As filed with the Securities and Exchange

Commission on January 14, 2015

No. 333-199991

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1 TO

FORM

S-1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

RIGHTSCORP,

INC.

(Exact name of registrant as specified

in its charter)

| Nevada |

|

7380 |

|

33-1219445 |

| (State of incorporation) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

3100 Donald Douglas Loop North

Santa Monica, CA 90405

(310) 751-7510

(Address, including

zip code, and telephone number of registrant’s principal executive offices)

Christopher Sabec

Chief Executive Officer

3100 Donald Douglas Loop North

Santa Monica, CA 90405

(310) 751-7510

(Name, address,

including zip code, and telephone number of agent for service)

With Copies to:

Gregory Sichenzia, Esq.

Henry Nisser, Esq.

Sichenzia Ross Ference Friedman LLP

61 Broadway, 32nd Floor

New York, NY 10006

(212) 930-9700

Approximate date

of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act

of 1933 check the following box. [X]

If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

[ ]

If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is

a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check

mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting

company” in Rule 12b-2 of the Securities Exchange Act of 1934. (Check one):

| Large accelerated filer |

[ ] |

|

Accelerated filer |

[ ] |

| Non-accelerated filer |

[ ] |

(Do not check if a smaller reporting company) |

Smaller reporting company |

[X] |

| CALCULATION

OF REGISTRATION FEE | |

| | |

Title

of Each Class Of

Securities To Be Registered | |

Amount

To Be

Registered (1) | | |

Proposed

Maximum

Offering Price Per

Security (2) | | |

Proposed

Maximum

Aggregate

Offering Price | | |

Amount

Of

Registration Fee | |

| Common Stock, $0.001

par value | |

| 10,928,000 | | |

$ | 0.20 | | |

$ | 2,185,600 | | |

$ | 253.97 | |

| Common Stock, $0.001 par value

issuable upon exercise of warrants exercisable at $0.25 per share | |

| 16,392,000 | | |

$ | 0.25 | | |

$ | 4,098,000 | | |

$ | 476.19 | |

| Total | |

| 27,320,000 | | |

$ | | | |

$ | 6,283,600 | | |

$ | 730.16 | (3) |

| (1) |

Includes shares of our common stock, par value $0.001 per share, which may be offered pursuant to this registration statement, which shares are issuable upon exercise of warrants held by the selling stockholders. In addition to the shares set forth in the table, the amount to be registered includes an indeterminate number of shares issuable upon exercise of the warrants, as such number may be adjusted as a result of stock splits, stock dividends and similar transactions in accordance with Rule 416. The number of shares of common stock registered hereunder represents a good faith estimate by us of the number of shares of common stock issuable upon exercise of the warrants. |

| |

|

| (2) |

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and Rule 457(g) under the Securities Act of 1933, using the average of the high and low price as reported on the OTC QB on November 3, 2014, which was $0.20 per share and the warrant exercise price, which is $0.25 per share. |

| |

|

| (3) |

Previously paid. |

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall

become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities under

this prospectus until the registration statement of which it is a part and filed with the Securities and Exchange Commission is

effective. This prospectus is not an offer to sell these securities and it is not a solicitation of an offer to buy these securities

in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 14, 2015

PROSPECTUS

Up

to 27,320,000 Shares of Common Stock

This prospectus relates

to the offering by the selling stockholders of Rightscorp, Inc. of up to 27,320,000 shares of common stock, par value $0.001 per

share. All of the shares of common stock offered by this prospectus are being sold by the selling stockholders. These shares include

10,928,000 issued and outstanding shares of common stock and 16,392,000 shares of common stock underlying unexercised warrants

to purchase common stock, each issued to the selling stockholders in connection with a private placement offering completed as

of September 30, 2014, or the September 2014 private placement. Each of the shares offered by the selling stockholders has been

issued or is issuable to the selling stockholders upon the exercise of warrants to purchase our common stock at an exercise price

of $0.25 per share.

The selling stockholders

have advised us that they will sell the shares of common stock from time to time in the open market, on the OTC QB maintained by

the OTC Markets Group, Inc., in privately negotiated transactions or a combination of these methods, at market prices prevailing

at the time of sale or at prices related to the prevailing market prices or at negotiated prices.

The selling stockholders

may sell the common shares to or through underwriters, brokers or dealers or directly to purchasers. Underwriters, brokers or dealers

may receive discounts, commissions or concessions from the selling stockholders, purchasers in connection with sales of the common

shares, or both. Additional information relating to the distribution of the common shares by the selling stockholders can be found

in this prospectus under the heading “Plan of Distribution.” If underwriters or dealers are involved in the sale of

any securities offered by this prospectus, their names, and any applicable purchase price, fee, commission or discount arrangement

between or among them, will be set forth, or will be calculable from the information set forth, in a supplement to this prospectus.

We will not receive

any proceeds from the sale of common stock by the selling stockholders. We will receive proceeds from the selling stockholders

from any exercise of their warrants, on a cash basis.

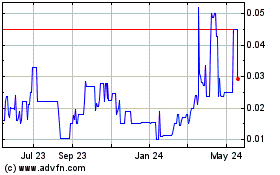

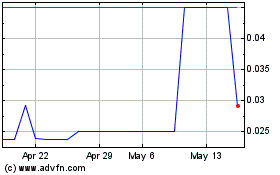

Our common stock

is traded on the OTC QB under the symbol “RIHT.” On January 6, 2015, the closing price of our common stock was $0.15

per share.

Investing

in our common stock involves a high degree of risk. Before making any investment in our common stock, you should read and carefully

consider the risks described in this prospectus under “Risk Factors” beginning on page 4 of this prospectus.

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment thereto. We have not

authorized anyone to provide you with different information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus

is dated , 2015

TABLE

OF CONTENTS

PROSPECTUS

SUMMARY

This summary highlights information

contained throughout this prospectus and is qualified in its entirety to the more detailed information and financial statements

included elsewhere in this prospectus. This summary does not contain all of the information that should be considered before investing

in our common stock. Investors should read the entire prospectus carefully, including the more detailed information regarding our

business, the risks of purchasing our common stock discussed in this prospectus under “Risk Factors” beginning on page

4 of this prospectus and our financial statements and the accompanying notes beginning on page F-1 of this prospectus.

Background

Rightscorp, Inc., a Nevada corporation,

was incorporated in Nevada on April 9, 2010. Since the closing of the Reverse Acquisition on October 25, 2013 (discussed below),

we have been the parent company of Rightscorp, Inc., a Delaware corporation.

