NowVertical Group Inc. (TSX-V: NOW) (OTCQB: NOWVF)

(“

NOW” or the “

Company the

vertical intelligence (VI) software and solutions company, today

announces its financial results for the three months ended March

31, 2023.

“Our financial performance in the first quarter

is the reflection of the hard work our whole team has put into

acquiring, integrating, operating, and formalizing a consolidated

go-to-market strategy with our business units,” said Sasha

Grujicic, President and incoming CEO of NOW. “We aim to further

establish ourselves as a global leader in the data, analytics and

AI space and will continue to be disciplined in how we lead our

customers through this exciting time.”

Selected Pro Forma and Financial

Highlights:

-

Revenue – Revenue was $13.6 million in Q1 2023, an

increase of 425% from $2.6 million in the prior year’s first

quarter, while Adjusted Revenues were $13.7 million in the first

quarter compared to $2.9 million in the first three months of 2022,

primarily due acquisitions completed in 2022, 2023.

- Adjusted

EBITDA1 – Adjusted EBITDA was $0.23

million for the three months ended March 31, 2023, compared to

$(0.2) million in the prior year’s quarter.

- Cost

Reductions – During the first quarter of 2023, NOW

implemented cost-saving initiatives that resulted in savings of

$0.15 million in the first quarter or $0.58 million annually.

- Net

Loss – Net Loss was $1.4 million in Q1 2023, or a net loss

per fully diluted share of $0.02, compared to a net loss per basic

and diluted share of $0.03 for the three months ended March 31,

2023.

- Cash and

Investments – Cash and Investments were $5.6 million

on March 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

(000)s |

|

Three months Ended |

| Reported: |

|

March 31,2023 |

|

December 31, 2022 |

|

Change |

|

|

March 31,2023 |

|

March 31,2022 |

Change |

|

Revenue |

$ |

13.622 |

$ |

8.392 |

|

|

62% |

|

$ |

13.622 |

$ |

2.594 |

425% |

| Adjusted Revenue |

$ |

13.688 |

$ |

8.575 |

|

|

60% |

|

$ |

13.688 |

$ |

2.983 |

359% |

| Adjusted EBITDA |

$ |

0.234 |

$ |

(0.021 |

) |

|

1,214% |

|

$ |

0.234 |

$ |

(0.247) |

195% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 2023 and Subsequent Business

Highlights:

- January 12, 2023,

NOW announced a new credit agreement with The Toronto-Dominion Bank

(“TD Bank”) for CAD$7 million and completed the

acquisitions of 100% of the issued and outstanding securities of

two U.K.-based data analytics solution providers, Acrotrend

Solutions and Smartlytics Consultancy.

- 2023 on February 2,

2023, NOW completed the acquisition of 100% of the issued and

outstanding securities of Group Analytics 10 and Inteligencia de

Negocios and its affiliate entities (collectively, the “A10

Group”).

- On February 21,

2023, Acrotrend, one of the newest additions to NOW’s Vertical

Intelligence offering, was awarded a gold rating in the sixth

annual listing of UK management firms most recommended by their

clients.

-

On February 28, 2023, NOW completed a marketed public offering of

9,631,500 units for aggregate gross proceeds of C$5.0 million.

- On March 6, 2023,

NOW announced its System Organization Control Type II (“SOC

2”) certification.

- On May 11, 2023, NOW

completed a partnership and sale of its Affinio Social Product to

Audiense Ltd., a private U.K.-based audience intelligence platform

provider, while retaining its core IP and software to operate NOW’s

Snowflake product. The transaction will generate approximately $3

million of free cash flow over a 24-month period and creates a

2-way reseller relationship with Audiense.

Leadership

Transition:

NOW is also announcing today that as a

part of a planned leadership transition, Mr. Daren Trousdell, the

Chief Executive Officer, is stepping back from his role at the

Company. The Company has appointed Mr. Sasha Grujicic, NOW’s

President, who initially served as Chief Operating Officer, as its

new Chief Executive Officer.

“I always knew that there would be a

point in our development that a strategic leadership transition

would take place,” Mr. Trousdell said. "We’ve spent the better part

of 18 months working on a succession, and I’m happy to hand the

company over to Sasha Grujicic.”

Mr. Daren Trousdell will remain with

the Company as a special advisor to the board of directors.

“I would like to thank Daren as

founder, CEO, and director for his dedicated and unwavering service

and substantial contributions to the Company. He has been

instrumental in building up the Company and its team and

positioning us to enter the next stage of our growth story,” said

Scott Nirenberski on behalf of the board of directors. “The team

Daren has put in place is exceptional, and we believe this

transition will provide the opportunity for continued success and

further growth”.

Board of Directors

Update:

In addition to the Leadership

transition, Ms. Elaine Kunda has been appointed as the Chairperson

of the Board, taking over from Mr. Daren Trousdell. Mr. Sasha

Grujicic, the Company’s CEO, and Mr. Andre Garber, the Company’s

EVP of Corporate Development and Legal Affairs, will also be

appointed to the board. Mr. John Adamovich will be stepping down

from his position on the board. The board remains majority

independent.

Corporate

Update:

The Company also

announced that it has renegotiated the timing of the $1.75 million

deferred payment owed to the CoreBI vendors, of which $250,000 was

paid on March 14, 2023, and the remainder will be paid over five

installments during FY 2023 and 2024.

Investor Webinar:

NOW invites shareholders, analysts, investors,

media representatives, and other stakeholders to attend our

upcoming webinar, where management will discuss Q1 2023 results,

followed by a question-and-answer session.

