|

|

|

|

|

OMB APPROVAL

|

|

OMB Number:

|

|

3235-0059

|

|

Expires:

|

|

January 31, 2008

|

|

Estimated average burden

|

|

hours per response 14

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act

of 1934

(Amendment No.

)

Filed by the Registrant

¨

Filed by a Party other than the

Registrant

¨

Check the appropriate box:

|

x

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

¨

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material Pursuant to §240.14a-12

|

AB&T FINANCIAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of

Filing Fee (Check the appropriate box):

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which the transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which the transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of the transaction:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

AB&T FINANCIAL CORPORATION

292 West Main Avenue

Gastonia, North Carolina 28052

(704) 865-1634

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held

December 9, 2009

NOTICE

is hereby given that the Annual Meeting of Shareholders of AB&T Financial Corporation (the

“Company”) will be held as follows:

|

|

|

|

|

Place:

|

|

Gaston County Library

1555 E.

Garrison Blvd.

Gastonia, North Carolina 28054

|

|

|

|

|

Date:

|

|

December 9, 2009

|

|

|

|

|

Time:

|

|

10:30 a.m.

|

The purposes of the meeting are:

|

|

1.

|

To elect two (2) members of the Board of Directors for three (3) year terms and one (1) member of the Board of Directors for a two (2) year

term.

|

|

|

2.

|

To ratify a non-binding shareholder resolution regarding executive compensation.

|

|

|

3.

|

To ratify the appointment of Elliott Davis, PLLC, as the Company’s independent registered public accounting firm for 2009.

|

|

|

4.

|

To transact any other business that may properly come before the meeting.

|

You are cordially invited to attend the meeting in person. However, even if you expect to attend the meeting, you are requested to complete, sign and date the enclosed appointment of proxy and return

it in the envelope provided for that purpose to ensure that a quorum is present at the meeting. The giving of an appointment of proxy will not affect your right to revoke it or to attend the meeting and vote in person.

|

|

|

By Order of the Board of Directors

|

|

|

|

/s/ Daniel C. Ayscue

|

|

|

|

Daniel C. Ayscue

|

|

President and Chief Executive Officer

|

November

, 2009

AB&T FINANCIAL CORPORATION

292 West Main Avenue

Gastonia, North Carolina 28052

(704) 865-1634

PROXY STATEMENT

Mailing Date: On or about

November

, 2009

ANNUAL MEETING OF SHAREHOLDERS

To Be Held December 9, 2009

General

This Proxy Statement is furnished in connection with the solicitation of the enclosed appointment of proxy by the

Board of Directors (the “Board”) of AB&T Financial Corporation (the “Company”) for the 2009 Annual Meeting of Shareholders of the Company to be held at the Gaston County Library, 1555 E. Garrison Blvd., Gastonia, North

Carolina at 10:30 a.m. on December 9, 2009, and any adjournments thereof. The Company is the holding company for Alliance Bank & Trust Company, Gastonia, North Carolina (the “Bank”).

Solicitation and Voting of Appointments of Proxy; Revocation

Persons named in the appointment of proxy as proxies to represent shareholders at the Annual Meeting are Wayne F. Shovelin, Kenneth Appling and David W. White. Shares represented by each appointment of

proxy that is properly executed and returned, and not revoked, will be voted in accordance with the directions contained in the appointment of proxy. If no directions are given, each such appointment of proxy will be voted

FOR

the election of

each of the three (3) nominees for director named in Proposal 1 below and

FOR

Proposals 2 and 3. If, at or before the time of the Annual Meeting, any nominee named in Proposal 1 has become unavailable for any reason, the proxies

will have the discretion to vote for a substitute nominee. On such other matters as may come before the meeting, the proxies will be authorized to vote shares represented by each appointment of proxy in accordance with their best judgment on such

matters. An appointment of proxy may be revoked by the shareholder giving it at any time before it is exercised by filing with the Company’s Corporate Secretary at its main office at 292 West Main Avenue, Gastonia, North Carolina 28052, a

written instrument revoking it or a duly executed appointment of proxy bearing a later date, or by attending the Annual Meeting and announcing his or her intention to vote in person.

Expenses of Solicitation

The Company will pay the cost of preparing, assembling and

mailing this Proxy Statement and other proxy solicitation expenses. In addition to the use of the mails, appointments of proxy may be

solicited in person or by telephone by the Company’s and Bank’s officers, directors and employees without additional compensation. The Company will reimburse banks, brokers and other

custodians, nominees and fiduciaries for their costs in sending the proxy materials to the beneficial owners of the Company’s common stock.

Record Date

The close of business on October 23, 2009 has been fixed as the record date (the “Record Date”) for

the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record on that date will be eligible to vote on the proposals described herein.

Voting Securities

The voting securities of

the Company are the shares of its common stock, par value $1.00 per share, of which 10,000,000 shares are authorized and 2,678,205 shares were outstanding on the Record Date. There are approximately 637 holders of record of the Company’s common

stock.

Voting Procedures; Quorum; Votes Required for Approval

Each shareholder is entitled to one vote for each share held of record on the Record Date on each director to be elected and on each other matter submitted for voting. In accordance with North Carolina

law, shareholders will not be entitled to vote cumulatively in the election of directors at the Annual Meeting.

A majority of the shares of

the Company’s common stock issued and outstanding on the Record Date must be present in person or by proxy to constitute a quorum for the conduct of business at the Annual Meeting.

Assuming a quorum is present, in the case of Proposal 1 below, the three (3) nominees receiving the greatest number of votes shall be elected.

In the case of Proposals 2 and 3 for each such Proposal to be approved, the number of votes cast for approval of the Proposal must exceed the number of

votes cast against such Proposal. Abstentions and broker nonvotes will have no effect.

