true

This amendment is being filed to comply with regulations.

0001391426

false

0001391426

2023-01-01

2023-09-30

0001391426

2023-09-30

0001391426

2022-12-31

0001391426

us-gaap:SeriesBPreferredStockMember

2023-09-30

0001391426

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001391426

us-gaap:SeriesAPreferredStockMember

2023-09-30

0001391426

us-gaap:SeriesAPreferredStockMember

2022-12-31

0001391426

us-gaap:SeriesCPreferredStockMember

2023-09-30

0001391426

us-gaap:SeriesCPreferredStockMember

2022-12-31

0001391426

2023-07-01

2023-09-30

0001391426

2022-07-01

2022-09-30

0001391426

2022-01-01

2022-09-30

0001391426

us-gaap:CommonStockMember

2022-12-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-12-31

0001391426

us-gaap:RetainedEarningsMember

2022-12-31

0001391426

us-gaap:NoncontrollingInterestMember

2022-12-31

0001391426

us-gaap:SeriesCPreferredStockMember

2021-12-31

0001391426

us-gaap:SeriesAPreferredStockMember

2023-03-31

0001391426

us-gaap:SeriesCPreferredStockMember

2023-03-31

0001391426

us-gaap:CommonStockMember

2023-03-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001391426

us-gaap:RetainedEarningsMember

2023-03-31

0001391426

us-gaap:NoncontrollingInterestMember

2023-03-31

0001391426

2023-03-31

0001391426

us-gaap:SeriesAPreferredStockMember

2023-06-30

0001391426

us-gaap:SeriesCPreferredStockMember

2023-06-30

0001391426

us-gaap:CommonStockMember

2023-06-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001391426

us-gaap:RetainedEarningsMember

2023-06-30

0001391426

us-gaap:NoncontrollingInterestMember

2023-06-30

0001391426

2023-06-30

0001391426

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001391426

us-gaap:CommonStockMember

2021-12-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001391426

us-gaap:RetainedEarningsMember

2021-12-31

0001391426

2021-12-31

0001391426

us-gaap:SeriesAPreferredStockMember

2022-03-31

0001391426

us-gaap:SeriesCPreferredStockMember

2022-03-31

0001391426

us-gaap:CommonStockMember

2022-03-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001391426

us-gaap:RetainedEarningsMember

2022-03-31

0001391426

2022-03-31

0001391426

us-gaap:SeriesAPreferredStockMember

2022-06-30

0001391426

us-gaap:SeriesCPreferredStockMember

2022-06-30

0001391426

us-gaap:CommonStockMember

2022-06-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001391426

us-gaap:RetainedEarningsMember

2022-06-30

0001391426

2022-06-30

0001391426

us-gaap:SeriesAPreferredStockMember

2023-01-01

2023-03-31

0001391426

us-gaap:SeriesCPreferredStockMember

2023-01-01

2023-03-31

0001391426

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-01-01

2023-03-31

0001391426

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001391426

us-gaap:NoncontrollingInterestMember

2023-01-01

2023-03-31

0001391426

2023-01-01

2023-03-31

0001391426

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001391426

us-gaap:SeriesAPreferredStockMember

2023-04-01

2023-06-30

0001391426

us-gaap:SeriesCPreferredStockMember

2023-04-01

2023-06-30

0001391426

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001391426

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001391426

us-gaap:NoncontrollingInterestMember

2023-04-01

2023-06-30

0001391426

2023-04-01

2023-06-30

0001391426

us-gaap:SeriesAPreferredStockMember

2023-07-01

2023-09-30

0001391426

us-gaap:SeriesCPreferredStockMember

2023-07-01

2023-09-30

0001391426

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0001391426

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001391426

us-gaap:NoncontrollingInterestMember

2023-07-01

2023-09-30

0001391426

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-03-31

0001391426

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-03-31

0001391426

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001391426

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001391426

2022-01-01

2022-03-31

0001391426

us-gaap:SeriesAPreferredStockMember

2022-04-01

2022-06-30

0001391426

us-gaap:SeriesCPreferredStockMember

2022-04-01

2022-06-30

0001391426

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001391426

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001391426

2022-04-01

2022-06-30

0001391426

us-gaap:SeriesAPreferredStockMember

2022-07-01

2022-09-30

0001391426

us-gaap:SeriesCPreferredStockMember

2022-07-01

2022-09-30

0001391426

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001391426

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001391426

us-gaap:CommonStockMember

2023-09-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001391426

us-gaap:RetainedEarningsMember

2023-09-30

0001391426

us-gaap:NoncontrollingInterestMember

2023-09-30

0001391426

us-gaap:SeriesAPreferredStockMember

2022-09-30

0001391426

us-gaap:SeriesCPreferredStockMember

2022-09-30

0001391426

us-gaap:CommonStockMember

2022-09-30

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001391426

us-gaap:RetainedEarningsMember

2022-09-30

0001391426

2022-09-30

0001391426

2022-01-01

2022-12-31

0001391426

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel1Member

2023-09-30

0001391426

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel2Member

2023-09-30

0001391426

us-gaap:DerivativeMember

us-gaap:FairValueInputsLevel3Member

2023-09-30

0001391426

us-gaap:FairValueInputsLevel1Member

2023-09-30

0001391426

us-gaap:FairValueInputsLevel2Member

2023-09-30

0001391426

us-gaap:FairValueInputsLevel3Member

2023-09-30

0001391426

CLNV:PyrolysisUnitMember

2023-09-30

0001391426

CLNV:PyrolysisUnitMember

2022-12-31

0001391426

us-gaap:EquipmentMember

2023-09-30

0001391426

us-gaap:EquipmentMember

2022-12-31

0001391426

CLNV:CleanSeasMorocoMember

2023-09-30

0001391426

CLNV:CleanSeasMorocoMember

2022-12-31

0001391426

CLNV:SilverbackCapitalCorporationMember

2023-01-01

2023-09-30

0001391426

CLNV:SilverbackCapitalCorporationMember

2022-01-01

2022-12-31

0001391426

CLNV:CoventryEnterprisesLLCMember

2023-01-01

2023-09-30

0001391426

CLNV:CoventryEnterprisesLLCMember

2022-01-01

2022-12-31

0001391426

CLNV:WalleyeOpportunitiesFundMember

2023-01-01

2023-09-30

0001391426

CLNV:WalleyeOpportunitiesFundMember

2022-01-01

2022-12-31

0001391426

CLNV:WalleyeOpportunitiesFundOneMember

2023-01-01

2023-09-30

0001391426

CLNV:WalleyeOpportunitiesFundFirstMember

2023-01-01

2023-09-30

0001391426

CLNV:WalleyeOpportunitiesFundFirstMember

2022-01-01

2022-12-31

0001391426

CLNV:WalleyeOpportunitiesFundSecondMember

2023-01-01

2023-09-30

0001391426

CLNV:WalleyeOpportunitiesFundSecondMember

2022-01-01

