SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13E-3

FINAL AMENDMENT

(Rule 13e-100)

Transaction Statement Under Section 13(e) of the Securities

Exchange Act of 1934 and Rule 13e-3 Thereunder

Rule 13e-3 Transaction Statement

under Section 13(e) of the Securities Exchange Act of 1934

CITIZENS BANCORP

(Name of Issuer)

CITIZENS BANCORP

(Name of Persons Filing Statement)

Common Stock

(Title of Class of Securities)

[

172950107

]

(CUSIP Number of Class of Securities)

Lark E. Wysham, Corporate Secretary

275 Southwest Third Street

Corvallis, Oregon, 97339

(541) 752-5161

(Name, Address and Telephone Numbers of Person Authorized to Receive Notices

and Communications on Behalf of the Persons Filing Statement)

Copy to:

Bennett H. Goldstein

Attorney at Law

1132 SW

19

th

Ave.

Portland, Oregon 97205

(503) 294-0940

(503) 294-7918 (facsimile)

email:bhgoldatty@aol.com

This statement is filed in connection with (check the appropriate box):

þ

a. The filing of solicitation materials or an information statement

subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the

Securities Exchange Act of 1934.

o

b. The filing of a registration statement under the Securities Act of 1933.

o

c. A tender offer.

o

d. None of the above.

Check the following box if the soliciting materials or information statement referred to in

checking box (a) are preliminary copies:

o

Check the following box if the filing fee is a final amendment reporting the results of the

transaction:

þ

CALCULATION OF FILING FEE

|

|

|

|

|

|

|

|

|

|

|

Transaction Value*

|

|

|

Amount of Filing Fee

|

|

|

|

$1,039,279

|

|

|

$31.69

|

|

|

|

|

|

|

|

|

*

|

|

Calculated solely for the purpose of determining the filing fee, which

was based upon the price of $23.50 per share (whereby the Company

would purchase common stock at $23.50 per share) multiplied by the

estimated number of shares of common stock held by holders of record

of fewer than 250 shares as of October 15, 2007, which shares would

be purchased for cash as a result of the Reclassification (43,929

shares).

|

|

|

|

|

|

o

|

|

Check the box if any part of the fee is offset as provided by

Exchange Act Rule 0-11(a)(2) and identify the filing with which

the offsetting fee was previously paid. Identify the previous

filing by registration statement number, or the Form or Schedule

and the date of filing.

|

Amount Previously Paid:________________________________________________________________________________________

Form or Registration No.:________________________________________________________________________________________

Filing Party:__________________________________________________________________________________________________

Date Filed:___________________________________________________________________________________________________

RULE 13E-3 TRANSACTION STATEMENT

This Rule 13e-3 transaction statement on Schedule 13E-3 is filed by Citizens Bancorp (the

“Company”) in connection with its share Reclassification and redemption, whereby shareholders

owning less than 2,500 shares of Company common stock will receive one share of Series A Preferred

Stock for each share of common stock they own, and shareholders owning less than 250 shares of

Company common stock will receive cash at the rate of $23.50 per share. Shares of common stock

held by shareholders owning more than 2,500 shares will remain outstanding and will be unaffected

by the reclassification.

Following the Reclassification, the Company will have fewer than 300 shareholders of its

common stock and will terminate the registration of its common stock under the Securities and

Exchange Act of 1934 (the “Exchange Act”).

Filed contemporaneously herewith are (i) the notice of special meeting of shareholders and a

preliminary proxy statement (the “Proxy Statement”) and (ii) a form of proxy that will accompany

the Proxy Statement. The Proxy Statement will be distributed to the Company’s shareholders in

connection with a special meeting of the shareholders anticipated to be held

on December 18,

2007

(the “Special Meeting”). At the Special Meeting, the shareholders would be requested to

vote on a proposed amendment to the Company’s Articles of Incorporation, which would authorize the

new class of Series A Preferred Stock, and the Reclassification.

The Company has securities registered under the Exchange Act and consequently is subject to

Regulation 14A of the Exchange Act. The Company is filing this Schedule 13E-3 with the Securities

and Exchange Commission contemporaneously with a preliminary Proxy Statement filed by the Company

pursuant to Regulation 14A of the Exchange Act. As of the date hereof, the Proxy Statement is in

preliminary form and is subject to completion or

amendment. This Schedule 13E-3 will be further amended to reflect such completion or amendment

of the Proxy Statement.