Authorization to Vote on Adjournment and Other

Matters

Unless the Secretary of the Company is instructed otherwise, by signing an appointment of proxy, shareholders will be authorizing

the proxy holders to vote in their discretion regarding any procedural motions which may come before the Annual Meeting. For example, this authority could be used to adjourn the Annual Meeting if the Company believes it is desirable to do so.

Adjournment or other procedural matters could be used to obtain more time before a vote is taken in order to solicit additional appointments of proxy or to provide additional information to shareholders. However, appointments of proxy voted against

any one of the Proposals will not be

2

used to adjourn the Annual Meeting. The Company does not have any plans to adjourn the Annual Meeting at this time, but intends to do so, if needed, to promote shareholder interests.

Beneficial Ownership of Voting Securities

As of October 23, 2009, the shareholders identified in the following table beneficially owned more than 5% of the Company’s common stock.

|

|

|

|

|

|

|

Name and Address of

Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

|

|

Percent of Class

|

|

|

|

|

|

Financial Stocks Capital Partners IV, LP

Cincinnati, OH

|

|

225,250

|

|

8.41

|

|

|

|

|

|

Franklin Mutual Advisors, LLC

Short Hills, NJ

|

|

226,100

|

|

8.44

|

|

|

|

|

|

Hot Creek Ventures 3, L. P.

Reno, NV

|

|

169,500

|

|

6.90

|

As of October 23, 2009, the beneficial ownership of the Company’s common stock by the

Company’s directors and nominees for director and by the Company’s and Bank’s executive officers (the “Named Executive Officers”) individually and by the Company’s directors and nominees for director and the Named

Executive Officers as a group, was as follows:

|

|

|

|

|

|

|

|

Name and Address of

Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

(1)(2)

|

|

|

Percent of

Class

(2)(3)

|

|

|

|

|

|

Kenneth Appling

Forest City, NC

|

|

46,468

|

|

|

1.74

|

|

|

|

|

|

Daniel C. Ayscue

Gastonia, NC

|

|

14,875

|

|

|

0.56

|

|

|

|

|

|

Joseph H. Morgan

Shelby, NC

|

|

28,523

|

(4)

|

|

1.18

|

|

|

|

|

|

Lawrence H. Pearson, M.D.

Shelby, NC

|

|

33,126

|

|

|

1.23

|

|

|

|

|

|

Wayne F. Shovelin

Gastonia, NC

|

|

65,192

|

(5)

|

|

2.43

|

|

|

|

|

|

David W. White

Shelby, NC

|

|

85,175

|

(6)

|

|

3.17

|

|

|

|

|

|

All Company Directors and Named

Executive Officers as a group (6 persons)

|

|

273,359

|

|

|

10.31

|

3

As of October 23, 2009, the beneficial ownership of the Company’s common stock, by Bank-only

directors individually and as a group with the directors of the Company and the Named Executive Officers, was as follows:

|

|

|

|

|

|

|

|

Name and Address of

Beneficial Owner

|

|

Amount and Nature of

Beneficial Ownership

(1)(2)

|

|

|

Percent of Class

(3)

|

|

|

|

|

|

Kelvin C. Harris, M.D.

Gastonia, NC

|

|

8,471

|

|

|

0.32

|

|

|

|

|

|

Susan J. Joyner

Gastonia, NC

|

|

16,572

|

(7)

|

|

0.62

|

|

|

|

|

|

Jerry L. Kellar

Gastonia, NC

|

|

17,302

|

(8)

|

|

0.65

|

|

|

|

|

|

Gerald F. McSwain

Gastonia, NC

|

|

15,325

|

(10)

|

|

0.57

|

|

|

|

|

|

Carl J. Stewart, Jr., Esq.

Gastonia, NC

|

|

7,510

|

|

|

0.26

|

|

|

|

|

|

H. Gene Washburn, M.D.

Boiling Springs, NC

|

|

9,613

|

|

|

0.36

|

|

|

|

|

|

John H. Whaley

Shelby, NC

|

|

20,187

|

(11)

|

|

0.75

|

|

|

|

|

|

Jack R. Williams

Sherills Ford, NC

|

|

9,915

|

|

|

0.37

|

|

|

|

|

|

All Company and Bank Directors and

Named Executive Officers as a group

(14 persons)

|

|

378,254

|

|

|

14.21

|

|

(1)

|

Except as otherwise noted, to the best knowledge of the Company’s management, the above individuals and group exercise sole voting and investment power with

respect to all shares shown as beneficially owned other than the following shares as to which such powers are shared:

|

|

(2)

|

Includes the following options to purchase shares of common stock exercisable within 60 days of October 23, 2009:

|

|

(3)

|

The calculation of the percentage of class beneficially owned by each individual and the group is based, in each case, on the sum of (i) a total of 2,678,205

outstanding shares of common stock and (ii) options to purchase shares of common stock which are exercisable within 60 days of October 23, 2009.

|

|

(4)

|

Includes 6,023 shares held by a business entity controlled by Mr. Morgan.

|

|

(5)

|

Includes 7,877 shares owned individually by Mr. Shovelin’s spouse and 625 shares owned by Mr. Shovelin’s minor son.

|

|

(6)

|

Includes 11,875 shares held by an entity controlled by Mr. White.

|

4

|

(7)

|

Includes 3,121 shares owned individually by Mrs. Joyner’s spouse.

|

|

(8)

|

Includes 500 shares owned by Mr. Kellar’s minor son.

|

|

(9)

|

Includes 625 shares held by Mr. McLean as custodian for minor children.

