FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2025

Commission File Number: 001-12518

Banco Santander, S.A.

(Exact name of registrant as specified in its charter)

Ciudad Grupo Santander

28660 Boadilla del Monte (Madrid) Spain

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

BANCO SANTANDER, S.A.

________________________

TABLE OF CONTENTS

| | | | | |

|

|

| |

Item 1. January - December 2024 Financial Report | |

Index

This report was approved by the board of directors on 4 February 2025, following a favourable report from the audit committee. Important information regarding this report can be found on pages 62 and 63.

Key consolidated data

| | | | | | | | | | | | | | | | | | | | | | | |

| BALANCE SHEET (EUR million) | Dec-24 | Sep-24 | % | Dec-24 | Dec-23 | % | Dec-22 |

| Total assets | 1,837,081 | | 1,802,259 | | 1.9 | | 1,837,081 | | 1,797,062 | | 2.2 | | 1,734,659 | |

| Loans and advances to customers | 1,054,069 | | 1,067,419 | | (1.3) | | 1,054,069 | | 1,036,349 | | 1.7 | | 1,036,004 | |

| Customer deposits | 1,055,936 | | 1,045,911 | | 1.0 | | 1,055,936 | | 1,047,169 | | 0.8 | | 1,009,722 | |

| Total funds | 1,348,422 | | 1,327,308 | | 1.6 | | 1,348,422 | | 1,306,942 | | 3.2 | | 1,239,981 | |

| Total equity | 107,327 | | 105,063 | | 2.2 | | 107,327 | | 104,241 | | 3.0 | | 97,585 | |

| Note: total funds includes customer deposits, mutual funds, pension funds and managed portfolios. |

| | | | | | | | | | | | | | | | | | | | | | | |

| INCOME STATEMENT (EUR million) | Q4'24 | Q3'24 | % | 2024 | 2023 | % | 2022 |

| Net interest income | 11,986 | | 11,225 | | 6.8 | | 46,668 | | 43,261 | | 7.9 | | 38,619 | |

| Total income | 16,026 | | 15,135 | | 5.9 | | 61,876 | | 57,423 | | 7.8 | | 52,117 | |

| | | | | | | |

| Net operating income | 9,254 | | 8,786 | | 5.3 | | 35,842 | | 31,998 | | 12.0 | | 28,214 | |

| | | | | | | |

| Profit before tax | 4,600 | | 4,919 | | (6.5) | | 19,027 | | 16,459 | | 15.6 | | 15,250 | |

| Profit attributable to the parent | 3,265 | | 3,250 | | 0.5 | | 12,574 | | 11,076 | | 13.5 | | 9,605 | |

| | | | | | | |

|

|

| | | | | | | | | | | | | | | | | | | | | | | |

EPS, PROFITABILITY AND EFFICIENCY (%) 1 | Q4'24 | Q3'24 | % | 2024 | 2023 | % | 2022 |

| EPS (euros) | 0.20 | | 0.20 | | 0.8 | | 0.77 | | 0.65 | | 17.9 | | 0.54 | |

| RoE | 13.3 | | 13.4 | | | 13.0 | | 11.9 | | | 10.7 | |

| RoTE | 16.6 | | 16.7 | | | 16.3 | | 15.1 | | | 13.4 | |

| RoA | 0.78 | | 0.80 | | | 0.76 | | 0.69 | | | 0.63 | |

| RoRWA | 2.27 | | 2.31 | | | 2.18 | | 1.96 | | | 1.77 | |

Efficiency ratio 2 | 42.3 | | 41.9 | | | 41.8 | | 44.1 | | | 45.8 | |

| | | | | | | | | | | | | | | | | | | | | | | |

UNDERLYING INCOME STATEMENT 2 (EUR million) | Q4'24 | Q3'24 | % | 2024 | 2023 | % | 2022 |

| Net interest income | 11,986 | | 11,225 | | 6.8 | | 46,668 | | 43,261 | | 7.9 | | 38,619 | |

| Total income | 16,026 | | 15,135 | | 5.9 | | 62,211 | | 57,647 | | 7.9 | | 52,154 | |

| | | | | | | |

| Net operating income | 9,254 | | 8,786 | | 5.3 | | 36,177 | | 32,222 | | 12.3 | | 28,251 | |

| | | | | | | |

| Profit before tax | 4,600 | | 4,919 | | (6.5) | | 19,027 | | 16,698 | | 13.9 | | 15,250 | |

| Profit attributable to the parent | 3,265 | | 3,250 | | 0.5 | | 12,574 | | 11,076 | | 13.5 | | 9,605 | |

| Changes in constant euros: | | | | | |

| Q4'24 / Q3'24: NII: +6.9%; Total income: +6.1%; Net operating income: +5.7%; Profit before tax: -5.9%; Attributable profit: +0.9%. |

| 2024 / 2023: NII: +9.5%; Total income: +9.9%; Net operating income: +14.6%; Profit before tax: +15.6%; Attributable profit: +15.3%. |

| | |

Note: for Argentina and any grouping which includes it, the variations in constant euros have been calculated considering the Argentine peso exchange rate on the last working day for each of the periods presented. Additionally, from Q2 2024 onwards for the Argentine peso, we apply an alternative exchange rate that better reflects the evolution of inflation (we continue to apply the official ARS exchange rate to all prior periods). For further information, see the 'Alternative performance measures' section in the appendix to this report. Certain figures contained in this report, have been subject to rounding to enhance their presentation. Accordingly, in certain instances, the sum of the numbers in a column or a row in tables contained in this report may not conform exactly to the total figure given for that column or row. |

| | |

The Q4 2024 Financial Report is a simplified version of the report that we publish in other quarters. It contains all the same information that we usually provide, except for the explanations in some of the sections, since all this information will be detailed in the annual report that we will publish in a few days. We will continue to publish the financial report with the usual structure and contents in the other quarters. |

| | | | | | | | | | | | | | | | | | | | | | | |

| SOLVENCY (%) | Dec-24 | Sep-24 | | Dec-24 | Dec-23 | | Dec-22 |

| Fully-loaded CET1 ratio | 12.8 | | 12.5 | | | 12.8 | | 12.3 | | | 12.0 | |

| Fully-loaded total capital ratio | 17.2 | | 16.8 | | | 17.2 | | 16.3 | | | 15.8 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

CREDIT QUALITY (%)1 | Q4'24 | Q3'24 | | 2024 | 2023 | | 2022 |

Cost of risk 2, 3 | 1.15 | | 1.18 | | | 1.15 | | 1.18 | | | 0.99 | |

| NPL ratio | 3.05 | | 3.06 | | | 3.05 | | 3.14 | | | 3.08 | |

| NPL coverage ratio | 65 | | 64 | | | 65 | | 66 | | | 68 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| MARKET CAPITALIZATION AND SHARES | Dec-24 | Sep-24 | % | Dec-24 | Dec-23 | % | Dec-22 |

| Shares (millions) | 15,152 | | 15,494 | | (2.2) | | 15,152 | | 16,184 | | (6.4) | | 16,794 | |

| Share price (euros) | 4.465 | | 4.601 | | (3.0) | | 4.465 | | 3.780 | | 18.1 | | 2.803 | |

| Market capitalization (EUR million) | 67,648 | | 71,281 | | (5.1) | | 67,648 | | 61,168 | | 10.6 | | 47,066 | |

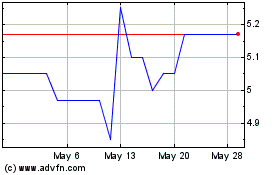

| Tangible book value per share (euros) | 5.24 | | 5.04 | | | 5.24 | | 4.76 | | | 4.26 | |

| Price / Tangible book value per share (X) | 0.85 | | 0.91 | | | 0.85 | | 0.79 | | | 0.66 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| CUSTOMERS (thousands) | Dec-24 | Sep-24 | % | Dec-24 | Dec-23 | % | Dec-22 |

| Total customers | 172,537 | | 170,944 | | 0.9 | | 172,537 | | 164,542 | | 4.9 | 159,844 | |

| Active customers | 103,262 | | 102,313 | | 0.9 | | 103,262 | | 99,503 | | 3.8 | | 99,190 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Digital customers | 59,317 | | 57,801 | | 2.6 | | 59,317 | | 54,161 | | 9.5 | 51,471 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| OTHER DATA | Dec-24 | Sep-24 | % | Dec-24 | Dec-23 | % | Dec-22 |

| Number of shareholders | 3,485,134 | | 3,501,621 | | (0.5) | | 3,485,134 | | 3,662,377 | | (4.8) | 3,915,388 | |

| Number of employees | 206,753 | | 208,080 | | (0.6) | | 206,753 | | 212,764 | | (2.8) | | 206,462 | |

| Number of branches | 8,011 | | 8,134 | | (1.5) | | 8,011 | | 8,518 | | (6.0) | | 9,019 | |

| | | | | |

| 1. | For further information, see the 'Alternative performance measures' section in the appendix to this report. |

| 2. | In addition to financial information prepared in accordance with International Financial Reporting Standards (IFRS) and derived from our consolidated financial statements, this report contains certain financial measures that constitute alternative performance measures (APMs) as defined in the Guidelines on Alternative Performance Measures issued by the European Securities and Markets Authority (ESMA) on 5 October 2015, and other non-IFRS measures, including the figures related to “underlying” results, which do not include factors that are outside the ordinary course of our business, or have been reclassified within the underlying income statement. Further details are provided in the 'Alternative performance measures' section of the appendix to this report. For further details on the APMs and non-IFRS measures used, including their definition or a reconciliation between any applicable management indicators and the financial data presented in the annual consolidated financial statements prepared under IFRS, please see our 2023 Annual Financial Report, published in the CNMV on 19 February 2024, our 20-F report for the year ending 31 December 2023 filed with the SEC in the United States on 21 February 2024 as well as the 'Alternative performance measures' section of the appendix to this report.

|

| |

| |

| 3. | Allowances for loan-loss provisions over the last 12 months / Average loans and advances to customers over the last 12 months. |

Our business model

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Customer focus |

| | | | | | | | |

| | | | | | | | |

Building a digital bank with branches | | → We continue to build a digital bank with branches, with a multichannel offer to fulfil all our customers' financial needs. | | | 173 mn | | 103 mn | |

| | | total customers | | active customers | |

| | | | | | | | |

| Scale |

| | → Our global and in-market scale helps us to improve our local banks' profitability, adding value and network benefits. → Our activities are organized under five global businesses: Retail & Commercial Banking (Retail), Digital Consumer Bank (Consumer), Corporate & Investment Banking (CIB), Wealth Management & Insurance (Wealth) and Payments. → Our five global businesses and our presence in Europe, DCB Europe, North America and South America support value creation based on the profitable growth and operational leverage that ONE Santander provides. | | | | | | |

| Global and in-market scale | | |

|

| | | | | | | | |

| Diversification |

| | | | | | | | |

| Business, geographical and balance sheet | | → Well-balanced diversification between businesses and markets with a solid and simple balance sheet that gives us recurrent net operating income with low volatility and more predictable results. |

