ATDS 88% YTD Revenue Growth And Sky's The Limit With COVID Media Usage Growth

28 August 2020 - 3:29AM

InvestorsHub NewsWire

New

York, NY -- August 27, 2020 -- InvestorsHub NewsWire -- via

NextBigTicker.com

Data443

Risk Mitigation, Inc. (ATDS)

recently published its Q2 2020 financials reporting 88% revenue

growth YTD compared to the same period last year. ATDS YTD

revenue through almost reached $1 million having achieved less than

$500,000 for the same period in the previous

year.

ATDS is

experiencing notable growth with notable clientele. ATDS has now

signed two NFL teams to its secure sports management software

providing industry-leading encryption and

security. With the Miami Dolphins and Pittsburg Steelers on

board, ATDS is on its way to becoming the industry standard for all

32 NFL teams not to mention all the college, high school and club

teams to follow suit.

ATDS is the de facto

industry leader in Data Privacy Solutions for All Things Data

Security, providing software and services to enable secure data

across local devices, network, cloud, and databases, at rest and in

flight.

The prevailing COVID19

social distancing environment is dramatically increasing internet usage over 50% in

some categories. The increase is driven in part by more

people working form home making data security more complex.

The opportunity for ATDS is benefitted by the COVID19

environment. Many of the COVID19 business practices are

likely to prevail post COVID19 extending the increased opportunity

for ATDS.

Other stocks on the move include

BANT,

BRTXQ, and

GAXY.

Disclaimer:

NextBigTicker.com (NBT) is a third party publisher and news

dissemination service provider. NBT is NOT affiliated in any

manner with any company mentioned herein. NBT is news dissemination

solutions provider and are NOT a registered

broker/dealer/analyst/adviser, holds no investment licenses and may

NOT sell, offer to sell or offer to buy any security. NBT's

market updates, news alerts and corporate profiles are NOT a

solicitation or recommendation to buy, sell or hold securities. The

material in this release is intended to be strictly informational

and is NEVER to be construed or interpreted as research material.

All readers are strongly urged to perform research and due

diligence on their own and consult a licensed financial

professional before considering any level of investing in

stocks. All material included herein is republished content

and details which were previously disseminated by the companies

mentioned in this release or opinion of the writer. NBT is not

liable for any investment decisions by its readers or subscribers.

Investors are cautioned that they may lose all or a portion of

their investment when investing in stocks. NBT has not been

compensated for this release and HOLDS NO SHARES OF ANY

COMPANY NAMED IN THIS RELEASE.

Disclaimer/Safe Harbor:

This news release contains forward-looking statements within the

meaning of the Securities Litigation Reform Act. The statements

reflect the Company's current views with respect to future events

that involve risks and uncertainties. Among others, these risks

include the expectation that any of the companies mentioned herein

will achieve significant sales, the failure to meet schedule or

performance requirements of the companies' contracts, the

companies' liquidity position, the companies' ability to obtain new

contracts, the emergence of competitors with greater financial

resources and the impact of competitive pricing. In the light of

these uncertainties, the forward-looking events referred to in this

release might not occur.

Source: www.nextbigticker.com

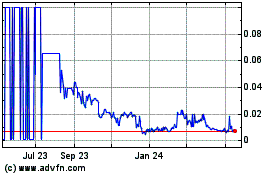

Bantec (PK) (USOTC:BANT)

Historical Stock Chart

From Dec 2024 to Jan 2025

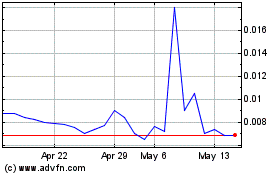

Bantec (PK) (USOTC:BANT)

Historical Stock Chart

From Jan 2024 to Jan 2025