|

|

(10)

|

Includes 795 shares owned individually by Mr. McSwain’s spouse.

|

|

(11)

|

Includes 1,250 shares held by Mr. Whaley’s minor son.

|

Section 16(a) Beneficial Ownership Reporting Compliance

The Company’s directors

and executive officers are required to file certain reports with the Securities and Exchange Commission regarding the amount of and changes in their beneficial ownership of the Company’s common stock (including, without limitation, an initial

report following election as an officer or director of the Company and a report following any change in a reporting person’s beneficial ownership). Based upon a review of copies of reports received by the Company, all required reports of

directors and executive officers of the Company were filed on a timely basis in 2008.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company’s bylaws provide that its Board shall consist of between five (5) and seven (7) members divided into three

classes in as equal number as possible. Such classes shall be elected to staggered three (3) year terms. The Board has set the number of directors of the Company at five (5). The Board recommends that shareholders vote for each of the following

three (3) directors for the terms indicated:

|

|

|

|

|

|

|

|

|

Name and Age

|

|

Position(s)

Held

|

|

Director

Since

(1)

|

|

Principal Occupation and

Business Experience During the Past Five Years

|

|

|

|

|

|

|

Three-Year Terms

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth Appling

(47)

|

|

Director

|

|

2004

|

|

President, Appling Boring Company, Forest City, NC, 1987–present (commercial pipe installation and horizontal boring)

|

|

|

|

|

|

|

Wayne F. Shovelin

(64)

|

|

Director

|

|

2004

|

|

President and Chief Executive Officer, CaroMont Health/Gaston Memorial Hospital, Gastonia, NC, 1976–present

|

|

|

|

|

|

|

Two-Year Term

|

|

|

|

|

|

|

|

|

|

|

|

|

Lawrence H. Pearson, M.D.

(58)

|

|

Director

|

|

2009

|

|

Cleveland Cosmetology, P.A., Shelby, NC

|

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “

FOR

” EACH OF THE

NOMINEES FOR DIRECTOR OF THE COMPANY FOR THE TERMS INDICATED.

5

Incumbent Directors

The Company’s Board of Directors includes the following directors whose terms will continue after the Annual Meeting. Certain information regarding those directors is set forth in the table below.

|

|

|

|

|

|

|

|

|

Name and Age

|

|

Term

Expires

|

|

Director

Since

(1)

|

|

Principal Occupation and

Business Experience During the Past Five Years

|

|

|

|

|

|

|

Joseph H. Morgan

(44)

|

|

2010

|

|

2004

|

|

President, J. Morgan Company, Shelby, NC, 1983–present (plastic recycling company)

|

|

|

|

|

|

|

David W. White

(58)

|

|

2011

|

|

2004

|

|

President, White Investments of Shelby, LLC, Shelby, NC, 1988–present (real estate development/management)

|

|

(1)

|

Includes prior service as a director of Alliance Bank & Trust Company.

|

Director Independence

Each member of the Company’s Board of Directors is

“independent” as defined by Nasdaq listing standards and the regulations promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”). In making this determination the Board considered insider transactions with

directors for the provision of goods or services to the Company and the Bank. All such transactions were conducted at arm’s length upon terms no less favorable than those that would be available from an independent third party.

Director Relationships

No director or

nominee is a director of any other corporation with a class of securities registered pursuant to Section 12 of the Securities Exchange Act of 1934 (the “Exchange Act”) or subject to the requirements of Section 15(d) of the

Exchange Act, or any corporation registered as an investment company under the Investment Company Act of 1940.

There are no family

relationships among directors and executive officers of the Company or Bank.

Meetings and Committees of the Board of Directors

There were four (4) meetings of the Company’s Board of Directors and ten (10) meetings of the Bank’s Board of

Directors in 2008. All directors attended at least 75% of the meetings they were scheduled to attend.

The Company does not currently have a

formal policy regarding attendance by directors at the Company’s Annual Shareholder Meetings, although attendance is encouraged.

6

The Company has standing Audit and Nominating Committees. Formal written charters for the Audit Committee

and the Nominating Committee are being developed and will be available on the Company’s website following adoption.

Audit

Committee

. The Audit Committee of the Company has in place pre-approval policies and procedures that involve an assessment of the performance and independence of the independent auditors of the Company, an evaluation of any conflicts of interest

that may impair the independence of the independent auditors and pre-approval of an engagement letter that outlines all services to be rendered by the independent auditors.

Report of the Audit Committee

The Company’s Audit Committee is

responsible for receiving and reviewing the annual audit report of the independent auditors and reports of examinations by the Company’s regulatory agencies. The committee helps to formulate, implement and review the internal audit program of

the Company. The Audit Committee assesses the performance and independence of the independent auditors and recommends their appointment and retention.

During the course of its examination of the Company’s audit process in 2008, the Company’s Audit Committee reviewed and discussed the audited financial statements with management. The Audit Committee also discussed with the

independent auditors, Elliott Davis, PLLC, all matters required to be discussed by the Statement of Auditing Standards No. 61, as amended. Furthermore, the Audit Committee received from Elliott Davis, PLLC disclosures regarding their

independence required by the Independence Standards Board Standard No. 1, as amended and discussed with Elliott Davis, PLLC their independence.

Based on the review and discussions above, the Audit Committee (i) recommended to the Board that the audited financial statements be included in the Company’s annual report on Form 10-K for the year ended December 31, 2008

for filing with the Securities and Exchange Commission and (ii) recommended that shareholders ratify the appointment of Elliott Davis, PLLC as auditors of the Bank and Company for 2009.

