UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024.

Commission File Number: 333-253466

Ayr

Wellness Inc.

(Exact Name of Registrant as Specified in Charter)

2601

South Bayshore Drive, Suite 900, Miami, FL, 33133

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F

¨ Form 40-F x

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 to

this Form 6-K of Ayr Wellness Inc. (the "Company") are hereby incorporated by reference as exhibits to the Registration

Statement on Form F-10 (File No. 333-278161) of the Company, as amended or supplemented.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

AYR WELLNESS INC. |

| |

(Registrant) |

| |

|

|

| Date: May 15, 2024 |

By: |

/s/ Brad Asher |

| |

Name: |

Brad Asher |

| |

Title: |

Chief Financial Officer |

EXHIBIT INDEX

Exhibit 99.1

Ayr Wellness

Inc.

UNAUDITED INTERIM

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE

MONTHS ENDED MARCH 31, 2024 AND 2023

(EXPRESSED

IN UNITED STATES DOLLARS)

Ayr Wellness

Inc.

UNAUDITED INTERIM

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

March 31,

2024 AND 2023

Unaudited Interim Condensed Consolidated

Financial Statements (“Interim Financial Statements”)

| Unaudited

Interim Condensed Consolidated Balance Sheets |

|

| (“Interim

Balance Sheets”) |

1 |

| |

|

| Unaudited

Interim Condensed Consolidated Statements of Operations |

|

| (“Interim

Statements of Operations”) |

2 |

| |

|

| Unaudited

Interim Condensed Consolidated Statements of Shareholders’ Equity |

|

| (“Interim

Statements of Shareholders’ Equity”) |

3 |

| |

|

| Unaudited

Interim Condensed Consolidated Statements of Cash Flows |

|

| (“Interim

Statements of Cash Flows”) |

4 |

| |

|

| Notes

to the Unaudited Interim Condensed Consolidated Financial Statements |

5-23 |

Ayr Wellness Inc.

Unaudited Interim Condensed Consolidated

Balance Sheets

(Expressed

in United States Dollars, in thousands, except share amounts)

| | |

As of | |

| | |

March 31, 2024 | | |

December 31, 2023 | |

| ASSETS | |

| | | |

| | |

| Current | |

| | | |

| | |

| Cash, cash equivalents and restricted cash | |

$ | 71,199 | | |

$ | 50,766 | |

| Accounts receivable, net | |

| 14,671 | | |

| 13,491 | |

| Inventory | |

| 113,518 | | |

| 106,363 | |

| Prepaid expenses, deposits, and other current assets | |

| 14,493 | | |

| 22,600 | |

| Total Current Assets | |

| 213,881 | | |

| 193,220 | |

| Non-current | |

| | | |

| | |

| Property, plant, and equipment, net | |

| 313,871 | | |

| 310,615 | |

| Intangible assets, net | |

| 673,229 | | |

| 687,988 | |

| Right-of-use assets - operating, net | |

| 131,911 | | |

| 127,024 | |

| Right-of-use assets - finance, net | |

| 39,895 | | |

| 40,671 | |

| Goodwill | |

| 94,108 | | |

| 94,108 | |

| Deposits and other assets | |

| 6,313 | | |

| 6,229 | |

| TOTAL ASSETS | |

$ | 1,473,208 | | |

$ | 1,459,855 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current | |

| | | |

| | |

| Trade payables | |

| 25,331 | | |

| 24,786 | |

| Accrued liabilities | |

| 29,305 | | |

| 40,918 | |

| Lease liabilities - operating - current portion | |

| 10,210 | | |

| 9,776 | |

| Lease liabilities - finance - current portion | |

| 9,190 | | |

| 9,789 | |

| Income tax payable | |

| 13,419 | | |

| 90,074 | |

| Debts payable - current portion | |

| 20,189 | | |

| 23,152 | |

| Accrued interest payable - current portion | |

| 7,585 | | |

| 1,983 | |

| Total Current Liabilities | |

| 115,229 | | |

| 200,478 | |

| Non-current | |

| | | |

| | |

| Deferred tax liabilities, net | |

| 64,965 | | |

| 64,965 | |

| Uncertain tax position liabilities | |

| 87,653 | | |

| - | |

| Lease liabilities - operating - non-current portion | |

| 130,581 | | |

| 125,739 | |

| Lease liabilities - finance - non-current portion | |

| 17,049 | | |

| 18,007 | |

| Construction finance liabilities | |

| 39,177 | | |

| 38,205 | |

| Debts payable - non-current portion | |

| 172,499 | | |

| 167,351 | |

| Senior secured notes, net of debt issuance costs | |

| 208,581 | | |

| 243,955 | |

| Accrued interest payable - non-current portion | |

| 5,632 | | |

| 5,530 | |

| Other long-term liabilities | |

| 24,971 | | |

| 24,973 | |

| TOTAL LIABILITIES | |

| 866,337 | | |

| 889,203 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders' equity | |

| | | |

| | |

| Multiple Voting Shares - no par value, unlimited authorized. Issued and outstanding - 3,696,486 shares | |

| - | | |

| - | |

| Subordinate, Restricted, and Limited Voting Shares - no par value, unlimited authorized. Issued and outstanding - 101,468,851 and 64,574,077 shares, respectively | |

| - | | |

| - | |

| Exchangeable Shares: no par value, unlimited authorized. Issued and outstanding - 9,525,789 and 9,645,016 shares, respectively | |

| - | | |

| - | |

| Additional paid-in capital | |

| 1,515,155 | | |

| 1,370,600 | |

| Treasury stock - 645,298 and 645,300 shares, respectively | |

| (8,987 | ) | |

| (8,987 | ) |

| Accumulated other comprehensive income | |

| 3,266 | | |

| 3,266 | |

| Accumulated deficit | |

| (889,176 | ) | |

| (783,101 | ) |

| Equity of Ayr Wellness Inc. | |

| 620,258 | | |

| 581,778 | |

| Noncontrolling interest | |

| (13,387 | ) | |

| (11,126 | ) |

| TOTAL SHAREHOLDERS' EQUITY | |

| 606,871 | | |

| 570,652 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | |

$ | 1,473,208 | | |

$ | 1,459,855 | |

The accompanying

notes are an integral part of these unaudited interim condensed consolidated financial statements.

Ayr Wellness Inc.

Unaudited

Interim Condensed Consolidated Statements of Operations

(Expressed

in United States Dollars, in thousands, except per share amounts)

| | |

Three Months Ended | |

| | |

March 31, 2024 | | |

March 31, 2023 | |

| Revenues, net of discounts | |

$ | 118,040 | | |

$ | 117,665 | |

| Cost of goods sold | |

| 67,377 | | |

| 69,383 | |

| Gross profit | |

| 50,663 | | |

| 48,282 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling, general, and administrative | |

| 39,232 | | |

| 52,050 | |

| Depreciation and amortization | |

| 12,074 | | |

| 15,614 | |

| Acquisition and transaction costs | |

| 1,324 | | |

| 2,241 | |

| (Gain) loss on sale of assets | |

| (4 | ) | |

| 58 | |

| Total operating expenses | |

| 52,626 | | |

| 69,963 | |

| | |

| | | |

| | |

| Loss from continuing operations | |

| (1,963 | ) | |

| (21,681 | ) |

| | |

| | | |

| | |

| Other income (expense), net | |

| | | |

| | |

| Fair value gain on financial liabilities | |

| - | | |

| 27,597 | |

| Loss on the extinguishment of debt | |

| (79,172 | ) | |

| - | |

| Interest expense, net | |

| (17,620 | ) | |

| (7,565 | ) |

| Interest income | |

| 103 | | |

| 165 | |

| Other income, net | |

| 1,800 | | |

| 279 | |

| Total other (expense) income, net | |

| (94,889 | ) | |

| 20,476 | |

| | |

| | | |

| | |

| Loss from continuing operations before income taxes and noncontrolling interest | |