On October 25, 2013 (the “Merger

Closing Date”), we entered into and closed an Agreement and Plan of Merger (the “Merger Agreement”), with Rightscorp

Merger Acquisition Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of ours (the “Subsidiary”) and Rightscorp,

Inc., a Delaware corporation (“Rightscorp Delaware”). Pursuant to the Merger Agreement, (i) the Subsidiary merged into

Rightscorp Delaware, such that Rightscorp Delaware became a wholly-owned subsidiary of our company, (ii) we issued (a) 45,347,102

shares (the “Acquisition Shares”), of our common stock to the shareholders of Rightscorp Delaware representing approximately

65.9% of our aggregate issued and outstanding common stock following the closing of the Merger Agreement (following the Share Cancellation

and the Private Placement, each as defined below), in exchange for all of the issued and outstanding shares of common stock of

Rightscorp Delaware, (b) outstanding warrants to purchase 1,831,969 shares of common stock of Rightscorp Delaware were converted

into outstanding warrants to purchase 5,312,703 shares of our common stock, and (iii) outstanding convertible notes in the aggregate

amount of $233,844 (including outstanding principal and accrued interest thereon) of Rightscorp Delaware were amended to be convertible

into shares of our common stock at a conversion price of $0.1276.

In connection with the Merger Agreement

and the Financing (defined below), as of the Merger Closing Date we issued and sold an aggregate of 950,000 units (the “Private

Placement”), for a purchase price of $0.50 per unit, with each unit consisting of one share of common stock and an eighteen

month warrant to purchase one share of common stock with an exercise price of $0.75 (the “Private Placement Warrants”).

In connection with the Merger Agreement

and the Private Placement, in addition to the foregoing:

| |

(i) |

Effective on the Merger Closing Date, 21,000,000 shares of common stock were returned to us for cancellation (the “Share Cancellation”). |

| |

|

|

| |

(ii) |

Effective on the Merger Closing Date, the following individuals were appointed as executive officers and directors of our company: |

| Name |

|

Title |

| Christopher Sabec |

|

Chief

Executive Officer, and Director |

| |

|

|

| Robert Steele |

|

President, Chief

Financial Officer, Chief Operating Officer and Director |

| |

|

|

| Brett Johnson |

|

Chairman

of the Board of Directors |

| |

(iii) |

Effective July 15, 2013, we amended our articles of incorporation to change our name from “Stevia Agritech Corp.” (“Stevia”) to “Rightscorp, Inc.” |

| |

|

|

| |

(iv) |

On June 18, 2013, we entered into a financing agreement (the “Financing Agreement”) with Hartford Equity Inc. (“Hartford”), under which Hartford agreed to purchase, directly or through its associates, an aggregate of $2,050,000 of common stock and warrants (the “Financing”). The Private Placement described above will be deemed part of the Financing such that as of the Merger Closing Date we closed on $475,000 of the Financing (which amounts were advanced by us to Rightscorp Delaware prior to the Merger Closing Date) and Hartford, directly or through its associates, agreed to purchase an additional $1,575,000 in common stock and warrants from us within 14 months from the Closing Date. As of the date of this prospectus, we have yet to receive $375,000 of the $1,575,000, which includes a $21,000 increase to the total amount agreed to be purchased. |

Effective on the Merger Closing Date,

pursuant to the Merger Agreement, Rightscorp Delaware became our wholly owned subsidiary. The acquisition of Rightscorp Delaware

is treated as a reverse acquisition (the “Reverse Acquisition”), and the business of Rightscorp Delaware became our

business. At the time of the Reverse Acquisition, Stevia was not engaged in any significant active business.

Rightscorp Delaware is a

Delaware corporation formed on January 20, 2011.

We are a technology company and have

a patent-pending, proprietary method for collecting payments from illegal downloaders of copyrighted content via notifications

sent to their internet service providers (ISPs).

Our principal office is located at

3100 Donald Douglas Loop North, Santa Monica, CA 90405. Our telephone number is (310) 751-7510. Our website address is www.rightscorp.com.

Overview

We protect copyright holders’

rights by seeking to assure they get paid for their copyrighted intellectual property (or IP). We offer and sell a service to copyright

owners under which copyright owners retain us to identify and collect settlement payments from Internet users who have infringed

on their copyrights. After we have received an order from a client, our software monitors the global Peer-to-Peer (or P2P) file

sharing networks to detect illegally distributed digital media. The technology sends automated notices of the infringing activity

to ISPs and the ISP forwards these notices, which contain settlement offers, to their infringing customers. The notice to ISPs

and settlement offers identify the date, time, title of copyrighted intellectual property and other specific technology identifiers

to confirm the infringement by the ISPs customer. Infringers who accept our settlement offers then remit payment to us for the

copyright infringement and we share the payments with the copyright owners.

We generate revenues by retaining a

portion of the settlement payments we receive from copyright infringers. Our customers, the copyright holders, benefit from our

service as we share a portion of the settlement with them. This helps them recapture the revenues they lost when their copyrighted

material was illegally copied and distributed. Current customers include, but are not limited to BMG Rights Management, Round Hill

Music, Shapiro/Bernstein and The Orchard. We have successfully obtained settlement payments more than 130,000 individual cases

of copyright infringement. To date, we have closed infringements and received settlement payments from subscribers on more than

50 ISPs including five of the top 10 US ISPs. We believe ISPs that participate with us and our clients by forwarding notices of

infringement achieve compliance with the Digital Millennium Copyright Act (or DMCA), as discussed below. Conversely, we believe

that companies that do not participate and do not have a policy for terminating repeat infringers fail to comply with the DMCA,

which may result in liability for them.

