Royal Helium Ltd. (TSXV:RHC) (OTCQB:RHCCF)

("

Royal" or the "

Company") is

pleased to announce that it has entered into an agreement with

Research Capital Corporation as the lead underwriter and sole

bookrunner, on behalf of a syndicate of underwriters (collectively,

the “

Underwriters”), pursuant to which the

Underwriters has agreed to purchase, on a bought deal basis,

66,667,000 units of the Company (the “

Units”) at a

price of $0.09 per Unit for aggregate gross proceeds to the Company

of $6,000,030 (the "

Offering").

Each Unit shall be comprised of one common share

of the Company (a "Common Share") and one Common

Share purchase warrant of the Company (a

"Warrant"). Each Warrant shall entitle the holder

thereof to purchase one Common Share at an exercise price of $0.12

per Common Share for a period of 36 months following closing of the

Offering. In addition, the Company will use commercial reasonable

efforts to obtain the necessary approvals to list the Warrants on

the TSX Venture Exchange (“Exchange”).

The net proceeds from the Offering will be used

for new high-impact drilling on the 40 Mile project in southern

Alberta, development through the Saskatchewan helium corridor,

completion and testing of an existing discovery at the Ogema

project, working capital and general corporate purposes. See below

for project details.

The Company has granted to the Underwriters an

option (the “Over-Allotment Option”) to increase

the size of the Offering by up to an additional number of Units,

and/or the components thereof, that in aggregate would be equal to

15% of the total number of Units to be issued under the Offering,

to cover over-allotments, if any, and for market stabilization

purposes, exercisable at any time and from time to time up to 30

days following the closing of the Offering.

The closing of the Offering is expected to occur

on or about May 1, 2024 (the “Closing”), or such

other earlier or later date as the Underwriters may determine.

Closing is subject to the Company receiving all necessary

regulatory approvals, including the approval of the Exchange to

list, on the date of Closing, the Common Shares, and the Common

Shares issuable upon exercise of the Warrants and the Underwriters’

broker warrants, on the Exchange.

In connection with the Offering, the Company

intends to file a prospectus supplement (the “Prospectus

Supplement”) to the Company’s short form base shelf

prospectus dated September 28, 2022 (the “Shelf

Prospectus”) following pricing of the Offering with the

securities regulatory authorities in each of the provinces and

territories of Canada (except Quebec). Copies of the Shelf

Prospectus and the Prospectus Supplement to be filed in connection

with the Offering, can be found on SEDAR+ at www.sedarplus.ca. The

Shelf Prospectus and the Prospectus Supplement will contain,

important detailed information about the Company and the Offering.

Prospective investors should read the Prospectus Supplement and

accompanying Shelf Prospectus and the other documents the Company

has filed on SEDAR+ at www.sedarplus.ca before making an investment

decision.

Steveville Helium Purification Facility,

Alberta: Ramping up and continuing sales

Since officially coming online at the end

December 2023, Royal has delivered 9 trailers of high purity helium

to its end customer in the aerospace and defence industry. As a

reminder, this customer has entered into offtake agreements with

Royal to purchase all of the helium volumes from this flagship

facility; these two offtake agreements are at an average net sales

price of approximately USD $500 per mcf or approximately CAD $700

per mcf. Given the increasing demand for purified helium,

Royal Helium anticipates a robust pricing environment for the

foreseeable future.

Royal Helium is continuing to ramp up its

throughout volumes through the plant site and steadily increase the

number of helium trailers leaving the plant gate and is expected to

reach an optimal run rate capacity volume over the coming months.

The processing facility at Steveville is being fed by highly

productive Devonian horizons that will provide material cash flow

to Royal through the offtake agreements that are already in

place.

