INTERVIEW: Swatch Cutting Component Supplies Will Boost Industry-CEO

09 June 2011 - 12:12AM

Dow Jones News

Swatch Group AG's (UHR.VX) attempt to reduce the amount of

components it supplies to rival Swiss watchmakers should strengthen

the country's watch industry, Chief Executive Nick Hayek said

Wednesday.

Swatch, which numbers Longines, Tissot and Omega among its

brands, and supplies components to most of its competitors, wants

to gradually reduce its delivery of movements, hands and other

parts to third party companies.

But it needs permission from Switzerland's Competition

Commission to do so, and Wednesday asked the commission to start an

investigation to that end.

"This will dyanamise the industry," Hayek told Dow Jones

Newswires in an interview.

"The industry is full of money at the moment, and all players

should invest in factories and workers, and know-how which will

give a push and bring innovation to the industry.

"The most important part of a mechanical watch is the movement,

not the diamonds or gold. You need to develop and spend money on

this to build up the industry, rather than only on marketing."

Swatch is the world's largest watchmaker, and controls 70% to

80% of the sector's watch movement production, according to a

research study published last month by the investment firm Sanford

C. Bernstein & Co.

This dominant position means it cannot unilaterally halt its

supply to other companies, which include Compagnie Financiere

Richemont (CFR.VX) and LVMH Moet Hennessey Louis Vuitton (MC.FR)

without infringing the Swiss Cartel Act.

In 2004 Swatch told customers that it would stop supplying them

with components after three years. But after complaints from

customers, the Competition Commission ordered Swatch to continue

deliveries for a further six years.

The regulator will speak to watchmakers in the next few months

to determine the likely impact of Swatch's intentions, and is

likely to report back in the second half of 2012, commission

spokesman Patrik Ducrey said.

Under the interim measures announced by the commission

Wednesday, Swatch must maintain its supplies at 2010 levels this

year, but in 2012 can reduce the supply of movements to 85% of 2010

levels and reduce other components to 95% of 2010 levels.

Hayek said he had received the backing of other watchmakers,

including Richemont, for having to work with what he called an

"insane situation."

"There is no industry in the world where one player should be

obliged to sell the most important component to competitors. It's

like BMW being asked to deliver an engine to all its competitors,"

he said.

He added that he does not want customers using Swatch like a

supermarket where they can pick and choose which components they

want, and then pass them off as their own work.

"We are in a situation today where we have to deliver to

everyone in the same way. During the crisis we didn't get rid of

people or close factories, but many of our clients just cancelled

orders.

"We have all the risks; while other companies prefer to spend

money on marketing. It is easier to buy companies and spend money

on marketing than it is to spend it on production."

Hayek said Swatch has been saying it wants to reduce supplies

and that other companies should start to invest in components since

2007.

"Everyone else is claiming they are doing everything so there

should not be a problem. For five years they have known this is

coming, so everybody has had time to get ready," said Hayek.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

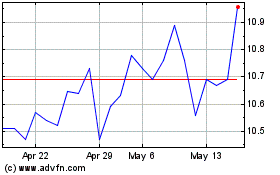

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jun 2024 to Jul 2024

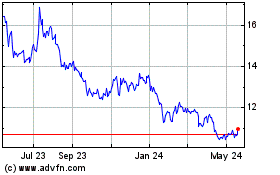

Swatch (PK) (USOTC:SWGAY)

Historical Stock Chart

From Jul 2023 to Jul 2024