Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

11 February 2025 - 8:14AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

February 10, 2025

Commission File Number: 001-38159

BRITISH AMERICAN TOBACCO P.L.C.

(Translation of registrant’s name into English)

Globe House

4 Temple Place

London WC2R 2PG

United Kingdom

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

This report includes materials as exhibits that have been published and made available by British American Tobacco p.l.c. (the “Registrant”) as of February 10, 2025.

The information contained in Exhibit 1 to this Form 6-K is incorporated by reference into the Form S-8 Registration Statements File Nos. 333-223678, 333-219440 and 333-237186 of the Registrant and into the Form F-3

Registration Statement File Nos. 333-265958, 333-265958-01, 333-265958-02, 333-265958-03, 333-265958-04 and 333-265958-05 of the Registrant, British American Tobacco Holdings (The Netherlands) B.V., Reynolds American Inc.,

B.A.T. Netherlands Finance B.V., B.A.T. International Finance p.l.c. and B.A.T Capital Corporation, and related Prospectuses, as such Registration Statements and Prospectuses may be amended from time to time.

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

British American Tobacco p.l.c.

|

|

| |

|

|

|

| |

|

|

|

|

|

By:

|

/s/ Christopher Worlock

|

|

| |

|

Name:

|

Christopher Worlock |

|

| |

|

Title:

|

Assistant Secretary

|

|

| |

|

|

|

Date: February 10, 2025

Exhibit 1

British American Tobacco p.l.c.

Board and Committee Changes

Uta Kemmerich-Keil will join the Board of British American Tobacco p.l.c. (BAT) as an independent Non-Executive Director with effect from 17 February 2025 and will be appointed as a member of the Audit and

Nominations Committees.

Uta previously held the role of Chief Executive Officer, Personal Healthcare International at P&G from 2018 to 2020, and prior to that spent 19 years at Merck Group where she held several roles including Chief

Executive Officer, Consumer Health Division, Chief Executive Officer, Allegropharma and Global Business Unit Head, Allergy as well as Head of Corporate M&A, Treasury and Finance. Prior to joining Merck Group, Uta was a Senior Financial Auditor

at Hoechst AG. Uta currently serves as a member of the Supervisory Board and Chair of the Audit Committee at Beiersdorf.

Commenting on the appointment, Luc Jobin, Chair of the Board, said: "I am pleased to welcome Uta Kemmerich-Keil to our Board. Her strong general management background in regulated industries, combined with her

experience in consumer, digital and strategic transformation will be beneficial as BAT continues on its ambition to build a Smokeless World".

BAT also announces that it has received notice from Murray S. Kessler, Non-Executive Director of the Company, that he will step down from the Board with effect from 17 February 2025 to focus on his recent appointment

as Chief Executive Officer of Wellington International LLC.

Commenting on Murray’s departure, Luc Jobin, said: "I would like to thank Murray for his contribution during his tenure and his valuable insights to the Board. We wish him well in this new endeavour."

In light of the above changes, a review of the Company's Board Committees membership has been undertaken. Karen Guerra, a Non-Executive Director of the Company, will join the Remuneration Committee and step down from

the Audit Committee with effect from 10 February 2025.

The Company's Audit Committee and Remuneration Committee membership as at 17 February 2025 is set out below:

|

Audit Committee

|

Remuneration Committee

|

|

Darrell Thomas (Committee Chair)

|

Kandy Anand (Committee Chair)

|

|

Holly Keller Koeppel

|

Karen Guerra

|

|

Uta Kemmerich-Keil

|

Serpil Timuray

|

|

Véronique Laury

|

|

Enquiries:

Media Centre

+44 (0) 20 7845 2888 (24 hours) | @BATplc

Investor Relations

Victoria Buxton: +44 (0)20 7845 2012 | IR_team@bat.com

Additional information

1. This announcement is made in compliance with the Company's obligations under UKLR 6.4.6.

2. In accordance with the Listing Rules, Uta Kemmerich-Keil is Board member of Beiersdorf AG and Karo Healthcare AB (formerly listed as Karo Pharma AB). She was previously a Board member of Biotest AG, Affimed N.V..

There are no additional matters that would require disclosure under UKLR 6.4.8 in respect of this appointment.

Exhibit 2

British American Tobacco p.l.c.

TR-1: Notification of major holdings

|

1a. Identity of the issuer or the underlying issuer of existing shares to which voting rights are attachedii:

|

British American Tobacco p.l.c.

|

|

1b. Please indicate if the issuer is a non-UK issuer (please mark with an “X” if appropriate)

|

|

Non-UK issuer

|

|

|

2. Reason for the notification (please mark the appropriate box or boxes with an “X”)

|

|

An acquisition or disposal of voting rights

|

X

|

|

An acquisition or disposal of financial instruments

|

|

|

An event changing the breakdown of voting rights

|

|

|

Other (please specify)iii:

|

|

|

3. Details of person subject to the notification obligationiv

|

|

Name

|

The Capital Group Companies, Inc.

