0001190370

true

--10-31

Q3

2023

0001190370

2022-11-01

2023-07-31

0001190370

2023-09-22

0001190370

2023-07-31

0001190370

2022-10-31

0001190370

2023-05-01

2023-07-31

0001190370

2022-05-01

2022-07-31

0001190370

2021-11-01

2022-07-31

0001190370

us-gaap:CommonStockMember

2022-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-10-31

0001190370

us-gaap:RetainedEarningsMember

2022-10-31

0001190370

us-gaap:CommonStockMember

2023-01-31

0001190370

ivdn:CommonStockToBeIssuedMember

2023-01-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2023-01-31

0001190370

us-gaap:RetainedEarningsMember

2023-01-31

0001190370

2023-01-31

0001190370

us-gaap:CommonStockMember

2023-04-30

0001190370

ivdn:CommonStockToBeIssuedMember

2023-04-30

0001190370

us-gaap:AdditionalPaidInCapitalMember

2023-04-30

0001190370

us-gaap:RetainedEarningsMember

2023-04-30

0001190370

2023-04-30

0001190370

us-gaap:CommonStockMember

2021-10-31

0001190370

ivdn:CommonStockToBeIssuedMember

2021-10-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2021-10-31

0001190370

us-gaap:RetainedEarningsMember

2021-10-31

0001190370

2021-10-31

0001190370

us-gaap:CommonStockMember

2022-01-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-01-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-01-31

0001190370

us-gaap:RetainedEarningsMember

2022-01-31

0001190370

2022-01-31

0001190370

us-gaap:CommonStockMember

2022-04-30

0001190370

ivdn:CommonStockToBeIssuedMember

2022-04-30

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-04-30

0001190370

us-gaap:RetainedEarningsMember

2022-04-30

0001190370

2022-04-30

0001190370

us-gaap:CommonStockMember

2022-11-01

2023-01-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-11-01

2023-01-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-11-01

2023-01-31

0001190370

us-gaap:RetainedEarningsMember

2022-11-01

2023-01-31

0001190370

2022-11-01

2023-01-31

0001190370

us-gaap:CommonStockMember

2023-02-01

2023-04-30

0001190370

ivdn:CommonStockToBeIssuedMember

2023-02-01

2023-04-30

0001190370

us-gaap:AdditionalPaidInCapitalMember

2023-02-01

2023-04-30

0001190370

us-gaap:RetainedEarningsMember

2023-02-01

2023-04-30

0001190370

2023-02-01

2023-04-30

0001190370

us-gaap:CommonStockMember

2023-05-01

2023-07-31

0001190370

ivdn:CommonStockToBeIssuedMember

2023-05-01

2023-07-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2023-05-01

2023-07-31

0001190370

us-gaap:RetainedEarningsMember

2023-05-01

2023-07-31

0001190370

us-gaap:CommonStockMember

2021-11-01

2022-01-31

0001190370

ivdn:CommonStockToBeIssuedMember

2021-11-01

2022-01-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2021-11-01

2022-01-31

0001190370

us-gaap:RetainedEarningsMember

2021-11-01

2022-01-31

0001190370

2021-11-01

2022-01-31

0001190370

us-gaap:CommonStockMember

2022-02-01

2022-04-30

0001190370

ivdn:CommonStockToBeIssuedMember

2022-02-01

2022-04-30

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-02-01

2022-04-30

0001190370

us-gaap:RetainedEarningsMember

2022-02-01

2022-04-30

0001190370

2022-02-01

2022-04-30

0001190370

us-gaap:CommonStockMember

2022-05-01

2022-07-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-05-01

2022-07-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-05-01

2022-07-31

0001190370

us-gaap:RetainedEarningsMember

2022-05-01

2022-07-31

0001190370

us-gaap:CommonStockMember

2023-07-31

0001190370

ivdn:CommonStockToBeIssuedMember

2023-07-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2023-07-31

0001190370

us-gaap:RetainedEarningsMember

2023-07-31

0001190370

us-gaap:CommonStockMember

2022-07-31

0001190370

ivdn:CommonStockToBeIssuedMember

2022-07-31

0001190370

us-gaap:AdditionalPaidInCapitalMember

2022-07-31

0001190370

us-gaap:RetainedEarningsMember

2022-07-31

0001190370

2022-07-31

0001190370

ivdn:FourInvestorsMember

2022-11-01

2023-07-31

0001190370

ivdn:OneInvestorMember

2023-07-31

0001190370

ivdn:OneInvestorMember

2022-11-01

2023-07-31

0001190370

ivdn:TwoInvestorsMember

2022-11-01

2023-07-31

0001190370

ivdn:TwoInvestorsMember

srt:MinimumMember

2023-07-31

0001190370

ivdn:TwoInvestorsMember

srt:MaximumMember

2023-07-31

0001190370

ivdn:SevenInvestorsMember

2021-11-01

2022-07-31

0001190370

ivdn:EightInvestorsMember

2021-11-01

2022-07-31

0001190370

ivdn:SevenInvestorsMember

srt:MinimumMember

2022-07-31

0001190370

ivdn:SevenInvestorsMember

srt:MaximumMember

2022-07-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2015-07-11

2015-07-12

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2022-11-01

2023-07-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2017-11-01

2018-10-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2018-11-01

2019-10-31

0001190370

ivdn:KetutJayaMember

ivdn:INSULTEXMaterialMember

2023-02-01

2023-02-28

0001190370

ivdn:SeparatePieceOfEquipmentsMember

2021-11-01

2022-10-31

0001190370

ivdn:SeparatePieceOfEquipmentsMember

2022-11-01

2023-07-31

0001190370

ivdn:ApparelMember

2022-11-01

2023-07-31

0001190370

ivdn:ApparelMember

2021-11-01

2022-07-31

0001190370

ivdn:HousewrapMember

2022-11-01

2023-07-31

0001190370

ivdn:HousewrapMember

2021-11-01

2022-07-31

0001190370

2022-06-28

2022-06-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q/A

| ☒ | QUARTERLY

REPORT PURSUANT TO SECTION 13l OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the quarterly period ended July 31, 2023

OR

| |

☐ |

TRANSITION REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from

_______ to ________.

Commission File Number: 000-51791

INNOVATIVE DESIGNS, INC.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

03-0465528 |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification No.) |

124 Cherry Street

Pittsburgh, Pennsylvania 15223

(Address of Principal Executive Offices, Zip

Code)

(412) 799-0350

(Issuer’s Phone Number Including Area

Code)

N/A

(Former Name or Former Address, if changed since

last report)

Indicate by check mark whether the registrant (1)

has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has

submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of regulation S-T during the preceding 12 months (or such shorter period that the registrant was required to submit

and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of

“large accelerated filer”, “accelerated filer” and “smaller reporting Company” in Rule 12b-2

of the Exchange Act.

