0001828748

true

Q1

--12-31

0001828748

2023-01-01

2023-03-31

0001828748

2023-05-19

0001828748

2023-03-31

0001828748

2022-12-31

0001828748

srt:DirectorMember

2023-03-31

0001828748

srt:DirectorMember

2022-12-31

0001828748

us-gaap:RelatedPartyMember

2023-03-31

0001828748

us-gaap:RelatedPartyMember

2022-12-31

0001828748

2022-01-01

2022-03-31

0001828748

us-gaap:CommonStockMember

2021-12-31

0001828748

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001828748

us-gaap:RetainedEarningsMember

2021-12-31

0001828748

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001828748

2021-12-31

0001828748

us-gaap:CommonStockMember

2022-12-31

0001828748

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001828748

us-gaap:RetainedEarningsMember

2022-12-31

0001828748

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001828748

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001828748

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001828748

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001828748

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-03-31

0001828748

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001828748

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001828748

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001828748

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001828748

us-gaap:CommonStockMember

2022-03-31

0001828748

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001828748

us-gaap:RetainedEarningsMember

2022-03-31

0001828748

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001828748

2022-03-31

0001828748

us-gaap:CommonStockMember

2023-03-31

0001828748

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001828748

us-gaap:RetainedEarningsMember

2023-03-31

0001828748

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001828748

ASFH:AsiaFINHoldingsCorpLabuanMember

2023-01-01

2023-03-31

0001828748

ASFH:AsiaFINHoldingsCorpLabuanMember

2023-03-31

0001828748

ASFH:AsiaFINHoldingsLimitedHongKongMember

2023-01-01

2023-03-31

0001828748

ASFH:AsiaFINHoldingsLimitedHongKongMember

2023-03-31

0001828748

ASFH:StarFINHoldingsLimitedMember

2023-01-01

2023-03-31

0001828748

ASFH:StarFINHoldingsLimitedMember

2023-03-31

0001828748

ASFH:StarFINAsiaSdnBhdMember

2023-01-01

2023-03-31

0001828748

ASFH:StarFINAsiaSdnBhdMember

2023-03-31

0001828748

ASFH:OrangeFINAcademySdnBhdMember

2023-01-01

2023-03-31

0001828748

ASFH:OrangeFINAcademySdnBhdMember

2023-03-31

0001828748

ASFH:InsiteMYSystemsSdnBhdMember

2023-01-01

2023-03-31

0001828748

ASFH:InsiteMYSystemsSdnBhdMember

2023-03-31

0001828748

ASFH:InsiteMYInnovationsSdnBhdMember

2023-01-01

2023-03-31

0001828748

ASFH:InsiteMYInnovationsSdnBhdMember

2023-03-31

0001828748

ASFH:OrangeFINAsiaSdnBhdMember

2023-01-01

2023-03-31

0001828748

ASFH:OrangeFINAsiaSdnBhdMember

2023-03-31

0001828748

ASFH:MurniStarFINSdnBhdMember

2023-01-01

2023-03-31

0001828748

ASFH:MurniStarFINSdnBhdMember

2023-03-31

0001828748

us-gaap:ConstructionInProgressMember

2023-01-01

2023-03-31

0001828748

us-gaap:ComputerEquipmentMember

srt:MinimumMember

2023-03-31

0001828748

us-gaap:ComputerEquipmentMember

srt:MaximumMember

2023-03-31

0001828748

us-gaap:FurnitureAndFixturesMember

2023-03-31

0001828748

ASFH:ElectricalFittingsMember

2023-03-31

0001828748

ASFH:HandphoneMember

2023-03-31

0001828748

us-gaap:OfficeEquipmentMember

2023-03-31

0001828748

us-gaap:VehiclesMember

2023-03-31

0001828748

ASFH:PropertyMember

2023-03-31

0001828748

ASFH:YearEndRMMember

2023-03-31

0001828748

ASFH:YearEndRMMember

2022-03-31

0001828748

ASFH:YearAverageRMMember

2023-03-31

0001828748

ASFH:YearAverageRMMember

2022-03-31

0001828748

ASFH:YearEndHKMember

2023-03-31

0001828748

ASFH:YearEndHKMember

2022-03-31

0001828748

ASFH:YearAverageHKMember

2023-03-31

0001828748

ASFH:YearAverageHKMember

2022-03-31

0001828748

ASFH:StarFINHoldingsLimitedMember

2023-01-23

0001828748

us-gaap:ComputerEquipmentMember

2023-03-31

0001828748

us-gaap:ComputerEquipmentMember

2022-12-31

0001828748

us-gaap:FurnitureAndFixturesMember

2022-12-31

0001828748

us-gaap:ElectricTransmissionMember

2023-03-31

0001828748

us-gaap:ElectricTransmissionMember

2022-12-31

0001828748

ASFH:HandphoneMember

2022-12-31

0001828748

us-gaap:OfficeEquipmentMember

2022-12-31

0001828748

ASFH:RenovationMember

2023-03-31

0001828748

ASFH:RenovationMember

2022-12-31

0001828748

ASFH:MotorVehicalMember

2023-03-31

0001828748

ASFH:MotorVehicalMember

2022-12-31

0001828748

ASFH:PropertyMember

2022-12-31

0001828748

us-gaap:ComputerEquipmentMember

2023-01-01

2023-03-31

0001828748

us-gaap:ComputerEquipmentMember

2022-01-01

2022-12-31

0001828748

us-gaap:FurnitureAndFixturesMember

2023-01-01

2023-03-31

0001828748

us-gaap:FurnitureAndFixturesMember

2022-01-01

2022-12-31

0001828748

ASFH:HandphoneMember

2023-01-01

2023-03-31

0001828748

ASFH:HandphoneMember

2022-01-01

2022-12-31

0001828748

us-gaap:OfficeEquipmentMember

2023-01-01

2023-03-31

0001828748

us-gaap:OfficeEquipmentMember

2022-01-01

2022-12-31

0001828748

ASFH:RenovationMember

2023-01-01

2023-03-31

0001828748

ASFH:RenovationMember

2022-01-01

2022-12-31

0001828748

ASFH:InvestmentPropertyMember

2023-01-01

2023-03-31

0001828748

ASFH:InvestmentPropertyMember

2022-01-01

2022-12-31

0001828748

2022-01-01

2022-12-31

0001828748

ASFH:InvestmentPropertyMember

srt:DirectorMember

2022-01-01

2022-12-31

0001828748

srt:DirectorMember

2023-01-01

2023-03-31

0001828748

srt:ChiefExecutiveOfficerMember

2023-01-01

2023-03-31

0001828748

us-gaap:VehiclesMember

2021-04-30

2021-04-30

0001828748

2021-04-30

2021-04-30

0001828748

2021-04-30

0001828748

ASFH:HirePurchaseLoanMember

2023-03-31

0001828748

2020-12-31

0001828748

2021-01-01

2021-12-31

0001828748

us-gaap:CustomerConcentrationRiskMember

2023-01-01

2023-03-31

0001828748

us-gaap:SupplierConcentrationRiskMember

2023-01-01

2023-03-31

0001828748

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ASFH:CustomerAMember

2023-01-01

2023-03-31

0001828748

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ASFH:CustomerBMember

2023-01-01

2023-03-31

0001828748

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ASFH:CustomerBMember

2023-03-31

0001828748

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ASFH:CustomerCMember

2023-01-01

2023-03-31

0001828748

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ASFH:CustomerDMember

2023-01-01

2023-03-31

0001828748

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ASFH:CustomerDMember

2023-03-31

0001828748

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ASFH:OthersMember

2023-01-01

2023-03-31

0001828748

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

ASFH:OthersMember

2023-03-31

0001828748

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

ASFH:SupplierAMember

2023-01-01

2023-03-31

0001828748

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

ASFH:SupplierAMember

2023-03-31

0001828748

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

ASFH:SupplierBMember

2023-01-01

2023-03-31

0001828748

us-gaap:AccountsPayableMember

us-gaap:SupplierConcentrationRiskMember

ASFH:SupplierBMember

2023-03-31

0001828748

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

ASFH:SupplierCMember

2023-01-01

2023-03-31

0001828748

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

ASFH:SupplierDMember

2023-01-01

2023-03-31

0001828748

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

ASFH:OthersMember

2023-01-01

2023-03-31

