Glencore Approaches Teck Over Its Coal Business -- Commodities Roundup

12 June 2023 - 9:39PM

Dow Jones News

MARKET MOVEMENTS:

--Brent crude oil fell 1.9% to $73.41 a barrel

--European natural gas prices fell 8.5% to EUR29.33 a megawatt

hour

--Gold futures edged up 0.1% to $1,980.00 a troy ounce

--LME three-month copper futures edged down 0.3% to $8,318 a

metric ton.

--Wheat futures rose 0.5% to $6.33 a bushel

TOP STORY:

Glencore Approaches Teck Over Its Coal Business

Swiss mining and trading giant Glencore has approached Canadian

miner Teck Resources over buying its coal assets, the companies

said, providing an alternative to Glencore's original proposal for

a full-blown merger between the two miners.

Glencore's original merger offer is still on the table, but the

company has indicated to Teck that it would also be willing to buy

just the coal business--which it had previously valued at more than

$8 billion--if that is the only asset up for sale.

The Wall Street Journal previously reported Glencore's

approach.

Glencore previously said it could revise its roughly $23 billion

bid for the whole company if Teck were to engage on a potential

transaction. So far, though, Teck has rejected that proposal. Teck

said in its statement that it is engaging with Glencore about its

proposal, which it called "preliminary in detail, conditional and

non-binding."

OTHER STORIES:

Iberdrola to Build Renewable Energy Network Co-Financed by

European Investment Bank

Iberdrola will build a network of 22 renewable-energy plants in

Europe after signing a 1 billion euro ($1.07 billion) loan with the

European Investment Bank.

The Spanish energy company on Monday said the loan will

co-finance the construction of 19 solar power plants and three

onshore wind farms in Spain, Portugal and Germany. The projects

will have a total installed capacity of 2.2 gigawatts.

MARKET TALKS:

Government Investments Could Prop Up Frontier Lithium's

Competitiveness -- Market Talk

0654 ET - There are a few catalysts that can help Frontier

Lithium on its way to developing a top tier lithium project in

Canada, Wayne Lam of RBC says in a note. As provincial governments

step up their investments in the surrounding areas, like in

northern Ontario and Quebec, this could give a boost to lithium

developers like Frontier Lithium develop and compete on a larger

scale. Lam sees "potential upside via government assistance with

infrastructure and/or construction in order to maintain

competitiveness vs funding commitments undertaken in the US via the

Inflation Reduction Act." (adriano.marchese@wsj.com)

---

Land Mines, Dam Flooding To Have Lasting Impact on Ukraine

Agriculture

0908 GMT - Land mines across Ukraine and the recent flooding of

the southeastern region from the explosion of the Kakhovka dam are

likely to have a lasting impact on the country's agricultural

output, according to Taras Kachka, Ukraine's Deputy Minister for

Economic Development. For agriculture there was a long-term cost of

the war and land was being "contaminated", he said speaking at the

International Grains Council Conference in London. He said 100,000

hectares was likely contaminated by mines, and that Ukraine was

working to ensure the land would not be affected by toxins released

by those mines. The flooding would also likely have contaminated

the land with garbage, but it would take time to see the long-term

impact of this, he added. (yusuf.khan@wsj.com)

---

Goldman Sachs Trims Oil Forecasts Despite Saudi Cut

0840 GMT - Goldman Sachs cuts its oil prices forecasts after

crude has shrugged at a planned production cut from Saudi Arabia.

The bank now believes oil prices will end the year at $86 a barrel,

down from its earlier forecast of $95 a barrel. For 2023, Goldman

forecasts an average price of $82 a barrel, compared to its prior

$88 a barrel forecast. Stronger-than-expected supplies are the

biggest reason for the change and explain why oil prices have

tumbled in recent months, the bank says. It increases its 2024

supply forecasts for Russia, Iran and Venezuela. The Saudi plan to

slash output by 1 million barrels a day from July will only partly

offset that increased supply, Goldman says in a note.

(william.horner@wsj.com)

---

Powell's Comments Seen Key for Gold Prices

0809 GMT - Metals prices are subdued ahead of a busy week of

macroeconomic data. Gold futures edge down 0.1% to $1,974.80 a troy

ounce while three-month copper prices on the LME decline 0.3% to

$8,317 a metric ton. U.S. inflation data Tuesday and the Federal

Reserve's meeting Wednesday will be key for metals, particularly

gold. The Fed is broadly expected to keep rates unchanged for the

time being as it waits to see how inflation develops. "Gold traders

will be reading between the lines, and looking for any signal from

Powell that the U.S. is heading for a recession or that core

inflation remains sticky," says Stuart O'Reilly, an analyst at the

Royal Mint. (william.horner@wsj.com)

---

Oil Slips as Investors Await US Rate Decision

0758 GMT - Oil prices slip as investors eye an important week

for the U.S. economy. Brent crude oil is down 1.3% at $73.82 a

barrel while WTI declines 1.4% to $69.20 a barrel. Analysts say

concerns about the economic outlook are driving oil prices lower

and that investors are, for now, ignoring signs of a sharply

tightening oil market. Oil prices are caught between "bearish asset

allocators who point to monetary contraction and bullish oil

speculators expecting lower inventories," Bank of America says in a

note. As a result, U.S. inflation figures on Tuesday and a meeting

of the Federal Reserve on Wednesday will be key for the direction

oil takes. (william.horner@wsj.com)

(END) Dow Jones Newswires

June 12, 2023 07:24 ET (11:24 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

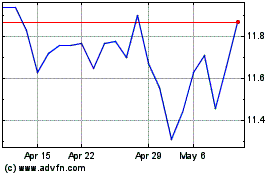

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Nov 2024

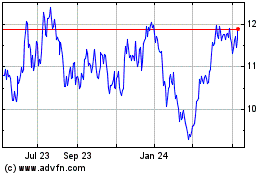

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Nov 2023 to Nov 2024