Quorum Releases Fiscal Year 2013 Results

30 April 2014 - 12:46AM

Marketwired

Quorum Releases Fiscal Year 2013 Results

Sales, net income and working capital all improve over FY2012

results

CALGARY, ALBERTA--(Marketwired - Apr 29, 2014) - Quorum

Information Technologies Inc. ("Quorum" or the "Company")

(TSX-VENTURE:QIS) today released its Fiscal Year (FY) 2013 results.

Quorum delivers its dealership management system (DMS),

XSellerator™, and related services to automotive dealerships

throughout North America. The Company is both a Dealer Technology

Assistance Program (DTAP) strategic partner with General Motors

Corporation (GM) and a strategic partner with Microsoft. Quorum's

XSellerator product is broadly promoted to its target dealerships

throughout North America by these prominent industry partners.

Quorum also supplies its product to Chrysler, Hyundai, Kia, Nissan,

Subaru, NAPA and Bumper to Bumper franchised dealership

customers.

Maury Marks, Quorum's President and CEO made the following

remarks about the Company's FY2013 operational and financial

results:

Operational results highlights for FY2013 are as follows:

- Key customer metrics are as follows:

- Customer Satisfaction Index ("CSI") semi-annual survey in Q3

FY2013 showed an average of 87% of dealer principals as "satisfied"

or "very satisfied" and an average of 75% of end users as

"satisfied" or "very satisfied" overall. The remaining 13% of

dealer principals reported "somewhat satisfied" and 3/4 of the

remaining 25% of end users reported "somewhat satisfied". The

results are up from our survey in Q1 FY2013 which reported

"satisfied" or "very satisfied" comparative numbers of 75% for

dealer principals and 73% for end users.

- Our monthly Support Center CSI survey reported an average of

over 95% "very satisfied" with the service received from our

support team.

- For our Support services, on average, we now close 73% of all

support calls within 30 minutes (up from 60% in 2008, when we first

started measuring this statistic) and 87% of all calls within 24

hours (up from 81% in 2008).

- Product - during FY2013 we released two new versions of

XSellerator to all of our dealership customers. The following two

ground-breaking product features were included in these versions:

- "Communicator," which transforms how dealership staff

communicate with their customers and each other. Communicator

features text, email and instant message functionality that is

integrated into the XSellerator workflow. The number of email and

texts that Communicator handles, for the 20% of our customers that

utilize the functionality, grew from 7,487 messages in September

2013 to 48,326 in December 2013. This explosive growth coincided

with the release of V4.7.6 which had a number of changes that

allowed us to scale the rollout of Communicator to our customers.

In Q1 and Q2 FY2014 we will focus on a broader rollout of

Communicator to more of our customers.

- Make More Money ("M3") initiative which focuses on ten key

XSellerator processes that drive incremental revenue into our

dealership customers' operations. During our pilot process, in

which we partnered with 11 of our dealership customers, we were

able to generate an increase in monthly service and parts revenue

of over $50,000 per dealership. In Q1 and Q2 FY2014, we will focus

on training more of our dealerships on the M3 processes.

- Employees - none of the Company's accomplishments are possible

without highly motivated, engaged people. Our sincere thanks to the

people that drive Quorum. Every year we measure our staff

engagement and we actively work towards improving our job

satisfaction and engagement throughout the Company.

Financial Results highlights for FY2013 are as follows:

- Quorum's key to growing profits is having a critical mass of

installed dealerships that supply a recurring revenue stream, along

with a well-managed fixed and variable cost structure. Sales

increased by 6% to $7,987K in FY2013 from $7,567K in FY2012 and

margin after direct costs increased to $4,487K in FY2013, from

$4,113K in FY2012, a 9% increase. The increase in sales is due to:

- An increase of $450K in recurring support revenue as a result

of having more active dealership rooftops at the end of FY2013

compared to the end of FY2012;

- A decrease in integration revenue of $126K because Quorum does

not receive paid integration work under the new GM DTAP

program;

- A decrease of $262K in net new revenue which was a result of

completing less installations in FY2013 as compared to FY2012;

and

- An increase of $358K in transitions revenue from converting our

customers to the new Microsoft Windows and SQL Server 2012

products.

- Earnings before interest, taxes, depreciation and amortization

(EBITDA) increased to $1,255K in FY2013 from $848K in FY2012.

Income before deferred income tax expense increased to $471K for

FY2013 compared to $189K in FY2012. The increases in both EBITDA

and income before deferred income tax expense are largely due to:

- $374K increase in margin after direct costs in FY2013 compared

to FY2012;

- $40K decrease in general and administrative expense in FY2013

compared to FY2012; and

- $9K decrease in sales and marketing expense in FY2013 compared

to FY2012.

- Net income for FY2013 was $295K or $0.0075 per share, compared

to net loss of $65K or $0.0017 per share for FY2012. This is a

$360K increase from FY2012 which is due to the above-noted

factors.

- Comprehensive income increased to $409K in FY2013 compared with

a loss of $118K in FY2012 due to a foreign exchange gain in FY2013

of $115K versus a foreign exchange loss in FY2012 of $53K.

- Working capital increased to $1,454K at December 31, 2013

compared with $1,004K at December 31, 2012. Cash increased to $812K

at the end of December 2013 compared with $425K at the end of

December 2012.

