Asian Shares Down, Though Higher Oil Prices Lift Energy Stocks

19 August 2016 - 2:10PM

Dow Jones News

Oil's push into bull territory boosted energy stocks across Asia

early on Friday, but the gains failed to lift other sectors and

kept most of the region's share markets in the red.

The Nikkei Stock Average was last down 0.1%, after rising as

much as 0.8% earlier in the session amid a weaker yen and strong

energy prices.

"This morning we see that the Japanese yen is weakening a little

bit against the U.S. dollar—that [helped] the Nikkei open higher,"

said Margaret Yang, a market analyst at CMC Markets.

Still, uncertainty over the U.S. interest-rate outlook still

weighs, analysts say, ahead of the Federal Reserve's Jackson Hole

symposium scheduled for next Friday.

"It's hard to expect Chairwoman [Janet] Yellen...will signal a

clear message to the market," said Masashi Murata, currency

strategist at Brown Brothers Harriman in Tokyo, in a note.

Rather, her speech at Jackson Hole will more likely provide a

mixture of optimistic and pessimistic views on the economy, he

said.

In the Tokyo market, trading firm Mitsui & Co. Ltd. was

trading 3.2% higher and oil explorer Inpex Corp. rose 4%. Japanese

trading houses were also benefiting from a recovery in global

economic sentiment, particularly in China, with analysts pointing

to Beijing's ongoing efforts to address excess capacity in world's

second largest economy.

"China-linked stocks such as trading houses are getting a boost"

in Japan, said Eiji Kinouchi, senior strategist at Daiwa

Securities.

In Australia, the S&P/ASX 200 rose 0.1%, held up by

commodity heavyweights BHP Billiton Ltd., which gained 1.9%, and

Rio Tinto Ltd., which added 1%.

Australian oil and gas explorer Woodside Petroleum Ltd. was 2.8%

higher, even though its profit for the first-half missed estimates.

But broker RBC Capital Markets said operating costs were

"pleasingly better" than forecast, and an upgrade on annual

production guidance was welcomed.

Shares in Greater China were down, on profit-taking pressure

following their recent strength. Hong Kong's Hang Seng Index was

off 0.5%, after hitting a fresh nine-month high on Thursday, while

the Shanghai Composite Index traded 0.4% lower.

In early Asian trade, the price of West Texas Intermediate crude

was 0.1% higher, with Brent giving up its gains to trade 0.3%

lower. Oil entered into bull market overnight in the U.S. as

falling stockpiles and talk of a production cap by the Organization

of the Petroleum Exporting Countries led to gains, in the latest in

a series of big swings for the oil market. The WTI crude prices

have climbed 22% since Aug. 2.

Meanwhile, Chinese government data on Thursday showed average

housing prices in the country were about steady in July compared

with a month earlier, as city governments tightened homebuying

rules to cool housing markets.

That pushed up commodity prices on Thursday, with aluminum up

0.3%, copper rising 1%, and nickel adding 1.7% on the London Metal

Exchange.

But shares of Chinese developers didn't react much to the latest

housing data. In Hong Kong, Agile Group Holdings was off 1.2%,

while China Evergrande Group fell 2.1%.

Tagline to Ese Erheriene, Kosaku Narioka, Robb Stewart,

Dominique Fong and Hiroyuki Kachi.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 18, 2016 23:55 ET (03:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

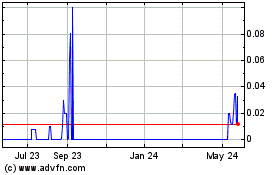

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Jan 2025 to Feb 2025

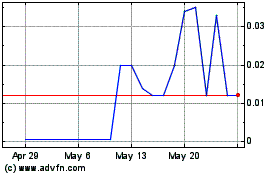

China Evergrande (CE) (USOTC:EGRNF)

Historical Stock Chart

From Feb 2024 to Feb 2025