0001828748

us-gaap:CostOfGoodsProductLineMember

us-gaap:SupplierConcentrationRiskMember

ASFH:OthersMember

2023-03-31

0001828748

country:US

2023-01-01

2023-03-31

0001828748

country:US

2022-01-01

2022-03-31

0001828748

country:HK

2023-01-01

2023-03-31

0001828748

country:HK

2022-01-01

2022-03-31

0001828748

ASFH:BritishVirginiaIslandMember

2023-01-01

2023-03-31

0001828748

ASFH:BritishVirginiaIslandMember

2022-01-01

2022-03-31

0001828748

ASFH:LabuanMember

2023-01-01

2023-03-31

0001828748

ASFH:LabuanMember

2022-01-01

2022-03-31

0001828748

country:MY

2023-01-01

2023-03-31

0001828748

country:MY

2022-01-01

2022-03-31

0001828748

ASFH:InsiteMYInnovationsSdnBhdMember

2022-01-01

2022-12-31

0001828748

ASFH:InsiteMYSystemsSdnBhdMember

2022-01-01

2022-12-31

0001828748

ASFH:MrWongKaiCheongAndMrHooSweePingMember

2022-01-01

2022-12-31

0001828748

ASFH:InformationTechnologyBusinessMember

2023-01-01

2023-03-31

0001828748

ASFH:InformationTechnologyBusinessMember

2023-03-31

0001828748

ASFH:NonMalaysiaMember

2023-01-01

2023-03-31

0001828748

country:MY

2023-03-31

0001828748

ASFH:NonMalaysiaMember

2023-03-31

0001828748

ASFH:InformationTechnologyBusinessMember

2022-01-01

2022-03-31

0001828748

ASFH:InformationTechnologyBusinessMember

2022-03-31

0001828748

ASFH:NonMalaysiaMember

2022-01-01

2022-03-31

0001828748

country:MY

2022-03-31

0001828748

ASFH:NonMalaysiaMember

2022-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:HKD

xbrli:shares

iso4217:HKD

iso4217:MYR

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q/A

(Amendment

No. 1)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the Quarterly Period Ended March 31, 2023

or

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from ______ to ______

Commission

File Number 000-56421

ASIAFIN

HOLDINGS CORP.

(Exact

name of registrant issuer as specified in its charter)

| Nevada |

|

7389 |

|

37-1950147 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Number) |

|

(IRS

Employer

Identification

Number) |

Suite

30.02, 30th Floor, Menara KH (Promet),

Jalan Sultan Ismail, 50250 Kuala Lumpur, Malaysia.

(Address of principal executive offices, including zip code)

+(60)3

2148 7170

(Registrant’s telephone number, including area code)

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data

File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (section 232.405 of this chapter) during the preceding

twelve months (or shorter period that the registrant was required to submit and post such files).

Yes

☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large

Accelerated Filer ☐ |

Accelerated

Filer ☐ |

Non-accelerated

Filer ☒ |

Smaller

reporting company ☒ |

| |

|

|

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE

PRECEDING

FIVE YEARS:

Indicate

by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

N/A

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

on each exchange on which registered |

| N/A |

|

N/A |

|

N/A |

APPLICABLE

ONLY TO CORPORATE ISSUERS:

Indicate

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| Class |

|

Outstanding

at May 19, 2023 |

| Common Stock,

$0.0001 par value |

|

81,551,838 |

TABLE

OF CONTENTS

PART

I — FINANCIAL INFORMATION

ITEM

1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

ASIAFIN

HOLDINGS CORP.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS

AS

OF MARCH 31, 2023 AND DECEMBER 31, 2022 (audited)

(Currency

expressed in United States Dollars (“US$”), except for number of shares or otherwise stated)

| | |

As of

March 31, 2023 | | |

As of

December 31, 2022 | |

| | |

Unaudited | | |

Audited | |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,647,733 | | |

$ | 874,690 | |

| Trade receivables, net | |

| 463,761 | | |

| - | |

| Prepayment, deposits and other receivables | |

| 90,406 | | |

| 3,000 | |

| Tax assets | |

| 549,319 | | |

| - | |

| Total current assets | |

$ | 2,751,219 | | |

$ | 877,690 | |

| | |

| | | |

| | |

| Non-current Assets | |

| | | |

| | |

| Right-of-use assets, net | |

$ | 111,752 | | |

$ | - | |

| Property, plant and equipment, net | |

| 572,176 | | |

| - | |

| Deferred income tax assets | |

| 869 | | |

| - | |

| Investment in associates | |

| 8,616 | | |

| - | |

| Total non-current assets | |

$ | 693,413 | | |

$ | - | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 3,444,632 | | |

$ | 877,690 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Other payables and accrued liabilities | |

$ | 809,959 | | |

$ | 17,805 | |

| Trade payable | |

| 65,197 | | |

| 3,357 | |

| Income tax payable | |

| 206,643 | | |

| - | |

| Amount due to director | |

| 265,441 | | |

| - | |

| Amount due to related parties | |

| 1,495 | | |

| - | |

| Hire purchase – current portion | |

| 11,650 | | |

| - | |

| Lease liability – current portion | |

| 81,687 | | |

| - | |

| Total current liabilities | |

$ | 1,442,072 | | |

$ | 21,162 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Hire purchase – non-current portion | |

$ | 1,981 | | |

$ | - | |

| Lease liability – non-current portion | |

| 30,065 | | |

| - | |

| Deferred tax liabilities | |

| 9,250 | | |

| - | |

| Total non-current liabilities | |

$ | 41,296 | | |

$ | - | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

$ | 1,483,368 | | |

$ | 21,162 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ DEFICIT | |

| | | |

| | |

| Preferred shares, $0.0001 par

value; 200,000,000 shares authorized; None issued and outstanding | |

$ | - | | |

$ | - | |

| Common stock, $0.0001 par value; 600,000,000 shares authorized; 81,551,838 and 73,319,800 shares issued and outstanding

as of March 31, 2023 and December 31, 2022 | |

| 8,155 | | |

| 7,332 | |

| Additional paid-in capital | |

| 10,467,687 | | |

| 1,413,268 | |

| Accumulated other comprehensive loss | |

| (264,705 | ) | |

| - | |

| Accumulated deficit | |

| (8,249,873 | ) | |

| (564,072 | ) |

| | |

| | | |

| | |

| TOTAL STOCKHOLDERS’ DEFICIT | |

$ | 1,961,264 | | |

$ | 856,528 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 3,444,632 | | |

$ | 877,690 | |

See

accompanying notes to unaudited condensed consolidated financial statements.

ASIAFIN

HOLDINGS CORP.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

FOR

THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022

(Currency

expressed in United States Dollars (“US$”), except for number of shares or otherwise stated)

| | |

| | |

| |

| | |

Three months ended March 31, 2023 | | |

Three months ended March 31, 2022 | |

| | |

| | |

| |

| REVENUE | |

| 474,802 | | |

$ | - | |

| | |

| | | |

| | |

| COST OF REVENUE | |

| (53,662 | ) | |

| - | |

| | |

| | | |

| | |

| GROSS PROFIT | |

| 421,140 | | |

$ | - | |

| | |

| | | |

| | |

| SELLING, GENERAL AND ADMINISTRATIVE EXPENSES | |

| (755,776 | ) | |

$ | (6,123 | ) |

| | |

| | | |

| | |

| | |

| | | |

| | |

| INCOME TAX PROVISION | |

| - | | |

| (241 | ) |

| | |

| | | |

| | |

| NET LOSS | |

| (334,636 | ) | |

$ | (6,364 | ) |

| | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | |

| - Foreign currency translation loss | |

| (4,653 | ) | |

| - | |

| | |

| | | |

| | |

| TOTAL COMPREHENSIVE LOSS | |

| (339,289 | ) | |

$ | (6,364 | ) |

| | |

| | | |

| | |

| NET LOSS PER SHARE, BASIC AND DILUTED | |

| (0.00 | ) | |

| (0.00 | ) |

| | |

| | | |

| | |

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING, BASIC AND DILUTED | |

| 76,612,615 | | |

$ | 73,319,800 | |

See

accompanying notes to unaudited condensed consolidated financial statements.

