0001528172

false

--12-31

Q2

P3Y

0001528172

2023-01-01

2023-06-30

0001528172

2023-08-21

0001528172

2023-06-30

0001528172

2022-12-31

0001528172

us-gaap:NonrelatedPartyMember

2023-06-30

0001528172

us-gaap:NonrelatedPartyMember

2022-12-31

0001528172

us-gaap:RelatedPartyMember

2023-06-30

0001528172

us-gaap:RelatedPartyMember

2022-12-31

0001528172

ENDV:SuperAASuperVotingPreferredStockMember

2023-06-30

0001528172

ENDV:SuperAASuperVotingPreferredStockMember

2022-12-31

0001528172

ENDV:SeriesBConvertiblePreferredStockMember

2023-06-30

0001528172

ENDV:SeriesBConvertiblePreferredStockMember

2022-12-31

0001528172

ENDV:SeriesCConvertiblePreferredStockMember

2023-06-30

0001528172

ENDV:SeriesCConvertiblePreferredStockMember

2022-12-31

0001528172

ENDV:SeriesDConvertiblePreferredStockMember

2023-06-30

0001528172

ENDV:SeriesDConvertiblePreferredStockMember

2022-12-31

0001528172

2023-04-01

2023-06-30

0001528172

2022-04-01

2022-06-30

0001528172

2022-01-01

2022-06-30

0001528172

2021-12-31

0001528172

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2022-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2022-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2022-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2022-12-31

0001528172

us-gaap:CommonStockMember

2022-12-31

0001528172

us-gaap:AdditionalPaidInCapitalMember

2022-12-31

0001528172

ENDV:SubscriptionReceivableMember

2022-12-31

0001528172

us-gaap:RetainedEarningsMember

2022-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2023-03-31

0001528172

us-gaap:CommonStockMember

2023-03-31

0001528172

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001528172

ENDV:SubscriptionReceivableMember

2023-03-31

0001528172

us-gaap:RetainedEarningsMember

2023-03-31

0001528172

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2021-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2021-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2021-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2021-12-31

0001528172

us-gaap:CommonStockMember

2021-12-31

0001528172

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001528172

ENDV:SubscriptionReceivableMember

2021-12-31

0001528172

us-gaap:RetainedEarningsMember

2021-12-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2022-03-31

0001528172

us-gaap:CommonStockMember

2022-03-31

0001528172

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001528172

ENDV:SubscriptionReceivableMember

2022-03-31

0001528172

us-gaap:RetainedEarningsMember

2022-03-31

0001528172

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2023-01-01

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2023-01-01

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2023-01-01

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2023-01-01

2023-03-31

0001528172

us-gaap:CommonStockMember

2023-01-01

2023-03-31

0001528172

us-gaap:AdditionalPaidInCapitalMember

2023-01-01

2023-03-31

0001528172

ENDV:SubscriptionReceivableMember

2023-01-01

2023-03-31

0001528172

us-gaap:RetainedEarningsMember

2023-01-01

2023-03-31

0001528172

2023-01-01

2023-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2023-04-01

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2023-04-01

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2023-04-01

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2023-04-01

2023-06-30

0001528172

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001528172

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001528172

ENDV:SubscriptionReceivableMember

2023-04-01

2023-06-30

0001528172

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2022-01-01

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2022-01-01

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2022-01-01

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2022-01-01

2022-03-31

0001528172

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001528172

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001528172

ENDV:SubscriptionReceivableMember

2022-01-01

2022-03-31

0001528172

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001528172

2022-01-01

2022-03-31

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2022-04-01

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2022-04-01

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2022-04-01

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2022-04-01

2022-06-30

0001528172

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001528172

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001528172

ENDV:SubscriptionReceivableMember

2022-04-01

2022-06-30

0001528172

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2023-06-30

0001528172

us-gaap:CommonStockMember

2023-06-30

0001528172

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001528172

ENDV:SubscriptionReceivableMember

2023-06-30

0001528172

us-gaap:RetainedEarningsMember

2023-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesAAPreferredStockMember

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesBConvertiblePreferredStockMember

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesCConvertiblePreferredStockMember

