false

0001391426

0001391426

2023-10-26

2023-10-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October

26, 2023

Clean

Vision Corporation

(Exact

name of registrant as specified in its charter)

| Nevada |

|

024-11501 |

|

85-1449444 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

2711

N. Sepulveda Blvd. Suite

1051

Manhattan

Beach, CA

90266

(Address

of Principal Executive Offices) (Zip Code)

(424)

835-1845

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on

which registered |

| N/A |

|

N/A |

|

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01. Entry into a Material Definitive Agreement.

On October 26, 2023, Clean Vision Corporation (the

“Company”) entered into a Securities Purchase Agreement (the “Agreement”) with an accredited investor (the “Purchaser”)

related to the Company’s sale of two 12% convertible notes in the aggregate principal amount of $660,000 (each note being in the

amount of $330,000 and containing an original issue discount of $30,000 such that the purchase price of each note is $300,000) (each a

“Note,” and together the “Notes”) convertible into shares of the Company’s common stock, par value $0.001

per share (the “Common Stock”), upon the terms and subject to the limitations set forth in each Note. The Company issued and

sold the first Note (the “First Note”) on October 26, 2023 (the “First Closing Date” or the “First Issuance

Date”). The closing for the second Note (the “Second Note”) is to occur approximately 30-60 days following the First

Closing Date (the “Second Closing Date,” and together with the First Closing Date, the “Closing Date”).

On the First Closing Date, the Company issued 800,000

restricted shares of Common Stock to the Purchaser as additional consideration for the purchase of the First Note (the “First Note

Commitment Shares”). Upon the closing of the Second Note, the Company will issue additional commitment shares in an amount calculated

based on the price per share of the Common Stock at the time of funding of such Second Note (the “Second Note Commitment Shares,”

and together with the First Note Commitment Shares, the “Commitment Shares”). In addition to the Commitment Shares, the Company

agreed to issue 7,500,000 shares of Common Stock to the Purchaser (the “Returnable Shares”) for each Note. Each issuance of

Returnable Shares is subject to recalculation based on the price per share of Common Stock at the time of funding for each Note, such

that the economic value of each set of Returnable Shares shall be equal to the value of the initial set of Returnable Shares. For example,

if on the Second Closing Date, the closing price of the Common Stock is 50% of the closing price of the Common Stock on the First Closing

Date, the Company will be required to issue 15,000,000 Returnable Shares on the Second Note Closing Date. The Returnable Shares must be

returned to the Company unless each Note enters into an uncured default during its term, or the Company is otherwise unable to repay each

Note on or prior to maturity.

While any portion of a Note is outstanding, if the

Company consummates aggregate financing in excess of $2,000,000 in one more closings, from the issuance of securities pursuant to a registration

statement or the Company’s sale of any convertible securities, the Company shall, within one (1) business day of the Company’s

receipt of such proceeds, inform the Purchaser of such receipt, following which the Purchaser shall have the right in its sole discretion

to require the Company to immediately apply one hundred percent (100%) of such proceeds to repay all or any portion of the outstanding

amounts owed under either Note. In the event that such proceeds are received by the Purchaser prior to the applicable Note’s maturity

date, the required prepayment shall be subject to all prepayment terms in the Note (if any).

The principal amount of each Note is $330,000 (the

“Principal”), with an original issue discount of $30,000, resulting in a purchase price of $300,000 for each Note. Each Note

carries guaranteed interest in the amount of twelve percent (12%) per calendar year from the date of issuance of each such Note (the “Interest”).

All Principal and Interest owing under the First Note is due and payable on July 26, 2024 (the “First Note Maturity Date”).

A lump-sum interest payment equal to $39,600 shall be immediately due on the First Issuance Date and shall be added to the principal balance

and payable on the First Note Maturity Date or upon acceleration or by prepayment or otherwise, notwithstanding the number of days which

the Principal is outstanding. Principal payments shall be made in four (4) installments, each in the amount of $75,000 commencing on the

one hundred eightieth (180th) daily anniversary following the First Issuance Date and continuing thereafter each thirty (30)

days for four (4) months thereafter. Notwithstanding anything in the First Note to the contrary, the final payment of Principal and Interest

shall be due on the First Note Maturity Date. Any amount of Principal or Interest on

the First Note which is not paid when due shall bear interest at the rate of the lesser of (i) twenty four percent (24%) per annum (which

shall be guaranteed and applied to the balance due under the First Note upon an Event of Default (as defined below)) and (ii) the maximum

amount permitted under law from the due date thereof until the same is paid (the “Default Interest”).