ASIAFIN

HOLDINGS CORP.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

FOR

THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022

(Currency

expressed in United States Dollars (“US$”), except for number of shares or otherwise stated)

| | |

NUMBER OF SHARES | | |

AMOUNT | | |

ADDITIONAL PAID-IN CAPITAL | | |

ACCUMULATED DEFICIT | | |

ACCUMULATED COMPREHENSIVE LOSS | | |

TOTAL STOCKHOLDERS’ EQUITY | |

| | |

COMMON STOCK | | |

| | |

| | |

| | |

| |

| | |

NUMBER OF SHARES | | |

AMOUNT | | |

ADDITIONAL PAID-IN CAPITAL | | |

ACCUMULATED DEFICIT | | |

ACCUMULATED COMPREHENSIVE LOSS | | |

TOTAL STOCKHOLDERS’ EQUITY | |

| Balance as of December 31, 2021 | |

| 73,319,800 | | |

$ | 7,332 | | |

$ | 1,413,268 | | |

$ | (451,870 | ) | |

$ | - | | |

$ | 968,730 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| (6,364 | ) | |

| - | | |

| (6,364 | ) |

| Balance as of March 31, 2022 | |

| 73,319,800 | | |

$ | 7,332 | | |

$ | 1,413,268 | | |

$ | (458,234 | ) | |

$ | - | | |

$ | 962,366 | |

| | |

COMMON STOCK | | |

| | |

| | |

| | |

| |

| | |

NUMBER OF SHARES | | |

AMOUNT | | |

ADDITIONAL PAID-IN CAPITAL | | |

ACCUMULATED DEFICIT | | |

ACCUMULATED COMPREHENSIVE LOSS | | |

TOTAL STOCKHOLDERS’ EQUITY | |

| Balance as of December 31, 2022 | |

| 73,319,800 | | |

$ | 7,332 | | |

$ | 1,413,268 | | |

$ | (564,072 | ) | |

$ | - | | |

$ | 856,528 | |

| Issuance of share for acquisition of StarFIN Holdings Limited on February

23, 2023 | |

| 8,232,038 | | |

| 823 | | |

| 9,054,419 | | |

| (7,351,165 | ) | |

| (260,052 | ) | |

| 1,444,025 | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| (334,636 | ) | |

| - | | |

| (334,636 | ) |

| Foreign currency translation | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,653 | ) | |

| (4,653 | ) |

| Balance as of March 31, 2023 | |

| 81,551,838 | | |

$ | 8,155 | | |

$ | 10,467,687 | | |

$ | (8,249,873 | ) | |

$ | (264,705 | ) | |

$ | 1,961,264 | |

See

accompanying notes to unaudited condensed consolidated financial statements

ASIAFIN

HOLDINGS CORP.

UNAUDITED

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

FOR

THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022

(Currency

expressed in United States Dollars (“US$”), except for number of shares or otherwise stated)

| | |

Three Months Ended March 31, 2023 | | |

Three Months

Ended March 31, 2022 | |

| | |

Three Months Ended March 31, 2023 | | |

Three Months

Ended March 31, 2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | | |

| | |

| Net loss | |

$ | (334,636 | ) | |

$ | (6,364 | ) |

| | |

| | | |

| | |

| Adjustments to reconcile net profit to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortisation | |

| 44,985 | | |

| - | |

| | |

| | | |

| | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Account payable | |

| 40,862 | | |

| (4,200 | ) |

| Account receivable | |

| 210,521 | | |

| - | |

| Prepayment, deposits and other receivables | |

| 114,166 | | |

| - | |

| Other payables and accrued liabilities | |

| 287,725 | | |

| (6,200 | ) |

| Deferred revenue | |

| 161,643 | | |

| - | |

| Tax assets | |

| (12,811 | ) | |

| - | |

| Change in lease liability | |

| (22,588 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash provided by/(used in) operating activities | |

$ | 489,867 | | |

$ | (16,764 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | |

| | | |

| | |

| Purchase of property, plant and equipment | |

| (11,395 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash used in investing activities | |

$ | (11,395 | ) | |

$ | - | |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | |

| | | |

| | |

| Advance to director | |

| (17,077 | ) | |

| - | |

| Repayment of hire purchase | |

| (2,866 | ) | |

| - | |

| Advances to related companies | |

| (177 | ) | |

| - | |

| Dividend paid | |

| (387,076 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash used in financing activities | |

$ | (407,196 | ) | |

$ | - | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

$ | (3,713 | ) | |

$ | - | |

| | |

| | | |

| | |

| Net increase in cash and cash equivalents | |

$ | 67,563 | | |

$ | (16,764 | ) |

| Cash and cash equivalents, beginning of year | |

| 1,580,170 | | |

| 980,681 | |

| | |

| | | |

| | |

| CASH AND CASH EQUIVALENTS, END OF YEAR | |

$ | 1,647,733 | | |

$ | 963,917 | |

| | |

| | | |

| | |

| SUPPLEMENTAL CASH FLOWS INFORMATION | |

| | | |

| | |

| Cash paid for income taxes | |

$ | 21,972 | | |

$ | 241 | |

| Cash paid for interest paid | |

$ | - | | |

$ | - | |

See

accompanying notes to unaudited condensed consolidated financial statements.

ASIAFIN

HOLDINGS CORP.

NOTES

TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR

THE THREE MONTHS ENDED MARCH 31, 2023 AND 2022

(Currency

expressed in United States Dollars (“US$”), except for number of shares or otherwise stated)

1.