|

|

City and country of registered office (if applicable)

|

Los Angeles, USA

|

|

4. Full name of shareholder(s) (if different from 3)v

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

Name

|

|

|

City and country of registered office (if applicable)

|

|

|

5. Date on which the threshold was crossed or reachedvi:

|

06/02/2025

|

|

6. Date on which issuer notified (DD/MM/YYYY):

|

07/02/2025

|

|

7. Total positions of person(s) subject to the notification obligation

|

| |

% of voting rights attached to shares (total of 8. A)

|

% of voting rights through financial instruments

(total of 8.B 1 + 8.B 2)

|

Total of both in %

(8.A + 8.B)

|

Total number of voting rights of issuervii

|

|

Resulting situation on the date on which threshold was crossed or reached

|

16.103223

|

0.000000

|

16.103223

|

355299930

|

|

Position of previous notification (if applicable)

|

15.075429

|

0.000000

|

15.075429

|

|

|

8. Notified details of the resulting situation on the date on which the threshold was crossed or reachedviii

|

|

A: Voting rights attached to shares

|

|

Class/type of shares

ISIN code (if possible)

|

Number of voting rightsix

|

% of voting rights

|

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

Direct

(Art 9 of Directive 2004/109/EC) (DTR5.1)

|

Indirect

(Art 10 of Directive 2004/109/EC) (DTR5.2.1)

|

|

GB0002875804 Common Stock

|

|

288893517

|

|

13.093492

|

|

US1104481072 Depository Receipt

|

|

66406413

|

|

3.009731

|

|

SUBTOTAL 8. A

|

355299930

|

16.103223%

|

|

B 1: Financial Instruments according to Art. 13(1)(a) of Directive 2004/109/EC (DTR5.3.1.1 (a))

|

|

Type of financial instrument

|

Expiration

datex

|

Exercise/

Conversion Periodxi

|

Number of voting rights that may be acquired if the instrument is exercised/converted.

|

% of voting rights

|

|

N/A

|

|

|

|

|

| |

|

SUBTOTAL 8. B 1

|

|

|

|

B 2: Financial Instruments with similar economic effect according to Art. 13(1)(b) of Directive 2004/109/EC (DTR5.3.1.1 (b))

|

|

Type of financial instrument

|

Expiration

datex

|

Exercise/

Conversion Period xi

|

Physical or cash settlementxii

|

Number of voting rights

|

% of voting rights

|

| |

|

|

|

|

|

| |

|

|

SUBTOTAL 8.B.2

|

|

|

| |

|

9. Information in relation to the person subject to the notification obligation (please mark the applicable box with an “X”)

|

|

Person subject to the notification obligation is not controlled by any natural person or legal entity and does not control any other undertaking(s) holding directly or indirectly an interest in the (underlying) issuerxiii

|

|

|

Full chain of controlled undertakings through which the voting rights and/or the financial instruments are effectively held starting with the ultimate controlling natural person or legal entityxiv (please add additional rows as necessary)

|

X

|

|

Namexv

|

Name of controlled undertaking

|

% of voting rights if it equals or is higher than the notifiable threshold

|

% of voting rights through financial instruments if it equals or is higher than the notifiable threshold

|

Total of both if it equals or is higher than the notifiable threshold

|

|

The Capital Group Companies, Inc.

|

Capital Research and Management Company

|

15.912291

|

|

15.912291%

|

|

The Capital Group Companies, Inc.

|

Capital International, Inc.

|

|

|

|

|

The Capital Group Companies, Inc.

|

Capital Group Private Client Services, Inc.

|

|

|

|

|

The Capital Group Companies, Inc.

|

Capital International Sarl

|

|

|

|

|

The Capital Group Companies, Inc.

|

Capital International Limited

|

|

|

|

|

|

|

10. In case of proxy voting, please identify:

|

|

Name of the proxy holder

|

|

|

The number and % of voting rights held

|

|

|

The date until which the voting rights will be held

|

|

|

11. Additional informationxvi

|

|

The Capital Group Companies, Inc. (”CGC”) is the parent company of Capital Research and Management Company (”CRMC”) and Capital Bank & Trust Company (”CB&T”). CRMC is a U.S.-based investment management company that serves as

investment manager to the American Funds family of mutual funds, other pooled investment vehicles, as well as individual and institutional clients. CRMC and its investment manager affiliates manage equity assets for various investment

companies through three divisions, Capital Research Global Investors, Capital International Investors and Capital World Investors. CRMC is the parent company of Capital Group International, Inc. (”CGII”), which in turn is the parent company

of six investment management companies (”CGII management companies”): Capital International, Inc., Capital International Limited, Capital International Sàrl, Capital International K.K., Capital Group Private Client Services Inc, and Capital

Group Investment Management Private Limited. CGII management companies primarily serve as investment managers to institutional and high net worth clients. CB&T is a U.S.-based registered investment adviser and an affiliated federally

chartered bank.

Neither CGC nor any of its affiliates own shares of the Issuer for its own account. Rather, the shares reported on this Notification are owned by accounts under the discretionary investment management of one or more of the investment

management companies described above.

|

|

Place of completion

|

Los Angeles

|

|

Date of completion

|

7 February 2025

|

Name of duly authorised officer of issuer responsible for making notification:

Christopher Worlock

Assistant Secretary

British American Tobacco p.l.c.

10 February 2025

Enquiries:

British American Tobacco Media Centre

+44 (0)20 7845 2888 (24 hours) │@BATPlc

Investor Relations

Victoria Buxton: +44 (0)20 7845 2012 | IR_team@bat.com

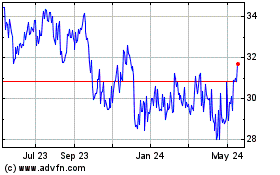

British American Tobacco (PK) (USOTC:BTAFF)

Historical Stock Chart

From Feb 2025 to Mar 2025

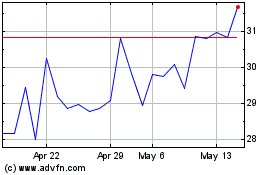

British American Tobacco (PK) (USOTC:BTAFF)

Historical Stock Chart

From Mar 2024 to Mar 2025