Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

20 February 2025 - 12:34AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

For the

month of February

HSBC Holdings plc

42nd

Floor, 8 Canada Square, London E14 5HQ, England

(Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F).

Form

20-F X Form 40-F

19 February 2025

HSBC HOLDINGS PLC

CHANGE IN OWN FUNDS AND MREL RECOGNITION OF CERTAIN DEBT

SECURITIES

HSBC Holdings plc ('HSBC') has in issue certain legacy New York

law-governed subordinated debt securities (the 'Legacy Tier 2

Securities') and one legacy New

York law-governed senior debt security (the 'Legacy Senior

Security'), each of which do

not contain a contractual recognition of UK bail-in powers

('CROB

clause') within their

respective terms and conditions. The Legacy Tier 2 Securities were

grandfathered as tier 2 capital instruments until 28 June 2025 and

the Legacy Senior Security was permanently grandfathered as

eligible liabilities, in each case pursuant to UK

CRR[1].

Details of the relevant securities are set out in the table

below.

HSBC announces that from today it will no longer count the Legacy

Tier 2 Securities as tier 2 capital instruments for UK CRR

purposes. Furthermore, HSBC will also not count the Legacy Tier 2

Securities and the Legacy Senior Security towards its minimum

requirement for own funds and eligible liabilities

('MREL')[2].

The action to no longer count the Legacy Tier 2 Securities is

intended to avoid the loss of tier 2 capital eligibility for HSBC's

other remaining non-legacy tier 2 securities pursuant to UK CRR,

which would otherwise have occurred at the end of the

grandfathering period in June 2025.

The action to no longer count the Legacy Senior Security towards

HSBC's MREL has been taken in order to be consistent with its

treatment of the Legacy Tier 2 Securities and in recognition of the

Bank of England's position on securities governed under non-UK law

without a CROB clause (as set out in its recent consultation

paper[3]).

These actions would have reduced HSBC's MREL as a percentage of

risk-weighted assets by 54 basis points and its total capital ratio

by 46 basis points had they been taken at the end of the financial

year ended 31 December 2024.There is no impact on the total capital

ratio excluding transitional arrangements of the UK

CRR.

|

Tier

|

ISIN

|

Currency

|

Amount outstanding

|

Maturity date

|

|

Legacy

Tier 2 Security

|

US404280AF65

|

USD

|

263,654,000

|

17/05/2032

|

|

Legacy

Tier 2 Security

|

US404280AE90

|

USD

|

124,748,000

|

27/11/2032

|

|

Legacy

Tier 2 Security

|

US404280AG49

|

USD

|

1,430,811,000

|

02/05/2036

|

|

Legacy

Tier 2 Security

|

US404280AH22

|

USD

|

1,514,640,000

|

15/09/2037

|

|

Legacy

Tier 2 Security

|

US404280AJ87

|

USD

|

961,295,000

|

01/06/2038

|

|

Legacy

Senior Security

|

US404280AM17

|

USD

|

750,000,000

|

14/01/2042

|

Investor enquiries to:

Greg

Case

+44 (0) 20 7992

3825 investorrelations@hsbc.com

Media enquiries to:

Press

Office

+44 (0) 20 7991

8096 pressoffice@hsbc.com

Note to editors:

HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in

London. HSBC serves customers worldwide from offices in

58 countries and territories. With assets of US$3,017bn at

31 December 2024, HSBC is one of the world's largest

banking and financial services organisations.

__________________________________________________________

[1] Regulation

(EU) No. 575/2013, as it forms part of domestic law in the UK by

virtue of the European Union (Withdrawal) Act 2018, as

amended.

[2] HSBC's

MREL requirements are set pursuant to (i) UK CRR and (ii) the Bank

of England's Statement of Policy entitled 'The Bank of England's

approach to setting a minimum requirement for own funds and

eligible liabilities (MREL)' (December 2021).

[3] The

Bank of England's Consultation paper entitled 'Amendments to the

Bank of England's approach to setting a minimum requirement for own

funds and eligible liabilities (MREL)' published on 15 October

2024.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

HSBC

Holdings plc

|

|

|

|

|

|

By:

|

|

|

Name:

Aileen Taylor

|

|

|

Title:

Group Company Secretary and Chief Governance Officer

|

|

|

|

|

|

Date:

19 February 2025

|

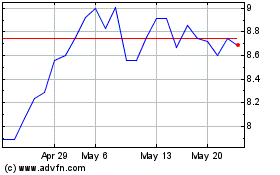

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Jan 2025 to Feb 2025

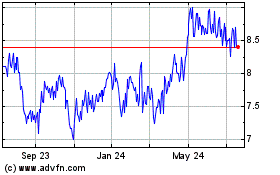

HSBC (PK) (USOTC:HBCYF)

Historical Stock Chart

From Feb 2024 to Feb 2025