Prospectus Supplement No. 1 to

Prospectus dated November 5, 2007

Registration No. 333-127193

Filed pursuant to Rule 424(b)(3)

PROSPECTUS

5,420,022 Shares

REMEDENT, INC.

Common Stock

Supplement No. 1

To

Prospectus Dated November 5, 2007

This

Prospectus Supplement supplements our Prospectus dated

November 5, 2007 and filed with the

Securities and Exchange Commission on November 6, 2007, (collectively, the “Prospectus”) relating

to the sale of up to 5,420,022 shares of our common stock, $.001 par value, (“Common Stock”) by the

Selling Stockholders listed under “Selling Stockholders” on page 35 of the Prospectus. This

Prospectus also covers the sale of 4,583,735 shares of our Common Stock by the Selling Stockholders

upon the exercise of outstanding warrants. This Prospectus Supplement No. 1 includes: (i) the

attached Quarterly Report on Form 10-QSB Amendment No. 1 as filed with the Securities and Exchange

Commission on November 26, 2007. We will receive gross proceeds of $7,288,138 if all of the

warrants are exercised for cash by the Selling Stockholders. We will not receive any proceeds from

the sale or other disposition of any common stock by the Selling Stockholders or their transferees.

We encourage you to read this Supplement carefully with the Prospectus.

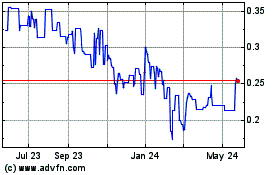

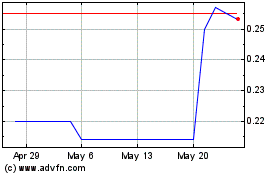

Our Common Stock is not traded on any national securities exchange or on a NASDAQ Stock Market. Our

Common Stock trades on the Over-The-Counter Bulletin Board, under the symbol “REMI.” On December

10, 2007, the last reported sale price for our Common Stock was $1.80. There is no public market

for the warrants.

INVESTING IN OUR COMMON STOCK INVOLVES CERTAIN RISKS AND UNCERTAINTIES. SEE “RISK FACTORS”

BEGINNING ON PAGE 3 OF THE PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY

REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus Supplement is December 11, 2007.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-QSB

AMENDMENT

NO. 1

|

|

|

|

|

þ

|

|

QUARTERLY REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

FOR THE QUARTERLY PERIOD ENDED SEPTEMBER 30, 2007

or

|

|

|

|

|

o

|

|

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File Number 001-15975

REMEDENT, INC.

(Exact name of small business issuer as specified in its charter)

|

|

|

|

|

NEVADA

|

|

86-0837251

|

|

|

|

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification Number)

|

|

|

|

|

|

XAVIER DE COCKLAAN 42, 9831 DEURLE, BELGIUM

|

|

N/A

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

011 32 9 321 70 80

(Issuer’s telephone number)

Check whether the Issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act during the past 12 months (or for such shorter period that the issuer was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes

þ

No

o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act). Yes

o

No

þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer,

or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in

Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

o

Accelerated filer

o

Non-accelerated filer

þ

Number of shares of issuer’s common stock outstanding as of November 15, 2007: 18,606,245

Transitional Small Business Disclosure Format (check one). Yes

o

No

þ

Documents incorporated by reference: None.

REMEDENT, INC.

TABLE OF CONTENTS

FORM 10-QSB REPORT

September 30, 2007

|

|

|

|

|

|

|

|

|

Page

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

|

|

|

3

|

|

|

|

|

|

4

|

|

|

|

|

|

5

|

|

|

|

|

|

6

|

|

|

|

|

|

8

|

|

|

|

|

|

20

|

|

|

|

|

|

26

|

|

|

|

|

|

26

|

|

|

|

|

|

26

|

|

|

|

|

|

26

|

|

|

|

|

|

27

|

|

|

|

|

|

27

|

|

|

|

|

|

27

|

|

|

|

|

|

27

|

|

|

|

|

|

29

|

|

2

PART I — FINANCIAL INFORMATION

Item 1. Interim Condensed Consolidated Financial Statements

REMEDENT, INC. AND SUBSIDIARIES

INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

SEPTEMBER 30, 2007

(unaudited)

REMEDENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

|

|

(unaudited)

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

3,778,185

|

|

|

$

|

126,966

|

|

|

Accounts receivable, net of allowance for doubtful accounts of $92,729 at September

30, 2007 and $79,996 at March 31, 2007

|

|

|

1,034,291

|

|

|

|

1,724,121

|

|

|

Inventories, net

|

|

|

1,025,512

|

|

|

|

1,132,941

|

|

|

Prepaid expense

|

|

|

889,639

|

|

|

|

668,421

|

|

|

|

|

|

|

Total current assets

|

|

|

6,727,627

|

|

|

|

3,652,449

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET

|

|

|

614,413

|

|

|

|

589,623

|

|

|

OTHER ASSETS

|

|

|

|

|

|

|

|

|

|

Long-term investment

|

|

|

300,000

|

|

|

|

—

|

|

|

Patents, net

|

|

|

132,121

|

|

|

|

135,894

|

|

|

|

|

|

|

TOTAL ASSETS

|

|

$

|

7,774,161

|

|

|

$

|

4,377,966

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Current portion, long term debt

|

|

$

|

26,498

|

|

|

$

|

43,499

|

|

|

Line of Credit

|

|

|

230,409

|

|

|

|

1,530,276

|

|

|

Notes payable

|

|

|

11,282

|

|

|

|

11,282

|

|

|

Accounts payable

|

|

|

1,586,013

|

|

|

|

1,441,502

|

|

|

Accrued liabilities

|

|

|

518,197

|

|

|

|

412,435

|

|

|

Due to related parties

|

|

|

50,536

|

|

|

|

50,536

|

|

|

|

|

|

|

Total current liabilities

|

|

|

2,422,935

|

|

|

|

3,489,530

|

|

|

|

|

|

|

LONG TERM DEBT

|

|

|

148,350

|

|

|

|

152,343

|

|

|

STOCKHOLDERS’ DEFICIT:

