Panoro Minerals Ltd. announces Column Leaching Test Results for Antilla Copper Project, Peru

07 August 2018 - 11:20PM

Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM)

(“Panoro”, the “Company”) Panoro is pleased to announce

results of column leach testing of the supergene secondary

sulphides at the 100% owned Antilla Copper Project.

The column leach testing indicates that copper

extractions of up to 77% are potentially achievable from the

secondary sulphides. The PEA results announced in May 2018

included an estimated 72.5% copper recovery over a 200 day span

from the secondary sulphides. The PEA mine plan included 117

million tonnes of secondary sulphide or 98% of the feed to the heap

leach pad. The column testwork was initiated early in 2018

while the PEA was underway but final results were not available

until July 2018. The recoveries estimated for the PEA were

derived from bottle roll and mineralogic testwork available at the

time of the completion of the PEA. Based on the foregoing 75%

Cu extraction in 200 days is an appropriate figure to use for PEA

level studies.

“We are pleased that the column leach tests

indicate the potential for recoveries higher than estimated by the

bottle roll tests included in the PEA estimate. A potential

increase in recoveries will further enhance the economics of this

already robust project. Additional testing is planned as part

of feasibility studies for the Antilla Project. The Company

is currently reviewing strategic alternatives to advance the

Antilla Project into feasibility studies, permitting and

development,” stated Luquman Shaheen, President & CEO of Panoro

Minerals.

The Antilla Project process included in the 2018

PEA is based on leaching secondary sulphides. This led to a column

leach program, together with associated mineralogical and bottle

roll leach testwork, being implemented during March 2018 at Aminpro

Laboratories, an ISO 9001 and 14001 Laboratory based in Lima, Peru.

All works were designed and supervised by Andrew Carter, General

Manager of Mining and Minerals of Tetra Tech Inc., UK Office.

About Panoro

Panoro Minerals is a uniquely positioned Peru

focused copper exploration and development company. The

Company is advancing its flagship project, Cotabambas

Copper-Gold-Silver Project and its Antilla Copper-Molybdenum

Project, both located in the strategically important area of

southern Peru. The Company is well financed to expand, enhance and

advance its projects in the region where infrastructure such as

railway, roads, ports, water supply, power generation and

transmission are readily available and expanding quickly. The

region boasts the recent investment of over US$15 billion into the

construction or expansion of four large open pit copper mines.

Since 2007, the Company has completed over

80,000 meters of exploration drilling at these two key projects

leading to substantial increases in the mineral resource base for

each, as summarized in the table below.

Summary of Cotabambas and Antilla

Project Resources

|

Project |

ResourceClassification |

MillionTonnes |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Mo (%) |

| Cotabambas Cu/Au/Ag |

Indicated |

117.1 |

0.42 |

0.23 |

2.74 |

0.001 |

|

Inferred |

605.3 |

0.31 |

0.17 |

2.33 |

0.002 |

| @ 0.20% CuEq cutoff, effective October 2013,

Tetratech |

| Antilla Cu/Mo |

Indicated |

291.8 |

0.34 |

- |

- |

0.01 |

|

Inferred |

90.5 |

0.26 |

- |

- |

0.007 |

| @ 0.175% CuEq cutoff, effective May 2016,

Tetratech |

Preliminary Economic Assessments (PEA) have been

completed for both the Cotabambas and Antilla Projects, the key

results are summarized below.

Summary of Cotabambas and Antilla

Project PEA Results

| Key Project Parameters |

|

Cotabambas Cu/Au/Ag Project1 |

Antilla Cu Project2 |

| Process Feed, life of mine |

million tonnes |

483.1 |

118.7 |

| Process Feed, daily |

Tonnes |

80,000 |

20,000 |

| Strip Ratio, life of mine |

|

1.25 : 1 |

1.38: 1 |

| BeforeTax1 |

NPV7.5% |

million USD |

1,053 |

520 |

|

IRR |

% |

20.4 |

34.7 |

|

Payback |

years |

3.2 |

2.6 |

| After Tax1 |

NPV7.5% |

million USD |

684 |

305 |

|

IRR |

% |

16.7 |

25.9 |

|

Payback |

years |

3.6 |

3.0 |

| Annual Average PayableMetals |

Cu |

thousand tonnes |

70.5 |

21.0 |

|

Au |

thousand ounces |

95.1 |

- |

|

Ag |

thousand ounces |

1,018.4 |

- |

|

Mo |

thousand tonnes |

- |

- |

| Initial Capital Cost |

million USD |

1,530 |

250 |

- Project economics estimated at commodity prices of; Cu =

US$3.00/lb, Au = US$1,250/oz, Ag = US$18.50/oz, Mo = US$12/lb

- Project economics estimated at long term commodity price of Cu

= US$3.05/lb and Short term commodity price of Cu = US$3.20,

US$3.15 and US$3.10 for Years 1,2 and 3 of operations,

respectively.