Our corporate culture

The Santander Way remains unchanged to continue to deliver for all our stakeholders

| | | | | | | | | | | |

| Our purpose To help people and businesses prosper. | | |

| | |

| Our aim To be the best open financial services platform, by acting responsibly and earning the lasting loyalty of our people, customers, shareholders and communities. | |

| | |

| Our how Everything we do should be Simple, Personal and Fair. | |

| | |

Group financial information

Highlights of the period: Main figures

| | | | | | | | | | | |

|

| | | |

| | u | In Q4 2024, profit attributable to the parent was EUR 3,265 million, a new record for the third consecutive quarter, with a slight increase quarter-on-quarter (+0.5%). In constant euros, profit rose 1%, due to positive trends across the main revenue lines, which offset higher costs, impacted by seasonality, and the provision for potential complaints related to motor finance dealer commissions in the UK. |

| | |

| u | Attributable profit increased 11% compared to Q4 2023. In constant euros, profit rose 16%, supported by strong revenue growth across all global businesses and regions. |

| | |

| u | In 2024, attributable profit totalled EUR 12,574 million, 14% higher than in 2023 (+15% in constant euros), underpinned by solid revenue growth, which outpaced the rise in costs, and with a cost of risk improvement. |

| | |

| u | By business, notable year-on-year profit growth in Retail, CIB and Wealth. Consumer's bottom line performance was impacted by higher CHF mortgage portfolio provisions in Poland and the provision related to motor finance in the UK, while Payments reflected impacts related to the discontinuation of our merchant platform in Germany and Superdigital in Latin America. |

| | |

| u | These strong Group results, with record levels of net interest income, net fee income, total income, net operating income and profit, enabled us to achieve the 2024 targets that we upgraded in Q2 2024. |

| | | |

| | u | Profitability improved strongly year-on-year. RoTE in 2024 stood at 16.3%, compared to 15.1% in 2023. |

| u | Sustained earnings per share growth, increasing 18% year-on-year to EUR 77.1 cents in 2024, supported by the good performance in profit and the share buybacks executed in the last 12 months. |

| | | |

| | | |

| | u | In terms of business volumes, growth of customer funds continued to outpace loans and advances to customers while we continued to focus on active capital management and disciplined capital allocation. Gross loans and advances to customers (excluding reverse repos) rose 1% year-on-year in constant euros, supported by increases in Consumer, Payments and Wealth. They were stable in CIB and they decreased slightly in Retail, as higher volumes in South America and Mexico did not completely offset the fall in Europe due to Spain (prepayments) and the UK (strategy to prioritize profitability), and in the US (focus on capital optimization). Customer funds (customer deposits excluding repurchase agreements plus mutual funds) increased 4% year-on-year in constant euros, underpinned by double-digit growth in mutual funds and a rise in deposits, mainly due to demand deposits, with a recovery in the quarter, particularly in Europe in a falling interest rate environment. |

| | |

| u | The benefits from our global scale, margin management and higher customer activity were reflected in year-on-year increases in net interest income (+8%, +10% in constant euros) and net fee income (+8%, +11% in constant euros), resulting in 8% total income growth (+10% in constant euros). |

| | | |

| | u | The structural changes we have implemented to move towards a simpler and more integrated model through ONE Transformation continued to contribute to efficiency gains and profitable growth. The efficiency ratio improved 2.3 pp year-on-year to 41.8% driven mainly by Retail, Consumer and Wealth. |

| | |

| | |

| | | |

| | u | Credit quality remains robust, supported by the positive overall macroeconomic environment and employment across our footprint. The NPL ratio improved 9 bps year-on-year to 3.05%. Total loan-loss reserves reached EUR 22,835 million, resulting in an NPL coverage ratio of 65%. |

| | |

| u | The Group's cost of risk improved 3 bps year-on-year to 1.15%, better than our target for 2024. In Retail, the cost of risk decreased to 0.92%, while in Consumer, the ratio continued to normalize, remaining at controlled levels (2.16%). Retail and Consumer accounted for approximately 85% of the Group's net loan-loss provisions. |

| | | |

| | u | As at end December 2024, the fully-loaded CET1 ratio stood at 12.8%, having increased 0.3 pp quarter-on-quarter, supported by 82 bps of organic generation, mainly resulting from gross profit generation, risk transfer and RWA mobilization, which amply offset RWA growth. The ratio was also impacted by a 26 bp deduction for expected shareholder remuneration against profit earned in Q4 2024 in line with our 50% payout target1, -17 bps in regulatory charges (SME models and DTAs) and -9 bps in markets and others. |

1.In line with the current shareholder remuneration policy of approximately 50% of the Group's reported profit (excluding non-cash, non-capital ratios impact items), divided approximately equally between cash dividends and share buybacks. The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

| | | | | | | | | | | |

| | u | In November, in accordance with the 2024 shareholder remuneration policy, the bank paid an interim cash dividend against 2024 results of EUR 10.00 cents per share, 23% higher than its 2023 equivalent. Including the EUR 9.50 cent dividend paid in May 2024, the total cash dividend per share during 2024 was 39% greater than cash dividends per share paid during 2023. In addition, between 27 August 2024 and 3 December 2024, the bank carried out the first share buyback programme against 2024 results totalling EUR 1,525 million. |

| | |

| | As a result, in this first round of shareholder remuneration charged against 2024 results, payout surpassed EUR 3,057 million, 17% higher than its equivalent in 2023, and represented approximately 50% of H1 2024 attributable profit (approximately 25% in cash dividends and 25% in share buybacks). |

| | |

| u | The bank's board of directors is expected to propose to the AGM the approval of a final cash dividend, in line with the current shareholder remuneration policy1. The total cash dividend per share charged against 2024 results is expected to be approximately 20% higher than the one charged against 2023 results. |

| | |

| | |

| u | As at end December 2024, TNAV per share was EUR 5.24. Including the EUR 9.50 cent dividend per share paid in May 2024 and the EUR 10.00 cent dividend per share paid in November 2024, the TNAV per share + cash dividend per share increased 14% year-on-year. |

| | | | | | | | | | | |

| | u | Our efforts to simplify and improve our product offering and service quality are reflected in an increase of 8 million customers year-on-year, bringing our total customers to 173 million. We have 103 million active customers, up 4 million year-on-year. |

| | |

| u | The volume of transactions per active customer rose 9% year-on-year in 2024. |

| | |

| | |

| | |

| u | We continue to focus on delivering great customer experience and improving our service quality, ranking in the top 3 in NPS2 in seven of our markets. |

| | | | | | | | | | | |

Contribution to Group revenue3 | | | 2024 data. Year-on-year changes in constant euros |

| | u | In Retail, attributable profit was EUR 7,263 million (+29%) driven by 11% growth in total income, structural improvements in costs due to our transformation efforts and lower provisions. |

| | |

| u | Efficiency improved 3.4 pp to 39.7%, cost of risk decreased year-on-year to 0.92%. RoTE increased to 18.9%. |

| | | |

| u | In Consumer, net operating income grew 11%, backed by positive trends in total income (+6%) and costs (-1%), which were not reflected in attributable profit's performance (-12% to EUR 1,663 million), due to cost of risk normalization and higher provisions (CHF mortgages in Poland and the aforementioned provision in the UK). |

| | |

| u | Efficiency stood at 40.1%, improving 2.7 pp, cost of risk continued to normalize reaching 2.16% and RoTE stood at 9.8%. |

| | | |

| | u | In CIB, record attributable profit of EUR 2,740 million, up 16%, driven by all-time high revenue, supported by double-digit growth in both net interest income and net fee income. |

| | |

| u | The efficiency ratio stood at 45.6%. RoTE was 18.1%. |

| | | |

| | u | In Wealth, attributable profit amounted to EUR 1,650 million (+14%) underpinned by increased activity, good margin management and higher fees, boosted especially by Private Banking. |

| | |

| u | Efficiency improved 2.0 pp to 35.9% and RoTE was 78.7%. |

| | | |

| | u | In Payments, attributable profit reached EUR 413 million, impacted by write-downs in PagoNxt related to the discontinuation of our merchant platform in Germany and Superdigital in Latin America in Q2 2024. Excluding them, profit increased 18% year-on-year, supported by revenue growth. |

| | |

| u | Cost of risk stood at 7.39%. In PagoNxt, EBITDA margin reached 27.5% (+2.7 pp year-on-year). |

1.In line with the current shareholder remuneration policy of approximately 50% of the Group's reported profit (excluding non-cash, non-capital ratios impact items), divided approximately equally between cash dividends and share buybacks. The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

2.Net Promoter Score, internal benchmark of individual customers' satisfaction audited by Stiga/Deloitte in H2 2024.

3.As % of total operating areas, excluding the Corporate Centre.