2022-12-31

0001391426

CLNV:CoventryEnterprisesLLC1Member

2023-01-01

2023-09-30

0001391426

CLNV:InitialValuationMember

srt:MinimumMember

2023-09-30

0001391426

CLNV:InitialValuationMember

srt:MaximumMember

2023-09-30

0001391426

CLNV:InitialValuationMember

srt:MinimumMember

2023-01-01

2023-09-30

0001391426

CLNV:InitialValuationMember

srt:MaximumMember

2023-01-01

2023-09-30

0001391426

2023-01-01

2023-06-30

0001391426

CLNV:JohnShawMember

2023-01-01

2023-09-30

0001391426

CLNV:ChrisGalazziMember

2023-01-01

2023-09-30

0001391426

CLNV:VenkatKumarTangiralaMember

2023-01-01

2023-09-30

0001391426

CLNV:AlpenGroupLLCMember

2023-01-01

2023-09-30

0001391426

CLNV:StrategicInnovationsMember

2023-01-01

2023-09-30

0001391426

CLNV:FraxonMarketingMember

2023-01-01

2023-09-30

0001391426

CLNV:LeonardTuckerLLCMember

2022-01-01

2022-12-31

0001391426

CLNV:JohnShawMember

2022-01-01

2022-12-31

0001391426

CLNV:StrategicInnovationsMember

2022-01-01

2022-12-31

0001391426

CLNV:ChrisGalazziMember

2022-01-01

2022-12-31

0001391426

CLNV:VenkatKumarTangiralaMember

2022-01-01

2022-12-31

0001391426

CLNV:AlpenGroupLLCMember

2022-01-01

2022-12-31

0001391426

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001391426

2021-01-01

2021-12-31

0001391426

us-gaap:SeriesAPreferredStockMember

2020-12-31

0001391426

us-gaap:SeriesCPreferredStockMember

2020-12-31

0001391426

us-gaap:CommonStockMember

2020-12-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-12-31

0001391426

us-gaap:RetainedEarningsMember

2020-12-31

0001391426

2020-12-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-12-31

0001391426

us-gaap:SeriesAPreferredStockMember

2021-01-01

2021-12-31

0001391426

us-gaap:SeriesCPreferredStockMember

2021-01-01

2021-12-31

0001391426

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2021-01-01

2021-12-31

0001391426

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001391426

us-gaap:SeriesAPreferredStockMember

2022-01-01

2022-12-31

0001391426

us-gaap:SeriesCPreferredStockMember

2022-01-01

2022-12-31

0001391426

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001391426

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001391426

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-01-01

2022-12-31

0001391426

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001391426

CLNV:PyrolysisUnitMember

2021-12-31

0001391426

us-gaap:EquipmentMember

2021-12-31

0001391426

us-gaap:WarrantMember

2022-12-31

0001391426

us-gaap:WarrantMember

2022-01-01

2022-12-31

0001391426

CLNV:WarrantOneMember

2022-12-31

0001391426

CLNV:WarrantOneMember

2022-01-01

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As filed

with the Securities and Exchange Commission on December 15, 2023

Registration No. 333-275286

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

S-1/A

AMENDMENT

NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES

ACT OF 1933

CLEAN

VISION CORPORATION

(Exact Name of

Registrant as Specified in Its Charter)

| Nevada |

|

7389 |

|

85–1449444 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

2711 N. Sepulveda

Blvd. #1051

Manhattan Beach,

CA 90266

(424)

835-1845

(Address, Including

Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Mr. Daniel Bates

Chief Executive

Officer

2711 N. Sepulveda

Blvd. #1051

Manhattan Beach,

CA 90266

(424)

835-1845

(Name, Address,

Including Zip Code, and Telephone Number, Including Area Code,

of Agent for Service)

Copies to:

Joseph

M. Lucosky, Esq.

Lucosky Brookman

LLP

101 Wood Avenue

South, 5th Floor

Woodbridge,

NJ 08830

Tel: (732)

395-4400 |

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. [X]

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

growth company |

☒ |

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The registrant

hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant

shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the SEC, acting pursuant

to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED:

DECEMBER 15, 2023 |

CLEAN VISION CORPORATION

Up to 19,000,000

Shares of Common Stock

This prospectus relates

to the resale, from time to time, of up to 19,000,000 shares (the “Shares”) of common stock, par value $0.001 per share (the

“Common Stock”), of Clean Vision Corporation, a Nevada corporation (the “Company”, “we”, “us”

or “our”), by the selling shareholders identified in this prospectus under “Selling

Shareholders” (the “Offering”), comprised of: (i) 10,000,000 Shares to be

issued to Dorado Goose, LLC (“Dorado”)

pursuant to that certain Securities Purchase Agreement, dated September 26, 2023, by and between the Company and Dorado (the “Dorado

Purchase Agreement”); and (ii) up to 9,000,000 Shares issuable upon exercise of that certain Warrant to Purchase up to 9,000,000

Shares of Common Stock (the “Silverback Warrant”), exercisable issued to Silverback Capital Corporation (“Silverback”

and, together with Dorado, the “Selling Shareholders”) pursuant to that certain Securities Purchase Agreement, dated March

31, 2022, between the Company and Silverback (the “Silverback Purchase Agreement”).

We are not selling

any shares of our Common Stock under this prospectus and will not receive any proceeds from the sale of the Shares. We will, however,

receive proceeds from the Silverback Warrant if exercised through the payment of the exercise price

in cash by Silverback. The Selling Shareholders will bear all commissions and discounts,

if any, attributable to the sale of the Shares. We will bear all costs, expenses and fees in connection with the registration of the

Shares.

The Selling Shareholders

may sell the shares of Common Stock described

in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more information about

how the Selling Shareholders may sell the Shares being registered pursuant to this prospectus.

The prices at which

the Selling Shareholders may sell the Shares in this Offering will be determined by the prevailing market prices for the shares of Common

Shares or in negotiated transactions.

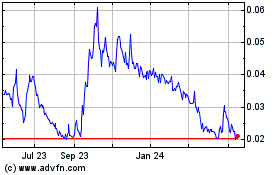

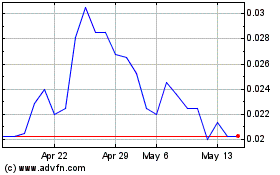

Our Common Stock is quoted on the OTCQB Market maintained

by OTC Markets Group, Inc. (“OTC Markets”), under the symbol “CLNV”. On December 14, 2023, the last reported

sale price of the Common Stock on the OTCQB Market was $0.0425 per share.

There has been a

very limited market for our securities. While our Common Stock is quoted on the OTC Markets, there has been negligible trading volume.

There is no guarantee that an active trading market will develop in our securities.

