Q.E.P. Co., Inc., Reports Fiscal 2006 Fourth-Quarter and Full-Year Financial Results; Full Year Sales Increase 22.3% to a Recor

20 June 2006 - 10:00PM

Business Wire

Q.E.P. CO., INC. (Nasdaq:QEPC), today announced financial results

for its fiscal 2006 fourth quarter and full year ended February 28,

2006. The Company filed its Annual Report on Form 10-K for fiscal

2006 on June 13, 2006. For the fiscal 2006 fourth quarter, net

sales increased 17.1 percent to $52.4 million, compared with $44.7

million in the fiscal 2005 fourth quarter. Net sales for fiscal

2006 increased 22.3 percent to $212.3 million, compared with net

sales of $173.6 million in fiscal 2005. Approximately $29.0 million

of the fiscal 2006 increase in sales was a result of higher

penetration of the Company's existing and new product offerings to

the Company's existing North American customers. A significant

portion of this improvement in North America was from the sales of

adhesive products. The remaining North American increase is due to

expansion of the Company's distribution customer base and the

effect of recent acquisitions. Sales outside North America

increased by approximately $1.4 million during fiscal 2006 over

fiscal 2005 and now represent approximately 21.0 percent of the

Company's total sales compared to 26.0 percent for the fiscal 2005

period. Changes in foreign currency exchange rates accounted for

approximately $2.5 million of the sales increase in fiscal 2006.

Gross profit for the fiscal 2006 fourth quarter was 28.1 percent of

net sales as compared with 24.1 percent for the fiscal 2005 fourth

quarter. The gross profit for fiscal 2006 was 29.2 percent compared

to 30.9 percent last year. The decline in gross profit for both the

fourth quarter and full year continued to include the effects of

increases in the costs of raw materials and finished goods related

to, among other matters, higher costs for crude oil and other

industrial commodities, and the relative increase in flooring

adhesive sales that have lower overall margins than specialty

tools. Although the Company increased the pricing of individual

product offerings by approximately 2.0 percent throughout the 2006

fiscal year to offset a portion of cost increases, the Company's

ability to increase pricing traditionally lags behind cost

increases. The Company remains committed to seeking additional

price increases that reflect the impact of continued cost

increases. The Company's gross profit was also negatively impacted

by the cost of increased rebates associated with higher sales

volume to the Company's larger home center customers and the

initiation of a direct shipment program. In the long term, the

direct shipping program is expected to improve margins through

reductions in certain operating expenses. For the fiscal 2006

fourth quarter, the Company reported a net loss of $2.7 million, or

$0.76 per share, compared with a net profit of $376,000, or $0.08

per diluted share, for the fourth quarter last fiscal year. The

Company reported a net loss for the fiscal 2006 full year of $1.2

million, or $0.37 per share, compared to a net income of almost

$4.0 million, or $1.06 per diluted share, last fiscal year. Lewis

Gould, Q.E.P.'s Chairman and Chief Executive Officer, stated:

"Fiscal 2006 was one of the most challenging years in our 26 year

history. I am pleased with our consistent top-line growth, as we

have recorded five consecutive years of record sales. However, we

continue to struggle with our ability to transfer this top-line

success into bottom-line profitability. Inflated commodity prices

remain the biggest culprit to our gross margin percentage. We

continue to work with our customers and suppliers to ease the cost

pressures and margin volatility. "During the year there were a

number of what we feel were one-time events that also negatively

affected our profitability. Earnings for the year were negatively

impacted by a $1.0 million expense related to an increase in the

estimated value of the warrant put liability, which was in part a

result of a change in the valuation methodology. The Company moved

its warehousing and distribution operations to Dalton, Georgia from

Boca Raton, Florida. In addition, the Company restructured a

portion of its European manufacturing and distribution operations.