Grupo Santander results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Statutory income statement | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | |

| Grupo Santander. Summarized income statement |

| EUR million | | | | | | | | |

| | | Change | | | Change |

| Q4'24 | Q3'24 | % | | 2024 | 2023 | % | |

| Net interest income | 11,986 | | 11,225 | | 6.8 | | | 46,668 | | 43,261 | | 7.9 | | |

Net fee income1 | 3,344 | | 3,189 | | 4.9 | | | 13,010 | | 12,057 | | 7.9 | | |

Gains or losses on financial assets and liabilities and exchange differences2 | 780 | | 536 | | 45.5 | | | 2,273 | | 2,633 | | (13.7) | | |

| Dividend income | 130 | | 91 | | 42.9 | | | 714 | | 571 | | 25.0 | | |

| Share of results of entities accounted for using the equity method | 214 | | 194 | | 10.3 | | | 711 | | 613 | | 16.0 | | |

Other operating income/expenses (net)3 | (428) | | (100) | | 328.0 | | | (1,500) | | (1,712) | | (12.4) | | |

| Total income | 16,026 | | 15,135 | | 5.9 | | | 61,876 | | 57,423 | | 7.8 | | |

| Operating expenses | (6,772) | | (6,349) | | 6.7 | | | (26,034) | | (25,425) | | 2.4 | | |

| Administrative expenses | (5,948) | | (5,535) | | 7.5 | | | (22,740) | | (22,241) | | 2.2 | | |

| Staff costs | (3,770) | | (3,497) | | 7.8 | | | (14,328) | | (13,726) | | 4.4 | | |

| Other general administrative expenses | (2,178) | | (2,038) | | 6.9 | | | (8,412) | | (8,515) | | (1.2) | | |

| Depreciation and amortization | (824) | | (814) | | 1.2 | | | (3,294) | | (3,184) | | 3.5 | | |

| Provisions or reversal of provisions | (1,362) | | (759) | | 79.4 | | | (3,883) | | (2,678) | | 45.0 | | |

| Impairment or reversal of impairment of financial assets not measured at fair value through profit or loss (net) | (3,120) | | (2,947) | | 5.9 | | | (12,644) | | (12,956) | | (2.4) | | |

| | | | | | | | |

| Impairment on other assets (net) | (192) | | (146) | | 31.5 | | | (628) | | (237) | | 165.0 | | |

| Gains or losses on non-financial assets and investments, net | (4) | | 5 | | — | | | 367 | | 313 | | 17.3 | | |

| Negative goodwill recognized in results | — | | — | | — | | | — | | 39 | | (100.0) | | |

| Gains or losses on non-current assets held for sale not classified as discontinued operations | 24 | | (20) | | — | | | (27) | | (20) | | 35.0 | | |

| Profit or loss before tax from continuing operations | 4,600 | | 4,919 | | (6.5) | | | 19,027 | | 16,459 | | 15.6 | | |

| Tax expense or income from continuing operations | (1,037) | | (1,330) | | (22.0) | | | (5,283) | | (4,276) | | 23.6 | | |

| Profit from the period from continuing operations | 3,563 | | 3,589 | | (0.7) | | | 13,744 | | 12,183 | | 12.8 | | |

| Profit or loss after tax from discontinued operations | — | | — | | — | | | — | | — | | — | | |

| Profit for the period | 3,563 | | 3,589 | | (0.7) | | | 13,744 | | 12,183 | | 12.8 | | |

| Profit attributable to non-controlling interests | (298) | | (339) | | (12.1) | | | (1,170) | | (1,107) | | 5.7 | | |

| Profit attributable to the parent | 3,265 | | 3,250 | | 0.5 | | | 12,574 | | 11,076 | | 13.5 | | |

| | | | | | | | |

| EPS (euros) | 0.20 | | 0.20 | | 0.8 | | | 0.77 | | 0.65 | | 17.9 | | |

| Diluted EPS (euros) | 0.20 | | 0.20 | | 0.7 | | | 0.77 | | 0.65 | | 17.9 | | |

| | | | | | | | |

| Memorandum items: | | | | | | | | |

| Average total assets | 1,834,476 | | 1,793,758 | | 2.3 | | | 1,803,272 | | 1,773,103 | | 1.7 | | |

| Average stockholders' equity | 97,952 | | 96,720 | | 1.3 | | | 96,744 | | 93,035 | | 4.0 | | |

| | | | | |

| Note: the summarized income statement groups some lines of the consolidated statutory income statement on page 60 as follows: |

1.‘Commission income’ and ‘Commission expense’. |

2.‘Gain or losses on financial assets and liabilities not measured at fair value through profit or loss, net’; ‘Gain or losses on financial assets and liabilities held for trading, net’; ‘Gains or losses on non-trading financial assets and liabilities mandatorily at fair value through profit or loss’; ‘Gain or losses on financial assets and liabilities measured at fair value through profit or loss, net’; ‘Gain or losses from hedge accounting, net’; and ‘Exchange differences, net’. |

3.‘Other operating income’; ‘Other operating expenses’; ’Income from insurance and reinsurance contracts’; and ‘Expenses from insurance and reinsurance contracts’. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Underlying income statement | | | | | |

| | | | | | | | | |

Results performance compared to 2023

The Group presents, both at the total Group level and for each of the business units, the changes in euros registered in the income statement, as well as variations excluding the exchange rate effect (i.e. in constant euros) except for Argentina and any grouping which includes it, understanding that the latter provide a better analysis of the Group’s management. For further information, see the 'Alternative performance measures' section in the appendix to this report.

At the Group level, exchange rates had a negative impact of 2.0 pp on total income and a positive impact of 1.6 pp on costs.

To better understand the business trends, we reclassified certain items under some headings of the underlying income statement. These items explain the differences between the statutory and underlying income statements and were:

•In 2024:

–The impact of the temporary levy on revenue earned in Spain totalling EUR 335 million in Q1 2024, which was reclassified from total income to other gains (losses) and provisions.

–Provisions which strengthen the balance sheet in Brazil of EUR 352 million in Q2 2024 (EUR 174 million net of tax and minority interests).

•In 2023:

–The impact of the temporary levy on revenue earned in Spain totalling EUR 224 million in Q1 2023, which was reclassified from total income to other gains (losses) and provisions.

–Provisions which strengthen the balance sheet in Brazil of EUR 235 million, net of tax and minority interests in Q1 2023.

For more details, see the 'Alternative Performance Measures' section in the appendix of this report.

As profit was not affected by results that fell outside the ordinary course of our business, no amount was recorded in the 'net capital gains and provisions' line in 2024 or in 2023 and so both profit attributable to the parent and underlying profit attributable to the parent were the same; EUR 12,574 million in 2024 and EUR 11,076 million in 2023. This represents a 14% year-on-year increase, a 15% rise in constant euros.

This year-on-year comparison is impacted by a higher charge relating to the temporary levy on revenue earned in Spain, and by charges in Q2 2024 related to the discontinuation of our merchant platform in Germany and Superdigital in Latin America (EUR 243 million, net of tax and minority interests) and by the provision in Q4 2024 for potential complaints related to motor finance dealer commissions in the UK (EUR 260 million, net of tax and minority interests). Additionally, there was a lower contribution to the Deposit Guarantee Fund in Spain (EUR 11 million, net of tax and minority interests in 2024) and there was no contribution to the Single Resolution Fund, as contributions ended in 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Summarized underlying income statement |

| EUR million | | | Change | | | Change |

| Q4'24 | Q3'24 | % | % excl. FX | 2024 | 2023 | % | % excl. FX |

| Net interest income | 11,986 | | 11,225 | | 6.8 | 6.9 | 46,668 | | 43,261 | | 7.9 | 9.5 |

| Net fee income | 3,344 | | 3,189 | | 4.9 | 5.3 | 13,010 | | 12,057 | | 7.9 | 10.7 |

Gains (losses) on financial transactions 1 | 780 | | 536 | | 45.5 | 44.6 | 2,273 | | 2,633 | | (13.7) | (11.3) |

| Other operating income | (84) | | 185 | | — | — | 260 | | (304) | | — | — |

| Total income | 16,026 | | 15,135 | | 5.9 | 6.1 | 62,211 | | 57,647 | | 7.9 | 9.9 |

| Administrative expenses and amortizations | (6,772) | | (6,349) | | 6.7 | 6.6 | (26,034) | | (25,425) | | 2.4 | 4.0 |

| Net operating income | 9,254 | | 8,786 | | 5.3 | 5.7 | 36,177 | | 32,222 | | 12.3 | 14.6 |

| Net loan-loss provisions | (3,114) | | (2,976) | | 4.6 | 5.0 | (12,333) | | (12,458) | | (1.0) | 2.0 |

| Other gains (losses) and provisions | (1,540) | | (891) | | 72.8 | 72.0 | (4,817) | | (3,066) | | 57.1 | 58.9 |

| Profit before tax | 4,600 | | 4,919 | | (6.5) | (5.9) | 19,027 | | 16,698 | | 13.9 | 15.6 |

| Tax on profit | (1,037) | | (1,330) | | (22.0) | (21.1) | (5,283) | | (4,489) | | 17.7 | 19.0 |

| Profit from continuing operations | 3,563 | | 3,589 | | (0.7) | (0.2) | 13,744 | | 12,209 | | 12.6 | 14.4 |

| Net profit from discontinued operations | — | | — | | — | | — | | — | | — | | — | | — | |

| Consolidated profit | 3,563 | | 3,589 | | (0.7) | (0.2) | 13,744 | | 12,209 | | 12.6 | 14.4 |

| Non-controlling interests | (298) | | (339) | | (12.1) | (11.2) | (1,170) | | (1,133) | | 3.3 | 5.3 |

| Net capital gains and provisions | — | | — | | — | — | — | | — | | — | — |

| Profit attributable to the parent | 3,265 | | 3,250 | | 0.5 | 0.9 | 12,574 | | 11,076 | | 13.5 | 15.3 |

Underlying profit attributable to the parent 2 | 3,265 | | 3,250 | | 0.5 | 0.9 | 12,574 | | 11,076 | | 13.5 | 15.3 |

| | | | | | | | |

1. Includes exchange differences.

2. Excludes net capital gains and provisions.

Grupo Santander balance sheet

| | | | | | | | | | | | | | | | | |

| Grupo Santander. Condensed balance sheet |

| EUR million | | | | | |

| | | Change | |

| Assets | Dec-24 | Dec-23 | Absolute | % | Dec-22 |

| Cash, cash balances at central banks and other demand deposits | 192,208 | | 220,342 | | (28,134) | | (12.8) | | 223,073 | |

| Financial assets held for trading | 230,253 | | 176,921 | | 53,332 | | 30.1 | | 156,118 | |

| Debt securities | 82,646 | | 62,124 | | 20,522 | | 33.0 | | 41,403 | |

| Equity instruments | 16,636 | | 15,057 | | 1,579 | | 10.5 | | 10,066 | |

| Loans and advances to customers | 26,591 | | 11,634 | | 14,957 | | 128.6 | | 9,550 | |

| Loans and advances to central banks and credit institutions | 40,280 | | 31,778 | | 8,502 | | 26.8 | | 28,097 | |

| Derivatives | 64,100 | | 56,328 | | 7,772 | | 13.8 | | 67,002 | |

Financial assets designated at fair value through profit or loss1 | 14,045 | | 15,683 | | (1,638) | | (10.4) | | 14,702 | |

| Loans and advances to customers | 5,652 | | 7,201 | | (1,549) | | (21.5) | | 6,642 | |

| Loans and advances to central banks and credit institutions | 408 | | 459 | | (51) | | (11.1) | | 673 | |

| Other (debt securities an equity instruments) | 7,985 | | 8,023 | | (38) | | (0.5) | | 7,387 | |

| Financial assets at fair value through other comprehensive income | 89,898 | | 83,308 | | 6,590 | | 7.9 | | 85,239 | |