(Check One)

| Large Accelerated

Filer ☐ |

Accelerated Filer ☐ |

| |

|

| Non-accelerated Filer ☐ |

Smaller reporting company ☒ |

☐

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is

a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of September 22, 2023, there were 36,417,560 shares

of the Registrant’s common stock, par value $.0001 per share, outstanding.

Transitional Small Business Disclosure Format: Yes ☐ No ☒

Explanatory

Note

Please

note the Company is filing this form 10-Q/A to correct an inadvertent tag of shell status as being true instead of false in its Ixbrl

tagging.

No

other changes were made.

Innovative Designs, Inc.

Index

Form 10-Q for the Quarter Ended July 31, 2023

ITEM 1. CONDENSED FINANCIAL STATEMENTS

INNOVATIVE DESIGNS, INC.

FINANCIAL

STATEMENTS

FOR THE QUARTER ENDED

JULY 31, 2023

| INNOVATIVE DESIGNS, INC. |

| |

| CONDENSED BALANCE SHEETS |

| JULY 31, 2023 (UNAUDITED) AND OCTOBER 31, 2022 |

| |

|

|

|

|

|

|

|

|

| |

|

July

31, 2023 |

|

October

31, 2022 |

| |

|

|

|

|

| ASSETS |

|

|

|

|

| |

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

|

|

|

| Cash |

|

$ |

178,817 |

|

|

|

263,293 |

|

| Accounts

receivable, net |

|

|

82 |

|

|

|

11,203 |

|

| Inventory,

net |

|

|

588,874 |

|

|

|

494,580 |

|

| |

|

|

|

|

|

|

|

|

| Total

current assets |

|

|

767,773 |

|

|

|

769,076 |

|

| |

|

|

|

|

|

|

|

|

| PROPERTY

AND EQUIPMENT, net |

|

|

24,247 |

|

|

|

5,960 |

|

| |

|

|

|

|

|

|

|

|

| OTHER

ASSETS: |

|

|

|

|

|

|

|

|

| Inventory

on consignment |

|

|

— |

|

|

|

1,625 |

|

| Deposits

on inventory |

|

|

— |

|

|

|

80,000 |

|

| Advance

to employees |

|

|

13,200 |

|

|

|

13,200 |

|

| Deposits

on equipment |

|

|

719,944 |

|

|

|

607,370 |

|

| |

|

|

|

|

|

|

|

|

| Total

other assets |

|

|

733,144 |

|

|

|

702,195 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL |

|

$ |

1,525,164 |

|

|

$ |

1,477,231 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES

AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

|

| Accounts

payable |

|

$ |

275,487 |

|

|

$ |

162,063 |

|

| Current

portion of note payable |

|

|

20,265 |

|

|

|

20,128 |

|

| Accrued

interest of stockholder loans |

|

|

54,073 |

|

|

|

46,345 |

|

| Current

portion of stockholder loans |

|

|

71,668 |

|

|

|

110,631 |

|

| |

|

|

|

|

|

|

|

|

| Total

current liabilities |

|

|

425,271 |

|

|

|

342,945 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM

LIABILITIES: |

|

|

|

|

|

|

|

|

| Long-term

portion of note payable |

|

|

49,530 |

|

|

|

64,547 |

|

| Long-term

portion of stockholder loans |

|

|

— |

|

|

|

66,667 |

|

| |

|

|

|

|

|

|

|

|

| Total

long-term liabilities |

|

|

49,530 |

|

|

|

131,214 |

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS’

EQUITY: |

|

|

|

|

|

|

|

|

| Preferred

stock, $0.0001 par value, |

|

|

|

|

|

|

|

|

| 25,000,000

shares authorized |

|

|

— |

|

|

|

— |

|

| Common

stock, $0.0001 par value, 100,800,000 shares authorized, and 36,092,560 and 34,650,560 issued and outstanding |

|

|

3,612 |

|

|

|

3,467 |

|

| Common

stock to be issued |

|

|

— | |

|

|

— | |

| Additional

paid-in capital |

|

|

11,637,980 |

|

|

|

11,335,184 |

|

| Accumulated

deficit |

|

|

(10,591,228 |

) |

|

|

(10,335,579 |

) |

| |

|

|

|

|

|

|

|

|

| Total

stockholders’ equity |

|

|

1,050,363 |

|

|

|

1,003,072 |

|

| |

|

|

|

|

|

|

|

|

| TOTAL |

|

$ |

1,525,164 |

|

|

$ |

1,477,231 |

|

The accompanying notes

are an integral part of these condensed financial statements.

| INNOVATIVE DESIGNS,

INC. |

| |

| CONDENSED STATEMENTS OF OPERATIONS

|

| THREE AND NINE MONTHS ENDED

JULY 31, 2023 AND 2022 (UNAUDITED) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended July 31, |

|

Nine Months Ended July 31, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

| REVENUES,

net |

|

$ |

124,650 |

|

|

$ |

135,048 |

|

|

$ |

223,546 |

|

|

$ |

235,164 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

76,480 |

|

|

|

56,224 |

|

|

|

106,839 |

|

|

|

109,884 |

|

| Selling,

general and administrative expenses |

|

|

124,944 |

|

|

|

115,384 |

|

|

|

359,917 |

|

|

|

545,212 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

operating expenses |

|

|

201,424 |

|

|

|

171,608 |

|

|

|

466,756 |

|

|

|

655,096 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income

(loss) from operations |

|

|

(76,774 |

) |

|

|

(36,560 |

) |

|

|

(243,210 |

) |

|

|

(419,932 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER

INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous

income (expense) |

|

|

— |

|

|

|

260,000 |

|

|

|

7,519 |

|

|

|

260,000 |

|

| Interest

expense |

|

|

(6,421 |

) |

|

|

(10,710 |

) |

|

|

(17,652 |

) |

|

|

(34,450 |

) |

| Depreciation |

|

|

(769 |

) |

|

|

(373 |

) |

|

|

(2,306 |

) |

|

|

(1,118 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

other income (expense) |

|

|

(7,190 |

) |

|

|

248,917 |

|

|

|

(12,439 |

) |

|

|

224,432 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

$ |

(83,964 |

) |

|

$ |

212,357 |

|

|

$ |

(255,649 |

) |

|

$ |

(195,500 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PER SHARE INFORMATION -