| (96,852 | ) | |

| (1,205 | ) |

| | |

| | | |

| | |

| Income taxes | |

| | | |

| | |

| Current tax provision | |

| (11,484 | ) | |

| (11,178 | ) |

| Total income taxes | |

| (11,484 | ) | |

| (11,178 | ) |

| | |

| | | |

| | |

| Net loss from continuing operations | |

| (108,336 | ) | |

| (12,383 | ) |

| | |

| | | |

| | |

| Discontinued operations | |

| | | |

| | |

| Loss from discontinued operations, net of taxes (including loss on disposal of $180,753 for the three months ended March 31, 2023) | |

| - | | |

| (185,245 | ) |

| Loss from discontinued operations | |

| - | | |

| (185,245 | ) |

| | |

| | | |

| | |

| Net loss | |

| (108,336 | ) | |

| (197,628 | ) |

| Net loss attributable to noncontrolling interests | |

| (2,261 | ) | |

| (3,025 | ) |

| Net loss attributable to Ayr Wellness Inc. | |

$ | (106,075 | ) | |

$ | (194,603 | ) |

| | |

| | | |

| | |

| Basic and diluted net loss per share | |

| | | |

| | |

| Continuing operations | |

$ | (1.08 | ) | |

$ | (0.13 | ) |

| Discontinued operations | |

| - | | |

| (2.65 | ) |

| Total (basic and diluted) net loss per share | |

$ | (1.08 | ) | |

$ | (2.78 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding (basic and diluted) | |

| 97,884 | | |

| 70,008 | |

The accompanying

notes are an integral part of these unaudited interim condensed consolidated financial statements.

Ayr Wellness

Inc.

Unaudited Interim Condensed Consolidated

Statements of Shareholders’ Equity

(Expressed

in United States Dollars, in thousands)

| | |

Multiple

Voting

Shares | | |

Subordinate,

Restricted,

and Limited

Voting

Shares

Number

| | |

Exchangeable

Shares | | |

Additional

paid-in

capital | | |

Treasury

stock | | |

Accumulated

other

comprehensive

income | | |

Accumulated

Deficit | | |

Noncontrolling

interest | | |

Total | |

| | |

# | | |

# | | |

# | | |

$ | | |

# | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| Balance,

December 31, 2022 | |

| 3,696 | | |

| 60,909 | | |

| 6,044 | | |

| 1,349,713 | | |

| (645 | ) | |

| (8,987 | ) | |

| 3,266 | | |

| (510,668 | ) | |

| 2,000 | | |

| 835,324 | |

| Stock-based

compensation | |

| - | | |

| 56 | | |

| - | | |

| 4,264 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,264 | |

| Tax

withholding on stock-based compensation awards | |

| - | | |

| (15 | ) | |

| - | | |

| (29 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (29 | ) |

| Conversion

of Exchangeable Shares | |

| - | | |

| 364 | | |

| (364 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net

loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (194,603 | ) | |

| (3,025 | ) | |

| (197,628 | ) |

| Balance,

March 31, 2023 | |

| 3,696 | | |

| 61,314 | | |

| 5,680 | | |

| 1,353,948 | | |

| (645 | ) | |

| (8,987 | ) | |

| 3,266 | | |

| (705,271 | ) | |

| (1,025 | ) | |

| 641,931 | |

| | |

Multiple

Voting

Shares | | |

Subordinate,

Restricted,

and Limited

Voting

Shares | | |

Exchangeable

Shares | | |

Additional

paid-in

capital | | |

Treasury

stock | | |

Accumulated

other

comprehensive

income | | |

Accumulated

Deficit | | |

Noncontrolling

interest | | |

Total | |

| | |

# | | |

# | | |

# | | |

$ | | |

# | | |

$ | | |

$ | | |

$ | | |

$ | | |

$ | |

| Balance, December 31, 2023 | |

| 3,696 | | |

| 64,574 | | |

| 9,645 | | |

| 1,370,600 | | |

| (645 | ) | |

| (8,987 | ) | |

| 3,266 | | |

| (783,101 | ) | |

| (11,126 | ) | |

| 570,652 | |

| Stock-based compensation | |

| - | | |

| 1,778 | | |

| - | | |

| 3,465 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,465 | |

| Tax withholding on stock-based

compensation awards | |

| - | | |

| (1 | ) | |

| - | | |

| (283 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (283 | ) |

| Conversion of Exchangeable Shares | |

| - | | |

| 119 | | |

| (119 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Shares

issued in connection with debt extinguishment | |

| - | | |

| 34,988 | | |

| - | | |

| 94,302 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 94,302 | |

| Warrants

issued in connection with debt extinguishment | |

| - | | |

| - | | |

| - | | |

| 47,049 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 47,049 | |

| Warrants exercised | |

| - | | |

| 11 | | |

| - | | |

| 22 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 22 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (106,075 | ) | |

| (2,261 | ) | |

| (108,336 | ) |

| Balance, March 31,

2024 | |

| 3,696 | | |

| 101,469 | | |

| 9,526 | | |

| 1,515,155 | | |

| (645 | ) | |

| (8,987 | ) | |

| 3,266 | | |

| (889,176 | ) | |

| (13,387 | ) | |

| 606,871 | |

The accompanying

notes are an integral part of these unaudited interim condensed consolidated financial statements.

Ayr Wellness

Inc.

Unaudited Interim

Condensed Consolidated Statements of Cash Flows

(Expressed

in United States Dollars, in thousands)

| | |

Three Months Ended | |

| | |

March 31, 2024 | | |

March 31, 2023 | |

| Operating activities | |

| | | |

| | |

| Consolidated net loss | |

$ | (108,336 | ) | |

$ | (197,628 | ) |

| Less: Loss from discontinued operations | |

| - | | |

| (4,492 | ) |

| Net loss from continuing operations before noncontrolling interest | |

| (108,336 | ) | |

| (193,136 | ) |

| Adjustments for: | |

| | | |

| | |

| Fair value gain on financial liabilities | |

| - | | |

| (27,597 | ) |

| Stock-based compensation | |

| 3,465 | | |

| 5,584 | |

| Depreciation and amortization | |

| 7,345 | | |

| 10,701 | |

| Amortization of intangible assets | |

| 14,818 | | |

| 14,336 | |

| Amortization of financing costs | |

| 3,948 | | |

| 573 | |

| Amortization of financing discount | |

| 1,399 | | |

| - | |

| Amortization of financing premium | |

| (152 | ) | |

| (754 | ) |

| Provision for credit losses | |

| 259 | | |

| - | |

| (Gain) loss on sale of assets | |

| (4 | ) | |

| 58 | |

| Loss on the extinguishment of debt | |

| 79,172 | | |

| - | |

| Loss on the disposal of Arizona business | |

| - | | |

| 180,753 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (1,438 | ) | |

| (2,087 | ) |

| Inventory | |

| (7,156 | ) | |

| 3,257 | |

| Prepaid expenses, deposits, and other current assets | |

| (1,145 | ) | |

| 1,204 | |

| Trade payables | |

| 938 | | |

| (6,171 | ) |

| Accrued liabilities | |

| (1,522 | ) | |

| 5,640 | |

| Accrued interest payable | |

| 5,703 | | |

| 5,053 | |

| Lease liabilities - operating | |

| 388 | | |

| 640 | |

| Income tax payable | |

| (76,655 | ) | |

| 10,581 | |

| Uncertain tax position liabilities | |

| 87,653 | | |

| - | |

| Cash provided by continuing operations | |

| 8,680 | | |

| 8,635 | |

| Cash provided by discontinued operations | |

| - | | |

| 1,621 | |

| Cash provided by operating activities | |

| 8,680 | | |

| 10,256 | |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Purchase of property, plant, and equipment | |

| (6,822 | ) | |

| (7,187 | ) |

| Capitalized interest | |

| (1,461 | ) | |

| (3,589 | ) |

| Proceeds from the sale of assets | |

| 40 | | |

| - | |

| Cash paid for business combinations and asset acquisitions, working capital | |

