DREAM Reports 2014 First Quarter Results

13 May 2014 - 5:43AM

Marketwired Canada

This news release contains forward-looking information that is based upon

assumptions and is subject to risks and uncertainties as indicated in the

cautionary note contained within this press release.

DREAM Unlimited Corp. (TSX:DRM)(TSX:DRM.PR.A) ("DREAM") today announced its

financial results for the three months ended March 31, 2014. Basic earnings per

share (EPS) for the first quarter of 2014 was $0.12.

Although the first quarter is not typically a significant period for DREAM's

overall core business and development activities, it was a very eventful start

to the year for the company. During and subsequent to the quarter we:

- completed our first ever bought-deal equity offering of $57.8 million

(gross proceeds, including over-allotment) through the issuance of 3.68

million Class A subordinate voting shares, which closed on April 29,

2014;

- entered into an agreement to acquire an interest in a development project

in Ottawa's National Capital Region consisting of 37 acres - the

development of these lands represents one of the largest urban

redevelopment opportunities in either Ottawa or Gatineau; and

- entered into an agreement to complete the re-organization of four funds

currently managed by Return on Innovation Advisors Ltd. ("ROI"), pursuant

to which approximately $700 million of net assets will be transferred to

a newly formed trust called the Dream Hard Asset Alternatives Trust

(Dream Alternatives). Provided certain conditions are satisfied, upon

successful completion of the reorganization, Dream Alternatives will be

managed by the asset management division of DREAM. A preliminary long-

form prospectus for Dream Alternatives is expected to be filed on SEDAR

on or about May 15, 2014.

"In the first quarter we have demonstrated how we can leverage both our land and

asset management divisions with our existing platform, capabilities and

expertise," commented Michael Cooper, Chief Executive Officer. "We have had a

strong start to the year, with our first quarter earnings results also exceeding

our internal expectations."

A summary of our 2014 first quarter results is included in the table below.

Three months ended March 31,

------------------------------

(in thousands of CDN dollars, except per share

amounts) 2014 2013

----------------------------------------------------------------------------

Revenue $ 83,924 $ 121,907

Net margin (1) $ 23,769 $ 31,371

Net margin % (1) 28.3% 25.7%

Earnings for the period before tax $ 20,730 $ 30,550

Earnings for the period $ 13,627 $ 22,054

Basic earnings per share $ 0.12 $ 0.20

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) "Net margin" represents revenue less direct operating costs and asset

management and advisory services expenses; including selling, marketing

and other operating costs.

Note: Basic EPS is computed by dividing DREAM's earnings attributable to owners

of the parent by the weighted average number of DREAM Subordinate Voting Shares

and DREAM Class B shares outstanding during the year.

Other Key Highlights:

- In the three month period ended March 31, 2014, we completed 100 lot

sales, 15 acre sales, 38 housing unit occupancies and 140 condominium

unit occupancies (71 condominium unit occupancies at DREAM's share).

- We continue to advance approvals for approximately 2,000 acres of

development land in Regina and 665 acres in Saskatoon.

- Land acquisitions in the three months ended March 31, 2014 totalled $15.1

million, representing 235 acres of additional land in Edmonton.

- Development of the Toronto 2015 Pan/Parapan American Games Athletes'

Village project that will evolve after the Games into a mixed use

neighbourhood known as the Canary District, is now approximately 78%

complete and is on time and on budget.

Each year, the BILD Awards (Building Industry Land Development

Association) recognize the very best of the GTA's developments. We are

proud to announce that the Canary District Condominiums, as part of the

Toronto 2015 Pan/Parapan American Athletes' Village won for Best

Community of The Year - High Rise. The award recognizes the unique mixed-

use urban village being developed in the heart of downtown Toronto.

- Effective today, we are launching the new Dream brand across our

divisions. As a result, the names of some of our divisions and funds will

change.

- Land Development: Dundee Developments is now Dream Development

- Housing Development: Homes by Dundee is now Homes by Dream

- Asset Management and Advisory Services: Dundee REIT is Dream Office

REIT, Dundee Industrial REIT is Dream Industrial REIT and Dundee

International REIT is Dream Global REIT.

Selected financial operating metrics for the three months ended March 31, 2014

are summarized below.

Traditionally, our highest sales volume quarter for our land and housing

divisions has been the fourth quarter, while our lowest has been the first

quarter. In the first quarter of 2013, we experienced higher lot sales than

would be typical within our business, due to a significant amount of delayed lot

sales recorded in that period. Therefore we note that there is limited direct

comparability in the year over year results within the land development business

segment.