In accordance with General Instruction F to Schedule 13E-3, the information set forth in the

Proxy Statement (including the appendices thereto) is incorporated herein by reference in response

to Items 1 through 14 of this Schedule 13E-3, in the manner and to the extent specified below. In

addition, the Company has incorporated by reference certain financial information contained in its

annual report on Form 10-K and quarterly report on Form 10-Q as specified below.

This Schedule 13E-3 contains certain statements and information with respect to the financial

condition, results of operations, and business of the Company. These statements are not guarantees

of future performance and involve risks and uncertainties and are based on the beliefs and

assumptions of management of the Company and on information available to management at the time

that these disclosures were prepared. These statements might be identified by the use of words

like “expect,” “anticipate,” “estimate,” and “believe,” variances of these words and other similar

expressions. A number of important factors could cause actual results to differ materially from

those in the statements.

TABLE OF CONTENTS

ITEM 1. SUMMARY TERM SHEET

The information set forth in the Proxy Statement under the caption “Summary Term Sheet” is

incorporated herein by reference.

ITEM 2. SUBJECT COMPANY INFORMATION

(a) The name of the company is Citizens Bancorp (the “Company”). The Company’s principal

executive office is located at 275 Southwest Third Street, Corvallis, OR 97339, and its business

telephone number is (541) 752-5161.

(b) As of

October 15, 2007, the Company had 4,671,504 shares of common stock, no par value,

issued and outstanding.

(c) The information required by this Item is set forth under “Information About the Company -

Description of Capital Stock” in the Proxy Statement and incorporated herein by reference.

(d) The information required by this Item is set forth under “Information About the Company -

Description of Capital Stock” in the Proxy Statement and incorporated herein by reference.

(e) The Company has not made an underwritten public offering of the Company’s common stock for

cash during the past three years that was registered under the Securities Act of 1933 or exempt

from registration under Regulation A (Securities Act Rule 251 through 263).

(f) The information required by this Item is set forth under “Information About the Company -

Description of Capital Stock” in the Proxy Statement and incorporated herein by reference.

ITEM 3. IDENTITY AND BACKGROUND OF FILING PERSON.

(a) The filing person to which this Schedule 13E-3 relates is Citizens Bancorp. The name,

business address and business telephone number of the Company is set forth in Item 2(a) above. The

information set forth in the Proxy Statement under the caption “Information About the Company -

Officers and Directors” and “Security Ownership of Officers, Directors and 5% Stockholders” is

incorporated herein by reference.

(b) Not applicable.

(c) The name and employment information with respect to each executive officer and director of

the Company is set forth in the Proxy Statement under the caption “Information About the Company -

Officers and Directors” and such information is incorporated herein by reference. To the Company’s

knowledge, none of the Company’s directors or executive officers has been convicted in a criminal

proceeding during the past five (5) years (excluding traffic violations or similar misdemeanors) or

has been a party to any judicial or administrative proceeding during the past five (5) years

(except for matters that were dismissed without sanction or settlement) that resulted in a

judgment, decree or final order enjoining the individual from future violations of, or prohibiting

activities subject to, federal or state securities laws, or finding of any violation of federal or

state securities laws. Each of the Company’s directors and executive officers is a citizen of the

United States.

ITEM 4. TERMS OF THE TRANSACTION.

(a) The information required by this item is set forth in the Proxy Statement under the

captions “Summary Term Sheet”, “Questions and Answers”, “Special Factors”, “Description of the

Amendment and Reclassification”, and “Additional Special Meeting Information — Vote Required for

Approval” and incorporated herein by reference.

(c) The information set forth in the Proxy Statement under the captions “Special Factors -

Recommendation of the Board of Directors; Fairness of Reclassification”, “Special Factors — General

Effects of Reclassification”, “Special Factors — Additional Effects of Reclassification on

Affiliated Stockholders”, and “Special Factors — Additional Effects of Reclassification on

Non-Affiliated Stockholders” is incorporated herein by reference.

(d) The information set forth in the Proxy Statement under the caption “Description of the

Amendment and Reclassification — Dissenters’ Rights” is incorporated herein by reference.

(e) Security holders will be entitled to access the Company’s corporate records in the manner

permitted by applicable federal and Oregon state law. The information set forth in the Proxy

Statement under the caption “Special Factors — Recommendation of the Board of Directors; Fairness

of the Reclassification” is incorporated herein by reference. Except as otherwise referenced

herein, the issuer is making no special provision to grant unaffiliated security holders access to

its corporate files; nor is it making any special provision to allow unaffiliated security holders

to obtain counsel or appraisal services at the expense of the Company.