| - | | |

| (2,600 | ) |

| Cash used in investing activities from continuing operations | |

| (8,243 | ) | |

| (13,376 | ) |

| Proceeds from sale of Arizona - discontinued operation | |

| - | | |

| 18,084 | |

| Cash used in investing activities of discontinued operations | |

| - | | |

| (44 | ) |

| Cash (used in) provided by investing activities | |

| (8,243 | ) | |

| 4,664 | |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Proceeds from exercise of warrants | |

| 22 | | |

| - | |

| Proceeds from notes payable | |

| 40,000 | | |

| 10,000 | |

| Proceeds from financing transaction, net of financing costs | |

| 8,309 | | |

| - | |

| Debt issuance costs paid | |

| (9,096 | ) | |

| - | |

| Payment for settlement of contingent consideration | |

| (10,094 | ) | |

| - | |

| Tax withholding on stock-based compensation awards | |

| (283 | ) | |

| (29 | ) |

| Repayments of debts payable | |

| (6,247 | ) | |

| (6,546 | ) |

| Repayments of lease liabilities - finance (principal portion) | |

| (2,615 | ) | |

| (2,378 | ) |

| Cash provided by financing activities by continuing operations | |

| 19,996 | | |

| 1,047 | |

| Cash used in financing activities from discontinued operations | |

| - | | |

| (123 | ) |

| Cash provided by financing activities | |

| 19,996 | | |

| 924 | |

| | |

| | | |

| | |

| Net increase in cash and cash equivalents and restricted cash | |

| 20,433 | | |

| 15,844 | |

| Cash, cash equivalents and restricted cash at beginning of the period | |

| 50,766 | | |

| 76,827 | |

| Cash included in assets held-for-sale | |

| - | | |

| 3,813 | |

| Cash, cash equivalents and restricted cash at end of the period | |

$ | 71,199 | | |

$ | 96,484 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Interest paid during the period, net | |

$ | 8,096 | | |

$ | 5,311 | |

| Income taxes paid during the period | |

| 486 | | |

| 908 | |

| Non-cash investing and financing activities: | |

| | | |

| | |

| Recognition of right-of-use assets for operating leases | |

| 8,195 | | |

| 1,358 | |

| Recognition of right-of-use assets for finance leases | |

| 1,502 | | |

| 468 | |

| Capital expenditure disbursements for cultivation facility | |

| 972 | | |

| 241 | |

| Extinguishment of note payable related to sale of Arizona business | |

| - | | |

| 22,505 | |

| Extinguishment of accrued interest payable related to sale of Arizona business | |

| - | | |

| 1,165 | |

| Reduction of lease liabilities related to sale of Arizona business | |

| - | | |

| 16,734 | |

| Reduction of right-of-use assets related to sale of Arizona business | |

| - | | |

| 16,739 | |

| Issuance of warrants in connection with debt extinguishment | |

| 47,049 | | |

| - | |

| Issuance of Equity Shares in connection with debt extinguishment | |

| 94,302 | | |

| - | |

The accompanying

notes are an integral part of these unaudited interim condensed consolidated financial statements.

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

1. NATURE

OF OPERATIONS

Ayr Wellness Inc.

(“Ayr” or the “Company”) is a vertically integrated cannabis multi-state operator in the United States of America

(“U.S.”); through its operating companies in various states throughout the U.S., Ayr is a leading cultivator, manufacturer,

and retailer of cannabis products and branded cannabis packaged goods. The Company prepares its segment reporting on the same basis that

its chief operating decision maker manages the business and makes operating decisions. The Company has one operating segment, cannabis

sales. The Company’s segment analysis is reviewed regularly and will be re-evaluated when circumstances change.

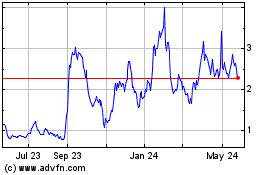

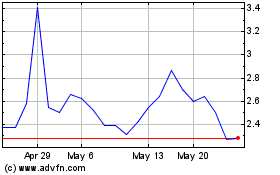

The Company is

a reporting issuer in the U.S. and Canada. The Company’s subordinate, restricted, and limited voting shares (“Equity Shares”)

are trading on the Canadian Stock Exchange (“CSE”), under the symbol “AYR.A.” The Company’s Equity Shares

are also quoted on the OTCQX® Best Market in the U.S. under the symbol “AYRWF.” The Company’s warrants (“Warrants”)

are trading on the CSE under the symbol “AYR.WT.U”. Ayr’s headquarter office is 2601 South Bayshore Drive, Suite 900,

Miami, FL 33133.

2. BASIS

OF PRESENTATION

These interim financial

statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim

financial information and in accordance with the rules and regulations of Canadian securities regulators and the United States Securities

and Exchange Commission (“SEC”). Accordingly, these interim financial statements are condensed and do not include all disclosures

required for annual financial statements.

The financial data

presented herein should be read in conjunction with the audited consolidated financial statements and accompanying notes for the year

ended December 31, 2023, included in the Company’s Annual Report on the Form 40-F filed with the SEC on March 13,

2024. In the opinion of management, the financial data presented includes all adjustments, consisting primarily of normal recurring adjustments,

necessary to present fairly the financial position, results of operations and cash flows for the periods presented. These interim financial

statements include estimates and assumptions of management that affect the amounts reported. Actual results could differ from these estimates.

The results of operations of unaudited interim periods are not necessarily indicative of the results to be expected for the entire year,

or any other period.

3. SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES

3.1 Basis of

consolidation

The interim financial

statements for the three months ended March 31, 2024 and 2023 include the accounts of the Company, its wholly-owned subsidiaries,

and entities over which the Company has a controlling interest. Entities over which the Company has control are presented on a consolidated

basis from the date control commences until the date control ceases. Equity investments where the Company does not exert a controlling

interest are not consolidated. All intercompany balances and transactions involving controlled entities are eliminated on consolidation.

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

3. SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

3.2 Earnings

per share

The basic loss per share is computed by dividing

the net loss by the weighted average number of shares outstanding, including Equity Shares, multiple voting shares of the Company and

Exchangeable Shares, as defined below, during the period. The diluted loss per share reflects the potential dilution of shares by adjusting

the weighted average number of shares outstanding to assume conversion of potentially dilutive shares, such as warrants (“Warrants”),

restricted stock units (“RSUs”), and vested options of the Company (“Vested Options”). The treasury stock method

is used for the assumed proceeds upon the exercise of the Warrants, and Vested Options that are used to purchase Equity Shares at the

average market price during the period. If the Company incurs a net loss during a reporting period, the calculation of fully diluted loss

per share will not include potentially dilutive equity instruments such as Warrants, RSUs, and Vested Options, because their effect would

be anti-dilutive, therefore, basic loss per share and diluted loss per share will be the same. For the three months ended March 31, 2024

and 2023, the potentially dilutive financial instruments excluded from the calculation of earnings per share included 2,855 and nil warrants,

nil and nil options and 1,107 and 3,480 RSUs, totaling 3,962 and 3,480 shares of potentially dilutive securities, respectively.

3.3 Significant

accounting judgments and estimates

Significant estimates

made by management include, but are not limited to: economic lives of leased assets; expected credit losses of accounts receivable; provisions

for inventory obsolescence; impairment assessment of goodwill and long-lived assets; depreciable lives of property, plant and equipment;

useful lives of intangible assets; accruals for contingencies, including tax contingencies; valuation allowances for deferred income

tax assets; contingent consideration obligations resulting from business combinations; estimates of fair value of derivative instruments;

estimates of fair value of debt; estimates of lease guarantees; estimates on uncertain tax positions; incremental borrowing rate used

for leases; and estimates of the fair value of stock-based payment awards.