|

|

|

|

|

|

|

|

|

|

Preferred Stock $0.001 par value (10,000,000 shares authorized, none issued and

outstanding)

|

|

|

—

|

|

|

|

—

|

|

|

Common stock, $0.001 par value; (50,000,000 shares authorized, 18,596,245 shares

issued and outstanding at September 30, 2007 and 12,996,245 shares issued and

outstanding at March 31, 2007)

|

|

|

18,596

|

|

|

|

12,996

|

|

|

Additional paid-in capital

|

|

|

17,809,487

|

|

|

|

11,904,000

|

|

|

Accumulated deficit

|

|

|

(12,543,300

|

)

|

|

|

(11,147,600

|

)

|

|

Accumulated other comprehensive income (loss) (foreign currency translation adjustment)

|

|

|

(81,907

|

)

|

|

|

(33,303

|

)

|

|

|

|

|

|

Total stockholders’ equity (deficit)

|

|

|

5,202,876

|

|

|

|

736,093

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT)

|

|

$

|

7,774,161

|

|

|

$

|

4,377,966

|

|

|

|

|

|

|

COMMITMENTS (Note 18)

|

|

|

|

|

|

|

|

|

|

SUBSEQUENT EVENT (Note 19)

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

3

REMEDENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

|

|

For the six months ended

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

2007

|

|

2006

|

|

2007

|

|

2006

|

|

|

|

Restated - Note 2

|

|

Restated - Note 2

|

|

Net sales

|

|

$

|

1,076,350

|

|

|

$

|

2,415,114

|

|

|

$

|

2,320,949

|

|

|

$

|

3,710,753

|

|

|

Cost of sales

|

|

|

686,649

|

|

|

|

1,210,012

|

|

|

|

1,352,076

|

|

|

|

1,955,674

|

|

|

|

|

|

|

Gross profit

|

|

|

389,701

|

|

|

|

1,205,102

|

|

|

|

968,873

|

|

|

|

1,755,079

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

46,168

|

|

|

|

115,218

|

|

|

|

75,557

|

|

|

|

240,500

|

|

|

Sales and marketing

|

|

|

282,553

|

|

|

|

236,839

|

|

|

|

385,793

|

|

|

|

623,414

|

|

|

General and administrative

|

|

|

1,059,371

|

|

|

|

833,762

|

|

|

|

1,803,852

|

|

|

|

1,671,112

|

|

|

Depreciation and amortization

|

|

|

70,150

|

|

|

|

46,432

|

|

|

|

135,784

|

|

|

|

87,694

|

|

|

|

|

|

|

TOTAL OPERATING EXPENSES

|

|

|

1,458,242

|

|

|

|

1,232,251

|

|

|

|

2,400,986

|

|

|

|

2,622,720

|

|

|

|

|

|

|

INCOME (LOSS) FROM OPERATIONS

|

|

|

(1,068,541

|

)

|

|

|

(27,149

|

)

|

|

|

(1,432,113

|

)

|

|

|

(867,641

|

)

|

|

|

|

|

|

OTHER INCOME (EXPENSES)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(26,441

|

)

|

|

|

(73,454

|

)

|

|

|

(55,214

|

)

|

|

|

(97,469

|

)

|

|

Interest income

|

|

|

90,233

|

|

|

|

—

|

|

|

|

91,625

|

|

|

|

—

|

|

|

Other income

|

|

|

—

|

|

|

|

2,746

|

|

|

|

—

|

|

|

|

27,523

|

|

|

|

|

|

|

TOTAL OTHER INCOME (EXPENSES)

|

|

|

63,792

|

|

|

|

(70,708

|

)

|

|

|

36,411

|

|

|

|

(69,946

|

)

|

|

|

|

|

|

NET LOSS

|

|

$

|

(1,004,749

|

)

|

|

$

|

(97,857

|

)

|

|

$

|

(1,395,702

|

)

|

|

$

|

(937,587

|

)

|

|

|

|

|

|

LOSS PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted

|

|

$

|

(0.05

|

)

|

|

$

|

(0.01

|

)

|

|

$

|

(0.08

|

)

|

|

$

|

(0.07

|

)

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES OUTSTANDING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted

|

|

|

18,596,245

|

|

|

|

12,996,245

|

|

|

|

17,035,589

|

|

|

|

12,947,479

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

4

REMEDENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

|

|

For the six months ended

|

|

|

|

September 30,

|

|

September 30,

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

|

|

2007

|

|

2006

|

|

2007

|

|

2006

|

|

Net Income (Loss)

|

|

$

|

(1,004,749

|

)

|

|

$

|

(97,857

|

)

|

|

$

|

(1,395,702

|

)

|

|

$

|

(937,587

|

)

|

|

OTHER COMPREHENSIVE INCOME

(LOSS):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency

translation

adjustment

|

|

|

(53,204

|

)

|

|

|

14,413

|

|

|

|

(48,604

|

)

|

|

|

25,415

|

|

|

|

|

|

|

Comprehensive income (loss)

|

|

$

|

(1,057,953

|

)

|

|

$

|

(83,444

|

)

|

|

$

|

(1,444,306

|

)

|

|

$

|

(912,712

|

)

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

5

REMEDENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended

|

|

|

|

September 30,

|

|

|

|

2007

|

|

2006

|

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(1,395,702

|

)

|

|

$

|

(937,587

|

)

|

|

Adjustments to reconcile net income (loss) to net cash used

by operating activities

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

135,784

|

|

|

|

87,694

|

|

|

Allowance for doubtful accounts

|

|

|

7,521

|

|

|

|

(6,172

|

)

|

|

Stock issued upon conversion of convertible debentures

|

|

|

—

|

|

|

|

25,706

|

|

|

Value of stock options to employees

|

|

|

12,846

|

|

|

|

189,515

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

752,589

|

|

|

|

(131,043

|

)

|

|

Inventories

|

|

|

(17,919

|

)

|

|

|

150,516

|

|

|

Prepaid expenses

|

|

|

(461,365

|

)

|

|

|

(7,399

|

)

|

|

Accounts payable

|

|

|

67,364

|

|

|

|

(171,177

|

)

|

|

Accrued liabilities

|

|

|

83,718

|

|

|

|

(69,527

|

)

|

|

Income taxes payable

|

|

|

—

|

|

|

|

(105,048

|

)

|

|

|

|

|

|

Net cash used by operating activities

|

|

|

(815,164

|

)

|

|

|

(974,522

|

)

