| Resolution 8: Amendment to the AstraZeneca Performance

Share Plan 2020

The purpose of Resolution 8, which is proposed as an ordinary resolution,

is to approve an amendment to the AstraZeneca Performance Share Plan

2020 (PSP) which was originally approved by shareholders at the 2020

AGM, with further amendments approved by shareholders at the

2021 Annual General Meeting.

A copy of the PSP that reflects the proposed amendment is

available for inspection, as noted on page 12 of this Notice of AGM.

The amendment ensures:

> The maximum number of the Company’s shares which may be put

under an award in respect of any employee will be increased from such

number as has a total market value equal to 650% of that employee’s

base pay to such number as has a total market value equal to 850% of

that employee’s base pay or, in the case of an Executive Director, such

limit as is set out in the shareholder approved Remuneration Policy from

time to time, as further set out in the revised Remuneration Policy on

pages 127 to 138 of the Annual Report and in the notes to Resolutions

6-7 in this Notice.

The Remuneration Committee’s rationale for increasing the maximum

opportunity for a PSP award is set out in detail in the Directors’

Remuneration Report from page 102 of the Annual Report.

Resolution 9: Political donations

The purpose of Resolution 9, which is proposed as an ordinary resolution,

is to authorise the Company and/or its subsidiaries to make limited

political donations or incur limited political expenditure, within the meaning

of such expressions as contained in the Companies Act 2006 (the Act).

It is the Company’s policy to not make such political donations or incur

such political expenditure. The Company is not intending to alter this

policy. However, the definitions of political donations and political

expenditure under the Act are very broad. Some of the Company’s

activities may therefore fall within the definitions of the Act. Without the

necessary authorisation, the Company’s ability to communicate its views

effectively to, for example, interest groups or lobbying organisations could

be inhibited.

Accordingly, the Company believes that the authority contained in

Resolution 9 is necessary to allow it and its subsidiaries to fund activities

which are in the interests of shareholders that the Company should

support. Such authority will enable the Company and its subsidiaries to be

sure that they do not unintentionally commit a technical breach of the

relevant sections of the Act. Any donations or expenditure, which may be

made or incurred under the authority of Resolution 9, will be disclosed in

next year’s Annual Report.

Resolution 10: Allotment of new shares

The purpose of Resolution 10, which is proposed as an ordinary

resolution, is to enable the Directors to exercise their power under the

Company’s Articles of Association to allot new shares in the capital of the

Company. The Directors may only allot shares or grant rights to subscribe

for shares, or convert any security into shares, if authorised to do so by

shareholders. The Directors’ authority will only be valid until the conclusion

of the Annual General Meeting in 2025 or the close of business on

11 July 2025, whichever is earlier. Other than the allotment of shares for

the purposes of fulfilling the Company’s obligations under certain of its

share plans, the Directors have no present intention to exercise this

authority. However, it is considered prudent to acquire the flexibility that

this authority provides. The Directors intend to seek renewal of this

authority annually.

> Paragraph (a)(i)(A) of Resolution 10 would authorise the Directors to allot

(or grant rights to subscribe for, or convert any security into) shares in

the Company up to a maximum nominal amount of US$129,170,514.

This amount represents 33.33% of the Company’s total issued ordinary

share capital as at 13 February 2024 (being the last practicable date

prior to publication of this Notice of AGM).

> Paragraph (a)(i)(B) of Resolution 10 would authorise the Directors to allot

shares and grant rights to subscribe for, or convert any security into,

shares, up to an aggregate nominal amount of US$258,341,028 (less

any shares allotted pursuant to paragraph (a)(i)(A) of Resolution 10) in

connection with a pre-emptive offer to existing shareholders (with

exclusions to deal with fractional entitlements to shares and overseas

shareholders to whom the offer cannot be made due to legal and

practical problems). This amount represents 66.66% of the

Company’s total issued ordinary share capital as at 13 February 2024.

This is in accordance with the latest guidelines published by the

Investment Association.

At 13 February 2024, no shares in the Company were held as

treasury shares.