3.4 Derivative liabilities and long-term debt

The Company’s debt instruments contain

a host liability and freestanding warrants. The Company uses the guidance under ASC Topic 815 – Derivatives and Hedging

(“ASC 815”) and ASC Topic 480 – Distinguishing Liabilities from Equity (“ASC 480”) to determine if

the embedded conversion feature must be bifurcated and separately accounted for as a derivative under ASC 815. It also determines

whether any embedded conversion features requiring bifurcation and/or freestanding warrants qualify for any scope exceptions

contained within ASC 815. Generally, contracts issued or held by a reporting entity that are both (i) indexed to its own stock; and

(ii) classified in shareholders’ equity, would not be considered a derivative for the purposes of applying ASC 815. Any

embedded conversion features and/or freestanding warrants that do not meet the scope exception noted above are classified as

derivative liabilities, initially measured at fair value and remeasured at fair value each reporting period with changes in fair

value recognized in the consolidated statements of operations. Any embedded conversion feature and/or freestanding warrants that

meet the scope exception under ASC 815 are initially recorded at their relative fair value in paid-in-capital and are not remeasured

at fair value in future periods. The Company concluded that the warrants meet the criteria to be classified as equity and should be

measured at fair value on the date of issuance. There were no derivative liabilities on the interim balance sheets as of March 31,

2024 and December 31, 2023.

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

3. SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

3.4 Derivative liabilities and long-term debt

(Continued)

The host debt instrument is initially recorded

at its relative fair value in long-term debt. The host debt instrument is accounted for in accordance with guidance applicable to non-convertible

debt under ASC Topic 470 – Debt (“ASC 470”) and is accreted to its face value over the term of the debt with accretion

expense and periodic interest expense recorded in the consolidated statements of operations. Issuance costs are allocated to each instrument

(the debt host, embedded conversion feature and/or freestanding warrants) in the same proportion as the proceeds that are allocated to

each instrument other than issuance costs directly related to an instrument are allocated to that instrument only. Issuance costs allocated

to the debt host instrument are netted against the proceeds allocated to the debt host. Issuance costs allocated to freestanding warrants

classified in equity are recorded in additional paid-in-capital.

3.5 Change in

accounting standards

The Company is

treated as an “emerging growth company” as defined under the Jumpstart Our Business Start-ups Act of 2012, as amended (the

“JOBS Act”). Under the JOBS Act, emerging growth companies may delay adopting new or revised accounting standards until the

standards apply to private companies, however, emerging growth companies are not precluded from early adopting new accounting standards

that allow so.

Recently Issued

and Adopted Accounting Standards

In June 2022, the FASB issued ASU No. 2022-03

Topic 820 – Fair Value Measurement – Fair Value Measurement of Equity Securities Subject to Contractual Sale Restrictions

(“ASU 2022-03”), (1) to clarify the guidance in Topic 820, Fair Value Measurement, when measuring the fair value of an equity

security subject to contractual restrictions that prohibit the sale of an equity security, (2) to amend a related illustrative example,

and (3) to introduce new disclosure requirements for equity securities subject to contractual sale restrictions that are measured at fair

value in accordance with Topic 820. ASU 2022-03 will be effective for public business entities for fiscal years beginning after December 15, 2023, including interim periods

therein, with early adoption permitted. All other entities, including Emerging Growth Companies, would be required to adopt this ASU for

fiscal years beginning after December 15, 2024 and interim periods therein. The Company’s historical accounting policy has been

to reflect discounts for contractual restrictions which will no longer be permissible once the ASU is adopted.

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

3. SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

3.5 Change in

accounting standards (Continued)

On

March 27, 2023, the FASB issued ASU No. 2023-01 Topic 842 – Leases – Common Control Arrangements (“ASU 2023-01”),

in response to private company stakeholder concerns about applying Topic 842 to related party arrangements between entities under common

control. ASU 2023-01 is effective for fiscal years beginning after December 15, 2023, including interim periods within those fiscal years,

early adoption is permitted. The adoption of this ASU did not have a material impact on the Company’s financial statements.

On

December 14, 2023, the FASB issued ASU No. 2023-09 Topic 740 – Income Taxes (“ASU

2023-09”) to enhance the transparency and decision usefulness of income tax disclosures. The amendments in this Update address

investor requests for more transparency about income tax information through improvements to income tax disclosures primarily related

to the rate reconciliation and income taxes paid information. ASU 2023-09 is effective for fiscal years beginning after December 15,

2024, including interim periods within those fiscal years, early adoption is permitted. The Company is currently evaluating the impact

the adoption of ASU 2023-09 may have on the Company's financial statements.

On

March 21, 2024, the FASB issued ASU No. 2024-01 Topic 718 – Stock Compensation (“ASU

2024-01”) which clarifies how an entity determines whether a profits interest or similar award is within the scope of ASC 718 or

not a share-based payment arrangement and therefore within the scope of other guidance. ASU 2024-01 is effective for fiscal years beginning

after December 15, 2024, including interim periods within those fiscal years, early adoption is permitted. The Company is currently

evaluating the impact the adoption of ASU 2024-01 may have on the Company's financial statements.

In November 2023,

the FASB issued ASU No. 2023-07 Topic 280 – Segment Reporting (“ASU 2023-07”) to improve the disclosures about

a public entity’s reportable segments and address requests from investors for additional, more detailed information about a reportable

segment’s expenses. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within

fiscal years beginning after December 15, 2024, early adoption is permitted. The Company is currently evaluating the impact the

adoption of ASU 2023-07 may have on the Company’s financial statements.

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

4. VARIABLE

INTEREST ENTITIES (“VIE”)

The following tables present the summarized financial

information about the Company’s consolidated VIEs which are included in the unaudited balance sheets as of March 31, 2024 and December

31, 2023 and interim statements of operations for the three months ended March 31, 2024 and 2023. As of March 31, 2024 and for the three

months ended March 31, 2024, these entities were determined to be VIEs as the Company possesses the power to direct activities and obligation

to absorb losses through management services agreements.

| | |

As

of | | |

As

of | |

| | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

NVG | | |

Parma | | |

Ohio

Dispensaries | | |

Total | | |

TH/NVG | | |

Parma | | |

Ohio

Dispensaries | | |

Total | |

| Current assets | |

$ | (644 | ) | |

$ | 10,437 | | |

$ | (2,811 | ) | |

$ | 6,982 | | |

$ | (351 | ) | |

$ | 10,616 | | |

$ | (2,257 | ) | |

$ | 8,008 | |

| Non-current

assets | |

| 2,227 | | |

| 12,914 | | |

| 6,901 | | |

| 22,042 | | |

| 1,077 | | |

| 13,210 | | |

| 6,441 | | |

| 20,728 | |

| Total

assets | |

$ | 1,583 | | |

$ | 23,351 | | |

$ | 4,090 | | |

$ | 29,024 | | |

$ | 726 | | |

$ | 23,826 | | |

$ | 4,184 | | |

$ | 28,736 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current liabilities | |