Following the

effectiveness of the registration statement of which this prospectus forms a part, the sale and distribution of securities offered hereby

may be effected from time to time in one or more transactions that may take place on the OTC Markets (or such other market or quotation

system on which our Common Stock is then listed or quoted), including ordinary brokers’ transactions, privately negotiated transactions

or through sales to one or more dealers for resale of such securities as principals, at market prices prevailing at the time of sale,

at prices related to such prevailing market prices or at negotiated prices. Usual and customary or specifically negotiated brokerage

fees or commissions may be paid by the Selling Shareholders.

This prospectus describes the general manner in which

the Shares may be offered and sold by any Selling Shareholder. When the Selling Shareholders sell Shares under this prospectus, we may,

if necessary and required by law, provide a prospectus supplement that will contain specific information about the terms of that offering.

Any prospectus supplement may also add to, update, modify or replace information contained in this prospectus. We urge you to carefully

read this prospectus, any accompanying prospectus supplement and any documents we incorporate

by reference into this prospectus and any accompanying prospectus supplement before you make your investment decision.

Investing in our

securities involves risks. See “Risk Factors” beginning on page 13 of this prospectus. We and our board of directors are

not making any recommendation regarding the exercise of your rights.

Neither the United

States Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of

these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We are an “emerging

growth company” under applicable SEC rules and will be subject to reduced public company reporting requirements.

An investment in our Common Stock involves

significant risks. You should carefully consider the risk factors set forth under “Risk Factors”, beginning on page 25 of

this prospectus before you make your decision to invest in this Offering and in our securities.

The date of this

prospectus is , 2023

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

You should rely only

on the information contained in this prospectus. Neither we, nor any of the Selling Shareholders, have authorized any other person, to

provide you with information that is different from that contained in this prospectus. If anyone provides you with different or inconsistent

information, you should not rely on it. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give you. You should assume that the information contained in this prospectus is accurate only as of the

date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our securities. Our business, financial

condition, results of operations and prospects may have changed since that date.

For investors outside

the United States: Neither we nor any of the Selling Shareholders have taken any action that would permit this Offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons

outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating

to, the Offering of the securities covered hereby and the distribution of this prospectus outside of the United States.

The information in

this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of

operations and prospects may have changed since those dates.

TRADEMARKS

We own directly, or have rights to, trademarks, service

marks, and trade names that we use in the operation of our business, such as AquaH®.

In addition, our names, logos, and website names and addresses are our service marks or trademarks. Other trademarks, service marks,

and trade names appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks, service

marks, trade names, and copyrights referred to in this prospectus are listed without the ©, ®, and ™ symbols, but we

will assert, to the fullest extent under applicable law, our rights, the rights of our parent company, or the rights of the applicable

licensors to these trademarks, service marks, and trade names.

CAUTIONARY NOTE

REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains

“forward-looking statements.” We use words such as “could,” “may,” “might,” “will,”

“expect,” “likely,” “believe,” “continue,” “anticipate,” “estimate,”

“intend,” “plan,” “project,” and other similar expressions to identify some forward-looking statements,

but not all forward-looking statements include these words. All of our forward-looking statements involve estimates and uncertainties

that could cause actual results to differ materially from those expressed in the forward-looking statements. Accordingly, any such statements

are qualified in their entirety by reference to the information described under the caption “Risk Factors” and elsewhere

in this prospectus.

The forward-looking

statements contained in this prospectus are based on assumptions that we have made in light of our industry experience and our perceptions

of historical trends, current conditions, expected future developments, and other factors we believe are appropriate under the circumstances.

As you read and consider this prospectus, you should understand that these statements are not guarantees of performance or results. They

involve risks, uncertainties (many of which are beyond our control), and assumptions. Although we believe that these forward-looking

statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial

performance and cause our performance to differ materially from the performance anticipated in the forward-looking statements. We believe

these factors include, but are not limited to, those described under “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations.” Should one or more of these risks or uncertainties materialize,

or should any of these assumptions prove incorrect, our actual operating and financial performance may vary in material respects from

the performance projected in these forward-looking statements.

Further, any forward-looking

statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking

statement contained in this prospectus to reflect events or circumstances after the date on which it is made or to reflect the occurrence

of anticipated or unanticipated events or circumstances. New factors that could cause our business not to develop as we expect emerge

from time to time, and it is not possible for us to predict all of them. Further, we cannot assess the impact of each currently known

or new factor on our results of operations or the extent to which any factor, or combination of factors, may cause actual results to

differ materially from those contained in any forward-looking statements.

The

forward-looking statements contained in this prospectus are set forth principally in “Risk Factors,” “Management’s

Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and other sections

in our PERIODIC FILINGS WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION and in “Management’s Discussion

and Analysis of Financial Condition and Results of Operations,” “Risk Factors” and other sections in our

Latest Form 10-Q. In addition, there may be events in the future that we are not able to predict accurately or control which may cause

actual results to differ materially from expectations expressed or implied by forward-looking statements. Please consider our forward-looking

statements in light of these risks as you read this prospectus.

MARKET, INDUSTRY

AND OTHER DATA

Unless otherwise

indicated, information in this prospectus concerning economic conditions, our industry, our markets and our competitive position is based

on a variety of sources, including information from third-party industry analysts and publications and our own estimates and research.

Some of the industry and market data contained in this prospectus are based on third-party industry publications. This information involves

a number of assumptions, estimates and limitations.

The industry publications,

surveys and forecasts and other public information generally indicate or suggest that their information has been obtained from sources

believed to be reliable. None of the third-party industry publications used in this prospectus were prepared on our behalf. The industry

in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk

Factors” in this prospectus. These and other factors could cause results to differ materially from those expressed in these publications.

Our internal data

and estimates are based upon information obtained from trade and business organizations and other contacts in the markets in which we

operate and our management’s understanding of industry conditions. Although we believe that such information is reliable, we have

not had this information verified by any independent sources.

Prospectus

Summary

This

summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information that

you should consider before investing in our securities. You should carefully read the entire prospectus including “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our Financial Statements

and the related notes included elsewhere in this prospectus, before making an investment decision. Unless the context otherwise requires,

the terms “Clean Vision,” “the company,” “we,” “us” and “our” in this prospectus

refer to Clean Vision Corporation and its consolidated subsidiaries.

