UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

| [X] |

Quarterly

Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| |

For

the quarterly period ended March 31, 2015 |

| |

|

| [ ] |

Transition

Report pursuant to 13 or 15(d) of the Securities Exchange Act of 1934 |

| |

|

| |

For

the transition period from __________ to__________ |

| |

|

| |

Commission

File Number: 333-168775 |

iWallet

Corp.

(Exact

name of registrant as specified in its charter)

| Nevada |

27-1830013 |

| (State

or other jurisdiction of incorporation or organization) |

(IRS

Employer Identification No.) |

| 7394

Trade Street, San Diego, California 92121 |

| (Address

of principal executive offices) |

| 1-800-508-5042 |

| (Registrant’s

telephone number) |

________________________________________________________________ |

| (Former

name, former address and former fiscal year, if changed since last report) |

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days [X] Yes [ ] No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[

] Yes [X] No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company.

| [

] Large accelerated filer Accelerated filer |

[

] Non-accelerated filer |

| [X]

Smaller reporting company |

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

[

] Yes [X] No

State

the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 33,919,419

as of May 13, 2015.

PART

I - FINANCIAL INFORMATION

Item

1. Financial Statements

Our

financial statements included in this Form 10-Q are as follows:

These

unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States

of America for interim financial information and the SEC instructions to Form 10-Q. In the opinion of management, all adjustments

considered necessary for a fair presentation have been included. Operating results for the interim period ended March 31, 2015

are not necessarily indicative of the results that can be expected for the full year.

iWallet

Corp

Condensed

Interim Balance Sheets

March

31, 2015 and December 31, 2014

| | |

| 2015 | | |

| 2014 | |

| |

| (Unaudited) | | |

| | |

| Assets | |

| | | |

| | |

| Current

assets | |

| | | |

| | |

| Cash | |

$ | 64,720 | | |

| 465,847 | |

| Funds

held in attorney trust | |

| 20,000 | | |

| 20,000 | |

| Accounts

receivable, net of allowance of $4,502 (2014 - $nil) | |

| 14,035 | | |

| 8,064 | |

| Deposits

and deferred costs (note 9) | |

| 183,546 | | |

| 211,534 | |

| Inventory

(note 4) | |

| 161,575 | | |

| 138,819 | |

| Due

from shareholder (note 7) | |

| 114,349 | | |

| 114,349 | |

| | |

| 558,225 | | |

| 958,613 | |

| Intangible

assets (note 5) | |

| 112,061 | | |

| 116,336 | |

| | |

$ | 670,286 | | |

$ | 1,074,949 | |

| Liabilities | |

| | | |

| | |

| Current

liabilities | |

| | | |

| | |

| Bank

indebtedness - current (note 6) | |

$ | 4,200 | | |

$ | 4,347 | |

| Accounts

payable (note 7) | |

| 207,757 | | |

| 235,391 | |

| Accrued

liabilities (note 13) | |

| 61,756 | | |

| 45,916 | |

| Due

to related party (note 7) | |

| 3,030 | | |

| 3,030 | |

| Advances

from investor (note 7) | |

| 474 | | |

| 474 | |

| Tooling

commitment liability (note 9) | |

| 41,153 | | |

| 41,153 | |

| | |

| 318,370 | | |

| 330,311 | |

| Bank

indebtedness - long-term (note 6) | |

| 12,846 | | |

| 13,764 | |

| | |

| 331,216 | | |

| 344,075 | |

| Shareholder's

(deficiency) equity | |

| | | |

| | |

| |

| | | |

| | |

| Common

shares, par value $0.001, 75,000,000 shares authorized; 33,919,419 issued (2014 - 33,919,419) (note

11) | |

| 33,919 | | |

| 33,919 | |

| Share

to be issued | |

| 5,166 | | |

| 2,973 | |

| Additional

paid-in capital | |

| 3,480,498 | | |

| 3,341,070 | |

| Deficit | |

| (3,180,513 | ) | |

| (2,647,088 | ) |

| | |

| 339,070 | | |

| 730,874 | |

| | |

$ | 670,286 | | |

$ | 1,074,949 | |

The

accompanying notes are an integral part of these condensed interim financial statements.

iWallet

Corp

Condensed

Interim Statements of Operations and Comprehensive Loss

for

the three month periods ended

March 31, 2015 and 2014 (unaudited)

| | |

| 2015 | | |

| 2014 | |

| Sales | |

$ | 24,522 | | |

$ | 16,132 | |

| Cost

of sales | |

| 32,824 | | |

| 16,946 | |

| Gross

(loss) profit | |

| (8,302 | ) | |

| (814 | ) |

| Expenses | |

| | | |

| | |

| Share-based

compensation | |

| 141,621 | | |

| — | |

| Salaries

& wages | |

| 106,500 | | |

| 62,100 | |

| Office

and general expenses | |

| 93,337 | | |

| 11,375 | |

| Research

and development | |

| 88,339 | | |

| 1,142 | |

| Legal

and professional fees | |

| 81,991 | | |

| 111,558 | |

| Travel | |

| 22,657 | | |

| 15,615 | |

| Rent | |

| 7,500 | | |

| 1,250 | |

| Interest

and bank fees | |

| 577 | | |

| 5,466 | |

| Amortization

of intangible assets | |

| 4,275 | | |

| 2,888 | |

| | |

| 546,797 | | |

| 211,394 | |

| Other

(income) loss | |

| | | |

| | |

| Foreign

exchange gain | |

| (21,674 | ) | |

| — | |

| Loss

before provision for income taxes | |

| (533,425 | ) | |

| (212,208 | ) |

| Provision

for income taxes | |

| — | | |

| — | |

| Net

and comprehensive loss for the periods | |

$ | (533,425 | ) | |

$ | (212,208 | ) |

| Loss per share basic and diluted

(note 14) | |

$ | (0.02 | ) | |

$ | (0.02 | ) |

| Weighted

average number of shares outstanding basic and diluted

(note 14) | |

| 33,919,419 | | |

| 10,000,000 | |

The

accompanying notes are an integral part of these condensed interim financial statements.

