UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

January 22, 2009

AB&T Financial Corporation

______________________________________________________________________________

(Exact name of Registrant as specified in its charter)

North Carolina 000-53249 84-1653729

______________________________________________________________________________

(State or other jurisdiction (Commission File Number) (IRS Employer Identification

of incorporation) No.)

292 West Main Avenue, Gastonia, North Carolina

28054

______________________________________________________________________________

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code

(704) 867-5828

Not Applicable

______________________________________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

I

tem

1.01 E

ntry into a Material Definitive Agreement.

On January 23, 2009, AB&T Financial Corporation (the “Registrant”), parent company of Alliance Bank & Trust Company, entered into a Letter Agreement, including the Securities Purchase Agreement – Standard Terms (together with the Letter Agreement, the “Purchase Agreement”), with the United States Department of the Treasury (the “Treasury”),

pursuant to which the Registrant issued and sold to the Treasury (1) 3,500 shares of the Registrant’s Fixed Rate Cumulative Perpetual Preferred Stock, Series A (the “Preferred Stock”) and (2) a warrant to purchase 80,153 shares of the Registrant’s common stock, $1.00 par value per share, for an aggregate purchase price of $3,500,000 in cash. The description of the Purchase Agreement contained or incorporated herein is a summary and is qualified in its entirety by

reference to the full text of the Purchase Agreement attached as Exhibit 10.1 hereto and incorporated herein by reference.

The Preferred Stock will qualify as Tier 1 capital and will pay cumulative dividends at a rate of 5% per annum for the first five years, and 9% per annum thereafter. The Registrant may not redeem the Preferred Stock during the first three years following the investment by the Treasury, except with the proceeds from a “Qualified Equity Offering” (as defined in Annex A to the articles of amendment described in Item 5.03 and attached as Exhibit 3.1 hereto and incorporated

herein by reference). After three years, the Registrant may, at its option, redeem the Preferred Stock at its liquidation preference plus accrued and unpaid dividends. The Preferred Stock is generally nonvoting. The description of the Preferred Stock contained herein is a summary and is qualified in its entirety by reference to the full text of the articles of amendment.

The warrant has a 10-year term and is immediately exercisable upon its issuance, with an initial per share exercise price of $6.55. The warrant has anti-dilution protections, registration rights, and certain other protections for the holder. If the Registrant receives aggregate gross cash proceeds of not less than $3,500,000 from Qualified Equity Offerings on or prior to December 31, 2009, the number of shares of common stock issuable pursuant to the Treasury’s exercise of the

warrant will be reduced by one-half of the original number of shares, taking into account all adjustments, underlying the warrant. Pursuant to the Purchase Agreement, the Treasury has agreed not to exercise voting power with respect to any shares of common stock issued upon exercise of the Warrant. The description of the warrant contained herein is a summary and is qualified in its entirety by reference to the full text of the warrant, which is attached as Exhibit 4.1 hereto and

incorporate by reference herein.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth under Item 1.01 is incorporated by reference into this Item 3.02.

The issuance and sale of the Preferred Stock and the Warrant is exempt from registration pursuant to section 4(2) of the Securities Act of 1933. The Registrant has not engaged in general solicitation or advertising with regard to the issuance and sale of such securities and has not offered securities to the public in connection with this issuance and sale.

Item 3.03 Material Modification to Rights of Security Holders.

Pursuant to the terms of the Purchase Agreement, upon issuance of the Preferred Stock, the ability of the Company to declare or pay dividends or distributions on, or purchase, redeem or otherwise acquire for consideration, shares of its Junior Stock (as defined below) and Parity Stock (as defined below) will be subject to restrictions. The redemption, purchase, or other acquisition of

trust preferred securities of the Registrant or its affiliates also will be restricted. These restrictions will terminate on the earlier of (1) the third anniversary of the date of issuance of the Preferred Stock and (2) the date on which the Preferred Stock has been redeemed in whole or the Treasury has transferred all of the Preferred Stock to third parties.

In addition, pursuant to the articles of amendment described in Item 5.03 below, the ability of the Registrant to declare or pay dividends or distributions on, or repurchase, redeem or otherwise acquire for consideration, shares of its Junior Stock and Parity Stock will be subject to restrictions in the event that the Registrant fails to declare and pay full dividends (or declare and set aside a sum sufficient for payment thereof) on the Preferred Stock.