The Offering

This prospectus relates to the resale

from time to time by the selling stockholders identified in this prospectus of up to 27,320,000 shares of our common stock. The

shares of common stock being offered have been or will be issued to the selling stockholders upon the exercise of certain warrants

received by the selling stockholders in the September 2014 private placement. No shares are being offered for sale by us.

| Common stock outstanding prior to offering |

|

89,896,421 (1) |

| |

|

| Common stock offered by the selling stockholders |

|

27,320,000 (2) |

| |

|

| Common stock to be outstanding after the offering |

|

106,288,421 (3) |

| |

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of common stock offered by the selling stockholders under this prospectus. However, we will receive up to $4,473,000 in the aggregate from the selling stockholders if they exercise in full, on a cash basis, all of their warrants to purchase 16,392,000 shares of common stock issued to the selling stockholders in connection with the September 2014 private placement. We will use such proceeds from the exercise of the warrants for working capital and other corporate purposes. |

| |

|

| OTC QB Symbol |

|

“RIHT” |

| (1) |

As of January 6, 2015. |

| |

|

| (2) |

Includes 10,928,000 shares of common

stock offered by the selling stockholders that are currently issued and outstanding and 16,392,000 shares of common stock offered

by the selling stockholders that are issuable upon exercise of warrants.

|

| (3) |

Includes 16,392,000 shares of common stock which remain subject to unexercised warrants as of the date of this prospectus and assumes that all other outstanding warrants and options are not exercised. Only the 16,392,000 shares receivable upon exercise and the 10,928,000 shares issued and outstanding warrants are being offered by the selling stockholders under this prospectus. |

Background of September 2014 Private

Placement of Units

Pursuant to the terms of the Unit Subscription

Agreement which was entered into with the subscribers for units (the “Subscribers”), we received approximately $2,982,000

in gross proceeds from the issuance of 10,928,000 shares of our common stock forming part of the units sold in the September 2014

private placement. Each unit consisted of 10,000 shares of our common stock and warrants to purchase 15,000 such shares. An aggregate

of 1,192.8 units (including 16,392,000 warrants) were sold in the September 2014 private placement. Assuming the full exercise

of the warrants for cash, we would receive additional proceeds of $4,098,000, for an aggregate of $6,830,000 in proceeds from the

purchase of the units in the private placement and the exercise of the warrants.

The warrants entitle the Subscribers

to purchase up to an aggregate of 16,392,000 shares of our common stock for a period of five years from the date of issuance at

an initial exercise price of $0.25 per share, subject to adjustments, with a cashless exercise provision. None of such warrants

been exercised. The warrants issued to the Subscribers have anti-dilution protection in the event we subsequently issue shares

of common stock, or securities convertible into shares of common stock, for a price of less than $0.25 per share. The warrants

are immediately exercisable.

The issuances of securities described

above were issued in a transaction exempt from the registration requirements of the Securities Act, pursuant to Section 4(a)(2)

and Rule 506 of Regulation D thereof.

Pursuant to the Unit Subscription Agreement,

we agreed, within 45 days of the closing of the private placement, to file a registration statement to register up to a certain

number of shares of common stock issued or issuable under the warrants issued in the September 2014 private placement, on a pro

rata basis among participating Subscribers. We have also agreed to file additional registration statements, of which this prospectus

forms a part, subject to certain time periods between these filings and limitations on the number of shares underlying warrants

required to be registered by us in any single registration statement, until all of the shares issued or issuable under the warrants

have been registered. We are required to keep these registration statements effective until the second anniversary of the closing

of the private placement, subject to, under limited circumstances, this obligation being terminated earlier.

Plan of Distribution

This offering is not being underwritten.

The selling stockholders will sell their shares of our common stock at prevailing market prices or privately negotiated prices.

The selling stockholders themselves directly, or through their agents, or through their brokers or dealers, may sell their shares

from time to time, in (i) privately negotiated transactions, (ii) in one or more transactions, including block transactions or

(iii) otherwise in accordance with the section of this prospectus entitled “Plan of Distribution.” To the extent required,

the specific shares to be sold, the names of the selling stockholders, the respective purchase prices and public offering prices,

the names of any agent, broker or dealer and any applicable commission or discounts with respect to a particular offer will be

described in an accompanying prospectus supplement. In addition, any securities covered by this prospectus which qualify for sale

pursuant to Rule 144 may be sold under Rule 144 rather than pursuant to this prospectus.

For additional information on the methods

of sale, you should refer to the section of this prospectus entitled “Plan of Distribution,” beginning on page XX.

About this Prospectus

You should read this prospectus together

with additional information described under the headings “Where You Can Find More Information.” If there is any inconsistency

between the information in this prospectus and the documents incorporated by reference herein, you should rely on the information

in this prospectus.

You should rely only on the information

contained in this prospectus or incorporated by reference herein. We have not authorized any person to provide you with different

or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither

we nor the selling stockholders are making an offer to sell these securities in any jurisdiction where the offer or sale is not

permitted. You should assume that the information appearing in this prospectus is accurate only as of their respective dates. Rightscorp’s

business, financial condition, results of operations and prospects may have changed since such dates.

Unless otherwise indicated or unless

the context requires otherwise, all references in this prospectus to “Rightscorp,” the “Company,” “we,”

“us” and “our” refer collectively to Rightscorp, Inc., the Nevada corporation and its wholly owned subsidiary,

Rightscorp, Inc., a Delaware corporation.

RISK FACTORS

Investing in our common stock involves

a high degree of risk. Potential investors should consider carefully the risks and uncertainties described below together with

all other information contained in this prospectus before making investment decisions with respect to our common stock. If any

of the following risks actually occur, our business, financial condition, results of operations and our future growth prospects

would be materially and adversely affected. Under these circumstances, the trading price and value of our common stock could decline

resulting in a loss of all or part of your investment. The risks and uncertainties described in this prospectus are not the only

ones facing our Company. Additional risks and uncertainties of which we are not presently aware, or that we currently consider

immaterial, may also affect our business operations.

This prospectus contains forward-looking

statements. Forward-looking statements relate to future events or our future financial performance. We generally identify forward-looking

statements by terminology such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,”

“believes,” “estimates,” “predicts,” “potential” or “continue” or the

negative of these terms or other similar words. These statements are only predictions. The outcome of the events described in these

forward-looking statements is subject to known and unknown risks, uncertainties and other factors that may cause our customers’

or our industry’s actual results, levels of activity, performance or achievements expressed or implied by these forward-looking

statements, to differ. “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and

Results of Operations” and “Business,” as well as other sections in this prospectus, discuss the important factors

that could contribute to these differences.

The forward-looking statements made

in this prospectus relate only to events as of the date on which the statements are made. We undertake no obligation to update

any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the

occurrence of unanticipated events.

This prospectus also contains market

data related to our business and industry. This market data includes projections that are based on a number of assumptions. If

these assumptions turn out to be incorrect, actual results may differ from the projections based on these assumptions. As a result,

our markets may not grow at the rates projected by these data, or at all. The failure of these markets to grow at these projected

rates may have a material adverse effect on our business, results of operations, financial condition and the market price of our

common stock.

