Avalon Closes Non-Brokered Private Placement for Gross Proceeds of $2.166 Million

03 July 2014 - 7:40AM

Avalon Rare Metals Inc. (TSX:AVL) (NYSE MKT:AVL)

("Avalon" or the "Company") is pleased to announce that it has

closed its previously announced non-brokered private placement of

flow-through common shares ("Flow-Through Shares") and non

flow-through units ("Non Flow-Through Units") (collectively, the

"Private Placement"), as described in the Company's news release of

June 19, 2014. The Private Placement was over-subscribed, resulting

in gross proceeds of $2.166 million. Each Non Flow-Through Unit

consists of one common share and one half share purchase warrant of

the Company. Each whole warrant entitles the subscriber to purchase

one common share of the Company at a price of $0.60 per share for a

period of three years from the date hereof.

On Closing, the Company issued 1,653,866 Flow-Through Shares

priced at $0.60 per Flow-Through Share and 2,445,000 Non

Flow-Through Units priced at $0.48 per Non Flow-Through Unit and

paid finders' fees of $47,000. Certain directors and officers of

the Company subscribed for an aggregate of 212,000 Flow-Through

Shares and 60,000 Non Flow-Through Units.

Don Bubar, Avalon's President and CEO, commented, "We are

pleased to have completed this Private Placement on an

over-subscribed basis. The proceeds from this Private Placement,

along with the proceeds from the US$4 million Registered Direct

Offering completed on June 13, 2014, provide the Company with

sufficient funding to complete all of our currently planned work

program commitments for the balance of 2014."

The proceeds from the sale of the Flow-Through Shares will be

used to fund the summer drilling programs and other eligible

exploration work on Avalon's 100% owned Nechalacho Rare Earth

Elements Property, Thor Lake, NWT and its 100% owned East

Kemptville Tin-Indium Property, Yarmouth County, Nova

Scotia. The proceeds from the sale of the Non Flow-Through

Units will be used for other engineering, permitting and market

development work for the Nechalacho Project, as well as general

corporate purposes.

The securities issued in connection with the Private Placement

are subject to a hold period which expires on November 3, 2014.

About Avalon Rare Metals Inc.

Avalon Rare Metals Inc. is a mineral development company focused

on rare metal deposits in Canada. Its 100%-owned Nechalacho

Deposit, Thor Lake, NWT is exceptional in its large size and

enrichment in the scarce 'heavy' rare earth elements, key to

enabling advances in clean technology and other growing high-tech

applications. With a positive feasibility study and environmental

assessment completed, the Nechalacho Project is a potential large

new source of heavy rare earths in the world outside of China,

currently the source of most of the world's supply. Social

responsibility and environmental stewardship are corporate

cornerstones.

For questions and feedback, please e-mail the Company at

ir@avalonraremetals.com, or phone Don Bubar, President & CEO at

416-364-4938.

This news release contains "forward-looking statements" within

the meaning of the United States Private Securities Litigation

Reform Act of 1995 and applicable Canadian securities legislation.

Forward-looking statements include, but are not limited to,

statements related to how the Company plans to use the net proceeds

from the Private Placement and the adequacy of cash available to

fund planned activities. Generally, these forward-looking

statements can be identified by the use of forward-looking

terminology such as "potential", "scheduled", "anticipates",

"continues", "expects" or "does not expect", "is expected",

"scheduled", "targeted", "planned", or "believes", or variations of

such words and phrases or state that certain actions, events or

results "may", "could", "would", "might" or "will be" or "will not

be" taken, reached or result, "will occur" or "be achieved".

Forward-looking statements are subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of Avalon to be

materially different from those expressed or implied by such

forward-looking statements. Forward-looking statements are based on

assumptions management believes to be reasonable at the time such

statements are made. Although Avalon has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking statements,

there may be other factors that cause results not to be as

anticipated, estimated or intended. Factors that may cause actual

results to differ materially from expected results described in

forward-looking statements include, but are not limited to market

conditions, and the possibility of cost overruns or unanticipated

costs and expenses as well as those risk factors set out in the

Company's current Annual Information Form, Management's Discussion

and Analysis and other disclosure documents available under the

Company's profile at www.SEDAR.com. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Such forward-looking statements have been provided

for the purpose of assisting investors in understanding the

Company's plans and objectives and may not be appropriate for other

purposes. Accordingly, readers should not place undue reliance on

forward-looking statements. Avalon does not undertake to update any

forward-looking statements that are contained herein, except in

accordance with applicable securities laws.

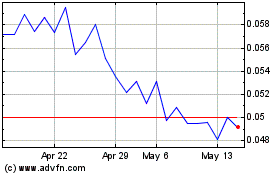

Avalon Advanced Materials (QB) (USOTC:AVLNF)

Historical Stock Chart

From Nov 2024 to Dec 2024

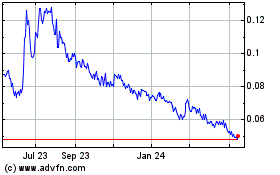

Avalon Advanced Materials (QB) (USOTC:AVLNF)

Historical Stock Chart

From Dec 2023 to Dec 2024