(f) The information required by this item is set forth in the Proxy Statement under the

caption “Special Factors — General Effects of Reclassification — Liquidity of Stock” which is

incorporated herein by reference.

ITEM 5. PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS.

The information set forth in the Proxy Statement under the caption “Information About the

Company — Security Ownership of Officers, Directors and 5% Stockholders” is incorporated by

reference. Except as otherwise described therein, the following responses are applicable.

(a)(1) Not applicable.

|

|

|

|

|

(2)

|

|

The information included in the Proxy Statement under the

caption “Information About the Company — Past Contacts,

Transactions, Negotiations, and Agreements” is incorporated

herein by reference.

|

|

|

(b)

|

|

Not applicable.

|

|

|

|

|

(c)

|

|

Not applicable.

|

|

|

|

|

(d)

|

|

The information included in the Proxy Statement under the caption

“Determination of fairness by Citizens Affiliates” and “Information

About the Company — Past Contacts, Transactions, Negotiations, and

Agreements” is incorporated herein by reference.

|

|

|

|

|

(e)

|

|

The information included in the Proxy Statement under the caption

“Information About the Company — Past Contacts, Transactions,

Negotiations, and Agreements” is incorporated herein by reference.

|

ITEM 6. PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS.

(b) The information in the Proxy Statement under the caption “Description of the Amendment and

Reclassification — Anticipated Accounting Treatment” is incorporated herein by reference.

(c) The information set forth in the Proxy Statement under the captions “Summary Term Sheet”,

“Questions and Answers”, “Reasons for the Reclassification”, “Positive Effects of the

Reclassification on Citizens”, “Negative Effects of the Reclassification on Citizens”, “Other

Effects of the Reclassification on Citizens”, “General Features of the Reclassification” is

incorporated herein by reference.

ITEM 7. PURPOSES, ALTERNATIVES, REASONS AND EFFECTS

(a) The information set forth in the Proxy Statement under the captions “Summary Term Sheet”,

“Questions and Answers”, “Background of the Reclassification”, and “Reasons for the

Reclassification” is incorporated herein by reference.

(b) The information set forth in the Proxy Statement under the caption “Alternatives

Considered” is incorporated herein by reference.

(c) The information set forth in the Proxy Statement under the captions “Summary Term Sheet”,

“Questions and Answers”, “Purpose of the Reclassification”, “Background of the Reclassification”,

“Alternatives Considered”, and “Recommendation of Board; Fairness of the Reclassification” is

incorporated herein by reference.

(d) The information set forth in the Proxy Statement under the captions “Summary Term Sheet”,

“General Features of the Reclassification,” “Purpose

of the Reclassification,“ Background of the

Reclassification”, “Effects of the Reclassification on Shareholders Generally”, “Effects of the

Reclassification on Remaining Common Shareholders”, “Effects of the Reclassification on

Shareholders Who Are Afilliates”, “Effects of the Reclassification on Shareholders Who Are Not

Afilliates”, and “Federal Income Tax Consequences of the Reclassification” is incorporated herein

by reference.

ITEM 8. FAIRNESS OF THE TRANSACTION.

(a) The information set forth in the Proxy Statement under the caption “Recommendation of the

Board; Fairness of the Reclassification” is incorporated herein by reference.

(b) The information set forth in the Proxy Statement under the captions “Recommendation of the

Board; Fairness of the Reclassification”, “Determination of Exchange Ratio” and “Determination of

Cash Payment” is incorporated herein by reference.

(c) The information set forth in the Proxy Statement under the captions “Recommendation of the

Board; Fairness of the Reclassification”, “Determination of Exchange Ratio” and “Determination of

Cash Payment” is incorporated herein by reference.

(d) The information set forth in the Proxy Statement under the captions “Recommendation of the

Board; Fairness of the Reclassification”, “Determination of Exchange Ratio” and “Determination of

Cash Payment” is incorporated herein by reference.

(e) The information set forth in the Proxy Statement under the captions “Recommendation of the

Board; Fairness of the Reclassification”, “Determination of Exchange Ratio” and “Determination of

Cash Payment” is incorporated herein by reference.

(f) Not applicable.

ITEM 9. REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS.

(a) The information set forth in the Proxy Statement under the captions “Recommendation of the

Board; Fairness of the Reclassification”, “Determination of Exchange Ratio”, “Determination of Cash

Payment” and Background of the Reclassification is incorporated herein by reference.

(b) The information set forth in “Determination of Exchange Ratio”, and “Determination of Cash

Payment”” of the Proxy Statement is incorporated herein by reference.

