Voxtur Analytics Corp. (TSXV: VXTR; OTCQB: VXTRF)

(“

Voxtur” or the “

Company”), a

North American technology company creating a more transparent and

accessible real estate lending ecosystem, echoes the concerns it

has heard from shareholders of the Company (“

Voxtur

Shareholders”) and demands the basic accountability and

transparency afforded under Canadian securities law from US-based

private equity fund RPC Ventures I Fund LP (“

Rice

Park”), Nicholas Smith and their unnamed associates who

form the Voxtur Shareholders for “Accountability” (the

“

Dissident Group”).

The Dissident Group announced it is nominating

six directors (the “Private Equity Nominees”) to,

in the opinion of Voxtur, execute a “no premium” takeover of

control of the Voxtur board of directors (the

”Board”), at the Company’s upcoming annual general

and special meeting (the “Meeting”) on June 28,

2024 at 9:00 a.m. (Eastern Time).

Rice Park has self-styled their secretive cabal

as the “Voxtur Shareholders for Accountability” at the same time

that they have declined to even identify who comprises their group.

As detailed in the Company’s June 21, 2024 press release, Voxtur

and Voxtur Shareholders have numerous outstanding questions about

the identity, conflicts of interest, questionable judgement, and

true motives of the Dissident Group, but Voxtur Shareholders aren’t

even able to assess what deeper concerns may lie with the rest of

the Dissident Group, since Rice Park and Nicholas Smith refuse to

publicly name their associates, in contravention of Canadian

securities law requirements.

Canadian securities law dictate that persons

making director nominations must file detailed information

statements under National Instrument 51-102 9.2(6)(a), which to

date, only Rice Park has filed. Voxtur Shareholders are right to

question why the Dissident Group is going to such lengths,

including not filing the documents required by Canadian Securities

Laws, to conceal the identities of its members1. Such solicitation

without disclosure of who forms the Dissident Group calls into

question whether proxies received by them, if any, were provided by

shareholders on a fully informed and legally compliant basis.

Are the Dissident Group and Private

Equity Nominees so unfamiliar and unknowledgeable about the

Canadian market so as to comply with the rules, or are they just

desperate enough to conceal their associates’ identities to ignore

them? In either case, this is NOT

the leadership Voxtur needs.

In Voxtur’s June 21 press release the question

was raised as to whether former Voxtur CEO Jim Albertelli is

associated with the Dissident Group; the Dissident Group issued a

seven-page press release yesterday, but couldn’t find room to

confirm or deny Mr. Albertelli’s involvement. If the Dissident

Group would simply comply with securities law, Voxtur Shareholders

would definitively know if Mr. Albertelli is a part of their group;

instead, the question remains unanswered.

While Mr. Albertelli’s involvement is unclear

pending the Dissident Group’s conformity with securities law,

Voxtur Shareholders should know that one of the Private Equity

Nominees, Thomas J. Holthus, became a shareholder of Voxtur through

a transaction with Mr. Albertelli, via Mr. Holthus’ investment

vehicle, Washington School House, LLC2.

In addition, Mr. Albertelli also has a business

relationship with Mr. Holthus’ law firm – which has been described

as follows by Mr. Albertelli:

““This

tremendous relationship provides singularity of

purpose…”

And

“Simply put,

we are aligning our interests with a great Firm and a great

friend.”

-ex-Voxtur CEO Jim Albertelli, on his relationship

with McCarthy Holthus3

Are Messrs. Albertelli and Holthus part of the

Dissident Group? Does their “great” friendship and “singularity of

purpose” extend to acting jointly and in concert with respect to

Voxtur? Voxtur Shareholders are owed transparency and

accountability on this matter.

As of the date of this press release, only Rice

Park has complied with solicitation rules and filed the required

detailed information statement; the remainder of this largely

unknown group, which includes Nick Smith, have been improperly

soliciting votes.

These reckless actions fit a pattern for Mr.