$ | 669 | | |

$ | 19,244 | | |

$ | 476 | | |

$ | 20,389 | | |

$ | 604 | | |

$ | 18,962 | | |

$ | 1,647 | | |

$ | 21,213 | |

| Non-current

liabilities | |

| 1,494 | | |

| 981 | | |

| 3,337 | | |

| 5,812 | | |

| 383 | | |

| 1,280 | | |

| 3,369 | | |

| 5,032 | |

| Total

liabilities | |

| 2,163 | | |

| 20,225 | | |

| 3,813 | | |

| 26,201 | | |

| 987 | | |

| 20,242 | | |

| 5,016 | | |

| 26,245 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Noncontrolling interest | |

| 589 | | |

| (10,553 | ) | |

| (3,423 | ) | |

| (13,387 | ) | |

| 796 | | |

| (10,158 | ) | |

| (1,764 | ) | |

| (11,126 | ) |

| Equity (deficit)

attributable to Ayr Wellness Inc. | |

| (1,169 | ) | |

| 13,679 | | |

| 3,700 | | |

| 16,210 | | |

| (1,057 | ) | |

| 13,742 | | |

| 932 | | |

| 13,617 | |

| Total

liabilities and equity | |

$ | 1,583 | | |

$ | 23,351 | | |

$ | 4,090 | | |

$ | 29,024 | | |

$ | 726 | | |

$ | 23,826 | | |

$ | 4,184 | | |

$ | 28,736 | |

| | |

Three

Months Ended | | |

Three

Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

NVG | | |

Parma | | |

Ohio

Dispensaries | | |

Total | | |

TH/NVG | | |

Parma | | |

Total | |

| Revenues, net of

discounts | |

$ | - | | |

$ | 1,340 | | |

$ | 1,184 | | |

$ | 2,524 | | |

$ | 538 | | |

$ | - | | |

$ | 538 | |

| Net loss attributable to noncontrolling

interest | |

| (207 | ) | |

| (395 | ) | |

| (1,659 | ) | |

| (2,261 | ) | |

| (243 | ) | |

| (2,782 | ) | |

| (3,025 | ) |

| Net loss

attributable to Ayr Wellness Inc. | |

| - | | |

| (380 | ) | |

| - | | |

| (380 | ) | |

| - | | |

| - | | |

| - | |

| Net loss | |

$ | (207 | ) | |

$ | (775 | ) | |

$ | (1,659 | ) | |

$ | (2,641 | ) | |

$ | (243 | ) | |

$ | (2,782 | ) | |

$ | (3,025 | ) |

| | |

TH/NVG | | |

Parma | | |

Ohio

Dispensaries | | |

Total | |

| Noncontrolling interest at January 1,

2023 | |

$ | 7,528 | | |

$ | (5,528 | ) | |

| - | | |

$ | 2,000 | |

| Acquisition of Tahoe Hydro | |

| (6,059 | ) | |

| - | | |

| - | | |

| (6,059 | ) |

| Net loss

during the period | |

| (673 | ) | |

| (4,630 | ) | |

| (1,764 | ) | |

| (7,067 | ) |

| Noncontrolling interest

at December 31, 2023 | |

| 796 | | |

| (10,158 | ) | |

| (1,764 | ) | |

| (11,126 | ) |

| Net loss

during the period | |

| (207 | ) | |

| (395 | ) | |

| (1,659 | ) | |

| (2,261 | ) |

| Noncontrolling

interest at March 31, 2024 | |

$ | 589 | | |

$ | (10,553 | ) | |

$ | (3,423 | ) | |

$ | (13,387 | ) |

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

5. INVENTORY

The Company’s

inventory includes the following:

| | |

March 31,

2024 | | |

December 31,

2023 | |

| Materials, supplies, and

packaging | |

$ | 6,981 | | |

$ | 7,505 | |

| Work in process | |

| 71,628 | | |

| 69,632 | |

| Finished goods | |

| 34,909 | | |

| 29,226 | |

| Total inventory | |

$ | 113,518 | | |

$ | 106,363 | |

The

amount of inventory included in cost of goods sold during the three months ended March 31, 2024 and 2023, was $56,618

and $59,208, respectively. The Company reviews inventory on hand for estimated obsolescence or unmarketable items, as compared to future

demand requirements and the shelf life of the various products. Based on the review, the Company records inventory write-downs, when

necessary, when costs exceed expected net realizable value.

6. PROPERTY,

PLANT, AND EQUIPMENT

As of March 31,

2024 and December 31, 2023, property, plant, and equipment, net consisted of the following:

| | |

March 31,

2024 | | |

December 31,

2023 | |

| Furniture and equipment | |

$ | 53,610 | | |

$ | 52,793 | |

| Auto and trucks | |

| 1,392 | | |

| 1,393 | |

| Buildings | |

| 97,122 | | |

| 94,914 | |

| Leasehold improvements | |

| 177,457 | | |

| 173,043 | |

| Land | |

| 16,067 | | |

| 13,877 | |

| Construction in

progress | |

| 11,683 | | |

| 12,571 | |

| Total | |

| 357,331 | | |

| 348,591 | |

| Less: Accumulated

depreciation and amortization | |

| 43,460 | | |

| 37,976 | |

| Total property, plant and equipment,

net | |

$ | 313,871 | | |

$ | 310,615 | |

Capitalized interest

for the three months ended March 31, 2024 and 2023, totaled $1,461 and $3,589, respectively. Depreciation and amortization expense

for the three months ended March 31, 2024 and 2023, totaled $5,511 and $8,970, respectively, of which $3,926 and $3,859 respectively,

is included in cost of goods sold.

Ayr

Wellness Inc.

Notes

to the Unaudited Interim Condensed Consolidated Financial Statements

For

the Three Months Ended March 31, 2024 and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

7. INTANGIBLE

ASSETS

In December 2023,

an entity co-owned by the Company was awarded a provisional Disproportionately Impacted Area cultivator license in Connecticut. The Company

recorded an intangible asset of $3,000 in connection with the cash payment for the cost of the provisional license. In December 2023,

the Company acquired a standalone delivery license in Connecticut and recorded an intangible asset of $200 in connection with the cash

payment for the cost of the license. Operations have not started in Connecticut, as such, no amortization expense has been recorded as

of the three months ended March 31, 2024.

Amortization expense

is recorded within cost of goods sold and total operating expenses. The amount in cost of goods sold for the three months March 31,

2024 and 2023, was $4,363 and $3,881, respectively.

The following table

represents intangible assets, net of accumulated amortization:

| | |

| | |

March 31,

2024 | | |

December 31,

2023 | |

| | |

|

Amortization period (# of years) |

|

|

|

| | |

| |

| Licenses/permits | |

| 15 | | |

$ | 627,818 | | |

$ | 641,036 | |

| Right-to-use licenses | |

| 15 | | |

| 16,080 | | |

| 16,407 | |

| Host community agreements | |

| 15 | | |

| 26,319 | | |

| 26,954 | |

| Trade name / brand | |

| 5 | | |

| 3,012 | | |

| 3,591 | |

| Total | |

| | | |

$ | 673,229 | | |

$ | 687,988 | |

The following table

presents the future amortization expense as of March 31, 2024:

| | |

Amortization

Expense | |

| Remainder of 2024 | |

$ | 43,304 | |

| 2025 | |

| 57,312 | |

| 2026 | |

| 57,312 | |

| 2027 | |

| 57,312 | |

| 2028 | |

| 57,312 | |

| 2029 and beyond | |

| 397,477 | |

| Total | |

$ | 670,029 | |

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 8. | RIGHT-OF-USE

ASSETS & LEASE LIABILITIES |

Information related to operating and finance

leases is as follows:

| | |

March 31,

2024 | | |

March 31,

2023 | |

| | |

| Operating

Leases | | |

| Finance

Leases | | |

| Operating

Leases | | |

| Finance

Leases | |

| Incremental borrowing rate (weighted average) | |

| 11.82% | | |

| 10.38% | | |

| 11.76% | | |

| 9.73% | |

| Weighted average remaining lease term | |

| 11.96

yrs | | |

| 4.81

yrs | | |

| 12.89

yrs | | |

| 4.87

yrs | |

The maturities of the contractual lease liabilities

as of March 31, 2024 are as follows:

| | |

Operating

Leases | | |

Finance

Leases | | |

Total | |

| Remainder of 2024 | |

$ | 22,792 | | |

$ | 8,959 | | |

$ | 31,751 | |

| 2025 | |

| 30,026 | | |

| 6,697 | | |

| 36,723 | |

| 2026 | |

| 29,363 | | |

| 4,709 | | |

| 34,072 | |

| 2027 | |

| 28,263 | | |

| 3,637 | | |

| 31,900 | |

| 2028 | |

| 27,681 | | |

| 2,805 | | |

| 30,486 | |

| 2029 and beyond | |

| 206,943 | | |

| 6,479 | | |

| 213,422 | |

| Total undiscounted lease liabilities | |

| 345,068 | | |

| 33,286 | | |

| 378,354 | |

| Impact of discounting | |

| (204,277 | ) | |

| (7,047 | ) | |

| (211,324 | ) |

| Total present value of minimum

lease payments | |

$ | 140,791 | | |

$ | 26,239 | | |

$ | 167,030 | |

Payments related to capitalized leases during

the three months ended March 31, 2024 and 2023, are as follows:

