Reconnaissance Energy Africa Ltd. (the “

Company”

or “

ReconAfrica”) (TSXV: RECO) (OTCQX: RECAF)

(Frankfurt: 0XD) announces it has signed a letter agreement

(“

Letter Agreement”), for a strategic farm down of

Petroleum Exploration Licence 73 (“

PEL 73”),

onshore Namibia with BW Energy Limited (“

BW

Energy”) (OSE: BWE), for a 20% working interest. In

connection with the Letter Agreement, BW Energy has agreed to a

strategic equity investment in the Company for US$16 million

(approximately C$22 million), pursuant to the brokered equity

offering, as defined below.

The Company has also entered into an agreement

with Research Capital Corporation as the lead underwriter and sole

bookrunner, on behalf of a syndicate of underwriters, in connection

with an overnight marketed public offering of units of the Company

(the “Units”) at a price of C$1.25 per Unit for

gross proceeds of C$35 million (the “Offering”).

Each Unit will be comprised of one common share of the Company (a

“Common Share”), and one Common Share purchase

warrant of the Company (a “Warrant”). Each Warrant

will entitle the holder thereof to purchase one Common Share at an

exercise price of C$1.75 at any time up to 24 months from closing

of the Offering, subject to an acceleration provision as detailed

further below.

The net proceeds from the Offering will be used

for exploration activities, working capital and general corporate

purposes.

Key Highlights of Letter

Agreement:

- Working interest sold to BW Energy

is 20%

- BW Energy to participate in two

Damara Fold Belt exploration wells and a 3D seismic program, with

an option to participate in two Rift Basin exploration wells over

2-year period

- US$16 million (C$22 million),

equity investment supporting the exploration program

- US$45 million (C$62 million), bonus

earned at declaration of commerciality (final investment decision),

providing additional capital carry through to first production

- US$80 million (C$109 million), of

production bonuses based on certain cash flow milestones achieved

by BW Energy

- US$141 million (C$192 million),

total potential consideration, including all incentives and

production bonuses which is paid after achieving positive free cash

flow

- The joint venture structure

preserves a 70% working interest in PEL 73 for ReconAfrica,

exposing shareholders to significant upside on success

- Provides alignment with strategic

partner to explore both the Damara Fold Belt and Kavango Rift Basin

with significant in country expertise on oil and gas monetization

markets

Brian Reinsborough, President and CEO

commented: “We are delighted to welcome BW Energy as our

partner in Namibia where we plan to drill a multi-well exploration

program and acquire a 3D seismic program in the Rift Basin. Our

farm out joint venture process was thorough and comprehensive,

which attracted significant interest from high quality companies of

all sizes. BW Energy’s offer met our guidelines to ensure strategic

alignment for a multi-well exploration drilling program while

retaining significant upside exposure on success. We continue to

execute our strategic priorities set out last year with the Company

on track to drill a portfolio of opportunities in the Damara Fold

Belt and the Kavango Rift Basin. The first well, Naingopo, is

currently drilling, and is supported by BW Energy whose

high-quality technical team will add significant value to the

execution of our forward exploration plans. This partnership

provides ReconAfrica with a strategic partner with a high-quality

technical and operational team which compliments ours along with a

shared view to expand the oil and gas potential in Namibia.

Additionally, we look forward to continuing to work closely with

NAMCOR, the Ministry of Mines and Energy in Namibia for the benefit

of all parties, including Namibia and its people.”

Carl K. Arnet, BW Energy CEO

commented: “The transaction will enable BW Energy to

expand its footprint in a strategically important energy region and

further our position as a leader in Namibia’s development towards

energy independence. The data and insights gained through

ReconAfrica’s exploration campaign will further our understanding

of the geology and petroleum system in Namibia and help de-risk

planned exploration and development of our Kudu licence.”