iWallet

Corp

Condensed

Interim Statement of Changes in Shareholders’ (Deficiency) Equity

for

the three month period March 31, 2015 and year ended December 31, 2014

| |

| |

| |

| |

| |

| |

Shareholder's |

| |

Class

A Common Shares | |

Shares | |

Additional | |

| |

(Deficiency) |

| |

Shares | |

Amount | |

to

be issued | |

Paid-in

Capital | |

Deficit | |

Equity |

| Balance, January 1, 2014 | |

| 10,000,000 | | |

| 10,000 | | |

| — | | |

| (9,989 | ) | |

| (222,812 | ) | |

| (222,801 | ) |

| Reverse recapitalization of Queensridge | |

| 9,037,147 | | |

| 9,037 | | |

| — | | |

| (9,037 | ) | |

| — | | |

| — | |

| Private placement | |

| 6,662,335 | | |

| 6,662 | | |

| — | | |

| 1,992,039 | | |

| — | | |

| 1,998,701 | |

| Cost of issue | |

| — | | |

| — | | |

| — | | |

| (217,815 | ) | |

| — | | |

| (217,815 | ) |

| Issuance of common stock units on conversion of convertible debenture | |

| 3,222,120 | | |

| 3,222 | | |

| — | | |

| 673,423 | | |

| — | | |

| 676,645 | |

| Beneficial conversion feature | |

| — | | |

| — | | |

| — | | |

| 289,991 | | |

| — | | |

| 289,991 | |

| Broker common stock units | |

| 599,610 | | |

| 600 | | |

| — | | |

| (600 | ) | |

| — | | |

| — | |

| Issuance of common stock units to management | |

| 4,398,207 | | |

| 4,398 | | |

| — | | |

| 623,058 | | |

| — | | |

| 627,456 | |

| Shares to be issued | |

| — | | |

| — | | |

| 2,973 | | |

| — | | |

| — | | |

| 2,973 | |

| Net and comprehensive

loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (2,424,276 | ) | |

| (2,424,276 | ) |

| Balance, December 31, 2014 | |

| 33,919,419 | | |

$ | 33,919 | | |

$ | 2,973 | | |

$ | 3,341,070 | | |

$ | (2,647,088 | ) | |

$ | 730,874 | |

| Issuance of common stock units to management | |

| — | | |

| — | | |

| — | | |

| 139,428 | | |

| — | | |

| 139,428 | |

| Shares to be issued | |

| — | | |

| — | | |

| 2,193 | | |

| — | | |

| — | | |

| 2,193 | |

| Net and comprehensive

loss | |

| — | | |

| — | | |

| — | | |

| — | | |

| (533,425 | ) | |

| (533,425 | ) |

| Balance, March

31, 2015 | |

| 33,919,419 | | |

| 33,919 | | |

| 5,166 | | |

| 3,480,498 | | |

| (3,180,513 | ) | |

| 339,070 | |

The

accompanying notes are an integral part of these condensed interim financial statements.

iWallet

Corp

Condensed

Interim Statements of Cash Flows

for

the three month periods ended March 31, 2015 and 2014 (unaudited)

| | |

| 2015 | | |

| 2014 | |

| Cash

flow from operating activities | |

| | | |

| | |

| Net

and comprehensive loss for the periods | |

$ | (533,425 | ) | |

| (212,208 | ) |

| Items

not affecting cash | |

| | | |

| | |

| Amortization

of intangible assets | |

| 4,275 | | |

| 2,888 | |

| Share-based

compensation | |

| 141,621 | | |

| — | |

| | |

| (387,529 | ) | |

| (209,320 | ) |

| Non-cash

operating items resulted from changes in: | |

| | | |

| | |

| Accounts

receivable | |

| (5,971 | ) | |

| 4,575 | |

| Deposits

and deferred costs | |

| 27,988 | | |

| (107,527 | ) |

| Inventory | |

| (22,756 | ) | |

| 5,545 | |

| Accounts

payable | |

| (27,634 | ) | |

| (13,269 | ) |

| Accrued

liabilities | |

| 15,840 | | |

| (956 | ) |

| | |

| (400,062 | ) | |

| (320,952 | ) |

| Cash

flow from investing activities | |

| | | |

| | |

| Expenditures

on intangible assets | |

| — | | |

| (12,190 | ) |

| | |

| — | | |

| (12,190 | ) |

| Cash

flow from financing activities | |

| | | |

| | |

| Funds

repaid to related party | |

| — | | |

| (9,585 | ) |

| Funds

advanced to shareholder | |

| — | | |

| (28,635 | ) |

| Receipt

of funds held in attorney trust | |

| — | | |

| 39,705 | |

| Repayment

of bank indebtedness | |

| (1,065 | ) | |

| (1,357 | ) |

| Advances

from investor | |

| — | | |

| 6,796 | |

| Proceeds

from issuance of convertible debentures | |

| — | | |

| 83,000 | |

| | |

| (1,065 | ) | |

| 89,924 | |

| Decrease

in cash | |

| (401,127 | ) | |

| (243,218 | ) |

| Cash,

beginning of periods | |

| 465,847 | | |

| 250,718 | |

Cash,

end of periods | |

$ | 64,720 | | |

$ | 7,500 | |

The

accompanying notes are an integral part of these condensed interim financial statements.

iWallet

Corp

Notes

to Condensed Interim Financial Statements

March

31, 2015 and 2014 (unaudited)

1. Nature

of Business and Going Concern

iWallet

Corp ("the Company") is engaged in the design, development, manufacturing and sales of bio-metric locking wallets, which

operate by scanning a user’s fingerprint to open the wallet.

iWallet

Corporation (“iWallet”) was incorporated on November 18, 2009 in the State of California and is located at 7968 Arjons

Drive, Suite D, San Diego, California 92126. On July 21, 2014 the Company merged with iWallet Acquisition Corporation (“the

Acquisition Sub”) (“the Merger”), a subsidiary formed by Queensridge Mining Resources, Inc. (“the Queensridge”)

for purposes of the Merger, which resulted in the Company becoming a wholley-owned subsidiary of Queensridge. Immediately following

the merger the Acquisition Sub merged with and into Queensridge. Queensridge immediately changes it name to iWallet Corp and is

continuing the business of iWallet as its only line of business.

The

Company began trading on July 21, 2014 in the United States of America (“USA”) on the OTCQB Exchange under the ticker

symbol IWAL.

The

unaudited condensed interim financial statements have been prepared in accordance with accounting principles generally accepted

in the United States of America ("U.S. GAAP"), which contemplates continuation of the Company as a going concern.

As

of March 31, 2015, the Company has a deficit of $3,180,513 (December 31, 2014 - $2,647,088) and has significant losses and negative

cash flows from operations. In addition as at March 31, 2014 the Company has a working capital deficiency of $239,856 (December

31, 2014 - $628,302). There is no certainty that the Company will be successful in generating sufficient cash flow from operations

or achieving and maintaining profitable operations in the near future to enable it to meet its obligations as they come due. As

a result there is substantial doubt regarding the Company's ability to continue as a going concern. The Company may require additional

financing to fund its operations, which may not be available at acceptable terms or at all. The Company plans on raising additional

funds from completing financing arrangements, whether as continued subscriptions for convertible debentures or private placements.