Overview

We are a new entrant in the clean energy and waste-to-value

industries focused on clean technology and sustainability opportunities. By leveraging innovative technology, we aim to responsibly

resolve environmental challenges by producing valuable products and strive to be recognized as an environmental, social and governance

company (“ESG”). Currently, we are focused on providing a solution to the plastic waste problem by converting plastic waste

into saleable byproducts, such as precursors used in the production of new plastic products, hydrogen and other clean-burning fuels that

can be used to generate clean energy. Using a technology known as pyrolysis, which heats the feedstock (i.e., plastic waste) at

high temperatures in the absence of oxygen so that the material does not burn, we are able to convert the plastic feedstock into (i)

low-sulfur fuels, (ii) clean hydrogen (specifically, the Company’s clean hydrogen, AquaH®,

which trademark was issued by the United States Patent and Trademark Office (the “USPTO”)

on November 8, 2023, and (iii) carbon char. Our business

model is focused on generating revenue from the following sources:

(i) Service revenue from the recycling services

we provide. We plan to establish plastic feedstock agreements with a number of feedstock suppliers for the delivery of plastic

to our facilities. Much of this plastic is currently a cost center for such feedstock suppliers, who pay "tipping fees" to landfills

or incinerators. We will accept this plastic feedstock at reduced price or for no tipping fees. In some cases, feedstock suppliers

will also share in revenue on products produced from their feedstock. This revenue will be realized and recognized upon receipt

of feedstock at one of our facilities.

(ii) Revenue generated from the sale of commodities. We

will produce commodities including, but not limited to, pyrolysis oil, fuel oil, lubricants, synthetic gas, hydrogen, and carbon char.

We are in negotiation with chemical and oil companies for purchasing, or off-taking, the fuels and oils we produce, and exploring applications

for carbon char. This revenue will be recognized upon shipment of products from one of our facilities and in some cases off-takers may

pre-pay for a contractual obligation to buy our commodities.

(iii) Revenue generated from the sale of

environmental credits. Our products are eligible for numerous environmental credits, including, but not limited to, carbon credits,

plastic credits, and biodiversity credits. These credits may be monetized directly on the relevant markets or may be realized as value-add

to off-takers, who will pay a premium for eligible products. Revenue from these credits will be recognized upon sale of applicable environmental

credits on recognized markets, and/or upon sale of commodities to off-takers when that off-take includes an environmental credit premium.

(iv) Revenue generated from royalties and/or

the sale of equipment. We expect to develop or acquire intellectual property which could generate revenue through royalties

and/or sales of manufactured equipment. Revenue may be recognized upon the terms of a contracted sale agreement.

As of September

30, 2023, our operations in Morocco, which are currently our only source of revenue,

had generated $188,205 in revenue, with a gross margin of $165,932

from the provision of pyrolysis services and sale of its

of byproducts.

Our mission is to aid in solving the problem of cost-effectively

upcycling the vast amount of waste plastic generated on land before it flows into the world’s oceans.

According to analysis and projections reported by

the U.S. Energy Information Administration (“EIA”) on April 7, 2022, it is estimated that 98.3 million barrels per day of

petroleum and liquid fuels were consumed globally in March 2022, an increase of 2.4 million barrels per day from March 2021. The EIA estimates

that global consumption of petroleum and liquid fuels will rise by 1.9 million barrels per day in 2023 to average 101.7 million barrels

per day.

In a report published by Markets and Markets Research

in February 2021 entitled “Hydrogen Generation Market by Application (Petroleum Refinery, Ammonia & Methanol production, Transportation,

Power Generation), Generation & Delivery Mode (Captive, Merchant), Source (Blue, Green & Grey Hydrogen), Technology, and Region-Forecast

to 2025,” the global hydrogen generation market is projected to reach $201 billion by 2025 from an estimated $130 billion in 2020,

at a compound annual growth rate (CAGR) of 9.2% during the forecast period. While the global green hydrogen market was valued at approximately

$0.8 billion in 2021, it is predicted to grow to about $10.2 billion by 2028, with a CAGR of approximately 55.2% over the projection period,

according to research and analysis published by Facts and Factors in March 2022 entitled “Green Hydrogen Market By Type (Solid Oxide

Electrolyzer, Alkaline Electrolyzer, and Proton Exchange Membrane Electrolyzer), By Use (Transport, Power Generation, and Others) By Customer

(Petrochemicals, Glass, Food & Beverages, Chemical, Medical, and Others), and By Region - Global and Regional Industry Overview, Market

Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022-2028.”

We believe that in the near future, a significant

growth sector of the economy will be in clean energy and sustainable products and services. This belief was a key factor in our shift

in our business focus in May 2020 and our acquisition of Clean-Seas, Inc. (“Clean-Seas”) which became our wholly owned subsidiary

on May 19, 2020. Clean-Seas believes that it has made significant progress in identifying and developing a new business model around

the clean energy and waste-to-value sectors.

Clean Vision was established in 2017 as a company

focused on the acquisition of disruptive technologies that will impact the digital economy. The Company, which was formerly known as Byzen

Digital Inc., changed its corporate name to Clean Vision on March 12, 2021.

We are now a holding company and currently operate

through our wholly owned subsidiary, Clean-Seas, which we acquired on May 19, 2020. Clean-Seas acquired its first pyrolysis unit in November

2021 for use in a pilot project in India, which began operations in early May 2022. On April 25, 2023 (the “Morocco Closing Date”),

Clean-Seas completed its acquisition of a fifty-one percent (51%) interest in EcoSynergie S.A.R.L., a limited liability company

organized under the laws of Morocco (“EcoSynergie”). On the Morocco Closing Date, (i) EcoSynergie’s name

was changed to Clean-Seas Morocco, LLC (“Clean-Seas Morocco”), (ii) Mrs. Halima Aboudeine and Mr. Daniel C. Harris, the Company’s

Chief Revenue Officer (“CRO”), were appointed as managers of Clean-Seas Morocco and (iii) Mr. Harris was appointed to serve

as the Chief Executive Officer of Clean-Seas Morocco. Clean-Seas Morocco began operations at its pyrolysis facility in Agadir, Morocco,

in April 2023, which currently has capacity to convert 20 tons per day (“TPD”) of waste plastic through pyrolysis.

Clean

Vision’s Purpose

We believe it is

no secret that global plastic waste recycling is facing unprecedented challenges. We believe that inadequate processing infrastructure,

fewer processing locales, changing laws and conventions, and political circumstances imperil what is already a deficient response to

a global problem. Developed nations, including the United States, the world’s largest generator of plastic waste, are finding disposal

of this waste increasingly difficult, due to expensive and inefficient processing capabilities; global conventions responding to environmental

implications of international plastic export; and political constraints. In January 2019, the People’s Republic of China,

which had been accepting plastic waste from countries including the U.S., implemented its National Sword policy limiting recyclable waste

imports. As a result, the worldwide recyclables market experienced drastic limits, fewer options for disposal, resulting in a global

backlog of plastic waste. Some of the recyclable material has been rerouted to Southeast Asian countries but the market remains in upheaval,

with, at best, plastic waste floating in waiting ships and at worst, illegal dumping into international waters or incinerated.

