New Zealand Energy Spuds Copper Moki-2 and Ranui-2 Wells

18 January 2012 - 11:30PM

Marketwired Canada

New Zealand Energy Corp. ("NZEC" or the "Company") (TSX VENTURE:NZ)(OTCQX:NZERF)

is pleased to provide an operational update on its production and exploration

activities on New Zealand's North Island.

HIGHLIGHTS

Taranaki Basin

-- Copper Moki-1 ("CM-1") has produced an average of 550 barrels of oil per

day over the first 30 days of long-term production

-- CM-1 cumulative production of 29,000 barrels of oil to date with

operating netbacks of approx. US$90 per barrel

-- Commenced drilling of Copper Moki-2 ("CM-2"), targeting the Mt.

Messenger and Urenui formations

-- Will commence drilling of Copper Moki-3 ("CM-3") in Q1-2012

-- Services and consents in place for a total of four wells from the Copper

Moki pad

East Coast Basin

-- Commenced drilling of Ranui-2 core well targeting the Whangai Shale

-- Completed the coring of two holes testing the Waipawa and Whangai Shales

TARANAKI BASIN UPDATE

The CM-1 well has been flowing from natural reservoir pressure since December

10, 2011 at an average rate of 550 barrels of 41.8 API oil per day and 685

thousand cubic feet of natural gas per day through a 20/64th inch choke. CM-1

has produced over 29,000 barrels of oil since it was first tested in August 2011

with operating netbacks of approximately US$90 per barrel. NZEC calculates the

netback as the oil sale price less fixed and variable operating costs and a 5%

royalty.

NZEC has commenced drilling of CM-2, its second exploration well in New

Zealand's Taranaki Basin. The Company expects to finish drilling the CM-2 well

by the end of January, targeting the Mt. Messenger and Urenui formations. NZEC

will continue to produce CM-1 as CM-2 is drilled and will bring CM-2 on-stream

using existing production facilities if the well is successful.

NZEC plans to drill CM-3 upon completion of CM-2, targeting the Mt. Messenger,

Urenui and deeper Moki formations. While the Company had originally planned to

drill CM-3 from a separate pad south of CM-1, the decision to drill from the

CM-1 pad will allow NZEC to bring CM-3 on-stream using existing production

facilities and eliminates the infrastructure costs associated with a separate

pad.

NZEC's rig contract includes the option to drill a fourth well from the CM-1

pad. NZEC's consents for the CM-1 pad allow for multiple wells and construction

of permanent surface facilities. The Company has installed surface facilities to

accommodate production of up to 1,000 barrels of oil per day, and can expand the

facilities to handle production from additional wells. NZEC anticipates

establishing permanent facilities by mid-2012 that will accommodate production

from an estimated four wells. The permanent facilities will include a gas

pipeline to allow the Company to market its natural gas production.

The Taranaki Basin is situated on the west coast of the North Island and is

currently New Zealand's only oil and gas producing basin, producing approx.

130,000 boe/day from 18 fields. Within the Taranaki Basin, NZEC holds and is the

operator of two permits covering 152,066 net acres. The Taranaki Basin offers

multi-zone potential, and NZEC's exploration strategy is to prioritize wells

identified on 3D seismic that have a well-defined, lower-risk Mt. Messenger

target coupled with deeper exploration targets such as the Moki and Kapuni

formations.

EAST COAST BASIN UPDATE

The East Coast Basin of New Zealand's North Island hosts two prospective shale

formations, the Waipawa and Whangai, which are the source of more than 300 oil

and gas seeps. NZEC has two granted permits and one pending permit in the East

Coast Basin, collectively covering more than 1.8 million acres. NZEC's Ranui

permit acquisition included the Ranui-1 well, drilled by the previous permit

holder in 2008. The Ranui-1 well encountered 224 metres of prospective Whangai

Shale but did not penetrate the base of the shale before reaching total depth of

1,134 metres.

The Ranui-2 well on NZEC's 100% working interest Ranui Permit will core the

Whangai Shale across several intervals and will drill through the base of the

Whangai Shale and into the underlying conventional reservoir sands, with a

planned depth of approximately 1,500 metres. Ranui-2 drilling commenced on

January 14, with drilling and coring expected to take approximately three weeks.

NZEC is planning to cut up to four cores in the Whangai Formation and will run a

full suite of open hole logs to assist in determining the reservoir

characteristics of the shale.

In Q4-2011, NZEC completed the coring of two test holes on its 100% working

interest Castlepoint Permit. The Orui (125 metres total depth) and Te Mai (195

metres total depth) test holes cored and tested the Waipawa and Whangai shales.

Analysis of the core is ongoing.

These three stratigraphic test wells will advance NZEC's understanding of the

Waipawa and Whangai formations. A review of the geochemical and physical

properties of the two shale packages will help focus NZEC's exploration strategy

for the East Coast shales. In addition, NZEC's technical team will reprocess

existing East Coast Basin seismic data and plans to shoot approximately 50

kilometres of 2D seismic in 2012 and complete additional technical studies to

advance the properties.

EXPANDED MANAGEMENT TEAM

NZEC has expanded its in-country management team to support the Company's

exploration, development and production efforts, with the appointments of a

Manager Exploration, Manager Land and Group Financial Controller. NZEC has

granted 523,000 options to officers and employees with a five-year term and an

exercise price of $1.30, with 25% vesting six months after the option grant date

and 25% vesting every six months thereafter.