The

unaudited condensed interim financial statements do not include any adjustments relating to the recoverability and classification

of the recorded asset amounts or the amounts and classification of liabilities that might be necessary should the Company be unable

to continue as a going concern. All adjustments, consisting only of normal recurring items, considered necessary for fair presentation

have been included in these financial statements.

2. Significant

Accounting Policies

Unaudited

Condensed Interim Financial Statements

These

unaudited condensed interim financial statements have been prepared on the same basis as the annual financial statements and should

be read in conjunction with those annual financial statements for the year ended December 31, 2014. In the opinion of management,

these unaudited condensed interim financial statements reflect adjustments, necessary to present fairly the Company's financial

position, results of operations and cash flows for the periods shown. The results of operations for such periods are not necessarily

indicative of the results expected for a full year or for any future period.

3. Recently

Adopted Accounting Pronouncement and Recently Issued Accounting Standards

On

May 28, 2014, the FASB issued ASU No. 2014-09, “Revenue from Contracts with Customers (Topic 606)”. The standard outlines

a single comprehensive model for entities to use in accounting for revenue arising from contracts with customers and supersedes

most current revenue recognition guidance. The accounting standard is effective for annual reporting periods (including interim

reporting periods within those periods) beginning after December 15, 2017. Early adoption is not permitted. The impact on the

condensed interim financial statements of adopting ASU 2014-09 will be assessed by management.

On

August 27, 2014, the FASB issued a new financial accounting standard on going concern, ASU No. 2014-15, “Presentation of

Financial Statements – Going Concern (Sub-Topic 205-40): Disclosure of Uncertainties about an Entity’s Ability to

Continue as a Going Concern.” The standard provides guidance about management’s responsibility to evaluate whether

there is a substantial doubt about the organization’s ability to continue as a going concern. The amendments in this Update

apply to all companies. They become effective in the annual period ending after December 15, 2016, with early application permitted.

The impact on the financial statements of adopting ASU 2014-15 will be assessed by management.

Management

does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material

effect on the accompanying unaudited condensed interim financial statements.

4. Inventory

| |

| March

31, | | |

| December

31, | |

| | |

| 2015 | | |

| 2014 | |

| Raw

materials and components | |

$ | 77,967 | | |

$ | 86,606 | |

| Finished

goods | |

| 83,608 | | |

| 32,622 | |

| Goods

in-transit | |

| — | | |

| 19,591 | |

| | |

$ | 161,575 | | |

$ | 138,819 | |

During

the period ended March 31, 2015, the Company recorded a provision relating to obsolete inventory of $nil (2014 - $nil).

5. Intangible Assets

| |

| |

| |

March 31, |

| | |

| |

| |

2015 |

| |

| | | |

| Accumulated | | |

| Net

Book | |

| | |

| Cost | | |

| Amortization | | |

| Value | |

| Patents | |

$ | 68,119 | | |

$ | 17,753 | | |

$ | 50,366 | |

| Trademarks | |

| 16,909 | | |

| 5,131 | | |

| 11,778 | |

| Software | |

| 40,000 | | |

| 4,750 | | |

| 35,250 | |

| Website

Development | |

| 16,000 | | |

| 1,333 | | |

| 14,667 | |

| | |

$ | 141,028 | | |

$ | 28,967 | | |

$ | 112,061 | |

| |

| |

| |

December 31, |

| | |

| |

| |

2014 |

| | |

| | | |

| Accumulated | | |

| Net

Book | |

| |

| Cost | | |

| Amortization | | |

| Value | |

| Patents | |

$ | 68,119 | | |

$ | 16,078 | | |

$ | 52,041 | |

| Trademarks | |

| 16,909 | | |

| 4,739 | | |

| 12,170 | |

| Software | |

| 40,000 | | |

| 3,875 | | |

| 36,125 | |

| Website

Development (i) | |

| 16,000 | | |

| — | | |

| 16,000 | |

| | |

$ | 141,028 | | |

$ | 24,692 | | |

$ | 116,336 | |

| (i) | The

Company engaged an arm's length third party vendor to complete development of their website

and mobile application software. Development was completed in December 2014; accordingly,

although ready for use, the costs were not amortized as of December 31, 2014. Amortization

commenced during the three-month period ended March 31, 2015. |

| | Amortization

for the three-month periods ended March 31, 2015 was $4,275 (March 31, 2014 - $2,888). |

6. Bank

Indebtedness

The

bank indebtedness of the Company consists of a secured line of credit with a limit of $35,000 bearing interest at the annual prime

rate plus 1.25%, which as at March 31, 2015 and December 31, 2014 was 4.5%, and with monthly repayments determined as follows:

a) the

greater of:

| i) | two

percent (2%) of the outstanding principal balance outstanding on the last day of the

billing period, or |

b) accrued

interest since the date of the last payment.

On

termination of the line of credit, the amount will become due over a period determined by the creditor of between thirty-six and

eighty-four months, or over three to seven years, which at the time of the agreement was determined to be forty-eight months,

or four years.

The

line of credit is subject to various non-financial covenants that would constitute an event of default, notably: ownership change

or sale of the business; closure or failure to maintain the related chequing account; insolvency or any bankruptcy proceedings;

or, any other defaults on other contracts with the creditor or with any other financial institution.

Security

for the line of credit is the cash in the chequing account held with the bank.

| |

March

31, | |

December 31, |

| | |

2015 | |

2014 |

| Line

of credit | |

$ | 17,046 | | |

$ | 18,111 | |

| Less: Current

portion - estimated based on (a)(i) above | |

| (4,200 | ) | |

| (4,347 | ) |

| | |

$ | 12,846 | | |

$ | 13,764 | |

Principal

repayments estimated based on (a)(i) above as at March 31, 2015:

| | 2016 | | |

$ | 4,294 | |

| | 2017 | | |

| 5,214 | |

| | 2018 | | |

| 3,338 | |

| | | | |

$ | 12,846 | |

7. Related

Party Transaction and Balances

| |

March

31, | |

December 31, |

| | |

2015 | |

2014 |

| Balances | |

| |

|

| Current

assets | |

| |

|

| Due

from shareholder | |

$ | 114,349 | | |

$ | 114,349 | |

| Current

liabilities | |

| | | |

| | |

| Due

to related party | |

$ | 3,030 | | |

$ | 3,030 | |

| Advances

from investor | |

$ | 474 | | |

$ | 474 | |

The

above balances are non-interest bearing, unsecured and due on demand. The related party is related by virtue of the common control

and ownership by the Company's shareholder.