2022-06-30

0001528172

us-gaap:PreferredStockMember

ENDV:SeriesDConvertiblePreferredStockMember

2022-06-30

0001528172

us-gaap:CommonStockMember

2022-06-30

0001528172

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001528172

ENDV:SubscriptionReceivableMember

2022-06-30

0001528172

us-gaap:RetainedEarningsMember

2022-06-30

0001528172

ENDV:AssetsPurchaseAgreementMember

2022-09-26

2022-09-26

0001528172

us-gaap:EmployeeStockOptionMember

2023-01-01

2023-06-30

0001528172

us-gaap:EmployeeStockOptionMember

2022-01-01

2022-06-30

0001528172

us-gaap:WarrantMember

2022-01-01

2022-06-30

0001528172

ENDV:RoyaltyAndLicensingNetMember

2023-04-01

2023-06-30

0001528172

ENDV:RoyaltyAndLicensingNetMember

2022-04-01

2022-06-30

0001528172

ENDV:RoyaltyAndLicensingNetMember

2023-01-01

2023-06-30

0001528172

ENDV:RoyaltyAndLicensingNetMember

2022-01-01

2022-06-30

0001528172

ENDV:DirectSalesMedicalCareProvidersGrossMember

2023-04-01

2023-06-30

0001528172

ENDV:DirectSalesMedicalCareProvidersGrossMember

2022-04-01

2022-06-30

0001528172

ENDV:DirectSalesMedicalCareProvidersGrossMember

2023-01-01

2023-06-30

0001528172

ENDV:DirectSalesMedicalCareProvidersGrossMember

2022-01-01

2022-06-30

0001528172

ENDV:SalesSupportServiceAgreementMember

ENDV:PulseTherapeuticTechnologyMember

2023-01-25

0001528172

ENDV:RioGrandeNeurosciencesIncMember

2017-12-01

2017-12-31

0001528172

2022-01-01

2022-12-31

0001528172

ENDV:FormerRelatedPartyMember

2023-06-30

0001528172

ENDV:FormerRelatedPartyMember

2022-12-31

0001528172

srt:MinimumMember

2023-06-30

0001528172

srt:MaximumMember

2023-06-30

0001528172

srt:MinimumMember

2023-01-01

2023-06-30

0001528172

srt:MaximumMember

2023-01-01

2023-06-30

0001528172

ENDV:FixedRateNotesMember

2023-06-30

0001528172

ENDV:FixedRateNotesMember

2022-12-31

0001528172

ENDV:VariableRateNotesMember

2023-01-01

2023-06-30

0001528172

ENDV:FormerRelatedPartyMember

srt:MinimumMember

2023-06-30

0001528172

ENDV:FormerRelatedPartyMember

srt:MaximumMember

2023-06-30

0001528172

ENDV:FormerRelatedPartyMember

2023-01-01

2023-06-30

0001528172

ENDV:ThreeFixedRatedNotesMember

2022-06-30

0001528172

ENDV:ThreeFixedRatedNotesMember

2022-01-01

2022-06-30

0001528172

ENDV:SixteenFixedRatedNotesMember

2022-06-30

0001528172

ENDV:PastMaturityMember

ENDV:SixteenFixedRatedNotesMember

2022-06-30

0001528172

us-gaap:PrivatePlacementMember

2015-08-31

0001528172

us-gaap:PrivatePlacementMember

2015-08-01

2015-08-31

0001528172

us-gaap:PrivatePlacementMember

2022-06-30

0001528172

us-gaap:PrivatePlacementMember

2021-12-31

0001528172

ENDV:VariableRateNotesMember

2022-06-30

0001528172

ENDV:PastMaturityMember

ENDV:VariableRateNotesMember

2022-06-30

0001528172

ENDV:PreferredStockDesignatedMember

2023-06-30

0001528172

ENDV:SeriesAAPreferredStockMember

2013-02-22

0001528172

ENDV:SeriesAAPreferredStockMember

2013-02-21

2013-02-22

0001528172

ENDV:SeriesAAPreferredStockMember

2023-06-30

0001528172

ENDV:SeriesAAPreferredStockMember

2022-12-31

0001528172

us-gaap:SeriesBPreferredStockMember

2017-02-07

0001528172

us-gaap:SeriesBPreferredStockMember

2017-02-06

2017-02-07

0001528172

us-gaap:SeriesBPreferredStockMember

2023-06-30

0001528172

us-gaap:SeriesBPreferredStockMember

2022-12-31

0001528172

ENDV:SeriesCConvertibleRedeemablePreferredStockMember

2017-12-22

0001528172

ENDV:SeriesCConvertibleRedeemablePreferredStockMember

2017-12-21

2017-12-22

0001528172

ENDV:SeriesCConvertibleRedeemablePreferredStockMember

2020-01-28

2020-01-29

0001528172

ENDV:SeriesCConvertibleRedeemablePreferredStockMember

2023-06-30

0001528172

ENDV:SeriesCConvertibleRedeemablePreferredStockMember

2022-12-31

0001528172

ENDV:SeriesDConvertiblePreferredStockMember

2019-11-11

0001528172

ENDV:SeriesDConvertiblePreferredStockMember

2023-01-01

2023-06-30

0001528172

us-gaap:CommonStockMember

2023-01-01

2023-06-30

0001528172

ENDV:OneInvestorMember

2023-01-01

2023-06-30

0001528172

us-gaap:CommonStockMember

us-gaap:SeriesDPreferredStockMember

2023-01-01

2023-06-30

0001528172

us-gaap:SeriesDPreferredStockMember

2023-01-01

2023-06-30

0001528172

us-gaap:PrivatePlacementMember

2023-01-01

2023-06-30

0001528172

ENDV:SecuritiesPurchaseAgreementsMember

2023-01-01

2023-06-30

0001528172

us-gaap:CommonStockMember

2022-01-01

2022-06-30

0001528172

ENDV:OneInvestorMember

2022-01-01

2022-06-30

0001528172

ENDV:PurchaseAgreementMember

2022-01-01

2022-06-30

0001528172

ENDV:SeriesAAMember

2023-06-30

0001528172

ENDV:PreferredSeriesBMember

2023-06-30

0001528172

ENDV:PreferredSeriesCMember

2023-06-30

0001528172

ENDV:PreferredSeriesDMember

2023-06-30

0001528172

ENDV:UndesignatedMember

2023-06-30

0001528172

ENDV:StockOptionsMember

2022-12-31

0001528172

ENDV:StockOptionsMember

2023-01-01

2023-06-30

0001528172

ENDV:StockOptionsMember

2023-06-30

0001528172

us-gaap:WarrantMember

2022-12-31

0001528172

us-gaap:WarrantMember

2023-01-01

2023-06-30

0001528172

us-gaap:WarrantMember

2023-06-30

0001528172

srt:ExecutiveOfficerMember

2023-06-30

0001528172

srt:ExecutiveOfficerMember

2023-01-01

2023-06-30

0001528172

ENDV:OneFormerExecutiveOfficerMember

2023-06-30

0001528172

srt:OfficerMember

2023-06-30

0001528172

ENDV:FormerPresidentMember

2023-06-30

0001528172

us-gaap:MeasurementInputExpectedTermMember

2023-01-01

2023-06-30

0001528172

us-gaap:MeasurementInputExpectedTermMember

2022-01-01

2022-06-30

0001528172

us-gaap:MeasurementInputExercisePriceMember

srt:MinimumMember

2023-06-30

0001528172

us-gaap:MeasurementInputExercisePriceMember

srt:MaximumMember

2023-06-30

0001528172

us-gaap:MeasurementInputExercisePriceMember

srt:MinimumMember

2022-06-30

0001528172

us-gaap:MeasurementInputExercisePriceMember

srt:MaximumMember

2022-06-30

0001528172

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2023-06-30

0001528172

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2023-06-30

0001528172

us-gaap:MeasurementInputPriceVolatilityMember

srt:MinimumMember

2022-06-30

0001528172

us-gaap:MeasurementInputPriceVolatilityMember

srt:MaximumMember

2022-06-30

0001528172

us-gaap:MeasurementInputExpectedDividendRateMember

2023-06-30

0001528172

us-gaap:MeasurementInputExpectedDividendRateMember

2022-06-30

0001528172

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2023-06-30

0001528172

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2023-06-30

0001528172

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MinimumMember

2022-06-30

0001528172

us-gaap:MeasurementInputRiskFreeInterestRateMember

srt:MaximumMember

2022-06-30

0001528172

ENDV:ForfeituresMember

2023-06-30

0001528172

ENDV:ForfeituresMember

2022-06-30

0001528172

us-gaap:FairValueInputsLevel3Member

2022-12-31

0001528172

us-gaap:FairValueInputsLevel3Member

2023-01-01

2023-06-30

0001528172

us-gaap:FairValueInputsLevel3Member

2023-06-30

0001528172

us-gaap:FairValueInputsLevel1Member

2023-06-30

0001528172

us-gaap:FairValueInputsLevel2Member

2023-06-30

0001528172

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

ENDV:OneSignificantCustomerMember

2023-01-01

2023-06-30

0001528172

us-gaap:SalesRevenueNetMember

us-gaap:SupplierConcentrationRiskMember

ENDV:SupplierMember

2023-01-01

2023-06-30

0001528172

ENDV:TwoNotesExtensionAgreementsMember

us-gaap:SubsequentEventMember

2023-07-01

2023-08-14

0001528172

ENDV:SecuriyPurchaseAgreementMember

us-gaap:SubsequentEventMember

ENDV:OneInvestorMember

2023-07-01

2023-08-14

0001528172

ENDV:ProductionAgreementMember

us-gaap:SubsequentEventMember

2023-07-01

2023-08-14

0001528172

us-gaap:ConvertibleDebtMember

us-gaap:SubsequentEventMember

2023-08-14

0001528172

us-gaap:ConvertibleDebtMember

us-gaap:SubsequentEventMember

2023-07-01

2023-08-14

0001528172

us-gaap:SubsequentEventMember

ENDV:ConsultantAndChiefExecutiveOfficerMember

2023-07-01

2023-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

ENDV:Integer

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

10-Q

(Mark

One)

☒

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the quarterly period ended: June 30, 2023

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _______ to _______.