| Debt securities | 76,558 | | 73,565 | | 2,993 | | 4.1 | | 75,083 | |

| Equity instruments | 2,193 | | 1,761 | | 432 | | 24.5 | | 1,941 | |

| Loans and advances to customers | 10,784 | | 7,669 | | 3,115 | | 40.6 | | 8,215 | |

| Loans and advances to central banks and credit institutions | 363 | | 313 | | 50 | | 16.0 | | — | |

| Financial assets measured at amortized cost | 1,203,707 | | 1,191,403 | | 12,304 | | 1.0 | | 1,147,044 | |

| Debt securities | 120,949 | | 103,559 | | 17,390 | | 16.8 | | 73,554 | |

| Loans and advances to customers | 1,011,042 | | 1,009,845 | | 1,197 | | 0.1 | | 1,011,597 | |

| Loans and advances to central banks and credit institutions | 71,716 | | 77,999 | | (6,283) | | (8.1) | | 61,893 | |

| Investments in subsidiaries, joint ventures and associates | 7,277 | | 7,646 | | (369) | | (4.8) | | 7,615 | |

| Tangible assets | 32,087 | | 33,882 | | (1,795) | | (5.3) | | 34,073 | |

| Intangible assets | 19,259 | | 19,871 | | (612) | | (3.1) | | 18,645 | |

| Goodwill | 13,438 | | 14,017 | | (579) | | (4.1) | | 13,741 | |

| Other intangible assets | 5,821 | | 5,854 | | (33) | | (0.6) | | 4,904 | |

Other assets2 | 48,347 | | 48,006 | | 341 | | 0.7 | | 48,150 | |

| Total assets | 1,837,081 | | 1,797,062 | | 40,019 | | 2.2 | | 1,734,659 | |

| | | | | |

| Liabilities and shareholders' equity | | | | | |

| Financial liabilities held for trading | 152,151 | | 122,270 | | 29,881 | | 24.4 | | 115,185 | |

| Customer deposits | 18,984 | | 19,837 | | (853) | | (4.3) | | 12,226 | |

| Debt securities issued | — | | — | | — | | — | | — | |

| Deposits by central banks and credit institutions | 39,584 | | 25,670 | | 13,914 | | 54.2 | | 15,553 | |

| Derivatives | 57,753 | | 50,589 | | 7,164 | | 14.2 | | 64,891 | |

| Other | 35,830 | | 26,174 | | 9,656 | | 36.9 | | 22,515 | |

| Financial liabilities designated at fair value through profit or loss | 36,360 | | 40,367 | | (4,007) | | (9.9) | | 40,268 | |

| Customer deposits | 25,407 | | 32,052 | | (6,645) | | (20.7) | | 31,143 | |

| Debt securities issued | 7,554 | | 5,371 | | 2,183 | | 40.6 | | 5,427 | |

| Deposits by central banks and credit institutions | 3,399 | | 2,944 | | 455 | | 15.5 | | 3,698 | |

| Other | — | | — | | — | | — | | — | |

| Financial liabilities measured at amortized cost | 1,484,322 | | 1,468,703 | | 15,619 | | 1.1 | | 1,423,858 | |

| Customer deposits | 1,011,545 | | 995,280 | | 16,265 | | 1.6 | | 966,353 | |

| Debt securities issued | 317,967 | | 303,208 | | 14,759 | | 4.9 | | 274,912 | |

| Deposits by central banks and credit institutions | 114,894 | | 130,028 | | (15,134) | | (11.6) | | 145,534 | |

| Other | 39,916 | | 40,187 | | (271) | | (0.7) | | 37,059 | |

| Liabilities under insurance contracts | 17,829 | | 17,799 | | 30 | | 0.2 | | 16,426 | |

| Provisions | 8,407 | | 8,441 | | (34) | | (0.4) | | 8,149 | |

Other liabilities3 | 30,685 | | 35,241 | | (4,556) | | (12.9) | | 33,188 | |

| Total liabilities | 1,729,754 | | 1,692,821 | | 36,933 | | 2.2 | | 1,637,074 | |

| Shareholders' equity | 135,196 | | 130,443 | | 4,753 | | 3.6 | | 124,732 | |

| Capital stock | 7,576 | | 8,092 | | (516) | | (6.4) | | 8,397 | |

Reserves (including treasury stock)4 | 116,578 | | 112,573 | | 4,005 | | 3.6 | | 107,709 | |

| Profit attributable to the Group | 12,574 | | 11,076 | | 1,498 | | 13.5 | | 9,605 | |

| Less: dividends | (1,532) | | (1,298) | | (234) | | 18.0 | | (979) | |

| Other comprehensive income | (36,595) | | (35,020) | | (1,575) | | 4.5 | | (35,628) | |

| Minority interests | 8,726 | | 8,818 | | (92) | | (1.0) | | 8,481 | |

| Total equity | 107,327 | | 104,241 | | 3,086 | | 3.0 | | 97,585 | |

| Total liabilities and equity | 1,837,081 | | 1,797,062 | | 40,019 | | 2.2 | | 1,734,659 | |

| | |

| Note: The condensed balance sheet groups some lines of the consolidated balance sheet on pages 58 and 59 as follows: |

1.'Non-trading financial assets mandatorily at fair value through profit or loss' and 'Financial assets designated at fair value through profit or loss'. |

2.‘Hedging derivatives’; ‘Changes in the fair value of hedged items in portfolio hedges of interest risk’; 'Assets under reinsurance contracts'; ‘Tax assets’; ‘Other assets’; and 'Non-current assets held for sale’. |

3.‘Hedging derivatives’; ‘Changes in the fair value of hedged items in portfolio hedges of interest rate risk’; ‘Tax liabilities’; ‘Other liabilities’; and ‘Liabilities associated with non-current assets held for sale‘. |

4.‘Share premium’; ‘Equity instruments issued other than capital’; ‘Other equity’; ‘Accumulated retained earnings’; ‘Revaluation reserves’; ‘Other reserves’; and ‘Own shares (-)’. |

| | | | | | | | |

10 | | January - December 2024 |

| | | | | | | | | | | | | | | | | | | | | |

| Balance sheet | | | | | | | |

| EUR million | | | | | | | |

| | / | Sep-24 | | | / | Dec-23 |

| Dec-24 | % | % excl. FX | | | % | % excl. FX |

| Loans and advances to customers | 1,054,070 | | (1.3) | | (1.8) | | | | 1.7 | | 2.2 | |

| Customer deposits | 1,055,936 | | 1.0 | | 0.5 | | | | 0.8 | | 1.6 | |

| | | | | | | |

| Memorandum items: | | | | | | | |

Gross loans and advances to customers 1 | 1,016,546 | | 0.3 | | (0.1) | | | | 0.2 | | 0.9 | |

| Customer funds | 1,211,342 | | 3.2 | | 3.0 | | | | 2.9 | | 4.4 | |

Customer deposits 2 | 977,620 | | 2.9 | | 2.6 | | | | 1.0 | | 1.6 | |

| Mutual funds | 233,722 | | 4.1 | | 4.8 | | | | 12.1 | | 18.1 | |

| | | | | | | |

1. Excluding reverse repos.

2. Excluding repos.

| | | | | |

| Gross loans and advances to customers (excl. reverse repos) |

| EUR billion |

1. In constant euros: +1%.

| | |

| Customer funds |

| EUR billion |

| | | | | | | | |

| | |

| +3 | % | 1a | |

| | |

| +12 | % | | |

| | |

| +1 | % | | |

| | |

| | |

•Total |

• Mutual funds |

•Deposits exc. repos |

| | |

| Dec-24 / Dec-23 |

| | |

1. In constant euros: +4%.

| | |

| Gross loans and advances to customers (excl. reverse repos) |

| % operating areas. December 2024 |

| | |

| Customer funds |

| % operating areas. December 2024 |

| | | | | | | | |

January - December 2024 | | 11 |

Solvency ratios

| | | | | | | | |

Eligible capital. December 2024 |

| EUR million | | |

| Fully-loaded | Phased-in1 |

| CET1 | 79,705 | | 79,799 | |

| Basic capital | 90,076 | | 90,170 | |

| Eligible capital | 107,105 | | 108,588 | |

| Risk-weighted assets | 624,477 | | 624,503 | |

| | |

| % | % |

| CET1 capital ratio | 12.8 | | 12.8 | |

| Tier 1 capital ratio | 14.4 | | 14.4 | |

| Total capital ratio | 17.2 | | 17.4 | |

| | | | | | | | |

| Fully-loaded capital ratio |

|

| | |

|

|

|

|

|

|

| TNAV per share |

TNAV per share was EUR 5.24, increasing 14% year-on-year including the cash dividends. |

| | | | | | | | | | | | | | | | | |

Eligible capital (phased-in) 1. Consolidated |

| EUR million | | | | | |

| | | Change | |

| Dec-24 | Dec-23 | Absolute | % | Dec-22 |

| Capital stock and reserves | 124,263 | | 121,185 | | 3,078 | | 2.5 | 116,956 | |

| Attributable profit | 12,574 | | 11,076 | | 1,498 | | 13.5 | 9,605 | |

| Dividends | (3,144) | | (2,769) | | (375) | | 13.5 | (1,921) | |

| Other retained earnings | (38,323) | | (34,484) | | (3,839) | | 11.1 | (35,068) | |

| Minority interests | 8,479 | | 6,899 | | 1,580 | | 22.9 | 7,416 | |

| Goodwill and intangible assets | (15,957) | | (17,220) | | 1,263 | | (7.3) | (17,182) | |

| Other deductions | (8,093) | | (7,946) | | (146) | | 1.8 | (5,604) | |

| CET1 | 79,799 | | 76,741 | | 3,059 | | 4.0 | 74,202 | |

| Preferred shares and other eligible tier 1 | 10,371 | | 9,002 | | 1,369 | | 15.2 | 8,831 | |

| Tier 1 | 90,170 | | 85,742 | | 4,428 | | 5.2 | 83,033 | |

| Generic funds and eligible tier 2 instruments | 18,418 | | 16,497 | | 1,921 | | 11.6 | 14,359 | |

| Eligible capital | 108,588 | | 102,240 | | 6,349 | | 6.2 | 97,392 | |

| Risk-weighted assets | 624,503 | | 623,731 | | 772 | | 0.1 | 609,266 | |

| | | | | |

| CET1 capital ratio | 12.8 | 12.3 | 0.5 | | 12.2 |

| Tier 1 capital ratio | 14.4 | 13.7 | 0.7 | | 13.6 |

| Total capital ratio | 17.4 | 16.4 | 1.0 | | 16.0 |

| | |

| Fully-loaded CET1 ratio performance |

| % |

1. The phased-in ratio includes the transitory treatment of IFRS 9, calculated in accordance with article 473 bis of the Capital Requirements Regulation (CRR) and subsequent modifications introduced by Regulation 2020/873 of the European Union. Total phased-in capital ratios include the transitory treatment according to chapter 4, title 1, part 10 of the CRR.