Investor Webinar Registration:

Time: May 31, 2023, 09:30 AM in Eastern Time (US and

Canada)Register here: https://bit.ly/NOW-Q1-2023-Registration

A recording of the webinar and supporting

materials will be made available in the investor’s section of the

company’s website at https://ir.nowvertical.com/news-and-media

Related links:

https://www.nowvertical.com

Additional Information:

The Company's unaudited first quarter 2023

condensed consolidated interim financial statements, notes to

financial statements, and management's discussion and analysis for

the three months ended March 31, 2023, are available on the

Company's SEDAR profile at www.sedar.com. Unless otherwise

indicated, all references to "$" in this press release refer to US

dollars, and all references to "CAD$" in this press release refer

to Canadian dollars.

An investor presentation, including supplemental financial

information and reconciliations of certain non-IFRS measures, is

available on NOW’s Investor Relations website

at:https://ir.nowvertical.com/news-and-media

About NowVertical Group Inc.:

NOW is a big data, analytics and VI software and

services company that is growing organically and through

acquisition. NOW's VI solutions are organized by industry vertical

and are built upon a foundational set of data technologies that

fuse, secure, and mobilize data in a transformative and compliant

way. The NOW product suite enables the creation of high-value VI

solutions that are predictive in nature and drive automation

specific to each high-value industry vertical. For more information

about the Company, visit www.nowvertical.com.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

For further information, please contact: Glen Nelson, Investor

Relationse: glen.nelson@nowvertical.comt: (403) 763-9797

NON-IFRS MEASURES:The non-IFRS financial

measures referred to in this news release are defined below. The

management discussion and analysis for the quarter ended March 31,

2023 (the “Q1 2023 MD&A”), available at

nowvertical.com and SEDAR, also contains supporting calculations

for Adjusted Revenues, EBITDA, Adjusted EBITDA and Pro Forma TTM

Adjusted Revenues.

“Adjusted Revenue” adjusts

revenue to eliminate the effects of acquisition accounting on the

Company’s revenues.

“Adjusted EBITDA” adjusts

EBITDA for revenue adjustments in “Adjusted Revenue” and items such

as acquisition accounting adjustments, transaction expenses related

to acquisitions, transactional gains or losses on assets, asset

impairment charges, non-recurring expense items, non-cash stock

compensation costs, and the full-year impact of cost synergies

related to the reduction of employees in relation to

acquisitions.

“Pro Forma TTM Adjusted

Revenue” adjusts Pro Forma TTM Adjusted Revenues to

include the Pro Forma TTM Adjusted Revenues of all acquisitions

completed through the date of the Company’s MD&A. The prior

year's comparable amount reflects acquisitions completed through

the date of the prior period’s MD&A.

Forward‐Looking Statements:This news release

may contain forward‐looking statements (within the meaning of

applicable securities laws) which reflect the Company's current

expectations regarding future events. Forward-looking statements

are identified by words such as "believe", "anticipate", "project",

"expect", "intend", "plan", "will", "may", "estimate" and other

similar expressions. These statements are based on the Company's

expectations, estimates, forecasts and projections and include,

without limitation, statements regarding the future success of the

Company's business.

The forward-looking statements in this news

release are based on certain assumptions. The forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties that are difficult to control or predict.

Several factors could cause actual results to differ materially

from the results discussed in the forward-looking statements.

Readers, therefore, should not place undue reliance on any such

forward-looking statements. Further, these forward-looking

statements are made as of the date of this news release and, except

as expressly required by applicable law, the Company assumes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Cautionary Note Regarding Non-IFRS

Measures:

This news release refers to certain non-IFRS

measures. These measures are not recognized measures under IFRS, do

not have a standardized meaning prescribed by IFRS and are

therefore unlikely to be comparable to similar measures presented

by other companies. Rather, these measures are provided as

additional information to complement those IFRS measures by

providing further understanding of the Company’s results of

operations from management’s perspective. The Company’s definitions

of non-IFRS measures used in this news release may not be the same

as the definitions for such measures used by other companies in

their reporting. Non-IFRS measures have limitations as analytical

tools and should not be considered in isolation nor as a substitute

for analysis of the Company’s financial information reported under

IFRS. The Company uses non-IFRS financial measures including

“Adjusted Revenue”, “EBITDA”, “Adjusted EBITDA”, “Pro Forma TTM

Adjusted Revenue”, and “Current Pro Forma TTM Adjusted Revenue”.

These non-IFRS measures are used to provide investors with

supplemental measures of our operating performance and to eliminate

items that have less bearing on our operational performance or

operating conditions and thus highlight trends in our core business

that may not otherwise be apparent when relying solely on IFRS

measures. The Company believes that securities analysts, investors

and other interested parties frequently use non-IFRS financial

measures in the evaluation of issuers. The Company’s management

also uses non-IFRS financial measures to facilitate operating

performance comparisons from period to period and prepare annual

budgets and forecasts.

1 See NON-IFRS MEASURES at the end of this news release.

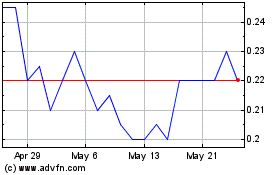

NowVertical (TSXV:NOW)

Historical Stock Chart

From Feb 2025 to Mar 2025

NowVertical (TSXV:NOW)

Historical Stock Chart

From Mar 2024 to Mar 2025