(c) The written opinion originally issued September 8, 2007 to the Company’s Board of

Directors by Southard Financial (“Southard”), as amended and reissued effective October 18, 2007

(“Southard Fairness Opinion”), will be made available for inspection and copying at the principal

executive offices of the Company at 275 Southwest Third Street, Corvallis, OR 97339 during the

Company’s regular business hours by any interested equity security holder of the Company or

representative who has been so designated in writing. A copy of the Southard Fairness Opinion will

be mailed by the Company to any interested Company stockholder or representative who has been so

designated in writing upon written request to the Company and at the expense of the requesting

stockholder. In addition, the information set forth in the Proxy Statement under the caption

“Determination of Exchange Ratio” and “Determination of Cash Payment” as well as

Appendix C

to the Proxy Statement, are incorporated herein by reference.

(d) Southard Financial also prepared for the Board a “Valuation Memorandum — Fair Value

Calculations of the Common Stock of Citizens Bancorp, Corvallis, Oregon as of June 30, 2007” that

was delivered to the Board on or about August 7, 2007. The Valuation Memorandum will be made

available for inspection and copying at the principal executive offices of the Company at 275 SW

Third Street, Corvallis, Oregon 97339 during the Company’s regular business hours by any interested

equity security holder of the Company or representative who has been so designated in writing. A

copy of the Value Memorandum will be mailed by the Company to any interested Company stockholder or

representative who has been so designated in writing upon written request to the Company A copy of

the Valuation Memorandum is attached to this Schedule 13E-3 as Exhibit 16(c)(5)(ii).

ITEM 10. SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION.

(a) The information set forth in the Proxy Statement under the captions “General Features of

the Reclassification” and “Negative Effects of the Reclassification on Citizens-Financial Effects”

is incorporated herein by reference.

(b) Not applicable.

(c) The information set forth in the Proxy Statement under the caption “Negative Effects of

the Reclassification on Citizens-Financial Effects” is incorporated herein by reference. The

foregoing expenses will be paid by the Company.

(d) Not applicable.

ITEM 11. INTEREST IN SECURITIES OF THE SUBJECT COMPANY.

(a) The information set forth in the Proxy Statement under the caption “Information About the

Company — Security Ownership of Officers, Directors and 5% Stockholders” is incorporated herein by

reference.

(b) Neither the Company nor any executive officer, director, affiliate or subsidiary of the

Company, or any of the Company’s or any subsidiary’s pension, profit sharing, or similar plan, has

engaged in any transaction in the Company’s common stock during the past sixty (60) days. The

information set forth in the Proxy Statement under the caption “Information About the Company -

Description of Capital Stock” is incorporated herein by reference.

ITEM 12. THE SOLICITATION OR RECOMMENDATION.

(d) The information set forth in the Proxy Statement under the captions “Information About the

Company — Security Ownership of Officers, Directors and 5% Shareholders”, “Information Regarding

The Special Meeting of Shareholders — Solicitation of Proxies”, and “Recommendation of the Board;

Fairness of the Reclassification” is incorporated herein by reference.

(e) The information set forth in the Proxy Statement under the caption “Recommendation of the

Board; Fairness of the Reclassification” is incorporated herein by reference.

ITEM 13. FINANCIAL STATEMENTS.

(a) The financial statements and accompanying notes to the financial statements included in

(i) the Company’s Annual Report to Shareholders, filed with the SEC as Exhibit 13 to the Company’s

Annual Report on Form 10-K for the year ended December 31, 2006, and (ii) the Company’s quarterly

report on Form 10-Q for the period ending June 30, 2007, as filed with the SEC, are incorporated

herein by reference. In addition, the information included in “Selected Consolidated Financial Data

(Unaudited)”, “Additional Information” and “Incorporation of Certain Documents by Reference” in the

Proxy Statement is incorporated herein by reference.

(b) The information set forth in the Proxy Statement under the caption “Selected Consolidated

Financial Pro Forma Financial Information (Unaudited)” is incorporated herein by reference.

ITEM 14. PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED.

(a) Not applicable.

(b) The information set forth in the Proxy Statement under the caption “Information Regarding

The Special Meeting of Shareholders — Solicitation of Proxies” is incorporated herein by reference.

ITEM 15. ADDITIONAL INFORMATION.

(b) Not applicable.

