Dundee Corporation Announces Acquisition of Senior Secured Notes and Units of Maritime Resources Corp.

22 August 2023 - 7:13AM

In accordance with regulatory requirements, Dundee Corporation

(TSX: DC.A) (“Dundee”) announces that its wholly owned subsidiary,

Dundee Resources Limited, has acquired US$1,000,000 principal

amount non-convertible senior secured notes of Maritime Resources

Corp. (TSXV - MAE) (“Maritime” or the “Issuer”) maturing August 14,

2025 which may be extended by Maritime in certain circumstances and

under certain conditions until August 14, 2026 (the “Extended

Maturity Date”). As part of the purchase of the senior secured

notes, Dundee Resources Limited received 7,662,285 warrants (“Note

Warrants”) of Maritime. Each Note Warrant is exercisable into one

common share in the capital of the Issuer at a price of $0.07 per

Note Warrant up until August 14, 2025, and subject to an extension

in the event that the maturity date of the senior secured notes is

extended to the Extended Maturity Date. Concurrently, Dundee

Resources also acquired 13,125,000 units (the “Units”) of Maritime

at the price of C$0.04 per Unit for aggregate consideration of

C$525,000. Each Unit is comprised of one common share and one

common share purchase warrant (a “Warrant”). Each Warrant is

exercisable to acquire one common share of the Issuer at an

exercise price of C$0.07 per share until August 14, 2026.

Immediately prior to the acquisition of

securities described in this news release, Dundee and its

affiliates owned 93,861,919 common shares of the Issuer

representing an approximate 19.79% interest in the Issuer on an

undiluted basis. Immediately following the transaction that

triggered the requirement to file this news release, Dundee and its

affiliates own or control an aggregate of 106,986,919 common shares

and 20,787,285 warrants, representing an approximate 19.75%

interest in the Issuer on an undiluted basis and a 22.72% interest

in the Issuer on a partially diluted basis.

Dundee acquired the securities of the Issuer for

investment purposes only. Dundee intends to review, on a continuous

basis, various factors related to its investment, including (but

not limited to) the price and availability of the securities of the

Issuer, subsequent developments affecting the Issuer or its

business, and the general market and economic conditions. Based

upon these and other factors, Dundee may decide to purchase

additional securities of the Issuer or may decide in the future to

sell all or part of its investment.

This news release is being issued in accordance

with National Instrument 62-103 – The Early Warning System and

Related Take-Over Bid and Insider Reporting Issues in connection

with the filing of an early warning report. The early warning

report respecting the acquisition will be filed on the System for

Electronic Document Analysis and Retrieval (“SEDAR”) at

www.sedar.com under the Issuer’s profile. To obtain a copy of the

early warning report filed by Dundee, please contact:

Dundee CorporationLegal Department80 Richmond

Street West, Suite 2000Toronto, Ontario M5H 2A4Tel: (416)

365-5172

ABOUT DUNDEE CORPORATION

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

Corporation is an active investor focused on delivering

long-term, sustainable value as a trusted partner in the mining

sector with more than 30 years of experience making accretive

mining investments.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Investor and Media RelationsT: (416) 864-3584E:

ir@dundeecorporation.com

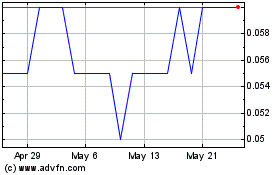

Maritime Resources (TSXV:MAE)

Historical Stock Chart

From Feb 2025 to Mar 2025

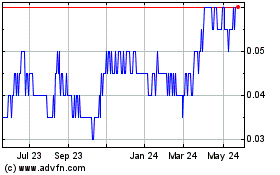

Maritime Resources (TSXV:MAE)

Historical Stock Chart

From Mar 2024 to Mar 2025