| | |

Three

Months Ended | |

| | |

March 31,

2024 | | |

March 31,

2023 | |

| Lease liabilities - operating | |

| | | |

| | |

| Lease liabilities - operating expense, COGS | |

$ | 2,245 | | |

$ | 2,207 | |

| Lease liabilities - operating expense, G&A | |

| 4,508 | | |

| 3,900 | |

| Lease liabilities - finance | |

| | | |

| | |

| Amortization of right-of-use assets, COGS | |

| 1,800 | | |

| 1,683 | |

| Amortization of right-of-use assets, G&A | |

| 34 | | |

| 48 | |

| Interest on lease liabilities - finance, COGS | |

| 671 | | |

| 752 | |

| Interest on lease liabilities - finance,

G&A | |

| 8 | | |

| 12 | |

| Total lease expense | |

$ | 9,266 | | |

$ | 8,602 | |

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 9. | RELATED PARTY

TRANSACTIONS AND BALANCES |

Related parties are defined as management and

members of the Company and/or members of their immediate family and/or other companies and/or entities in which a board member or senior

officer is a principal owner or senior executive. Other than disclosed elsewhere in the interim financial statements, related party transactions

and balances are as follows:

Mercer Park, L.P., a company owned by a

board member of Ayr, entered into a management agreement with the Company dated May 24, 2019. The management fee is paid

monthly and varies based on actual costs incurred by the related entity when providing the Company administrative support,

management services, office space, and utilities. In addition, the management fees paid to the related party also reimbursed them

for other corporate or centralized expenses based on actual cost, including but not limited to legal and professional fees,

software, and insurance. The agreement is a month-to-month arrangement.

As of March 31, 2024 and 2023, $nil and

$86, respectively, was included in prepaid expenses, a majority of which is for a letter of credit for an operating lease. Lease fees

included in the operating lease during the three months ended March 31, 2024 and 2023, were $214 and $213, respectively.

During the three months ended March 31,

2024 and 2023, the Company incurred fees from a company partially owned by a board member of Ayr. The total incurred fees were $nil and

$14 of office expenses, $nil and $24 of development fees, $311 and $231 of rental fees, and $7 and $28 of interest expense, respectively,

for the three months ended March 31, 2024 and 2023.

Refer below to the debts payable and senior secured

notes and share capital notes for additional information regarding the debts payable to related parties and non-cash stock-based compensation

plan, respectively, for the three months ended March 31, 2024 and 2023.

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 10. | DEBTS PAYABLE

AND SENIOR SECURED NOTES |

Senior Secured Notes

As of March 31, 2024 and December 31,

2023, the Company’s senior secured notes consisted of the following:

| | |

Senior

secured notes | |

| As of January 1, 2023 | |

$ | 244,682 | |

| Debt issuance costs amortized | |

| 2,291 | |

| Senior secured notes premium amortized | |

| (3,018 | ) |

| As of December 31, 2023 | |

$ | 243,955 | |

| Senior notes issued | |

| 50,000 | |

| Senior secured notes premium amortized | |

| (2,867 | ) |

| Debt issuance costs | |

| (56,734 | ) |

| Debt issuance costs amortized | |

| (2,686 | ) |

| Senior secured notes discount | |

| (24,486 | ) |

| Senior secured notes discount amortized | |

| 1,399 | |

| Total senior secured notes classified as non-current payable as of March 31, 2024 | |

$ | 208,581 | |

| Total accrued interest payable related to senior secured notes classified as non-current payable as of March 31, 2024 | |

$ | 5,520 | |

On November 12, 2021, the Company completed

a private placement offering of approximately $133,250 aggregate principal amount of secured promissory notes at a premium price, resulting

in approximately $147,000 of proceeds due December 2024, with a resulting yield-to-maturity of 9.8%. The notes were considered additional

notes under the indenture governing the Company’s existing notes of $110,000 which were entered into on December 10, 2020.

On February 7, 2024, following the receipt of

court and other required regulatory approvals, the Company completed the debt restructuring transactions contemplated by the Support Agreement

entered into with the Majority Noteholders, pursuant to which: (i) all of the Senior Secured Notes were exchanged for an equivalent principal

amount of new 13% senior secured notes due December 10, 2026 (the “13% Senior Notes" and such exchange, the “Exchange

Transaction”); (ii) an additional $40,000 in gross cash proceeds was raised through the issuance of additional 13% Senior Notes

in an aggregate principal amount of $50,000 (the “New Money Notes”) (subject to a 20% original issue discount) concurrent

with the completion of the Exchange Transaction; (iii) as the offering of the New Money Notes was backstopped by one of the Majority Noteholders,

such backstop party received a backstop premium on closing payable in the form of 5,948 Equity Shares (the “Backstop Shares”)

in the Company, and (iv) holders of the 12.5% Senior Secured Notes received 29,040 Equity Shares (the “New Shares”) in the

Company. The Backstop Shares and New Shares have contractual restrictions on their ability to be sold for six months, applicable to 50%

of the shares issued. The fair value of the shares was based on the share price on the CSE at the date of closing and a 28.6% discount

rate attributed to the equity security-specific restrictions, resulting in a fair value of $94,302 at issuance. The Backstop Shares and

New Shares met the criteria to be recorded as equity under ASC 815 and the fair value is included in the loss on extinguishment.

In accordance with debt extinguishment accounting

rules outlined in ASC 470, the Company recorded a loss on extinguishment of $79,172 for the three months ended March 31, 2024 in the interim

statement of operations related to the restructuring of debt. In connection with the extinguishment in the aggregate amount of $243,894,

the Company issued new debt in the principal amount of $293,250, including additional proceeds of $40,000, which was recorded at fair

value of $268,764 and the Backstop Shares and New Shares issued on the closing date. On the closing date, the Company fully amortized

the debt premium of $2,615 related to the old debt that was extinguished and recognized a debt discount of $24,486 related to the new

debt.

In addition, 23,046 warrants (the “Anti-Dilutive

Warrants”) were issued to all the existing shareholders of Ayr (excluding recipients of the New Shares and the Backstop Shares).

The Anti-Dilutive Warrants are exercisable for an equal number of Equity Shares at a price of $2.12 per share until February 7, 2026.

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 10. | DEBTS PAYABLE

AND SENIOR SECURED NOTES (Continued) |

Senior Secured Notes (Continued)

The Anti-Dilutive Warrants are only exercisable

by non-U.S. Persons and Accredited Investors in the U.S., as such terms are defined under U.S. securities laws. The Anti-Dilutive Warrants

commenced trading on the CSE on February 14, 2024 under the ticker symbol AYR.WT.U. The Company evaluated the warrants issued under ASC

480 and ASC 815. These warrants do not have a redemption feature and are traded separately from our common shares on the CSE exchange.

They can be converted into shares, on a one-for-one conversion ratio, upon payment of a fixed exercise price. The Company determined that

these warrants are freestanding financial instruments that qualify for the scope exemption for being accounted as derivatives. The Company

therefore concluded that the warrants meet the criteria to be classified as equity and should be measured at fair value on the date of

closing. No changes would be required to the measurement amount or the classification unless an event that requires a reclassification

of the warrants out of equity occurs.

Additionally, the Company incurred financing costs

of $65,314 related to the restructuring, which includes warrants issued to shareholders that had a fair value of $47,049 at issuance,

which was calculated using a Black-Scholes model and included assumptions such as volatility of 104.3% and a risk-free rate of 4.4%. The

financing costs are being amortized to interest expense over the term of the loan using the straight-line method, approximating the effective

interest method.