ORGANIZATION AND BUSINESS BACKGROUND

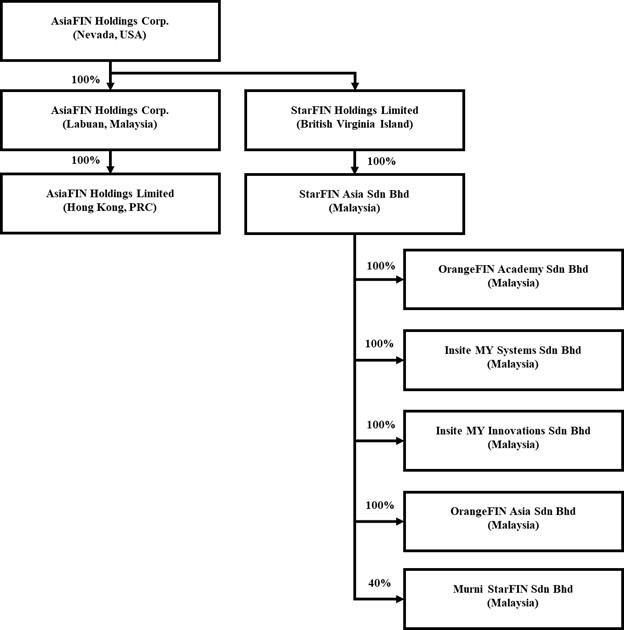

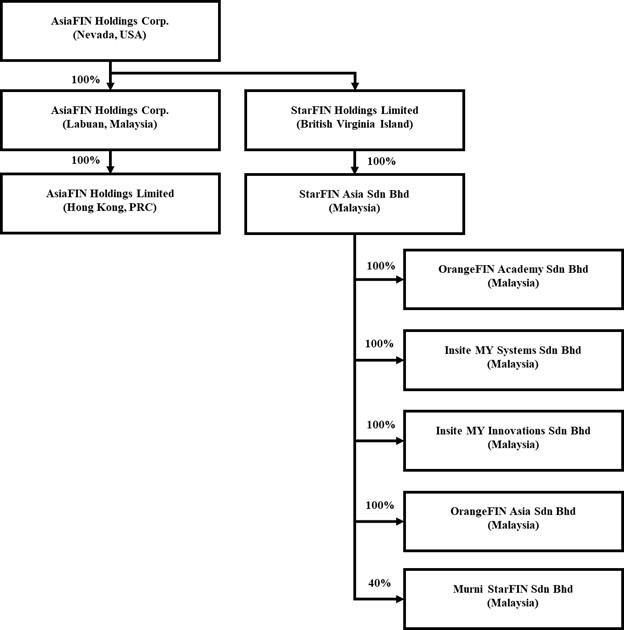

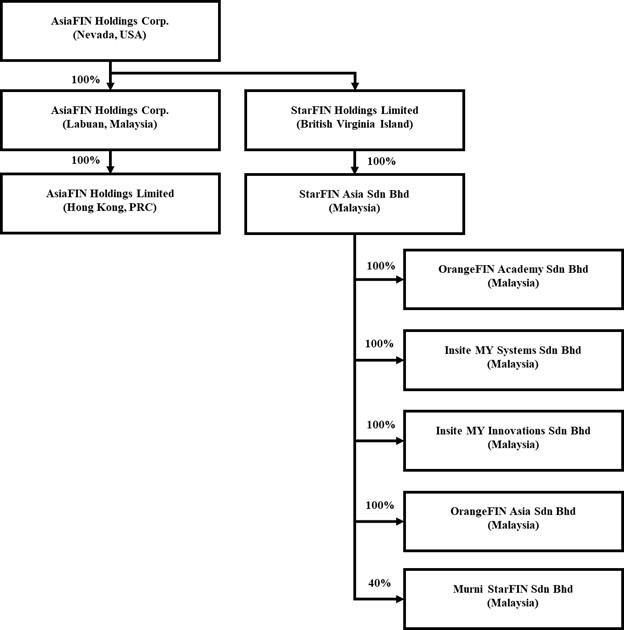

AsiaFIN

Holdings Corp. (“the Company”) was incorporated under the jurisdiction of Nevada on June 14, 2019. The Company, through its

wholly owned subsidiaries, provides information technology services. Details of the Company’s subsidiaries and associate:

SCHEDULE OF SUBSIDIARIES

| No. |

|

Subsidiary

Company Name |

|

Domicile

and Date of Incorporation |

|

Particulars

of Issued Capital |

|

Principal

Activities |

| 1 |

|

AsiaFIN Holdings Corp. |

|

Labuan at July 15, 2019 |

|

1 shares of common stock |

|

Investment holding company |

| |

|

|

|

|

|

|

|

|

| 2 |

|

AsiaFIN Holdings Limited |

|

Hong Kong at July 5, 2019 |

|

1 shares of common stock |

|

Investment holding company |

| |

|

|

|

|

|

|

|

|

| 3 |

|

StarFIN Holdings Limited |

|

British Virgin Island at August 19, 2021 |

|

10,000 shares of common stock |

|

Investment holding company |

| |

|

|

|

|

|

|

|

|

| 4 |

|

StarFIN Asia Sdn Bhd |

|

Malaysia at May 24, 2018 |

|

11,400,102 shares of common

stock |

|

Investment holding company |

| |

|

|

|

|

|

|

|

|

| 5 |

|

OrangeFIN Academy Sdn Bhd |

|

Malaysia at February 2,

2000 |

|

100,000 shares of common

stock |

|

Provision of business system

integration and management services |

| |

|

|

|

` |

|

|

|

|

| 6 |

|

Insite MY Systems Sdn Bhd |

|

Malaysia at January 18,

2000 |

|

500,000 shares of common

stock |

|

Provision of information

technology services |

| |

|

|

|

|

|

|

|

|

| 7 |

|

Insite MY Innovations Sdn

Bhd |

|

Malaysia at January 18,

2010 |

|

540,000 shares of common

stock |

|

Provision of information

technology services |

| |

|

|

|

|

|

|

|

|

| 8 |

|

OrangeFIN Asia Sdn Bhd |

|

Malaysia at January

25, 2018 |

|

50,000 shares of common

stock |

|

Provision of computer programming

activities and services |

| No. |

|

Associate

Company Name |

|

Domicile

and Date of Incorporation |

|

Particulars

of Issued Capital |

|

Principal

Activities |

| 1 |

|

Murni StarFIN Sdn Bhd |

|

Malaysia at September 9,

2022 |

|

100,000 shares of common

stock |

|

Provision of information

technology services |

Mr.

Wong Kai Cheong is the common director of all of aforementioned companies.

2.

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis

of Presentation

These

accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States

of America (“US GAAP”).

The

accompanying financial statements include the accounts of the Company and its subsidiaries and associates. Intercompany transactions

and balances were eliminated in consolidation. The Company has adopted December 31 as its fiscal year end. Below is the organization

chart of the Group.

The

accompanying unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2023 and 2022 have

been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) that permit reduced

disclosure for interim periods. Certain information and footnote disclosures normally included in financial statements prepared in accordance

with accounting principles generally accepted in the United States of America (“US GAAP”) have been condensed or omitted.

In the opinion of management, all adjustments (consisting of normal recurring accruals) considered necessary for a fair presentation

have been included. Operating results for the period ended March 31, 2023 are not necessarily indicative of the results that may be expected

for the year ending December 31, 2023. The Condensed Consolidated Balance Sheet information as of December 31, 2022 was derived from

the Company’s audited Consolidated Financial Statements as of and for the year ended December 31, 2022 included in the Company’s

Annual Report on Form 10-K filed with the SEC on February 16, 2023. These financial statements should be read in conjunction with that

report.

The

accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries

and majority-owned subsidiaries which the Company controls and entities for which the Company is the primary beneficiary. For those consolidated

subsidiaries where the Company’s ownership is less than 100%, the outside shareholders’ interests are shown as noncontrolling

interests in equity. Acquired businesses are included in the consolidated financial statements from the date on which control is transferred

to the Company. Subsidiaries are deconsolidated from the date that control ceases. All inter-company accounts and transactions have been

eliminated in consolidation.

Use

of Estimates

In

preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities

in the balance sheets and revenues and expenses during the years reported. Actual results may differ from these estimates.

Cash

and Cash Equivalents

The

Company considers short-term, highly liquid investments with an original maturity of 90 days or less to be cash equivalents.

Our

deposit in Malaysia banks are secured by Perbadanan Insurans Deposit Malaysia, compensating up to a limit of Malaysia Ringgit MYR250,000

per deposit per member bank, which is equivalent to $56,923, if any of our bank fail.

Property,

Plant and Equipment

Property, plant

and equipment are stated at cost, with depreciation and amortization provided using the straight-line method over the following periods:

SCHEDULE

OF PLANT AND EQUIPMENT DEPRECIATION PERIODS

| Asset

Categories |

|

Depreciation

Periods |

| Renovation |

|

over the remaining lease

period |

| Computer Systems |

|

4 to 5 years |

| Furniture and Fittings |

|

10 years |

| Electrical Fittings |

|

10 years |

| Handphone |

|

5 years |

| Office Equipment |

|

10 years |

| Motor Vehicle |

|

5 years |

| Property |

|

50 years |

Revenue

recognition

The

Company through subsidiaries generate multiple streams of revenues based on different business model adopted by each subsidiary through

provisions of services and recognized upon customer obtained control of promised services and recognized in an amount that reflects the

consideration that the Company expects to receive in exchange for those services. In addition, the standard requires disclosure of the

nature, amount, timing, and uncertainty of revenue and cash flows arising from contracts with customers. The Company applies the following

five-step model in order to determine this amount:

(i)

Identify contract with customer;

(ii)

Identify distinct performance obligations in contract, including promises if any;

(iii)

Measurement of the transaction price, including the constraint on variable consideration;

(iv)

Allocation of the transaction price to the performance obligations; and

(v)

Recognition of revenue when (or as) the Company satisfies each performance obligation.

Cost

of revenue

Cost

of revenue includes direct costs associated with provision of services such as development costs, purchases of third-party software,

maintenance fees and consultation fees.