Commission

File Number: 000-55453

ENDONOVO

THERAPEUTICS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

45-2552528 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

6320

Canoga Avenue, 15th Floor, Woodland Hills, CA 91367

(Address

of principal executive offices, zip code)

(800)

489-4774

(Registrant’s

telephone number, including area code)

Securities

registered pursuant to Section 12(b) of the Securities Exchange Act: None

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files). Yes ☒ No ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| |

|

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

|

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes

☐ No ☒

As

of August 21, 2023, there were 317,902,405 shares of common stock, $0.0001 par value issued and outstanding.

ENDONOVO

THERAPEUTICS, INC.

TABLE

OF CONTENTS

FORM

10-Q REPORT

June

30, 2023

PART

I - FINANCIAL INFORMATION

Item

1. Financial Statements.

Endonovo

Therapeutics, Inc.

Condensed

Consolidated Balance Sheets

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

(Unaudited) | | |

(Audited) | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 32,602 | | |

$ | 98 | |

| Prepaid expenses and other current assets | |

| 40,231 | | |

| 15,724 | |

| Total current assets | |

| 72,833 | | |

| 15,822 | |

| | |

| | | |

| | |

| Patents, net | |

| 941,988 | | |

| 1,265,444 | |

| Total assets | |

$ | 1,014,821 | | |

$ | 1,281,266 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ DEFICIT | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 1,166,997 | | |

$ | 884,195 | |

| Accounts payable and accrued liabilities – related party | |

| 282,000 | | |

| - | |

| Accounts payable and accrued liabilities | |

| 282,000 | | |

| - | |

| Accrued interest related to notes payable | |

| 4,134,397 | | |

| 3,542,650 | |

| Deferred compensation | |

| 4,053,368 | | |

| 3,918,788 | |

| Deferred compensation – related party | |

| 570,068 | | |

| 523,818 | |

| Deferred compensation | |

| 570,068 | | |

| 523,818 | |

| Notes payable, net of discounts of $25,585 and $10,587 as of June 30, 2023 and December 31, 2022 | |

| 6,922,497 | | |

| 7,041,145 | |

| Notes payable – former related party | |

| 104,600 | | |

| 112,100 | |

| Notes payable | |

| 104,600 | | |

| 112,100 | |

| Derivative liability | |

| 5,902,829 | | |

| 17,359,064 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 23,136,756 | | |

| 33,381,760 | |

| | |

| | | |

| | |

| Acquisition payable | |

| 79,825 | | |

| 79,825 | |

| Total liabilities | |

| 23,216,581 | | |

| 33,461,585 | |

| COMMITMENTS AND CONTINGENCIES, note 9 | |

| - | | |

| - | |

| | |

| | | |

| | |

| Shareholders’ deficit | |

| | | |

| | |

| Super AA super voting preferred stock, $0.001 par value; 1,000,000 authorized and 25,000 issued and outstanding at June 30, 2023 and December 31, 2022 | |

| 25 | | |

| 25 | |

| Series B convertible preferred stock, $0.0001 par value; 50,000 shares authorized, 600 shares issued and outstanding at June 30, 2023 and December 31, 2022 | |

| 1 | | |

| 1 | |

| Series C convertible preferred stock, $0.0001 par value; 8,000 shares authorized, 738 shares issued and outstanding at June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Series D convertible preferred stock, $0.0001 par value; 20,000 shares authorized, 0 and 50 issued and outstanding at June 30, 2023 and December 31, 2022 | |

| - | | |

| - | |

| Preferred stock value | |

| - | | |

| - | |

| Common stock, $0.0001 par value; 2,500,000,000 shares authorized; 278,802,405 and 213,227,538 shares issued and outstanding as of June 30, 2023 and December 31, 2022 | |

| 27,880 | | |

| 21,322 | |

| Additional paid-in capital | |

| 43,636,323 | | |

| 42,919,086 | |

| Stock subscriptions receivable | |

| (1,570 | ) | |

| (1,570 | ) |

| Accumulated deficit | |

| (65,864,419 | ) | |

| (75,119,183 | ) |

| Total shareholders’ deficit | |

| (22,201,760 | ) | |

| (32,180,319 | ) |

| Total liabilities and shareholders’ deficit | |

$ | 1,014,821 | | |

$ | 1,281,266 | |

See

accompanying summary of accounting policies and notes to unaudited condensed consolidated financial statements.

Endonovo

Therapeutics, Inc.

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

June 30, | | |

June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 45,200 | | |

$ | 650 | | |

$ | 132,740 | | |

$ | 2,932 | |

| Cost of revenue | |

| - | | |

| 383 | | |

| 3,996 | | |

| 1,097 | |

| Gross profit | |

| 45,200 | | |

| 267 | | |

| 128,744 | | |

| 1,835 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| 1,176,509 | | |

| 1,799,016 | | |

| 1,789,343 | | |

| 2,286,346 | |

| Loss from operations | |

| (1,131,309 | ) | |

| (1,798,749 | ) | |

| (1,660,599 | ) | |

| (2,284,511 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of derivative liability | |

| 3,419,564 | | |

| (316,606 | ) | |

| 11,445,466 | | |

| (1,846,964 | ) |

| Gain (loss) on settlement of debt | |

| 103,602 | | |

| 104,760 | | |

| 156,062 | | |

| 43,813 | |

| Other expense | |

| (15,328 | ) | |

| (178,000 | ) | |

| (24,518 | ) | |

| (178,000 | ) |

| Interest expense, net | |

| (312,869 | ) | |

| (337,536 | ) | |

| (622,249 | ) | |

| (673,678 | ) |

| Other income (expense) | |

| 3,194,969 | | |

| (727,382 | ) | |

| 10,954,761 | | |

| (2,654,829 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss) | |

$ | 2,063,660 | | |

$ | (2,526,131 | ) | |

$ | 9,294,162 | | |

$ | (4,939,340 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic Income (Loss) per share | |

$ | 0.00 | | |

$ | (0.02 | ) | |

$ | 0.04 | | |

$ | (0.05 | ) |

| Diluted Loss per share | |

$ | (0.01 | ) | |

$ | (0.02 | ) | |

$ | (0.00 | ) | |

$ | (0.05 | ) |

| Weighted average common share outstanding: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 276,330,405 | | |

| 134,360,871 | | |

| 263,948,243 | | |

| 106,696,127 | |

| Diluted | |

| 1,350,743,592 | | |

| 134,360,871 | | |

| 1,338,361,430 | | |

| 106,696,127 | |

See

accompanying summary of accounting policies and notes to unaudited condensed consolidated financial statements.