“Junior Stock” means the Registrant’s common stock and any other class or series of stock of the Registrant the terms of which expressly provide that it ranks junior to the Preferred Stock as to dividend rights and/or rights on liquidation, dissolution or winding up of the Company. “Parity Stock” means any class or series of stock of the Company the terms of which do not expressly provide that such class or series will rank senior or junior to the Preferred

Stock as to dividend rights and/or rights on liquidation, dissolution or winding up of the Company (in each case without regard to whether dividends accrue cumulatively or noncumulatively).

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

Pursuant to the terms of the Purchase Agreement, the Company is required to have in place certain limitations on the compensation of certain executives, applicable in certain situations. In that regard, the top five senior executive officers of the Registrant executed and delivered a waiver whereby the executive voluntarily released the Registrant from any and all obligations to pay

compensation prohibited by section 111 of the Emergency Economic Stabilization Act of 2008 or any regulations promulgated thereunder and waives any present or future claims against the Registrant for any changes to executive’s regular, bonus, or incentive compensation or benefit-related arrangements, agreements or policies and any other changes required to be made by the Treasury to comply with the terms of the Purchase Agreement. The top five senior executive officers of the

Company also entered into Executive Compensation Modification Agreements to ensure compliance with Section 111 of the Emergency Economic Stabilization Act of 2008 and regulations promulgated thereunder. The form of Executive Compensation Modification Agreement is filed herewith as Exhibit 10.2.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On January 22, 2009, the Registrant filed articles of amendment for the purpose of amending its articles of incorporation to fix the designations, preferences, limitations and relative rights of a series of Fixed Rate Cumulative Perpetual Preferred Stock, Series A, no par value, with a liquidation preference of $1,000 per share in connection with the Purchase Agreement. The articles of

amendment were effective immediately upon filing. A copy of the articles of amendment is attached as Exhibit 3.1 hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

The following exhibits are filed herewith:

|

EXHIBIT NO

.

|

|

DESCRIPTION OF EXHIBIT

|

|

|

|

|

3.1

|

|

Articles of Amendment of AB&T Financial Corporation, filed January 22, 2009

|

|

4.1

|

|

Warrant to Purchase Common Stock of AB&T Financial Corporation, dated January 23, 2009

|

|

4.2

|

|

Form of Certificate for the Series A Preferred Stock

|

|

10.1

|

|

Letter Agreement including the Securities Purchase Agreement- Standard Terms, between AB&T Financial Corporation and the United States Department of the Treasury, dated January 23, 2009

|

|

10.2

|

|

Form of Executive Compensation Modification Agreement

|

The Current Report on Form 8-K (including information included or incorporated by reference herein) may contain, among other things, certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, (i) statements regarding certain of the Registrant’s goals and

expectations with respect to earnings, income per share, revenue, expenses and the growth rate in such items, as well as other measures of economic performance, including statements relating to estimates of credit quality trends, and (ii) statements preceded by, followed by or that include the words “may,” “could,” “should,” “would,” “believe,” “anticipate,” “estimate,” “expect,”

“intend,” “plan,” “projects,” “outlook” or similar expressions. These statements are based upon the current belief and expectations of the Registrant’s management and are subject to significant risks and uncertainties that are subject to change based on various factors (many of which are beyond the Registrant’s control).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

AB&T FINANCIAL CORPORATION

By:

/s/ Daniel C. Ayscue

Daniel C. Ayscue

Interim President and Chief Executive Officer

Dated: January 28, 2009

EXHIBIT INDEX

|

EXHIBIT NO

.

|

|

DESCRIPTION OF EXHIBIT

|

|

|

|

|

3.1

|

|

Articles of Amendment of AB&T Financial Corporation, filed January 22, 2009

|

|

4.1

|

|

Warrant to Purchase Common Stock of AB&T Financial Corporation, dated January 23, 2009

|

|

4.2

|

|

Form of Certificate for the Series A Preferred Stock

|

|

10.1

|

|

Letter Agreement including the Securities Purchase Agreement- Standard Terms, between AB&T Financial Corporation and the United States Department of the Treasury, dated January 23, 2009

|

|

10.2

|

|

Form of Executive Compensation Modification Agreement

|

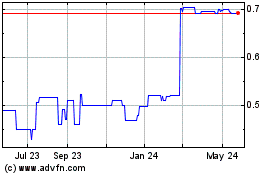

AB and T Financial (CE) (USOTC:ABTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

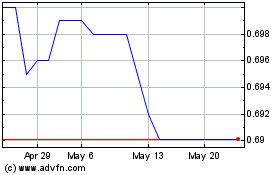

AB and T Financial (CE) (USOTC:ABTO)

Historical Stock Chart

From Jul 2023 to Jul 2024