By Scott Patterson and Sarah McFarlane

The Trump administration's aluminum tariffs are aimed at

boosting U.S. producers' profits. But another move by the

administration--sanctions against Russian aluminum giant United Co.

Rusal and its founder Oleg Deripaska--is having the opposite

effect.

The sanctions have pushed up prices for aluminum's key

ingredient, alumina, eating into the profits of U.S. producers,

analysts and aluminum makers say. It takes about two tons of

alumina to make one ton of aluminum and companies that had

previously purchased the white powdery material from Rusal, which

makes 6% of the world's alumina, have been scrambling to get

supplies from other producers, squeezing limited supplies.

Production curbs at the world's largest alumina refinery in

Brazil and a strike by workers at aluminum giant Alcoa Corp. have

also put pressure on alumina prices. Through mid-September, alumina

prices had surged about 60% from a year ago to $625 a metric ton,

according to London commodities researcher CRU Research.

Alumina supplies "are really stretched globally, smelters are

scraping the bottom of the silos for stocks," said Ami Shivkar,

analyst at consultancy Wood Mackenzie.

While high alumina prices haven't translated into higher

aluminum prices yet, they are likely to do so by next year,

analysts say, pushing up the price of everything from beer cans to

cars. BMO Capital Markets forecasts London Metal Exchange aluminum

prices will average $2,182 a ton in the fourth quarter of 2018,

before rising to $2,314 a ton in 2019.

Century Aluminum Co., the biggest aluminum producer in the U.S.

ahead of Alcoa, said on an August earnings call that while the

administration's tariffs have boosted earnings, it expects higher

alumina prices to reduce adjusted third-quarter earnings by $35

million to $45 million.

The trouble for aluminum producers such as Century is that while

alumina prices have soared, the price for aluminum has remained

relatively stable. Through mid-September, aluminum traded on the

London Metal Exchange fell about 3% from a year ago to $2,050 a

ton, according to CRU.

The price of alumina as a percentage of aluminum prices this

month hit an all-time high of 31%, compared with 16% a year ago,

according to CRU.

New York brokerage Berenberg Capital Markets last week initiated

coverage of Century with a "sell" rating, citing high alumina

prices. "The drag from alumina is higher than the benefit from

tariffs at this point," said Berenberg analyst Paretosh Misra.

Century declined to comment.

Alumina prices dipped below $600 a ton after the Trump

administration eased some of its sanctions against Rusal last week

by allowing companies to enter new supply contracts with the

Russian producer, but remain historically high.

Alumina has become the biggest cost for aluminum producers,

eclipsing the cost of electricity used in production, analysts

say.

"Alumina is the tightest market right now of the commodities we

cover," said BMO analyst Kash Kamal.

Global output of alumina to make aluminum--excluding China,

which typically consumes nearly all of its alumina--is expected to

dip below 50 million tons this year, the lowest annual production

in a decade, according to BMO. A boost in supply next year is

expected to come from Emirates Global Aluminium's two-million-ton

alumina refinery, but for now supplies are tight, analysts say. In

2018, China began exporting more alumina than is normally does,

taking advantage of higher prices, according to CRU.

Aluminum plants are dependent on frequent deliveries of alumina,

only carrying a couple of weeks of supply at any one time.

Disruptions in the supply chain can quickly lead to higher prices.

Alumina is a product of refining bauxite mined by companies

including Rio Tinto PLC and Alcoa.

Aluminum producers that also sell alumina, such as Alcoa, aren't

as vulnerable to the spike in prices of the metal. Alcoa said in

July that the administration's tariffs are hurting its profits

because it relies on imports from Canada, a target of the

tariffs.

Problems in the market began with the world's largest alumina

refinery, Alunorte in Brazil. The refinery, which is owned by

Norway's Norsk Hydro ASA, has been operating at half its capacity

since March 1, when heavy rain triggered government concerns of

water contamination.

Then in April, the Trump administration sanctioned Rusal, one of

the world's biggest alumina producers. Rusal has until November to

implement governance changes required by the Treasury Department,

opening a path for its removal from the sanctions list. But

analysts say it is uncertain when the company's supply would be

coming back to market.

Rusal has said it is working to address problems created by the

sanctions and to protect the interests of shareholders.

A Norsk Hydro spokesman said the timing for resuming full

production at Alunorte remained up to the Brazilian environmental

authorities and a federal court, but noted the plant was "ready to

restart anytime."

Separately, Alcoa's three refineries in Western Australia--which

account for about 7% of global alumina supplies--have been hit by a

strike that began on Aug. 8. An Alcoa spokesman said the Australian

Workers Union was meeting on Friday to discuss whether to continue

their strike.

Write to Scott Patterson at scott.patterson@wsj.com and Sarah

McFarlane at sarah.mcfarlane@wsj.com

(END) Dow Jones Newswires

September 27, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

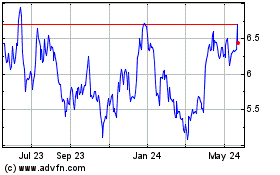

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Nov 2024 to Dec 2024

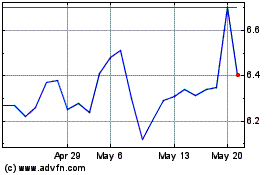

Norsk Hydro ASA (QX) (USOTC:NHYDY)

Historical Stock Chart

From Dec 2023 to Dec 2024