Impala Platinum To Raise Cash to Repair Finances

03 September 2015 - 9:00PM

Dow Jones News

JOHANNESBURG—Impala Platinum Holdings Ltd. is to raise 4 billion

South African rand ($297.4 million) through a stock sale to bolster

its finances, battered by tumbling metal prices and the costs of

ramping up South African output which contributed to a hefty annual

loss.

The world's second-largest producer of platinum said on Thursday

that the capital increase is fully underwritten by Swiss bank UBS

and will allow the Rustenburg mine, hit hard by last year's

five-month platinum-sector strike, to improve output and

profitability.

Implats, along with other South African platinum miners, is

still struggling to recover from the worker strike, which hit

production and profits at a time when prices for the precious metal

were already low. In February, the company began cost-cutting and

restructuring in an attempt to improve profit margins and conserve

cash. Lonmin PLC, the world's No. 3 platinum producer, said in July

that it would cut 6,000 workers, or 17% of its workforce, over the

next two years.

Even large diversified mining groups are embarking on drastic

measure to rein in costs as raw material prices have tumbled. Anglo

American PLC, whose main commodities include platinum, copper and

iron ore, has said it would slash 53,000 jobs over several years, a

35% reduction of its current workforce. The group's

Johannesburg-listed Anglo American Platinum Ltd. unit, the world's

top platinum producer, said in July that it still wants to sell or

spin off its older Rustenburg and Union mines, which analysts say

are burning through cash.

Implats may have judged its fundraising well. "The timing of it

is very good," said SBG Securities platinum analyst Setendra

Naidoo. The funds will help the company complete two shafts at the

Rustenburg mine by 2020, Mr. Naidoo said.

Platinum miners say they expect the challenging price

environment to continue, with further downside still possible for

platinum prices, given industrial and investment demand are both

relatively flat.

Implats said it would have to tighten its belt further.

"We've now had to go back into our plans and look at further

cuts," said Chief Executive Terence Goodlace. Global prices for

platinum, which is used mainly to make car exhaust filters and

jewelry, have fallen 28% over the last 12 months, recently trading

just over $1,000 an ounce.

Implats shares are down 54% over the same period of time. Shares

on the Johannesburg Stock Exchange tumbled in early trading

Thursday but have since trimmed those loses, recently down 3.5% at

43.04 rand.

"Implats remains committed to returning excess cash flow to

shareholders going forward," the company said. Implats hasn't

declared a dividend since fiscal 2013.

The company reported a loss of 3.66 billion rand in the year to

June 30, a turnaround from a profit of 8 million rand the previous

year, in line with expectations. Revenue for the fiscal year rose

12% to 32.48 billion rand.

Implats said its performance was "severely impacted" by the

revving up of the Rustenburg mine, after the county's longest-ever

strike ended in June 2014, as well as safety-related work

stoppages, and power shortages. South Africa's economy is currently

blighted by frequent black outs, with capacity-constrained

state-owned utility Eskom struggling to supply the country with

enough electricity from its aging infrastructure.

The company's Zimbabwe operations were hit by the precautionary

closure of a mine there after a partial collapse of underground

tunnels in August 2014.

Implats' mine-to-market platinum output was up 16% from the

previous year as production began to recover from the industry

strike in 2014. Unit costs rose 14%.

A weaker rand, which has recently been plumbing all-time lows

against the U.S. dollar, helped cushion those cost increases in

dollar terms. The cost to produce an ounce of platinum rose only

3.9% to $1,947, given the rand was an average of 10% weaker over

the fiscal year compared with the previous year.

"The rand's been a bit of a safety valve and it probably will

continue to be that," said Daniel Sacks, portfolio manager of

Investec Asset Management's 353.4 million rand commodity fund in

Cape Town.

Still, the average price Implats received for its platinum fell

13% in dollar terms to $1,241 an ounce.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 03, 2015 06:45 ET (10:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

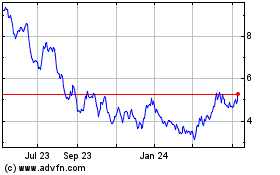

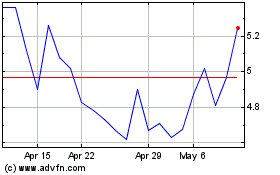

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Impala Platinum (QX) (USOTC:IMPUY)

Historical Stock Chart

From Dec 2023 to Dec 2024