Although the Company’s common stock is not traded on any exchange, the members of the Audit Committees are “independent” and

“financially literate” as defined by Nasdaq listing standards. The Company’s Audit Committee has not appointed, an “audit committee financial expert,” because no member of either Committee meets the criteria to be deemed an

“audit committee financial expert.”

The Audit Committee met seven (7) times during 2008. This report is submitted by the Audit

Committee: Gerald F. McSwain – Chair, Joseph. H. Morgan and Jack R. Williams.

Nominating Committee

. The members of the

Nominating Committee are Kenneth Appling, Joseph H. Morgan, Lawrence H. Pearson, M.D., Wayne F. Shovelin and David W. White. The Nominating Committee recommends nominees for election as directors. The Nominating Committee met once in 2008. In making

recommendations to the Board, the Nominating

7

Committee, in accordance with the bylaws, will consider candidates recommended by shareholders, in writing, to the Secretary of the Company if received at least 120 days prior to the annual

meeting at which directors are to be elected. Such recommendations of nominees shall include the nominee’s written consent to serve as a director if elected and a statement of the nominee’s qualifications to serve.

Director Compensation

Board

Fees.

Directors received cash compensation for attendance at Board and committee meetings during 2008. As of December 31, 2008, each director received $300 and the chairperson received $500 per board meeting attended. Each director

received $150 and the chairperson received $200 per committee meeting attended.

2005 Nonstatutory Stock Option Plan.

The

shareholders of the Bank approved the Alliance Bank & Trust Company 2005 Nonstatutory Stock Option Plan for Directors at the 2005 Annual Meeting of Shareholders. Following this approval, options to purchase 133,845 (as adjusted for the

5-for-4 stock split effected in the form of a 25% stock dividend in May 2006) shares of common stock were made available for issuance to members of the Bank’s Board of Directors under the Nonstatutory Plan. In connection with the reorganization

of the Bank into the holding company form of organization which resulted in the creation of the Company, the 2005 Nonstatutory Plan was adopted by the Company and options under that plan were converted into options to purchase shares of the

Company’s common stock. At the Company’s 2008 annual meeting, the shareholders approved the adoption of an amendment to the Nonstatutory Plan whereby an aggregate of 133,910 shares were added to the original 133,845 shares then reserved

under the Nonstatutory Plan. At December 31, 2008, 243,911 options had been granted under the Nonstatutory Plan.

The following table

presents a summary of all compensation paid by the Bank to its directors for their service as such during the year ended December 31, 2008.

DIRECTOR COMPENSATION TABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees

Earned

|

|

Option

Awards

(1)

|

|

All Other

Compensation

|

|

Total

|

|

|

|

|

|

|

|

Kenneth Appling

|

|

$

|

2,900

|

|

$

|

16,780

|

|

—

|

|

$

|

19,680

|

|

|

|

|

|

|

|

Joseph H. Morgan

|

|

|

2,700

|

|

|

7,574

|

|

—

|

|

|

10,274

|

|

|

|

|

|

|

|

Wayne F. Shovelin

|

|

|

5,500

|

|

|

16,571

|

|

—

|

|

|

22,071

|

|

|

|

|

|

|

|

G. William Sudyk

(2)

|

|

|

—

|

|

|

—

|

|

—

|

|

|

—

|

|

|

|

|

|

|

|

David W. White

|

|

|

2,700

|

|

|

13,035

|

|

—

|

|

|

15,735

|

|

(1)

|

Calculated in accordance with FAS 123R.

|

|

(2)

|

Mr. Sudyk resigned from the Board of Directors on November 20, 2008.

|

8

Executive Officers

Set forth below is certain information regarding the Company and Bank’s Executive Officers.

|

|

|

|

|

|

|

|

|

NAME

|

|

AGE

|

|

POSITION WITH COMPANY

|

|

BUSINESS EXPERIENCE

|

|

|

|

|

|

|

Daniel C. Ayscue

|

|

44

|

|

Secretary and Treasurer of the Company, Executive Vice President, Chief Credit Officer and Chief Financial Officer of the Bank

|

|

Group Vice President of Corporate Lending, SouthTrust Bank. Commenced banking career in 1990. Active member of the Gaston County Chamber of Commerce subcommittee, The Public/Private

Partnership.

|

|

|

|

|

|

|

Eric Dixon

|

|

47

|

|

Senior Vice President, Senior Commercial Lender and Market Executive Gastonia of the Bank

|

|

Vice President of Lending, SouthTrust Bank. Twenty-plus years in banking.

|

|

|

|

|

|

|

Matthew J. Triplett

|

|

38

|

|

Senior Vice President and Market Executive Shelby of the Bank

|

|

Vice President and Commercial Account Manager, SouthTrust Bank. Commenced banking career in 1995 as a loan development officer in Shelby.

|

Executive Compensation

The following table shows cash and certain other compensation paid to or received or deferred by the Company’s named executive officers for services rendered in all capacities during 2008, 2007 and

2006.

No other current executive officer of the Bank or Company received compensation for 2008 which exceeded $100,000.