Endonovo

Therapeutics, Inc.

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

2023 | | |

2022 | |

| | |

Six Months ended June 30, | |

| | |

2023 | | |

2022 | |

| Operating activities: | |

| | | |

| | |

| Net Income (Loss) | |

$ | 9,294,162 | | |

$ | (4,939,340 | ) |

| Adjustments to reconcile net income (loss) to cash used in operating activities: | |

| | | |

| | |

| Amortization expense | |

| 323,457 | | |

| 323,456 | |

| Stock compensation expense | |

| 566,500 | | |

| - | |

| Fair value of equity issued for services | |

| 107,468 | | |

| 1,281,900 | |

| Loss (gain) on extinguishment of debt | |

| (156,062 | ) | |

| (43,813 | ) |

| Amortization of note discount and original issue discount | |

| 14,627 | | |

| 59,138 | |

| Change in fair value of derivative liability | |

| (11,445,466 | ) | |

| 1,846,964 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Prepaid expenses and other current assets | |

| 11,974 | | |

| 2,975 | |

| Account payable and accrued liabilities (related and unrelated parties) | |

| 74,827 | | |

| 205,844 | |

| Accrued interest | |

| 600,747 | | |

| 614,540 | |

| Deferred compensation | |

| 268,770 | | |

| 318,900 | |

| Net cash used in operating activities | |

| (338,996 | ) | |

| (329,436 | ) |

| | |

| | | |

| | |

| Financing activities: | |

| | | |

| | |

| Proceeds from the issuance of notes payable not of costs | |

| 146,000 | | |

| 250,000 | |

| Repayments on former related party of notes payable | |

| (7,500 | ) | |

| (6,500 | ) |

| Repayments of convertible debt in cash | |

| (20,000 | ) | |

| - | |

| Proceeds from issuance of common stock and units, net | |

| 253,000 | | |

| - | |

| Net cash provided by financing activities | |

| 371,500 | | |

| 243,500 | |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| 32,504 | | |

| (85,936 | ) |

| Cash, beginning of year | |

| 98 | | |

| 85,936 | |

| Cash, end of period | |

$ | 32,602 | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | - | | |

$ | - | |

| Cash paid for income taxes | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Non-Cash Investing and Financing Activities: | |

| | | |

| | |

| Conversion of notes payable and accrued interest to common stock | |

$ | 109,000 | | |

$ | 204,000 | |

| Conversion of Preferred C Stock to common stock | |

$ | 500 | | |

$ | - | |

| Issuance of common stock to settle debt | |

$ | 45,000 | | |

$ | - | |

| Debt discount from issuance of debt | |

$ | 29,625 | | |

$ | 33,167 | |

Conversion of notes to common stock pursuant to settlement agreement | |

$ | 159,419 | | |

$ | - | |

See

accompanying summary of accounting policies and notes to unaudited condensed consolidated financial statements.

Endonovo

Therapeutics, Inc.

Condensed

Consolidated Statement of Shareholders’ Deficit

(Unaudited)

For

three and six months ended June 30, 2023

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Re

ceivable | | |

Deficit | | |

Deficit | |

| | |

Series

AA Preferred Stock | | |

Series

B Convertible Preferred Stock | | |

Series

C Convertible Preferred Stock | | |

Series

D Convertible Preferred Stock | | |

Common

Stock | | |

Additional Paid-in | | |

Subscription | | |

Accumulated | | |

Total Shareholder’s | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Receivable | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance December 31, 2022 | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| 50 | | |

$ | - | | |

| 213,227,538 | | |

$ | 21,322 | | |

$ | 42,919,086 | | |

$ | (1,570 | ) | |

$ | (75,119,183 | ) | |

$ | (32,180,319 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for conversion of notes payable and accrued interest | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 10,900,000 | | |

| 1,090 | | |

| 107,910 | | |

| - | | |

| - | | |

| 109,000 | |

| Shares issued pursuant to make good provision | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 1,507,277 | | |

| 151 | | |

| 24,719 | | |

| | | |

| | | |

| 24,870 | |

| Shares issued for settlement of debt | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 4,300,590 | | |

| 430 | | |

| 66,659 | | |

| - | | |

| - | | |

| 67,089 | |

| Issuance of common shares for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 12,850,000 | | |

| 1,285 | | |

| 171,665 | | |

| - | | |

| - | | |

| 172,950 | |

| Common stock issued for cash, net of fees | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 22,500,000 | | |

| 2,250 | | |

| 204,750 | | |

| - | | |

| - | | |

| 207,000 | |

| Shares issued for conversion of Preferred Series D to common shares | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (50 | ) | |

| - | | |

| 5,000,000 | | |

| 500 | | |

| (500 | ) | |

| - | | |

| - | | |

| - | |

| Inducement loss related to conversion of preferred stock | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 39,398 | | |

| - | | |

| (39,398 | ) | |

| - | |

| Net income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 7,230,502 | | |

| 7,230,502 | |

| Balance March 31, 2023 | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| - | | |

$ | - | | |

| 270,285,405 | | |

$ | 27,028 | | |

$ | 43,533,687 | | |

$ | (1,570 | ) | |

$ | (67,928,079 | ) | |

$ | (24,368,908 | ) |

| Shares issued for conversion of deferred compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,667,000 | | |

| 167 | | |

| 24,171 | | |

| - | | |

| - | | |

| 24,338 | |

| Issuance of commitment shares in connection with promissory notes | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 850,000 | | |

| 85 | | |

| 11,040 | | |

| - | | |

| - | | |

| 11,125 | |

| Stock-based compensation | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,025 | | |

| - | | |

| - | | |

| 6,025 | |

| Common Shares issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,000,000 | | |

| 100 | | |

| 15,900 | | |

| - | | |

| - | | |

| 16,000 | |

| Common stock issued for cash, net of fees | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 5,000,000 | | |

| 500 | | |

| 45,500 | | |

| - | | |

| - | | |

| 46,000 | |

| Net Income | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 2,063,660 | | |

| 2,063,660 | |

| Balance June 30, 2023 | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| - | | |

$ | - | | |

| 278,802,405 | | |

$ | 27,880 | | |

$ | 43,636,323 | | |

$ | (1,570 | ) | |

$ | (65,864,419 | ) | |

$ | (22,201,760 | ) |

For

three and six months ended June 30, 2022

| | |

Series

AA Preferred Stock | | |

Series

B Convertible Preferred Stock | | |

Series

C Convertible Preferred Stock | | |

Series

D Convertible Preferred Stock | | |

Common

Stock | | |

Additional Paid-in | | |

Subscription | | |

Accumulated | | |

Total Shareholder’s | |

| | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Shares | | |

Amount | | |

Capital | | |

Receivable | | |

Deficit | | |

Deficit | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance December 31, 2020 | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| 305 | | |