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Decrease (increase) in restricted cash

|

|

|

—

|

|

|

|

(10,285

|

)

|

|

Purchases of patents

|

|

|

(11,152

|

)

|

|

|

—

|

|

|

Purchases of equipment

|

|

|

(83,919

|

)

|

|

|

(111,322

|

)

|

|

|

|

|

|

Net cash used by investing activities

|

|

|

(95,071

|

)

|

|

|

(121,607

|

)

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|

|

|

|

|

|

|

|

|

Net proceeds from private placement

|

|

|

5,898,241

|

|

|

|

—

|

|

|

Principal payments on capital lease note payable

|

|

|

(31,741

|

)

|

|

|

(11,170

|

)

|

|

Note payments — related parties

|

|

|

—

|

|

|

|

(8,422

|

)

|

|

Proceeds from (repayments of) line of credit

|

|

|

(1,331,646

|

)

|

|

|

987,560

|

|

|

|

|

|

|

Net cash provided by financing activities

|

|

|

4,534,854

|

|

|

|

967,968

|

|

|

|

|

|

|

NET (DECREASE) INCREASE IN CASH

|

|

|

3,624,619

|

|

|

|

(128,161

|

)

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

26,600

|

|

|

|

(52,224

|

)

|

|

CASH AND CASH EQUIVALENTS, BEGINNING

|

|

|

126,966

|

|

|

|

332,145

|

|

|

|

|

|

|

CASH AND CASH EQUIVALENTS, ENDING

|

|

$

|

3,778,185

|

|

|

$

|

151,761

|

|

|

|

|

|

|

Supplemental Information:

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$

|

23,376

|

|

|

$

|

48,572

|

|

|

|

|

|

|

Income taxes paid

|

|

$

|

—

|

|

|

$

|

—

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

6

SUPPLEMENTAL NON-CASH INVESTING

AND FINANCING ACTIVITIES:

On July 31, 2006, the Company issued 32,133 shares of its common stock in exchange for $20,000 in

convertible debentures and accrued interest of $12,133. The difference between the conversion price

of $1.00 per share and the market value of the common stock exchanged valued at $1.80 per share

totaled $25,706 and was charged to interest expense.

7

NOTES TO INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

1. BACKGROUND AND ORGANIZATION

The Company is a manufacturer and distributor of cosmetic dentistry products, including a full

line of professional dental and retail “Over-The-Counter” tooth whitening products which are

distributed in Europe, and recently in Asia and the United States. The Company manufactures many

of its products in its facility in Deurle, Belgium as well as outsourced manufacturing in China.

The Company distributes its products using both its own internal sales force and through the use

of third party distributors.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization and Principles of Consolidation

The accompanying consolidated financial statements include the accounts of Remedent, Inc.

(formerly Remedent USA, Inc.), a Nevada corporation, and its three subsidiaries, Remedent N.V.

(Belgian corporation) located in Deurle, Belgium, Remedent Professional, Inc. (incorporated in

California) and a subsidiary of Remedent Professional Holdings, Inc. and Remedent Asia Pte. Ltd,

a wholly-owned subsidiary formed under the laws of Singapore (collectively, the “Company”).

Remedent, Inc. is a holding company with headquarters in Deurle, Belgium. Remedent Professional,

Inc. and Remedent Professional Holdings, Inc. have been dormant since inception. Remedent Asia

Pte. Ltd., commenced operations as of July 2005. All significant inter-company accounts and

transactions have been eliminated in the consolidated financial statements. Corporate

administrative costs are not allocated to subsidiaries.

Interim Financial Information

The interim consolidated financial statements of Remedent, Inc. and Subsidiaries (the “Company”)

are condensed and do not include some of the information necessary to obtain a complete

understanding of the financial data. Management believes that all adjustments necessary for a

fair presentation of results have been included in the unaudited consolidated financial

statements for the interim periods presented. Operating results for the six months ended

September 30, 2007, are not necessarily indicative of the results that may be expected for the

year ended March 31, 2008. Accordingly, your attention is directed to footnote disclosures found

in the Annual Report on Form 10-KSB for the year ended March 31, 2007, and particularly to Note

1, which includes a summary of significant accounting policies.

Basis of Presentation

The Company’s financial statements have been prepared on an accrual basis of accounting, in

conformity with accounting principles generally accepted in the United States of America. These

principles contemplate the realization of assets and liquidation of liabilities in the normal

course of business. The preparation of financial statements in conformity with accounting

principles generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the financial statements and

reported amounts of revenues and expenses during the reporting periods. Actual results could

differ from those estimates. These financial statements do not include any adjustments that might

be necessary if the Company is unable to continue as a going concern.

Revenue Recognition

The Company recognizes revenue from product sales when persuasive evidence of a sale exists: that

is, a product is shipped under an agreement with a customer; risk of loss and title has passed to

the customer; the fee is fixed or determinable; and collection of the resulting receivable is

reasonably assured. Sales allowances are estimated based upon historical experience of sales

returns.

Impairment of Long-Lived Assets

8

Long-lived assets consist primarily of patents and property and equipment. The

recoverability of long-lived assets is evaluated by an analysis of operating results and

consideration of other significant events or changes in the business environment. If impairment

exists, the carrying amount of the long-lived assets is reduced to its estimated fair value, less

any costs associated with the final settlement. As of September 30, 2007, management believes

there was no impairment of the Company’s long-lived assets.