Smith; in the June 24, 2024 Dissident Group press release, the

Dissident Group feigns surprise that a change of control would

trigger an event of default to the Corporations’ credit agreements

and that the Private Equity Nominees will work with the creditor

after triggering the default. Surely, Mr. Smith was aware of such

clauses as the former Chair of the Board, just three months ago;

why did he not consider working with the creditor before he pushes

Voxtur into default?

This reckless behaviour of Mr. Smith has

resulted in Voxtur’s creditor delivering a letter to Voxtur

yesterday which contained the following:

“The Lender is aware

of the June 19, 2024 press release made by the so-called Voxtur

Shareholders for Accountability advising that they will seek to

replace Voxtur’s entire board of directors (the “Board”) at the

June 28, 2024 annual general meeting.”

“Any action that is

or causes an Event of Default under the Credit Agreement or an

Accommodation Termination Event under the Accommodation Agreement,

including any action that materially adversely affects the Lender’s

security position, will immediately and automatically terminate the

Lender’s accommodation obligations and may result in swift

enforcement action.”

Why would the Dissident Group put Voxtur and all

of its shareholders at risk for their personal ambitions? Was a

call in advance to the creditor too much of an inconvenience for

Mr. Smith, or was he afraid of what he would be told? The Dissident

Group has yet to reveal what their plan would be to avoid default

under Voxtur’s credit facility should they be successful. Would a

responsible and diligent person embark on such a dangerous course

of action without consultation with the Lender and a plan?

In addition, it has come to Voxtur’s attention

that the law firm acting for the Dissident Group previously acted

for Blue Water prior to Voxtur’s acquisition of Blue Water. The

sheer number of conflicts of interests at play should give Voxtur

Shareholders serious pause about the Private Equity Nominees and

their true motives.

Voxtur has also confirmed that, with the

exception of Mr. Smith (who previously filed a Personal Information

Form with the TSX Venture Exchange (“TSXV”) when

he was first appointed a director of Voxtur), none of the other

Private Equity Nominees have filed Personal Information Forms with

the TSXV in order for the TSXV to confirm their suitability to act

as officers or directors of Voxtur. Once again, either the Private

Equity Nominees’ are exhibiting their lack of Canadian market

experience, or worse, their disregard for the rules and norms in

this jurisdiction. Further Voxtur has not received any consent to

act as a director from any of the Private Equity Nominees; Voxtur

Shareholders can’t even be certain the Private Equity Nominees have

agreed to act as directors, should they be elected.

Meeting Information

Consistent with previous Voxtur shareholder meetings, the

Meeting will be held in a virtual format

at https://virtual-meetings.tsxtrust.com/en/1654 (password:

voxtur2024) on June 28, 2024 at 9:00 a.m. (Eastern Time).

Registered Voxtur Shareholders and duly appointed proxyholders will

be able to vote and ask questions at the meeting, while guests may

attend and view the meeting.

Voxtur Shareholders are encouraged to vote TODAY to

protect their investment from the highly conflicted Private Equity

Nominees. Shareholders should vote as soon as possible, but in any

case, before Wednesday, June 26, 2024 at 9:00 a.m. (Eastern

Time).

The Company urges shareholders to REJECT the

conflicted Private Equity Nominees and vote FOR

each of the Voxtur director nominees: Gary Yeoman, Michael Harris,

Ray Williams, and Allan Bezanson.

Questions? Need Help Voting?

If you have questions or require assistance with voting, please

contact Voxtur’s proxy solicitation agent, Laurel Hill Advisory

Group by telephone at 1-877-452-7184 (toll-free in North America),

or +1 416-304-0211 (outside North America), or email at

assistance@laurelhill.com.

For more information, please visit Voxtur.com or contact Jordan

Ross at jordan@voxtur.com.

About Voxtur

Voxtur is a transformational real estate

technology company that is redefining industry standards in a

dynamic lending environment. The Company offers targeted data

analytics to simplify the multifaceted aspects of the lending

lifecycle for investors, lenders, government agencies and

servicers. Voxtur's proprietary data hub and workflow platforms

more accurately and efficiently value assets, originate and service

loans, and securitize portfolios. As an independent and transparent

mortgage technology provider, the Company offers primary and

secondary market solutions in the United States and Canada. For

more information, visit www.voxtur.com.