Risks Related to our Company and our Business

We have a limited operating

history and are subject to the risks encountered by early-stage companies.

Rightscorp Delaware was formed on January

20, 2011. Because we have a limited operating history, our operating prospects should be considered in light of the risks and uncertainties

frequently encountered by early-stage companies in rapidly evolving markets. These risks include:

| |

● |

risks that we may not have sufficient capital to achieve our growth strategy; |

| |

|

|

| |

● |

risks that we may not develop our product and service offerings in a manner that enables us to be profitable and meet our customers’ requirements; |

| |

|

|

| |

● |

risks that our growth strategy may not be successful; and |

| |

|

|

| |

● |

risks that fluctuations in our operating results will be significant relative to our revenues. |

These risks are described in more detail

below. Our future growth will depend substantially on our ability to address these and the other risks described in this section.

If we do not successfully address these risks, our business would be significantly harmed.

We have a history of operating

losses and we may need additional financing to meet our future long term capital requirements.

We have a history of losses and may

continue to incur operating and net losses for the foreseeable future. As of September 30, 2014, we had a working capital deficit

of $721,827, and stockholders’ deficit of $594,377. We incurred a net loss of approximately $2,299,522 for the nine months

ended September 30, 2014 and a net loss of approximately $2,042,779 for the year ended December 31, 2013. As of September 30, 2014,

our accumulated deficit was approximately $6,540,194. We have not achieved profitability on an annual basis. We may not be able

to reach a level of revenue to achieve profitability. If our revenues grow slower than anticipated, or if operating expenses exceed

expectations, then we may not be able to achieve profitability in the near future or at all, which may depress our stock price.

While we anticipate that our current

cash, cash equivalents and cash generated from operations, and the capital raised subsequent to the nine months ended September

30, 2014 will be sufficient to meet our projected operating plans for a period of at least 12 months from the date of this prospectus,

we may require additional funds, either through additional equity or debt financings or collaborative agreements or from other

sources. We have no commitments to obtain such additional financing, and we may not be able to obtain any such additional financing

on terms favorable to us, or at all. In the event that we are unable to obtain additional financing, we may be unable to implement

our business plan. Even with such financing, we have a history of operating losses and there can be no assurance that we will ever

become profitable.

We may need significant additional

capital, which we may be unable to obtain.

We may need to obtain additional financing

over time to fund operations. Our management cannot predict the extent to which we will require additional financing, and can provide

no assurance that additional financing will be available on favorable terms or at all. The rights of the holders of any debt or

equity that may be issued in the future could be senior to the rights of common shareholders, and any future issuance of equity

could result in the dilution of our common shareholders’ proportionate equity interests in our company. Failure to obtain

financing or an inability to obtain financing on unattractive terms could have a material adverse effect on our business, prospects,

results of operation and financial condition.

Our resources may not be sufficient

to manage our potential growth; failure to properly manage our potential growth would be detrimental to our business.

We may fail to adequately manage our

potential future growth. Any growth in our operations will place a significant strain on our administrative, financial and operational

resources, and increase demands on our management and on our operational and administrative systems, controls and other resources.

We cannot assure you that our existing personnel, systems, procedures or controls will be adequate to support our operations in

the future or that we will be able to successfully implement appropriate measures consistent with our growth strategy. As part

of this growth, we may have to implement new operational and financial systems, procedures and controls to expand, train and manage

our employee base, and maintain close coordination among our technical, accounting, finance, marketing and sales staff. We cannot

guarantee that we will be able to do so, or that if we are able to do so, we will be able to effectively integrate them into our

existing staff and systems. To the extent we acquire businesses, we will also need to integrate and assimilate new operations,

technologies and personnel. If we are unable to manage growth effectively, such as if our sales and marketing efforts exceed our

capacity to install, maintain and service our products or if new employees are unable to achieve performance levels, our business,

operating results and financial condition could be materially and adversely affected.

We will need to increase the size

of our organization, and we may be unable to manage rapid growth effectively.

Our failure to manage growth effectively

could have a material and adverse effect on our business, results of operations and financial condition. We anticipate that a period

of significant expansion will be required to address possible acquisitions of business, products, or rights, and potential internal

growth to handle licensing and research activities. This expansion will place a significant strain on management, operational and

financial resources. To manage the expected growth of our operations and personnel, we must both improve our existing operational

and financial systems, procedures and controls and implement new systems, procedures and controls. We must also expand our finance,

administrative, and operations staff. Our current personnel, systems, procedures and controls may not adequately support future

operations. Management may be unable to hire, train, retain, motivate and manage necessary personnel or to identify, manage and

exploit existing and potential strategic relationships and market opportunities.

We are dependent on the continued

services and performance of our senior management, the loss of any of whom could adversely affect our business, operating results

and financial condition.

Our future performance depends on the

continued services and continuing contributions of our senior management to execute our business plan, and to identify and pursue

new opportunities and product innovations. The loss of services of senior management, particularly Christopher Sabec and Robert

Steele, Rightscorp Delaware’s founders, could significantly delay or prevent the achievement of our strategic objectives.

The loss of the services of senior management for any reason could adversely affect our business, prospects, financial condition

and results of operations.

Our ability to protect our intellectual

property and proprietary technology through patents and other means is uncertain and may be inadequate, which would have a material

and adverse effect on us.

Our success depends significantly on

our ability to protect our proprietary rights to the technologies used in our products. In particular, we have twenty-nine patents

pending worldwide for our system of identifying and collecting settlement payments for repeat copyright infringements. Even if

our pending patents are granted, we cannot assure you that we will be able to control all of the rights for all of our intellectual

property. We rely on patent protection, as well as a combination of copyright, trade secret and trademark laws and nondisclosure,

confidentiality and other contractual restrictions to protect our proprietary technology, including our licensed technology. However,

these legal means afford only limited protection and may not adequately protect our rights or permit us to gain or keep any competitive

advantage. For example, our pending United States and foreign patent applications may not issue as patents in a form that will

be advantageous to us or may issue and be subsequently successfully challenged by others and invalidated. Both the patent application

process and the process of managing patent disputes can be time-consuming and expensive. Competitors may be able to design around

our patents or develop products which provide outcomes which are comparable or even superior to ours. Steps that we have taken

to protect our intellectual property and proprietary technology, including entering into confidentiality agreements and intellectual

property assignment agreements with some of our officers, employees, consultants and advisors, may not provide meaningful protection

for our trade secrets or other proprietary information in the event of unauthorized use or disclosure or other breaches of the

agreements. Furthermore, the laws of foreign countries may not protect our intellectual property rights to the same extent as do

the laws of the United States.