$ | - | | |

| 74,498,760 | | |

$ | 7,449 | | |

$ | 40,663,187 | | |

$ | (1,570 | ) | |

$ | (56,443,416 | ) | |

$ | (15,774,324 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares issued for conversion of notes payable and accrued interest | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 3,700,000 | | |

| 370 | | |

| 88,430 | | |

| - | | |

| - | | |

| 88,800 | |

| Common stock issued for settlement of debt | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| 2,428,777 | | |

| 243 | | |

| 45,904 | | |

| | | |

| | | |

| 46,147 | |

| Issuance of commitment shares in connection with promissory note | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 700,000 | | |

| 70 | | |

| 15,680 | | |

| - | | |

| - | | |

| 15,750 | |

| Net loss for the quarter ended March 31, 2022 | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| | | |

| - | | |

| (2,413,209 | ) | |

| (2,413,209 | ) |

| Balance March 31, 2022 | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| 305 | | |

$ | - | | |

| 81,327,538 | | |

$ | 8,132 | | |

$ | 40,813,201 | | |

$ | (1,570 | ) | |

$ | (58,856,625 | ) | |

$ | (18,036,836 | ) |

| Balance | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| 305 | | |

$ | - | | |

| 81,327,538 | | |

$ | 8,132 | | |

$ | 40,813,201 | | |

$ | (1,570 | ) | |

$ | (58,856,625 | ) | |

$ | (18,036,836 | ) |

| Shares issued for conversion of notes payable and accrued interest | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 6,500,000 | | |

| 650 | | |

| 114,550 | | |

| - | | |

| - | | |

| 115,200 | |

| Issuance of commitment shares in connection with promissory note | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 350,000 | | |

| 35 | | |

| 5,698 | | |

| - | | |

| - | | |

| 5,733 | |

| Common Shares issued for services | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 62,250,000 | | |

| 6,225 | | |

| 1,275,675 | | |

| - | | |

| - | | |

| 1,281,900 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,526,131 | ) | |

| (2,526,131 | ) |

| Net Income (loss) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (2,526,131 | ) | |

| (2,526,131 | ) |

| Balance June 30, 2022 | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| 305 | | |

$ | - | | |

| 150,427,538 | | |

$ | 15,042 | | |

$ | 42,209,124 | | |

$ | (1,570 | ) | |

$ | 61,382,756 | | |

$ | (19,160,134 | ) |

| Balance | |

| 25,000 | | |

$ | 25 | | |

| 600 | | |

$ | 1 | | |

| 738 | | |

$ | - | | |

| 305 | | |

$ | - | | |

| 150,427,538 | | |

$ | 15,042 | | |

$ | 42,209,124 | | |

$ | (1,570 | ) | |

$ | 61,382,756 | | |

$ | (19,160,134 | ) |

See

accompanying summary of accounting policies and notes to unaudited condensed consolidated financial statements.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements

Note

1 - Organization and Nature of Business

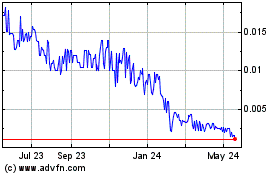

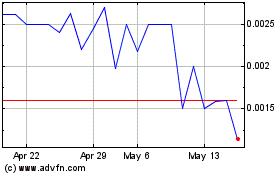

Endonovo

Therapeutics, Inc. (Endonovo or the “Company”) is an innovative biotechnology company that has developed a bio-electronic

approach to regenerative medicine. Endonovo is a growth stage company whose stock is publicly traded (OTCQB: ENDV).

The

Company develops, manufactures, and distributes evolutionary medical devices focused on the rapid healing of wounds and reduction of

pain, edema, and inflammation in the human body. The Company’s non-invasive bioelectric medical devices are designed to target

inflammation, cardiovascular diseases, chronic kidney disease, and central nervous system disorders (“CNS” disorders).

The

Company’s non-invasive Electroceutical® therapeutics device, SofPulse®, using pulsed short-wave radiofrequency at 27.12

MHz has been FDA-Cleared and CE Marked for the palliative treatment of soft tissue injuries and post-operative plain and edema, and has

CMS National Coverage for the treatment of chronic wounds. The Company’s current portfolio of pre-clinical stage Electroceutical®

therapeutics devices address chronic kidney disease, liver disease non-alcoholic steatohepatitis (NASH), cardiovascular and peripheral

artery disease (PAD) and ischemic stroke.

Endonovo’s

core mission is to transform the field of medicine by developing safe, wearable, non-invasive bioelectric medical devices that deliver

the Company’s Electroceutical® Therapy. Endonovo’s bioelectric Electroceutical® devices harnesses

bioelectricity to restore key electrochemical processes that initiate anti-inflammatory processes and growth factors in the body

necessary for healing to rapidly occur.

The

Company intends to be structured into two separate divisions:

| ■ | A

commercial stage developer primarily of non-invasive wearable Electroceuticals® therapeutic devices for pain relief, general

wellness, and wound curatives with many of its products marketed under the SofPulse® brand name. This division will be

controlled by Ira Weisberg, the Company’s President and Chief Commercial Officer. |

| ■ | M&A

division with a strategy of purchasing profitable companies, which will be managed by the Company’s current Chief Executive Officer. |

Note

2 – Summary of significant accounting policies.

Basis

of Presentation and Principles of Consolidation

The

accompanying unaudited interim condensed consolidated financial statements have been presented in accordance with accounting principles

generally accepted in the United States of America (“GAAP”) for interim financial information and the instructions to Article

8 of Regulation S-X. Accordingly, the financial statements do not include all of the information and notes required by GAAP for complete

financial statements. The accompanying consolidated condensed balance sheet as of June 30, 2023, the consolidated statements of operations

for the three and six months ended June 30, 2023 and 2022, the consolidated statements of cash flows for the six months ended June 30,

2023 and 2022, and the consolidated statements of shareholders’ deficit for the three and six months ended June 30, 2023 and 2022

are unaudited; however, in the opinion of management such interim consolidated financial statements reflect all adjustments, consisting

solely of normal recurring adjustments, necessary for a fair presentation of the results for the periods presented. The accompanying

financial information should be read in conjunction with the financial statements and the notes thereto in the Company’s most recent

Annual Report on Form 10-K, as filed with the Securities and Exchange Commission (the “SEC”) on April 17, 2023. The results

of operations for the period presented are not necessarily indicative of the results that might be expected for future interim periods

or for the full year.

Liquidity

and Going Concern

The

Company’s unaudited condensed consolidated financial statements are prepared using GAAP applicable to a going concern, which contemplates

the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing

source of revenues sufficient to cover its operating costs and to continue as a going concern. The ability of the Company to continue

as a going concern is dependent on the Company’s ability to obtain adequate capital to fund operating losses until it becomes profitable.