Strategic Farm Down

Transaction

ReconAfrica is selling a 20% working interest in

PEL 73, onshore northeast Namibia, to BW Energy, in exchange for

total potential consideration of US$141 million (C$193 million),

including US$16 million (C$22 million), equity investment and an

additional US$45 million (C$62 million) in carry payments based on

achievement of commerciality (final investment decision). These

payments will be paid in two installments, one at FID and the

second payment one year after production. In the event of

development of discoveries, production milestone payments could

total an additional US$80 million (C$109 million). Three separate

production payments of US$25 million (C$34 million), are made after

BW Energy reaches certain free cash flow milestones. An additional

first production payment of US$5 million (C$7 million), is paid

sixty days after the start of commercial production. On completion

of the transaction, the ownership interests in PEL 73 will be;

ReconAfrica 70%, BW Energy 20%, and NAMCOR 10%. ReconAfrica remains

the operator of PEL 73.

Completion of the transaction is subject to the

satisfaction of customary closing conditions, including entering

into a definitive farm down agreement and approvals from NAMCOR

(the state oil company of Namibia) and the Ministry of Mines and

Energy in Namibia.

Multi-Well Exploration Drilling Campaign

and Development Capital

The Joint Venture transaction has been

structured to provide tiers of financing to cover capital

requirements in each of the phases of exploration, development and

production.

Together with the concurrent Offering, the

Company has the financial runway to execute a high impact

multi-well exploration drilling program with play opening exposure

in the Damara Fold Belt, on a 100% working interest basis, to over

17.1 billion barrels of undiscovered original oil-in-place,

consisting of 3.4 billion barrels of unrisked prospective oil

resources, based on the most recent prospective resource report

prepared by Netherland, Sewell & Associates Inc.

(“NSAI”), dated March 12, 2024(1) (as announced in

a press release dated March 14, 2024). On exploration success, the

Company has built-in bonus payments to fund the program to first

production. On commencement of commercial production, the

transaction further exposes shareholders to certain production

payments based on cash flow milestones.

(1) There is no certainty that any portion of

the resources will be discovered. If discovered, there is no

certainty that it will be commercially viable to produce any

portion of the resources. Prospective resources are those

quantities of oil estimated, as of a given date, to be potentially

recoverable from undiscovered accumulations by application of

future development projects. Prospective resources have both an

associated chance of discovery and a chance of development.

Prospective resources are the arithmetic sum of multiple

probability distributions. Unrisked prospective resources are

estimates are the volumes that could reasonably be expected to be

recovered in the event of the discovery and development of these

prospects. Namibian Stock Exchange Listing

The Company intends to apply, in the near

future, for a dual-listing on the Namibian Stock Exchange,

alongside its existing listing on the TSXV in Canada, to further

broaden our global exposure.

Equity Offering Details

The Company has granted to the Underwriters an

option (the “Over-Allotment Option”), exercisable,

in whole or in part, in the sole discretion of the Underwriters, to

purchase up to an additional number of Units, and/or the components

thereof, that in aggregate would be equal to 15% of the total

number of Units to be issued under the Offering, to cover

over-allotments, if any, and for market stabilization purposes,

exercisable at any time and from time to time up to 30 days

following the closing of the Offering.

All Units purchased by BW Energy will be subject

to a six-month lock-up agreement.

In the event that, at any time four months and

one day after the date of issuance and prior to the expiry date of

the Warrants, the moving volume weighted average trading price of

the Common Shares on the TSX Venture Exchange

(“Exchange”), or other principal exchange on which

the Common Shares are listed, is equal to or greater than C$3.70

for any 20 consecutive trading days, the Company may, within 10

business days of the occurrence of such event, deliver a notice to

the holders of Warrants accelerating the expiry date of the

Warrants to the date that is 30 days following the date of such

notice (the “Accelerated Exercise Period”). Any

unexercised Warrants shall automatically expire at the end of the

Accelerated Exercise Period.

The Offering is expected to be completed

pursuant to an underwriting agreement to be entered into by the

Company and the Underwriters. The closing of the Offering is

expected to occur on or about July 31, 2024 (the

“Closing”), or such other earlier or later date as

the Underwriters may determine. Closing is subject to the Company

receiving all necessary regulatory approvals, including the

approval of the Exchange to list, on the date of Closing, the

Common Shares, and the Common Shares issuable upon exercise of the

Warrants and the Underwriters’ broker warrants, on the Exchange. In

addition, the Company will use commercial reasonable efforts to

obtain the necessary approvals to list the Warrants on the

Exchange.