Pervasiveness of Estimates

The preparation of financial statements in conformity with accounting principles generally

accepted in the United States requires the Company to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and

expenses during the reporting period. On an on-going basis, the Company evaluates estimates and

judgments, including those related to revenue, bad debts, inventories, fixed assets, intangible

assets, stock based compensation, income taxes, and contingencies. Estimates are based on

historical experience and on various other assumptions that the Company believes reasonable in

the circumstances. The results form the basis for making judgments about the carrying vales of

assets and liabilities that are not readily apparent from other sources. Actual results could

differ from those estimates.

Cash and Cash Equivalents

The Company considers all highly liquid investments with maturities of three months or less

to be cash or cash equivalents.

Accounts Receivable and Allowance for Doubtful Accounts

The Company sells professional dental equipment to various companies, primarily to

distributors located in Western Europe. The terms of sales vary by customer, however, generally

are 2% 10 days, net 30 days. Accounts receivable is reported at net realizable value and net of

allowance for doubtful accounts. The Company uses the allowance method to account for

uncollectible accounts receivable. The Company’s estimate is based on historical collection

experience and a review of the current status of trade accounts receivable.

Inventories

The Company purchases certain of its products in components that require assembly prior to

shipment to customers. All other products are purchased as finished goods ready to ship to

customers.

The Company writes down inventories for estimated obsolescence to estimated market value

based upon assumptions about future demand and market conditions. If actual market conditions are

less favorable than those projected, then additional inventory write-downs may be required.

Inventory reserves for obsolescence totaled $14,179 at September 30, 2007 and $13,366 at March

31, 2007.

Prepaid Expense

The Company’s prepaid expense consists of prepayments to suppliers for inventory purchases

and to the Belgium customs department, to obtain an exemption of direct VAT payments for imported

goods out of the European Union (“EU”). This prepayment serves as a guarantee to obtain the

facility to pay VAT at the moment of sale and not at the moment of importing goods at the border.

Prepaid expenses also include VAT payments made for goods and services in excess of VAT payments

received from the sale of products as well as amounts for other prepaid operating expenses.

Property and Equipment

Property and equipment are stated at cost. Major renewals and improvements are charged to

the asset accounts while replacements, maintenance and repairs, which do not improve or extend

the lives of the respective assets, are expensed. At the time property and equipment are retired

or otherwise disposed of, the asset and related accumulated depreciation accounts are relieved of

the applicable amounts. Gains or losses from retirements or sales are credited or charged to

income.

9

The Company depreciates its property and equipment for financial reporting purposes using

the straight-line method based upon the following useful lives of the assets:

|

|

|

|

|

Tooling

|

|

3 Years

|

|

Furniture and fixtures

|

|

4 Years

|

|

Machinery and Equipment

|

|

4 Years

|

Patents

Patents consist of the costs incurred to purchase patent rights and are reported net of

accumulated amortization. Patents are amortized using the straight-line method over a period

based on their contractual lives.

Research and Development Costs

The Company expenses research and development costs as incurred.

Advertising

Costs incurred for producing and communicating advertising are expensed when incurred and

included in sales and marketing and general and administrative expenses. For the six month

periods ended September 30, 2007 and September 30, 2006, advertising expense was $100,104 and

$219,925, respectively.

Income taxes

Income taxes are provided in accordance with Statement of Financial Accounting Standards No.

109 (SFAS 109), “Accounting for Income Taxes.” Deferred taxes are recognized for temporary

differences in the bases of assets and liabilities for financial statement and income tax

reporting as well as for operating losses and credit carry forwards. A provision has been made

for income taxes due on taxable income and for the deferred taxes on the temporary differences.

The components of the deferred tax asset and liability are individually classified as current and

non-current based on their characteristics.

Deferred tax assets are reduced by a valuation allowance when, in the opinion of management,

it is more likely than not that some portion or all of the deferred tax assets will not be

realized. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws

and rates on the date of enactment.

Warranties

The Company typically warrants its products against defects in material and workmanship for

a period of 18 months from shipment. Based upon historical trends and warranties provided by the

Company’s suppliers and sub-contractors, the Company has made a provision for warranty costs of

$21,269 and $20,049 as of September 30, 2007 and March 31, 2007, respectively.

Segment Reporting

Statement of Financial Accounting Standards No. 131 (“SFAS 131”), “Disclosure About Segments

of an Enterprise and Related Information” requires use of the “management approach” model for

segment reporting. The management approach model is based on the way a company’s management

organizes segments within the company for making operating decisions and assessing performance.

Reportable segments are based on products and services, geography, legal structure, management

structure, or any other manner in which management disaggregates a company. The Company’s

management considers its business to comprise one segment for reporting purposes.

Computation of Earnings (Loss) per Share

Basic net income (loss) per common share is computed by dividing net income (loss)

attributable to common stockholders by the weighted average number of shares of common stock

outstanding during the period. Net income (loss) per common share attributable to common

stockholders assuming dilution is computed by dividing net income by the weighted average number

of shares of common stock outstanding plus the number of additional common shares that would have

been outstanding if all dilutive

10

potential common shares had been issued. Potential common shares related to stock options

and stock warrants are excluded from the computation when their effect is anti-dilutive.

Conversion of Foreign Currencies

The reporting currency for the consolidated financial statements of the Company is the U.S.

dollar. The functional currency for the Company’s European subsidiary, Remedent N.V. is the Euro.

The functional currency for Remedent Professional, Inc. is the U.S. dollar. The Company

translates foreign currency statements to the reporting currency in accordance with FASB 52. The

assets and liabilities of companies whose functional currency is other that the U.S. dollar are

included in the consolidation by translating the assets and liabilities at the exchange rates

applicable at the end of the reporting period. The statements of income of such companies are

translated at the average exchange rates during the applicable period. Translation gains or

losses are accumulated as a separate component of stockholders’ deficit.

Comprehensive Income (Loss)

The Company has adopted the provisions of Statement of Financial Accounting Standards No. 130,

“

Reporting Comprehensive Income

” (“SFAS No. 130”). SFAS No. 130 establishes standards for the

reporting and display of comprehensive income, its components and accumulated balances in a full

set of general purpose financial statements. SFAS No. 130 defines comprehensive income (loss) to

include all changes in equity except those resulting from investments by owners and distributions

to owners, including adjustments to minimum pension liabilities, accumulated foreign currency

translation, and unrealized gains or losses on marketable securities.