Income

tax expense

Income

taxes are determined in accordance with the provisions of ASC Topic 740, “Income Taxes” (“ASC Topic 740”). Under

this method, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the

financial statement carrying amounts of existing assets and liabilities and their respective tax basis. Deferred tax assets and liabilities

are measured using enacted income tax rates expected to apply to taxable income in the years in which those temporary differences are

expected to be recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income

in the period that includes the enactment date.

ASC

740 prescribes a comprehensive model for how companies should recognize, measure, present, and disclosed in their financial statements

uncertain tax positions taken or expected to be taken on a tax return. Under ASC 740, tax positions must initially be recognized in the

financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax

positions must initially and subsequently be measured as the largest amount of tax benefit that has a greater than 50% likelihood of

being realized upon ultimate settlement with the tax authority assuming full knowledge of the position and relevant facts.

The

Company conducts major businesses in Malaysia and is subject to tax in their own jurisdictions. As a result of its business activities,

the Company will file separate tax returns that are subject to examination by the foreign tax authorities.

Foreign

currencies translation

Transactions

denominated in currencies other than the functional currency are translated into the functional currency at the exchange rates prevailing

at the dates of the transaction. Monetary assets and liabilities denominated in currencies other than the functional currency are translated

into the functional currency using the applicable exchange rates at the balance sheet dates. The resulting exchange differences are recorded

in the statement of operations and comprehensive income (loss).

The

functional currency of the Company is the United States Dollars (“US$”) and the accompanying financial statements have been

expressed in US$. In addition, the Company’s subsidiary maintains its books and record in Malaysia Ringgits (“MYR”),

United States Dollars (“US$”) and Hong Kong Dollars (“HK$”), which is the respective functional currency as being

the primary currency of the economic environment in which the entity operates.

In

general, for consolidation purposes, assets and liabilities of its subsidiaries whose functional currency is not US$ are translated into

US$, in accordance with ASC Topic 830-30, “Translation of Financial Statement”, using the exchange rate on the balance sheet

date. Revenues and expenses are translated at average rates prevailing during the period. The gains and losses resulting from translation

of financial statements of foreign subsidiary are recorded as a separate component of accumulated other comprehensive income.

Translation

of amounts from the local currency of the Company into US$1 has been made at the following exchange rates for the respective periods:

SCHEDULE OF FOREIGN EXCHANGE RATE

| | |

For the period three months ended March 31 | |

| | |

2023 | | |

2022 | |

| Period-end MYR : US$1 exchange rate | |

| 4.42 | | |

| 4.20 | |

| Period-average MYR : US$1 exchange rate | |

| 4.39 | | |

| 4.20 | |

| Period-end HK$ : US$1 exchange rate | |

| 7.75 | | |

| 7.83 | |

| Period-average HK$ : US$1 exchange rate | |

| 7.75 | | |

| 7.81 | |

Related

parties

Parties,

which can be a corporation or individual, are considered to be related if the Company has the ability, directly or indirectly, to control

the other party or exercise significant influence over the other party in making financial and operating decisions. Companies are also

considered to be related if they are subject to common control or common significant influence.

Fair

value of financial instruments

The

carrying value of the Company’s financial instruments: cash and cash equivalents, trade receivable, deposits and other receivables,

amount due to related parties and other payables approximate at their fair values because of the short-term nature of these financial

instruments.

The

Company also follows the guidance of the ASC Topic 820-10, “Fair Value Measurements and Disclosures” (“ASC 820-10”),

with respect to financial assets and liabilities that are measured at fair value. ASC 820-10 establishes a three-tier fair value hierarchy

that prioritizes the inputs used in measuring fair value as follows:

Level

1 : Observable inputs such as quoted prices in active markets;

Level

2 : Inputs, other than the quoted prices in active markets, that are observable either directly or indirectly; and

Level

3 : Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

As

of March 31, 2023, the Company did not have any nonfinancial assets and liabilities that are recognized or disclosed at fair value in

the financial statements, at least annually, on a recurring basis, nor did the Company have any assets or liabilities measured at fair

value on a non-recurring basis.

Net

Income/(Loss) per Share

The

Company calculates net income/(loss) per share in accordance with ASC Topic 260, “Earnings per Share.” Basic income/(loss)

per share is computed by dividing the net income/(loss) by the weighted-average number of common shares outstanding during the period.

Diluted income per share is computed similar to basic income/(loss) per share except that the denominator is increased to include the

number of additional common shares that would have been outstanding if the potential common stock equivalents had been issued and if

the additional common shares were dilutive.

Lease

The

Company offices for fixed periods pre-emptive extension options. The Company recognizes lease payments for its short-term lease on a

straight-line basis over the lease term.

Lease

liability is initially and subsequently measured at the present value of the unpaid lease payments at the lease commencement date. The

right-of-use asset is initially measured at cost, which comprises the initial amount of the lease liability adjusted for lease payments

made at or before the lease commencement date, plus any initial direct costs incurred less any lease incentives received. Costs associated

with operating lease assets are recognized on a straight-line basis within operating expenses over the term of the lease.

In

determining the present value of the unpaid lease payments, ASC 842 requires a lessee to discount its unpaid lease payments using the

interest rate implicit in the lease or, if that rate cannot be readily determined, its incremental borrowing rate. As most of the Company

leases do not provide an implicit rate, the Company uses its incremental borrowing rate as the discount rate for the lease. The Company

incremental borrowing rate is estimated to approximate the interest rate on a collateralized basis with similar terms and payments.

Recently

Adopted Accounting Standards

In

June 2016, the FASB issued Accounting Standards Update No. 2016-13, Financial Instruments—Credit Losses (Topic 326): Measurement

of Credit Losses on Financial Instruments, which introduced the expected credit losses methodology for the measurement of credit losses

on financial assets measured at amortized cost basis, replacing the previous incurred loss methodology. In November 2019, the FASB issued

ASU 2019-10 highlighted the adoption timeline. For smaller reporting entities, Topic 326 is effective for annual periods beginning after

December 15, 2022, including interim periods within those fiscal years, of which is effective for the Company on January 1, 2023.

Credit

loss rate is determined by historical collection based on aging schedule, adjusted for current conditions using reasonable and supportable

forecasts. Based on the aging categorization and the adjusted loss rate per category, an allowance for credit losses is calculated by

multiplying the adjusted loss rate with the amortized cost in the respective age category.

Recently

Issued Accounting Standards

The

Company reviews new accounting standards as issued. Management has not identified any other new standards that it believes will have

a significant impact on the Company’s financial statements.

3. BUSINESS COMBINATIONS

On January 23, 2023, the Company acquired 100% equity

interest in StarFIN Holdings Limited and its subsidiaries which offers a range of system solutions services naming from Payment Processing,

Robotic Process Automation (RPA), and Regulatory Technology (RegTech) services through its wholly owned subsidiaries, which are StarFIN

Asia Sdn Bhd., OrangeFIN Asia Sdn. Bhd., OrangeFIN Academy Sdn. Bhd., Insite MY Innovations Sdn. Bhd., and Insite MY Systems Sdn. Bhd.

The acquisition of SFHL has been accounted for under

the purchase method of accounting in accordance with Statement of Financial Accounting Standards No. 141, “Business Combinations.”

Under the purchase method of accounting, the purchase price is allocated to the assets acquired and liabilities assumed based on their

estimated fair values.

4.

TRADE RECEIVABLE

SCHEDULE

OF TRADE RECEIVABLE

| | |

As of March 31, 2023 | | |

As of December 31, 2022 | |

| Trade receivable, gross | |

$ | 528,679 | | |

$ | - | |

| Allowance for expected credit loss | |

| (64,918 | ) | |

| - | |

| Trade receivable, net | |

$ | 463,761 | | |

$ | - | |

5. PREPAYMENT,

DEPOSITS AND OTHER RECEIVABLES

SCHEDULE

OF PREPAYMENT,

DEPOSITS AND OTHER RECEIVABLES

| | |

As of March 31, 2023 | | |

As of December 31, 2022 | |

| Rental deposits | |

$ | 26,940 | | |

$ | - | |

| Prepaid expenses | |

| 58,897 | | |

| - | |

| Other receivables | |

| 264 | | |

| 3,000 | |

| Other deposits | |

| 4,305 | | |

| - | |

| Unbilled revenue | |

| - | | |

| - | |

| Total | |

$ | 90,406 | | |

$ | 3,000 | |

The

rental deposits represent the deposit of the tenancy agreements.