In connection with the Offering, the Company

intends to file a prospectus supplement, to the Company’s short

form base shelf prospectus dated February 29, 2024, with the

securities regulatory authorities in each of the provinces of

Canada (except Québec). Copies of the base shelf prospectus and any

supplement thereto to be filed in connection with the Offering, are

and will be available under the Company’s profile on SEDAR+ at

www.sedarplus.ca. The Units are being offered in each of the

provinces of Canada (except Québec) and may be offered in the

United States on a private placement basis pursuant to an

appropriate exemption from the registration requirements under

applicable U.S. law, and outside of Canada and the United States on

a private placement or equivalent basis.

This press release is not an offer to sell or

the solicitation of an offer to buy the securities in the United

States or in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to qualification or registration under

the securities laws of such jurisdiction. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States or

to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from U.S. registration

requirements and applicable U.S. state securities laws.

About BW Energy Limited

BW Energy is a growth E&P company with a

differentiated strategy targeting proven offshore oil and gas

reservoirs through low risk phased developments. The Company has

access to existing production facilities to reduce time to first

oil and cashflow with lower investments than traditional offshore

developments. The Company's assets are 73.5% of the producing

Dussafu Marine licence offshore Gabon, 100% interest in the

Golfinho and Camarupim fields, a 76.5% interest in the BM-ES-23

block in, a 95% interest in the Maromba field in Brazil and a 95%

interest in the Kudu field in Namibia, all operated by BW

Energy.

BW Energy, 74% owned by BW Group Ltd., was

created as the E&P arm of Oslo listed BW Offshore, a company

with more than four decades of experience in operating advanced

offshore production solutions and executing complex projects. Since

its origin, BW Offshore has executed 40 FPSO and FSO projects.

About ReconAfrica

ReconAfrica is a Canadian oil and gas company

engaged in the opening of the newly discovered Kavango Sedimentary

Basin in the Kalahari Desert of northeastern Namibia and

northwestern Botswana, where the Company holds petroleum licences

comprising ~8 million contiguous acres. In all aspects of its

operations ReconAfrica is committed to minimal disturbance of

habitat in line with international standards and will implement

environmental and social best practices in all of its project

areas.

Neither the TSXV nor its Regulation Services

Provider (as that term is defined in policies of the TSXV) accepts

responsibility for the adequacy or accuracy of this release.

For further information

contact:

Brian Reinsborough, President and Chief

Executive Officer | Tel: +1-877-631-1160Grayson Andersen, Vice

President Investor Relations | Tel: +1-877-631-1160

Email:

admin@reconafrica.comIR Inquiries Email:

investors@reconafrica.comMedia Inquiries Email:

media@reconafrica.com

Cautionary

Note Regarding

Forward-Looking Statements:

Certain statements contained in this press

release constitute forward-looking information under applicable

Canadian, United States and other applicable securities laws, rules

and regulations, including, without limitation, statements with

respect to the completion of the strategic joint venture

transaction, the timing and amount of cash payments relating to the

joint venture transaction, the timing and amount of any bonus

payments, the timing and amount of production milestone payments,

entering into a definitive agreement, the drilling of four

exploration wells, the undertaking of additional seismic

acquisition, statements with respect to prospective resources of

oil and natural gas, the financing of exploration, development and

production related costs, the expected use of proceeds from the

Offering, the expected closing date of the Offering, the completion

of the Offering being subject to the receipt of all necessary

regulatory approvals, including acceptance of the TSXV, any

potential acceleration of the expiry date of the Warrants, the

listing of the Warrants, and the Company’s commitment to minimal

disturbance of habitat, in line with best international standards

and its implementation of environmental and social best practices

in all of its project areas. These statements relate to future

events or future performance. The use of any of the words "could",

"intend", "expect", "believe", "will", "projected", "estimated" and

similar expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on ReconAfrica's current belief or

assumptions as to the outcome and timing of such future events.