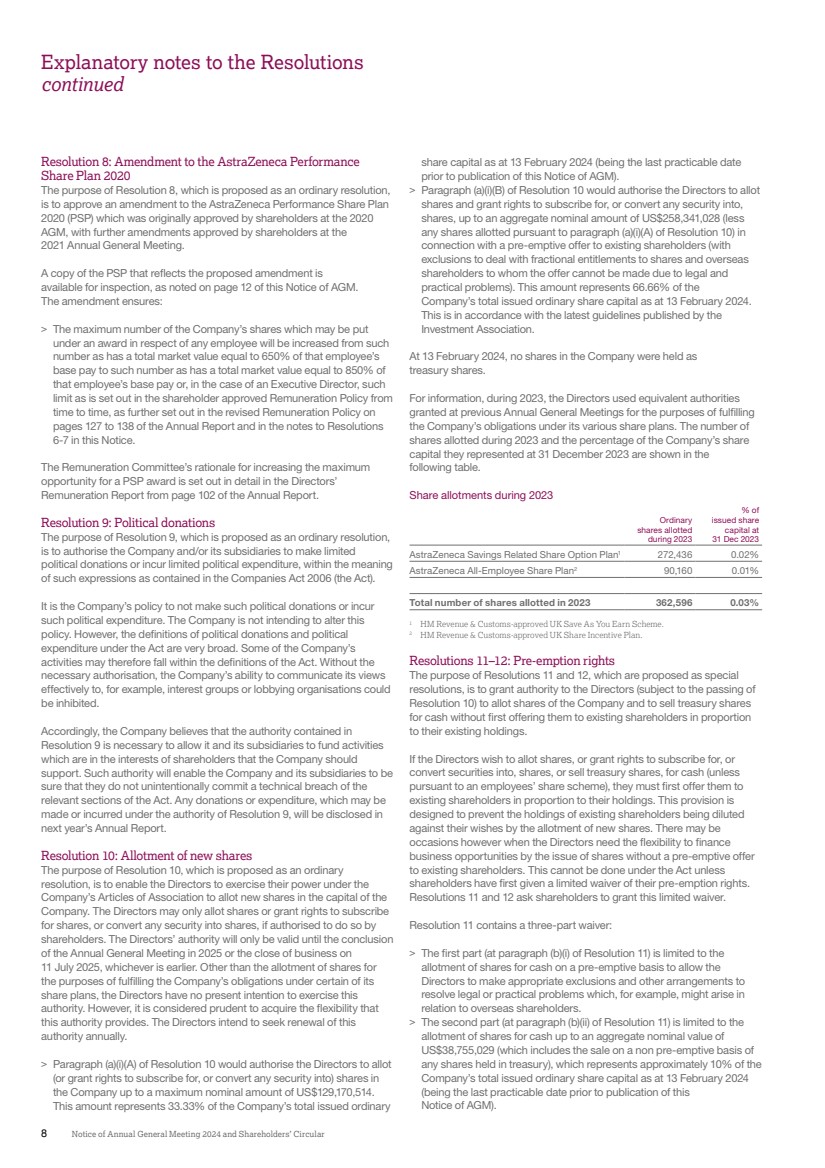

For information, during 2023, the Directors used equivalent authorities

granted at previous Annual General Meetings for the purposes of fulfilling

the Company’s obligations under its various share plans. The number of

shares allotted during 2023 and the percentage of the Company’s share

capital they represented at 31 December 2023 are shown in the

following table.

Share allotments during 2023

Ordinary

shares allotted

during 2023

% of

issued share

capital at

31 Dec 2023

AstraZeneca Savings Related Share Option Plan1 272,436 0.02%

AstraZeneca All-Employee Share Plan2 90,160 0.01%

Total number of shares allotted in 2023 362,596 0.03%

1

HM Revenue & Customs-approved UK Save As You Earn Scheme. 2

HM Revenue & Customs-approved UK Share Incentive Plan.

Resolutions 11–12: Pre-emption rights

The purpose of Resolutions 11 and 12, which are proposed as special

resolutions, is to grant authority to the Directors (subject to the passing of

Resolution 10) to allot shares of the Company and to sell treasury shares

for cash without first offering them to existing shareholders in proportion

to their existing holdings.

If the Directors wish to allot shares, or grant rights to subscribe for, or

convert securities into, shares, or sell treasury shares, for cash (unless

pursuant to an employees’ share scheme), they must first offer them to

existing shareholders in proportion to their holdings. This provision is

designed to prevent the holdings of existing shareholders being diluted

against their wishes by the allotment of new shares. There may be

occasions however when the Directors need the flexibility to finance

business opportunities by the issue of shares without a pre-emptive offer

to existing shareholders. This cannot be done under the Act unless

shareholders have first given a limited waiver of their pre-emption rights.

Resolutions 11 and 12 ask shareholders to grant this limited waiver.

Resolution 11 contains a three-part waiver:

> The first part (at paragraph (b)(i) of Resolution 11) is limited to the

allotment of shares for cash on a pre-emptive basis to allow the

Directors to make appropriate exclusions and other arrangements to

resolve legal or practical problems which, for example, might arise in

relation to overseas shareholders.

> The second part (at paragraph (b)(ii) of Resolution 11) is limited to the

allotment of shares for cash up to an aggregate nominal value of

US$38,755,029 (which includes the sale on a non pre-emptive basis of

any shares held in treasury), which represents approximately 10% of the

Company’s total issued ordinary share capital as at 13 February 2024

(being the last practicable date prior to publication of this

Notice of AGM).

8 Notice of Annual General Meeting 2024 and Shareholders’ Circular

Explanatory notes to the Resolutions

continued |