9

SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and

Principal Position

|

|

Year

|

|

Salary

|

|

Bonus

|

|

Option

Awards

(1)

|

|

Non-Equity

Incentive Plan

Compensation

|

|

Nonqualified

Deferred

Compensation

Earnings

|

|

All Other

Compensation

(2)

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

Daniel C. Ayscue,

Executive Vice President

|

|

2008

|

|

$

|

132,792

|

|

—

|

|

$

|

13,149

|

|

$

|

-0-

|

|

—

|

|

$

|

27,887

|

|

$

|

173,828

|

|

|

2007

|

|

|

117,408

|

|

—

|

|

|

-0-

|

|

|

29,972

|

|

—

|

|

|

17,327

|

|

|

164,707

|

|

|

2006

|

|

|

110,473

|

|

—

|

|

|

7,929

|

|

|

48,732

|

|

—

|

|

|

15,312

|

|

|

182,446

|

|

|

|

|

|

|

|

|

|

|

|

Matthew J. Triplett,

Senior Vice President

|

|

2008

|

|

$

|

95,982

|

|

—

|

|

$

|

8,236

|

|

$

|

-0-

|

|

—

|

|

$

|

23,715

|

|

$

|

127,933

|

|

|

2007

|

|

|

87,599

|

|

—

|

|

|

-0-

|

|

|

12,994

|

|

—

|

|

|

15,463

|

|

|

116,056

|

|

|

2006

|

|

|

80,870

|

|

—

|

|

|

5,597

|

|

|

19,967

|

|

—

|

|

|

13,485

|

|

|

119,920

|

|

|

|

|

|

|

|

|

|

|

|

Eric Dixon,

Senior Vice President

|

|

2008

|

|

$

|

105,924

|

|

—

|

|

$

|

8,236

|

|

$

|

-0-

|

|

—

|

|

$

|

25,414

|

|

$

|

139,574

|

|

|

2007

|

|

|

99,609

|

|

—

|

|

|

-0-

|

|

|

14,523

|

|

—

|

|

|

15,872

|

|

|

130,004

|

|

|

2006

|

|

|

94,027

|

|

—

|

|

|

5,597

|

|

|

20,901

|

|

—

|

|

|

13,926

|

|

|

134,450

|

|

|

|

|

|

|

|

|

|

|

|

G. William Sudyk

(3)

Former President and Chief Executive Officer

|

|

2008

|

|

$

|

154,696

|

|

—

|

|

$

|

8,394

|

|

$

|

-0-

|

|

—

|

|

$

|

26,319

|

|

$

|

189,409

|

|

|

2007

|

|

|

152,409

|

|

—

|

|

|

8,862

|

|

|

48,517

|

|

—

|

|

|

20,055

|

|

|

229,843

|

|

|

2006

|

|

|

146,875

|

|

—

|

|

|

8,862

|

|

|

81,646

|

|

—

|

|

|

17,355

|

|

|

254,738

|

|

(1)

|

Calculated in accordance with FAS 123R.

|

|

(2)

|

Includes 401(k) contributions and the dollar value of premiums paid on behalf of the named officer for group term life, health and dental insurance. In addition to

compensation paid in cash, the Bank’s executive officers receive certain personal benefits. However, the aggregate value of such non-cash benefits received by Messrs. Ayscue, Triplett and Dixon did not exceed $10,000.

|

|

(3)

|

On September 2, 2008 the Company announced the departure of G. William Sudyk as President and Chief Executive Officer of the Company and the Bank. At that time,

Daniel C. Ayscue assumed the duties of President and Chief Executive Officer.

|

Employment Agreements.

The Bank has

entered into employment agreements with Daniel C. Ayscue as its President, Matthew J. Triplett as a Senior Vice President and Eric Dixon as a Senior Vice President. The employment agreements establish the duties and compensation of each of the

officers and provide for the officers’ continued employment with the Bank. The Employment Agreements provide for an initial term of employment of one year, with provisions for a one-year extension on the anniversary of the date of execution.

They also provide that each officer may be terminated for “cause” (as defined in the Employment Agreements) by the Bank, and may otherwise be terminated by the Bank (subject to vested rights) or by each officer.

The Employment Agreements provide for annual base salary to be reviewed by the Board of Directors not less often than annually. In addition, the Employment

Agreements provide for discretionary bonuses, participation in other pension and profit-sharing retirement plans maintained by the Bank on behalf of its employees, as well as fringe benefits normally associated with the officers’ respective

offices or made available to all other employees.

The Employment Agreements provide that in the event of a “termination event”

within eighteen months after a change in control of the Bank the employee shall be able to terminate the agreement and receive 299% of his base amount of compensation. A “termination event” will occur if (i) the

10

employee is assigned any duties or responsibilities that are inconsistent with his position, duties, responsibilities or status at the time of the change in control or with his reporting

responsibilities or title with the Bank in effect at the time of the change in control; (ii) the employee’s annual base salary rate is reduced below the annual amount in effect as of the change in control; (iii) the employee’s

life insurance, medical or hospitalization insurance, disability insurance, stock option plans, stock purchase plans, deferred compensation plans, management retention plans, retirement plans or similar plans or benefits being provided by the Bank

to the employee as of the date of the change in control are reduced in their level, scope or coverage, or any such insurance, plans or benefits are eliminated, unless such reduction or elimination applies proportionately to all salaried employees of

the Bank who participated in such benefits prior to the change in control; or (iv) the employee is transferred to a location outside of Gastonia, North Carolina in the case of Messrs. Ayscue and Dixon and Shelby, North Carolina in the case of

Mr. Triplett, without the employee’s express written consent. A change in control of the Bank will occur if (i) any individual or entity, directly or indirectly, acquires beneficial ownership of voting securities or acquires

irrevocable proxies or any combination of voting securities and irrevocable proxies, representing 50% or more of any class of voting securities or the Bank, or acquires control in any manner of the election of a majority of the directors of the

Bank; (ii) the Bank is consolidated or merged with or into another corporation, association or entity where the Bank is not the surviving corporation; or (iii) all or substantially all of the assets of the Bank are sold or otherwise

transferred to or are acquired by any other corporation, association or other person, entity or group. The Employment Agreements also provide for restrictions on each officer’s right to compete with the Bank for a period of one year after

termination of employment. Such noncompete restrictions do not apply if the officer is terminated with cause. In the event the employee’s employment is terminated and the employee is not entitled to any further benefits, the Employment

Agreements provide that the employee shall continue to receive salary compensation for an additional twelve months provided the employee abides by the noncompete restrictions. If after the expiration of the noncompete restrictions, the employee has

not obtained new employment with another financial institution, the Bank shall pay the employee as additional compensation his regular salary until he secures new employment or the expiration of six months, whichever is earlier. As of

December 31, 2008, the value of the lump sum payment that would have been payable to Messrs. Ayscue, Triplett and Dixon upon the occurrence of a “change in control” followed by a termination event would have been approximately

$377,048, $286,987 and $316,711 respectively.