The 13% Senior Notes require the Company to comply

with customary covenants, including restrictions on the payment of dividends, repurchase of stock, incurrence of indebtedness, dispositions,

and acquisitions. The 13% Senior Notes also contain customary events of default including non-payment of principal or interest; violations

of covenants; bankruptcy; cross defaults to other debt; and material judgment defaults. The 13% Senior Notes are guaranteed by all the

Company’s subsidiaries and are secured by substantially all the assets of the Company and its subsidiaries (subject to certain exceptions

for excluded property). No prepayment premium is required for prepayment.

The 13% Senior Notes also require the Company

to comply with two financial covenants under the 13% Senior Notes. The Company shall maintain an amount of unrestricted cash balance of

no less than $20,000, to be tested on the last day of each month, beginning on January 31, 2024. Additionally, commencing with the fiscal

quarter ending September 30, 2024, the Company shall not permit the Consolidated Net Leverage Ratio (as defined in the Amended and Restated

Indenture of the 13% Senior Notes) as of the end of any period of four (4) consecutive fiscal quarters ending on any date set forth below,

as applicable, to be greater than the applicable leverage ratio set forth below:

| Fiscal

Quarter End |

Consolidated

Net Leverage Ratio |

| September

30, 2024 |

4.65:1.00 |

| December

31, 2024 |

4.35:1.00 |

| March

31, 2025 |

4.30:1.00 |

| June

30, 2025 |

4.20:1.00 |

| September

30, 2025 |

4.10:1.00 |

| December

31, 2025 |

3.95:1.00 |

| March

31, 2026 |

3.90:1.00 |

| June

30, 2026 |

3.55:1.00 |

| September

30, 2026 |

3.50:1.00 |

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 10. | DEBTS PAYABLE AND SENIOR SECURED NOTES (Continued) |

Senior Secured Notes (Continued)

The Company has an equity cure right,

through the new issuance of, or out of the net cash proceeds of, the sale of equity interests of the Company, for each of these

financial covenants. The Company is in compliance with these covenants, as of March 31, 2024.

Debts Payable

As of March 31, 2024 and December 31, 2023, debts

payable, including construction liabilities, other than senior secured notes consisted of the following:

| | |

Debts payable | |

| As of January 1, 2023 | |

$ | 235,524 | |

| Discounted as of December 31, 2022 | |

| 598 | |

| Debt issuance costs | |

| (1,000 | ) |

| Debt issuance costs amortized | |

| 50 | |

| Debt issued | |

| 66,245 | |

| Construction financing | |

| 2,024 | |

| Less: extinguishment related to sale of Arizona business | |

| (22,505 | ) |

| Less: repayment | |

| (52,029 | ) |

| Less: discounted to fair value | |

| (199 | ) |

| As of December 31, 2023 | |

| 228,708 | |

| Discounted as of December 31, 2022 | |

| 199 | |

| Debt issuance costs | |

| (454 | ) |

| Debt issuance costs amortized | |

| 25 | |

| Debt issued | |

| 8,763 | |

| Construction financing | |

| 972 | |

| Less: repayment | |

| (6,247 | ) |

| Total debts payable, undiscounted as of March 31, 2024 | |

| 231,966 | |

| Less: discounted to fair value | |

| (101 | ) |

| Total debts payable as of March 31, 2024 | |

$ | 231,865 | |

| Total accrued interest payable

related to debts payable as of March 31, 2024 | |

$ | 7,697 | |

The details of debts payable, including construction

liabilities, were as follows:

| | |

March 31,

2024 | |

| | |

| Related

party debt | | |

| Non-related

party debt | | |

| Total

debt | |

| Total debts payable, undiscounted | |

$ | 369 | | |

$ | 232,975 | | |

$ | 233,344 | |

| Less: current portion | |

| 369 | | |

| 19,820 | | |

| 20,189 | |

| Less: debt issuance costs - current portion | |

| - | | |

| 214 | | |

| 214 | |

| Total non-current debt, undiscounted | |

| - | | |

| 212,941 | | |

| 212,941 | |

| Less: discount to fair value | |

| - | | |

| 101 | | |

| 101 | |

| Less: debt issuance costs - non-current

portion | |

| - | | |

| 1,165 | | |

| 1,165 | |

| Total non-current debt | |

$ | - | | |

$ | 211,675 | | |

$ | 211,675 | |

The

following table presents the future obligations, under debts payable, other than senior secured notes as of March 31, 2024:

| Future

debt obligations (per year) | | |

| |

| Remainder

of 2024 | | |

$ | 16,928 | |

| 2025 | | |

| 24,077 | |

| 2026 | | |

| 64,896 | |

| 2027 | | |

| 15,071 | |

| 2028 | | |

| 3,359 | |

| 2029

and beyond | | |

| 109,013 | |

| Total

debt obligations | | |

$ | 233,344 | |

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 10. | DEBTS PAYABLE

AND SENIOR SECURED NOTES (Continued) |

As part of business combinations and asset

acquisitions, the Company issued and assumed notes with related and non-related parties. The related party notes are considered part

of the purchase price to the former shareholders of the acquired businesses. As a result of the combinations and acquisitions, several

of these individual shareholders are now considered related parties of the Company across various roles including directors, officers,

and shareholders.

On

October 31, 2023, the Company entered into an agreement with LivFree Wellness, LLC (“LivFree”) to amend certain terms of the

promissory note dated May 24, 2019 (the “LivFree Note”) executed in connection with the Company’s acquisition of LivFree.

The amendments to the LivFree Note provided, among other things, for a principal payment of $3,000, paid upon closing of the debt restructuring

transactions on February 7, 2024, and a deferral of the maturity of the remaining $17,000 of principal and $5,530 of accrued payment-in-kind

interest for a period of two years to May 24, 2026. In addition, the interest on the LivFree Note converted from payment-in-kind to monthly

cash interest payments and the interest rate increased from 6.0% to 10.0%. The modification for this loan did not meet the requirement

of a debt extinguishment under ASC 470 and no gain or loss was recognized for the three months ended March 31, 2024.

On May 11, 2023, the Company reached an

agreement to amend the terms of contingent consideration under the membership interest purchase agreements of GSD NJ LLC (“GSD”)

and Sira Naturals, Inc. (“Sira”). The amendment for GSD settles the contingent consideration with total proceeds of

$38,860, consisting of $10,000 in cash, promissory notes in an aggregate principal amount of $14,000, $10,925 in deferred cash, and $4,647

of Equity Shares. The $14,000 promissory notes are due December 2026 with monthly interest-only payments of 13.5% until May 2024

(with 1% monthly amortization thereafter). The number of Equity Shares was calculated based on a market price equal to $0.79 which represents

3,797 Equity Shares. The deferred cash balance was paid in full in February 2024. The amendment for Sira represents a two-year deferral

of the $27,500 of proceeds payable from the original May 2024 payment date, with an annual interest rate of 6.0% and 10% annual

amortization payments. The deferred payment is classified within other current and non-current liabilities.

On

July 7, 2023, the Company entered into a loan agreement to refinance and upsize an existing mortgage which was due to mature in May 2024.

The loan agreement included total proceeds of $40,000, with an interest rate of 5-year Federal Home Loan Bank Rate plus 4%, which implies

a current rate of 8.27% with interest-only payments for the first 18 months. The note extends the maturity of the existing mortgage to

10 years. Proceeds from the loan were used to pay down the Company’s existing mortgage of $25,219. Additionally, on March

26, 2024, the Company completed an $8,400 upsizing of its existing mortgage for the Gainesville cultivation facility, raising the principal

amount to $48,400. These funds will be allocated towards additional investments, as well as for general working capital needs. Aside from

the upsizing, there were no modifications to the mortgage terms, including the interest rate or the maturity date set for 2033. The modification

for this loan did not meet the requirement of a debt extinguishment under ASC 470 and no gain or loss was recognized for the three months

ended March 31, 2024.

Interest expense associated with related party

debt payable for the three months ended March 31, 2024 and 2023, was $7 and $28, respectively.