The

advances from investor were funds advanced for purposes of covering operating expenses of the Company and $81,000 of these advances

were formalized into a convertible debenture during the year (note 8). At December 31, 2013, the investor was also serving as

interim Chief Financial Officer (“CFO”) and accordingly these transactions constitute related party transactions;

however, on January 1, 2014 the investor resigned as interim CFO.

For

the period ended March 31, 2015, the Company expensed $6,635 (2014 – $nil) to Shelter Rock International, LLC (“SRI”)

for consulting services. The Principal of SRI is a director of the Company. As at March 31, 2015, the balance owing to SRI was

$nil (December 31, 2014 – $2,788) included in accounts payable.

8. Convertible

Debentures

In

December of 2013, the Company entered into a series of secured convertible debenture agreements (the “convertible debentures”)

with various investors amounting to $354,000. During fiscal 2014 the Company closed on an additional $309,000 of convertible debentures

with the same terms, inclusive of $81,000 of advances from investor formalized into a convertible debenture during the year, bringing

the total convertible debentures outstanding to $663,000. The convertible debentures had an interest of 5% per annum calculated

monthly and payable on maturity and had a maturity date of August 15, 2014.

At

the time of issuance there was no beneficial conversion feature since each convertible debenture contains a conversion option

contingently exercisable upon the approval from the Securities and Exchange Commission or the TSX Venture Exchange for listing

of its common shares. The conversion price is based on the price at which the Company sells or issues common shares or units,

less a discount of 30%. A unit would consist of one common stock and one common stock purchase warrant entitling the holder to

purchase one additional common share at an exercise price of $0.20 and with a term of 24 months. Similarly, the Company has the

option to force conversion upon approval of a public listing at the same conversion price.

On

July 21, 2014, the Company completed the Transaction and forced conversion of the aggregate of $663,000 Convertible Debentures

and $13,645 of accrued interest into 3,222,120 common stock and common stock purchase warrants at an exercise price of $0.20 and

with a term of 24 months (see notes 11 and 12).

9. Deposits,

Deferred Costs and Tooling Commitment Liability

On

May 26, 2011, the Company signed a contract with a supplier under which they are required to pay for tooling costs in addition

to their regular purchase orders (the "tooling commitment"). Under the terms of the tooling commitment the Company was

required to pay for 30% of the contracted tooling costs upon execution (the "tooling commitment deposit") and the remaining

70% over the purchase of 5,000 units over a nine month period (the "tooling commitment liability"). If 5,000 units were

not purchased within those nine months, then the remaining amount was due within thirty days.

As

of February 27, 2012, the Company had not reached the contracted level of purchases and an informal agreement to extend the period

was made; however, by December 31, 2012 the Company had not complied and as a result, the entire amount would have been considered

due.

On

August 24, 2013, the Company entered into a revised agreement with the supplier that extended the term another twelve months to

August 24, 2014. As of March 31, 2015, the contract expired and the tooling commitment of $41,153 is due on demand.

The

tooling commitment deposit is included in deposits and deferred costs and is capitalized into inventory as units are purchased

based on the 5,000 unit commitment. The tooling commitment liability becomes due and is recognized into accounts payable as units

are purchased and the corresponding deferred costs are capitalized into inventory, all of which is based on the 5,000 unit commitment.

| |

March

31, | |

December 31, |

| | |

2015 | |

2014 |

| Tooling

commitment deposit | |

$ | 2,566 | | |

$ | 6,682 | |

| Tooling

commitment deferred costs | |

| — | | |

| — | |

| Tooling

commitment deposit and deferred costs | |

| 2,566 | | |

| 6,682 | |

| Other

prepaid deposits and insurance | |

| 180,980 | | |

| 204,852 | |

| Total

deposits and deferred costs | |

$ | 183,546 | | |

$ | 211,534 | |

| Tooling

commitment liability | |

$ | 41,153 | | |

$ | 41,153 | |

10. Income

Taxes

The

Company calculates its income tax expense by estimating the annual effective tax rate and applying that rate to the year-to-date

ordinary income at the end of the period. The Company records a tax valuation allowance when it is more likely than not that it

will not be able to recover the value of its deferred tax assets. As of March 31, 2015 and 2014, the Company calculated its estimated

annualized effective tax rate at 0% and 0%, respectively. The Company had no income tax expense on its $533,425 loss for the three

months ended March 31, 2015. The Company recognized no income tax expense based on its $212,208 pre-tax loss for the three months

ended March 31, 2014.

The

Company recognizes the financial statement benefit of a tax position only after determining that the relevant tax authority would

more likely than not sustain the position following an audit. For tax positions meeting the more-likely-than-not threshold, the

amount recognized in the financial statements is the largest benefit that has a greater than 50% likelihood of being realized

upon ultimate settlement with the relevant tax authority. The Company recognizes interest accrued on uncertain tax positions as

well as interest received from favorable tax settlements within interest expense. The Company recognizes penalties accrued on

unrecognized tax benefits within general and administrative expenses. As of March 31, 2015 and December 31, 2014, the Company

had no uncertain tax positions.

The

Company does not anticipate any significant changes to the total amounts of unrecognized tax benefits in the next twelve months.

In many cases the Company's uncertain tax positions are related to tax years that remain subject to examination by tax authorities.

The following describes the open tax years, by major tax jurisdiction, as of March 31, 2015:

Federal 2010

– present

State 2010

– present

11. Share

Capital

The

Company is authorized to issue 75,000,000 shares of Common Stock with a par value of $0.001 and had 33,919,419 shares of Common

Stock issued and outstanding as of March 31, 2015.

| |

No.

of shares | |

Amount |

| Balance

December 31, 2013 (i) | |

| 10,000,000 | | |

$ | 10,000 | |

| Recapitalization

adjustment (ii) | |

| 9,037,147 | | |

| 9,037 | |

| Issuance

of shares under private placement (iii) | |

| 6,479,002 | | |

| 6,479 | |

| Issuance

of shares under private placement (iv) | |

| 183,333 | | |

| 183 | |

| Issuance

of shares for servies(iii)(iv) | |

| 599,610 | | |

| 600 | |

| Issuance

of shares to convertible debenture holders (v) | |

| 3,222,120 | | |

| 3,222 | |

| Issuance

of shares to employees (vi) | |

| 4,398,207 | | |

| 4,398 | |

| Balance

December 31, 2014 and March 31, 2015 | |

| 33,919,419 | | |

$ | 33,919 | |

On

July 21, 2014, the Company entered into a merger agreement with Queensridge Mining Resources Inc. (“Queensridge”)

to complete the Merger whereby all of the issued and outstanding common stock of the Company will be exchanged for shares of Queensridge.