There can be no assurance that such statements will prove to be

accurate, as the Company's actual results and future events could

differ materially from those anticipated in these forward-looking

statements as a result of the factors discussed in the "Risk

Factors" section in the Company's annual information form dated

December 4, 2023, available under the Company's profile at

www.sedarplus.ca. Actual future results may differ materially.

Various assumptions or factors are typically applied in drawing

conclusions or making the forecasts or projections set out in

forward-looking information. Those assumptions and factors are

based on information currently available to ReconAfrica. The

forward-looking information contained in this release is made as of

the date hereof and ReconAfrica undertakes no obligation to update

or revise any forward-looking information, whether as a result of

new information, future events or otherwise, except as required by

applicable securities laws. Because of the risks, uncertainties and

assumptions contained herein, investors should not place undue

reliance on forward-looking information. The foregoing statements

expressly qualify any forward-looking information contained

herein.

Disclosure of Oil and Gas

Information:

The report of Netherland, Sewell &

Associates, Inc. (“NSAI”) entitled “Estimates of Prospective

Resources to the Reconnaissance Energy Africa Ltd. Interests in

Certain Opportunities Located in Damara Fold and Thrust Belt Play

Area in Petroleum Exploration Licence 73, Kavango Basin, Namibia as

of February 29, 2024” (the “NSAI Report”) and the prospective

resource estimates contained therein and in this press release were

prepared by NSAI, an independent qualified reserves evaluator, with

an effective date of February 29, 2024. The NSAI Report was

prepared in accordance with the definitions and guidelines of the

Canadian Oil and Gas Evaluation Handbook prepared jointly by the

Society of Petroleum and Engineers (Calgary Chapter) (the “COGE

Handbook”) and the Canadian Institute of Mining, Metallurgy &

Petroleum and National Instrument 51-101 – Standards of Disclosure

for Oil and Gas Activities (“NI 51-101”). For additional

information concerning the risks and the level of uncertainty

associated with recovery of the prospective resources detailed

herein and in the NSAI Report, the significant positive and

negative factors relevant to the prospective resources estimates

detailed herein and in the NSAI Report and a description of the

project to which the prospective resources estimates detailed

herein and in the NSAI Report applies are contained within the NSAI

Report, a copy of which has been filed with the Canadian Securities

Administrators and is available under the Company’s issued profile

on SEDAR+ at www.sedarplus.ca.

The prospective resources shown in the NSAI

Report have been estimated using probabilistic methods and are

dependent on a petroleum discovery being made. If a discovery is

made and development is undertaken, the probability that the

recoverable volumes will equal or exceed the unrisked estimated

amounts is 90 percent for the low estimate, 50 percent for the best

estimate, and 10 percent for the high estimate. Low estimate and

high estimate prospective resources have not been included in the

NSAI Report. For the purposes of the NSAI Report, the volumes and

parameters associated with the best estimate scenario of

prospective resources are referred to as 2U. The 2U prospective

resources have been aggregated beyond the prospect and lead level

by arithmetic summation; therefore, these totals do not include the

portfolio effect that might result from statistical aggregation.

Statistical principles indicate that the arithmetic sums of

multiple estimates may be misleading as to the volumes that may

actually be recovered.

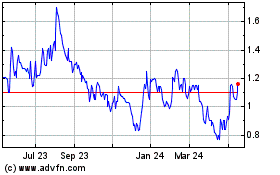

Reconnaissance Energy Af... (TSXV:RECO)

Historical Stock Chart

From Nov 2024 to Dec 2024

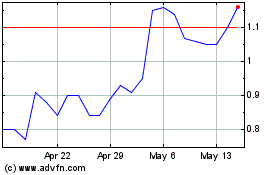

Reconnaissance Energy Af... (TSXV:RECO)

Historical Stock Chart

From Dec 2023 to Dec 2024