2.Deduction for expected shareholder remuneration. Our target payout is approximately 50% of Group reported profit (excluding non-cash, non-capital ratios impact items), divided approximately equally between cash dividends and share buybacks. The implementation of the shareholder remuneration policy is subject to future corporate and regulatory decisions and approvals.

| | | | | | | | |

12 | | January - December 2024 |

Risk management

Credit risk

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key risk metrics |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | Net loan-loss provisions 1 | | Cost of risk (%) 2 | | NPL ratio (%) | | NPL coverage ratio (%) |

| | Q4'24 | 2024 | Chg (%)

/ 2023 | Chg (%)

/ Q3'24 | | 2024 | Chg (bps)

/ 2023 | Chg (bps)

/ Q3'24 | | 2024 | Chg (bps)

/ 2023 | Chg (bps)

/ Q3'24 | | 2024 | Chg (pp)

/ 2023 | Chg (pp)

/ Q3'24 |

| Retail | 1,388 | 5,845 | (7.3) | 2.8 | | 0.92 | (10) | (5) | | 3.18 | (3) | (10) | | 58.4 | (3.0) | 0.7 |

| Consumer | 1,248 | 4,562 | 12.4 | 9.8 | | 2.16 | 13 | 4 | | 5.07 | 33 | 20 | | 73.6 | (2.9) | (1.1) |

| CIB | 17 | 174 | 7.3 | (72.7) | | 0.10 | 0 | (11) | | 0.86 | (50) | (3) | | 39.3 | (2.0) | 3.3 |

| Wealth | 17 | 41 | — | 57.4 | | 0.18 | 25 | 9 | | 0.67 | (73) | (2) | | 80.3 | 51.0 | 7.2 |

| Payments | 448 | 1,714 | 8.2 | 10.0 | | 7.39 | 17 | 38 | | 5.14 | 12 | (38) | | 140.1 | 0.3 | 7.0 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| TOTAL GROUP 3 | 3,114 | 12,333 | 2.0 | 5.0 | | 1.15 | (3) | (3) | | 3.05 | (9) | (1) | | 64.8 | (1.2) | 1.1 |

| | | | | | | | | | | | | | | | | |

| Europe | 418 | 1,862 | (27.7) | (2.0) | | 0.32 | (12) | (3) | | 2.15 | (17) | (9) | | 50.2 | 0.9 | 1.8 |

| DCB Europe | 345 | 1,209 | 51.9 | 23.6 | | 0.88 | 27 | 13 | | 2.50 | 37 | 6 | | 82.5 | (5.5) | (0.8) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| North America | 950 | 3,786 | 2.4 | (0.4) | | 2.04 | (1) | (11) | | 4.22 | 12 | 24 | | 69.7 | (4.2) | (1.6) |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| South America | 1,404 | 5,478 | 9.0 | 7.3 | | 3.50 | 14 | (5) | | 5.42 | (30) | (13) | | 76.5 | (1.9) | 1.0 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| TOTAL GROUP 3 | 3,114 | 12,333 | 2.0 | 5.0 | | 1.15 | (3) | (3) | | 3.05 | (9) | (1) | | 64.8 | (1.2) | 1.1 |

1.EUR million and % change in constant euros.

2.Provisions to cover losses due to impairment of loans in the last 12 months / average customer loans and advances of the last 12 months.

3.Total Group includes the Corporate Centre.

For more detailed information, please see the 'Alternative Performance Measures' section.

| | | | | | | | | | | | | | | | | | | | | | | |

| Coverage ratio by stage | |

| EUR billion |

| Exposure1 | | Coverage |

| Dec-24 | Sep-24 | Dec-23 | | Dec-24 | Sep-24 | Dec-23 |

| Stage 1 | 1,002 | 1,008 | 1,000 | | 0.4 | % | 0.4 | % | 0.4 | % |

| Stage 2 | 88 | 87 | 80 | | 5.6 | % | 5.7 | % | 6.4 | % |

| Stage 3 | 35 | 36 | 36 | | 40.6 | % | 40.1 | % | 40.6 | % |

1. Exposure subject to impairment. Additionally, in December 2024 there were EUR 32 billion in loans and advances to customers not subject to impairment recorded at mark to market with changes through P&L (EUR 39 billion in September 2024 and EUR 19 billion in December 2023).Stage 1: financial instruments for which no significant increase in credit risk has been identified since its initial recognition.

Stage 2: if there has been a significant increase in credit risk since the date of initial recognition but the impairment event has not materialized, the financial instrument is classified in Stage 2.

Stage 3: a financial instrument is catalogued in this stage when it shows effective signs of impairment as a result of one or more events that have already occurred resulting in a loss.

| | | | | | | | | | | |

| Credit impaired loans and loan-loss allowances |

| EUR million | | |

| | Change (%) |

| Q4'24 | QoQ | YoY |

| Balance at beginning of period | 35,723 | | 1.8 | | 0.5 | |

| Net additions | 2,819 | | (37.4) | | (34.1) | |

| Increase in scope of consolidation | — | | (100.0) | | — | |

| Exchange rate differences and other | 115 | | — | | — | |

| Write-offs | (3,392) | | 0.3 | | (10.7) | |

| Balance at period-end | 35,265 | | (1.3) | | (1.0) | |

| | | |

| Loan-loss allowances | 22,835 | | 0.4 | | (2.8) | |

| For impaired assets | 14,301 | | 0.4 | | (1.1) | |

| For other assets | 8,534 | | 0.5 | | (5.5) | |

| | | | | | | | |

January - December 2024 | | 13 |

Market risk

| | | | | | | | | | | | | | |

Trading portfolios1. VaR by region |

| EUR million | | | | |

| 2024 | | 2023 |

| Q4 | Average | Last | | Average |

| | | | |

| Total | 18.4 | | 18.7 | | | 12.7 | |

| Europe | 14.0 | | 16.0 | | | 10.9 | |

| North America | 6.2 | | 6.4 | | | 5.3 | |

| South America | 9.2 | | 9.5 | | | 6.8 | |

| | | | | | | | | | | | | | |

Trading portfolios1. VaR by market factor |

| EUR million | | | | |

| Q4 2024 | Min. | Avg. | Max. | Last |

| VaR total | 14.4 | | 18.4 | | 23.0 | | 18.7 | |

| Diversification effect | (14.5) | | (23.8) | | (38.0) | | (27.3) | |

| Interest rate VaR | 11.4 | | 17.1 | | 21.6 | | 20.2 | |

| Equity VaR | 7.0 | | 10.6 | | 18.8 | | 9.5 | |

| FX VaR | 4.4 | | 6.1 | | 8.5 | | 5.9 | |

| Credit spreads VaR | 3.9 | | 5.4 | | 7.0 | | 5.3 | |

| Commodities VaR | 2.2 | | 3.0 | | 5.1 | | 5.1 | |

Note: in the North America, South America and Asia portfolios, VaR corresponding to the credit spreads factor other than sovereign risk is not relevant and is included in the interest rate factor.

| | |

Trading portfolios1. VaR performance

|

| EUR million |

1. Activity in Santander Corporate & Investment Banking markets.

| | | | | | | | |

14 | | January - December 2024 |

Santander Share

| | | | | | | | | | | | | | |

| Share price |

| | |

| | |

START 29/12/2023 | | END 31/12/2024 |

| €3.780 | | €4.465 |

| | | | |

| | |

Maximum 29/04/2024 | | Minimum 30/01/2024 |

| €4.928 | | €3.563 |

| | | | | | | | | | | |

| 2nd | |

| Bank in the eurozone by market capitalization |

| | |

EUR 67,648 million |

|

| | | | | |

| The Santander share |

| 31 December 2024 | |

| |

| Shares and trading data | |

| Shares (number) | 15,152,492,322 | |

| Average daily turnover (number of shares) | 30,127,309 | |

| Share liquidity (%) | 49 |

| (Annualized number of shares traded during the period / number of shares) |

| |

| Stock market indicators |

| Price / Tangible book value (X) | 0.85 | |

| |

| Free float (%) | 99.90 |

| | |

| Comparative share performance |

|

| | | | | | | | |

January - December 2024 | | 15 |

| | | | | | | | |

| Share capital distribution by geographic area |

| 31 December 2024 |

| The Americas | Europe | Rest of the world |

| | |

| 25.72% | 72.73% | 1.55% |

|

| Source: Banco Santander, Shareholder Register. |

. | | | | | |

| Share capital distribution by type of shareholder |

| 31 December 2024 |

| | | |

| Institutions |

| 58.70% |

| |

| Board* |

| 1.29% |

| |

| Retail |

| 40.01% |

| |

* Shares owned or represented by directors.

| | | | | | | | |

16 | | January - December 2024 |

Financial information by segment

Description of segments

Following the creation of two new global segments and in order to align the operating and management model, at the beginning of 2024 we adapted our reporting, starting with the financial information for Q1 2024, with global businesses becoming the primary segments.

Main changes to the composition of Santander's segments

The main changes, which we started to apply from 1 January 2024 to the management information for all periods included in the consolidated financial statements, are as follows:

•All of the Group's businesses across all markets were consolidated into five global areas: Retail & Commercial Banking, Digital Consumer Bank, Corporate & Investment Banking, Wealth Management & Insurance and Payments. These became the new primary segments.

•The changes in financial information were:

–The former Retail Banking was split into two new segments: Retail & Commercial Banking and Digital Consumer Bank. Our cards business now forms part of the new Payments segment.

–The results of activities mainly related to financial management located in the countries are fully allocated to their global businesses based on the segment that generates the financial position.

–The local corporate centres are fully allocated to the global businesses.

–The revenue sharing criteria between global businesses were revised to better reflect the contribution of each business to the Group.

•The former primary segments (Europe, North America, South America and Digital Consumer Bank - which is renamed DCB Europe) became our secondary segments. 2023 published figures for the regions, countries and the Corporate Centre remain unchanged.

All the changes described above have no impact on the reported Group consolidated financial statements.

Composition of Santander's segments

Primary segments

This primary level of segmentation, which is based on the Group's management structure from 1 January 2024, comprises six reportable segments: five operating areas plus the Corporate Centre.

The operating areas are:

Retail & Commercial Banking (Retail): area that integrates the retail banking business and commercial banking (individuals, SMEs and corporates), except for business originated in the consumer finance and the cards businesses.