In the event a competitor infringes

upon our licensed or pending patent or other intellectual property rights, enforcing those rights may be costly, uncertain, difficult

and time consuming. Even if successful, litigation to enforce our intellectual property rights or to defend our patents against

challenge could be expensive and time consuming and could divert our management’s attention. We may not have sufficient resources

to enforce our intellectual property rights or to defend our patents rights against a challenge. The failure to obtain patents

and/or protect our intellectual property rights could have a material and adverse effect on our business, results of operations

and financial condition.

Our patent applications and licenses

may be subject to challenge on validity grounds, and our patent applications may be rejected.

We rely on our patent applications,

licenses and other intellectual property rights to give us a competitive advantage. Whether a patent application should be granted,

and if granted whether it would be valid, is a complex matter of science and law, and therefore we cannot be certain that, if challenged,

our patents (should any be granted), patent applications and/or other intellectual property rights would be upheld. If one or more

of these intellectual property rights are invalidated, rejected or found unenforceable, that could reduce or eliminate any competitive

advantage we might otherwise have had.

We may become subject to claims

of infringement or misappropriation of the intellectual property rights of others, which could prohibit us from developing our

products, require us to obtain licenses from third parties or to develop non-infringing alternatives and subject us to substantial

monetary damages.

Third parties could, in the future,

assert infringement or misappropriation claims against us with respect to products we develop. Whether a product infringes a patent

or misappropriates other intellectual property involves complex legal and factual issues, the determination of which is often uncertain.

Therefore, we cannot be certain that we have not infringed the intellectual property rights of others. Our potential competitors

may assert that some aspect of our product infringes their patents. Because patent applications may take years to issue, there

also may be applications now pending of which we are unaware that may later result in issued patents upon which our products could

infringe. There also may be existing patents or pending patent applications of which we are unaware upon which our products may

inadvertently infringe.

Any infringement or misappropriation

claim could cause us to incur significant costs, place significant strain on our financial resources, divert management’s

attention from our business and harm our reputation. If the relevant patents in such claim were upheld as valid and enforceable

and we were found to infringe them, we could be prohibited from selling any product that is found to infringe unless we could obtain

licenses to use the technology covered by the patent or are able to design around the patent. We may be unable to obtain such a

license on terms acceptable to us, if at all, and we may not be able to redesign our products to avoid infringement. A court could

also order us to pay compensatory damages for such infringement, plus prejudgment interest and could, in addition, treble the compensatory

damages and award attorney fees. These damages could be substantial and could harm our reputation, business, financial condition

and operating results. A court also could enter orders that temporarily, preliminarily or permanently enjoin us and our customers

from making, using, or selling products, and could enter an order mandating that we undertake certain remedial activities. Depending

on the nature of the relief ordered by the court, we could become liable for additional damages to third parties.

The prosecution and enforcement

of patents licensed to us by third parties are not within our control. Without these technologies, our product may not be successful

and our business would be harmed if the patents were infringed or misappropriated without action by such third parties.

We have obtained licenses from third

parties for patents and patent application rights related to the products we are developing, allowing us to use intellectual property

rights owned by or licensed to these third parties. We do not control the maintenance, prosecution, enforcement or strategy for

many of these patents or patent application rights and as such are dependent in part on the owners of the intellectual property

rights to maintain their viability. Without access to these technologies or suitable design-around or alternative technology options,

our ability to conduct our business could be impaired significantly.

We may not be successful in the

implementation of our business strategy or our business strategy may not be successful, either of which will impede our development

and growth.

Our business strategy involves having

copyright owners agree to use our service. Our ability to implement this business strategy is dependent on our ability to:

| |

● |

predict

copyright owner’s concerns; |

| |

|

|

| |

● |

identify

and engage copyright owners; |

| |

|

|

| |

● |

convince

ISPs to accept our notices; |

| |

|

|

| |

● |

establish

brand recognition and customer loyalty; and |

| |

|

|

| |

● |

manage

growth in administrative overhead costs during the initiation of our business efforts. |

We do not know whether we will be able

to continue successfully implementing our business strategy or whether our business strategy will ultimately be successful. In

assessing our ability to meet these challenges, a potential investor should take into account our limited operating history and

brand recognition, our management’s relative inexperience, the competitive conditions existing in our industry and general

economic conditions. Our growth is largely dependent on our ability to successfully implement our business strategy. Our revenues

may be adversely affected if we fail to implement our business strategy or if we divert resources to a business that ultimately

proves unsuccessful.

We have limited existing brand

identity and customer loyalty; if we fail to market our brand to promote our service offerings, our business could suffer.

Because of our limited operating history,

we currently do not have strong brand identity or brand loyalty. We believe that establishing and maintaining brand identity and

brand loyalty is critical to attracting customers to our program. In order to attract copyright holders to our program, we may

be forced to spend substantial funds to create and maintain brand recognition among consumers. We believe that the cost of our

sales campaigns could increase substantially in the future. If our branding efforts are not successful, our ability to earn revenues

and sustain our operations will be harmed.

Promotion and enhancement of our services

will depend on our success in consistently providing high-quality services to our customers. Since we rely on technology partners

to provide portions of the service to our customers, if our suppliers do not send accurate and timely data, or if our customers

do not perceive the products we offer as superior, the value of the our brand could be harmed. Any brand impairment or dilution

could decrease the attractiveness of our services to one or more of these groups, which could harm our business, results of operations

and financial condition.

Our service offerings may not

be accepted.

As is typically the case involving service

offerings, anticipation of demand and market acceptance are subject to a high level of uncertainty. The success of our service

offerings primarily depends on the interest of copyright holders in joining our service. In general, achieving market acceptance

for our services will require substantial marketing efforts and the expenditure of significant funds, the availability of which

we cannot be assured, to create awareness and demand among customers. We have limited financial, personnel and other resources

to undertake extensive marketing activities. Accordingly, we cannot assure you that any of our services will be accepted or with

respect to our ability to generate the revenues necessary to remain in business.

A competitor with a stronger or

more suitable financial position may enter our marketplace.