On January 23, 2009, the Company, entered into a Letter Agreement, including the

Securities Purchase Agreement – Standard Terms (together with the Letter Agreement, the “Purchase Agreement”), with the United States Department of the Treasury (the “Treasury”), pursuant to which the Registrant issued and

sold to the Treasury (1) 3,500 shares of the Registrant’s Fixed Rate Cumulative Perpetual Preferred Stock, Series A (the “Preferred Stock”) and (2) a warrant to purchase 80,153 shares of the Registrant’s common stock,

$1.00 par value per share, for an aggregate purchase price of $3,500,000 in cash.

Pursuant to the terms of the Purchase Agreement, the

Company was and is required to have in place certain limitations on the compensation of certain executives, including but not limited to restrictions on the payment of bonuses, incentive compensation and change in control payments. In that regard,

Messers. Ayscue, Triplett and Dixon, have each executed and delivered a waiver

11

whereby each executive voluntarily released the Company from any and all obligations to pay compensation prohibited by Section 111 of the Emergency Economic Stabilization Act of 2008 or any

regulations promulgated thereunder and waived any present or future claims against the Company for any changes to executive’s regular, bonus, or incentive compensation or benefit-related arrangements, agreements or policies and any other

changes required to be made by the Treasury or applicable law, as amended from time to time, to comply with the terms of the Purchase Agreement. Such changes include those imposed by the American Recovery and Reinvestment Act of 2009. Messers.

Ayscue, Triplett and Dixon have also entered into Executive Compensation Modification Agreements to ensure compliance with Section 111 of the Emergency Economic Stabilization Act of 2008, as amended, the regulations promulgated thereunder and

other regulatory requirements imposed as a result of the Treasury’s investment in the Company.

2005 Incentive Stock Option

Plan

.

At the Bank’s 2005 Annual Meeting, the shareholders approved the adoption of the Alliance Bank & Trust Company 2005 Incentive Stock Option Plan, which provides for the issuance of incentive stock options, as

defined in Section 422 of the Internal Revenue Code (the “Code”). In connection with the reorganization of the Bank into the holding company form of organization which resulted in the creation of the Company, the 2005 Incentive Plan

was adopted by the Company and options under that plan were converted into options to purchase shares of the Company’s common stock. The Incentive Plan provides for the grant of stock options covering up to 267,755 shares of the Company’s

common stock, as adjusted following the 5-for-4 stock split effected in the form of a 25% stock dividend in May 2006 and subject to adjustment for further stock dividends, stock splits or similar changes in capitalization. At the Company’s 2008

annual meeting, the shareholders approved the adoption of an amendment to the Incentive Plan whereby an aggregate of 133,910 shares were added to the original 133,845 shares currently reserved under the Incentive Plan. At December 31, 2008,

184,044 options had been granted under the Incentive Plan.

Stock options are periodically granted under the Incentive Plan to executive

officers and other employees. All stock options authorized under the Incentive Plan are required to be granted with an exercise price not less than 100% of fair market value of our common stock on the date of the grant.

The following table sets forth information regarding equity awards granted to Messrs. Ayscue, Triplett, Dixon and Sudyk that were outstanding as of

December 31, 2008.

12

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

No. of

Securities

Underlying

Unexercised

Options

Exercisable

|

|

No. of Securities

Underlying

Unexercised Options

Unexerciseable

|

|

Option Exercise

Price

|

|

Option Expiration

Date

|

|

|

|

|

|

|

|

Daniel C. Ayscue

|

|

6,826

-0-

|

|

10,239

51,956

|

|

$

|

8.80

7.00

|

|

May 1, 2016

November 3, 2018

|

|

|

|

|

|

|

|

Matthew J. Triplett

|

|

4,818

-0-

|

|

7,228

26,269

|

|

$

|

8.80

7.00

|

|

May 1, 2016

November 3,

2018

|

|

|

|

|

|

|

|

Eric Dixon

|

|

4,818

-0-

|

|

7,228

26,269

|

|

$

|

8.80

7.00

|

|

May 1, 2016

November 3,

2018

|

|

|

|

|

|

|

|

G. William Sudyk

(1)

|

|

-0-

|

|

-0-

|

|

|

—

|

|

—

|

|

(1)

|

On September 2, 2008 the Company announced the departure of G. William Sudyk as President and Chief Executive Officer of the Company and the Bank. At that time,

Daniel C. Ayscue assumed the duties of President and Chief Executive Officer.

|

401(k) Savings Plan.

The Bank has a 401(k)

Plan covering employees. The Bank makes matching contributions on the first 3% of an employee’s compensation which is contributed to the 401(k) Plan. On employee contributions that exceed 3% of such employee’s compensation, the Bank makes

matching contributions equal to 50% of such employee contributions up to an additional 1.5% of such employee’s compensation.

Indebtedness of and Transactions with Management

The Bank has, and expects in the future to have, banking transactions in the

ordinary course of business with certain of its or the Company’s current directors, nominees for director, executive officers and their associates. All loans included in such transactions will be made on substantially the same terms, including

interest rates, repayment terms and collateral, as those prevailing for comparable transactions with other persons at the time such loans were made, and will not involve more than the normal risk of collectibility or present other unfavorable

features.