The Steveville plant is designed to process

15,000 mcf/day of raw gas fed by the two 100% owned helium wells at

Steveville, Alberta and produce 22,000 mcf of 99.999% helium per

year. The engineered life of the plant is 25 years, produces enough

fuel gas to power the plant itself, and is capable of producing up

to 22,000,000 pounds of commercial CO2. Royal has also recently

entered into its first offtake agreement for the sale of food and

beverage grade CO2 from its Steveville facility. This initial CO2

offtake agreement significantly expands the overall economics and

cashflows of the plant facility with this new offtake to primarily

serve markets in the Pacific Northwest Region of the United

States.

40-Mile Project, Alberta: High Impact

New Appraisal Drilling

In 2023, Royal acquired its newest project area

in southern Alberta. Acquired under a seismic option agreement with

an independent private vendor, the 40 Mile project is comprised of

7,000 acres and boasts one historic well that was drilled, flow

tested and assayed. This well flowed at exceptionally high rates

during initial testing and returned helium concentrations exceeding

anything that Royal has tested or produced to date.

Royal completed seismic work at 40 Mile in 2023

and has multiple seismically defined drill targets across multiple

prospective zones. Royal plans to drill a high impact well on the

40 Mile project in H2 2024.

Climax/Cadillac: Core Project,

Saskatchewan: Developing in the Existing Helium

Fairway

The Core of Royal’s Saskatchewan lands are

located within the prolific Southwestern Saskatchewan Helium

fairway that features highly economic helium concentrations coupled

with multiple helium purification facilities near its borders.

Royals technical team has completed extensive geological and

geophysical subsurface work in the Climax/Cadillac corridor and,

with many new analog wells adjacently offsetting these core lands,

the team has identified and selected numerous new drilling targets

among these three project areas.

The amount of drilling and testing data

available in the area has helped verify Royal’s subsurface model

and has enabled the team to understand the different Helium play

types that are found in Saskatchewan and more importantly on Royal

leasehold.

Royal has several seismically defined drilling

targets in the Climax/Cadillac corridor that it intends to drill in

a follow-on program to the initial drilling already completed.

Ogema Project, Saskatchewan: Testing of

an Already Drilled Discovery

The Ogema project in south central Saskatchewan

comprises more than 60,000 acres and is home to the eastern most

helium wells drilled in Saskatchewan. Drilled in 2021, Royal

received helium concentration tests results of 0.60-0.70%. The

Company now intends to complete and test the newly acquired rights

to the Ordovician Red River formation within the wellbore with the

view of making a production and plant decision, once final testing

of both concentration and flow rate have been completed.

The Red River formation in south central and

southeastern Saskatchewan has long been a prolific oil and gas

producing formation that boasts helium prospectivity with numerous

shows across the province. This formation has returned some of the

highest concentrations of helium historically in Canada, with test

results as high as 2.45%.

Strategic $25 Million Joint Venture and

Economic Partnership with Sparrow Hawk for New Multi-well

Development and Plant Construction on the Val Marie Project in

Saskatchewan

As announced on April 16, 2024, Royal Helium has

entered into an economic partnership with Sparrow Hawk Developments

Ltd. to develop the Royal’s next core area for helium production.

Under the terms of a signed Economic Participation Agreement and

letter of intent, Sparrow Hawk Developments Ltd. will fund

$25,000,000 into the drilling and completion of new wells (drill,

test and tie-in 4 to 5 new development wells), as well as the

construction of the associated helium purification facility.

Pursuant to the agreement terms, Sparrow Hawk will have an

approximate 57.5% non-operating working interest in the wells and

an approximate 46% non-operating interest in the processing

facility. The Val Marie helium project comprises a 32,000-acre,

21-year lease land package representing approximately 3% of Royal's

current helium permit and lease lands across Saskatchewan and

Alberta. Royal Helium will operate the newly constructed plant

facility and multi-well development.

This press release is not an offer to sell or

the solicitation of an offer to buy the securities in the United

States or in any jurisdiction in which such offer, solicitation or

sale would be unlawful prior to qualification or registration under

the securities laws of such jurisdiction. The securities being

offered have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and such

securities may not be offered or sold within the United States or

to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from U.S. registration

requirements and applicable U.S. state securities laws.

