NetworkNewsWire

Editorial Coverage: Growth in demand for batteries is pushing

up nickel production around the world.

- Nickel is an essential component in batteries, including those

for cars and phones.

- Demand for metals is growing, especially in China, a major

battery manufacturer.

- Indonesia is the world’s largest nickel producer.

- The country is working to expand its manufacturing sector.

To view an infographic of this editorial, click here.

Pacific Rim Cobalt Corporation (CSE: BOLT) (OTCQB:

PCRCF) (PCRCF

Profile) is making the most of Indonesian nickel

through an aggressive exploration and development program there.

Ivanhoe Mines Ltd. (TSX: IVN) (OTCQX: IVPAF) has

announced mine development is underway at its platinum-group

metals, nickel, copper and gold Platreef Project in South Africa.

BHP Group (NYSE: BHP), the world’s biggest mining

company, is holding on to its Western Australia-based Nickel West

operations, based on a positive battery market forecast.

Glencore (OTC: GLNCY) mines nickel and produces

byproduct metals as a result of that production. One of the major

drivers behind the rising demand for batteries is car production by

companies such as Volkswagen AG (OTC: VWAGY),

which is building two additional plants in China to produce a total

of 600,000 vehicles on its dedicated battery-car platform.

Building Better Batteries

The past two decades has seen the demand for battery materials

surge upward. A host of electronic gadget and vehicles — everything

mobile phones, laptops and hybrid cars — are spreading around the

world. And each one relies on batteries for power, causing a spike

in demand for the minerals used in these batteries.

This flood of electronic devices has created an opportunity for

countries with rich nickel deposits, including Indonesia. By

reforming laws and opening up the industry to foreign investors,

these countries are seeing a boost to their economies and enjoying

a growing influence on the global stage. The growing demand also

creates promising potential for savvy companies that are willing to

seize the opportunity to mine the world’s mineral wealth.

The Need for Nickel

For mineral exploration companies such as Pacific Rim

Cobalt Corporation (CSE:BOLT) (OTCQB:PCRCF), there’s

never been a better time to focus on nickel. Two trends are buoying

up demand for battery minerals: green energy and high-tech

gadgetry. These two trends will undoubtedly only increase, ensuring

a shiny future for nickel companies.

People around the world today live increasingly connected lives,

thanks to the proliferation of electronic gadgets. From smartphones

to laptops to watches that track fitness, first-world consumers and

the rising middle class of the rest of the world are using portable

technology around the clock. The portability of these powerful

devices is made possible because of their rechargeable batteries,

which rely upon elements such as nickel to work.

At the same time, the push for environmentally friendly living

is also boosting the need for batteries. Electric and hybrid cars

are fueled by powerful batteries, batteries that are essential for

self-driving and driver-assistance technology. National energy

production networks, which increasingly use renewable energy to

reduce pollution, also depend on battery-power storage solutions to

see them through the ebb and flow of solar and wind power. Mining

companies such as Pacific Rim Cobalt are emerging as a vital

component in the creation of a cleaner environment.

For Pacific Rim Cobalt, this means continued development of

projects with the end goal of eventually producing cathode

materials such as nickel to meet growing demand. Though tensions

over President Donald Trump’s trade wars have softened metal prices

in the short term, longer-term needs are essentially immune to

presidential policies. Across Asia in particular, demand for

battery materials keeps rising, and the market’s long-term strength

seems assured.

Indonesia: A Nickel Powerhouse

To make the most of this market, Pacific Rim Cobalt has been

building its operations in Indonesia, the largest nickel-producing

nation in the world. With cobalt being a byproduct of nickel

production, Indonesia remains in the running to potentially become

the largest source of this critical battery mineral outside of

Africa.

Located in northern Indonesia, Pacific Rim’s Cyclops Project is the company’s current focus on

nickel operations. The project is in its early stages, with 20

step-out holes already drilled to gather information about the

mineral resources in the region. The company has just announced

(June 6) the commencement of Phase 2 drilling at Cyclops with a

goal of completing up to an additional 50 holes. Combined with

historical estimates, this information will allow the company to

establish a maiden compliant (NI 43-101) resource on the project

and determine how best to go about extracting those resources. Up

to this point, drilling has confirmed elevated nickel and cobalt

values, demonstrating a potentially highly profitable mining

site.

The Cyclops site was carefully chosen from among available

options in Indonesia. “The Cyclops Project was acquired following

extensive due diligence on over 40 projects across Indonesia,” said

Pacific Rim CEO Ranjeet Sundher. “We expect the near-surface nature

of cobalt and nickel mineralization at the Cyclops Project will

lend itself well to low-cost, logistically straightforward

drilling. We anticipate the opportunity to undertake a resource

calculation study, as well as ongoing metallurgy and process option

testing, will present itself in the near future."