Neither TSXV nor its Regulation Services

Provider (as that term is defined in the policies of the TSXV)

accepts responsibility for the adequacy or accuracy of this

release.

Forward-Looking Information

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking information”). Any information

contained herein that is not based on historical facts may be

deemed to constitute forward-looking information within the meaning

of Canadian and United States securities laws. Forward-looking

information may be based on expectations, estimates and projections

as at the date of this news release, and may be identified by the

words “may”, “would”, “could”, “should”, “will”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “expect” or similar

expressions. Forward-looking information may include, but is not

limited to: the completion of the Issuance; approval of the

Issuance by the TSXV; expectations for the effects of certain

milestones or the ability of the Company to successfully achieve

certain business objectives; the effects of unexpected costs,

liabilities or delays; success of software activities; regulatory

approval; the competition for skilled personnel; expectations for

other economic, business, environmental, regulatory and/or

competitive factors related to the Company, or the real estate

industry generally; anticipated future production costs; and other

events or conditions that may occur in the future. Investors are

cautioned that forward-looking information is not based on

historical facts but instead reflects estimates or projections

concerning future results or events based on the opinions,

assumptions and estimates of management considered reasonable at

the date the information is provided. Although the Company believes

that the expectations reflected in such forward-looking information

are reasonable, such information involves risks and uncertainties,

and undue reliance should not be placed on such information, as

unknown or unpredictable factors could have material adverse

effects on future results, performance, or achievements of the

Company. Among the key factors that could cause actual results to

differ materially from those projected in the forward-looking

information include but are not limited to: additional costs

related to acquisitions; ; integration of acquired businesses;

implementation of new products; changing global financial

conditions, especially in light of the COVID-19 global pandemic;

reliance on specific key employees and customers to maintain

business operations; competition within the Company's industry; a

risk in technological failure or failure to implement technological

upgrades in accordance with expected timelines; changing market

conditions; failure of governing agencies and regulatory bodies to

approve the use of products and services developed by the Company;

the Company’s dependence on maintaining intellectual property and

protecting newly developed intellectual property; operating losses

and negative cash flows; and currency fluctuations. Accordingly,

readers should not place undue reliance on forward-looking

information contained herein.

This forward-looking information is provided as

of the date of this news release and, accordingly, is subject to

change after such date. The Company does not assume any obligation

to update or revise this information to reflect new events or

circumstances except as required in accordance with applicable

laws.

Voxtur's common shares are traded on the TSX

Venture Exchange under the symbol VXTR and in the US on the OTCQB

under the symbol VXTRF.

For media inquiries:

Jacob GaffneyTel: (817)

471-7627jacob@gaffneyaustin.com

For shareholder inquiries:

Laurel Hill Advisory GroupToll-free:

1-877-452-7184 (North America)Collect calls outside North America:

+1 416-304-0211assistance@laurelhill.com

__________________________________1 FOR IMMEDIATE RELEASE –

Plymouth, Minnesota – June 19, 2024, a group of shareholders (the

“Voxtur Shareholders for Accountability”, “We”, “Us”, or “Our”) of

Voxtur Analytics Corp. (TSXV: VXTR; OTCQB: VXTRF) (“Voxtur” or the

“Company”), including Nicholas H. Smith, the former Chairman of

Voxtur, announce that they are seeking to reconstitute the board of

directors of Voxtur (the “Board”)……. The six nominees that the

Voxtur Shareholders for Accountability are nominating are…..2

https://www.voxtur.com/voxtur-announces-sale-of-debt-to-strategic-investors/3

https://www.alaw.net/alaw_mccarthy_holthus/

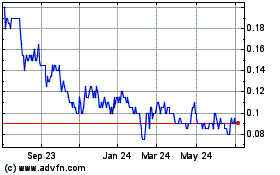

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

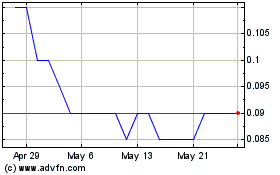

Voxtur Analytics (TSXV:VXTR)

Historical Stock Chart

From Jan 2024 to Jan 2025