According to an article

published by the United Nations Environment Programme (“UNEP”) on March 2, 2022, entitled “What you need to know about

the plastic pollution resolution,” the world currently produces approximately 400 million tons of plastic waste per year, with

the rate of plastic production forecasted to double by 2040. It is also

estimated that by 2050, there will be more plastic in the ocean by weight than fish. According to an article published by National Geographic

entitled “A Whopping 91 Percent of Plastic Isn’t Recycled,” plastic takes more than 400 years to degrade, so most of

it still exists in some form. It is estimated that only 9% of plastic waste has been recycled to date, while the vast majority (approximately

79%) is accumulating in landfills or ending up as litter in the natural environment, including the oceans.

The waste plastics

recycling industry was valued at $55.1 billion in 2020 and is poised to become an $88 billion industry by 2030, as reported in a March

2022 report entitled “Market value of waste recycling services worldwide 2020-2030” published by Statista. Pyrolysis is an

invaluable technology that can be used to transform certain materials, which traditional mechanical recycling technologies currently

cannot handle, into clean energy and other valuable byproducts. Pyrolysis is also an important alternative solution to handling materials

that have exhausted their potential for further traditional mechanical recycling.

The emerging markets

of the world are especially critical to the plastic pollution problem, where waste handling and collection are not supported with the

same infrastructure as in developed nations. We believe this market condition presents a unique opportunity for us. Clean-Seas intends

to leverage its management’s experience of working in the developing nations of the world for the past decade, providing renewable

energy products and services to this sector and now will provide recycling solutions and energy generation. As stated by the Organization

for Economic Co-operation and Development (“OECD”) in 2021, “The path to net zero requires that emerging markets transform

their energy systems, yet reliance on hydrocarbons alongside existing policy barriers pose challenges to the green transition.”

Clean Vision plans

to help provide a solution to the plastic waste problem that the world is facing, while simultaneously creating hydrogen and other clean-burning

fuels that can be used to generate clean energy.

Our Strengths

We believe that the following are the

critical investment attributes of our Company:

| |

● |

Experienced

management team. Members of our management team have significant prior experience in the renewable energy sector and have

established relationships with providers of pyrolysis technology that led to the establishment of our first Plastic Conversion Network

(“PCN”) in Agadir, Morocco, following our April 25, 2023 acquisition of a 51% interest

in Ecosynergie and the establishment of our first revenue source. |

| |

|

|

| |

● |

Pilot

Research and Development Project Commenced. We acquired our first pyrolysis unit for use in Hyderabad, India, which began

operations in May 2022. We established this project to develop technology focused on optimizing the process of converting waste plastic

into byproducts, including the Company’s branded clean hydrogen, AquaH®, which is our branded name for

clean hydrogen we produce from plastic waste that falls between the blue (natural gas) and green (renewable energy resourced) classifications. |

| |

|

|

| |

● |

Established Revenue

Stream. On April 25, 2023, we completed our acquisition of a 51% interest

in Ecosynergie, a company focused on sustainable products and solutions based in Agadir, Morocco, establishing our first PCN host

country. In connection with this PCN host facility, we intend to purchase two additional pyrolysis units, which are capable

of processing up to 20 tons of plastic waste per day. We anticipate that this Moroccan facility will process up to 350 tons of plastic

waste per day within the next 24 months, which would make it the largest plastic pyrolysis facility in the world. Since commencing

operations in April 2023, Clean-Seas Morocco has generated $188,205 in revenue, with a gross margin of $165,932 from

the provision of pyrolysis services and its sale of byproducts. |

| |

|

|

| |

● |

West Virginia State Incentive Package. On June 12, 2023, Clean-Seas announced that it secured $12 million in state incentives, which includes $1.75 million in cash to establish a PCN facility outside of Charleston, West Virginia. Clean-Seas West Virginia, Inc., a West Virginia corporation (“Clean-Seas West Virginia”), has an existing feedstock supply agreement for 100 TPD of post-industrial plastic waste and is planned to be a PCN hub servicing the Mid-Atlantic states. The project will commence in phases, Phase 1 being 100 TPD, scaling up to 500 TPD. Additional project finance capital is in the process of being secured and the Company received the $1.75 million cash disbursement on September 25, 2023. |

| |

|

|

| |

● |

Clean-Seas Arizona.

Officially established on September 25, 2022, Clean-Seas Arizona, Inc., an Arizona corporation and wholly owned subsidiary of Clean-Seas

(“Clean-Seas Arizona”) announced a Services Agreement with the Rob and Melani Walton Sustainability Solutions Service

(“WS3”) and Arizona State University (“ASU”) to commission a PCN facility to service the Western United States,

starting at 100 TPD and scaling to 500 TPD. The facility is currently planned to produce plastic precursors and clean fuels with

the intent to transition to AquaH®. |

| |

|

|

| |

● |

New Approach to Vertical Supply Chain. Our PCN is a patent-pending software network connecting sources of waste plastic (feedstock) with conversion facilities, which will produce environmentally friendly commodities. We intend to strategically locate the conversion facilities around the world in locations that are easily accessible and in close proximity to countries that produce a large amount of plastic waste. Currently, we have entered into contracts, letters of intent and/or joint venture agreements for the development of facilities in the following locations: Morocco, India, West Virginia, Arizona, Massachusetts, Michigan, Puerto Rico, France, Turkey and Sri Lanka. |

| |

|

|

| |

● |

Large market opportunity for effective solution. Renewable energy is a large market we see with an unmet need. Plastic waste disposal affects all countries, including developing nations. With a more recent focus of governments on environmentally friendly waste removal solutions, we believe there is a large opportunity for us. |

| |

|

|

| |

● |

Unique technology.

Pyrolysis technology reduces plastic waste while creating valuable byproducts, such as precursors used in the production of new plastic

products, hydrogen (our branded AquaH®) and other clean-burning fuels that can be used to generate clean energy.

Our AquaH® is unique because of how we produce it. Our process is unique in that we use waste plastic and the

pyrolysis reaction to create a large volume of synthetic gas (syngas), split that syngas apart, remove the hydrogen and leave the

methane, carbon monoxide and carbon dioxide to power the pyrolysis process. We believe our process, including the price, volume and

efficiency in which we utilize the pyrolysis process is what differentiates us in the marketplace. Additionally, our relationships

with vendors have allowed us to access to pyrolysis technology that is not available to other users of similar technology. |

| |

● |

Increased support for clean technologies to protect the environment. In recent years, we have seen an increased focus on environmental sustainability and more investors directing their investments towards companies based on ESG factors. |

| |

|

|

| |

● |

New Approach to Vertical Supply Chain. The PCN is a patent-pending software network connecting sources of waste plastic (feedstock) with conversion facilities, which will produce environmentally friendly commodities. We intend to strategically locate the conversion facilities around the world in locations that are easily accessible and in close proximity to countries that produce a large amount of plastic waste. Currently, we have begun operations in Morocco and entered into contracts for the development of facilities in: India, West Virginia, Arizona, Michigan, Massachusetts, Puerto Rico, France, Turkey and Sri Lanka. |

Our

Strategies and Competitive Advantages

Our main strategy is to focus on waste-to-value

projects in locations with a close proximity to plastic waste and are a part of municipalities that focus on clean energy projects.