The Company’s only component of other comprehensive income is the accumulated foreign currency

translation consisting of a loss of $48,604 and a gain of $25,415 for the six month periods ended

September 30, 2007 and September 30, 2006, respectively. These amounts have been recorded as a

separate component of stockholders’ deficit.

Stock Based Compensation

In December 2004, the Financial Accounting Standards Board issued SFAS No. 123R, “

Share-Based

Payment

.” Subsequently, the Securities and Exchange Commission (“SEC”) provided for a phase-in

implementation process for SFAS No. 123R, which required adoption of the new accounting standard

no later than January 1, 2006. SFAS No. 123R requires accounting for stock options using a

fair-value-based method as described in such statement and recognize the resulting compensation

expense in the Company’s financial statements. Prior to January 1, 2006, the Company accounted

for employee stock options using the intrinsic value method under APB No. 25, “Accounting for

Stock Issued to Employees” and related Interpretations, which generally resulted in no employee

stock option expense. The Company adopted SFAS No. 123R on January 1, 2006 and does not plan to

restate financial statements for prior periods. The Company plans to continue to use the

Black-Scholes option valuation model in estimating the fair value of the stock option awards

issued under SFAS No. 123R. The adoption of SFAS No. 123R has a material impact on the Company’s

results of operations. For the six month periods ended September 30, 2007 and September 30, 2006,

equity compensation in the form of stock options and grants of restricted stock totaled $12,846

and $189,515, respectively.

Restatement

The Company has restated its financial statements for the three and six month periods ended

September 30, 2007, due to a reclassification error between cost of sales and general and

administrative expenses. The disclosure in Note 9 has also been revised. The effect of the

adjustments on the Company’s consolidated statement of operations is as follows:

11

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

|

|

|

|

|

September 30,

|

|

|

|

|

2007

|

|

|

|

|

Previously

|

|

|

As

|

|

|

|

|

|

|

|

Reported

|

|

|

Restated

|

|

|

Difference

|

|

|

Cost of sales

|

|

$

|

799,763

|

|

|

$

|

686,649

|

|

|

$

|

(113,114

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

276,587

|

|

|

|

389,701

|

|

|

|

113,114

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

946,257

|

|

|

|

1,059,371

|

|

|

|

113,114

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Operating Expenses

|

|

|

1,345,128

|

|

|

|

1,458,242

|

|

|

|

(113,114

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$

|

(1,004,749

|

)

|

|

$

|

(1,004,749

|

)

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted

|

|

$

|

(0.05

|

)

|

|

$

|

(0.05

|

)

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended

|

|

|

|

|

September 30,

|

|

|

|

|

2007

|

|

|

|

|

Previously

|

|

|

As

|

|

|

|

|

|

|

|

Reported

|

|

|

Restated

|

|

|

Difference

|

|

|

Cost of sales

|

|

$

|

1,244,598

|

|

|

$

|

1,352,076

|

|

|

$

|

107,478

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

1,076,351

|

|

|

|

968,873

|

|

|

|

(107,478

|

)

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

1,911,130

|

|

|

|

1,803,852

|

|

|

|

(107,278

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

|

|

|

(2,508,464

|

)

|

|

|

(2,400,986

|

)

|

|

|

107,278

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS

|

|

$

|

(1,395,702

|

)

|

|

$

|

(1,395,702

|

)

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and fully diluted

|

|

$

|

(0.05

|

)

|

|

$

|

(0.05

|

)

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

3. PRIVATE PLACEMENT

On June 25, 2007, the Company completed its private offering of 5,600,000 shares of its common

stock, par value $.001 per share at a purchase price of $1.25 per share (the “Shares”) and

warrants to purchase 4,200,000 shares of common stock, par value $.001 per share, at an exercise

price of $1.55 per share (the “Warrants”) to certain institutional and accredited investors, for

an aggregate purchase price of $7,000,000 (the “Offering”).

Under the terms of the Offering, the Warrants are exercisable for a period of five years and

entitle the holder to purchase one share of restricted common stock (the “Warrant Shares”) for

$1.55 per Warrant Share. The Company also has the right to redeem the Warrants for $0.001 per

Warrant Share covered by the Warrants if the Shares trade on the OTC Electronic Bulletin Board or

similar market above $5.25 per share for 20 consecutive trading days following the initial

effective date of the registration statement covering the resale of the Shares and Warrant

Shares, based upon the closing bid price for the Shares for each trading day (the “Redemption

Right”). Once the Redemption Right vests, the Company has the right, but not the obligation, to

redeem the Warrants for $0.001 per Warrant Share covered by the Warrants upon 30 days written

notice to the holders of the Warrants.

Under the terms of the Purchase Agreement and the Registration Rights Agreement, the Company was

required to prepare and file with the Securities and Exchange Commission (the “Commission”) a

registration statement covering the resale of the Shares and the Warrant Shares. The Company

agreed to prepare and file a registration statement covering the resale no later than 30 days

after the Closing. The registration statement became effective October 23, 2007.

The Company engaged Roth Capital Partners, LLC, as its exclusive agent to offer the Shares and

Warrants (the “Placement Agent”). The Placement Agent is entitled to a fee equal to ten percent

(10%) of the gross proceeds derived from the Offering, of

12

which the Placement Agent may, at its option, receive up to 2% of its 10% fee in securities

issued in the Offering. Further, the Company agreed to pay the Placement Agent 5% of the exercise

price of the Warrants promptly following the Company’s receipt thereof. In addition, the Company

agreed to reimburse the Placement Agent for its out-of-pocket expenses related to the Offering,

including an up front payment of $25,000 to cover such expenses, of which any unused amount will

be netted against the Placement Agent’s 10% fee.

The total costs of this private placement were $1,101,759, comprising of: commissions of

$762,505; out-of-pocket costs of $25,000; professional fees of $242,274 and direct travel costs

of $71,980; and have been recorded against share capital as a cost of financing.