UNDILUTED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) per common share |

|

|

(0.002 |

) |

|

|

0.006 |

|

|

$ |

(0.007 |

) |

|

$ |

(0.006 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of common shares outstanding |

|

|

35,656,821 |

|

|

|

33,845,560 |

|

|

|

35,339,663 |

|

|

|

33,845,560 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PER SHARE INFORMATION -

DILUTED: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) per common share |

|

|

(0.002 |

) |

|

|

0.006 |

|

|

$ |

(0.007 |

) |

|

$ |

(0.006 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average number

of common shares outstanding |

|

|

36,633,430 |

|

|

|

34,902,893 |

|

|

|

36,153,406 |

|

|

|

34,902,893 |

|

The accompanying notes

are an integral part of these condensed financial statements.

| INNOVATIVE DESIGNS,

INC. |

| |

| CONDENSED STATEMENTS OF CHANGES

IN STOCKHOLDERS’ EQUITY |

THREE

AND NINE MONTHS ENDED JULY 31, 2023 AND 2022 (UNAUDITED)

|

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

Common

Stock | |

Common Stock | |

Additional Paid-In | |

Accumulated | |

|

| | |

Shares | |

Amount | |

To

Be Issued | |

Capital | |

Deficit | |

Total |

| | |

| |

| |

| |

| |

| |

|

| Balance

at October 31, 2022 | |

| 34,650,560 | | |

$ | 3,467 | | |

$ | — | | |

$ | 11,335,184 | | |

$ | (10,335,579 | ) | |

$ | 1,003,072 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| 500,000 | | |

| 50 | | |

| — | | |

| 109,950 | | |

| — | | |

| 110,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares

issued for services | |

| 27,000 | | |

| 3 | | |

| — | | |

| 5,937 | | |

| — | | |

| 5,940 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (59,094 | ) | |

| (59,094 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at January

31, 2023 | |

| 35,177,560 | | |

| 3,520 | | |

| — | | |

| 11,451,071 | | |

| (10,394,673 | ) | |

| 1,059,918 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares

issued for services | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (112,591 | ) | |

| (112,591 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at April 30,

2023 | |

| 35,177,560 | | |

| 3,520 | | |

| — | | |

| 11,451,071 | | |

| (10,507,264 | ) | |

| 947,327 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| 695,000 | | |

| 70 | | |

| — | | |

| 140,931 | | |

| — | | |

| 141,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Exercise of warrants | |

| 40,000 | | |

| 4 | | |

| — | | |

| 9,996 | | |

| — | | |

| 10,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares

issued for services | |

| 180,000 | | |

| 18 | | |

| — | | |

| 35,982 | | |

| — | | |

| 36,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (83,964 | ) | |

| (83,964 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at July 31, 2023 | |

| 36,092,560 | | |

| 3,612 | | |

| — | | |

| 11,637,980 | | |

| (10,591,228 | ) | |

| 1,050,363 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at October

31, 2021 | |

| 33,315,560 | | |

$ | 3,333 | | |

$ | — | | |

$ | 11,039,118 | | |

$ | (10,110,090 | ) | |

$ | 932,361 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| 340,000 | | |

| 34 | | |

| — | | |

| 60,966 | | |

| — | | |

| 61,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares

issued for services | |

| 50,000 | | |

| 5 | | |

| — | | |

| 9,995 | | |

| — | | |

| 10,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| (132,040 | ) | |

| (132,040 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at January

31, 2022 | |

| 33,705,560 | | |

| 3,372 | | |

| — | | |

| 11,110,079 | | |

| (10,242,130 | ) | |

| 871,321 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| 120,000 | | |

| 12 | | |

| — | | |

| 25,188 | | |

| — | | |

| 25,200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares

issued for services | |

| 700,000 | | |

| 70 | | |

| — | | |

| 174,930 | | |

| — | | |

| 175,000 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) | |

| | | |

| | | |

| — | | |

| — | | |

| (275,816 | ) | |

| (275,816 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at April 30,

2022 | |

| 34,525,560 | | |

| 3,454 | | |

| — | | |

| 11,310,197 | | |

| (10,517,946 | ) | |

| 795,705 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Sale of stock | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares

issued for services | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

income (loss) | |

| — | | |

| — | | |

| — | | |

| — | | |

| 212,357 | | |

| 212,357 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

at July 31, 2022 | |

| 34,525,560 | | |

$ | 3,454 | | |

$ | — | | |

$ | 11,310,197 | | |

$ | (10,305,589 | ) | |

$ | 1,008,062 | |

The accompanying notes

are an integral part of these condensed financial statements.

| INNOVATIVE DESIGNS,

INC. |

| |

| CONDENSED STATEMENTS OF CASH

FLOWS |

NINE

MONTHS ENDED JULY 31, 2023 AND 2022 (UNAUDITED)

|

| |

|

|

|

|

|

|

|

|

| |

|

Nine Months Ended July 31, |

| |

|

2023 |

|

2022 |

| |

|

|

|

|

| CASH FLOWS

FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

(255,649 |

) |

|

$ |

(195,500 |

) |

| Adjustments

to reconcile net income (loss) to net cash provided

by (used in) operating activities: |

|

|

|

|

|

|

|

|

| Bad debt

expense |

|

|

— |

|

|

|

— |

|

| Common

stock issued for services |

|

|

41,940 |

|

|

|

185,000 |

|

| Depreciation |

|

|

2,306 |

|

|

|

1,118 |

|

| Amortization

of right of use asset |

|

|

— |

|

|

|

30,510 |

|

| Gain on

sale of asset |

|

|

(7,519 |

) |

|

|

— |

|

| (Increase)