To our knowledge, there is currently

no other company offering a copyright settlement service for P2P infringers. The success of our service offerings primarily depends

on the interest of copyright holders in joining our service, as opposed to a similar service offered by a competitor. If a direct

competitor arrives in our market, achieving market acceptance for our services may require additional marketing efforts and the

expenditure of significant funds, the availability of which we cannot be assured, to create awareness and demand among customers.

We have limited financial, personnel and other resources to undertake additional marketing activities. Accordingly, no assurance

can be given that we will be able to win business from a stronger competitor.

A significant portion of our revenue

is dependent upon a small number of customers and the loss of any one of these customers would negatively impact our revenues and

our results of operations.

We derived approximately 25% of our

revenues from a contract with one customer in 2013. For the year ended December 31, 2013, we derived approximately 32% of our revenues

from contracts with two customers. We derived approximately 77% of our revenues from a contract with one customer during the nine

months ended September 30, 2014. For the nine months ended September 30, 2014, we derived approximately 90% of our revenues from

contracts with two customers. Our standard contract, which is entitled a Representation Agreement, with customers is for an initial

six month term, and renews automatically for successive one month terms, unless either party terminates upon 30 days’ written

notice to the other party. If any of our major customers were to terminate their business relationships with us, our operating

results would be materially harmed.

Our exposure to outside influences beyond

our control, including new legislation or court rulings could adversely affect our enforcement activities and results of operations.

Our enforcement activities are subject

to numerous risks from outside influences, including the following:

| |

● |

Legal

precedents could change which could either make enforcement of our client’s copyright rights more difficult, or which

could make out-of-court settlements less attractive to either our clients or potential infringers. |

| |

|

|

| |

● |

New

legislation, regulations or rules related to copyright enforcement could significantly increase our operating costs or decrease

our ability to effectively negotiate settlements. |

| |

|

|

| |

● |

Changes

in consumer privacy laws could make internet service providers more reluctant to identify their end users or may otherwise

make identification of individual infringers more difficult. |

The occurrence of any one of the foregoing

could significantly damage our business and results of operations.

Software defects or errors in

our products could harm our reputation, result in significant costs to us and impair our ability to sell our products, which would

harm our operating results.

Our products may contain undetected

defects or errors when first introduced or as new versions are released, which could materially and adversely affect our reputation,

result in significant costs to us and impair our ability to sell our products in the future. The costs incurred in correcting any

defects or errors may be substantial and could adversely affect our operating results.

Enforcement actions against individuals

may result in negative publicity which could deter customers from doing business with us.

In the past, online trademark infringement

cases have garnered significant press coverage. Coverage which is sympathetic to the infringing parties or which otherwise portrays

our Company in a negative light, whether or not warranted, may harm our reputation or cause our clients to have concerns about

being associated with us. Such negative publicity could decrease the demand for our products and services and adversely affect

our business and operating results.

Litigation may harm our business.

Substantial, complex or extended litigation

could cause us to incur significant costs and distract our management. For example, lawsuits by employees, stockholders, collaborators,

distributors, customers, competitors or others could be very costly and substantially disrupt our business. Disputes from time

to time with such companies, organizations or individuals are not uncommon, and we cannot assure you that we will always be able

to resolve such disputes or on terms favorable to us. Unexpected results could cause us to have financial exposure in these matters

in excess of recorded reserves and insurance coverage, requiring us to provide additional reserves to address these liabilities,

therefore impacting profits.

If we experience a significant

disruption in our information technology systems or if we fail to implement new systems and software successfully, our business

could be adversely affected.

We depend on information systems throughout

our company to control our manufacturing processes, process orders, manage inventory, process and bill shipments and collect cash

from our customers, respond to customer inquiries, contribute to our overall internal control processes, maintain records of our

property, plant and equipment, and record and pay amounts due vendors and other creditors. If we were to experience a prolonged

disruption in our information systems that involve interactions with customers and suppliers, it could result in the loss of sales

and customers and/or increased costs, which could adversely affect our overall business operation.

Risks Related to the Securities

Markets and Ownership of our Equity Securities

The Common Stock is thinly traded,

so you may be unable to sell at or near ask prices or at all if you need to sell your shares to raise money or otherwise desire

to liquidate your shares.

The Common Stock has historically been

sporadically traded on the OTC QB, meaning that the number of persons interested in purchasing our shares at or near ask prices

at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the

fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others

in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons,

they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase

of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or

more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady

volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give

you any assurance that a broader or more active public trading market for our common shares will develop or be sustained, or that

current trading levels will be sustained.

The market price for the common

stock is particularly volatile given our status as a relatively unknown company with a small and thinly traded public float, limited

operating history and lack of revenue, which could lead to wide fluctuations in our share price. The price at which you purchase

our shares may not be indicative of the price that will prevail in the trading market. You may be unable to sell your common shares

at or above your purchase price, which may result in substantial losses to you.

The market for our shares of common

stock is characterized by significant price volatility when compared to seasoned issuers, and we expect that our share price will

continue to be more volatile than a seasoned issuer for the indefinite future. In fact, during the 52-week period ended January

6, 2015, the high and low closing sale prices of a share of common stock were $0.32 and $0.10, respectively. The volatility in

our share price is attributable to a number of factors. First, as noted above, our shares are sporadically traded. As a consequence

of this lack of liquidity, the trading of relatively small quantities of shares may disproportionately influence the price of those

shares in either direction. The price for our shares could, for example, decline precipitously in the event that a large number

of our shares is sold on the market without commensurate demand, as compared to a seasoned issuer which could better absorb those

sales without adverse impact on its share price. Secondly, we are a speculative investment due to, among other matters, our limited

operating history and lack of revenue or profit to date, and the uncertainty of future market acceptance for our potential products.

As a consequence of this enhanced risk, more risk-averse investors may, under the fear of losing all or most of their investment

in the event of negative news or lack of progress, be more inclined to sell their shares on the market more quickly and at greater

discounts than would be the case with the securities of a seasoned issuer. The following factors may add to the volatility in the

price of our shares: actual or anticipated variations in our quarterly or annual operating results; acceptance of our inventory

of games; government regulations, announcements of significant acquisitions, strategic partnerships or joint ventures; our capital

commitments and additions or departures of our key personnel. Many of these factors are beyond our control and may decrease the

market price of our shares regardless of our operating performance. We cannot make any predictions or projections as to what the

prevailing market price for our shares will be at any time, including as to whether our shares will sustain their current market

prices, or as to what effect the sale of shares or the availability of shares for sale at any time will have on the prevailing

market price.