ITEM 16. EXHIBITS.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

16(a)(i)

|

|

Notice of Special Meeting and Final Proxy Statement*

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

16(a)(ii)

|

|

Form of Proxy Card

|

|

|

|

16(a)(5)(i)

|

|

Letter to Shareholders from William V. Humphreys, Sr.,

President and Chief Executive Officer

|

|

|

|

|

|

16(a)(5)(ii)

|

|

Press Release dated September 11, 2007**

|

|

|

|

|

|

16(c)(5)(i)

|

|

Fairness Opinion of Southard Financial, issued effective September 8, 2007, and revised and reissued effective October

18, 2007***

|

|

|

|

|

|

16(c)(5)(ii)

|

|

Southard Financial’s “Valuation Memorandum — Fair Value

Calculations of the Common Stock of Citizens Bancorp,

Corvallis, Oregon as of June 30, 2007,” delivered to the

Board on or about August 7, 2007.

|

|

|

|

|

|

16(d)

|

|

Citizens Bancorp Incentive Stock Option Plan****

|

|

|

|

16(f)

|

|

The information set forth in “Dissenters Rights” of the Proxy

Statement and Appendix B to Exhibit 16(a)(i) is incorporated

by reference.

|

|

16(g)

|

|

Not applicable.

|

|

|

|

|

|

*

|

|

Incorporated by reference to the Company’s Schedule 14A, filed with the SEC on or

about November 20, 2007.

|

|

|

|

**

|

|

Incorporated by reference to Exhibit 99.1 to the Company’s Form 8-K

filed with the SEC on September 12, 2007.

|

|

|

|

***

|

|

Incorporated by reference to Appendix C to Exhibit 16(a)(1).

|

|

|

|

****

|

|

Incorporated by reference to the Exhibit 10.1 of the Company’s 10-K

filed with the SEC for fiscal year December 31, 2004.

|

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information

set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

CITIZENS BANCORP

|

|

|

|

By:

|

/s/ William V. Humphreys, Sr.

|

|

|

|

|

William V. Humphreys, Sr.

|

|

|

|

|

President and Chief Executive Officer

|

|

|

|

Dated: November 20, 2007

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

16(a)(i)

|

|

Notice of Special Meeting and Final Proxy Statement*

|

|

|

|

16(a)(ii)

|

|

Form of Proxy Card

|

|

|

|

16(a)(5)(i)

|

|

Letter to Shareholders from William V. Humphreys, Sr.,

President and Chief Executive Officer

|

|

|

|

|

|

16(a)(5)(ii)

|

|

Press Release dated September 11, 2007**

|

|

|

|

|

|

16(c)(5)(i)

|

|

Fairness Opinion of Southard Financial, issued effectiveSeptember 8, 2007, and revised and reissued effective October

18, 2007***

|

|

|

|

|

|

16(c)(5)(ii)

|

|

Southard Financial’s “Valuation Memorandum — Fair Value

Calculations of the Common Stock of Citizens Bancorp,

Corvallis, Oregon as of June 30, 2007,” delivered to the

Board on or about August 7, 2007.

|

|

|

|

|

|

16(d)

|

|

Citizens Bancorp Incentive Stock Option Plan****

|

|

|

|

16(f)

|

|

The information set forth in “Dissenters Rights” of the Proxy

Statement and Appendix B to Exhibit 16(a)(i) is incorporated

by reference.

|

|

16(g)

|

|

Not applicable.

|

|

|

|

|

|

*

|

|

Incorporated by reference to the Company’s Schedule 14A, filed with the

SEC on or about November 20, 2007.

|

|

|

|

**

|

|

Incorporated by reference to Exhibit 99.1 to the Company’s Form 8-K

filed with the SEC on September 12, 2007.

|

|

|

|

***

|

|

Incorporated by reference to Appendix C to Exhibit 16(a)(1).

|

|

|

|

****

|

|

Incorporated by reference to the Exhibit 10.1 of the Company’s 10-K

filed with the SEC for fiscal year December 31, 2004.

|

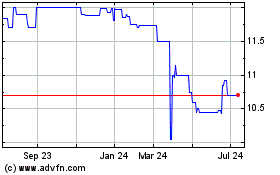

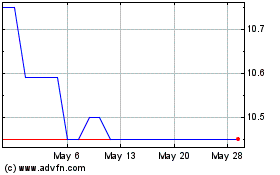

Citizens Bancorp (PK) (USOTC:CZBC)

Historical Stock Chart

From May 2024 to Jun 2024

Citizens Bancorp (PK) (USOTC:CZBC)

Historical Stock Chart

From Jun 2023 to Jun 2024