Telecom Italia Shares Surge After Report That KKR Is Mulling Higher Takeover Bid

25 November 2021 - 2:41AM

Dow Jones News

By Mauro Orru and Olivia Bugault

Shares in Telecom Italia SpA jumped Wednesday after a report

that KKR & Co. is considering increasing its bid to take the

telecommunications company private.

The share move came just days after the U.S. investment firm

first expressed interest in Telecom Italia through an offer with an

equity value of roughly 10.79 billion euros ($12.14 billion).

At 1510 GMT, Telecom Italia shares were trading 16% higher at

EUR0.50.

The Italian company said late Sunday that it had received a

friendly and non-binding indication of interest from KKR aimed at

delisting it, paving the way for a possible buyout offer at

EUR0.505 a share--a 45% premium on Friday's closing price.

Its current share price is still below KKR's tentative offer,

despite Wednesday's rise.

A person familiar with the deal told The Wall Street Journal

that KKR is "totally and solely" focused on the offer that was

announced Sunday.

Bloomberg reported late Tuesday that KKR was debating increasing

its bid for Telecom Italia to around EUR0.70 or EUR0.80 a share to

overcome potential resistance from Vivendi SE, the media

conglomerate steered by the family of French billionaire Vincent

Bollore that has amassed a 23.75% stake in Telecom Italia.

Vivendi believes KKR's offer doesn't reflect the value of the

company, a spokesperson told The Wall Street Journal. The French

company is a long-term investor in Telecom Italia, they added.

Opposition by Vivendi, which has built its stake in Telecom

Italia at an average price of EUR1.07 a share, was to be expected,

analysts at Jefferies said earlier this week.

"In our view, the critical point is whether the offer will be

approved by the board. If so, we think there may be room for

negotiation on the valuation," Equita Sim analysts said.

A spokesman for Telecom Italia said the company's board would

meet on Friday.

If successful, KKR's bid would make Telecom Italia the latest in

a line of European telecommunications companies to be taken private

this year. Billionaire businessman Xavier Niel, who founded French

telecommunications company Iliad in 1999, unveiled an offer to take

it private in July, following the precedent set by fellow

entrepreneur Patrick Drahi earlier this year when he delisted

Altice Europe.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94 and

Olivia Bugault at olivia.bugault@wsj.com

(END) Dow Jones Newswires

November 24, 2021 10:26 ET (15:26 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

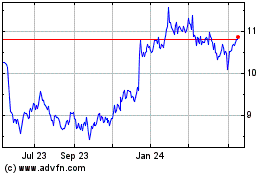

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Nov 2024 to Dec 2024

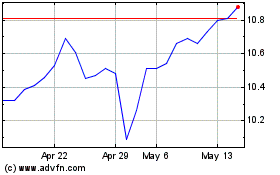

Vivendi (PK) (USOTC:VIVHY)

Historical Stock Chart

From Dec 2023 to Dec 2024