As

of June 30, 2023, the Company had cash of approximately $32,600 and a working capital deficiency of approximately $23.1 million. During

the six months ended June 30, 2023, the Company used approximately $0.3 million of cash in its operation. The Company has incurred recurring

losses resulting in an accumulated deficit of approximately $65.9 million as of June 30, 2023. These conditions raise substantial doubt

as to its ability to continue as going concern within one year from issuance date of these unaudited consolidated financial statements.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

During

the six months ended June 30, 2023, the Company has raised $0.4 million in equity and debt financings. The Company will continue to raise

additional capital through either debt or equity financing to fund its operations. However, there is no assurance that the Company can

raise enough funds or generate sufficient revenues to pay its obligations as they become due, which raises substantial doubt about our

ability to continue as a going concern.

On

September 26, 2022, the Company entered into an asset purchase agreement with a Company, which is engaged in the business of providing

and laying of concrete primarily for residential tract developers, pursuant to which the Company will acquire all of the assets and liabilities

for approximately $25.2 million. The Company intends to raise the consideration through debt and equity financing. Such a transaction

has not yet closed at the report date.

No

adjustments have been made to the carrying value of assets or liabilities as a result of this uncertainty. To reduce the risk of not

being able to continue as a going concern, management is commercializing its FDA cleared and CE marked products and has commenced implementing

its business plan to materialize revenues from potential future license agreements, and or diversifying its business activities with

the potential acquisition of specialty construction company. The Company will continue to raise additional capital through the issuance

of fixed-rate conversion feature promissory notes.

Use

of Estimates

The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires

management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and

accompanying notes. Critical estimates include the assessment of impairment of finite lived intangibles, the valuation of the derivative

liability, the valuation of warrants and stock options, and the valuation of deferred income tax assets. Management uses its historical

records and knowledge of its business in making these estimates. Actual results could differ from these estimates.

Earnings

(Loss) Per Share

The

Company utilizes Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 260,

“Earnings per Share.” Basic earnings (loss) per share is computed based on the earnings (loss) attributable to common shareholders

divided by the weighted average number of shares outstanding for the period excluding any dilutive effects of options, warrants, unvested

share awards and convertible securities. Diluted earnings (loss) per common share is calculated similar to basic earnings (loss) per

share except that the denominator is increased to include additional common share equivalents available upon exercise of stock option,

warrants, common shares issuable under convertible debt and restricted stock using the treasury stock method. Dilutive common share equivalents

include the dilutive effect of in-the-money share equivalents, which are calculated based on the average share price for each period

using the treasury stock method, excluding any common share equivalents if their effect would be anti-dilutive. In periods in which a

net loss has been incurred, all potentially dilutive common shares are considered anti-dilutive and thus are excluded from the calculation.

Securities that are excluded from the calculation of weighted average dilutive common shares because their inclusion would have been

antidilutive for the six months ended June 30, 2023, include stock options, warrants, and notes payable.

The

Company has 6,011,750 stock options to purchase an equivalent number of shares of common stock outstanding at June 30, 2023. The Company

has 513,730 options and 2,000 warrants to purchase common stock outstanding at June 30, 2022.

The

components of basic and diluted income (loss) per share for the six months ended June 30, 2023 and 2022 were as follows:

Schedule of Earnings Per Share Basic and Diluted

| | |

2023 | | |

2022 | |

| | |

Six months ended June 30, | |

| | |

2023 | | |

2022 | |

| Numerator: | |

| | | |

| | |

| Net income (loss) attributable to common shareholders | |

$ | 9,294,162 | | |

$ | (4,939,340 | ) |

| | |

| | | |

| | |

| Effect of dilutive securities | |

| | | |

| | |

| Convertible notes | |

| (10,823,217 | ) | |

| - | |

| Net loss for diluted earnings per share | |

$ | (1,529,055 | ) | |

$ | (4,939,340 | ) |

| Denominator: | |

| | | |

| | |

| Weighted-average number of common shares outstanding during the period | |

| 263,948,243 | | |

| 106,696,127 | |

| Dilutive effect of convertible notes payable | |

| 1,074,413,187 | | |

| - | |

| Common stock and common stock equivalents used for diluted loss per share | |

| 1,338,361,430 | | |

| 106,696,127 | |

The

components of basic and diluted income (loss) per share for the three months ended June 30, 2023 and 2022 were as follows:

| | |

2023 | | |

2022 | |

| | |

Three months ended June 30, | |

| | |

2023 | | |

2022 | |

| Numerator: | |

| | | |

| | |

| Net income (loss) attributable to common shareholders | |

$ | 2,063,660 | | |

$ | (2,526,131 | ) |

| | |

| | | |

| | |

| Effect of dilutive securities | |

| | | |

| | |

| Convertible notes | |

| (3,106,695 | ) | |

| - | |

| Net loss for diluted earnings per share | |

$ | (1,043,035 | ) | |

$ | (2,526,131 | ) |

| Denominator: | |

| | | |

| | |

| Weighted-average number of common shares outstanding during the period | |

| 276,330,405 | | |

| 134,360,871 | |

| Dilutive effect of convertible notes payable | |

| 1,074,413,187 | | |

| - | |

| Common stock and common stock equivalents used for diluted loss per share | |

| 1,350,743,592 | | |

| 134,360,871 | |

Accounts

Receivable

The

Company uses the specific identification method for recording the provision for doubtful accounts, which was $0 as of June 30, 2023 and

December 31, 2022. Account receivables are written off when all collection attempts have failed.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

Newly

Adopted Accounting Principles

The

Company has evaluated all the recent accounting pronouncements and determined that there are no other accounting pronouncements that

will have a material effect on the Company’s consolidated financial statements.

Note

3 - Revenue Recognition

Contracts

with Customers

The

Company adopted ASC 606, Revenue from Contracts with Customers effective January 1, 2019, using the modified retrospective method

applied to those contracts which were not substantially completed as of January 1, 2019. These standards provide guidance on recognizing

revenue, including a five-step model to determine when revenue recognition is appropriate. The standard requires that an entity recognize

revenue to depict the transfer of control of promised goods or services to customers in an amount that reflects the consideration to

which the entity expects to be entitled in exchange for those goods or services.

The

Company routinely plans on entering into contracts with customers that include general commercial terms and conditions, notification

requirements for price increases, shipping terms and in most cases prices for the products and services that we offer. The Company’s

performance obligations are established when a customer submits a purchase order notification (in writing, electronically or verbally)

for goods and services, and we accept the order. The Company identified performance obligations as the delivery of the requested product

or service in appropriate quantities and to the location specified in the customer’s contract and/or purchase order. The Company

generally recognize revenue upon the satisfaction of these criteria when control of the product or service has been transferred to the

customer at which time, the Company has an unconditional right to receive payment. The Company’s sales and sale prices are final,

and our prices are not affected by contingent events that could impact the transaction price.

Revenues

for our SofPulse® product is typically recognized at the time the product is shipped, at which time the title passes to the customer,

and there are no further performance obligations. Royalty/licensing revenue is also recognized at one point in time, when the units are

shipped.