Prepaid

expenses include website domain, third party software maintenance and subscription, rental, employee and motor vehicle insurance.

Other

receivables include deposits payment made for utility purposes, car park for director and employees.

Other

deposits primarily consist of deposit made for security deposit for renovation.

6.

SCHEDULE

OF PROPERTY, PLANT AND EQUIPMENT

| | |

As of March 31, 2023 | | |

As of December 31, 2022 | |

| Computer systems | |

$ | 259,585 | | |

$ | - | |

| Furniture and fittings | |

| 82,555 | | |

| - | |

| Electrical fittings | |

| 9,889 | | |

| - | |

| Handphone | |

| 49,414 | | |

| - | |

| Office equipment | |

| 92,863 | | |

| - | |

| Renovation | |

| 82,381 | | |

| - | |

| Motor vehicle | |

| 378,440 | | |

| - | |

| Property | |

| 418,278 | | |

| - | |

| Total property, plant and equipment | |

$ | 1,373,405 | | |

$ | - | |

| Less: Accumulated depreciation | |

| (801,229 | ) | |

| - | |

| Total property, plant and equipment, net | |

$ | 572,176 | | |

$ | - | |

SCHEDULE OF INVESTMENT IN PROPERTY AND

PLANT

| | |

For three months ended March 31, 2023 | | |

For the year ended December 31, 2022 | |

| Investment in computer systems | |

$ | 8,538 | | |

$ | - | |

| Investment in furniture and fittings | |

| - | | |

| - | |

| Investment in handphone | |

| - | | |

| - | |

| Investment in office equipment | |

| 2,494 | | |

| - | |

| Investment in renovation | |

| 363 | | |

| - | |

| Investment in property | |

| - | | |

| - | |

| Total investment in property and plant | |

$ | 11,395 | | |

$ | - | |

| | |

| | | |

| | |

| Depreciation for the period | |

| 22,396 | | |

$ | - | |

For

the year ended December 31, 2022, the Company acquired a property amounted $420,225 financed through loan from director which

is unsecured, non-interest bearing and payable on demand and cash in hand.

7. OTHER PAYABLES AND ACCRUED LIABILITIES

SCHEDULE

OF ACCRUED EXPENSES AND OTHER PAYABLES

| | |

As of March 31, 2023 | | |

As of December 31, 2022 | |

| Accrued expenses | |

$ | 311,097 | | |

$ | 17,805 | |

| Other payable | |

| 80,149 | | |

| - | |

| Receipt in advance | |

| 418,713 | | |

| - | |

| Total | |

$ | 809,959 | | |

$ | 17,805 | |

Accrued

expenses consist of outstanding audit fee, employee claims and salary, service tax and miscellaneous expenses.

Other

payable includes primarily service tax payable.

Receipt

in advance consist of monies received from customer but have yet to satisfied performance obligation.

8.

AMOUNT DUE TO DIRECTOR

As of March 31, 2023, the company had an outstanding

amount due to director amounted $265,441, mainly consist of a loan from Mr. Wong Kai Cheng for the acquisition of property.

Aforementioned

amount is unsecured, non-interest bearing and payable on demand.

9.

AMOUNT DUE TO A RELATED PARTIES

As

of March 31, 2023, the Company has an outstanding amount due to a number of related companies with common director and shareholder pertaining

to miscellaneous expenses made by these related parties on behalf in aggregate amounted $1,495.

Aforementioned

amount is unsecured, non-interest bearing and payable on demand.

For

the three months ended March 31, 2023, the Company has paid $24,202 to Ms. Tan Siew Meng, spouse of our Chief Executive Officer, Mr. Wong Kai Cheong

pertaining to leasing of office space.

10.

HIRE PURCHASE

On

April 30, 2021, the Company through subsidiary acquired a motor vehicle amounted $69,148

financed by $36,006

hire purchase loan for 36

months at a fixed flat rate of 1.88%

per annum with first installment commencing June 5, 2021 and monthly installment amounted approximately $1,063.

Remaining balance finance through cash in hand.

For the three months ended March 31, 2023, the Company

repaid $2,866 in hire purchase loan with an outstanding $13,631 as of March 31, 2023.

Maturities

of the loan for each of the two years and thereafter are as follows:

SCHEDULE OF MATURITIES OF THE LOAN

| Year ending December 31 | |

| | |

| 2023 | |

$ | 8,699 | |

| 2024 | |

$ | 4,932 | |

| Total | |

$ | 13,631 | |

11.

LEASE RIGHT-OF-USE ASSET AND LEASE LIABILITIES

SCHEDULE OF LEASE RIGHT OF USE

ASSETS AND LEASE LIABILITIES

| Right-Of-Use Assets | |

| | |

| Balance as of December 31,

2020 | |

$ | 152,685 | |

| Amortization for the year

ended December 31, 2021 | |

| (87,327 | ) |

| Balance as of December 31,

2021 | |

$ | 65,358 | |

| Recognition of new lease | |

| 163,956 | |

| Amortization for the year

ended December 31, 2022 | |

| (90,886 | ) |

| Adjustment for foreign currency

translation difference | |

| (3,621 | ) |

| Balance as of December 31,

2022 | |

$ | 134,807 | |

| Amortization for the three months ended March 31, 2023 | |

| (22,588 | ) |

| Adjustment for foreign currency translation difference | |

| (467 | ) |

| Balance as of March 31, 2023 | |

$ | 111,752 | |

| | |

| | |

| Lease Liability | |

| | |

| Balance as of December 31,

2020 | |

$ | 152,685 | |

| Imputed interest for the

year ended December 31, 2021 | |

| 5,369 | |

| Gross repayment for the

year ended December 31, 2021 | |

| (92,696 | ) |

| Balance as of December 31,

2021 | |

$ | 65,358 | |

| Recognition of new lease | |

| 163,956 | |

| Imputed interest for the

year ended December 31, 2022 | |

| 4,212 | |

| Gross repayment for the

year ended December 31, 2022 | |

| (95,098 | ) |

| Adjustment for foreign currency

translation difference | |

| (3,621 | ) |

| Balance as of December 31,

2022 | |

$ | 134,807 | |

| Imputed interest for three months ended March 31, 2023 | |

| 1,614 | |

| Gross repayment for three months ended March 31, 2023 | |

| (24,202 | ) |

| Adjustment for foreign currency translation difference | |

| (467 | ) |

| Balance as of March 31, 2023 | |

| 111,752 | |

| | |

| | |

| Lease liability current portion | |

| 81,687 | |

| Lease liability non-current portion | |

$ | 30,065 | |

Other

information:

SCHEDULE OF OTHER INFORMATION

| | |

Three months ended March 31, 2023 | | |

Three months ended March 31, 2022 | |

| Cash paid for amounts included in the measurement of lease liabilities: | |

| | | |

| | |

| Operating cash flow to operating lease | |

$ | 24,202 | | |

$ | - | |

| Right-of-use assets obtained in exchange for operating lease liabilities | |

| - | | |

| - | |

| Remaining lease term for operating lease (years) | |

| 1.35 | | |

| - | |

| Weighted average discount rate for operating lease | |

| 5.40 | % | |

| - | % |

12.

