The Marketing Alliance, Inc. (Pink Sheets: MAAL) (�TMA� or the

�Company�), a consortium of independent life insurance brokerage

general agencies located throughout the United States, today

announced financial results for its fiscal 2007 fourth quarter and

year ended March 31, 2007 (see attached tables). Timothy M. Klusas,

TMA�s President, stated, �Higher gross profit margins and operating

margins during the fiscal 2007 fourth quarter, despite lower

revenues, demonstrates our success in meeting our previously stated

goal of improving TMA�s operating performance by lowering expenses,

gaining efficiencies, and establishing an infrastructure to manage

the growth and balance of insurance products through the Company�s

distributors. We have also commenced initiatives to grow the

business: In March, 2007, TMA implemented a new incentive plan

designed to encourage our members to drive additional business

through TMA. Importantly, this new plan allows our members to

deliver insurance products and utilize TMA�s benefits and services

that are tailored to needs of their customers. We are hopeful that,

over time, members who have previously used TMA for specific

purposes will recognize the wider breadth of services and products

we are now offering. While early, we are encouraged by the

performance of this new program. In the past 15 months, TMA has

begun offering insurance products from three new carriers: ING, Met

Life Investors and Aviva / AmerUs Indianapolis Life. As we have

noted in the past, TMA begins recognizing the first measurable

revenues from these new products approximately 6-9 months following

the addition of the carrier to our network. TMA�s goal is to

continue exposing these products to existing members, while also

looking to add new carriers to further expand our product offerings

while also making sure that TMA�s current carriers� business

continues to expand and be profitable.� FISCAL FOURTH QUARTER 2007

REVIEW Revenues for the three-month period ended March 31, 2007

were $3.2 million as compared to $3.6 million in the same period

for the prior year. The decline was in part due to the

consolidation of certain insurance carriers, whose products are

sold through TMA. As a result of lower revenues, TMA�s net

operating revenue (gross profit) declined to $1.7 million from $1.9

million. However, TMA�s gross profit margin improved to 53.4% of

revenues in the fiscal fourth quarter of 2007 from 51.5% of

revenues in the prior year period. TMA reported operating income of

$940,933 during the three month period ended March 31, 2007. The

impact of lower revenues for the 2007 period was offset by a

$136,348 decline in operating expenses, which produced an operating

margin 29.4%. Operating income for the three months ended March 31,

2006 was $962,644, or 26.6% of revenues. TMA reported net income of

$636,581, or $0.31 per share for the fiscal fourth quarter of 2007,

versus net income of $779,377, or $0.38 per share, for the fiscal

fourth quarter of 2006. This decrease is primarily due to a $35,150

realized and unrealized loss on investments in the fiscal fourth

quarter of 2007, as compared to a $338,520 gain on investments

during the prior year period. The Company�s portfolio is comprised

largely of investments in the banking industry and is managed by

third-party financial managers. Over the past five years, TMA�s

investment portfolio has yielded a 17% annual return, including a

return of 26% in fiscal 2006. However, the sub-prime mortgage

market and interest rate concerns led to a lower than expected

return in the fourth quarter and year-ended March 31, 2007. The

Company continually assesses its investment strategy, adhering to a

philosophy of steady, long-term growth consistent with TMA�s

capital needs. FISCAL 2007 ANNUAL REVIEW As a result of the factors

listed above, total revenues for fiscal 2007 were $15.0 million

versus $16.0 million in fiscal 2006. Fiscal 2007 net operating

revenue (gross profit) decreased to $4.2 million from $4.3 million,

but gross profit margins increased to 28.2% from 27.1%. Fiscal 2007

operating income increased 25.8% to $1.3 million, or 9.0% of

revenues, versus $1.1 million, or 6.7% of revenues, in fiscal 2006.