Based on this strategy, we are currently focused on waste-to-value projects in Morocco, India,

West Virginia, Arizona, Michigan, Massachusetts, Puerto Rico, France, Turkey and Sri Lanka. We believe there is a large supply of waste

plastic for such projects and the demand for our byproducts (particularly plastic precursors) is and will continue to grow consistently.

Another strategy we employ is to develop projects

that could generate environmental credits, which is another component of the clean energy and waste-to-value industry in the United

States. Recycling of waste plastic mitigates the need for fossil fuels for energy generation and the production of clean-burning diesel.

We plan to aggregate these off-sets and sell them to users of fossil fuels in the form of carbon credits or renewable energy credits

depending on the location of the facilities and local market conditions. These can be used as off-set as more governments impose a “Carbon-tax”

on the end users of fossil fuels. In addition, we are seeing new exchanges coming online specifically focused on plastic waste, and credits

will be sought after, allowing producers of plastic products to off-set their plastic footprint, much like what has happened in the carbon

markets.

We believe our network and management’s global

relationships give us a competitive advantage by being able to quickly identify sources of land, feedstock, applicable permits, technology,

and off-take arrangements for projects in locations we see as valuable. Once a project has been identified, we leverage these relationships

to organize and deploy projects in a manner that we believe is more efficient than competitors.

We currently expect our projects to generate revenue

in several ways:

| |

● |

Recycling Services. We currently estimate that gate fees or tipping fees will be paid to us to accept plastic waste from a government, municipality, or corporate entity that must dispose of its waste. Fees will be on a per ton basis and are expected to vary in range from approximately £18 per ton (excluding transport) to £25 per ton (including transport), depending on the jurisdiction, land availability, and daily volumes of waste. |

| |

● |

Commodity Sales.

● Hydrogen and Other Fuels.

Our pyrolysis facilities convert waste into gasses, such as AquaH®, and other clean-burning

fuels. The hydrogen and other fuels can be sold to off-takers as a cleaner fuel or precursor feedstock for the production

of new plastic products, for marine use (low sulfur oil made through pyrolysis can be used as a bunker fuel for low grade marine

diesel), electrical generators, or refined into a clean-burning road grade fuel. Depending on the installation, this fuel output

product can be sold to a local fuel distributor or used in the generator sets for the generation of electricity as above.

● Carbon Char. Carbon char

is an additional byproduct of our pyrolysis technology, which is used for the manufacturing of bonding agents, roadway surfaces, and more.

We intend to enter into agreements with consumers of carbon char to serve as an additional revenue stream to us. |

| |

● |

Environmental

Credits. Recycling of waste plastic mitigates the need for fossil fuels for energy generation and the production of clean-burning

diesel. These off-sets can be aggregated and sold to users of fossil fuels in the form of carbon credits or renewable energy credits

depending on the location of the facilities and local market conditions. These can be used as off-set as more governments impose

a “Carbon-tax” on the end users of fossil fuels. Additionally, plastic credits may be sold through plastic credit exchanges,

such as the Plastic Credit Exchange (PCX), the HOPEx Environment Group, or similar established exchanges, to producers of new plastic

products as a means of offsetting their plastic footprint. |

| |

● |

Equipment

Sales. Clean Vision has entered into a Licensing Agreement (the “Kingsberry License Agreement”) with Kingsberry

Fuel Cell, Inc. (“Kingsberry”) whereby we have obtained the exclusive, worldwide rights (exclusive of the United States

and Canada) to the fuel cell intellectual property developed and manufactured by Kingsberry and Dr. K. Joel Berry for a term of five

years, which we intend to sell to third-parties throughout the world. Once established, these sales will provide a revenue stream

to us, as well as recurring revenue through a royalty model and ongoing service. |

Summary

of Risks

Before

you invest in our securities, you should carefully consider all the information in this prospectus, including matters set forth in the

section of this prospectus entitled “Risk Factors”. We believe that the following are some of the major risks and uncertainties

that may affect us:

| |

● |

Our

independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern |

| |

|

|

| |

● |

We have a history of operating

losses, will likely continue to generate operating losses, we may not be able to achieve or sustain profitability, and to date we have

not generated revenue sufficient to fund our ongoing operations. |

| |

● |

We are at an

early stage of development of our current business line and we have a limited operating history, which makes it difficult to evaluate

our business and prospects. |

| |

● |

We require

additional financing, and we may not be able to raise funds on favorable terms or at all. |

| |

● |

Servicing our debt

requires a significant amount of cash. |

| |

|

|

| |

● |

Covenant

restrictions under our indebtedness may limit our ability to operate our business. |

| |

● |

The equipment

that is required for our operations is expensive and to date, three of which are operational and two of which are currently being

manufactured. |

| |

● |

We do not yet

have adequate internal controls and our failure to achieve and maintain effective internal control over financial reporting could

have a material adverse effect on our business and share price. |

| |

● |

We are a holding

company without any operations of our own and depend on our subsidiaries for cash to meet our obligations. |

| |

● |

We have not

generated sufficient revenue or cash flow to pay our convertible debt in the principal amount of $4,480,602

as of December 13, 2023. |

| |

● |

Our success

depends on the acceptance of our products and services and that our products and services will develop and grow. |

| |

● |

As public awareness

of the benefits of fuel converted from waste plastic grows, we expect competition to increase. |

| |

● |

We face risks

with obtaining raw materials. |

| |

● |

We do not believe

that we will be able to negotiate worldwide exclusive rights to the technology we will need to acquire. |

| |

● |

Project construction

and development requires significant outlays of capital and is subject to numerous risks. |

| |

● |

Failure to

adequately manage our planned aggressive growth strategy may harm our business or increase our risk of failure. |

| |

● |

Our business

model will depend on performance by third parties under contractual arrangements. |

| |

● |

Our operations

in foreign markets could cause us to incur additional costs and risks associated with doing business internationally. |

| |

● |

Volatility

in foreign exchange currency rates could adversely affect our financial condition and results of operations. |

| |

● |

Operations

in the developing world could cause us to incur additional costs and risks associated with doing business in developing markets. |

| |

● |

Our business

and reputation could be adversely affected if we or third parties with whom we have a relationship fail to comply with United States

or foreign anti-corruption laws or regulations. |

| |

● |

If we are unable

to maintain our corporate reputation, our business may suffer. |

| |

● |

We will incur significant

increased costs as a result of operating as a public company and our management will be required to devote substantial time to new compliance

initiatives. |

| |

|

|

| |

● |

Our

ability to utilize our net operating loss carryforwards and certain other tax attributes may be limited. |

| |

● |

Our

stock price has been volatile and may continue to be volatile. |

| |

|

|

| |

● |

The price of our Common Stock may

have little or no relationship to the historical bid prices of our Common Stock on the OTCQB. |

| |

|

|

| |

● |

We have a substantial number

of authorized shares of Common Stock available for future issuance that could cause dilution of our stockholders’ interest and

adversely impact the rights of holders of our Common Stock. |

| |

● |

The holders

of our Series B Convertible Non-Voting Preferred Stock (the “Series B Preferred Stock”) and our Series C Convertible