2013 was a strong year with revenues up 6% to $7,987K, working

capital up $451K, and income before deferred income tax expense of

$471K. During the year we introduced our innovative Communicator

and Make More Money ("M3") initiatives. These features allow our

dealerships to provide a better level of customer service to their

customers and drive additional revenue into their dealerships. By

the end of Q2 FY2014, we expect to have completed a broader roll

out of these features to our customers. With broader adoption, we

anticipate that our customers' demonstrated results from using

these two features will enhance the value equation that we present

to prospective customers and to help increase sales of new

systems.

My sincere appreciation is extended to Quorum's Board of

Directors and to our employees and consultants who have been

diligent and dedicated in their support of the Corporation's goals

and objectives. My thanks also extend to our investors for their

long-term and continued support of Quorum.

Quorum has filed its 2013 consolidated financial statements and

notes thereto as at and for the period ended December 31, 2013 and

accompanying management's discussion and analysis in accordance

with National Instrument 51-102 - Continuous Disclosure Obligations

adopted by the Canadian securities regulatory authorities.

Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at

www.QuorumDMS.com.

Financial Highlights

|

Year ended December 31, 2013 |

Year ended December 31, 2012 |

|

Year ended December 31, 2011 |

|

|

|

|

|

| Gross revenue |

$ |

7,986,772 |

$ |

7,566,580 |

|

$ |

7,727,502 |

|

|

|

|

|

|

|

|

| Direct costs |

|

3,499,641 |

|

3,453,317 |

|

|

3,280,810 |

|

|

|

|

|

|

|

|

| Margin after direct costs |

|

4,487,131 |

|

4,113,263 |

|

|

4,446,692 |

|

|

|

|

|

|

|

|

| Earnings before interest, taxes, depreciation and

amortization (EBITDA) |

|

1,254,890 |

|

847,906 |

|

|

1,307,465 |

|

|

|

|

|

|

|

|

| Income before deferred income tax |

|

470,924 |

|

188,588 |

|

|

611,124 |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

294,686 |

|

(65,237 |

) |

|

331,147 |

|

|

|

|

|

|

|

|

| Comprehensive income (loss) |

|

409,402 |

|

(118,488 |

) |

|

371,523 |

|

|

|

|

|

|

|

|

| Basic net income (loss) per share |

$ |

0.008 |

$ |

(0.002 |

) |

$ |

0.008 |

| Fully diluted net income (loss) per share |

$ |

0.008 |

$ |

(0.002 |

) |

$ |

0.008 |

|

|

|

|

|

|

|

|

| Weighted average number of common shares |

|

|

|

|

|

|

|

|

Basic |

|

39,298,438 |

|

39,298,438 |

|

|

39,298,438 |

|

Diluted |

|

39,298,438 |

|

39,298,438 |

|

|

39,298,438 |

|

|

|

|

|

|

|

|

About Quorum

Quorum is a North American company focused on developing,

marketing, implementing and supporting its XSellerator product for

GM, Chrysler, Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to

Bumper dealerships. XSellerator is a dealership and customer

management software product that automates, integrates and

streamlines every process across departments in a dealership. One

of the select North American suppliers under General Motors' DTAP

program, Quorum is also one of largest DMS provider for GM's

Canadian dealerships with 25% of the market. Quorum is a Microsoft

Partner in both Canada and the United States. Quorum Information

Technologies Inc. is traded on the Toronto Venture Exchange (TSX-V)

under the symbol QIS. For additional information please go to

www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking

statements and forward-looking information ("forward-looking

information") within the meaning of applicable Canadian securities

laws. Forward-looking information is often, but not always,

identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate",

"expect", "may", "will", "project", "should" or similar words

suggesting future outcomes. In particular, this press release

includes forward-looking information relating to results of

operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such

forward-looking information are reasonable but no assurance can be

given that these expectations will prove to be correct and such

forward-looking information should not be unduly relied

upon.

Forward-looking information is not a guarantee of future

performance and involves a number of risks and uncertainties some

of which are described herein. Such forward-looking information

necessarily involves known and unknown risks and uncertainties,

which may cause Quorum's actual performance and financial results

in future periods to differ materially from any projections of

future performance or results expressed or implied by such

forward-looking information. These risks and uncertainties include

but are not limited to the risks identified in Quorum's

Management's Discussion and Analysis for the year ended December

31, 2013. Any forward-looking information is made as of the date

hereof and, except as required by law, Quorum assumes no obligation

to publicly update or revise such information to reflect new

information, subsequent or otherwise.

The TSX

Venture Exchange does not accept responsibility for the adequacy or

accuracy of this release.

Quorum Information Technologies Inc.Maury Marks403-777-0036 ext

104MarksM@QuorumDMS.com

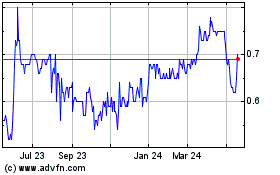

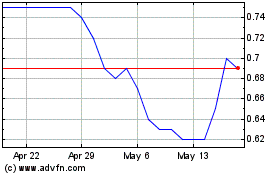

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Dec 2023 to Dec 2024