decrease from changes in: |

|

|

|

|

|

|

|

|

| Accounts

receivable |

|

|

11,121 |

|

|

|

(8,412 |

) |

| Inventory |

|

|

(92,669 |

) |

|

|

11,104 |

|

| Deposits

on inventory |

|

|

80,000 |

|

|

|

(40,000 |

) |

| Receivable

due |

|

|

— |

|

|

|

(260,000 |

) |

| Increase

(decrease) from changes in: |

|

|

|

|

|

|

|

|

| Accounts

payable and accrued expenses |

|

|

113,424 |

|

|

|

45,826 |

|

| Accrued

interest expense |

|

|

7,728 |

|

|

|

(2,640 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash

provided by (used in) operating activities |

|

|

(99,318 |

) |

|

|

(232,994 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS

FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Purchase of equpment |

|

|

(20,593 |

) |

|

|

— |

|

| Deposits

on equipment |

|

|

(112,574 |

) |

|

|

(7,370 |

) |

| Proceeds

from sale of equipment |

|

|

7,519 |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Net cash

provided by (used in) investing activities |

|

|

(125,648 |

) |

|

|

(7,370 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS

FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds

from sale of stock |

|

|

261,000 |

|

|

|

86,200 |

|

| Payments

on shareholder advances |

|

|

(105,630 |

) |

|

|

(135,667 |

) |

| Payments

on lease liability |

|

|

— |

|

|

|

(30,510 |

) |

| Proceeds

on notes payable |

|

|

— |

|

|

|

1,818 |

|

| Payments

on notes payable |

|

|

(14,880 |

) |

|

|

(2,418 |

) |

| |

|

|

|

|

|

|

|

|

| Net cash

provided by (used in) financing activities |

|

|

140,490 |

|

|

|

(80,577 |

) |

| |

|

|

|

|

|

|

|

|

| NET INCREASE

(DECREASE) IN CASH |

|

|

(84,476 |

) |

|

|

(320,941 |

) |

| |

|

|

|

|

|

|

|

|

| CASH,

BEGINNING OF YEAR |

|

|

263,293 |

|

|

|

480,451 |

|

| |

|

|

|

|

|

|

|

|

| CASH, END OF THE PERIOD |

|

$ |

178,817 |

|

|

$ |

159,510 |

|

| |

|

|

|

|

|

|

|

|

| SUPPLEMENTAL

DISCLOSURE OF CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Cash paid

for interest |

|

$ |

9,924 |

|

|

$ |

37,090 |

|

| |

|

|

|

|

|

|

|

|

| Non-cash

financing activities - common stock issued for services |

|

$ |

41,940 |

|

|

$ |

185,000 |

|

The accompanying notes

are an integral part of these condensed financial statements.

INNOVATIVE

DESIGNS, INC.

NOTES TO FINANCIAL STATEMENTS

In the opinion of management,

the accompanying unaudited financial statements contain all adjustments necessary to present fairly Innovative Designs, Inc.’s

(the “Company”) financial position as of July 31, 2023, the changes therein for the three and nine month periods then

ended and the

results of operations

for the three

and nine month

periods ended July 31,

2023 and 2022.

The

financial statements included

in the Form

10-Q (the “Form”)

are presented in

accordance with the requirements of the Form and do not include all of the disclosures required by accounting principles

generally accepted in the United States of America. For additional information, reference is made to the Company’s annual

report on Form 10-K for the fiscal year ended October 31, 2022. The results of operations

for the three and nine month periods ended July 31, 2023 and 2022 are not necessarily indicative of operating results for the full

year.

These financial statements

have been prepared on a going concern basis, which implies that the Company

will continue to

realize its assets

and discharge its

liabilities in the

normal course of business.

The Company had

a net loss

of ($255,649) and

a negative cash

flow of ($84,476) for

the nine month

period ended July

31, 2023. In

addition, the Company

has an accumulated deficit of ($10,591,228).

Management’s plans include cash receipts through sales, sales of Company stock, and borrowings from private parties. These

factors raise substantial doubt regarding the Company’s ability to continue as a going concern for a period of one year from

the issuance of these financial statements. These financial statements do not include any adjustments to the recoverability and

classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable

to continue as a going concern.

Accounts receivable are reported

at their net realizable value. The Company evaluates its receivables on a quarterly basis to assess the validity of remaining receivables.

Management has determined that there is significant doubt regarding the receivable balance over 90 days. There

were no balances

over 90 days

as July 31,

2023. As of

October 31, 2022,

balances over 90 days totaled $5,860 which have been recorded as an

allowance.

| INNOVATIVE DESIGNS, INC. |

| NOTES TO FINANCIAL STATEMENTS |

| |

| 4. | | OPENING

AND CLOSING BALANCE OF RECEIVABLES |

The opening balance of accounts

receivable was $11,203 which was net of the allowance for doubtful accounts of $5,860.

The ending balance of accounts receivable for the nine month period ended

July 31, 2023

was $82. There

was not an

allowance for doubtful

accounts at the end of the

period.

Inventory consists principally

of purchased apparel inventory and house wrap which is manufactured by the Company.

Inventory is stated at the lower of cost or net realizable value on a first-in, first-out basis. The Company has decided

to discontinue the manufacturing of its Artic Armor, hunting and swimming line of

apparel. The Company has booked a reserve against apparel

inventory as of

July 31, 2023

and October 31,

2022 of $75,468.

Management has determined that no allowance is currently necessary on the house wrap inventory.

Management will continue to evaluate its obsolete inventory reserve throughout the year and make adjustments as

needed.

The Company provides a ten-year

limited warranty covering defects in workmanship. These warranties are

included in the

contract and do

not provide customers

with a service

in addition to assurance

of compliance with

agreed-upon specifications. The

Company does not

consider these assurance-type warranties to be separate performance obligations.

Management has determined that

no warranty reserve is currently necessary on the Company’s products. Management will continue to evaluate the need for a

warranty reserve throughout the year and make adjustments as needed.

During 2005, the Company entered

into an agreement with the U.S. Small Business Association. The note is payable in monthly installments of $1,820 with the balance

due and payable in November 2026, at an interest rate of 2.60%.

Stockholder

loans to the

Company, including

accrued interest totaled

$125,741 and $226,793 as of July

31, 2023 and 2022, respectively. The loans bear interest between 10% and 12%.

| INNOVATIVE DESIGNS, INC. |

| NOTES TO FINANCIAL STATEMENTS |

| |

Revenues are measured based

on the amount of consideration specified in a contract with a customer. The Company recognizes revenue when and as performance

obligations (i.e., obligations to transfer goods and/or services) are satisfied, which generally occurs with the transfer of control

of the goods or services to the customer.

To

determine proper revenue recognition, the Company evaluates whether two or more contracts

should be combined

and accounted for

as a single

contract and whether

a combined or single contract should be accounted for as more than one performance

obligation. This evaluation requires significant judgment, and the decision to combine contracts or separate a combined

or single contract

into multiple performance

obligations could change

the amount of revenue and profit

recorded in a given period. Contracts are considered to contain a single performance obligation

if the promise

to transfer individual

goods or services

is not separately identifiable

from other promises in the contracts.