In

connection with offering products and services provided to the end user by third-party vendors, the Company reviews the relationship

between us, the vendor, and the end user to assess whether revenue should be reported on a gross or net basis. In asserting whether revenue

should be reported on a gross or net basis, the Company considers whether the Company acts as a principal in the transaction and control

the goods and services used to fulfill the performance obligation(s) associated with the transaction.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

Sources

of Revenue

The

Company has identified the following revenues by revenue source:

| 1. |

Sales

to plastic surgeons |

| 2. |

Sales

to wound care facilities |

| 3. |

Sales

to hospital |

| 4. |

Sales

to other physicians |

| 5. |

Royalty

fee from licensing, net |

For

the three and six months ended June 30, 2023 and 2022, the sources of revenue were as follows:

Schedule of Source of Revenue

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

Three Months Ended June 30, | | |

Six Months Ended June 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Royalty/licensing, net | |

$ | 45,200 | | |

$ | - | | |

$ | 126,520 | | |

$ | - | |

| Direct sales- medical care providers, gross | |

| - | | |

| 650 | | |

| 6,220 | | |

| 2,932 | |

| Total sources of revenue | |

$ | 45,200 | | |

$ | 650 | | |

$ | 132,740 | | |

$ | 2,932 | |

The

royalty/licensing revenue recognized in the six months ended June 30, 2023, resulted from specific transactions. No general patent rights

were assigned to the distributor. The royalty / licensing revenue is recorded on a net basis as the Company was not considered the principal

but an agent for accounting purposes. The royalty / licensing revenue, net includes an ongoing contract with a customer that has a total

gross sales value of $300,000,

for which the Company recognized net revenue of $126,520

based on 1,000

units delivered during the period ended June

30, 2023. The royalty/licensing revenue is recognized when Pulse Therapeutic Technology picks up the units from the Company’s vendor.

On January 25, 2023, the Company entered into a sales support services

agreement with Pulse Therapeutic Technology (“PTT”), an entity controlled by a former related party, under which PTT has been

selling Sofpulse® on a nonexclusive basis. Pursuant to such agreement, the deferred compensation owed to this former related party has

been fully extinguished for a total amount of approximately $118,000.

Warranty

Our

general product warranties do not extend beyond an assurance that the product delivered will be consistent with stated specifications

and do not include separate performance obligations.

Significant

Judgments in the Application of the Guidance in ASC 606

There

are no significant judgments associated with the satisfaction of our performance obligations. We generally satisfy performance obligations

upon shipment of the product to the customer. This is consistent with the time in which the customer obtains control of the products.

Performance obligations are also generally settled quickly after the purchase order acceptance, therefore the value of unsatisfied performance

obligations at the end of any reporting period is generally immaterial.

We

consider variable consideration in establishing the transaction price. Forms of variable consideration applicable to our arrangements

include sales returns, rebates, volume-based bonuses, and prompt pay discounts. We use historical information along with an analysis

of the expected value to properly calculate and to consider the need to constrain estimates of variable consideration. Such amounts are

included as a reduction to revenue from the sale of products in the periods in which the related revenue is recognized and adjusted in

future periods as necessary.

Practical

Expedients

Our

payment terms for sales direct to distributors are substantially less than the one-year collection period that falls within the practical

expedient in determination of whether a significant financing component exists.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

Note

4 – Patents.

In

December 2017, we acquired from Rio Grande Neurosciences, Inc. (RGN) a patent portfolio for $4,500,000. The earliest patents expire in

2024. The following is a summary of patents less accumulated amortization at June 30, 2023 and December 31, 2022:

Schedule of Patents

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| Patents | |

$ | 4,500,000 | | |

$ | 4,500,000 | |

| | |

| | | |

| | |

| Less accumulated amortization | |

| 3,558,012 | | |

| 3,234,556 | |

| | |

| | | |

| | |

| Patents, net | |

$ | 941,988 | | |

$ | 1,265,444 | |

Amortization

expense associated with patents was $323,456 for the six months ended June 30, 2023 and 2022.

The

estimated future amortization expense related to patents as of June 30, 2023, is as follows:

Schedule of Estimated Future Amortization Expense

| Twelve Months Ending June 30, | |

Amount | |

| | |

| |

| 2024 | |

$ | 646,910 | |

| 2025 | |

| 295,078 | |

| | |

| | |

| Total | |

$ | 941,988 | |

Note

5- Notes Payable

As

of June 30, 2023, and December 31, 2022, the notes payable activity was as follows:

Schedule of Notes Payable

| | |

June 30, 2023 | | |

December 31, 2022 | |

| | |

| | |

| |

| Notes payable at beginning of period | |

$ | 7,163,832 | | |

$ | 7,256,930 | |

| Notes payable issued | |

| 150,000 | | |

| 465,000 | |

| Repayments of notes payable in cash | |

| (27,500 | ) | |

| (14,000 | ) |

| Settlement on note payable | |

| (133,650 | ) | |

| (163,826 | ) |

| Less amounts converted to stock | |

| (100,000 | ) | |

| (380,272 | ) |

| Notes payable at end of period | |

| 7,052,682 | | |

| 7,163,832 | |

| Less debt discount | |

| (25,585 | ) | |

| (10,587 | ) |

| Note payable, net | |

$ | 7,027,097 | | |

$ | 7,153,245 | |

| | |

| | | |

| | |

| Notes payable issued to a former related party | |

$ | 104,600 | | |

$ | 112,100 | |

| Notes payable issued to non-related parties | |

$ | 6,922,497 | | |

$ | 7,041,145 | |

The

maturity dates on the notes-payable are as follows:

Schedule of Maturity Dates of Notes Payable

| | |

Notes to | | |

| |

| 12 months ending, | |

Former

related party | | |

Non-related

parties | | |

Total | |

| | |

| | |

| | |

| |

| Past due | |

$ | 104,600 | | |

$ | 6,733,082 | | |

$ | 6,837,682 | |

| June 30, 2024 | |

| - | | |

| 215,000 | | |

| 215,000 | |

| | |

$ | 104,600 | | |

$ | 6,948,082 | | |

$ | 7,052,682 | |

Activity

for the six months ended June 30, 2023

Fixed

rate notes

During

the six months ended June 30, 2023, the Company converted $100,000 in principal and $9,000 in accrued interest into 10,900,000 shares

of common stock.

During

the six months ended June 30, 2023, the Company executed a second amendment to a fixed rate note to extend the maturity date in exchange

for $20,000 payment to the current balance of the note as of June 30, 2023, and $2,500 in extension fee payable at the revised maturity

date.

During

the six months ended June 30, 2023, the Company issued three fixed-rate notes for an aggregate amount of $150,000, which carry interest

between 10% and 15% and with maturity ranging between one to nine (1 to 9) months from issuance.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

As

of June 30, 2023, the Company has a total of twenty-two (22) fixed-rate notes, of which sixteen (16) have a make good provision for

a total principal of $1,395,000

and $338,403

in accrued interest. Balance of fixed-rate notes was $1,849,728 and $1,819,728 as of June 30, 2023, and December 31, 2022, respectively.

