Swatch CFO Fears Continued Franc Strength, Calls For Action

11 March 2011 - 12:38AM

Dow Jones News

Swatch Group AG (UHR.VX) has called for action from the Swiss

National Bank after losing around 100 million Swiss francs in sales

in the first two months of 2011 due to the strong value of the

Swiss franc.

The figure is on top of CHF164 million lost by the watchmaker in

2010 because of currency translation.

Chief Financial Officer Thierry Kenel said the strong Swiss

franc is "a problem for exporters of Swiss products."

"We had a loss of CHF100million if you compare January and

February with the previous year," Kenel said.

The franc appreciated by around 16% against the Euro and 7%

against the dollar last year and remains near record levels.

"If you compare January and February to last year, the dollar

was at 1.08 and now is under a franc, the euro was 1.46 now it is

around 1.28. That makes a lot of difference," Kenel told Dow Jones

Newswires on the sidelines of a press conference in Biel.

"We have had these losses in January and February and we hope

they don't continue.

Kenel said he thought the situation would be resolved in the

medium term, although urgent action is needed.

"The franc cannot stay at its current levels forever. It would

kill industry, and bring unemployment and then the franc would not

be that interesting any more.

"The machine industry is crying right now."

He said he hopes the Swiss National Bank will look at the

situation when it meets to discuss interest rates next week.

"They cannot buy dollars or euros. The bank is too small to buy

other currencies. If the other countries increase interest rates,

they could maybe decrease them, put them at zero."

Swatch has to be careful about increasing prices to protect its

margins, he added.

"We do increase prices, but we will do this slowly and slightly.

We are not going to do it because the exchange rate is the wrong

way and then the next day we have to decrease them again."

Watch price decreases could also alienate customers, he said

"If we sell a Breguet for GBP20,000 one day, and then the next

day the customer discovers it is GBP18,000 the customer feels

cheated."

Swatch will protect its margins by reducing costs in production,

retail and distribution, he said.

"We still made a very good profit last year, but it could have

been CHF164 million better," he said, adding that currency

volatility is also a problem.

"The exchange rate can change by 1.6% in a day. That makes

pricing outside Switzerland very difficult thee days," Kenel

said.

Volatility also makes it extremely risky to hedge, Kenel

said.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

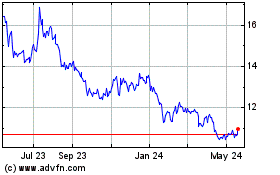

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

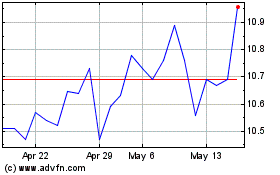

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jul 2023 to Jul 2024