Shareholders should be aware that, according

to SEC Release No. 34-29093, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns

include (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

(2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler

room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive

and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities

by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse

of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the

penny stock market. Although we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who

participate in the market, management will strive within the confines of practical limitations to prevent the described patterns

from being established with respect to our securities. The occurrence of these patterns or practices could increase the volatility

of our share price.

The market price of our common

stock may be volatile and adversely affected by several factors.

The market price of our common stock

could fluctuate significantly in response to various factors and events, including, but not limited to:

| |

● |

our

ability to integrate operations, technology, products and services; |

| |

|

|

| |

● |

our

ability to execute our business plan; |

| |

|

|

| |

● |

operating

results below expectations; |

| |

|

|

| |

● |

our

issuance of additional securities, including debt or equity or a combination thereof; |

| |

|

|

| |

● |

announcements

of technological innovations or new products by us or our competitors; |

| |

|

|

| |

● |

loss

of any strategic relationship; |

| |

|

|

| |

● |

industry

developments, including, without limitation, changes in healthcare policies or practices; |

| |

|

|

| |

● |

economic

and other external factors; |

| |

|

|

| |

● |

period-to-period

fluctuations in our financial results; and |

| |

|

|

| |

● |

whether

an active trading market in our common stock develops and is maintained. |

In addition, the securities markets

have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of

particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Our officers and directors beneficially

own approximately 24.6% of our outstanding shares of common stock as of the date of this prospectus.

Our officers and directors beneficially

own approximately 24.6 % of our outstanding shares of common stock as of the date of this prospectus. These individuals will have

the ability to substantially influence all matters submitted to our shareholders for approval and to control our management and

affairs, including extraordinary transactions such as mergers and other changes of corporate control, including going private transactions.

Because we became public by means

of a reverse acquisition, we may not be able to attract the attention of brokerage firms.

Because we became public through a “reverse

acquisition”, securities analysts of brokerage firms may not provide coverage of us since there is little incentive to brokerage

firms to recommend the purchase of our common stock.

A large number of shares are issuable

upon exercise of outstanding warrants and convertible notes. The exercise or conversion of these securities could result in the

substantial dilution of your investment in terms of your percentage ownership in our company. The sale of a large amount of common

shares received upon exercise of these warrants on the public market, or the perception that such sales could occur, could substantially

depress the prevailing market prices for our shares.

As of the date of this prospectus, there

were outstanding presently exercisable warrants entitling the holders to purchase 24,149,961shares of common stock at a weighted

average exercise price of $0.26 per share. As of the date of this prospectus, there were 78,370 shares of common stock underlying

promissory notes convertible into common stock at a conversion price of $0.1276. The exercise or conversion price for all of the

aforesaid securities may be less than your cost to acquire our shares. In the event of the exercise or conversion of these securities,

you could suffer substantial dilution of your investment in terms of your percentage ownership in our company. In addition, the

holders of the warrants may sell shares in tandem with their exercise of those warrants to finance that exercise, which could further

depress the market price of the common stock.

Our issuance of additional shares

of Common Stock, or options or warrants to purchase those shares, would dilute your proportionate ownership and voting rights.

We are entitled under our articles of

incorporation to issue up to 250,000,000 shares of common stock. We have issued and outstanding, as of the date of this prospectus,

89,896,421 shares of common stock. In addition, we are entitled under our articles of incorporation to issue up to 10,000,000 shares

of “blank check” preferred stock, none of which is presently issued or outstanding. Our board may generally issue shares

of common stock, preferred stock or options or warrants to purchase those shares, without further approval by our shareholders

based upon such factors as our board of directors may deem relevant at that time. It is likely that we will be required to issue

a large amount of additional securities to raise capital to further our development. It is also likely that we will issue a large

amount of additional securities to directors, officers, employees and consultants as compensatory grants in connection with their

services, both in the form of stand-alone grants or under our stock plans. We cannot give you any assurance that we will not issue

additional shares of common stock, or options or warrants to purchase those shares, under circumstances we may deem appropriate

at the time.

The elimination of monetary liability

against our directors, officers and employees under our Articles of Incorporation and the existence of indemnification rights to

our directors, officers and employees may result in substantial expenditures by our company and may discourage lawsuits against

our directors, officers and employees.

Our Articles of Incorporation contains

provisions that eliminate the liability of our directors for monetary damages to our company and shareholders. Our bylaws also

require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our agreements

with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring substantial

expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable to

recoup. These provisions and resultant costs may also discourage our company from bringing a lawsuit against directors, officers

and employees for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders

against our directors, officers and employees even though such actions, if successful, might otherwise benefit our company and

shareholders.

Anti-takeover provisions may impede

the acquisition of our company.

Certain provisions of the Nevada Revised

Statutes have anti-takeover effects and may inhibit a non-negotiated merger or other business combination. These provisions are

intended to encourage any person interested in acquiring us to negotiate with, and to obtain the approval of, our board of directors

in connection with such a transaction. However, certain of these provisions may discourage a future acquisition of us, including

an acquisition in which the shareholders might otherwise receive a premium for their shares. As a result, shareholders who might

desire to participate in such a transaction may not have the opportunity to do so.

Shares of our common stock that

have not been registered under the Securities Act regardless of whether such shares are restricted or unrestricted, are subject

to resale restrictions imposed by Rule 144, including those set forth in Rule 144(i) which apply to a “shell company.”

Pursuant to Rule 144 of the Securities

Act (or Rule 144), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal

assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents

and nominal other assets. As such, we may be deemed a “shell company” pursuant to Rule 144 prior to the Reverse Acquisition,

and as such, sales of our securities pursuant to Rule 144 are not able to be made until a period of at least twelve months has

elapsed from the date on which our Current Report on Form 8-K disclosing the Reverse Acquisition was filed with the SEC (which

filing occurred on October 28, 2013). Therefore, any restricted securities we sell in the future or issue to consultants or employees,

in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered

with the SEC and we have otherwise complied with the other requirements of Rule 144. As a result, it may be harder for us to fund

our operations and pay our employees and consultants with our securities instead of cash. Furthermore, it will be harder for us

to raise funding through the sale of debt or equity securities unless we agree to register such securities with the SEC, which

could cause us to expend additional resources in the future. Our previous status as a “shell company” could prevent

us from raising additional funds, engaging employees and consultants, and using our securities to pay for any acquisitions (although

none is currently planned), which could cause the value of our securities, if any, to decline in value or become worthless.