The First Note

sets forth certain standard events of default (each such event, an “Event of Default”), which, upon such Event of Default,

the First Note shall become immediately and automatically due and payable by the Company in an amount equal to the then outstanding Principal,

plus (x) accrued and unpaid Interest on the unpaid Principal to the date of payment (the “Mandatory Prepayment Date”),

plus (y) Default Interest, if any, plus (z) any amounts owed to the Purchaser pursuant to Sections 1.3 and 1.4(g) of the

First Note, multiplied by one point five (1.5).

The Purchaser has the right at any

time following an Event of Default, and ending on the date of payment of the Default Amount (as defined in Article III of the First Note),

to convert all or any part of the outstanding and unpaid Principal, Interest, penalties and all other amounts due under the First Note

into fully paid and non-assessable shares of Common Stock, as such Common Stock exists on the on the First Issuance Date, or any shares

of capital stock or other securities of the Company into which such Common Stock shall thereafter be changed or reclassified at the Conversion

Price (as defined below) determined as provided in the First Note (a “Conversion”); provided, however, that

in no event shall the Purchaser be entitled to convert any portion of the First Note in excess of that portion of the First Note upon

conversion of which the sum of (1) the number of shares of Common Stock beneficially owned by the Purchaser and its affiliates (other

than shares of Common Stock which may be deemed beneficially owned through the ownership of the unconverted portion of the Notes or the

unexercised or unconverted portion of any other security of the Purchaser subject to a limitation on conversion or exercise analogous

to the limitations contained in the First Note) and (2) the number of shares of Common Stock issuable upon the conversion of the portion

of the First Note with respect to which the determination of this proviso is being made, would result in beneficial ownership by the Purchaser

and its affiliates of more than 4.99% of the outstanding shares of Common Stock.

The number of shares of Common Stock

to be issued upon each conversion of the First Note shall be determined by dividing the Conversion Amount (as defined below) by the applicable

Conversion Price then in effect on the date specified in the notice of conversion delivered to the Company by the Purchaser. The “Conversion

Price” is equal to, subject to adjustments as described in the First Note, $0.025 per share (the “Fixed Price”). Provided,

however, that in the event the Common Stock trades (i) below $0.02 per share for more than five (5) consecutive trading days, then the

Fixed Price shall be lowered to equal to $0.0145 per share, (ii) below $0.0145 per share for more than for more than five (5) consecutive

trading days, then the Fixed Price shall be eliminated and the Conversion Price shall reset to the lowest traded price of the default

period, and shall be re-adjusted every 21 days the First Note remains in default such that if the trading price of the Common Stock is

lower 21 days later, the Purchaser may avail itself of the resulting lower conversion price. The “Conversion Amount” means,

with respect to any conversion of the First Note, the sum of (a) the principal amount of the First Note to be converted in such conversion

plus (b) at the Purchaser’s option, accrued and unpaid interest, if any, on such principal amount at the interest rates provided

in the First Note to the date of such conversion; provided, however, that the Company shall have the right to pay any or

all interest in cash, plus (c) at the Purchaser’s option, Default Interest, if any, on the amounts referred to in the immediately

preceding clauses (a) and/or (b), plus (d) at the Purchaser’s option, any amounts owed to the Purchaser pursuant to Sections

1.3 and 1.4(g) of the First Note.

The material terms of the Second Note

are expected to be as set forth in the First Note. Pursuant to the terms and provisions of the Agreement, the Second Note is expected

to be issued approximately 30-40 days following the First Closing Date.

All

capitalized terms not defined herein shall have their respective meanings as set forth in the Agreement and the Notes. The foregoing descriptions

of the Agreement and Note do not purport to be complete and each is qualified in its entirety by reference to the form of the Agreement

and the Note, each attached to this Current Report on Form 8-K as Exhibits 10.1 and 4.1, respectively.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

CLEAN VISION CORPORATION |

| |

|

| Date: December 12, 2023 |

By: |

/s/

Daniel Bates |

| |

Name: |

Daniel Bates |

| |

Title: |

Chief Executive Officer |

Exhibit 4.1

Exhibit 10.1

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

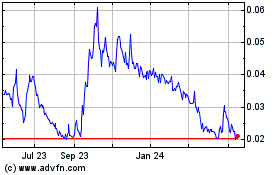

Clean Vision (QB) (USOTC:CLNV)

Historical Stock Chart

From Mar 2024 to Apr 2024

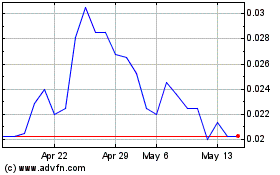

Clean Vision (QB) (USOTC:CLNV)

Historical Stock Chart

From Apr 2023 to Apr 2024