The Offering was conducted in reliance upon an exemption from registration under the Securities

Act of 1933, as amended (the “Securities Act”), including, without limitation, that under Section

506 of Regulation D promulgated under the Securities Act. The Units were offered and sold by the

Company to accredited investors in reliance on Section 506 of Regulation D of the Securities Act

of 1933, as amended.

4. CONCENTRATION OF RISK

Financial Instruments — Financial instruments, which potentially subject the Company to

concentrations of credit risk, consist principally of trade accounts receivable.

Concentrations of credit risk with respect to trade receivables are normally limited due to the

number of customers comprising the Company’s customer base and their dispersion across different

geographic areas. At September 30, 2007 one customer accounted for 15.67% of the Company’s trade

accounts receivable compared to 67.6% as at September 2006. The Company performs ongoing credit

evaluations of its customers and normally does not require collateral to support accounts

receivable.

Purchases — The Company has diversified its sources for product components and finished goods

and, as a result, the loss of a supplier would not have a material impact on the Company’s

operations. For the six month period ended September 30, 2007, the Company had four suppliers who

accounted for a total of 15.7% of gross purchases. For the six month period ended September 30,

2006, the Company relied on one factory to manufacture certain components of its new MetaTray and

iWhite products which represented 24.9% of the Company’s purchases.

Revenues — For the six month period ended September 30, 2007 the Company had five customers that

accounted for 26.51% of total revenues. For the six months ended September 30, 2006 the Company

had two customers that accounted for 49% and 10%, respectively of total revenues.

13

5. ACCOUNTS RECEIVABLE AND ALLOWANCE FOR DOUBTFUL ACCOUNTS

A summary of accounts receivable and allowance for doubtful accounts as of September 30, 2007 and

March 31, 2007 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

Accounts receivable, gross

|

|

$

|

1,127,020

|

|

|

$

|

1,804,117

|

|

|

Less: allowance for doubtful

accounts

|

|

|

(92,729

|

)

|

|

|

(79,996

|

)

|

|

|

|

|

|

Accounts receivable, net

|

|

$

|

1,034,291

|

|

|

$

|

1,724,121

|

|

|

|

|

|

6. INVENTORIES

Inventories are stated at the lower of cost (weighted average) or market. Inventory costs include

material, labor and manufacturing overhead. Individual components of inventory are listed below

as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

Raw materials

|

|

$

|

30,369

|

|

|

$

|

30,579

|

|

|

Components

|

|

|

749,094

|

|

|

|

786,728

|

|

|

Finished goods

|

|

|

260,228

|

|

|

|

329,000

|

|

|

|

|

|

|

|

|

|

1,039,691

|

|

|

|

1,146,307

|

|

|

Less: reserve for obsolescence

|

|

|

(14,179

|

)

|

|

|

(13,366

|

)

|

|

|

|

|

|

Net inventory

|

|

$

|

1,025,512

|

|

|

$

|

1,132,941

|

|

|

|

|

|

7. PREPAID EXPENSES

Prepaid expenses are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

Prepaid materials and components

|

|

$

|

468,853

|

|

|

$

|

394,598

|

|

|

Prepaid Belgium income taxes

|

|

|

70,985

|

|

|

|

66,830

|

|

|

Prepaid consulting

|

|

|

142,665

|

|

|

|

66,830

|

|

|

VAT payments in excess of VAT receipts

|

|

|

83,036

|

|

|

|

47,260

|

|

|

Royalties

|

|

|

35,448

|

|

|

|

33,415

|

|

|

Prepaid trade show expenses

|

|

|

23,216

|

|

|

|

6,523

|

|

|

Prepaid rent

|

|

|

9,695

|

|

|

|

7,054

|

|

|

Other

|

|

|

37,830

|

|

|

|

45,911

|

|

|

|

|

|

|

|

|

$

|

889,639

|

|

|

$

|

668,421

|

|

|

|

|

|

8. PROPERTY AND EQUIPMENT

Property and equipment are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

Furniture and Fixtures

|

|

$

|

155,493

|

|

|

$

|

137,560

|

|

|

Machinery and Equipment

|

|

|

681,032

|

|

|

|

559,422

|

|

|

Tooling

|

|

|

188,450

|

|

|

|

188,450

|

|

|

|

|

|

|

|

|

|

1,024,975

|

|

|

|

885,432

|

|

|

Accumulated depreciation

|

|

|

(410,562

|

)

|

|

|

(295,809

|

)

|

|

|

|

|

|

Property & equipment, net

|

|

$

|

614,413

|

|

|

$

|

589,623

|

|

|

|

|

|

14

9. LONG TERM INVESTMENT

Effective July 15, 2007 the Company entered into a Limited Liability Company Merger and Equity

Reallocation Agreement (the “Participation Agreement”) through its subsidiary, Remedent N.V.

Pursuant to the terms of the Participation Agreement, the Company has acquired a 10% equity

interest in Innovative Medical & Dental Solutions, LLC (“IMDS, LLC”) in consideration for

$300,000 which was converted against IMDS receivables.

The agreement stipulates certain exclusive world wide rights to certain tooth whitening

technology, and the right to purchase at standard cost certain whitening lights and accessories

and to sell such lights in markets not served by the LLC. The terms of the Participation

Agreement also provide that Remedent N.V. has the first right to purchase additional equity.

Parties to the Participation Agreement include two officers of IMDS, LLC, and an individual who

is both an officer and director of Remedent Inc., and certain unrelated parties.

IMDS, LLC is registered with the Secretary of the State of Florida as a limited liability company

and with the Secretary of the State of California as a foreign corporation authorized to operate

in California. IMDS, LLC is merging with White Science World Wide, LLC, a limited liability

company organized in under the laws of the State of Georgia. The merged companies will operate as

a single entity as IMDS, LLC, a Florida limited liability company.