The abundance of mineral deposits isn't the only thing that

makes Indonesia and, in particular, its north coast an attractive

place for nickel mining. It’s also location. Close to China,

Indonesia is in an ideal position to supply its neighboring

country’s huge battery-production market. Chinese batteries play an

essential part both in their home country’s embrace of modern

technology and in exports to the rest of the world. Chinese

companies are becoming leaders and innovators in telecoms and

electric cars, making this an important market for nickel

producers.

Good transportation links are essential to making the most of

mineral extraction. Whether it’s the solid road connections around

Pacific Rim Cobalt’s project or the maritime trade connections

between Indonesia and China, these dynamic elements ensure that

Indonesia — and the companies working within the country — can make

the most of its mineral resources.

Opening Up Markets

Indonesia, however, has set its sights on becoming more than

just a resource base. The country’s Industry Minister, Airlangga

Hartarto, has identified a bold agenda. The government’s plan is

to build Indonesia into a regional manufacturing

powerhouse, turning its own raw resources into consumer goods.

This strategic move could create even more opportunities for

companies already in the country, such as Pacific Rim Cobalt.

The government’s goal is not just a grand statement of intent.

Plans are afoot to revise labor laws and open up various parts of

the economy to foreign involvement. These moves are expected to

make the country even more attractive to investors, whose money can

drive the development of the manufacturing base.

The abundance of nickel ore will be one of the

draws for these investors. This rich resource will remain a

unique selling point for Indonesia, as manufacturing within the

country appears certain to reduce transport costs associated with

acquiring the mineral and allow greater efficiencies in the

end-to-end battery production process.

With ongoing demand from China and the development of strong

internal markets, nickel companies working in Indonesia almost

certainly will see demand for their products continue to rise. By

tapping into buried deposits, both Indonesia and the companies

operating in the country appear certain to profit. This promising

future is what companies such as Pacific Rim Cobalt are banking

on.

Pushing Up Nickel Production

Reports from Ivanhoe Mines Ltd.’s (TSX: IVN) (OTCQX:

IVPAF) Platreef project appear promising. The project’s

mining team delivered the first high-grade

mineralization from underground mine development to surface

stockpiles for metallurgical sampling three months ago. A total of

fifty grab samples yielded an average grab sample grade of 6.35

grams per tonne platinum, palladium and rhodium plus gold, as well

as significant quantities of nickel and copper.

Glencore (OTC: GLNCY), one of the world’s

largest diversified natural resources companies, has invested

heavily in mining for battery metals, including nickel. Producers

of some of the world’s purest nickel, Glencore relies on assets from Australia, Canada and Europe to produce its

supply of nickel. As a byproduct of its nickel production, the

company also produces byproduct metals such as cobalt and

copper.

The decision by BHP Group (NYSE: BHP) to keep

Nickel West was announced by BHP CEO

Andrew Mackenzie during a recent mining conference. “Nickel

West, which we will now retain in the portfolio, offers high-return

potential as a future growth option, linked to the expected growth

in battery markets and the relative scarcity of quality nickel

sulphide supply,” he said. Nickel West is a fully integrated

mine-to-market nickel business with all operations (mines,

concentrators, a smelter and a refinery) located in Western

Australia.

The hunt for battery metals is made more urgent by the work of

car manufacturers such as Volkswagen AG (OTC:

VWAGY), which began producing cars in China in 1984; the

company has become a significant presence in the country since

then. Opening two more plants in the country will likely place the

company in a strong position in the growing e-vehicle market. VW

plans to produce some 70 battery-powered

models across its 12 auto brands by 2028 and make 22 million

electric cars over the next decade. In addition, the Volkwagen

Group opened four new plants

in China last year. This growth should boost China’s burgeoning

battery industry along with the country’s demand for Indonesian

nickel.

As battery demand continues to grow, so will the world’s nickel

industry. And the companies involved in that industry appear

certain to benefit.

For more information on Pacific Rim Cobalt Corp., visit Pacific Rim

Cobalt Corp. (OTCQB: PCRCF) (CSE: BOLT)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, (5) a full array

of corporate communications solutions, and (6) a total news

coverage solution with NNW Prime. As a

multifaceted organization with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

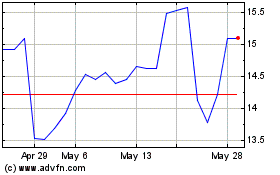

Ivanhoe Mines (QX) (USOTC:IVPAF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Ivanhoe Mines (QX) (USOTC:IVPAF)

Historical Stock Chart

From Dec 2023 to Dec 2024