For contracts with multiple

performance obligations, the Company allocates the transaction price to

each performance obligation

using the best

estimate of the

standalone selling price

of each distinct good or service in the contract.

The Company calculates net

loss per share in accordance with Financial Accounting Standards Board

(“FASB”) Accounting

Standard Codification (“ASC”)

Topic 260,

“Earnings per Share”.

Basic earnings (loss)

per share is

calculated by dividing

income (loss) by

the weighted average number of common shares outstanding for the period. During

the periods presented, the Company

only has common

stock outstanding. In 2021,

the Company issued

a convertible debt instrument. In addition, the Company also has stock warrants

of 954,000 and 994,000 as of July 31,

2023 and 2022, respectively. The

Company has calculated diluted

earnings per share utilizing the outstanding stock warrants and convertible

debt.

The Company accounts for income

taxes in accordance with FASB ASC Topic 740 “Income Taxes”, which requires an asset and liability approach for

financial reporting purposes.

Deferred income taxes are provided

for differences between the tax bases of assets and liabilities and the financial reporting amounts at the end of the period, and

for net operating loss and tax

credit carryforwards available

to offset future

taxable income. Changes

in enacted tax rates or laws result in adjustments to recorded deferred tax

assets and liabilities in the periods in which

the tax laws

are enacted or

tax rates are

changed. The Company

will continue to evaluate its income tax obligation throughout the year and

will record a tax provision when it is necessary.

| INNOVATIVE DESIGNS, INC. |

| NOTES TO FINANCIAL STATEMENTS |

| |

| 12. | SHIPPING

AND

HANDLING

COSTS |

The

Company pays shipping

and handling costs

on behalf of

customers for purchased

apparel merchandise. These costs are billed back to the customer through the billing invoice. The shipping and handling

costs associated with merchandise ordered by the Company are included as part of inventory as these costs are allocated across

the merchandise received. With house wrap orders, the customer pays the shipping cost. The shipping and handling costs associated

with customer orders was approximately $27,070 and $21,199 for the nine month periods ended July 31, 2023 and 2022,

respectively.

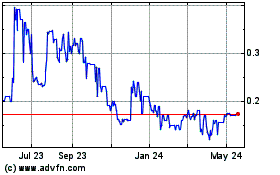

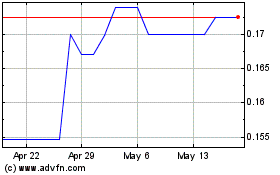

During the nine month period

ended July 31, 2023, the Company sold 645,000 shares of common stock

to four investors

for total proceeds

of $131,000, one

investor exercised 40,000 warrants

for stock for total proceeds of $10,000, and 230,000 shares were issued to two investors for services. The stock was issued between

$0.20 and $0.25 per share.

During the nine month period

ended July 31, 2022, the Company sold 460,000 shares of common stock

to seven investors

for total proceeds

of $86,200 and

issued 750,000 shares

to eight individuals for services. The stock was issued between $0.17 and $0.25 per

share.

On July 12, 2015, the Company

reached an agreement with Ketut Jaya to purchase the machinery and equipment utilized to produce the INSULTEX material. The purchase

price is $700,000 and to be made in four installments. The first installment of $300,000 is to be made at the execution of the

agreement. The second installment of $200,000 is to be made when the machinery and equipment is ready to be shipped to the United

States. The third installment of $100,000 is to be made once the machinery and equipment is producing INSULTEX, and

the fourth and final installment of $100,000 is to be made after the first commercial production run of INSULTEX is

completed. As of October 31, 2018, the Company has made payments of $500,000 in accordance with the agreement and made a $100,000

pre-payment as the machine is not yet producing INSULTEX. Additionally, the Company has

incurred $17,000 of additional expenses related to shipping, site improvements and installation of the equipment. During 2019, the

Company determined the shipping costs of $17,000 were impaired and these costs were written off the

balance due. In February 2023, the Company made an additional prepayment of $10,000 on the equipment and owes an additional $73,000

for the installation of the equipment.

During the fiscal year ending

October 31, 2022, the Company made deposits on a separate piece of equipment of $7,370. During the three quarters ended July 31,

2023, the Company made additional deposits of $29,574 on this piece of equipment. Total deposits for this piece equipment as of

July 31, 2023 total $36,944.

Total deposits made for the three

quarters ended July 31, 2023 total $112,574.

| INNOVATIVE DESIGNS, INC. |

| NOTES TO FINANCIAL STATEMENTS |

| |

Total overall

deposits on equipment

as of July

31, 2023 and

2022 were $719,944

and $607,370, respectively.

FASB

ASC Topic

842, “Leases”, establishes

a right of

use (“ROU”) model

that requires a

lessee to recognize a ROU asset and lease liability on the condensed balance sheets. ROU assets and

lease liabilities are

recognized at the

commencement date based

on the present

value of lease payments over the lease term. ROU assets are reduced each period

by an amount equal to the

difference between the

lease expense and

the amount of

interest expense on

the lease liability,

using the effective

interest method. The Company

used the average

commercial real estate interest rate of 5.50% to calculate the present value of the lease. The Company recognizes lease

expense on a straight-line basis over the leased term on the condensed statements of operations.

The Company entered into a lease

for office space at the time the Company was formed through June 2022. Effective July 2022, the Company is leasing the office space

on a month to month basis.

As a result,

the Company has

elected to apply

the short-term lease

exemption to its lease of the facilities and therefore has not recorded a ROU asset and related lease liability.

The

Company has organized

operations into two

segments based on

an internal management reporting

process that provides segment information for purposes of making financial decisions and allocating

resources.

