2nd UPDATE: Michelin Stock Drops 10% On Rights Issue Plan

29 September 2010 - 2:30AM

Dow Jones News

Tire maker Michelin (ML.FR) Tuesday launched a heavily

discounted EUR1.2 billion capital increase to finance its

expansion, particularly in fast-growing emerging markets, prompting

a sharp slide in its share price as investors fretted over the

dilutive impact it will have on earnings.

The move took investors by surprise and they dumped the stock,

which ended the day down 10% at EUR58.60, by far the biggest faller

in the benchmark CAC-40 index, which traded down just 0.1%.

The subscription price of the new shares was set at EUR45, a

hefty 27% discount to the closing price Monday. Shareholders are

entitled to two new shares for every 11 shares currently held. The

subscription period runs from Sept. 30 to Oct. 13 and the new

shares will begin trading Oct. 25.

Michelin wants the cash to fund its ambitious medium-term growth

plans that include boosting volume sales by 25% between now and

2015 and by 50% by 2020. The company has been spending about EUR1.2

billion a year on capital expenditure annually in recent years, but

this will rise to EUR1.6 billion from 2011, joint managing partner

Jean-Dominique Senard told reporters.

But analysts said they fear that the shift in strategy signals a

return to the Michelin of previous years that tended to overinvest

while paying little attention to cash generation. Michelin has

never been particularly generous to its shareholders, and that may

be a reflection of its structure as a limited partnership company

in which the decision-making is controlled by three powerful joint

managing partners.

Michelin in the past had a reputation of springing nasty

surprises on its shareholders. "I'm disappointed that management

seems to be backing away from the policy of cash generation and

discipline that we've seen in recent years," a Paris-based analyst

noted. Thomas Besson, automotive analyst at Merrill Lynch, took a

more direct stand, downgrading his recommendation on Michelin to

neutral from buy and slashing his target price to EUR60 from

EUR75.

Michelin intends to add 150,000 tons of production capacity

annually in its target markets of Brazil, China and India,

equivalent to more than one new factory every year. The tire maker

is following in the tracks of the world's major automakers, which

are driving full-speed into emerging markets in search of faster

growth.

Investment will increase between 5% and 6% annually through

2015, said Michel Rollier, Senard's co-chief. Of the EUR1.6 billion

in annual investment, EUR1 billion will be devoted to emerging

markets.

Rollier said he doesn't exclude taking advantage of acquisition

opportunities, but Senard said there was no "hidden project" for a

purchase behind the rights issue. And Rollier said the capital hike

wasn't designed to shore up Michelin's finances, as the company

"has the best balance sheet it has had in 30 years."

Michelin expects to increase its global tire sales by 50%

through 2020, with sales in emerging countries likely to double

while those in mature markets will rise by 25%, Senard said. The

fast ramp-up outside Europe and North America will mean that 45% of

the company's sales will be in emerging countries by 2020, compared

to 33% at present, he said, and nearly half of total sales will be

of energy-efficient tires with low rolling resistance, compared to

only 10% now.

Rollier said the company intends to maintain a pricing policy

whereby any increases in raw materials prices are passed on to

customers. The company, which vies with Japanese competitor

Bridgestone Corp. (5108.TO) to be the world's leading tire maker,

enjoys strong pricing power due to its large market shares.

Michelin reaffirmed its earnings guidance for 2010, saying it

still expects to achieve an operating margin of around 9% of sales

on a increase of more than 10% in volume sales, together with a

positive cash flow. It said the planned capital boost will have no

impact on its 2010 cash flow.

Other medium-term goals include achieving an operating profit

excluding exceptional items of substantially more than EUR2

billion, a long-term return on capital employed of more than 9%, to

generate significantly positive cash flow through 2015, and a

dividend payout ratio of around 30% over that period.

Analysts say management's apparent focus shift from a fairly

conservative financial stance to one of growth and market share

capture isn't likely to help the company's valuation, currently 6.6

times estimated 2011 operating earnings, according to a FactSet

consensus, compared to 9.6 times for Bridgestone and 8.1 times for

Germany's Continental AG (CON.XE). Over the longer-term, and if

emerging market growth does turn out to be as robust as economists

are predicting, Michelin could consolidate its market positions in

regions where per-capita income--and vehicle ownership--currently

are outstripping the more mature markets by a wide margin.

-By David Pearson, Dow Jones Newswires; +33140171740;

david.pearson@dowjones.com

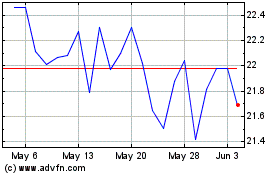

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Dec 2024 to Jan 2025

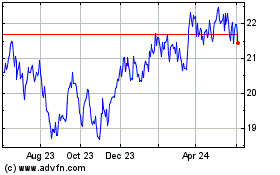

Bridgestone (PK) (USOTC:BRDCY)

Historical Stock Chart

From Jan 2024 to Jan 2025