Investor relations activities,

nominal “float” and supply and demand factors may affect the price of our stock.

We expect to utilize various techniques

such as non-deal road shows and investor relations campaigns in order to create investor awareness for our company. These campaigns

may include personal, video and telephone conferences with investors and prospective investors in which our business practices

are described. We may provide compensation to investor relations firms and pay for newsletters, websites, mailings and email campaigns

that are produced by third-parties based upon publicly-available information concerning our company. We will not be responsible

for the content of analyst reports and other writings and communications by investor relations firms not authored by us or from

publicly available information. We do not intend to review or approve the content of such analysts’ reports or other materials

based upon analysts’ own research or methods. Investor relations firms should generally disclose when they are compensated

for their efforts, but whether such disclosure is made or complete is not under our control. In addition, investors in our company

may be willing, from time to time, to encourage investor awareness through similar activities. Investor awareness activities may

also be suspended or discontinued which may impact the trading market our common stock.

The SEC and FINRA enforce various statutes

and regulations intended to prevent manipulative or deceptive devices in connection with the purchase or sale of any security and

carefully scrutinize trading patterns and company news and other communications for false or misleading information, particularly

in cases where the hallmarks of “pump and dump” activities may exist, such as rapid share price increases or decreases.

We, and our shareholders may be subjected to enhanced regulatory scrutiny due to the small number of holders who initially will

own the registered shares of our common stock publicly available for resale, and the limited trading markets in which such shares

may be offered or sold which have often been associated with improper activities concerning penny-stocks, such as the OTC QB Marketplace

(Pink OTC) or pink sheets. Until such time as our restricted shares are registered or available for resale under Rule 144, there

will continue to be a relatively small percentage of shares held by a small number of investors that will constitute the entire

available trading market. The Supreme Court has stated that manipulative action is a term of art connoting intentional or willful

conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities. Oftentimes,

manipulation is associated by regulators with forces that upset the supply and demand factors that would normally determine trading

prices. Since a small percentage of our outstanding common stock will initially be available for trading, held by a small number

of individuals or entities, the supply of our common stock for sale will be extremely limited for an indeterminate amount of time,

which could result in higher bids, asks or sales prices than would otherwise exist. Securities regulators have often cited thinly-traded

markets, small numbers of holders, and awareness campaigns as components of their claims of price manipulation and other violations

of law when combined with manipulative trading, such as wash sales, matched orders or other manipulative trading timed to coincide

with false or touting press releases. There can be no assurance that our or third-parties’ activities, or the small number

of potential sellers or small percentage of stock in the “float,” or determinations by purchasers or holders as to

when or under what circumstances or at what prices they may be willing to buy or sell stock will not artificially impact (or would

be claimed by regulators to have affected) the normal supply and demand factors that determine the price of the stock.

If we fail to comply with Section

404 of the Sarbanes-Oxley Act of 2002 our business could be harmed and our stock price could decline.

Rules adopted by the SEC pursuant to

Section 404 of the Sarbanes-Oxley Act of 2002 require an annual assessment of our internal control over financial reporting. Accordingly,

we are subject to the rules requiring an annual assessment of our internal controls. The standards that must be met for management

to assess the internal control over financial reporting as effective are complex, and require significant documentation, testing

and possible remediation to meet the detailed standards. In addition, in the event we are no longer a smaller reporting company,

the independent registered public accounting firm auditing our financial statements would be required to attest to the effectiveness

of our internal controls over financial reporting. Such attestation requirement by our independent registered public accounting

firm would not be applicable to us until the report for the year ended December 31, 2015 at the earliest, if at all. If we are

unable to conclude that we have effective internal control over financial reporting or if our independent registered public accounting

firm is required to, but is unable to provide us with a report as to the effectiveness of our internal controls over financial

reporting, investors could lose confidence in the reliability of our financial statements, which could result in a decrease in

the value of our securities.

We may become involved in securities

class action litigation that could divert management’s attention and harm our business.

The stock market in general, and the

shares of early stage companies in particular, have experienced extreme price and volume fluctuations. These fluctuations have

often been unrelated or disproportionate to the operating performance of the companies involved. If these fluctuations occur in

the future, the market price of our shares could fall regardless of our operating performance. In the past, following periods of

volatility in the market price of a particular company’s securities, securities class action litigation has often been brought

against that company. If the market price or volume of our shares suffers extreme fluctuations, then we may become involved in

this type of litigation, which would be expensive and divert management’s attention and resources from managing our business.

As a public company, we may also from

time to time make forward-looking statements about future operating results and provide some financial guidance to the public markets.

Our management has limited experience as a management team in a public company and as a result projections may not be made timely

or set at expected performance levels and could materially affect the price of our shares. Any failure to meet published forward-looking

statements that adversely affect the stock price could result in losses to investors, stockholder lawsuits or other litigation,

sanctions or restrictions issued by the SEC.

Our common stock is currently

deemed a “penny stock,” which makes it more difficult for our investors to sell their shares.

The SEC has adopted Rule 15g-9 which

establishes the definition of a “penny stock,” for the purposes relevant to us, as any equity security that has a market

price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt,

the rules require that a broker or dealer approve a person’s account for transactions in penny stocks, and the broker or

dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock

to be purchased.

In order to approve a person’s

account for transactions in penny stocks, the broker or dealer must obtain financial information and investment experience objectives

of the person, and make a reasonable determination that the transactions in penny stocks are suitable for that person and the person

has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver,

prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which,

in highlight form sets forth the basis on which the broker or dealer made the suitability determination, and that the broker or

dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing

to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors

to dispose of our common stock if and when such shares are eligible for sale and may cause a decline in the market value of its

stock.

Disclosure also has to be made about

the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both

the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available

to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price

information for the penny stock held in the account and information on the limited market in penny stock.

As an issuer of “penny stock,”

the protection provided by the federal securities laws relating to forward-looking statements does not apply to us.

Although federal securities laws provide

a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this

safe harbor is not available to issuers of penny stocks. As a result, we will not have the benefit of this safe harbor protection

in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact

or was misleading in any material respect because of our failure to include any statements necessary to make the statements not

misleading. Such an action could hurt our financial condition.

Securities analysts may elect

not to report on our common stock or may issue negative reports that adversely affect the stock price.