Selected Operating Metrics

----------------------------------------------------------------------------

Three months ended March 31,

----------------------------------------------------------------------------

(in thousands of Canadian dollars) 2014 2013

----------------------------------------------------------------------------

LAND DEVELOPMENT

----------------------------------------------

Revenue(i) $ 20,550 $ 54,402

Net Margin(i) $ 6,357 $ 17,322

Net Margin 30.9% 31.8%

Lots Sold 100 380

Average selling price - lot units $ 116,300 $ 117,400

Acres Sold 15 19

Average selling price - acre units $ 611,000 $ 522,100

HOUSING DEVELOPMENT

----------------------------------------------

Housing units occupied 38 49

Backlog 58 126

Revenue(i) $ 15,850 $ 20,824

Net margin(i) $ 1,231 $ 3,168

Net margin 7.8% 15.2%

Average selling price - housing units $ 417,000 $ 425,000

(i) Results include land revenues and net margin on internal lot sales to

our housing division, as the homes have been sold to external customers by

the housing division during the period. Revenues (and net margin) results

of $2.1 million ($0.7 million) in Q1 2014 and $3.5 million ($1.1 million)

in Q1 2013, recognized in both the land and housing divisions have been

eliminated on consolidation.

CONDOMINIUM DEVELOPMENT

----------------------------------------------

Attributable to DREAM, excluding equity

accounted investments

Condominium occupancies (units) 71 78

Revenue $ 25,974 $ 28,577

Net margin $ 8,802 $ 3,190

Net margin 33.9% 11.2%

Average selling price of condominiums occupied

Per unit $ 320,600 $ 368,300

Per square foot $ 483 $ 484

Pre-sold condominiums (units) 400 459

ASSET MANAGEMENT AND ADVISORY SERVICES

----------------------------------------------

Fee earning assets under management - listed

funds $ 10,743,990 $ 9,238,912

Revenue $ 9,876 $ 11,184

Net margin $ 5,010 $ 7,464

Net margin 50.7% 66.7%

INVESTMENT AND RECREATIONAL PROPERTIES

----------------------------------------------

Revenue $ 13,782 $ 10,450

Net margin $ 3,093 $ 1,308

Net margin 22.4% 12.5%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Capital Structure

At April 30, 2014, DREAM had 76.3 million shares Class A subordinate voting

shares outstanding. Including the non-controlling interest, the capitalization

was $1.7 billion and the enterprise value was $2.0 billion. Our

debt-to-enterprise value was approximately 18%.

We believe our capital structure remains conservative, which offers significant

flexibility to grow the business over time by seeking out new opportunities

where we can use our experience, expertise and relationships to achieve

attractive risk adjusted returns.

Other Information

Information appearing in this news release is a select summary of results. The

financial statements and management's discussion and analysis for the Company

are available at www.dream.ca and on www.sedar.com.

Conference Call

Senior management will host a conference call to discuss the results tomorrow,

May 13 at 9:00 a.m. (ET). To access the call, please dial 1-866-229-4144 in

Canada and the United States or 416-216-4169 elsewhere and use passcode 8674

239#.

To access the conference call via webcast, please go to DREAM's website at

www.dream.ca and click on the link for Investors, then click on Calendar of

Events. A taped replay of the conference call and the webcast will be available

for 90 days.

Annual General Meeting

Our annual general meeting will be held at our corporate offices in Toronto, at

30 Adelaide Street East, 3rd Floor on May 12, 2014 at 4:00 p.m. (ET).

About DREAM Unlimited Corp.

DREAM is one of Canada's leading real estate companies with approximately $13.5

billion of assets under management in North America and Europe. The scope of the

business includes residential land development, housing and condominium

development, asset management for three TSX-listed real estate investment

trusts, investments in and management of Canadian renewable energy

infrastructure and commercial property ownership. DREAM has an established track

record for being innovative and for its ability to source, structure and execute

on compelling investment opportunities.

Forward Looking Information

This press release may contain forward-looking information within the meaning of

applicable securities legislation. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond DREAM's control, which could cause actual results to

differ materially from those that are disclosed in or implied by such

forward-looking information. These risks and uncertainties include, but are not

limited to general and local economic and business conditions, employment

levels, regulatory risks, mortgage rates and regulations, environmental risks,

consumer confidence, seasonality, adverse weather conditions, reliance on key

clients and personnel and competition. All forward looking information in this

press release speaks as of May 12, 2014 DREAM does not undertake to update any

such forward looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is disclosed in filings with securities regulators filed on

SEDAR (www.sedar.com).

FOR FURTHER INFORMATION PLEASE CONTACT:

DREAM Unlimited Corp.

Michael J. Cooper

Chief Executive Officer

(416) 365-5145

mcooper@dream.ca

DREAM Unlimited Corp.

Pauline Alimchandani

Chief Financial Officer

(416) 365-5992

palimchandani@dream.ca

www.dream.ca

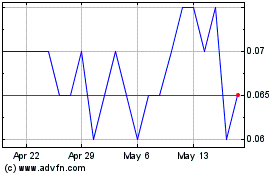

Route 1 (TSXV:ROI)

Historical Stock Chart

From Apr 2024 to May 2024

Route 1 (TSXV:ROI)

Historical Stock Chart

From May 2023 to May 2024