| (i) | The

holder of the common shares of the Company exchanged their shares on a pro-rata basis

for 10,000,000 newly-issued shares of common stock prior to the closing of the Merger.

|

| (ii) | The

total number of Queensridge common shares issued and outstanding as of June 30, 2014

was 6,427,800 with a par value of $0.001 for a total of $6,428. On July 10, 2014 Queensridge

completed a stock split transaction of the authorized and outstanding common stock. As

a result, the authorized shares of common stock capital increased to 34,113,790. On July

21, 2014 prior to the Merger, Mr. Philip Stromer and certain other shareholders cancelled

25,076,643 shares. As a result, the remaining number of shares outstanding prior to the

Merger was 9,037,147. |

| (iii) | Concurrently

with the Merger, the Company closed a Private Placement of 6,479,002 units (each a “Unit”)

at $0.30 per Unit for gross proceeds of $1,943,701. Each Unit consists of one share of

common stock and one common stock purchase warrant exercisable at $0.60 for a period

of two years. |

The

agent of the Private Placement received 583,110 broker Units at an exercise price of $0.60 per Unit for a period of two years.

Each Unit is comprised of one share of Common stock and one common stock purchase warrant exercisable at $0.60 for a period of

two years.

The

agent of the Private Placement received cash compensation of 9% of the gross proceeds of the financing for a total of $174,933

plus additional costs of $34,092 for legal expenses.

11. Share

Capital (continued)

| (iv)

| On

September 2, 2014, the Company closed an additional private placement of 183,333 units

at $0.30 per Unit for gross proceeds of $55,000. Each Unit consists of one share of common

stock and one common stock purchase warrant exercisable at $0.60 for a period of two

years. |

The

agent of the Private Placement received 16,500 broker Units at an exercise price of $0.60 per Unit for a period of two years.

Each Unit consists of one share of common stock and one common stock purchase warrant exercisable at $0.60 for a period of two

years.

The

agent of the Private Placement received cash compensation at 9% of the gross proceeds of the financing for a total of $4,950 plus

additional costs of $3,840 for legal expenses.

In

connection with the closing of the Merger, the Company issued 3,222,120 units at a price of $0.30 per Unit upon conversion of

the Convertible Debentures, originally valued at $663,000 (see note 8). Each unit consists of one share of common stock and one

common stock purchase warrant exercisable at $0.20 for a period of two years from conversion date.

| (v) | On

September 2, 2014 the Company entered into an agreement with the Chief Executive Officer

(CEO) to issue 4,398,207 shares, or 15% of the Company’s outstanding common stock

as of July 21, 2014. The Company’s stock price was $0.30 at the time of issuance,

resulting in a total value of $1,319,462. The shares will vest as to 1,172,855 on each

of September 2, 2014, August 31, 2015 and August 31, 2016, and 879,642 shares on August

31, 2017. For the year ended December 31, 2014 1,172,855 shares have vested, with remaining

amounts to be vested on each anniversary date. For the period ended March 31, 2015 a

total of $139,428 (March 31, 2014 - $nil) has been expensed as stock-based compensation

using the graded vesting method. |

To

account for subsequent dilution, the CEO is to maintain a 15% ownership at the end of the initial term of his employment contract

August 31, 2017. Additional equity shall be issued and vested on each anniversary date.

Subsequent

to the agreement, the Company completed a private placement (note

11(iv)) for 199,833 common stock. The CEO is to be issued an additional 29,975 common stock.

At the time of issuance, the Company’s stock price was $0.30 per share, resulting in a total value of $8,992. For the period

ended March 31, 2015, $2,193 has vested which is presented as shares to be issued and expensed as stock-based compensation using

the graded vesting method.

12. Warrants

The

following is a continuity schedule of the Company’s common stock purchase warrants:

| |

| No.

of Warrants | | |

| Exercise

Price | |

| Issued

July 21, 2014 | |

| 6,479,002 | | |

$ | 0.6 | |

| Issued July 21, 2014

– broker warrants | |

| 583,110 | | |

$ | 0.6 | |

| Conversion of convertible

debentures | |

| 3,222,120 | | |

$ | 0.2 | |

| Issued September 2,

2014 | |

| 183,333 | | |

$ | 0.6 | |

| Issued September 2,

2014 – broker warrants | |

| 16,500 | | |

$ | 0.6 | |

| Expired | |

| — | | |

$ | — | |

| Outstanding

and exercisable, December 31, 2014 and March 31, 2015 | |

| 10,484,065 | | |

$ | 0.48 | |

The

following is a summary of the common stock purchase warrants outstanding as of December 31, 2014 and March 31, 2015:

| Exercise

Price ($) | |

No.

of Warrants | |

Expiry

Date |

| | 0.6 | | |

| 7,062,112 | | |

| 7/21/2016 | |

| | 0.2 | | |

| 3,222,120 | | |

| 7/21/2016 | |

| | 0.6 | | |

| 199,833 | | |

| 9/2/2016 | |

| | | | |

| 10,484,065 | | |

| | |

13. Commitments

and Contingencies

Legal

Matters

From

time to time, the Company may be involved in a variety of claims, suits, investigations and proceedings arising from the ordinary

course of our business, collections claims, breach of contract claims, labor and employment claims, tax and other matters. Although

claims, suits, investigations and proceedings are inherently uncertain and their results cannot be predicted with certainty, the

Company believes that the resolution of current pending matters will not have a material adverse effect on its business, financial

position, results of operations or cash flow. Regardless of the outcome, litigation can have an adverse impact on the Company

because of legal costs, diversion of management resources and other factors.

Warranty

Provisions

The

Company is also exposed to warranty contingencies associated with the iWallet and has recorded a provision for these for the three

month ended March 31, 2015 of $7,180 (2014 - $6,679) which is included in accrued liabilities, however, the actual amount

of loss could be materially different.

The

actual warranty claims for the three month period ended March 31, 2015 was $1,628 (March 31, 2014 - $115) which is included

in cost of sales.

14. Basic

and Diluted Loss Per Share

Basic

and diluted loss per share is computed using the weighted average number of common stock outstanding. Diluted loss per share and

the weighted average number of shares of common stock exclude 10,484,065 potentially dilutive warrants (note 12) and 29,975 shares

(note 11(vi)) since their effect is anti-dilutive.