The

following tables present

the Company’s business

segment information for

the nine month period ended July

31, 2023 and 2023:

| Schedule of business segment information | |

| | | |

| | |

| | |

2023 | |

2022 |

| Revenues: | |

| | | |

| | |

| Apparel | |

$ | 31,105 | | |

$ | 59,126 | |

| House

wrap | |

| 192,441 | | |

| 176,038 | |

| | |

| | | |

| | |

| Total

revenues | |

$ | 223,546 | | |

$ | 235,164 | |

| | |

| | | |

| | |

| Assets: | |

| | | |

| | |

| Apparel | |

$ | 167,822 | | |

$ | 81,045 | |

| House

wrap | |

| 1,318,342 | | |

| 1,546,171 | |

| | |

| | | |

| | |

| Total

assets | |

$ | 1,486,164 | | |

| 1,627,216 | |

| | |

| | | |

| | |

| Depreciation: | |

| | | |

| | |

| Apparel | |

$ | — | | |

$ | — | |

| House

wrap | |

| 2,306 | | |

| 1,118 | |

| | |

| | | |

| | |

| Total

depreciation | |

$ | 2,306 | | |

$ | 1,118 | |

| INNOVATIVE DESIGNS, INC. |

| NOTES TO FINANCIAL STATEMENTS |

| |

On November 4, 2016, the Federal

Trade Commission (“FTC”) filed a complaint against the Company in the

U.S. District Court Western District of Pennsylvania, Case number 16-1669. In the complaint, the FTC alleges that, among other

matters, the Company did not have substantiation of

claims made by

the Company regarding

the R value

and energy efficiency

of its INSULTEX house wrap products. The complaint asks to redress a rescission

of revenue the Company received from the sale of the house wrap and a permanent injunction. On September 24, 2020, a judgment was

entered in favor of the Company as to all claims set forth in the FTC complaint. It was further ordered that as there were no remaining

claims in the action the case shall be marked as closed.

On

November 23, 2020,

the Company was

informed that the

FTC had filed

a notice of

appeal in regard to the case. The appeal is from the District Court’s September 24, 2020, Order granting the Company’s

Motion for Judgment on Partial Findings Pursuant to Fed. R. Civ. P.

52(c) and subsequent Judgment in favor of the Company and from the District Court’s February

14, 2020, striking

Dr. David

Yarbrough’s expert

testimony made on

behalf of the

FTC. The FTC filed its appeal and on March 24, 2021, the Company filed its answer.

On July 22, 2021, the Registrant

was informed that the U.S. Court of Appeals for the Third District affirmed the District Court’s ruling in favor of the Registrant.

The ruling was in connection with the FTC complaint filed against the Registrant in November 2016, alleging, among other matters,

that the Registrant did not have substantiation for claims made by the Registrant regarding

the R-value and

energy efficiency of

its INSULTEX

house wrap products.

In November 2021, in connection

with the FTC litigation, the Company filed an application for attorney fees, expenses and cost in the U.S. District Court for the

Western District of Pennsylvania, Case No.2:16-cv-01669-NBF. On June 29, 2022, a settlement order was signed by the Court. Pursuant

to the Order, the FTC paid the Company $260,000 to resolve all such claims. The parties agreed to waive all rights to appeal or

otherwise challenge or contest the validity of the Order.

The Company has evaluated subsequent

events in accordance with ASC Topic 855, “Subsequent

Events”, through September

20, 2023 which

is the date

financial statements were available

to be issued. The Company identified no material subsequent events that require recognition or additional disclosure in these financial

statements.

INNOVATIVE DESIGNS,

INC.

ITEM 2.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

General

The following information should be

read in conjunction with the financial statements and the notes thereto and in conjunction with Management’s Discussion and

Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended October 31,

2022.

Forward-Looking Statements

This Quarterly Report on Form 10-Q

includes forward-looking statements within the meaning of the Private Securities Reform Act of 1995. All statements other than

statements of historical fact, including statements regarding future results of operation, made in this Quarterly Report on Form

10-Q are forward-looking statements. We use words such as expects, believes, intends, and similar expressions to identify forward-looking

statements. Forward looking-looking statements reflect management’s current expectations and are inherently uncertain. Actual

results could differ materially for a variety of reasons, including, among others, an adverse outcome in our legal matter with

the Federal Trade Commission, competition in our cold weather markets, our inability to secure sufficient funding to maintain and/or

expand our current level of operations and the seasonality of our cold weather product line. These risks and uncertainties, as

well as other risks and uncertainties that could cause our actual results to differ significantly from management’s expectations,

are described in greater detail in our Annual Report on Form 10-K for the fiscal year ended October 31, 2017. The Company undertakes

no obligation to publicity update or revise any forward-looking statement, whether as a result of new information, future events

or otherwise except as required by law.

Background

Innovative Desings, Inc. (herein after

referred to as the “Company”, “we” or “our”) was formed on June 25, 2002. We produce, market

and sell products made from Insultex, which is a low-density polyethylene semi-crystalline, closed cell foam in which the cells

are totally evacuated with buoyancy and thermal resistant properties. Other than Korea and Japan, we are the sole worldwide supplier/

distributor of the Insultex material. Our main product line is a house wrap, Insultex House Wrap, for the building construction

industry. Insultex House Wrap is a multi-ply weatherization membrane that provides a protective layer under a building’s

outer covering that resists water and air infiltration, preventing mold and mildew buildup that can cause structural rotting. What

differentiates Insultex House Wrap from its competition is the fact that it offers an R-Value of R-6. R-value is a term used to

measure thermal resistance and is most commonly used when referring to the insulating qualities of a building structure, thus increasing

energy efficiency. We also sell a cold weather line of outdoor apparel and cold weather gear call Artic Armor made using Insultex.

We no longer produce this line and are only selling from our remaining inventory. The fact that Insultex is a thermal insulation

means it has many other applications such as other clothing apparel, tents and sleeping bags. It can also be used in refrigerated

environments where keeping the temperature low is a requirement.

INNOVATIVE DESIGNS,

INC.

Results of Operations

Comparison of the Three Month Period

Ended July 31, 2023 with the Three Month Period Ended July 31, 2022.