Digital Consumer Bank (Consumer): comprises all business originated in the consumer finance companies, plus Openbank, Open Digital Services (ODS) and SBNA Consumer.

Corporate & Investment Banking (CIB): this business, which includes Global Transaction Banking, Global Banking (Global Debt Financing and Corporate Finance) and Global Markets, offers products and services on a global scale to corporate and institutional customers, and collaborates with other global businesses to better serve our broad customer base.

Wealth Management & Insurance (Wealth): includes the corporate unit of Private Banking and International Private Banking in Miami and Switzerland (Santander Private Banking), the asset management business (Santander Asset Management) and the insurance business (Santander Insurance).

Payments: the Group's digital payments solutions, providing global technology solutions for our banks and new customers in the open market. It is structured in two businesses: PagoNxt (Getnet, Ebury and PagoNxt Payments) and Cards (cards platform and business in the countries where we operate).

Secondary segments

At this secondary level, Santander is structured into the segments that made up the primary segments until 2023, which are Europe, DCB Europe, North America and South America:

Europe: comprises all business activity carried out in the region, except that included in DCB Europe. Detailed financial information is provided on Spain, the UK, Portugal and Poland.

DCB Europe: includes Santander Consumer Finance, which incorporates the entire consumer finance business in Europe, Openbank in Spain and ODS.

North America: comprises all the business activities carried out in Mexico and the US, which includes the holding company (SHUSA) and the businesses of Santander Bank (SBNA), Santander Consumer USA (SC USA), the specialized business unit Banco Santander International, the New York branch and Santander US Capital Markets (SanCap).

South America: includes all the financial activities carried out by Santander through its banks and subsidiary banks in the region. Detailed information is provided on Brazil, Chile and Argentina.

| | | | | | | | |

January - December 2024 | | 17 |

In addition to these operating units, both at the primary and secondary segment level, the Group continues to maintain the area of the Corporate Centre, which includes the centralized activities relating to equity stakes in financial companies, financial management of the structural exchange rate position, assumed within the sphere of the Group’s assets and liabilities committee, as well as management of liquidity and of shareholders’ equity via issuances.

As the Group’s holding entity, this area manages all capital and reserves and allocations of capital and liquidity with the other businesses. It also incorporates goodwill impairment but not the costs related to the Group’s central services (charged to the areas), except for corporate and institutional expenses related to the Group’s functioning.

| | |

The businesses included in each of the segments in this report and the accounting principles under which their results are presented here may differ from the businesses included and accounting principles applied in the financial information separately prepared and disclosed by our subsidiaries (some of which are publicly listed) which in name or geographical description may seem to correspond to the business areas covered in this report. Accordingly, the results of operations and trends shown for our business areas in this document may differ materially from those of such subsidiaries. The results of our segments presented below are provided on the basis of underlying results only and include the impact of foreign exchange rate fluctuations. However, for a better understanding of the changes in the performance of our business areas, we also provide and discuss the year-on-year changes to our results excluding such exchange rate impacts (i.e. in constant euros), except for Argentina, and any grouping which includes it, where the variations in constant euros have been calculated considering the Argentine peso exchange rate on the last working day for each of the periods presented. Additionally, from Q2 2024 onwards for the Argentine peso, we apply an alternative exchange rate that better reflects the evolution of inflation (we continue to apply the official ARS exchange rate to all prior periods). For further information, see methodology in the 'Alternative performance measures' section in the appendix to this report. Certain figures contained in this report, have been subject to rounding to enhance their presentation. Accordingly, in certain instances, the sum of the numbers in a column or a row in tables contained in this report may not conform exactly to the total figure given for that column or row. |

| | | | | | | | |

18 | | January - December 2024 |

| | | | | | | | | | | | | | | | | | | | |

| January-December 2024 |

| Main items of the underlying income statement |

| EUR million | | | | | | |

| Primary segments | Net interest

income | Net fee

income | Total

income | Net operating

income | Profit

before tax | Profit attributable to the parent |

| Retail & Commercial Banking | 27,942 | | 4,681 | | 32,461 | | 19,584 | | 10,874 | | 7,263 | |

| Digital Consumer Bank | 10,777 | | 1,508 | | 12,916 | | 7,733 | | 2,232 | | 1,663 | |

| Corporate & Investment Banking | 4,020 | | 2,548 | | 8,343 | | 4,537 | | 4,009 | | 2,740 | |

| Wealth Management & Insurance | 1,627 | | 1,489 | | 3,661 | | 2,348 | | 2,259 | | 1,650 | |

| Payments | 2,609 | | 2,793 | | 5,505 | | 3,030 | | 969 | | 413 | |

| PagoNxt | 132 | | 958 | | 1,240 | | 80 | | (233) | | (299) | |

| Cards | 2,478 | | 1,835 | | 4,265 | | 2,950 | | 1,202 | | 712 | |

| Corporate Centre | (308) | | (11) | | (676) | | (1,055) | | (1,317) | | (1,154) | |

| TOTAL GROUP | 46,668 | | 13,010 | | 62,211 | | 36,177 | | 19,027 | | 12,574 | |

| | | | | | |

| Secondary segments | | | | | | |

| Europe | 16,720 | | 4,659 | | 23,510 | | 14,102 | | 10,129 | | 6,644 | |

| Spain | 7,256 | | 2,867 | | 11,974 | | 7,703 | | 5,440 | | 3,762 | |

| United Kingdom | 4,950 | | 283 | | 5,216 | | 2,299 | | 1,794 | | 1,306 | |

| Portugal | 1,548 | | 467 | | 2,100 | | 1,553 | | 1,481 | | 1,001 | |

| Poland | 2,844 | | 674 | | 3,555 | | 2,591 | | 1,650 | | 800 | |

| Other | 121 | | 367 | | 664 | | (42) | | (236) | | (225) | |

| DCB Europe | 4,361 | | 902 | | 5,679 | | 3,075 | | 1,131 | | 642 | |

| North America | 10,330 | | 2,594 | | 13,915 | | 7,214 | | 3,091 | | 2,579 | |

| US | 5,693 | | 1,152 | | 7,580 | | 3,750 | | 1,053 | | 1,109 | |

| Mexico | 4,631 | | 1,385 | | 6,278 | | 3,613 | | 2,274 | | 1,671 | |

| Other | 7 | | 57 | | 57 | | (149) | | (236) | | (201) | |

| South America | 15,566 | | 4,864 | | 19,783 | | 12,841 | | 5,993 | | 3,863 | |

| Brazil | 10,121 | | 3,414 | | 13,536 | | 9,184 | | 3,830 | | 2,422 | |

| Chile | 1,822 | | 551 | | 2,592 | | 1,659 | | 1,111 | | 629 | |

| Argentina | 2,919 | | 602 | | 2,487 | | 1,465 | | 827 | | 665 | |

| Other | 703 | | 298 | | 1,168 | | 533 | | 225 | | 146 | |

| | | | | | |

| Corporate Centre | (308) | | (11) | | (676) | | (1,055) | | (1,317) | | (1,154) | |

| TOTAL GROUP | 46,668 | | 13,010 | | 62,211 | | 36,177 | | 19,027 | | 12,574 | |

| | |

Profit attributable to the parent distribution1. 2024 |

1. As a % of operating areas. Excluding the Corporate Centre.

| | |

Profit attributable to the parent. 2024 |

| EUR million. % change YoY |

| | | | | |

| Var | Var2 |

| +28 | % | +29 | % |

| -13 | % | -12 | % |

| +12 | % | +16 | % |

| +12 | % | +14 | % |

| -32 | % | -26 | % |

| |

| +21 | % | +19 | % |

| -46 | % | -47 | % |

| +10 | % | +12 | % |

| +27 | % | +36 | % |

| |

| |

2. Changes in constant euros.

| | | | | | | | |

January - December 2024 | | 19 |

| | | | | | | | | | | | | | | | | | | | |

| January-December 2023 |

| Main items of the underlying income statement |

| EUR million | | | | | | |

| Primary segments | Net interest

income | Net fee

income | Total

income | Net operating

income | Profit

before tax | Profit attributable to the parent |

| Retail & Commercial Banking | 25,550 | | 4,497 | | 29,754 | | 16,930 | | 7,989 | | 5,659 | |

| Digital Consumer Bank | 10,221 | | 1,229 | | 12,296 | | 7,033 | | 2,677 | | 1,901 | |

| Corporate & Investment Banking | 3,594 | | 2,131 | | 7,527 | | 4,140 | | 3,795 | | 2,440 | |

| Wealth Management & Insurance | 1,513 | | 1,262 | | 3,210 | | 1,994 | | 1,994 | | 1,467 | |

| Payments | 2,424 | | 2,952 | | 5,298 | | 2,954 | | 1,205 | | 607 | |

| PagoNxt | 93 | | 954 | | 1,140 | | 49 | | (17) | | (77) | |

| Cards | 2,331 | | 1,998 | | 4,158 | | 2,905 | | 1,222 | | 684 | |

| Corporate Centre | (41) | | (13) | | (439) | | (829) | | (961) | | (998) | |

| TOTAL GROUP | 43,261 | | 12,057 | | 57,647 | | 32,222 | | 16,698 | | 11,076 | |

| | | | | | |

| Secondary segments | | | | | | |

| Europe | 15,910 | | 4,399 | | 21,439 | | 12,409 | | 8,195 | | 5,482 | |

| Spain | 6,641 | | 2,699 | | 10,132 | | 5,905 | | 3,399 | | 2,371 | |

| United Kingdom | 5,152 | | 338 | | 5,525 | | 2,779 | | 2,107 | | 1,545 | |

| Portugal | 1,465 | | 464 | | 1,982 | | 1,440 | | 1,314 | | 896 | |

| Poland | 2,543 | | 589 | | 3,182 | | 2,320 | | 1,392 | | 674 | |

| Other | 109 | | 309 | | 618 | | (35) | | (17) | | (3) | |

| DCB Europe | 4,193 | | 796 | | 5,502 | | 2,884 | | 2,019 | | 1,199 | |

| North America | 10,159 | | 2,192 | | 13,174 | | 6,708 | | 2,837 | | 2,354 | |

| US | 5,742 | | 766 | | 7,209 | | 3,531 | | 863 | | 932 | |

| Mexico | 4,408 | | 1,374 | | 5,899 | | 3,311 | | 2,119 | | 1,560 | |

| Other | 8 | | 52 | | 66 | | (133) | | (145) | | (138) | |

| South America | 13,040 | | 4,684 | | 17,971 | | 11,050 | | 4,608 | | 3,038 | |

| Brazil | 9,116 | | 3,462 | | 13,104 | | 8,574 | | 2,911 | | 1,921 | |

| Chile | 1,383 | | 572 | | 2,285 | | 1,265 | | 951 | | 582 | |

| Argentina | 1,879 | | 396 | | 1,544 | | 769 | | 505 | | 386 | |

| Other | 662 | | 254 | | 1,038 | | 441 | | 241 | | 150 | |

| | | | | | |

| Corporate Centre | (41) | | (13) | | (439) | | (829) | | (961) | | (998) | |

| TOTAL GROUP | 43,261 | | 12,057 | | 57,647 | | 32,222 | | 16,698 | | 11,076 | |

| | | | | | | | |

20 | | January - December 2024 |

| | | | | | | | | | | |

| | Retail & Commercial Banking | Underlying attributable profit |

| EUR 7,263 mn |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| EUR million | | | | | | | |