CONCENTRATION OF RISK

For

the three months ended March 31, 2023, the Company generated total revenue of $474,802, of which four customers accounted for more than

10% of the Company’s total revenue. For the three months ended March 31, 2022, the Company does not generate any revenue and hence

there was no customer accounted for more than 10% of the Company’s revenue. The customers who accounted for more than 10% of the

Company’s total revenue and its outstanding receivable balance at period-end is presented below:

SCHEDULE

OF CONCENTRATION OF RISK

| | |

For the three months ended March 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Revenue | | |

Percentage of Revenue | | |

Accounts

receivable, gross | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Customer A | |

$ | 97,543 | | |

$ | - | | |

| 21 | % | |

| - | % | |

$ | - | | |

$ | - | |

| Customer B | |

| 78,464 | | |

| - | | |

| 17 | % | |

| - | % | |

| 207,487 | | |

| - | |

| Customer C | |

| 72,861 | | |

| - | | |

| 15 | % | |

| - | % | |

| - | | |

| - | |

| Customer D | |

| 54,145 | | |

| - | | |

| 11 | % | |

| - | % | |

| 56,991 | | |

| - | |

| Others | |

| 171,789 | | |

| - | | |

| 36 | % | |

| - | % | |

| 264,201 | | |

| - | |

| Total | |

$ | 474,802 | | |

$ | - | | |

| 100 | % | |

| - | % | |

$ | 528,679 | | |

$ | - | |

For

the three months ended March 31, 2023, the Company incurred cost of revenue of $53,662, of which four suppliers accounted for more than

10% of the Company’s cost of revenue. For the three months ended March 31, 2022, the Company does not incur any cost of revenue

and hence there was no supplier accounted for more than 10% of the Company’s cost of revenue. The suppliers who accounted for more

than 10% of the Company’s cost of revenue and its outstanding payable balance at period-end is presented below:

SCHEDULE

OF CONCENTRATION OF RISK

| | |

For the three months ended March 31 | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Cost of revenue | | |

Percentage of Cost of revenue | | |

Accounts

payable, trade | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Supplier A | |

$ | 23,877 | | |

$ | - | | |

| 44 | % | |

| - | % | |

$ | 20,199 | | |

$ | - | |

| Supplier B | |

| 13,422 | | |

| - | | |

| 25 | % | |

| - | % | |

| 40,715 | | |

| - | |

| Supplier C | |

| 7,286 | | |

| - | | |

| 14 | % | |

| - | % | |

| - | | |

| - | |

| Supplier D | |

| 6,831 | | |

| - | | |

| 13 | % | |

| - | % | |

| - | | |

| - | |

| Others | |

| 2,246 | | |

| - | | |

| 4 | % | |

| - | % | |

| 4,283 | | |

| - | |

| Total | |

$ | 53,662 | | |

$ | - | | |

| 100 | % | |

| - | % | |

$ | 65,197 | | |

$ | - | |

Our

Chief Executive Officer, Mr. Wong Kai Cheong is a majority shareholder of Supplier A.

13.

INCOME TAXES

The

loss before income taxes of the Company for the three months ended March 31, 2023 and 2022 were comprised of the following:

SCHEDULE

OF COMPONENTS OF LOSS BEFORE INCOME TAXES

| | |

2023 | | |

2022 | |

| | |

For the three months ended March 31 | |

| | |

2023 | | |

2022 | |

| Tax jurisdictions from: | |

| | | |

| | |

| - Local | |

$ | ) | |

$ | ) |

| - Foreign, representing: | |

| | | |

| | |

| British Virginia Island (non-taxable jurisdiction) | |

| (300 | ) | |

| - | |

Provision

for income taxes consisted of the following:

SCHEDULE

OF PROVISION FOR INCOME TAXES

| | |

2023 | | |

2022 | |

| | |

For the three months ended March 31 | |

| | |

2023 | | |

2022 | |

| Current: | |

| | | |

| | |

| - Local | |

$ | - | | |

$ | - | |

| - Foreign | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Deferred tax assets: | |

| | | |

| | |

| - Local | |

$ | - | | |

$ | - | |

| - Foreign | |

$ | 549,319 | | |

$ | - | |

| | |

| | | |

| | |

| Deferred tax liabilities: | |

| | | |

| | |

| - Local | |

$ | - | | |

$ | - | |

| - Foreign | |

$ | 9,250 | | |

$ | - | |

| | |

| | | |

| | |

| Income tax payable: | |

| | | |

| | |

| - Local | |

$ | - | | |

$ | - | |

| - Foreign | |

$ | 206,643 | | |

$ | - | |

All

Malaysia companies are subject to the Malaysia Corporate Tax Laws at a two-tier corporate income tax rate based on amount of paid-up

capital. The 2022 tax rate for company with paid-up capital of MYR 2,500,000 (approximately $567,872) or less and that are not part of

a group containing a company exceeding this capitalization threshold is 17% on the first MYR 600,000 (approximately $136,289) taxable

profit with the remaining balance being taxed at 24%.

14.

DIVIDEND

For

the year ended December 31, 2022, Insite MY Innovations Sdn Bhd and Insite MY Systems Sdn Bhd, passed a board resolution for declaration

of dividend amounted MYR1,700,000 (approximately $385,680) and MYR4,294,000 (approximately $974,182), respectively to StarFIN Asia Sdn

Bhd. Subsequently, StarFIN Asia Sdn Bhd passed a board resolution for declaration of dividend amounted MYR5,794,000 to Mr. Wong Kai Cheong

and Mr. Hoo Swee Ping, before acquired by StarFIN Holdings Limited on January 20, 2023.

No

dividend was declared for the three months ended March 31, 2023.

15.

FOREIGN CURRENCY EXCHANGE RATE

The

Company cannot guarantee that the current exchange rate will remain stable, therefore there is a possibility that the Company could post

the same amount of income for two comparable periods and because of the fluctuating exchange rate post higher or lower income depending

on exchange rate converted into US$ at the end of the financial year. The exchange rate could fluctuate depending on changes in political

and economic environments without notice.

16.

SEGMENT REPORTING

ASC

280, “Segment Reporting” establishes standards for reporting information about operating segments on a basis consistent with

the Company’s internal organization structure as well as information about services categories, business segments and major customers

in financial statements. The Company has single reportable segment based on business unit, information technology business and two reportable

segments based on country, Malaysia and Non-Malaysia.

In

accordance with the “Segment Reporting” Topic of the ASC, the Company’s chief operating decision maker has been identified

as the Chief Executive Officer and President, who reviews operating results to make decisions about allocating resources and assessing

performance for the entire Company. Existing guidance, which is based on a management approach to segment reporting, establishes requirements

to report selected segment information quarterly and to report annually entity-wide disclosures about products and services, major customers,

and the countries in which the entity holds material assets and reports revenue. All material operating units qualify for aggregation

under “Segment Reporting” due to their similar customer base and similarities in economic characteristics; nature of products

and services; and procurement, manufacturing and distribution processes.

SCHEDULE

OF SEGMENT REPORTING

| | |

For the Three Months Ended and

As of March 31, 2023 | |

| By Business Unit | |

Information

Technology Business | | |

Total | |

| Revenue | |

$ | 474,802 | | |

$ | 474,802 | |

| | |

| | | |

| | |

| Cost of revenue | |

| (53,662 | ) | |

| (53,662 | ) |

| | |

| | | |

| | |

| Gross profit | |

$ | 421,140 | | |

$ | 421,140 | |

| | |

| | | |

| | |

| Selling, general and administrative expenses and other income | |

| (755,776 | ) | |

| (755,776 | ) |

| | |

| | | |

| | |

| Loss from operations | |

| (334,636 | ) | |

| (334,636 | ) |

| | |

| | | |

| | |

| Total assets | |

$ | 3,444,632 | | |

$ | 3,444,632 | |

| Capital expenditure | |

$ | 11,395 | | |

$ | 11,395 | |

| | |

For the Three Months Ended and

As of March 31, 2023 | |

| By Country | |

Malaysia | | |

Non-Malaysia | | |

Total | |

| Revenue | |

$ | 474,802 | | |

$ | - | | |

$ | 474,802 | |

| | |

| | | |

| | | |

| | |

| Cost of revenue | |

| (53,662 | ) | |

| - | | |

| (53,662 | ) |

| | |

| | | |

| | | |

| | |

| Gross profit | |

$ | 421,140 | | |

$ | - | | |

$ | 421,140 | |

| | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses and other income | |

| (632,279 | ) | |

| (123,497 | ) | |

| (755,776 | ) |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| (211,139 | ) | |