Preferred Stock (the “Series C Preferred Stock”) are protected from dilution upon future issuances of our Common Stock. |

| |

● |

Daniel Bates,

our CEO and Chairman, owns 2,000,000 shares of Series C Preferred Stock, which shares of Series C Convertible Preferred Stock vote

together with our Common Stock on all stockholder matters, and vote one hundred Common Stock votes per share of Series C Preferred

Stock owned (the “Series C Preferred Voting Rights”). Such shares of Series C Preferred Stock automatically converted

into 20,000,000 shares of Common Stock on January 1, 2023, and

on such date the contractual right to vote the shares of Series C Preferred Stock in accordance with the Series C Preferred Voting

Rights ceased. The conversion of the Series C Preferred Stock into Common Stock has not been effectuated with the Company’s

transfer agent as of the date hereof. |

| |

|

|

| |

● |

If it is determined that

Mr. Bates still holds the contractual right to vote his Series C Preferred Stock in accordance with its terms, Mr. Bates will be

able to influence our management and affairs and control the outcome of matters submitted to our stockholders for approval, including

the election of directors and any sale, merger, consolidation, or sale of all or substantially all of our assets. |

| |

● |

Ongoing litigation

with holders of our Series B Preferred Stock could negatively impact our financial stability and reputation as the outcome of such matter

is unknown and cannot be predicted. |

| |

● |

If securities

or industry analysts do not publish research or reports about our business, or if they downgrade their recommendations regarding

our Common Stock, its trading price and volume could decline. |

| |

● |

We rely on

our management and if they were to leave us or not devote sufficient time to our company, our business plan could be adversely affected. |

| |

● |

Our Bylaws

provide for indemnification of officers and directors at our expense. |

| |

● |

Failure to adequately manage our planned aggressive growth strategy may harm our business or increase our risk of failure. |

| |

|

|

| |

● |

If we make

any acquisitions, they may disrupt or have a negative impact on our business. |

| |

● |

We rely on

network and information systems and other technologies for our business activities and certain events, such as computer hackings,

viruses or other destructive or disruptive software or activities may disrupt our operations. |

| |

● |

We may apply

working capital and future funding to uses that ultimately do not improve our operating results or increase the value of our securities. |

| |

● |

Claims, litigation,

government investigations, and other proceedings may adversely affect our business and results of operations. |

| |

● |

We may incur

indebtedness in the future which could reduce our financial flexibility, increase interest expense and adversely impact our operations

and our costs. |

| |

● |

Our operations

could be impacted by natural disaster. |

| |

● |

Delays in collection,

or non-collection, of our accounts receivable could adversely affect our business, financial position, results of operations and

liquidity. |

| |

● |

Our patent

application may not issue as a patent, which may have a material adverse effect on our ability to prevent others from commercially

exploiting products similar to ours. |

| |

● |

We may not

be able to prevent others from unauthorized use of our intellectual property, which could harm our business and competitive position. |

| |

● |

If we are issued

patents for our technology and such patents expire or are not maintained, our patent applications are not granted or our patent rights

are contested, circumvented, invalidated or limited in scope, we may not be able to prevent others from selling, developing or exploiting

competing technologies or products, which could have a material adverse effect on our business, prospects, financial condition, results

of operations, and cash flows. |

| |

● |

We may become

subject to claims that we or our employees have wrongfully used or disclosed alleged trade secrets. |

| |

● |

A significant

portion of our intellectual property is not protected through patents or formal copyright registration. |

| |

● |

Confidentiality

agreements may not adequately prevent disclosure of trade secrets and other proprietary information. |

| |

|

|

| |

● |

We may

need to defend ourselves against patent, copyright or trademark infringement claims. |

| |

● |

We are subject

to extensive government regulation and changes thereto could have a material adverse effect on our business and financial condition,

results of operations and cash flows. |

| |

● |

We may be unable

to obtain, modify, or maintain the required regulatory permits, approvals and consents for our projects. |

| |

● |

We are subject

to environmental laws and potential exposure to environmental liabilities. |

| |

● |

Changes in

applicable laws and regulations can adversely affect our business, financial condition and results of operations. |

| |

● |

Anti-takeover

provisions in our Bylaws, as well as provisions of Nevada law, might discourage, delay or prevent a change in control of our company

or changes in our management. |

| |

● |

The Jumpstart

Our Business Startup Act (the “JOBS Act”) allows us to postpone the date by which we must comply with certain laws and

regulations and to reduce the amount of information provided in reports filed with the SEC. |

| |

● |

Our election

not to opt out of the JOBS Act extended accounting transition period may not make our financial statements easily comparable to other

companies. |

| |

● |

Global, regional

and U.S. economic and geopolitical conditions may have adverse effects on our business and financial condition. |

| |

● |

We may not

maintain sufficient insurance coverage for the risks associated with our business operations. |

| |

● |

We do not anticipate

paying any cash dividends. |

| |

● |

Any failure to protect

our intellectual property rights could impair our ability to protect our technology and our brand. |

Implications

of Being an Emerging Growth Company and a Smaller Reporting Company

As a company with

less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging

growth company” under the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting

requirements and are relieved of certain other significant requirements that are otherwise generally applicable to public companies.

As an emerging growth company:

● we may present

only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial

Condition and Results of Operations;

● we are exempt

from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial

reporting under the Sarbanes-Oxley Act;

● we are permitted

to provide less extensive disclosure about our executive compensation arrangements; and

● we are not

required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements.

We may take advantage

of these provisions until December 31, 2028, so

long as we continue to be an emerging growth company. We will continue to remain an “emerging growth company” until the earliest

of the following: (i) December 31, 2028; (ii) the last day of the fiscal year in which our total annual gross revenue is equal to or

more than $1.235 billion; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three

years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

We are also a “smaller

reporting company” as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take

advantage of certain of the scaled disclosures available to smaller reporting companies. To the extent that we continue to qualify as

a “smaller reporting company” as such term is defined in Rule 12b-2 under the Exchange Act, after we cease to qualify as

an emerging growth company, certain of the exemptions available to us as an “emerging growth company” may continue to be

available to us as a “smaller reporting company,” including exemption from compliance with the auditor attestation requirements

pursuant to SOX and reduced disclosure about our executive compensation arrangements. We will continue to be a “smaller reporting

company” until we have $250 million or more in public float (based on our Common Stock) measured as of the last business day of

our most recently completed second fiscal quarter or, in the event we have no public float (based on our Common Stock) or a public float

(based on our Common Stock) that is less than $700 million, annual revenues of $100 million or more during the most recently completed

fiscal year.