Loans made by the Bank to directors and executive officers are subject to the requirements of Regulation O of the Board of

Governors of the Federal Reserve System. Regulation O requires, among other things, prior approval of the Board of Directors with any “interested director” not participating, dollar limitations on amounts of certain loans and prohibits any

favorable treatment being extended to any director or executive officer in any of the Bank’s lending matters. To the best knowledge of the management of the Bank, Regulation O has been complied with in its entirety.

13

PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

The American Recovery and Reinvestment Act of 2009 (“ARRA”) was enacted on February 17, 2009. This law requires that any proxy statement for

an annual meeting of the stockholders of any participant in the U.S. Department of the Treasury’s TARP Capital Purchase Program include a separate proposal in its proxy statement for a non-binding shareholder vote on the compensation paid to

its executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission. This “say on pay” proposal is required during the period in which any obligation arising as a result of

participation under the TARP Capital Purchase Program remains outstanding.

Accordingly, our Board of Directors has proposed the following

resolution for shareholder consideration:

Resolved, that the compensation paid or provided to executive officers of

AB&T Financial Corporation (the “Company”) and its subsidiary, and the Company’s and its subsidiary’s executive compensation policies and practices, as described in the tabular and narrative compensation disclosures contained

in the Company’s proxy statement for its 2009 Annual Meeting, hereby are ratified and approved.

As provided in ARRA, the vote by our

shareholders will be a non-binding, advisory vote. The vote will not be binding on our Board of Directors and our Compensation Committee and will not overrule or affect any previous action or decision by the Board or Committee or any compensation

previously paid or awarded, and it will not create or imply any additional duty on the part of the Board or Committee. However, the Board and the Compensation Committee will take the voting results on the proposed resolution into account when

considering future executive compensation matters.

THE BOARD OF DIRECTORS BELIEVES THAT THE COMPANY’S EXECUTIVE COMPENSATION POLICIES

AND PRACTICES ARE ALIGNED WITH THE INTERESTS OF OUR SHAREHOLDERS AND RECOMMENDS THAT SHAREHOLDERS VOTE “

FOR

” RATIFICATION OF THE RESOLUTION REGARDING EXECUTIVE COMPENSATION.

14

PROPOSAL 3: RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Board of Directors has appointed the firm of Elliott Davis, PLLC, as the Company’s independent registered public accounting firm for 2009. A

representative of Elliott Davis, PLLC is expected to be present at the Annual Meeting and available to respond to appropriate questions, and will have the opportunity to make a statement if he or she desires to do so.

The Company has paid Elliott Davis, PLLC fees in connection with its assistance in the Company’s annual audit and review of the Company’s

financial statements. From time to time, the Company engages Elliott Davis, PLLC to assist in other areas of financial planning. The following table sets forth the fees paid or expected to be paid to Elliott Davis, PLLC by the Company in various

categories during 2008 and 2007.

|

|

|

|

|

|

|

|

|

Category

|

|

2008

Amount Billed

|

|

2007

Amount Billed

|

|

|

|

|

|

Audit Fees:

|

|

$

|

59,850

|

|

$

|

45,100

|

|

|

|

|

—

|

|

|

—

|

|

Audit-Related Fees:

|

|

|

|

|

|

—

|

|

Tax Fees:

|

|

|

6,585

|

|

|

5,465

|

|

|

|

|

|

|

|

|

|

Total Fees Billed:

|

|

$

|

66,435

|

|

$

|

50,565

|

|

|

|

|

|

|

|

|

The audit fees include fees for professional services for the audit of the Company’s financial

statements included in its Annual Report on Form 10-K and review of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and for services that are normally provided by the auditor in connection with statutory

and regulatory filings or engagements.

The tax fees include fees billed for tax compliance, tax advice and tax planning assistance.

All services rendered by Elliott Davis during 2008 and 2007 were subject to pre-approval by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “

FOR

” RATIFICATION OF ELLIOTT DAVIS, PLLC AS THE COMPANY’S INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR 2009.

OTHER MATTERS

The Board knows of no other business that will be brought before the Annual Meeting. Should other matters properly come before the meeting, the proxies will

be authorized to vote shares represented by each appointment of proxy in accordance with their best judgment on such matters.

15

PROPOSALS FOR 2010 ANNUAL MEETING

It is anticipated that the 2010 Annual Meeting will be held on a date during May 2010. Any proposal of a shareholder which is intended to be presented at

the 2010 Annual Meeting must be received by the Company at its main office at 292 West Main Avenue, Gastonia, North Carolina 28052 no later than January 31, 2010, in order that any such proposal be timely received for inclusion in the proxy

statement and appointment of proxy to be issued in connection with that meeting. If a proposal for the 2010 Annual Meeting is not expected to be included in the proxy statement for that meeting, the proposal must be received by the Company by

March 15, 2010 (or such later date as is required by SEC Rule 14a-8) for it to be timely received for consideration. The Company will use its discretionary authority for any proposals received thereafter.

SHAREHOLDER COMMUNICATIONS

The Company does not currently have a formal policy regarding shareholder communications with the Board of Directors, however, any shareholder may submit written communications to the Secretary of the Company, at the Company’s main

office at 292 West Main Avenue, Gastonia, North Carolina 28052, whereupon such communications will be forwarded to the Board of Directors if addressed to the Board of Directors as a group or to the individual director or directors addressed.