| (123,497 | ) | |

| (334,636 | ) |

| | |

| | | |

| | | |

| | |

| Total assets | |

$ | 2,708,958 | | |

$ | 735,674 | | |

$ | 3,444,632 | |

| Capital expenditure | |

$ | 11,395 | | |

$ | - | | |

$ | 11,395 | |

| | |

For the Three Months Ended and

As of March 31, 2022 | |

| By Business Unit | |

Information

Technology Business | | |

Total | |

| Revenue | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Cost of revenue | |

| - | | |

| - | |

| | |

| | | |

| | |

| Gross profit | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| General and administrative expenses and other income | |

| (6,123 | ) | |

| (6,123 | ) |

| | |

| | | |

| | |

| Loss from operations | |

| (6,123 | ) | |

| (6,123 | ) |

| | |

| | | |

| | |

| Total assets | |

$ | 965,166 | | |

$ | 965,166 | |

| Capital expenditure | |

$ | - | | |

$ | - | |

| | |

For the Three Months Ended and

As of March 31, 2022 | |

| By Country | |

Malaysia | | |

Non-Malaysia | | |

Total | |

| Revenue | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| Cost of revenue | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Gross profit | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| General and administrative expenses and other income | |

| - | | |

| (6,123 | ) | |

| (6,123 | ) |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| - | | |

| (6,123 | ) | |

| (6,123 | ) |

| | |

| | | |

| | | |

| | |

| Total assets | |

$ | - | | |

$ | 965,166 | | |

$ | 965,166 | |

| Capital expenditure | |

$ | - | | |

$ | - | | |

$ | - | |

17.

SUBSEQUENT EVENTS

In

accordance with ASC Topic 855, “Subsequent Events”, which establishes general standards of accounting for and disclosure

of events that occur after the balance sheet date but before financial statements are issued, the Company has evaluated all events or

transactions that occurred after March 31, 2023 up through the date the Company presented these unaudited financial statements.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The

information contained in this quarter report on Form 10-Q is intended to update the information contained in our Form 10-K dated February

16, 2023, for the year ended December 31, 2022 and presumes that readers have access to, and will have read, the “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and other information contained in such Form 10-K. The

following discussion and analysis also should be read together with our financial statements and the notes to the financial statements

included elsewhere in this Form 10-Q.

The

following discussion contains certain statements that may be deemed “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements appear in a number of places in this Report, including, without limitation,

“Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These statements are not guarantees

of future performance and involve risks, uncertainties and requirements that are difficult to predict or are beyond our control. Forward-looking

statements speak only as of the date of this quarter report. You should not put undue reliance on any forward-looking statements. We

strongly encourage investors to carefully read the factors described in our Form S-1/A registration statement, filed on March 19, 2021,

in the section entitled “Risk Factors” for a description of certain risks that could, among other things, cause actual results

to differ from these forward-looking statements. We assume no responsibility to update the forward-looking statements contained in this

quarter report on Form 10-Q. The following should also be read in conjunction with the unaudited Condensed Consolidated Financial Statements

and notes thereto that appear elsewhere in this report.

Company

Overview

Our

Company offer range of system solutions in Payment Processing, Robotic Process Automation (RPA), and Regulatory Technology (RegTech)

to financial institutions, regulatory agencies, professional service providers and private enterprises from various industries, with

existing client in the Asia region with over 60 key bank customers on payment processing and our Robotic Process Automation solution

company has more than 100 customers in Asia. Our solutions includes:

Payment

Processing

We

have our own web-based payment processing system for check clearing used in central banks, financial institutions and payment system

providers. This image-based check truncation system (CTS) is similar to the one used in the United States of America, under the CHECK21

standards. Our CTS systems are sold in Malaysia, Singapore, Indonesia, Philippines, Myanmar, Thailand, Pakistan and Bangladesh.

We

also have a ISO20022 compliant payment gateway solutions for central bank and financial institutions that is capable of supporting the

Straight Through Processing (STP) of all types of payment transactions (including SWIFT, Real-Time Gross Settlement (RTGS), GIRO (NACHA

standards) and FAST payment and extendable to interface with various types of payment gateways. Our STP payment gateway are sold in Malaysia,

Myanmar and Indonesia.

RegTech

We

have a regulatory and financial reporting (RegTech) system which conform to XBRL reporting standards and other compliance reporting required

by Regulatory agencies such as Central Bank, Securities Commission, Tax Authority Department and Companies Registry. Our reporting platform

covers financial statistic reporting, credit risk exposure and analysis, risk management reports, FATCA & CRS reporting, external

sector reporting, Goods and Services Tax (GST) reporting for reporting entities. We have more than 20 financial institutions using our

platform.

Robotic

Process Automation

We

have our own Artificial Intelligent (AI) based, Robotic Process Automation Software (RPA) solutions for financial institutions, large

corporations and small medium enterprises. RPA utilises software Robots for the automation of mundane, labour intensive, manual computer

operations. Robots are utilized for the processes where it helps to reduce operational costs and also costs arising from human error.

Our system automate the capturing of customer information from identity cards, passports and other identification peripherals. Our solution

automatically extract data from customers’ identity card, passport, etc. and immediately fill-in the forms, eliminating the friction

and errors caused by manual input, through Intelligent Character Recognition technology and other AI based technologies. Information

extracted from an official identification document will then be checked against existing financial institutions database for regulatory

screening in Internal Blacklist Check, Anti Money Laundering, Credit Scoring Check, FATCA, Common Reporting Standard (CRS) and ESG reporting,

etc.

Results

of operations

Three

months ended March 31, 2023 and 2022

Revenues

For

the three months ended March 31, 2023, the Company generated revenue in the amount of $474,802. The revenue was generated as a result

of the Company having provided services related to information technology business to the customers.

For

the three months ended March 31, 2022, the Company does not generate any revenue.

Selling,

General and Administrative Expenses

For

the three months ended March 31, 2023, the Company had selling, general and administrative expenses in the amount of $755,776. These

were primarily comprised of salary expenses, audit fees, insurance and other professional fees.

For

the three months ended March 31, 2022, the Company had general and administrative expenses in the amount of $6,123. These were primarily

comprised of audit fees and other professional fees.

The

significant increase of the general and administrative expenses was the result of the significant increase in salary expenses as the

Company hired more employees to expand their business.

Net

Loss

For

the three months ended March 31, 2023, the Company has incurred a net loss of $334,636.

For

the three months ended March 31, 2022, the Company has incurred a net loss of $6,364.

Liquidity

and Capital Resources

Three

months ended March 31, 2023 and 2022

Cash

Used In Operating Activities

For

the three months ended March 31, 2023, the Company has received $489,867 provided by operating activity, of which primarily consist of

increase in account payable, decrease in account receivable, decrease in prepayment, deposits and other receivables, increase in other

payables and accrued liabilities, increase in deferred revenue contra by net loss, decrease in tax assets and reduction in lease liability.

For

the three months ended March 31, 2022, the Company has used $16,764 in operating activity, of which primarily consist of net loss, decrease

in account payable and decrease in other payables and accrued liabilities.

Cash

Used In Investing Activities

For

the three months ended March 31, 2023 and 2022, the Company has invested $11,395 and $0 in investing activities, respectively for the

acquisition of computer systems and office equipment.

Cash

Provided by Financing Activities

For

the three months ended March 31, 2023, the Company has used $407,196 in financing activity, primarily consist of advances to director

and dividend paid.

For

the three months ended March 31, 2022, the Company did not receive nor used any cash in financing activity.

Off-balance

Sheet Arrangements

We

have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial

condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital

resources that are material to our stockholders as of March 31, 2023.

Contractual

Obligations

As

a smaller reporting company, we are not required to provide the aforementioned information.

Critical

Accounting Policies

The

Company reviews new accounting standards as issued. Management has not identified any other new standards that it believes will have

a significant impact on the Company’s consolidated financial statements.

Item

3 Quantitative and Qualitative Disclosures About Market Risk.

As

a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide information

required by this Item.

Item

4 Controls and Procedures.

Disclosure

Controls and Procedures

We