The Marketing Alliance, Inc. (Pink Sheets: MAAL) (�TMA�), a

provider of services and distributor of products to independent

insurance agencies throughout the United States, today announced

financial results for its fiscal second quarter and first half

ended September 30, 2008. Timothy M. Klusas, TMA�s President,

stated, �Our Company continued to produce strong operating results

in a difficult economic climate during this quarter. TMA achieved

over 39% growth in revenues, a 66% increase in operating profit,

and continued improvements in operating margins. We have continued

to realize the benefits of our operating initiatives designed to

streamline costs while delivering value-added insurance products

and services to our member base. Our ability to deliver these

services in a cost-effective manner generates substantial operating

leverage for TMA and provides our members with the tools they need

to help grow their businesses.� FISCAL 2009 SECOND QUARTER

FINANCIAL HIGHLIGHTS Total revenues for the three-month period

ended September 30, 2008 increased 39% to $5.4 million from $3.9

million for the three-month period ended September 30, 2007. The

increase was due in part to further sales penetration among a

larger number of carriers in the TMA�s network, including

well-recognized providers such as ING and Met Life. Distributor

bonus and commissions increased to $3.8 million from $2.4 million

in the same period last year, largely due to distributors taking

advantage of TMA�s new incentive programs. Benefits and processing

expenses decreased to $652,000 from $677,000 in the second quarter

of fiscal 2008, due in part to improvements in efficiencies at the

Company�s business processing center in Omaha, NE. Net operating

revenue (gross profit) increased to $932,000 from $808,000 in the

comparable fiscal 2008 period. The Company�s gross profit margins

declined to 17.3% from 20.9% in the prior year period, largely due

to higher bonus payments as distributors are benefiting from

changes in the new incentive structures. Operating expenses for the

three months ended September 30, 2008 were down, to $611,000, or

11.3% of revenues, from $614,000, or 15.9% of revenues, in the

prior three-month period. Operating income rose 66% to $322,000, or

6.0% of revenues, from operating income of $194,000, or 5.0% of

revenues, for the prior year period. Realized and unrealized losses

on investments during the period totaled $380,000, compared to a

realized and unrealized gain of $61,000 for the second quarter of

fiscal 2008. The Company continues to closely monitor its

investment holdings, and reiterates that while short-term

unrealized gains and losses affect current earnings, it has not

meaningfully affected TMA�s ability to execute its strategic

initiatives. The Company reported a net loss for the fiscal 2009

second quarter of $25,000, or $0.01 per share, as compared to net

income of $167,000, or $0.08 per share, for the fiscal 2008 second

quarter. The net loss for the fiscal 2009 period was to due to the

above-referenced realized and unrealized losses on investments.

FISCAL 2009 FIRST HALF HIGHLIGHTS Total revenues for the first half

of fiscal 2009 were $10.6 million, up 36% from $7.8 million for the

first half of fiscal 2008. Distributor bonus and commissions

increased to $7.2 million from $4.7 million in the first half of

fiscal 2008, while benefits and processing expenses remained flat

at $1.3 million for both half years. Net operating revenues for the

six months ended September 30, 2008 increased 12% to $2.1 million

from $1.9 million for the prior half year. Operating expenses for

the six months ended September 30, 2008 were down 3%, to $1.37

million, or 13.0% or revenues, from $1.42 million, or 18.1% of

revenues, in the prior six-month period. Operating income increased

to $706,000 from $440,000 in the first half of fiscal 2008.

