Hong Kong Stocks Draw Investors -- WSJ

01 September 2016 - 5:03PM

Dow Jones News

By Anjie Zheng

HONG KONG -- Chinese investors are plowing money into well-known

Hong Kong-listed stocks as they join the global hunt for yield and

safe assets, a trend that points to a change in investing tastes on

the mainland.

The surge of mainland money has helped boost the share prices of

the major Chinese banks listed in Hong Kong, such as Industrial

& Commercial Bank of China Ltd., the world's biggest bank by

assets, and China Construction Bank Corp.

Chinese investors have also piled into blue-chip companies such

as global bank HSBC Holdings PLC and tech giant Tencent Holdings

Ltd. this year, the two biggest components of the index.

Mainland Chinese investors, who can access the Hong Kong market

via a trading link with the Shanghai exchange, have in the past

preferred investing in smaller companies that had high growth

potential but carried plenty of risk.

This year, amid relatively subdued markets -- the Hang Seng is

up 4.85% in 2016 -- Chinese investors have swung toward companies

that may have less exciting prospects but at least pay a decent

dividend. ICBC, for example, yields around 5.6%, while HSBC yields

7.7%. That compares with an average dividend yield of 3.5% for Hang

Seng Index stocks and 2.1% for Shanghai Composite shares.

"Chinese investors last year bought small-caps because they were

chasing capital gains since the market was rallying strongly," said

Edmond Law, an analyst at UOB Kay Hian Research. "This year,

because the market isn't performing as strongly, they are chasing

yield."

Bi-weekly data on the most popular stocks for Chinese funds

buying Hong Kong shares via Shanghai bear out the trend. ICBC's

Hong Kong shares, for example, have been among the 10 most-traded

stocks during 12 two-week periods out of 15 this year, helping push

its share price up 5.3% this year. Over the same period last year,

it was a top-traded stock just once.

One attraction for mainland investors is that shares of

dual-listed Chinese companies, particularly banks, are often

cheaper in Hong Kong, where they are known as H-shares, than in

Shanghai, where they are called A-shares. ICBC trades at a 5.1%

discount in Hong Kong, for example, while China Construction Bank

Corp. and Agricultural Bank of China Ltd. trade at 4.9% and 16.8%

discounts, respectively. Hong Kong-listed shares of China

Construction Bank are up 9.2% this year, while Agricultural Bank is

up 0.6%.

The difference means the yield is higher in Hong Kong -- an

increasingly important consideration for mainland investors,

according to Qi Wang, chief executive at MegaTrust Investments, a

mainland-based fund manager.

The shift into high-dividend stocks is "not a temporary market

change like picking different sectors every month," Mr. Wang said.

"It's a long-term secular change. Very few A-shares pay dividends.

So investors are desperately seeking higher yield. This is

something we're seeing in both A- and H-share markets."

There is little clear data on what type of mainland investors

are leading the charge into major Hong Kong-listed stocks. However,

the trend appears to be driven in part by large institutional

investors such as insurance and pension funds, because Chinese

retail investors are still less focused on high-yield stocks,

according to Jian Shi Cortesi, China fund manager at GAM Holding

AG, which manages $115.49 billion globally.

Chinese investors' hunt for yield has helped so-called

southbound investment flows from Shanghai to Hong Kong via the

Stock Connect system to outweigh those going in the other direction

this year. And analysts expect that more money could start to flow

from the mainland into Hong Kong later this year, when a new

trading link between Hong Kong and the Shenzhen Stock Exchange is

opened.

For sure, Chinese investors have other reasons to invest in Hong

Kong. Often it is the only place they can buy shares in major

Chinese brands that don't have a listing at home, such as Tencent,

electric-vehicle maker Geely Automobile Holdings Ltd., telecom

giant China Mobile Ltd. and casino operator Sands China Ltd.

Some Chinese investors have also looked to invest in Hong Kong

to act as a defense against currency depreciation. The yuan has

dropped 7% in the past year against the U.S. dollar. The Hong Kong

dollar is pegged to the greenback.

"High-yielding bank stocks are being used as a proxy against the

weakening yuan," said Wendy Liu, equity strategist at Nomura

Holdings Inc.

Write to Anjie Zheng at Anjie.Zheng@wsj.com

(END) Dow Jones Newswires

September 01, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

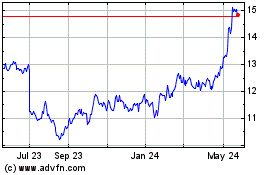

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Dec 2024 to Jan 2025

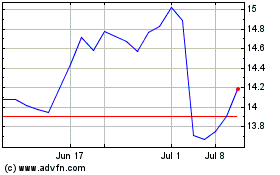

China Construction Bank (PK) (USOTC:CICHY)

Historical Stock Chart

From Jan 2024 to Jan 2025