10. LICENSED PATENTS

Teeth Whitening Patents

In October 2004, the Company acquired from the inventor the exclusive, perpetual license to two

issued United States patents which are applicable to several teeth whitening products currently

being marketed by the Company. Pursuant to the terms of the license agreement, the Company was

granted an exclusive, worldwide, perpetual license to manufacture, market, distribute and sell

the products contemplated by the patents subject to the payment of $65,000 as reimbursement to

the patent holder for legal and other costs associated with obtaining the patents, which was paid

in October 2004, and royalties for each unit sold subject to an annual minimum royalty of

$100,000 per year. The Company is amortizing the initial cost of $65,000 for these patents over a

ten year period and accordingly has recorded $19,500 of accumulated amortization for this patent

as of September 30, 2007. The Company accrues this royalty when it becomes payable to the

inventory therefore no provision has been made for this obligation as of September 30, 2007.

Universal Applicator Patent

In September 2004, the Company entered into an agreement with Lident N.V. (“Lident”), a company

controlled by Mr. De Vreese, the Company’s Chairman, to obtain an option, exercisable through

December 31, 2005, to license an international patent (excluding the US) and worldwide

manufacturing and distribution rights for a potential new product which Lident had been assigned

certain rights by the inventors of the products, who are unrelated parties, prior to Mr. De

Vreese association with the Company. The patent is an Italian patent which relates to a single

use universal applicator for dental pastes, salves, creams, powders, liquids and other substances

where manual application could be relevant. The Company has filed to have the patent approved

throughout Europe. The agreement required the Company to advance to the inventors through Lident

a fully refundable deposit of €100,000 subject to the Company’s due diligence regarding the

enforceability of the patent and marketability of the product, which, if viable, would be

assigned to the Company for additional consideration to the inventors of €100,000 and an

ongoing royalty from sales of products related to the patent equal to 3% of net sales and, if not

viable, the deposit would be repaid in full by Lident. The consideration the Company had agreed

to pay Lident upon the exercise of the option is the same as the consideration Lident is

obligated to pay the original inventors. Consequently, Lident would not have profited from the

exercise of the option. Furthermore, at a meeting of the Company’s Board of Directors on July 13,

2005, the Board accepted Lident’s offer to facilitate an assignment of Lident’s intellectual

property rights to the technology to the Company in exchange for the reimbursement of Lident’s

actual costs incurred relating to the intellectual property. Consequently, when the Company

exercises the option, all future payments, other than the reimbursement of costs would be paid

directly to the original inventors and not to Lident.

On December 12, 2005, the Company exercised the option and the Company and the patent holder

agreed to revise the assignment agreement whereby the Company agreed to pay €50,000 additional

compensation in the form of prepaid royalties instead of the

15

€

100,000 previously agreed,

€

25,000 of which had been paid by the Company in September 2005 and

the remaining

€

25,000 to be paid upon the Company’s first shipment of a product covered by the

patent. The patent is being amortized over five (5) years and accordingly, the Company has

recorded $43,775 of accumulated amortization for this patent as of September 30, 2007.

11. LINE OF CREDIT

On October 8, 2004, our wholly owned subsidiary, Remedent N.V., obtained a mixed-use line of

credit facility with Fortis Bank, a Belgian bank, for

€

1,070,000 (the “Facility”). The Facility

was secured by a first lien on the assets of Remedent N.V. The purpose of the Facility is to

provide working capital to grow our business and to finance certain accounts receivable as

necessary. Since opening the Facility in 2004, Remedent N.V. and Fortis Bank have subsequently

amended the Facility several times to increase or decrease the line of credit. On May 3, 2005

the Facility was amended to decrease the line of credit to

€

1,050,000. On March 13, 2006 the

Facility was amended to increase the mixed-use line of credit to

€

2,300,000, consisting of a

€

1,800,000 credit line based on the eligible accounts receivable and a

€

500,000 general line of

credit. The latest amendment to the Facility, dated September 1, 2006, amended and decreased the

mixed-use line of credit to

€

2,050,000. Each line of credit carries its own interest rates and

fees as provided in the Facility. Remedent N.V. is currently only utilizing two lines of credit,

advances based on account receivables and the straight loan. As of September 30, 2007 and March

31, 2007, Remedent N.V. had, in the aggregate, $230,409 and $1,530,276 advances outstanding,

respectively, under this mixed-use line of credit facility.

12. NOTE PAYABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

|

|

|

|

Union Bank Debt:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maturity Dates: April 26,

2005 Interest rate: 7.5% per

annum Security: All of the

assets of the company.

Unpaid principal balance:

|

|

$

|

11,282

|

|

|

$

|

11,282

|

|

|

|

|

|

|

|

|

|

|

Total note payable

|

|

$

|

11,282

|

|

|

$

|

11,282

|

|

|

|

|

|

|

|

|

|

13. LONG TERM DEBT

On September 15, 2005, the Company entered into two five year capital lease agreements for

manufacturing equipment totaling

€

70,296 (US $85,231). On October 24, 2006, the Company entered

into another five year capital lease agreement for additional manufacturing equipment totaling

€

123,367 (US $157,503). The leases require monthly payments of principal and interest at 7.43%

of

€

1,258 (US$1,784 at September 30, 2007) for the first two leases and 9.72% of

€

2,256

(US$3,200 at September 30, 2007) and provide for buyouts at the conclusion of the five year term

of

€

2,820 (US$3,998) or 4.0% of original value for the first two contracts and

€

4,933 (US

$6,944) or 4.0 % of the original value for the second contract. The book value as of September

30, 2007 and March 31, 2007 of the equipment subject to the foregoing leases are $183,059 and

$198,225, respectively.

14. DUE TO RELATED PARTIES AND RELATED PARTY TRANSACTIONS

Balances due to related parties consist of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

|

March 31, 2007

|

|

|

Demand loan from a former

officer and major stockholder

|

|

$

|

50,536

|

|

|

$

|

50,536

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

50,536

|

|

|

$

|

50,536

|

|

|

|

|

|

|

|

|

|

Borrowings from employees and entities controlled by officers of the Company are, unsecured,

non-interest bearing, and due on demand.

Transactions with related parties consisted of the following:

16

Compensation:

During the six month periods ended September 30, 2007 and 2006 respectively, the Company

incurred $342,644 and $291,220 respectively, as compensation for all directors and officers.

Effective August 8, 2007, the Company appointed a Senior Vice President and Head of U.S.