About Royal Helium Ltd.

Royal Helium is an exploration, production, and

infrastructure company with a primary focus on the development and

production of helium and associated gases. The Company’s extensive

footprint includes prospective helium permits and leases across

southern Saskatchewan and southeastern Alberta. Given the current

and foreseeable global undersupplied nature of this critical and

non-renewable product, Royal is well positioned to be a leading

North American producer of this increasingly high value

commodity.

Royal Helium’s helium reservoirs are carried

primarily with nitrogen. Nitrogen is not considered a greenhouse

gas (GHG) and therefore the plant has a low GHG footprint when

compared to plants in other jurisdictions that rely on large scale

natural gas production for helium extraction. Helium extracted from

wells in Saskatchewan and Alberta can be up to 90% less carbon

intensive than helium extraction processes in other

jurisdictions.

Andrew DavidsonPresident and Chief Executive

OfficerRoyal Helium Ltd.

For more information, please contact:

For Royal Helium Ltd :Spiro KletasVP Investor

Relations 1

(306)

500-9397spiro@royalheliumltd.com

Dean NawataBusiness Development1 (306)

500-9420dean@royalheliumltd.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION

This news release includes certain statements

and information that constitute forward-looking information within

the meaning of applicable Canadian securities laws. All statements

in this news release, other than statements of historical facts are

forward-looking statements. Such forward-looking statements and

forward-looking information specifically include, but are not

limited to, statements that relate to the completion of the

Offering and the timing thereof, the use of proceeds of the

Offering, the exercise by the Underwriters of the Over-Allotment

Option, the timely receipt of all necessary approvals, including

any requisite approval of the TSX Venture Exchange.

Statements contained in this release that are

not historical facts are forward-looking statements that involve

various risks and uncertainty affecting the business of the

Company. Such statements can generally, but not always, be

identified by words such as “expects”, “plans”, “anticipates”,

“intends”, “estimates”, “forecasts”, “schedules”, “prepares”,

“potential” and similar expressions, or that events or conditions

“will”, “would”, “may”, “could” or “should” occur. All statements

that describe the Company’s plans relating to operations and

potential strategic opportunities are forward-looking statements

under applicable securities laws. These statements address future

events and conditions and are reliant on assumptions made by the

Company’s management, and so involve inherent risks and

uncertainties, as disclosed in the Company’s periodic filings with

Canadian securities regulators. As a result of these risks and

uncertainties, and the assumptions underlying the forward-looking

information, actual results could materially differ from those

currently projected, and there is no representation by the Company

that the actual results realized in the future will be the same in

whole or in part as those presented herein. the Company disclaims

any intent or obligation to update forward-looking statements or

information except as required by law. Readers are referred to the

additional information regarding the Company’s business contained

in the Company’s reports filed with the securities regulatory

authorities in Canada. Although the Company has attempted to

identify important factors that could cause actual actions, events,

or results to differ materially from those described in

forward-looking statements, there may be other factors that could

cause actions, events or results not to be as anticipated,

estimated or intended. For more information on the Company and the

risks and challenges of its business, investors should review the

Company’s filings that are available at www.sedarplus.ca.

The Company provides no assurance that

forward-looking statements and information will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements or

information. Accordingly, readers should not place undue reliance

on forward-looking statements or information. The Company does not

undertake to update any for-ward looking statements, other than as

required by law.

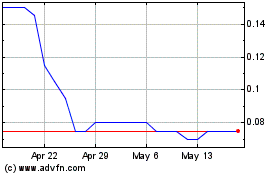

Royal Helium (TSXV:RHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

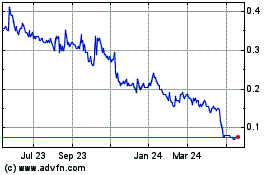

Royal Helium (TSXV:RHC)

Historical Stock Chart

From Nov 2023 to Nov 2024