Realized and unrealized loss on investments during the first half

totaled $411,000, compared to a realized and unrealized gain of

$123,000 for the first half of fiscal 2008. Net income was

$200,000, or $0.10 per share, as compared to $357,000, or $0.18 per

share, in the first half of fiscal 2008. BOARD OF DIRECTORS ELECTS

TIM KLUSAS TO FINISH TERM OF LATE DIRECTOR K.V. DEY TMA also

announced today the election of its President, Timothy M. Klusas,

as a member of the Company�s Board of Directors. Mr. Klusas

replaces K.V. Dey, who passed away earlier this year. Mr. Klusas

will serve the remainder of Mr. Dey�s term and the Company

continues to have a nine member Board of Directors. Mr. Klusas

stated, �We are saddened by K.V.�s passing and we have expressed

our sympathies to his family. Everyone at TMA is appreciative of

his leadership and efforts on behalf of TMA�s shareholders and we

will miss him personally and professionally.� Also subsequent to

the end of the quarter, three of TMA�s directors, Gary Glassford,

Jack Dewald and Art Jetter, were each re-elected by shareholders as

their terms expired to additional three-year terms. SELECTED OTHER

FINANCIAL INFORMATION TMA�s balance sheet at September 30, 2008

reflected cash of $1.7 million, working capital of $4.1 million and

no long-term debt. Shareholders� equity at September 30, 2008

totaled $4.3 million. TMA DECLARES 2008 CASH DIVIDEND The Company

recently announced that its Board of Directors authorized a $0.23

per share cash dividend for shareholders of record on December 1,

2008, to be paid on or about December 15, 2008. This is the latest

dividend payment to shareholders and an increase of 10% over last

year�s cash dividend of $0.21 per share. ABOUT THE MARKETING

ALLIANCE, INC. Headquartered in St. Louis, MO, TMA is one of the

largest organizations offering support to independent insurance

brokerage agencies, with a goal of providing members value-added

services on a more efficient basis than they can achieve

individually. The Company provides its members located across the

country access to a wide array of life insurance and annuity

products from an extensive network of carriers. Investor

information can be accessed through the shareholder section of

TMA�s website at http://www.themarketingalliance.com/si_who.cfm.

TMA stock is quoted in the �pink sheets� (www.pinksheets.com) under

the symbol �MAAL�. FORWARD LOOKING STATEMENT Investors are

cautioned that forward-looking statements involve risks and

uncertainties that may affect TMA's business and prospects. Any

forward-looking statements contained in this press release

represent our estimates only as of the date hereof, or as of such

earlier dates as are indicated, and should not be relied upon as

representing our estimates as of any subsequent date. These

statements involve a number of risks and uncertainties, including,

but not limited to, general changes in economic conditions. While

we may elect to update forward-looking statements at some point in

the future, we specifically disclaim any obligation to do so.

Consolidated Statement of Operations � Quarter Ended Year to Date �

6 Months Ended 9/30/08 9/30/07 9/30/08 � 9/30/07 � Revenues $

5,379,392 � $ 3,869,093 � $ 10,604,214 � $ 7,823,956 � �

Distributor Related Expenses Distributor bonus & commissions

paid 3,795,305 2,384,602 7,181,018 4,669,270 Distributor benefits

& processing � 652,008 � � 676,544 � � 1,343,056 � � 1,295,891

� Total � 4,447,313 � � 3,061,146 � � 8,524,074 � � 5,965,161 � �

Net Operating Revenue 932,079 807,947 2,080,140 1,858,795 17 % 21 %

20 % 24 % � Operating Expenses � 610,528 � � 614,137 � � 1,373,658

� � 1,418,654 � � Operating Income 321,551 193,810 706,482 440,141

6 % 5 % 7 % 6 % � Other Income (Expense) Interest & dividend

income [net] 23,878 32,239 44,513 46,942 Realized & unrealized

gains [losses] - on investments (net) (379,975 ) 60,833 (411,120 )

120,748 � Interest expense � (1,229 ) � (1,182 ) � (4,256 ) �

(2,023 ) � Income (Loss) Before Provision for Income Tax (35,775 )

285,700 335,619 605,808 � Benefit (Provision) for income taxes �

11,000 � � (119,000 ) � (136,000 ) � (249,000 ) � Net Income (Loss)

$ (24,775 ) $ 166,700 � $ 199,619 � $ 356,808 � � Average Shares

Outstanding 1,945,703 1,977,675 1,945,703 1,977,675 � Operating

Income per Share $ 0.17 $ 0.10 $ 0.36 $ 0.22 Net Income (Loss) per

Share $ (0.01 ) $ 0.08 $ 0.10 $ 0.18 Consolidated Balance Sheet

Items � � � � As of � Assets 9/30/2008 3/31/2008 Current Assets

Cash & Equivalents $ 1,692,365 $ 1,709,172 Receivables

4,468,009 4,497,987 Investments 2,510,005 2,715,997 Other � 440,545

� 32,105 Total Current Assets 9,110,924 8,916,109 � Other Non

Current Assets � 235,027 � 289,792 � Total Assets $ 9,345,951 $

9,205,901 � Liabilities & Stockholders' Equity � Total Current

Liabilities $ 5,024,978 $ 5,084,543 � Total Liabilities 5,024,978

5,084,543 � Stockholders' Equity � 4,320,973 � 4,121,358 �

Liabilities & Stockholders' Equity $ 9,345,951 $ 9,205,901

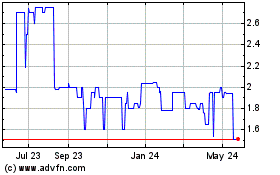

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

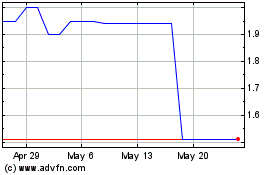

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jul 2023 to Jul 2024