NZEC currently employs, directly and indirectly, approximately 60 people from

local communities to support production and exploration activities in the Copper

Moki area, with an additional 10 employees and consultants in its Wellington

corporate office. NZEC currently employs, directly and indirectly, eight people

from local communities to support exploration activities in the East Coast

Basin.

June Cahill is a geologist with 32 years of experience working in applied earth

science, and previously held the position of senior geologist with NZEC. As

Manager Exploration, Ms. Cahill will manage the Wellington based team of

geologists and geophysicists. Ms. Cahill has extensive knowledge and experience

with New Zealand sedimentary basin geology and the management of geological and

geophysical databases. Her early professional experience was with the New

Zealand Geological Survey division of the Department of Scientific and

Industrial Research. From 1993 through to joining NZEC, she was a senior

geologist with the consulting company Ian R Brown Associates Ltd. Ms. Cahill has

a Bachelor of Science in geology from Victoria University of Wellington, and a

Bachelor of Applied Economics from Massey University.

Tokatumoana (Toka) Walden has joined NZEC as Manager Land, responsible for the

Company's land access activities including negotiating access provisions and

managing the resource consent application process. Mr. Walden will also have an

important role as the Company continues to build a strong relationship with iwi

groups across all operational areas. Mr. Walden started his career as a teacher;

before joining NZEC he was a senior manager with New Zealand's Department of

Conservation. Mr. Walden is also a director of Parininihi Ki Waitotara Inc.,

Taranaki's largest corporate dairy farmer.

John Hudson has been working with NZEC as a consultant since October 2011 and

has joined the Company full time as Group Financial Controller. Mr. Hudson has a

Bachelor of Business Studies in accounting from Massey University and is a

Chartered Accountant with more than 15 years of experience covering a range of

accounting responsibilities. Mr. Hudson joined NZEC after nearly four years as

the Financial Controller of Weatherford New Zealand Ltd., an international

company providing well construction and intervention services to the oil and gas

industry. Prior to that Mr. Hudson held a number of positions including Finance

Manager with Parker Drilling and Chartered Accountant with Ernst & Young. As

Group Controller, Mr. Hudson will be responsible for all New Zealand accounting

and financial reporting.

On behalf of the Board of Directors

Bruce McIntyre, President & Director

ABOUT NEW ZEALAND ENERGY CORP.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers nearly two million acres of conventional

and unconventional prospects in the Taranaki Basin and East Coast Basin of New

Zealand's North Island. The Company's management team has extensive experience

exploring and developing oil and natural gas fields in New Zealand and Canada,

and takes a multi-disciplinary approach to value creation with a track record of

successful discoveries. NZEC plans to add shareholder value by executing a

technically disciplined exploration and development program focused on the

onshore and offshore oil and natural gas resources in the politically and

fiscally stable country of New Zealand. NZEC is listed on the TSX Venture

Exchange under the symbol NZ and on the OTCQX International under the symbol

NZERF. More information is available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Forward-looking Statements

This news release contains certain forward-looking information and

forward-looking statements within the meaning of applicable securities

legislation (collectively "forward-looking statements"). The use of any of the

words "will", "expects", "expected", "plans", "planning", "allow", "advance" and

similar expressions are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties and other factors that

may cause actual results or events to differ materially from those anticipated

in such forward-looking statements, including without limitation, the

speculative nature of exploration, appraisal and development of oil and natural

gas properties; uncertainties associated with estimating oil and natural gas

resources; uncertainties in both daily and long-term production rates and

resulting cash flow; volatility in market prices for oil and natural gas;

changes in the cost of operations, including costs of extracting and delivering

oil and natural gas to market, that affect potential profitability of oil and

natural gas exploration; the need to obtain various approvals before exploring

and producing oil and natural gas resources; uncertainty in the timing of

receipt of permits and the Company's ability to extend the permits if required;

exploration hazards and risks inherent in oil and natural gas exploration;

operating hazards and risks inherent in oil and natural gas operations; market

conditions that prevent the Company from raising the funds necessary for

exploration and development on acceptable terms or at all; global financial

market events that cause significant volatility in commodity prices; unexpected

costs or liabilities for environmental matters; competition for, among other

things, capital, acquisitions of resources, skilled personnel, and access to

equipment and services required for exploration, development and production;

changes in exchange rates, laws of New Zealand or laws of Canada affecting

foreign trade, taxation and investment; failure to realize the anticipated

benefits of acquisitions; and other factors as disclosed in documents released

by NZEC as part of its continuous disclosure obligations. NZEC believes the

expectations reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be correct. Such

forward-looking statements included in this news release should not be unduly

relied upon. These statements speak only as of the date of this news release and

NZEC does not undertake to update any forward-looking statements that are

contained in this news release, except in accordance with applicable securities

laws.

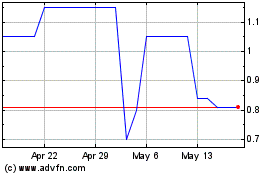

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

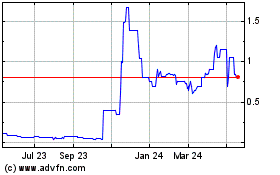

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024