| | / | Q3'24 | | | / | 2023 |

| Underlying income statement | Q4'24 | % | % excl. FX | | 2024 | % | % excl. FX |

| Net interest income | 7,125 | | 4.7 | | 5.3 | | | 27,942 | | 9.4 | | 11.0 | |

| Net fee income | 1,166 | | 1.5 | | 2.6 | | | 4,681 | | 4.1 | | 7.3 | |

Gains (losses) on financial transactions 1 | 257 | | 101.2 | | 95.8 | | | 812 | | (4.9) | | (4.0) | |

| Other operating income | (306) | | 128.1 | | 128.9 | | | (974) | | (15.1) | | (14.3) | |

| Total income | 8,242 | | 3.7 | | 4.3 | | | 32,461 | | 9.1 | | 11.0 | |

| Administrative expenses and amortizations | (3,352) | | 8.1 | | 8.5 | | | (12,877) | | 0.4 | | 2.5 | |

| Net operating income | 4,890 | | 1.0 | | 1.6 | | | 19,584 | | 15.7 | | 17.4 | |

| Net loan-loss provisions | (1,388) | | 1.4 | | 2.8 | | | (5,845) | | (10.6) | | (7.3) | |

| Other gains (losses) and provisions | (804) | | 66.0 | | 65.1 | | | (2,865) | | 19.4 | | 20.7 | |

| Profit before tax | 2,697 | | (9.8) | | (9.3) | | | 10,874 | | 36.1 | | 35.9 | |

| Tax on profit | (636) | | (21.6) | | (21.2) | | | (3,091) | | 60.4 | | 57.4 | |

| Profit from continuing operations | 2,062 | | (5.4) | | (4.9) | | | 7,783 | | 28.4 | | 28.9 | |

| Net profit from discontinued operations | — | | — | | — | | | — | | — | | — | |

| Consolidated profit | 2,062 | | (5.4) | | (4.9) | | | 7,783 | | 28.4 | | 28.9 | |

| Non-controlling interests | (130) | | (25.0) | | (24.3) | | | (520) | | 29.0 | | 29.1 | |

| Profit attributable to the parent | 1,932 | | (3.7) | | (3.2) | | | 7,263 | | 28.3 | | 28.8 | |

|

| Balance sheet and activity metrics | | | | | | | |

| Loans and advances to customers | 608,945 | | (1.7) | | (0.4) | | | 608,945 | | (1.5) | | (0.9) | |

| Customer deposits | 661,152 | | 1.6 | | 1.7 | | | 661,152 | | (0.8) | | 0.3 | |

| | | | | | | |

| Memorandum items: | | | | | | | |

| Gross loans and advances to customers ² | 609,490 | | (0.7) | | (0.6) | | | 609,490 | | (1.5) | | (0.7) | |

| Customer funds | 747,567 | | 2.0 | | 2.3 | | | 747,567 | | 3.0 | | 4.4 | |

| Customer deposits ³ | 649,619 | | 1.8 | | 1.9 | | | 649,619 | | 1.8 | | 2.6 | |

| Mutual funds | 97,948 | | 3.6 | | 4.9 | | | 97,948 | | 11.6 | | 18.8 | |

| Risk-weighted assets | 290,922 | | (0.8) | | | | 290,922 | | (0.9) | | |

|

| Ratios (%) and customers | | | | | | | |

| RoTE ⁴ | 20.1 | | (0.6) | | | | 18.9 | | 3.7 | | |

| Efficiency ratio | 40.7 | | 1.6 | | | | 39.7 | | (3.4) | | |

| NPL ratio | 3.18 | | (0.10) | | | | 3.18 | | (0.03) | | |

| NPL coverage ratio | 58.4 | | 0.7 | | | | 58.4 | | (3.0) | | |

| | | | | | | |

| | | | | | | |

| Number of total customers (thousands) | 147,140 | | 1.1 | | | | 147,140 | | 6.0 | | |

| Number of active customers (thousands) | 79,079 | | 1.3 | | | | 79,079 | | 5.3 | | |

| | |

| 1. Includes exchange differences. |

| 2. Excluding reverse repos. |

| 3. Excluding repos. |

| 4. Allocated according to RWA consumption. |

|

| | | | | | | | |

January - December 2024 | | 21 |

| | | | | | | | | | | |

| | Digital Consumer Bank | Underlying attributable profit |

| EUR 1,663 mn |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| EUR million | | | | | | | |

| | / | Q3'24 | | | / | 2023 |

| Underlying income statement | Q4'24 | % | % excl. FX | | 2024 | % | % excl. FX |

| Net interest income | 2,798 | | 7.1 | | 5.9 | | | 10,777 | | 5.4 | | 6.1 | |

| Net fee income | 394 | | 5.5 | | 5.3 | | | 1,508 | | 22.7 | | 23.8 | |

Gains (losses) on financial transactions 1 | (24) | | — | | — | | | (4) | | — | | — | |

| Other operating income | 164 | | 12.7 | | 10.4 | | | 635 | | (13.0) | | (13.3) | |

| Total income | 3,332 | | 6.3 | | 5.2 | | | 12,916 | | 5.0 | | 5.7 | |

| Administrative expenses and amortizations | (1,287) | | 0.7 | | (0.5) | | | (5,183) | | (1.5) | | (1.2) | |

| Net operating income | 2,045 | | 10.1 | | 9.1 | | | 7,733 | | 10.0 | | 10.9 | |

| Net loan-loss provisions | (1,248) | | 11.3 | | 9.8 | | | (4,562) | | 11.1 | | 12.4 | |

| Other gains (losses) and provisions | (530) | | 375.0 | | 370.8 | | | (939) | | 276.0 | | 283.0 | |

| Profit before tax | 267 | | (57.2) | | (56.9) | | | 2,232 | | (16.6) | | (16.4) | |

| Tax on profit | (43) | | (63.3) | | (60.8) | | | (295) | | (30.9) | | (30.8) | |

| Profit from continuing operations | 225 | | (55.8) | | (56.0) | | | 1,938 | | (13.9) | | (13.6) | |

| Net profit from discontinued operations | — | | — | | — | | | — | | — | | — | |

| Consolidated profit | 225 | | (55.8) | | (56.0) | | | 1,938 | | (13.9) | | (13.6) | |

| Non-controlling interests | (69) | | (2.1) | | (1.7) | | | (275) | | (21.3) | | (21.1) | |

| Profit attributable to the parent | 155 | | (64.5) | | (64.7) | | | 1,663 | | (12.5) | | (12.3) | |

|

| Balance sheet and activity metrics | | | | | | | |

| Loans and advances to customers | 207,104 | | 2.3 | | 0.8 | | | 207,104 | | 4.0 | | 3.4 | |

| Customer deposits | 128,975 | | 5.0 | | 2.3 | | | 128,975 | | 11.7 | | 9.2 | |

| | | | | | | |

| Memorandum items: | | | | | | | |

| Gross loans and advances to customers ² | 215,160 | | 2.4 | | 0.8 | | | 215,160 | | 4.1 | | 3.6 | |

| Customer funds | 137,122 | | 5.0 | | 2.3 | | | 137,122 | | 13.3 | | 10.8 | |

| Customer deposits ³ | 128,933 | | 5.0 | | 2.3 | | | 128,933 | | 12.8 | | 10.3 | |

| Mutual funds | 8,189 | | 4.8 | | 1.5 | | | 8,189 | | 22.9 | | 19.4 | |

| Risk-weighted assets | 152,399 | | (0.6) | | | | 152,399 | | (1.3) | | |

|

| Ratios (%) and customers | | | | | | | |

| RoTE ⁴ | 3.7 | | (6.5) | | | | 9.8 | | (1.8) | | |

| Efficiency ratio | 38.6 | | (2.1) | | | | 40.1 | | (2.7) | | |

| NPL ratio | 5.07 | | 0.20 | | | | 5.07 | | 0.33 | | |

| NPL coverage ratio | 73.6 | | (1.1) | | | | 73.6 | | (2.9) | | |

| | | | | | | |

| Number of total customers (thousands) | 25,041 | | (0.3) | | | | 25,041 | | (1.5) | | |

| | | | | | | |

| | | | | | | |

| | |

| 1. Includes exchange differences. |

| 2. Excluding reverse repos. |

| 3. Excluding repos. |

| 4. Allocated according to RWA consumption. |

| | | | | | | | |

22 | | January - December 2024 |

| | | | | | | | | | | |

| | Corporate & Investment Banking | Underlying attributable profit |

| EUR 2,740 mn |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| EUR million | | | | | | | |

| | / | Q3'24 | | | / | 2023 |

| Underlying income statement | Q4'24 | % | % excl. FX | | 2024 | % | % excl. FX |

| Net interest income | 1,088 | | 20.7 | | 20.5 | | | 4,020 | | 11.9 | | 14.8 | |

| Net fee income | 657 | | 7.2 | | 6.8 | | | 2,548 | | 19.6 | | 21.4 | |

Gains (losses) on financial transactions 1 | 413 | | (17.4) | | (17.0) | | | 1,619 | | (9.9) | | (6.7) | |

| Other operating income | (74) | | — | | — | | | 156 | | — | | — | |

| Total income | 2,083 | | 0.5 | | 0.6 | | | 8,343 | | 10.8 | | 13.6 | |

| Administrative expenses and amortizations | (1,024) | | 6.1 | | 5.5 | | | (3,807) | | 12.4 | | 13.8 | |

| Net operating income | 1,059 | | (4.4) | | (3.6) | | | 4,537 | | 9.6 | | 13.4 | |

| Net loan-loss provisions | (17) | | (73.1) | | (72.7) | | | (174) | | 5.7 | | 7.3 | |

