Teck Separation Plans Supported by Shareholder Sumitomo

20 April 2023 - 11:44PM

Dow Jones News

By Robb M. Stewart

Teck Resources Ltd. has secured support for its plan to split in

two from one of its biggest shareholders, Sumitomo Metal Mining

Co., presenting a hurdle to Glencore PLC's bid to buy the Canadian

miner.

Tokyo-based Sumitomo said Thursday it will vote in favor of

Teck's move to separate its steelmaking coal business from the base

metals operations at the shareholders meeting set for next

Wednesday.

Sumitomo said it has since 1997 built a trusted partnership with

Teck, beginning with joint exploration at the Pogo gold mine in

Alaska through development of the mine, to a move in 2018 by

Sumitomo to buy an indirect 25% stake in the Quebrada Blanca copper

mine in Chile where phase two of its development is underway. The

company owns almost 19% of Teck's Class A shares, and a 49% stake

in Canada's Temagami Mining Co., which holds 55% of the A

shares.

Early in the week, controlling shareholder and chairman emeritus

Norman Keevil said he fully supports the Teck board's rejection of

the takeover proposal from metals and mining giant Glencore, and

noted there are numerous parties in the mining industry with their

eyes on Teck that would be interested in partnering or investing in

the company after it separates its operations.

The Keevil family together with Sumitomo control a combined

about 48% of the total voting power over Teck via the A shares.

In an open letter Wednesday, Glencore said it is prepared to

engage with Teck's board to consider improvements to its takeover

proposal, but that it is also prepared to go directly to Teck's

shareholders with its takeover offer.

Glencore's letter sought to win over holders of Teck's Class B

shares. Last week, it said it would add a cash component to its

roughly $23 billion unsolicited merger proposal that offered

shareholders 24% of MetalsCo, a standalone company that would be

created in the merger, and $8.2 billion in cash.

Teck has rejected Glencore's approach as opportunistic and

continues to urge its shareholders to support its separation

plans.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

April 20, 2023 09:29 ET (13:29 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

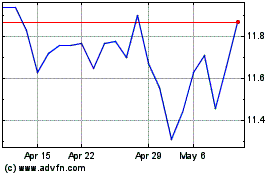

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Jan 2025 to Feb 2025

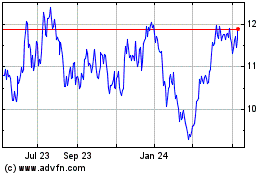

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Feb 2024 to Feb 2025