transaction will be completed as proposed or at all.

Our actual results and financial condition may differ materially

from those indicated in the forward-looking statements. Therefore,

you should not rely on any of these forward-looking

statements.

Any forward-looking statement made by us in this news release is

based only on information currently available to us and speaks only

as of the date on which it is made. Except as required by

applicable securities laws, we undertake no obligation to update

any forward-looking statement publicly, whether written or oral,

that may be made from time to time, whether as a result of new

information, future developments or otherwise.

For more information, please contact:George Pretli, Chief

Financial Officer+1.613.319.3540gpretli@leonovus.com

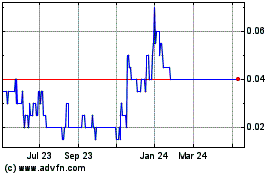

LeoNovus (TSXV:LTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

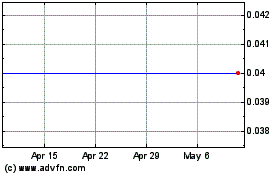

LeoNovus (TSXV:LTV)

Historical Stock Chart

From Jan 2024 to Jan 2025