We may choose to

take advantage of some but not all of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus.

Accordingly, the information contained herein may be different from the information you receive from other public companies in which

you hold stock. In addition, the JOBS Act provides that an emerging growth company may take advantage of an extended transition period

for complying with new or revised accounting standards, delaying the adoption of these accounting standards until they would apply to

private companies. We have elected to avail ourselves of the extended transition period for complying with new or revised financial accounting

standards. As a result of the accounting standards election, we will not be subject to the same implementation timing for new or revised

accounting standards as other public companies that are not emerging growth companies which may make comparison of our financials to

those of other public companies more difficult.

Recent

Developments

October 2023 Note

On October 26,

2023, the Company entered into a Securities Purchase Agreement (the “October Agreement”) with an accredited investor (the

“October Purchaser”) related to the Company’s sale of two 12% convertible notes in the aggregate principal amount of

$660,000 (each note being in the amount of $330,000 and containing an original issue discount of $30,000 such that the purchase price

of each note is $300,000) (each an “October Note,” and together the “October Notes”) convertible into shares

of Common Stock, upon the terms and subject to the limitations set forth in each October Note. The Company issued and sold the first

October Note (the “First October Note”) on October 26, 2023 (the “First October Note Closing Date” or the “First

October Issuance Date”). The closing for the second October Note (the “Second October Note”) is to occur approximately

30-60 days following the First October Note Closing Date (the “Second October Note Closing Date,” and together with the First

October Note Closing Date, the “October Note Closing Date”). On the First October Note Closing Date, the Company issued 800,000

shares (the “October Inducement Shares”) to the October Purchaser as an additional inducement for the October Purchaser to

enter into the October Agreement.

On the First October Note Closing Date, the Company

issued 800,000 restricted shares of Common Stock to the October Purchaser as additional consideration for the purchase of the First October

Note (the “First October Note Commitment Shares”). Upon the closing of the Second October Note, the Company will issue additional

commitment shares in an amount calculated based on the price per share of the Common Stock at the time of funding of such Second October

Note (the “Second October Note Commitment Shares,” and together with the First October Note Commitment Shares, the “October

Note Commitment Shares”). In addition to the October Note Commitment Shares, the Company agreed to issue 7,500,000 shares of Common

Stock to the October Purchaser (the “Returnable Shares”) for each October Note. Each issuance of Returnable Shares is subject

to recalculation based on the price per share of Common Stock at the time of funding for each October Note, such that the economic value

of each set of Returnable Shares shall be equal to the value of the initial set of Returnable Shares. For example, if on the Second October

Note Closing Date, the closing price of the Common Stock is 50% of the closing price of the Common Stock on the First October Note Closing

Date, the Company will be required to issue 15,000,000 Returnable Shares on the Second October Note Closing Date. The Returnable Shares

must be returned to the Company unless each October Note enters into an uncured default during its term, or the Company is otherwise

unable to repay each October Note on or prior to maturity.

While any portion of a October Note is outstanding,

if the Company consummates aggregate financing in excess of $2,000,000 in one more closings, from the issuance of securities pursuant

to a registration statement or the Company’s sale of any convertible securities, the Company shall, within one (1) business day

of the Company’s receipt of such proceeds, inform the October Purchaser of such receipt, following which the October Purchaser

shall have the right in its sole discretion to require the Company to immediately apply one hundred percent (100%) of such proceeds to

repay all or any portion of the outstanding amounts owed under either October Note. In the event that such proceeds are received by the

October Purchaser prior to the applicable October Note’s maturity date, the required prepayment shall be subject to all prepayment

terms in the October Note (if any).

The principal

amount of each October Note is $330,000 (the “October Note Principal”), with an original issue discount of $30,000, resulting

in a purchase price of $300,000 for each October Note. Each October Note carries guaranteed interest in the amount of twelve percent

(12%) per calendar year from the date of issuance of each such October Note (the “October Note Interest”). All October Note

Principal and October Note Interest owing under the First October Note is due and payable on July 26, 2024 (the “First October

Note Maturity Date”). A lump-sum interest payment equal to $39,600 shall be immediately due on the First October Note Issuance

Date and shall be added to the principal balance and payable on the First October Note Maturity Date or upon acceleration or by prepayment

or otherwise, notwithstanding the number of days which the October Note Principal is outstanding. October Note Principal payments shall

be made in four (4) installments, each in the amount of $75,000 commencing on the one hundred eightieth (180th) daily anniversary

following the First October Note Issuance Date and continuing thereafter each thirty (30) days for four (4) months thereafter. Notwithstanding

anything in the First October Note to the contrary, the final payment of October Note Principal and October Interest shall be due on

the First October Note Maturity Date. Any amount of October Note Principal or October Note Interest on the First October Note which is

not paid when due shall bear interest at the rate of the lesser of (i) twenty four percent (24%) per annum (which shall be guaranteed

and applied to the balance due under the First October Note upon an October Note Event of Default (as defined below)) and (ii) the maximum

amount permitted under law from the due date thereof until the same is paid (the “October Note Default Interest”).

The

First October Note sets forth certain standard events of default (each such event, an “October

Note Event of Default”), which, upon such October Note

Event of Default, the First October Note shall become immediately and automatically due

and payable by the Company in an amount equal to the then outstanding Principal, plus

(x) accrued and unpaid October Note Interest on the unpaid October Note

Principal to the date of payment (the “October Note Mandatory Prepayment Date”),

plus (y) October Note Default Interest,

if any, plus (z) any amounts owed to the October Purchaser

pursuant to Sections 1.3 and 1.4(g) of the First October Note, multiplied by one point five

(1.5).

The

October Purchaser has the right at any time following an October Note Event of Default, and ending on the date of payment of the October

Note Default Amount (as defined in Article III of the First October Note), to convert all or any part of the outstanding and unpaid October

Note Principal, October Note Interest, penalties and all other amounts due under the First October Note into fully paid and non-assessable

shares of Common Stock, as such Common Stock exists on the on the First October Note Issuance Date, or any shares of capital stock or

other securities of the Company into which such Common Stock shall thereafter be changed or reclassified at the October Note Conversion

Price (as defined below) determined as provided in the First October Note (an “October Note Conversion”); provided,

however, that in no event shall the October Purchaser be entitled to convert any portion of the First October Note in excess of

that portion of the First October Note upon conversion of which the sum of (1) the number of shares of Common Stock beneficially owned

by the October Purchaser and its affiliates (other than shares of Common Stock which may be deemed beneficially owned through the ownership