|

The PEAs are considered preliminary in nature

and include Inferred Mineral Resources that are considered too

speculative to have the economic considerations applied that would

enable classification as Mineral Reserves. There is no certainty

that the conclusions within the updated PEA will be realized.

Mineral Resources are not Mineral Reserves and do not have

demonstrated economic viability.

Luis Vela, a Qualified Person under National

Instrument 43-101, has reviewed and approved the scientific and

technical information in this press release.

On behalf of the Board of Panoro

Minerals Ltd.

Luquman Shaheen. PEng, PE, MBAPresident & CEO

FOR FURTHER INFORMATION, CONTACT:

| Panoro Minerals

Ltd. Luquman Shaheen, President & CEO Phone:

604.684.4246 Fax: 604.684.4200 Email: info@panoro.com Web:

www.panoro.com |

Renmark Financial Communications Inc. Laura Welsh

Tel.: (416) 644-2020 or (416) 939-3989 blwelsh@renmarkfinancial.com

www.renmarkfinancial.com |

CAUTION REGARDING FORWARD LOOKING

STATEMENTS: Information and statements

contained in this news release that are not historical facts are

“forward-looking information” within the meaning of applicable

Canadian securities legislation and involve risks and

uncertainties.

Forward-looking statements are subject to a

variety of known and unknown risks, uncertainties and other factors

which could cause actual events or results to differ materially

from those expressed or implied by the forward-looking statements,

including, without limitation:

- risks relating to metal price fluctuations;

- risks relating to estimates of mineral resources, production,

capital and operating costs, decommissioning or reclamation

expenses, proving to be inaccurate;

- the inherent operational risks associated with mining and

mineral exploration, development, mine construction and operating

activities, many of which are beyond Panoro’s control;

- risks relating to Panoro’s ability to enforce Panoro’s legal

rights under permits or licenses or risk that Panoro’s will become

subject to litigation or arbitration that has an adverse

outcome;

- risks relating to Panoro’s projects being in Peru, including

political, economic and regulatory instability;

- risks relating to the uncertainty of applications to obtain,

extend or renew licenses and permits;

- risks relating to potential challenges to Panoro’s right to

explore and/or develop its projects;

- risks relating to mineral resource estimates being based on

interpretations and assumptions which may result in less mineral

production under actual circumstances;

- risks relating to Panoro’s operations being subject to

environmental and remediation requirements, which may increase the

cost of doing business and restrict Panoro’s operations;

- risks relating to being adversely affected by environmental,

safety and regulatory risks, including increased regulatory burdens

or delays and changes of law;

- risks relating to inadequate insurance or inability to obtain

insurance;

- risks relating to the fact that Panoro’s properties are not yet

in commercial production;

- risks relating to fluctuations in foreign currency exchange

rates, interest rates and tax rates; and

- risks relating to Panoro’s ability to raise funding to continue

its exploration, development and mining activities.

This list is not exhaustive of the factors that

may affect the forward-looking information and statements contained

in this news release. Should one or more of these risks and

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

in the forward‑looking information. The forward‑looking

information contained in this news release is based on beliefs,

expectations and opinions as of the date of this news

release. For the reasons set forth above, readers are

cautioned not to place undue reliance on forward-looking

information. Panoro does not undertake to update any

forward-looking information and statements included herein, except

in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

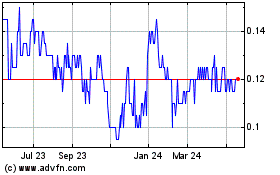

Panoro Minerals (TSXV:PML)

Historical Stock Chart

From Nov 2024 to Dec 2024

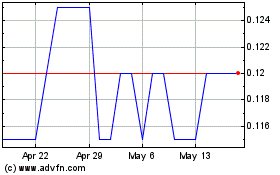

Panoro Minerals (TSXV:PML)

Historical Stock Chart

From Dec 2023 to Dec 2024