15. Segmented

Reporting

All

of the Company's long-lived assets are located in the United States.

During

the three month period ended March 31, 2015, the Company had sales to customers in Canada amounting to 30% of total sales. The

remaining sales consists primarily of domestic sales; however, additional international sales accounted for 7% of total sales.

During

the three month period ended March 31, 2014, the Company had sales to customers in Ireland amounting to 10% of total sales. The

remaining sales consisted primarily of domestic sales; however, additional international sales accounted for 26% of total sales

although no other individual country was in excess of ten percent of total sales.

16. Risk

Management

Concentrations

of Credit Risk

The

Company’s cash balances are maintained in bank accounts in the United States. Deposits held in banks in the United States

are insured up to $250,000 per depositor for each bank by the Federal Deposit Insurance Corporation. Actual balances at times

may exceed these limits.

The

Company performs on-going credit evaluations of its customers’ financial condition and generally does not require collateral

from its customers. For the period ended March 31, 2015, one customer accounted for 26% of the company’s total revenue.

For the period ended March 31, 2014, one customer accounted for 14% of total revenue. As of March 31, 2015, one customer accounted

for 61% of the accounts receivable balance. As of December 31, 2014, two customers accounted for 97% of the accounts receivable

balance.

Economic

Dependence

For

the three month ended March 31, 2015, the Company purchased 100% of its raw material inventory from one vendor. For the three

month period ended March 31, 2015, one vendor assembled 100% of its finished goods inventory. For the three month period ended

March 31, 2015, all raw materials were purchased and all finished goods inventory were assembled by one vendor.

17. Subsequent

Events

The

Company issued secured convertible debentures (“the Debentures”) dated April 30, 2015 totaling $372,000. The Company

incurred $29,800 in broker’s commissions resulting in net proceeds of $342,700. The Debentures bear interest at a rate of

8% per year, with interest payments due semi-annually beginning on October 31, 2015. The Debentures mature on April 30, 2017.

The Debentures are convertible at any time, in whole, to shares of common stock at a conversion price of $0.15 per share.

Item

2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking

Statements

Certain

statements, other than purely historical information, including estimates, projections, statements relating to our business plans,

objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking

statements.” These forward-looking statements generally are identified by the words “believes,” “project,”

“expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,”

“may,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are

subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our

ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have

a material adverse effect on our operations and future prospects on a consolidated basis include, but are not limited to: changes

in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted

accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue

reliance should not be placed on such statements.

Management’s

Discussion and Analysis of Financial Condition and Results of Operations

Company

Overview

We

were incorporated as “Queensridge Mining Resources, Inc.” on January 29, 2010, in the State of Nevada for the purpose

of engaging in mineral exploration. On July 21, 2014, we entered into a Merger Agreement with iWallet Corporation, a private California

corporation, whereby we acquired all of the issued and outstanding common stock of iWallet Corporation through a subsidiary. Following

this merger, we merged the subsidiary with and into our corporation, and changed our name to “iWallet Corp.” (‘iWallet”)

as part of that process. As a result of entering into the Merger Agreement, we are in the business of designing and developing

biometric locking cases and related physical, personal security products.

Description

of Business

We

are a designer and developer of innovative, physical, personal security products that incorporate the latest security and communication

technologies to protect against identity, personal and financial information theft. iWallet is a registered trademark in the United

States. Our flagship product is a biometric locking luxury storage case that protects cash, credit cards and personal information

with a proprietary fingerprint security system. The iWallet features a carbon fiber case which protects credit cards from being

read by many types of RF devices in public spaces. Using Bluetooth Smart technology, iWallet owners can tether the iWallet to

a supported smart device. A proximity alarm sounds on both devices when separated by about five meters. In addition, GPS tracking

capabilities can be achieved through the same Bluetooth Smart technology and the smart phone.

In

addition to our retail sales strategy, we also intend to focus on developing and licensing the following new technologies based

upon our design and utility patents: biometric touch sensors coupled with Bluetooth Smart technology, Zero Passwords, voice and

gesture recognition, and other biometric physical communication through iWallet products. We are working with outside software

companies to enhance the firmware in all of our products.

We

are based in San Diego, California and our business was originally founded in 2009. The initial version of the iWallet generated

sales of over $700,000 in the first eighteen months following its launch. With improved designs and a better manufacturing partner,

iWallet is ready to re-launch the product on a larger scale. Established sales channels include Stebis in Belgium, Luxemburg and

the Netherlands, the Urban Collection Loyalty program in the U.S., UK and Canada, Peters Of Kensington in Australia, Hontus group,

Planet Traveler in the U.S., Vivadi in Latin America, Brentano in the UK, and Gold Tree, LTD in Asia. We have been licensed by

Apple Inc. as an official Accessory Developer.

Products

and Technology

At

this time, we are preparing to re-launch our flagship product the iWallet 2.0. The suggested retail price will be $499. The new

iWallets have the following features:

| |

• |

Sleek, compact industrial design with

carbon fiber case |

| |

• |

Pairs with the owner’s cellular

phone via Bluetooth Smart technology |

| |

• |

Patented, exclusive tamper resistant

locking mechanism utilizes innovative fingerprint biometric reader for unlocking |

| |

• |

Unique latch control that only consumes

power during latching hence providing extended battery life |

| |

• |

RFID blocking capability for enhanced

wireless protection |

| |

• |

Speaker providing audible feedback |

| |

• |

GPS tracking capabilities through the

user’s smart phone |

Over

the course of the next twelve months, we intend to bring the following additional products to market:

| |

• |

Storage devices with co-branding luxury

partners |

| |

• |

A secure passport case called the iPassport |

| |

• |

A women’s iWallet version |

| |

• |

A secure mobile personal safe in which

to store pharmaceuticals |

| |

• |

A smart “padlock” with

a biometric reader for gym lockers and other personal areas that require security |

We

hold over twenty patents and patent applications filed in various countries around the world. Our products are currently manufactured

under contract by a manufacturer based in Zhuhai, China, Apollo Electronics. The suppliers for our raw materials are currently

Future Electronics, Namiki Motors, Cotech Taiwan, Digital Persona, Avnet Electronics, Avnet Taiwan, and Apollo Electronics. Historically,

our largest major customer has been Neiman Marcus, which has been the source of approximately 51% of our gross revenues over the

past year. As we expand our sales and distribution channels, we expect that our customer base will diversify and that, in the

future, our revenues will not be dependent upon one or a few major customers.