"Moving forward, I am optimistic about the direction of the

Company. We have learned a lot over the past year and are working

hard to control costs, while maintaining our position as one of the

leading manufacturers, marketers, and distributors of specialty

tools," concluded Mr. Gould. The Company will host a conference

call at 10:00 a.m. Eastern Time today to discuss this press release

and to answer questions. To participate in the conference call,

please dial 800-936-9754 five to 10 minutes before the call is

scheduled to begin. The financial information to be discussed

during the conference call was included in the Company's Form 10-K

filed with the Securities and Exchange Commission ("SEC") on June

13, 2006 and will be added to Q.E.P.'s website at www.qep.com in

the Investor Relations section. Certain statements in this press

release, including statements regarding our expectations regarding

continued manufacturing efficiencies, increases in our gross and

operating profit margins, the expected benefits of our direct

shipping program, our ability to manage operating expenses, and our

ability to implement additional price increases are forward-looking

statements, which are made pursuant to the safe-harbor provisions

of the Securities Litigation Reform Act of 1995. The

forward-looking statements are made only as of the date of this

report and are subject to risks and uncertainties which could cause

actual results to differ materially from those discussed in the

forward-looking statements and from historical results of

operations. Among the risks and uncertainties that could cause such

a difference are the Company's assumptions relating to the expected

growth in sales of its products, the continued success of the

Company's manufacturing processes, continued increases in the cost

of raw materials and finished goods, improvements in productivity

and cost reductions, the continued success of initiatives with

certain of the Company's customers, the success of the Company's

price increases initiatives, and the success of the Company's sales

and marketing efforts. A more detailed discussion of risks

attendant to the forward-looking statements included in this press

release are set forth in the "Forward-Looking Statements" section

of the Company's Annual Report on Form 10-K for the year ended

February 28, 2006, filed with the SEC, and in other reports already

filed with the SEC. -0- *T Q.E.P. CO., INC., AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In thousands, except

per-share data) Twelve Months Ended Three Months Ended 2/28/06

2/28/05 2/28/06 2/28/05 --------- --------- ----------- -----------

(unaudited) (unaudited) Net sales $212,314 $173,625 $52,367 $44,720

Cost of goods sold 150,318 120,038 37,637 33,953 ---------

--------- ----------- ----------- Gross profit 61,996 53,587 14,730

10,767 Costs and expenses Shipping 20,943 17,299 5,527 4,472

General and administrative 18,821 15,068 5,019 4,052 Selling and

marketing 20,208 16,764 5,236 4,461 Other (income) expense (1,156)

243 120 212 --------- --------- ----------- ----------- Operating

income 3,180 4,213 (1,172) (2,430) Change in Warrant put liability

(1,006) 1,160 (874) 1,255 Interest expense, net (2,498) (1,537)

(686) (540) --------- --------- ----------- ----------- Income

before provision for income taxes (324) 3,836 (2,732) (1,715)

Provision for income taxes 922 (119) (81) (2,091) ---------

--------- ----------- ----------- Net income $(1,246) $3,955

$(2,651) $376 ========= ========= =========== =========== Basic

earnings per common share $(0.37) $1.14 $(0.76) $0.10 =========

========= =========== =========== Diluted earnings per common share

$(0.37) $1.06 $(0.76) $0.08 ========= ========= ===========

=========== Weighted average number of diluted common shares

outstanding 3,458 3,711 3,458 3,652 CONDENSED CONSOLIDATED BALANCE

SHEETS (In thousands) 2/28/06 2/28/05 -------- -------- Assets

Current Assets Cash and cash equivalents $852 $1,869 Accounts

receivable 33,258 27,016 Inventories 34,128 29,929 Other current

assets 2,190 2,504 -------- -------- 70,428 61,318 Property and

equipment, net 8,296 9,186 Other assets 20,218 16,604 --------

-------- Total Assets $98,942 $87,108 ======== ======== Liabilities

and Shareholders' Equity Current liabilities (including current

portion of debt and, at 2/28/06, warrant put liability) $62,056

$49,949 Long-term debt 9,147 6,532 Other liabilities 213 -- Warrant

put liability -- 782 Shareholders' equity 27,526 29,845 --------

-------- Total Liabilities and Shareholders' Equity $98,942 $87,108

======== ======== *T

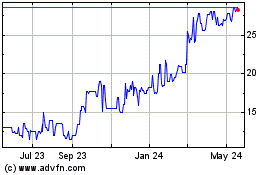

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Feb 2025 to Mar 2025

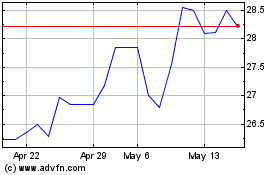

Q E P (QX) (USOTC:QEPC)

Historical Stock Chart

From Mar 2024 to Mar 2025