Accrued interest on fixed-rate notes was approximately $429,500 and $310,960 as of June 30, 2023, and December 31, 2023, respectively.

Such

provision will require the Company to issue additional shares to ensure that the investor can realize a profit of 15% or 18% reselling

the conversion shares. The value of the make good provision was approximately $250,000 as of June 30, 2023 and is reported under Accounts

payable and accrued liabilities in the condensed consolidated balance sheet as of June 30, 2023. In addition, certain fixed-rate notes

include a prepayment provision, which entitles the holder to a 15% cash premium. The Company concluded that such provision was not deemed

material and probable as of June 30, 2023.

Variable-rate

notes

During

the six months ended June 30, 2023, the Company executed a settlement agreement with one investor to extinguish the remaining principal

balance of a promissory note into 4,300,590 shares of common stock, which resulted in a gain from debt extinguishment of approximately

$77,000.

Fixed

Rate note (former related party)

Notes

payable to a former related party in the aggregate amount of $104,600 were outstanding at June 30, 2023, which are past maturity date.

The notes bear interest between 10% and 12% per annum. During the six months ended June 30, 2023, the Company repaid $7,500 in principal

amount to this former related party. Refer to Note 7- Related Party Transactions.

Activity

for the six months ended June 30, 2022

Fixed

rates Notes

During

the six months ended June 30, 2022, the Company issued three (3) fixed rate promissory notes totaling $250,000 for funding of $250,000

with original terms of nine months and interest rates of 15%. The holder of the promissory note can convert the outstanding unpaid principal

and accrued interest at a fixed conversion rate, subject to standard anti-dilution features, six months after issuance date.

As

of June 30, 2022, the Company has sixteen (16) fixed-rate promissory notes with an outstanding balance of $1,891,204, of which $1,116,204

are past maturity.

In

October 2013, July 2014, October 2014 and August 2015, the Company initiated a series of private placements for up to $500,000, each,

of financing by the issuance of notes payable at a minimum of $25,000, one unit. The notes bear interest at 10% per annum and were due

and payable with accrued interest one year from issuance. During the six months ended June 30, 2022, the Company did not issue notes

in connection with these private placements and did not repay any of these notes. As of June 30, 2022, and December 31, 2021, notes payable

outstanding under these private placements are $624,903, all of which are past maturity.

During

the six months ended June 30, 2022, the Company converted $110,204 in accrued interest and $93,796 in principal balance into 10,200,000

shares of common stock.

As

of June 30, 2022, the Company has a total of sixteen (16) fixed-rate notes, of which twelve (12) for total principal amount of $1,250,000

includes a make good shares provision. Such provision will require the Company to issue additional shares to ensure that the investor

can realize a profit of 15% reselling the conversion shares. The Company accrued $178,000 related to the make-good provision as the amount

is probable and can be reasonably estimated pursuant to ASC 450 Contingencies. Such amount was presented as other expense in the condensed

consolidated statement of operations.

Certain

fixed-rate notes include a prepayment provision, which entitles the holder to a 15% premium upon cash redemption by the Company. The

prepayment penalty approximates $121,000 as of June 30, 2022, but the Company determined that such liability is not probable as of June

30, 2022, pursuant to ASC 450 Contingencies.

Variable-rate

notes

The

gross amount of all convertible notes with variable conversion rates outstanding as of June 30, 2022, is $4,770,926, of which $4,770,926

are past maturity. There has been no conversion of notes into the Company’s common stock during the three and six months ended

June 30, 2022.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

Note

6 - Shareholders’ Deficit

Preferred

Stock

The

Company has authorized 5,000,000 shares of preferred stock which have been designated as follows:

Schedule of Preferred Stock

| | |

Number of Shares

Authorized | | |

Number of Shares

Outstanding at

June 30, 2023 | | |

Par Value | | |

Liquidation

Value | |

| Series AA | |

| 1,000,000 | | |

| 25,000 | | |

$ | 0.0010 | | |

$ | - | |

| Preferred Series B | |

| 50,000 | | |

| 600 | | |

$ | 0.0001 | | |

$ | 100 | |

| Preferred Series C | |

| 8,000 | | |

| 738 | | |

$ | 0.0001 | | |

$ | 1,000 | |

| Preferred Series D | |

| 20,000 | | |

| - | | |

$ | 0.0001 | | |

$ | 1,000 | |

| Undesignated | |

| 3,922,000 | | |

| - | | |

| - | | |

| - | |

Series

AA Preferred Shares

On

February 22, 2013, the Board of Directors of the Company authorized an amendment to the Company’s Articles of Incorporation, as

amended (the “Articles of Incorporation”), in the form of a Certificate of Designation that authorized the issuance of up

to one million (1,000,000) shares of a new series of preferred stock, par value $0.001 per share, designated “Series AA Super Voting

Preferred Stock,” for which the board of director established the rights, preferences and limitations thereof.

Each

holder of outstanding shares of Series AA Super Voting Preferred Stock shall be entitled to one hundred thousand (100,000) votes for

each share of Series AA Super Voting Preferred Stock held on the record date for the determination of stockholders entitled to vote at

each meeting of stockholders of the Company. The Series AA Super Voting Preferred Stockholders will receive no dividends nor any value

on liquidation.

There

was no activity during the six months ended June 30, 2023. There were 25,000 shares of Series AA Preferred stock outstanding as of June

30, 2023 and December 31, 2022.

Series

B Convertible Preferred Stock

On

February 7, 2017, the Company filed a certificate of designation for 50,000 shares of Series B Convertible Preferred Stock designated

as Series B (“Series B”) which are authorized and convertible, at the option of the holder, commencing six months from the

date of issuance into common shares and warrants. For each share of Series B, the holder, on conversion, shall receive the stated value

divided by 75% of the market price on the date of purchase of Series B and a three-year warrant exercisable into up to a like amount

of common shares with an exercise price of 150% of the market price as defined in the Certificate of Designation. Dividends shall be

paid only if dividends on the Company’s issued and outstanding Common Stock are paid, and the amount paid to the Series B holder

will be as though the conversion shares had been issued. Series B holders have no voting rights. Upon liquidation, the holder of Series

B, shall be entitled to receive an amount equal to the stated value, $100 per share, plus any accrued and unpaid dividends thereon before

any distribution is made to Series C Secured Redeemable Preferred Stock or common stockholders.

There

was no activity during the six months ended June 30, 2023. There were 600 shares of Series B outstanding as of June 30, 2023 and December

31, 2022.

Endonovo

Therapeutics, Inc.

Notes

to Condensed Consolidated Financial Statements (continued)

Series

C Convertible Redeemable Preferred Stock

On

December 22, 2017, the Company filed a certificate of designation for 8,000 shares of Series C Secured Redeemable Preferred Stock (“Series

C”). Each share of the C Preferred is entitled to receive a $20 quarterly dividend commencing March 31, 2018, and each quarter

thereafter and is to be redeemed for the stated value, $1,000 per share, plus accrued dividends in cash (i) at the Company’s option,