MedMira Reports 2019 Fourth Quarter and Year End Financial Results

29 November 2019 - 12:00PM

MedMira Inc. (MedMira) (TSXV: MIR), reported today on its financial

results for the financial year ended July 31, 2019.

Profit and Loss Highlights

- Revenue: The Company recorded revenues in FY2019 of $527,445

compared to $574,860 in FY2018. The decrease in revenue was due to

the Company’s strategy to focus on high profit margin markets. As

outlined below, this strategy has resulted in the Company recording

a higher contribution margin and has also indirectly decreased

expenses.

- Gross Profit: The Company recorded a gross profit in FY2018 of

$423,351 compared to $461,111 for the same period last year. The

overall gross margin percentage on sales increased by 2% from 78%

in FY2018 to 80% in this financial year.

- Operating expenses: In this financial year, the Company

recorded operating expenses of $1,719,384 compared to $2,301,408 in

FY2018. The decrease of 25% in operating expenses was due to the

management’s efforts to decrease its operating fixed costs.

- Net loss: The Company recorded a net loss of $2,106,448

compared to $2,509,464 in FY2018.

Balance Sheet Highlights

- Assets: The Company had an expected decrease of its assets by

$48,394 or 16% compared to last financial year due to receipt of

trade receivables, lower inventory and tax receivables.

- Liabilities: The Company’s liabilities increased by $2,070,554

or 18% between FY2018 and FY2019. This was mainly due to additional

loans provide from the main shareholder and the management of the

Company.

- Loans in default increased by $1,040,627 or 14% compared to

financial year. This increase was due to a number of related

parties loans being due in FY2019. All long and short terms debts

are currently under negotiation to restructure terms and conditions

of repayment.

- Working Capital deficit: As a result of the increases noted

above, the Company recorded higher working capital deficit of

$2,096,748 or 18% compared to last financial year.

The Company’s financial statements and management’s discussion

and analysis are available on the Company’s profile on SEDAR at

www.sedar.com. For matters of going concern, reference is

made to the Auditor’s Emphasis of Matter statement in the fiscal

year ended 2017 Auditors Report and note 2b in the audited

financial statements which are also available on SEDAR.

About MedMira

MedMira is the developer and owner of Rapid

Vertical Flow (RVF) Technology™. The Company’s rapid test

applications built on RVF Technology provide hospitals, labs,

clinics and individuals with instant diagnosis for diseases such as

HIV and hepatitis C in just three easy steps. The Company’s tests

are sold under the Reveal, Multiplo and Miriad™ brands in global

markets. MedMira’s corporate offices and manufacturing facilities

are located in Halifax, Nova Scotia, Canada and the Company has a

sales and customer service office located in the United States. For

more information visit medmira.com. Follow us on Twitter and

LinkedIn.

This news release contains forward-looking

statements, which involve risk and uncertainties and reflect the

Company’s current expectation regarding future events including

statements regarding possible approval and launch of new products,

future growth, and new business opportunities. Actual events

could materially differ from those projected herein and depend on a

number of factors including, but not limited to, changing market

conditions, successful and timely completion of clinical studies,

uncertainties related to the regulatory approval process,

establishment of corporate alliances and other risks detailed from

time to time in the company quarterly filings.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

MedMira Contacts:

Markus Meile,

CFO

Tel:

902-450-1588

Email: m.meile@medmira.com

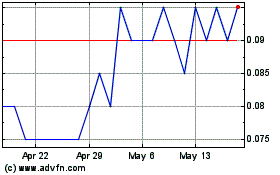

MedMira (TSXV:MIR)

Historical Stock Chart

From Nov 2024 to Dec 2024

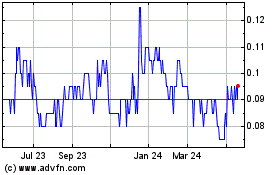

MedMira (TSXV:MIR)

Historical Stock Chart

From Dec 2023 to Dec 2024