| Other gains (losses) and provisions | (129) | | 28.9 | | 28.1 | | | (353) | | 95.3 | | 100.1 | |

| Profit before tax | 913 | | (3.4) | | (2.5) | | | 4,009 | | 5.7 | | 9.5 | |

| Tax on profit | (157) | | (40.5) | | (38.8) | | | (1,065) | | (6.3) | | (2.2) | |

| Profit from continuing operations | 756 | | 10.9 | | 11.7 | | | 2,944 | | 10.8 | | 14.4 | |

| Net profit from discontinued operations | — | | — | | — | | | — | | — | | — | |

| Consolidated profit | 756 | | 10.9 | | 11.7 | | | 2,944 | | 10.8 | | 14.4 | |

| Non-controlling interests | (55) | | 13.6 | | 14.7 | | | (204) | | (6.5) | | (1.1) | |

| Profit attributable to the parent | 701 | | 10.7 | | 11.5 | | | 2,740 | | 12.3 | | 15.8 | |

|

| Balance sheet and activity metrics | | | | | | | |

| Loans and advances to customers | 184,923 | | (5.3) | | (7.3) | | | 184,923 | | 9.4 | | 9.4 | |

| Customer deposits | 202,355 | | (3.3) | | (4.2) | | | 202,355 | | (0.7) | | 1.0 | |

| | | | | | | |

| Memorandum items: | | | | | | | |

| Gross loans and advances to customers ² | 136,818 | | (0.2) | | (1.9) | | | 136,818 | | (0.6) | | 0.2 | |

| Customer funds | 152,450 | | 8.5 | | 8.8 | | | 152,450 | | (10.2) | | (7.0) | |

| Customer deposits ³ | 136,672 | | 8.0 | | 7.7 | | | 136,672 | | (12.0) | | (9.7) | |

| Mutual funds | 15,777 | | 13.0 | | 18.8 | | | 15,777 | | 8.3 | | 26.2 | |

| Risk-weighted assets | 122,274 | | (2.4) | | | | 122,274 | | 6.5 | | |

|

| Ratios (%) | | | | | | | |

| RoTE ⁴ | 18.4 | | 2.0 | | | | 18.1 | | 0.5 | | |

| Efficiency ratio | 49.2 | | 2.6 | | | | 45.6 | | 0.6 | | |

| NPL ratio | 0.86 | | (0.03) | | | | 0.86 | | (0.50) | | |

| NPL coverage ratio | 39.3 | | 3.3 | | | | 39.3 | | (2.0) | | |

| | | | | | | |

| | |

| 1. Includes exchange differences. |

| 2. Excluding reverse repos. |

| 3. Excluding repos. |

| 4. Allocated according to RWA consumption. |

| | | | | | | | |

January - December 2024 | | 23 |

| | | | | | | | | | | |

| | Wealth Management & Insurance | Underlying attributable profit |

| EUR 1,650 mn |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| WEALTH MANAGEMENT & INSURANCE | | | | | | | |

| EUR million | | | | | | | |

| | / | Q3'24 | | | / | 2023 |

| Underlying income statement | Q4'24 | % | % excl. FX | | 2024 | % | % excl. FX |

| Net interest income | 394 | | (3.1) | | (3.4) | | | 1,627 | | 7.6 | | 8.2 | |

| Net fee income | 405 | | 10.8 | | 10.5 | | | 1,489 | | 18.0 | | 19.2 | |

Gains (losses) on financial transactions 1 | 71 | | 29.3 | | 29.4 | | | 213 | | 25.7 | | 27.3 | |

| Other operating income | 74 | | (28.1) | | (25.8) | | | 332 | | 24.7 | | 32.0 | |

| Total income | 944 | | 1.5 | | 1.5 | | | 3,661 | | 14.0 | | 15.4 | |

| Administrative expenses and amortizations | (383) | | 21.4 | | 20.7 | | | (1,313) | | 8.0 | | 9.2 | |

| Net operating income | 561 | | (8.6) | | (8.3) | | | 2,348 | | 17.7 | | 19.3 | |

| Net loan-loss provisions | (17) | | 55.5 | | 57.4 | | | (41) | | — | | — | |

| Other gains (losses) and provisions | (15) | | 459.1 | | 455.0 | | | (48) | | 170.8 | | 170.3 | |

| Profit before tax | 529 | | (11.9) | | (11.6) | | | 2,259 | | 13.3 | | 14.8 | |

| Tax on profit | (125) | | (6.2) | | (6.2) | | | (531) | | 16.9 | | 18.1 | |

| Profit from continuing operations | 404 | | (13.6) | | (13.1) | | | 1,728 | | 12.2 | | 13.8 | |

| Net profit from discontinued operations | — | | — | | — | | | — | | — | | — | |

| Consolidated profit | 404 | | (13.6) | | (13.1) | | | 1,728 | | 12.2 | | 13.8 | |

| Non-controlling interests | (20) | | 0.9 | | 1.8 | | | (79) | | 7.9 | | 11.6 | |

| Profit attributable to the parent | 384 | | (14.2) | | (13.8) | | | 1,650 | | 12.5 | | 13.9 | |

|

| Balance sheet and activity metrics | | | | | | | |

| Loans and advances to customers | 24,479 | | 5.7 | | 3.6 | | | 24,479 | | 8.8 | | 7.7 | |

| Customer deposits | 60,986 | | 0.8 | | 0.1 | | | 60,986 | | 4.2 | | 3.9 | |

| | | | | | | |

| Memorandum items: | | | | | | | |

| Gross loans and advances to customers ² | 24,611 | | 5.7 | | 3.7 | | | 24,611 | | 8.9 | | 7.9 | |

| Customer funds | 171,866 | | 2.4 | | 2.1 | | | 171,866 | | 9.4 | | 11.6 | |

| Customer deposits ³ | 60,058 | | 0.8 | | 0.1 | | | 60,058 | | 4.2 | | 3.7 | |

| Mutual funds | 111,807 | | 3.3 | | 3.2 | | | 111,807 | | 12.4 | | 16.4 | |

| Risk-weighted assets | 11,559 | | 11.5 | | | | 11,559 | | (37.2) | | |

| Assets under management | 498,289 | | 1.1 | | 1.3 | | | 498,289 | | 8.4 | | 12.7 | |

| Gross written premiums | 2,567 | | (8.7) | | (9.5) | | | 11,526 | | (11.8) | | (8.5) | |

|

| Ratios (%) and customers | | | | | | | |

| RoTE ⁴ | 73.5 | | (11.1) | | | | 78.7 | | 6.5 | | |

| Efficiency ratio | 40.6 | | 6.6 | | | | 35.9 | | (2.0) | | |

| NPL ratio | 0.67 | | (0.02) | | | | 0.67 | | (0.73) | | |

| NPL coverage ratio | 80.3 | | 7.2 | | | | 80.3 | | 51.0 | | |

| | | | | | | |

| Number of Private Banking customers (thousands) | 299 | | 2.8 | | | | 299 | | 13.7 | | |

| | |

| 1. Includes exchange differences. |

| 2. Excluding reverse repos. |

| 3. Excluding repos. |

| 4. Allocated according to RWA consumption. |

| | | | | | | | |

24 | | January - December 2024 |

| | | | | | | | | | | |

| | Payments | Underlying attributable profit |

| EUR 413 mn |

| | | |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| EUR million | | | | | | | |

| | / | Q3'24 | | | / | 2023 |

| Underlying income statement | Q4'24 | % | % excl. FX | | 2024 | % | % excl. FX |

| Net interest income | 694 | | 16.4 | | 17.7 | | | 2,609 | | 7.6 | | 12.9 | |

| Net fee income | 725 | | 3.8 | | 5.0 | | | 2,793 | | (5.4) | | (1.5) | |

Gains (losses) on financial transactions 1 | 41 | | — | | — | | | 41 | | — | | — | |

| Other operating income | 38 | | 120.7 | | 125.0 | | | 61 | | — | | — | |

| Total income | 1,497 | | 14.6 | | 15.6 | | | 5,505 | | 3.9 | | 8.6 | |

| Administrative expenses and amortizations | (621) | | 5.6 | | 6.3 | | | (2,475) | | 5.6 | | 8.0 | |

| Net operating income | 876 | | 21.9 | | 23.1 | | | 3,030 | | 2.6 | | 9.0 | |

| Net loan-loss provisions | (448) | | 8.2 | | 10.0 | | | (1,714) | | 2.9 | | 8.2 | |

| Other gains (losses) and provisions | (37) | | 15.7 | | 15.9 | | | (347) | | 314.3 | | 320.1 | |

| Profit before tax | 391 | | 43.5 | | 43.8 | | | 969 | | (19.6) | | (12.9) | |

| Tax on profit | (132) | | 13.6 | | 15.3 | | | (464) | | (8.8) | | (2.2) | |

| Profit from continuing operations | 259 | | 65.8 | | 64.8 | | | 505 | | (27.4) | | (20.8) | |

| Net profit from discontinued operations | — | | — | | — | | | — | | — | | — | |

| Consolidated profit | 259 | | 65.8 | | 64.8 | | | 505 | | (27.4) | | (20.8) | |

| Non-controlling interests | (24) | | (12.1) | | (10.6) | | | (92) | | 3.4 | | 12.0 | |

| Profit attributable to the parent | 235 | | 82.1 | | 79.9 | | | 413 | | (31.9) | | (25.7) | |

| | | | | | | |

| Balance sheet and activity metrics | | | | | | | |

| Loans and advances to customers | 22,840 | | 8.5 | | 11.2 | | | 22,840 | | 3.6 | | 15.0 | |

| Customer deposits | 1,038 | | 5.7 | | 5.7 | | | 1,038 | | (26.8) | | (26.8) | |

| | | | | | | |

| Memorandum items: | | | | | | | |

| Gross loans and advances to customers ² | 24,614 | | 8.4 | | 11.0 | | | 24,614 | | 3.8 | | 15.3 | |

| Customer funds | 1,038 | | 5.7 | | 5.7 | | | 1,038 | | (26.8) | | (26.8) | |

| Customer deposits ³ | 1,038 | | 5.7 | | 5.7 | | | 1,038 | | (26.8) | | (26.8) | |

| Mutual funds | — | | — | | — | | | — | | — | | — | |

| Risk-weighted assets | 20,346 | 5.8 | | | | 20,346 | (2.9) | | |

| | | | | | | |

| Ratios (%) | | | | | | | |

| RoTE ⁴ | 35.0 | | 14.9 | | | | 15.6 | | (9.4) | | |

| NPL ratio | 5.14 | | (0.38) | | | | 5.14 | | 0.12 | | |