| |

|

Three Month Period Ended 31-Jul 2023 |

|

% of Sales |

|

Three Month Period Ended 31-Jul 2022 |

|

% of Sales |

|

Increase

(Decrease) |

|

% Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUE

- NET |

|

$ |

124,650.00 |

|

|

|

|

|

|

$ |

135,048.00 |

|

|

|

|

|

|

$ |

-10,398.00 |

|

|

|

-8.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost

of sales |

|

$ |

76,480.00 |

|

|

|

61.4 |

% |

|

$ |

56,224.00 |

|

|

|

41.6 |

% |

|

$ |

20,256.00 |

|

|

|

26.5 |

% |

| Selling,

general and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| administrative

expenses |

|

$ |

124,944.00 |

|

|

|

100.2 |

% |

|

$ |

115,384.00 |

|

|

|

85.4 |

% |

|

$ |

9,560.00 |

|

|

|

7.7 |

% |

| Total

Operating Expenses |

|

$ |

201,424.00 |

|

|

|

|

|

|

$ |

171,608.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss

from operations |

|

$ |

-76,774.00 |

|

|

|

-61.6 |

% |

|

$ |

-36,560.00 |

|

|

|

-27.1 |

% |

|

$ |

-40,214.00 |

|

|

|

52.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous

Income (expense) |

|

$ |

0.00 |

|

|

|

|

|

|

$ |

260,000.00 |

|

|

|

100.0 |

% |

|

$ |

-260,000.00 |

|

|

|

100.0 |

% |

| Interest

expense |

|

$ |

-6,421.00 |

|

|

|

-5.2 |

% |

|

$ |

-10,710.00 |

|

|

|

-7.9 |

% |

|

$ |

4,289.00 |

|

|

|

-66.8 |

% |

| Depreciation |

|

$ |

-769.00 |

|

|

|

|

|

|

$ |

-373.00 |

|

|

|

-0.3 |

% |

|

$ |

-396.00 |

|

|

|

51.5 |

% |

| Total

other income (expense) |

|

$ |

-7,190.00 |

|

|

|

|

|

|

$ |

248,917.00 |

|

|

|

184.3 |

% |

|

$ |

-256,107.00 |

|

|

|

3562.0 |

% |

| Net

Loss |

|

$ |

-83,964.00 |

|

|

|

-7.4 |

% |

|

$ |

212,357.00 |

|

|

|

157.2 |

% |

|

$ |

-296,321.00 |

|

|

|

352.9 |

% |

Revenues for the three month period

ended July 31, 2023 were $124,650 compared to revenues of $135,048 for the three month period ended July 31, 2021. See Note 16

of the Notes to the Condensed Financial Statements appearing elsewhere in this Report for a description of our segment products

sales. Our net loss for the three-month period ended July 31, 2023, was ($83,964).

Our cost of sales was $76,480 for

the three months ended July 31, 2023, compared to $56,224 for the three months ended July 31, 2022. The increase is largely on

account of the increase in the price we pay to our supplier of the House Wrap product line.

Our selling, general and administrative

expenses were $124,944 for the three month period ended July 31, 2023 compared to $115,384 for the three month period ended July

31, 2022.

INNOVATIVE DESIGNS,

INC.

Comparison of the Nine Month Period Ended July 31, 2023, with the Nine Month Period Ended July 31, 2022.

The following table shows a comparison

of the results of operations between the nine month periods ended July 31, 2023 and July 31, 2022:

| |

|

Nine Month Period Ended 31-Jul 2023 |

|

%

of Sales |

|

Nine Month Period Ended 31-Jul 2022 |

|

%

of Sales |

|

Increase

(Decrease) |

|

%

Change |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| REVENUE

- NET |

|

$ |

223,546.00 |

|

|

|

|

|

|

$ |

235,164.00 |

|

|

|

|

|

|

$ |

-11,618.00 |

|

|

|

-5.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost

of sales |

|

$ |

106,839.00 |

|

|

|

47.8 |

% |

|

$ |

109,884.00 |

|

|

|

46.7 |

% |

|

$ |

-3,045.00 |

|

|

|

-2.9 |

% |

| Selling,

general and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| administrative

expenses |

|

$ |

359,917.00 |

|

|

|

161.0 |

% |

|

$ |

545,212.00 |

|

|

|

231.8 |

% |

|

$ |

-185,295.00 |

|

|

|

-51.5 |

% |

| Total

Operating Expenses |

|

$ |

466,756.00 |

|

|

|

|

|

|

$ |

655,096.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss

from operations |

|

$ |

-243,210.00 |

|

|

|

-108.8 |

% |

|

$ |

-419,932.00 |

|

|

|

-178.6 |

% |

|

$ |

176,722.00 |

|

|

|

-72.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous

Income (expense) |

|

$ |

7,519.00 |

|

|

|

|

|

|

$ |

260,000.00 |

|

|

|

100.0 |

% |

|

$ |

-252,481.00 |

|

|

|

100.0 |

% |

| Interest

expense |

|

$ |

-17,652.00 |

|

|

|

-7.9 |

% |

|

$ |

-34,450.00 |

|

|

|

-14.6 |

% |

|

$ |

16,798.00 |

|

|

|

-95.2 |

% |

| Depreciation |

|

$ |

-2,306.00 |

|

|

|

|

|

|

$ |

-1,118.00 |

|

|

|

-0.5 |

% |

|

$ |

-1,188.00 |

|

|

|

51.5 |

% |

| Total

other income (expense) |

|

$ |

-12,439.00 |

|

|

|

|

|

|

$ |

224,432.00 |

|

|

|

95.4 |

% |

|

$ |

-236,871.00 |

|

|

|

1904.3 |

% |

| Net

Loss |

|

$ |

-255,649.00 |

|

|

|

-114.4 |

% |

|

$ |

-195,500.00 |

|

|

|

-83.1 |

% |

|

$ |

-60,149.00 |

|

|

|

23.5 |

% |

Revenues for the nine month period

ended July 31, 2023 were $223,546 compared to revenues of $235,164 for the nine month period ended July 31, 2021. The decrease

is caused, by the decrease in our apparel sales and the sales in our House Wrap product line. The apparel sales were adversely

affected by warm weather. During the nine month period ended July 31, 2023 House Wrap sales totaled $192,441 in comparison with

$176,038 during the nine month period ended July 31, 2022. See Note 16 of the Notes to the Condensed Financial Statements appearing

elsewhere in this Report for a description of our segment product sales. Our net loss for the nine month period ended July 31,

2023 was ($255,649).

Our selling, general and administrative

expenses were $106,839 for the nine months ended July 31, 2023, compared to $109,884 for the nine month period ended July 31, 2022.

Professional fees for the period were approximately $63,000. Salaries were approximately $107,000, travel expenses were approximately

$20,000 and rent expense was $21,000.

INNOVATIVE DESIGNS,

INC.

Liquidity and

Capital Resources

During the period ended July 31, 2023,

we funded our operations from revenues and from sales of our securities.

Subsequent to the period we raised

$60,000 from the sale of our securities.

Short Term: We will continue to fund our operations

from sales and the sale of our securities. We continue to pay our creditors when payments are due. We will require more funds to

be able to order the material for our Insultex products and to purchase equipment needed for the manufacture of the Insultex product.

The Company reached an agreement with the manufacturer of the Insultex material to purchase a machine capable of producing the

Insultex material. Also included in the proposed agreement will be the propriety formula that creates Insultex. The Company took

delivery of the equipment in December 2015. The Company will have to have the machine installed and ensure that it can be operated

in compliance with all environmental rules and regulations. It is the Company intentions to have the equipment operational but

cannot currently provide a time estimate. Among the factors affecting the time estimate are the financial resources available to

the Company, finding a suitable facility and bringing technical personnel from abroad to install the equipment. The Company has

currently made deposits of $600,000 on the equipment. The Company has incurred $17,000 of additional expenses related to shipping.