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

The following activity occurred during the three

months ended March 31, 2023:

| · | In

relation to the vesting of 56 RSUs, 41 Equity Shares were issued due to net settlement. |

| o | 55

shares were forfeited during the period. |

| · | 354

Exchangeable Shares were exchanged for 354 Equity Shares related to the Q2 2022 acquisition

of Herbal Remedies. |

| · | 10

Exchangeable Shares were converted into Equity Shares as of March 31, 2023. |

The following activity occurred during the three

months ended March 31, 2024:

| · | In

relation to the vesting of 1,778 RSUs, 1,777 Equity Shares were issued due to net settlement. |

| o | 14

shares were forfeited during the period. |

| · | 34,988

Subordinate Shares were issued in connection with the debt restructuring. |

| · | 23,046

Anti-Dilutive Warrants were issued to existing shareholders. |

| · | 10

Subordinate Shares were issued in connection with the exercise of Warrants. |

Warrants

The average remaining life of the Dilutive Warrants

is under 2 months in 2024 (2023: 1.1 years) with an aggregate intrinsic value of $nil in 2024 (2023: $nil). The Dilutive Warrants

have an exercise price of $9.07US. The average remaining life of the Anti-Dilutive Warrants is under one year and eleven months with an

intrinsic value of $11,897. The Anti-Dilutive Warrants have an exercise price of $2.12US. The number of Warrants outstanding as of March

31, 2024 and December 31, 2023 is:

| | |

Number | |

| Balance as of January 1, 2023 | |

| 2,874 | |

| No activity | |

| - | |

| Balance as of December 31, 2023 | |

| 2,874 | |

| Warrants Issued | |

| 23,046 | |

| Exercise of Warrants | |

| (10 | ) |

| Balance as of March 31, 2024 | |

| 25,910 | |

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 12. | STOCK-BASED

COMPENSATION |

The stock-based compensation expense is based

on either the Company’s share price for service-based and market-based conditions on the date of the grant or the fair value of

the performance-based RSU. The RSUs vest over a one to four-year period, based on service, market, and/or performance conditions. During

the three months ended March 31, 2024, there were 650 of both market and performance based RSUs outstanding, totaling 1,300. During

the three months ended March 31, 2024 and 2023, the Company recognized stock-based compensation relating to the granting of RSUs

in the current and prior periods, except for the market and performance based RSUs as they did not meet the probable threshold. Any cumulative

adjustment prior to vesting is recognized in the current period with no adjustment to prior periods for expense previously recognized.

During the three months ended March 31, 2024 and 2023 there were 14 and 55 forfeitures of nonvested RSUs, respectively.

During the three months ended March 31,

2024, 1,777 Equity Shares vested, of which 1,777 were issued due to net settlement. During the three months ended March 31, 2024,

the result of the net settlement was 1 Equity Share was withheld with a total value of $283. As of March 31, 2024, the average remaining

life of unvested RSUs is one year and eight months with an expected expense over the next 12 months of $12,536 with an aggregate intrinsic

value of $10,385 using the stock price as of March 28, 2024.

| | |

Number

of

Shares | | |

Weighted

Average

Grant Date

Fair Value | |

| RSUs outstanding and nonvested, as of January 1, 2023 | |

| 6,628 | | |

$ | 17.56 | |

| Granted | |

| 1,760 | | |

| 1.20 | |

| Vested | |

| (3,262 | ) | |

| 18.15 | |

| Forfeited | |

| (137 | ) | |

| 9.09 | |

| RSUs outstanding and nonvested, as of December 31,

2023 | |

| 4,989 | | |

$ | 17.56 | |

| Granted | |

| 2,041 | | |

| 2.13 | |

| Vested | |

| (1,777 | ) | |

| 16.96 | |

| Forfeited | |

| (14 | ) | |

| 0.67 | |

| RSUs

outstanding and nonvested, as of March 31, 20241 | |

| 5,239 | | |

$ | 11.80 | |

1 Includes Ayr granted but

unvested market and performance based RSUs totaling 1,300 that do not meet the probability threshold

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 12. | STOCK-BASED

COMPENSATION (Continued) |

Options

The range of exercise price is between $10.59

and $29.05. As of March 31, 2024 and 2023, the weighted average remaining life of the options is under six months and seven months, respectively,

with an aggregate intrinsic value of $nil and $nil, respectively.

The number of options outstanding as of March

31, 2024 and December 31, 2023 is:

| | |

Number

of

Options | | |

Weighted

Average

Fair Value | |

| Balance as of January 1, 2023 | |

| 165 | | |

$ | 17.93 | |

| Options exercised | |

| (6 | ) | |

| 17.93 | |

| Balance as of December 31, 2023 | |

| 159 | | |

$ | 20.30 | |

| Options expired/cancelled | |

| (33 | ) | |

| 29.60 | |

| Balance as of March 31, 2024 | |

| 126 | | |

$ | 17.84 | |

| 13. | COMMITMENTS

AND CONTINGENCIES |

Commitments

As of March 31, 2024, the Company guaranteed

the lease obligation of a location related to a third-party that operates a dispensary in New Jersey. The Company is the guarantor of

the lease with maximum total payments of $792 and will continue as the guarantor through December 2028. The Company would be required

to perform under the guarantee if the third-party is in default. As of March 31, 2024, the Company does not anticipate any defaults

under the foregoing lease, and therefore, no liability has been accrued.

Ayr Wellness Inc.

Notes to the Unaudited Interim Condensed

Consolidated Financial Statements

For the Three Months Ended March 31, 2024

and 2023

(Expressed

in United States Dollars, in thousands, except where stated otherwise)

| 13. | COMMITMENTS

AND CONTINGENCIES (Continued) |

Contingencies

On March 27, 2020, the U.S. Coronavirus Aid,

Relief, and Economic Security Act (“CARES Act”) was signed into law, aimed at providing emergency assistance and health

care for individuals, families, and businesses affected by the COVID-19 pandemic and generally supporting the U.S. economy. The

CARES Act, among other things, includes provisions relating to refundable payroll tax credits, deferment of employer social security

payments, net operating loss carryback periods, alternative minimum tax credit refunds, and modifications to the net interest

deduction limitations. Employee Retention Credit (“ERC”) is a refundable credit against certain employment taxes equal

to 50% of the qualified wages an eligible employer paid to employees from March 17, 2020 to December 31, 2020. The U.S. Disaster Tax

Relief Act, enacted on December 27, 2020, extended the employee retention credit for qualified wages paid from January 1, 2021 to

June 30, 2021, and the credit was increased to 70% of qualified wages an eligible employer paid to employees during the extended

period. The American Rescue Plan Act of 2021, enacted on March 11, 2021, further extended the employee retention credit through

December 31, 2021. The general statute of limitations for employment tax audits is three years, but the Internal Revenue

Service’s (“IRS”) ERC guidance has an extended five-year statute. The Company experienced full or partial

suspension of portions of the business during the period covered by the ERC due to government orders limiting commerce, travel, or

group meeting due to COVID-19. In 2023, the Company filed for an ERC for the period beginning January 1 to June 30, 2021 in the

amount of $12,354. During 2023, the Company received notices from the Internal Revenue Service for a total ERC refund of $5,238 and

recorded a receivable included as part of prepaid expenses, deposits, and other current assets in the interim balance sheets and

other income on the interim statements of operations. In accordance with ASC 958-605, Not-for-Profit Entities – Revenue

Recognition, the Company determined that the condition to record a receivable is met when the IRS confirms the claim is valid or the

cash is received. Absent of any confirmation, there remains uncertainty as to whether the amounts will be received. Due to the

degree of uncertainty regarding the implementation of the CARES Act and other stimulus legislation and the nature of our business,

although the Company expects to receive the remaining ERC, the Company determined that the remaining claim did not yet meet the

criteria to record as a receivable as of March 31, 2024. Subsequent to March 31, 2024, the Company received partial proceeds

relating to its ERC refund in the amount of $2,728.