By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

Ship owner Seaspan Corp. is placing a bigger bet on container

shipping. The ship-leasing heavyweight is buying out the

controlling shares of a China-based joint venture called GCI from

private-equity firm Carlyle Group, giving the company a bigger

share of a charter market that's been in broad recovery. The WSJ's

Julie Steinberg writes the $450 million deal brings Seaspan 18

container ships and a jumpstart to what may turn into a bigger

acquisition strategy. Seaspan is the world's largest containership

lessor by cargo-carrying capacity, according to Alphaliner, and the

combined companies would have 8% of the market. Alphaliner said in

a report this week that charter demand has been "robust" in recent

weeks, boosting ship leasing prices. The added revenues, along with

a new $250 million investment infusion from Canada's Fairfax

Financial Holdings Ltd., may give Seaspan the financial ballast to

corner still more of the market.

One of the world's iconic retail brands is giving up in the face

of changing consumer buying habits and relentless competition from

other channels. Toys "R" Us Inc. says it will sell or close all its

U.S. stores, the WSJ's Paul Ziobro and Lillian Rizzo report. The

collapse threatens up to 33,000 American jobs as well as some 1,600

stores and 60,000 jobs around the world as the company shutters or

sells stores across Europe and Asia. It marks perhaps the biggest

failure yet in a rapidly changing retail landscape, including a toy

market that's been fractured and fragmented by growing sales

through online sites and by the rise of digital games. The demise

of Toys "R" Us poses a serious challenge to the $27 billion U.S.

toy industry. The chain has been a vital cog in the industry as its

stores carried a breadth of toys unmatched by rivals and nurtured

smaller companies hoping to hit it big.

Union Pacific Corp. is adding safety monitoring to its rail yard

operations, and it's not going over well with the carrier's

employees. The freight railroad recently started flying drones over

the yards to ensure workers were following safety guidelines,

triggering citations for violations and protests from workers who

complained that the drones were a safety hazard because they

distracted them from their jobs. The clash is part of a growing

debate over the aerial technology across transportation operations

as companies look for ways to use drones to improve services and

operations -- and bumping up against traditional work patterns. The

WSJ's Paul Ziobro writes that drone use is in its infancy among

railroads, which are using the technology to inspect bridges and

track, assess damage after natural disasters and map their

far-flung networks. The UP operation is on hold, however, as the

company debates with the union over whether it's aimed at safety or

discipline.

E-COMMERCE

The parent company of fast-fashion logistics icon Zara is adding

online real estaterather than physical stores. Inditex SA is

accelerating digital investment after reporting its weakest

comparable annual sales growth since 2015, the WSJ's Jeannette

Neumann reports, pushing the trend-setting retailer to overhaul its

strategy and its supply chain. The company is following its

customers: Overall online sales surged 41% last year, although they

still made up just 10% of Inditex's sales. The company's store

closures outpaced openings in the fourth quarter, as the company

focused on opening big flagship sites while shuttering smaller

shops. The company plans to operate online stores in all 96 of its

markets, up from 49 markets today. That could chip away at

profitability since Inditex will take on extra shipping costs, but

the company insists it has fashioned a fulfillment strategy that

makes the online sales just as profitable as store sales.

The best online trend some retail real-estate experts have heard

of lately is what they call "clicks-to-bricks." A New York City

landlord recently signed four web-based apparel retailers to open

storefronts at a single Manhattan property, the WSJ's Esther Fung

reports, making the site a destination for shoppers looking to test

out physical products before they buy online. It's the latest move

by retail-space owners to rethink and renovate stores as e-commerce

continues to whittle down sales at brick-and-mortar sites.

Amazon.com Inc. has added 15 bookstores, its latest a

10,000-square-foot site in Washington, D.C., that opened this week.

Analysts say more lesser-known online sellers are looking to open

physical stores to complement their online presence. The companies

have slimmer track records and carry more risk, but they provide

landlords a new market while bigger retailers are shutting

shops.

QUOTABLE

IN OTHER NEWS

U.S. retail sales fell 0.1% in February, the third straight

monthly decline. (WSJ)

The producer-price index, a gauge of U.S. business prices, rose

a modest 0.2% last month. (WSJ)

Shares of truckers, railroads and other transportation companies

have caught up with the broader stock market after a slow start to

the year. (WSJ)

Maryland-based Transport Logistics International Inc. will pay

$2 million to settle federal charges it bribed a Russian

nuclear-energy official in exchange for uranium-shipping contracts.

(WSJ)

Sears Holdings Corp. won $540 million in new loan agreements and

said reported another dismal quarter in which sales fell by nearly

a third. (WSJ)

The board of Anglo-Dutch consumer-goods giant Unilever PLC is

favoring a plan that would consolidate its dual headquarters in

Rotterdam. (WSJ)

Lawmakers and farm groups agreed on a change to a tax provision

that favored sales to agriculture cooperatives. (WSJ)

President Donald Trump is targeting technology and

telecommunications products for potential tariffs on up to $60

billion of Chinese imports. (Reuters)

Daimler AG car unit will invest more than $123.6 million to

manufacture Mercedes-Benz cars in Thailand. (MarketWatch)

Japan's Toray Industries is set to buy TenCate Advanced

Composites, a manufacturer of aerospace and automotive parts.

(Nikkei Asian Review)

FedEx Corp. will spend $1 billion to upgrade its main

air-express hub at Tennessee's Memphis International Airport.

(Associated Press)

China's SF Express and logistics operator HAVI set up a joint

venture business for refrigerated transport. (Air Cargo News)

Cathay Pacific Airways posted its first back-to-back loss in the

airline's 71-year history despite robust earnings from cargo.

(South China Morning Post)

A fire that burned for at least two days destroyed a large DHL

warehouse in Northamptonshire in the U.K. (The Sun)

The bodies of three sailors who were missing after a fire on a

Maersk container ship were found. (AllAfrica)

The Suez Canal Authority added tankers to a discounting program

meant to draw in India-bound vessels. (Lloyd's List)

Diesel fuel prices in the U.S. fell to their lowest level of the

year. (Commercial Carrier Journal)

Amazon won a patent for an inflatable air bag that cushions

packages dropped from delivery drones. (San Jose Mercury-News)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the WSJ Logistics Report team:

@jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ Logistics Report

on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

March 15, 2018 06:45 ET (10:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

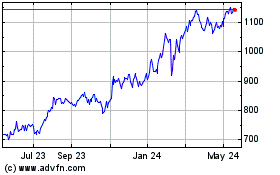

Fairfax Financial (PK) (USOTC:FRFHF)

Historical Stock Chart

From Jun 2024 to Jul 2024

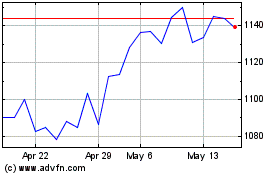

Fairfax Financial (PK) (USOTC:FRFHF)

Historical Stock Chart

From Jul 2023 to Jul 2024