This marks the second consecutive year of operating margin

improvement. TMA reported net income of $888,032, or $0.44 per

share, for fiscal 2007, versus net income of $1.1 million, or $0.52

per share, in fiscal 2006. The decline is largely due to the loss

on realized and unrealized investments noted above. On January 31,

2007, the Company paid a $0.17 per share cash dividend for

shareholders of record on December 1, 2006. This is the latest

dividend payment to shareholders and an increase of 13% over last

year�s cash dividend of $0.15 per share. FINANCIAL CONDITION TMA�s

balance sheet at March 31, 2007 reflected working capital of $3.8

million and no long-term debt. Shareholders� equity at March 31,

2007 increased 12.5% to $4.2 million from $3.7 million at March 31,

2006. ABOUT THE MARKETING ALLIANCE, INC. Headquartered in St.

Louis, MO, TMA is one of the largest organizations providing

support to independent insurance brokerage agencies, with a goal of

providing members value-added services on a more efficient basis

than they can achieve individually. TMA�s network is comprised of

independent life brokerage and general agencies in 43 states.

Investor information can be accessed through the shareholder

section of TMA�s website at

http://www.themarketingalliance.com/si_who.cfm. TMA stock is traded

in the �pink sheets� (www.pinksheets.com) under the symbol �MAAL�.

These shares may be purchased or sold through any broker, or

through a market-maker in TMA stock, such as Robotti & Company.

FORWARD LOOKING STATEMENT Investors are cautioned that

forward-looking statements involve risks and uncertainties that may

affect TMA's business and prospects. Any forward-looking statements

contained in this press release represent our estimates only as of

the date hereof, or as of such earlier dates as are indicated, and

should not be relied upon as representing our estimates as of any

subsequent date. These statements involve a number of risks and

uncertainties, including, but not limited to, general changes in

economic conditions. While we may elect to update forward-looking

statements at some point in the future, we specifically disclaim

any obligation to do so. Consolidated Statement of Operations �

Quarter Ended Fiscal Year Ended � 3/31/2007 3/31/2006 3/31/2007

3/31/2006 � � � Revenues $ 3,199,947 $ 3,625,713 $ 15,002,688 $

15,992,770 � Distributor Related Expenses Distributor bonus &

commissions paid 690,194 1,068,023 7,963,988 9,007,138 Distributor

benefits & processing � 800,127 � 690,005 � 2,814,939 �

2,658,594 Total � 1,490,321 � 1,758,028 � 10,778,927 � 11,665,732 �

Net Operating Revenue 1,709,626 1,867,685 4,223,761 4,327,038 �

Operating Expenses � 768,693 � 905,041 � 2,875,577 � 3,255,169 �

Operating Income 940,933 962,644 1,348,184 1,071,869 � Other Income

(Expense) Interest & dividend income [net] 25,576 23,429 55,713

88,567 Realized & unrealized gains [losses] on investments

(net) (35,150) 338,520 (40,679) 672,647 Interest expense � (1,354)

� (6,690) � (15,762) � (11,315) � Income Before Tax 930,005

1,317,903 1,347,456 1,821,768 � Provision for income taxes �

(293,424) � (538,526) � (459,424) � (758,526) � Net Income $

636,581 $ 779,377 $ 888,032 $ 1,063,242 � Shares Outstanding

2,036,247 2,036,747 2,036,247 2,036,747 � Operating Income per

Share $ 0.46 $ 0.47 $ 0.66 $ 0.53 Net Income per Share $ 0.31 $

0.38 $ 0.44 $ 0.52 Consolidated Selected Balance Sheet Items As of

� Assets 3/31/2007 3/31/2006 Current Assets Cash $ 1,283,240 $

89,440 Receivables 2,715,997 4,878,709 Investments 4,389,604

2,963,394 Other � 140,488 � 525,035 Total Current Assets 8,529,329

8,456,578 � Other Non Current Assets � 367,571 � 462,480 � Total

Assets $ 8,896,900 $ 8,919,058 � Liabilities & Stockholders'

Equity � Total Current Liabilities $ 4,707,409 $ 5,196,537 � Total

Liabilities 4,707,409 5,196,537 � Stockholders' Equity � 4,189,491

� 3,722,521 � Liabilities & Stockholders' Equity $ 8,896,900 $

8,919,058

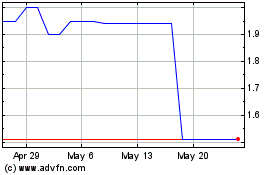

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

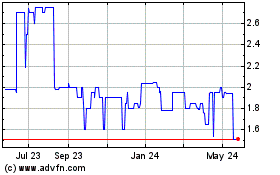

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jul 2023 to Jul 2024