We

hold both utility and design patents and patent applications. All of our current utility patents will remain in effect until September

14, 2027. The duration of our design patents varies by country. The expiration dates of our current design patents, by country,

is as follows:

| Canada |

June

10, 2023 |

| Europe |

December

9, 2036 |

| China |

December

12, 2021 |

| Japan |

May

18, 2032 |

| Russia |

December

13, 2036 |

| Singapore |

December

9, 2026 |

| Taiwan |

December

9, 2023 |

Market

and Competition Overview

Our

primary target demographic will be consumers who are in the market for luxury secure storage cases and similar accessories. We

do not believe that the $500 approximate retail price to the end user will be an obstacle for our initial target demographic.

The carbon fiber process is labor intensive to manufacture. High net worth individuals appreciate the advantages of carbon

fiber construction and spend tens of thousands of dollars outfitting their automobiles and other accessories with this material.

A

comparison of the iWallet to the leather or canvas sure storage accessories currently offered by several major fashion designers

is below:

| Brand | |

Model | |

Price | |

Material | |

Bluetooth

(Anti-theft/loss) | |

Fingerprint

Reader | |

RFID

Anti-Theft | |

Owner

Access Only |

| Cartier | |

Santos

de Cartier | |

$ | 380 | | |

Leather | |

| No | | |

No | |

| No | | |

No |

| Salvatore Ferragamo | |

Bifold | |

$ | 350 | | |

Leather | |

| No | | |

No | |

| No | | |

No |

| Louis Vuitton | |

Classic | |

$ | 565 | | |

Canvas | |

| No | | |

No | |

| No | | |

No |

| Gucci | |

Bifold | |

$ | 550 | | |

Canvas | |

| No | | |

No | |

| No | | |

No |

| iWallet | |

Slim | |

$ | 529 | | |

Carbon Fiber | |

| Yes | | |

Yes | |

| Yes | | |

Yes |

We

believe the security, high technology, slim design, and carbon fiber construction of the iWallet product offerings can position

it to compete for a share of the luxury secure accessories market.

Sales,

Distribution and Growth Strategy

Our

plan for marketing and raising awareness for the iWallet includes the following strategies:

| |

• |

Sell and market at major trade shows

that attract global buyers such as the CES. |

| |

• |

Align iWallet with high profile celebrities,

bloggers, etc. for product validation. |

| |

• |

Optimize the company’s e-commerce

strategy through a multi-lingual program which allows the customer to communicate in over 70 different languages. |

| |

• |

Continue worldwide media attention,

primarily from BBC Worldwide, Fox News (Fox and Friends), Discovery Channel. |

| |

• |

Establish a global distribution network

for the retail, incentive, and loyalty markets |

Our

established distribution channels for the iWallet, as originally launched, include the following:

| |

• |

Neiman Marcus in North America |

| |

• |

Stebis in Belgium, Luxemburg and Netherlands |

| |

• |

Urban Collection Loyalty program in

US, UK and Canada |

| |

• |

Peters of Kensington’s in Australia |

| |

• |

Hontus Group/Planet Traveler in US

(co-branded) |

| |

• |

Vivadi in Latin America |

| |

• |

Oak Incentives in Canada |

| |

• |

Brentano in UK |

| |

• |

Gold Tree, LTD in Asia |

The

following are current prospective sales channels:

| |

• |

Co-branding for Dunhill and Ducati

as well as other potential luxury partners. We are currently in partnering or licensing discussions with these companies. |

| |

• |

Internal Revenue Service |

We

plan to increase our consumer off take within newly gained distribution at major regional high-end department stores, luxury specialty

stores, and to expand to private brand stores. Together with our distribution partners, we are targeting major national retail

channels. We believe a partnership with any one leading national chain would be transformative. We intend to develop our website

towards wider market accessibility through links to other major potential purchasers. We will continue to be featured in ingadget.com

and gizmodo.com, where the iWallet has been dubbed “The Fort Knox of Wallets.” We will also begin limited selling

efforts in key international markets using further regional distributors in Europe, Asia, Canada, Australia, and South America.

We are also in discussions with distribution companies in key opportunity geographies.

Results

of Operations for the Three Months ended March 31, 2015 and 2014.

During

the three months ended March 31, 2015, we generated sales of $24,522. Our cost of sales was $32,824, resulting in gross loss of

$8,302. Our expenses for the three months ended March 31, 2015 were $546,797, and consisted of legal and professional fees of

$81,991, share based compensation of $141,621, salaries and wages of $106,500, interest and bank charges of $577, office and general

expenses of $93,337, research and development of $88,339, travel expenses of $22,657, rent of $7,500, and amortization of intangible

assets of $4,275. We also recorded a foreign exchange gain of $21,674. Our net loss for the three months ended March 31, 2015

was $533,425. By comparison, during the three months ended March 31, 2014, we generated sales of $16,132. Our cost of sales was

$16,946, resulting in gross loss of $814. Our expenses for the three months ended March 31, 2014 were $211,394, and consisted

of legal and professional fees of $111,558, salaries and wages of $62,100, interest and bank charges of $5,466, office and general

expenses of $11,375, research and development of $1,142, travel expenses of $15,615, rent of $1,250, and amortization of intangible

assets of $2,888. Our net loss for the three months ended March 31, 2014 was $212,208

Our

expenses and net loss for the three months ended March 31, 2015 were larger than in the same period last year primarily due to

increased operating costs as we expanded our operations, personnel and marketing budgets and intensified our research and development

efforts. Our sales have also increased as a result of our launch of the iWallet 2.0 and increased marketing and distribution efforts.

In

order to significantly increase our revenue base and achieve profitability we will need to, among other matters, significantly

increase our customer base and our distribution channels. We cannot assure you that we will be able to increase our revenue in

this manner and achieve profitability on a consistent basis. As we expect to continue to invest in the development of our business,

this investment could outpace growth in our revenue, and thereby impair our ability to achieve and maintain profitability in the

near future.

Liquidity

and Capital Resources

As

of March 31, 2015, we had current assets of $558,225, consisting of cash in the amount of $64,720, funds held in attorney trust

of $20,000, deposits and deferred costs of $183,546, inventory of $161,575, a loan due from a shareholder of $114,349, and accounts

receivable of $14,035. Our current liabilities as of March 31, 2015 were $318,370, and consisted of the current portion of long

term bank debt in the amount of $4,200, accounts payable of $207,757, accrued liabilities of $61,756, amounts due to a related

party of $3,030, advances from an investor of $474, and a liability for a manufacturer tooling commitment of $41,153. Our working

capital as of March 31, 2015 was therefore $239,855.