Marketing. Terms of the appointment provide for an initial base salary of $150,000 per year and

options to purchase 100,000 shares of common stock under the Company’s 2004 Incentive and

Nonstatutory Stock Option Plan (granted — Refer to Note 16).

Sales Transactions:

One of the Company’s directors owns a 5% interest in a client company, IMDS Inc. (refer to Note

9), to which goods were sold during the years ended March 31, 2007 and 2006 totaling $476,122

and $38,494 respectively. Accounts receivable with this customer totaled $22,809 and $0 as at

September 30, 2007 and 2006 respectively.

All related party transactions involving provision of services or tangible assets were recorded

at the exchange amount, which is the value established and agreed to by the related parties

reflecting arms length consideration payable for similar services or transfers.

Other related party transactions are disclosed in Supplemental Non-Cash Investing and Financing

Activities, clause (e), and Note 17. (Refer to Note 9.)

15. ACCRUED LIABILITIES

Accrued liabilities are summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2007

|

|

March 31, 2007

|

|

|

|

|

|

Accrued private placement costs

|

|

$

|

29,946

|

|

|

$

|

—

|

|

|

|

|

|

|

Accrued customer prepayments

|

|

|

31,570

|

|

|

|

—

|

|

|

|

|

|

|

Accrued employee benefit taxes

|

|

|

242,701

|

|

|

|

260,676

|

|

|

|

|

|

|

Commissions

|

|

|

4,431

|

|

|

|

2,834

|

|

|

|

|

|

|

Accrued audit and tax preparation fees

|

|

|

21,692

|

|

|

|

27,282

|

|

|

|

|

|

|

Reserve for warranty costs

|

|

|

21,269

|

|

|

|

20,049

|

|

|

|

|

|

|

Accrued interest

|

|

|

81

|

|

|

|

6,180

|

|

|

|

|

|

|

Accrued consulting fees

|

|

|

37,531

|

|

|

|

2,528

|

|

|

|

|

|

|

Other accrued expenses

|

|

|

128,976

|

|

|

|

92,886

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

518,197

|

|

|

$

|

412,435

|

|

|

|

|

|

|

|

|

|

16. EQUITY COMPENSATION PLANS

The Board of Directors and stockholders approved the Nonstatutory Stock Option Plan (the “2001

Plan”) and adopted it on May 29, 2001. The Company has reserved 250,000 shares of its common

stock for issuance to the directors, employees and consultants under the Plan. The Plan is

administered by the Board of Directors. Vesting terms of the options range from immediately to

five years.

Pursuant to an Information Statement on Schedule 14C mailed on May 9, 2005 to all stockholders

of record as of the close of business on February 1, 2005 and became effective September 3,

2005, the Company authorized the implementation of a 2004 Incentive and Nonstatutory Stock

Option Plan (“2004 Plan”) reserving 800,000 shares of common stock for issuance to employees,

directors and consultants of the Company or any subsidiaries. This plan became effective as of September 3,

2005 after the Company had completed a one for twenty reverse split.

On October 1, 2006, the Company granted to a marketing consultant 25,000 options to purchase the

Company’s common stock at a price of $1.80 per share. These options vested immediately upon

grant and are exercisable for a period of five years. The Company valued the foregoing options

using the Black Scholes option pricing model using the following assumptions: no

17

dividend yield;

expected volatility rate of 91.58%; risk free interest rate of 5% and an average life of 5 years

resulting in a value of $1.298 per option granted.

On September 14, 2006, pursuant to an S-8 filed with the SEC, the Company registered 1,150,000

common shares, pursuant to compensation arrangements.

On August 17, 2007 the Company granted to an employee 100,000 options to purchase the Company’s

common stock at a price of $1.50 per share. These options will vest over the next 3 years and

are exercisable for a period of 5 years. The Company valued the foregoing options using the

Black Scholes option pricing model using the following assumptions: no dividend yield; expected

volatility rate of 115%; risk free interest rate of 4.75% and an average life of 5 years

resulting in a value of $1.24 per option granted. The value of these options will be recognized

on a straight-line basis over the next three years and accordingly a value of $5,982 has been

recorded in the period ended September 30, 2007.

On September 21, 2007 the Company granted to employees and directors a total of 570,000 options

to purchase the Company’s common stock at a price of $1.75 per share. These options will vest

over the next 3 years and are exercisable for a period of 10 years. The Company valued the

foregoing options using the Black Scholes option pricing model using the following assumptions:

no dividend yield; expected volatility rate of 115%; risk free interest rate of 4.75% and an

average life of 7 years resulting in a value of $1.47 per option granted. The value of these

options will be recognized on a straight-line basis over the next three years and accordingly a

value of $6,864 has been recorded in the period ended September 30, 2007.

A summary of the option activity for the six months ended September 30, 2007 pursuant to the

terms of the plans is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2001 Plan

|

|

|

2004 Plan

|

|

|

Other

|

|

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

|

|

Weighted

|

|

|

|

|

Outstanding

|

|

|

Average

|

|

|

Outstanding

|

|

|

Average

|

|

|

Outstanding

|

|

|

Average

|

|

|

|

|

Options

|

|

|

Exercise Price

|

|

|

Options

|

|

|

Exercise Price

|

|

|

Options

|

|

|

Exercise Price

|

|

|

Options outstanding , March

31, 2007

|

|

|

222,500

|

|

|

$

|

1.29

|

|

|

|

210,666

|

|

|

$

|

3.19

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Granted

|

|

|

—

|

|

|

|

—

|

|

|

|

520,000

|

|

|

|

1.71

|

|

|

|

150,000

|

|

|

$

|

1.75

|

|

|

Exercised

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Cancelled or expired

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options outstanding, September

30, 2007

|

|

|

222,500

|

|

|

$

|

1.29

|

|

|

|

730,666

|

|

|

$

|

2.29

|

|

|

|

150,000

|

|

|

$

|

1.75

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options exercisable September

30, 2007

|

|

|

222,500

|

|

|

$

|

1.29

|

|

|

|

210,666

|

|

|

$

|

4.46

|

|