ADDITIONAL INFORMATION

THE COMPANY’S 2008 ANNUAL REPORT ON FORM 10-K HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. A COPY OF THAT REPORT IMMEDIATELY FOLLOWS THIS PROXY STATEMENT. ADDITIONAL COPIES WILL BE

PROVIDED WITHOUT CHARGE UPON THE WRITTEN REQUEST OF ANY SHAREHOLDER ENTITLED TO VOTE AT THE ANNUAL MEETING. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE CORPORATE SECRETARY, AB&T FINANCIAL CORPORATION, 292 WEST MAIN AVENUE, GASTONIA, NORTH

CAROLINA 28052.

16

REVOCABLE PROXY

AB&T FINANCIAL CORPORATION

292 West Main Avenue

Gastonia, North Carolina 28052

APPOINTMENT OF PROXY

SOLICITED BY BOARD OF DIRECTORS

The undersigned hereby appoints Wayne F. Shovelin, Kenneth Appling and David W. White (the “Proxies”), or any of them, as attorneys and proxies,

with full power of substitution, to vote all shares of the common stock of AB&T Financial Corporation (the “Company”) held of record by the undersigned on October 23, 2009 at the Annual Meeting of Shareholders of the Company to be

held at the Gaston County Library, 1555 E. Garrison Boulevard, Gastonia, North Carolina, at 10:30 a.m. on December 9, 2009, and at any adjournments thereof. The undersigned hereby directs that the shares represented by this Appointment of Proxy

be voted as follows on the proposals listed below:

|

1.

|

ELECTION OF DIRECTORS:

Proposal to elect two (2) members of the Board of Directors of the Company for three (3) year terms and one (1) member of

the Board of Directors for a two (2) year term.

|

|

|

|

|

|

FOR

all

nominees listed below

(except as indicated otherwise below)

|

|

WITHHOLD

AUTHORITY

to vote for all nominees listed below

|

NOMINEES

|

|

|

|

|

Two Year Term

|

|

Three Year Terms

|

|

Lawrence H. Pearson, M.D.

|

|

Kenneth Appling

Wayne F. Shovelin

|

Instruction

: To withhold authority to vote for one or more nominees, write

that nominee’s name on the line below.

|

2.

|

RATIFICATION OF A NON-BINDING SHAREHOLDER RESOLUTION REGARDING EXECUTIVE COMPENSATION

: Proposal to ratify a non-binding shareholder resolution regarding

executive compensation.

|

FOR

AGAINST

ABSTAIN

|

3.

|

RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

: Proposal to ratify the appointment of Elliott Davis, PLLC as the Company’s independent registered public

accounting firm for 2009.

|

FOR

AGAINST

ABSTAIN

|

4.

|

OTHER BUSINESS

: On such other matters as may properly come before the Annual Meeting, the proxies are authorized to vote the shares represented by this

Appointment of Proxy in accordance with their best judgment.

|

THE SHARES REPRESENTED BY THIS APPOINTMENT OF PROXY WILL BE VOTED BY THE PROXIES IN ACCORDANCE WITH THE

SPECIFIC INSTRUCTIONS ABOVE. IN THE ABSENCE OF INSTRUCTIONS, THE PROXIES WILL VOTE SUCH SHARES “FOR” THE ELECTION OF EACH OF THE NOMINEES LISTED IN PROPOSAL 1 ABOVE AND “FOR” PROPOSALS 2 AND 3 ABOVE. IF, AT OR BEFORE THE TIME OF

THE MEETING, ANY OF THE NOMINEES LISTED IN PROPOSAL 1 FOR ANY REASON HAVE BECOME UNAVAILABLE FOR ELECTION OR UNABLE TO SERVE AS DIRECTORS, THE PROXIES HAVE THE DISCRETION TO VOTE FOR A SUBSTITUTE NOMINEE OR NOMINEES. THIS APPOINTMENT OF PROXY MAY BE

REVOKED AT ANY TIME BEFORE IT IS EXERCISED BY FILING WITH THE SECRETARY OF THE COMPANY AN INSTRUMENT REVOKING IT OR A DULY EXECUTED APPOINTMENT OF PROXY BEARING A LATER DATE, OR BY ATTENDING THE ANNUAL MEETING AND REQUESTING THE RIGHT TO VOTE IN

PERSON.

|

|

|

|

|

|

|

(SEAL)

|

|

(Signature)

|

|

|

|

|

|

|

|

|

(SEAL)

|

|

(Signature, if shares held jointly)

|

|

|

|

|

|

Instruction: Please sign above

exactly

as your name appears on this appointment of proxy. Joint owners of shares should

both

sign. Fiduciaries or other

persons signing in a representative capacity should indicate the capacity in which they are signing.

|

IMPORTANT: TO ENSURE THAT A QUORUM IS PRESENT, PLEASE SEND IN YOUR APPOINTMENT OF PROXY

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING. EVEN IF YOU SEND IN YOUR APPOINTMENT OF PROXY YOU WILL BE ABLE TO VOTE IN PERSON AT THE MEETING IF YOU SO DESIRE.

PLEASE MARK, SIGN, DATE AND PROMPTLY RETURN THIS PROXY CARD

IN

THE ENCLOSED ENVELOPE

2

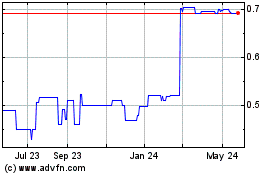

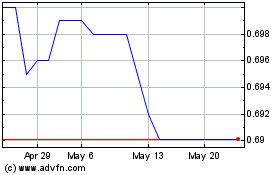

AB and T Financial (CE) (USOTC:ABTO)

Historical Stock Chart

From Jun 2024 to Jul 2024

AB and T Financial (CE) (USOTC:ABTO)

Historical Stock Chart

From Jul 2023 to Jul 2024