Our

bank indebtedness consists of a line of credit with a limit of $35,000, secured by cash on deposit in a checking account. The

line bears interest at a rate of prime plus 1.25%. As of March 31, 2015, the balance owed was $17,046.

On

May 7, 2015, we obtained new financing through the issuance of Secured Convertible Debentures dated April 30, 2015 (the “Debentures”)

totaling $372,500. After broker’s selling commissions of $29,800, we received net proceeds of $342,700 from the debenture

offering. The Debentures bear interest at a rate of eight percent (8%) per year, with interest payments due semi-annually beginning

on October 31, 2015. The Debentures mature on April 30, 2017.

In

order to continue our growth and development plan, however, we will require additional financing. Management is currently seeking

additional debt and/or equity financing in order to fund the long term development of the company. There can be no assurance that

we will be successful in raising additional funding, either through increased sales and debt and/or other equity financing arrangements.

If we are not able to secure significant additional funding, the long term implementation of our business plan will be impaired.

There can be no assurance that such additional financing will be available to us on acceptable terms or at all.

Off

Balance Sheet Arrangements

As

of March 31, 2015, there were no off balance sheet arrangements.

Going

Concern

We

have negative working capital and have incurred losses since inception. These factors create substantial doubt about our ability

to continue as a going concern. The financial statements do not include any adjustment that might be necessary if we are unable

to continue as a going concern.

Our

ability to continue as a going concern is dependent on generating cash from the sale of our common stock and/or obtaining debt

financing and attaining future profitable operations. Management’s plans include selling our equity securities and obtaining

debt financing to fund our capital requirement and ongoing operations; however, there can be no assurance we will be successful

in these efforts.

Item

3. Quantitative and Qualitative Disclosures About Market Risk

A

smaller reporting company is not required to include this item.

Item

4. Controls and Procedures

We

carried out an evaluation of the effectiveness of the design and operation of our disclosure controls and procedures (as defined

in Exchange Act Rules 13a-15(e) and 15d-15(e)) as of March 31, 2015. This evaluation was carried out under the supervision and

with the participation of our Chief Executive Officer and our Chief Financial Officer. Based upon that evaluation, our Chief Executive

Officer and Chief Financial Officer concluded that, as of March 31, 2015, our disclosure controls and procedures were not effective.

There have been no changes in our internal controls over financial reporting during the quarter ended March 31, 2015. Management

determined that the material weaknesses that resulted in controls being ineffective are primarily due to lack of resources and

number of employees. Material weaknesses exist in the segregation of duties required for effective controls and various reconciliation

and control procedures not regularly performed due to the lack of staff and resources.

Disclosure

controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed

in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported, within the time periods

specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures

designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated

to management, including our Chief Executive Officer and Chief Financial Officer, to allow timely decisions regarding required

disclosure.

Limitations

on the Effectiveness of Internal Controls

Our

management does not expect that our disclosure controls and procedures or our internal control over financial reporting will necessarily

prevent all fraud and material error. Further, the design of a control system must reflect the fact that there are

resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations

in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud,

if any, within the Company have been detected. These inherent limitations include the realities that judgments in decision-making

can be faulty, and that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by

the individual acts of some persons, by collusion of two or more people, or by management override of the internal control. The

design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there

can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time,

control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may

deteriorate.

PART

II - OTHER INFORMATION

Item

1. Legal Proceedings

We

are not a party to any other pending legal proceeding. We are not aware of any other pending legal proceeding to which any of

our officers, directors, or any beneficial holders of 5% or more of our voting securities are adverse to us or have a material

interest adverse to us.

Item

1A. Risk Factors

A

smaller reporting company is not required to include this item.

Item

2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item

3. Defaults upon Senior Securities

None.

Item

4. Mine Safety Disclosures

Not

applicable.

Item

5. Other Information

None.

Item

6. Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

iWallet

Corporation |

| |

|

| Date: |

May

15, 2015

|

| |

|

| |

/s/

Jack Chadsey |

| By: |

Jack Chadsey |

| Title: |

Chief Executive

Officer and Chief Financial Officer |

CERTIFICATIONS

I, Jack B. Chadsey, certify that;

| 1. |

|

I have reviewed this quarterly report on Form 10-Q for the quarter ended March 31, 2015 of iWallet Corporation (the “registrant”); |

| 2. |

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. |

|

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. |

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. |

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. |

|

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. |

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. |

|

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a. |

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b. |

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: May 15, 2015

/s/ Jack B. Chadsey

By: Jack B. Chadsey

Title: Chief Executive Officer

CERTIFICATIONS

I, Jack B. Chadsey, certify that;

| 1. |

|

I have reviewed this quarterly report on Form 10-Q for the quarter ended March 31, 2015 of iWallet Corporation (the “registrant”); |

| 2. |

|

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| 3. |

|

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report; |

| 4. |

|

The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have: |

| a. |

|

Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared; |

| b. |

|

Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles; |

| c. |

|

Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and |

| d. |

|

Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant's fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and |

| 5. |

|

The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions): |

| a. |

|

All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and |

| b. |

|

Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting. |

Date: May 15, 2015

/s/ Jack B. Chadsey

By: Jack B. Chadsey

Title: Chief Financial Officer

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

AND

CHIEF FINANCIAL OFFICER

PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF

2002

In connection with the quarterly Report of

iWallet Corporation (the “Company”) on Form 10-Q for the quarter ended March 31, 2015 filed with the Securities and

Exchange Commission (the “Report”), I, Jack B. Chadsey, Chief Executive Officer and Chief Financial Officer of the

Company, certify, pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

| 1. | The Report fully complies with the requirements of Section 13(a)

of the Securities Exchange Act of 1934; and |

| 2. | The information contained in the Report fairly presents, in all material

respects, the consolidated financial condition of the Company as of the dates presented and the consolidated result of operations

of the Company for the periods presented. |

| By: |

/s/ Jack B. Chadsey |

| Name: |

Jack B. Chadsey |

| Title: |

Principal Executive Officer, Principal Financial Officer and Director |

| Date: |

May 15, 2015 |

This certification has been furnished solely pursuant to Section

906 of the Sarbanes-Oxley Act of 2002.

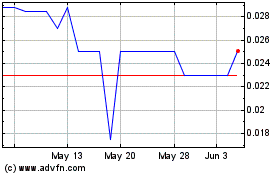

iWallet (PK) (USOTC:IWAL)

Historical Stock Chart

From Nov 2024 to Dec 2024

iWallet (PK) (USOTC:IWAL)

Historical Stock Chart

From Dec 2023 to Dec 2024