Earlier this year, our CEO traveled to Indonesia to inspect the manufacturing facility of the Ketut Group where Insultex is currently

produced. He also discussed with Ketut management the plans for the Company to install in the United States the machinery and equipment

utilized to produce the Insultex material and for Ketut to arrange for the technical personal needed to assist in the installation.

The Company is currently looking for a suitable site for the onshore manufacturing of Insultex. It is also seeking the financing

needed to accomplish the installation which is estimated to cost between 1.5 to 2 million dollars.

The Company will produce

Insultex under its own brand name. See Note 14 of the Notes to the Condensed Financial Statements.

We must purchase new quality control testing

equipment for our products. The vendor is currently working on the project and we expect delivery of the equipment within the next

few weeks. After such testing is complete the certification process can begin. We have paid approximately $39,000 as of July 31,

2023, for the equipment.

Long Term: The Company will continue to fund

its operations from revenues, borrowings from private parties and the possible sale of our securities. Should we not be able to

rely on the private sources for borrowing and /or increased sales, our operations would be severely affected as we would not be

able to fund our purchase orders to our suppliers for finished goods and our efforts to produce our own Insultex would be delayed.

INNOVATIVE DESIGNS,

INC.

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDING

See Note 17 of the

Notes to Condensed Financial Statements appearing elsewhere in this Report.

ITEM 2. UNREGISTERED

SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

On

May 17, 2023, we issued 185,000 shares of our common stock to a consultant

for services pursuant to an agreement dated April 17, 2023. Also on May 17, 2023, we sold 50,000 Units to one investor at a price

of $.20 per Unit. Each Unit contained one share of common stock and a warrant with a two year term to purchase one share of common stock.

The warrant has an exercise price of $.20 per warrant. We received $10,000 in proceeds.

On June 2, 2023,

, we sold 40,000 Units each to one investors at a price of $.25 per Unit. The warrant had an exercise price of $.25. We received

$10,000 in total proceeds.

On June 23, 2023,

a warrant holder exercised warrants to purchase 40,000 shares of common stock at an exercise price of $.25. We received $10,000

in proceeds.

Between August

16, 2023, and August 24, 2023, we sold a total of 180,000 Unites to five investors at a price of $.25 per Unit. The warrant had

an exercise price of $0.25 per warrant. Total proceeds were $45,000.

On September 6,

2023, we sold 20,000 Units each to three investors at a price of $.25 per Unit. The warrant had an exercise price of $.25 per warrant.

We relied on Rule

506 of Regulation D promulgated under the Securities Act of 1933, as amended.

INNOVATIVE DESIGNS,

INC.

ITEM 3. QUANTITATATIVE AND QUALITATIVE DISCLOSURES

ABOUT MARKET RISK

As a smaller reporting company, we

are not required to provide the information otherwise required by this Item.

ITEM 4T. CONTROLS AND

PROCEDURES

Management has developed and implemented

a policy and procedures for reviewing, on a quarterly basis, our disclosure controls and procedures. During the period ended July

31, 2023, our principal executive/financial officer concluded that these controls and procedures were ineffective. At this time,

we do not have the financial resources to employ a financial staff with accounting and financial expertise. Once we have the necessary

financial resources, we plan to hire and designate an individual responsible for identifying reportable developments and to implement

procedures designed to remediate the material weakness by focusing additional attention and resources in our internal accounting

functions.

Changes in Internal Control Over Financial

Reporting

During the most recent fiscal quarter,

there were no changes in the Company’s internal control over financial reporting identified in connection with the evaluation

required by paragraph (d) of Exchange Act Rules 13(a)-15 or 15d-15 that have materially affected, or are reasonably likely to materially

affect, the Company’s internal control over financial reporting.

Until the Company has the financial

resources to employ a financial staff with accounting and financial expertise, to be able to properly account for internal financial

reporting, errors that may have a material effect on the financial statements have the potential to occur.

INNOVATIVE DESIGNS,

INC.

ITEM 6. EXHIBITS

| * | Incorporated

by reference

to the

Company’s

Form

10-K

filed

February

12,

2015 |

| | | |

| ** | Incorporated

by

reference

to

the

Company’s

registration

statement

on

Form

SB-2,

filed

March

11,

2003 |

| | | |

| 99*** | Incorporated

by

reference

to

the

Company’s

Current

Report

on

Form

8-k,

filed

November

4,

2016 |

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Innovative Designs, Inc. |

| |

Registrant |

| |

|

| Date: September 27, 2023 |

By: /s/ Joseph Riccelli |

| |

Joseph Riccelli, Chief Executive Officer |

| |

and Chief Financial Officer |

-20-

EXHIBIT 31.1

INNOVATIVE DESIGNS, INC.

CERTIFICATIONS

I, Joseph Riccelli, certify that:

1. I have reviewed

this amended quarterly report on Form 10-Q/A of Innovative Designs, Inc.;

2. Based on my knowledge, this quarterly

report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements

made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by

this quarterly report;

3. Based on my knowledge, the financial

statements, and other financial information included in this quarterly report, fairly present in all material respects the financial

condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this quarterly report;

4. I am responsible for establishing and

maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control

over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f) for the registrant and have:

| (a) | Designed

such

disclosure

controls

and

procedures,

or caused

such

disclosure

controls

and

procedures

to be

designed

under

my supervision,

to ensure

that

material

information

relating

to the

registrant,

including

its

consolidated

subsidiaries,

is made

known

to me

by others

within

those

entities,

particularly

during

the

period

in which

this

quarterly

report

is being

prepared; |

| (b) | Designed

such

internal

control

over

financial

reporting,

or caused

such

internal

control

over

financial

reporting

to be

designed

under

my supervision,

to provide

reasonable

assurance

regarding

the

reliability

of financial

reporting

and

the

preparation

of financial

statements

for

external

purposes

in accordance

with

generally

accepted

accounting

principles; |

| (c) | Evaluated

the

effectiveness

of the

registrant’s

disclosure

controls

and

procedures

and

presented

in this

quarterly

report

my conclusions

about

the

effectiveness

of the

disclosure

controls

and

procedures,

as of

the

end

of the

period

covered

by this

report

based

on such

evaluation;

and |

| (d) | Disclosed

in this

report

any