Current Report Filing (8-k)

26 August 2020 - 7:06AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

Current

Report

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 19, 2020

mPHASE

TECHNOLOGIES, INC.

(Exact

name of registrant as specified in its charter)

|

New

Jersey

|

|

000-30202

|

|

22-2287503

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

9841

Washingtonian Boulevard, #390

Gaithersburg,

MD 20878

(Address

of principal executive offices) (zip code)

(301)

329-2700

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[

]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[

]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[

]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

On

August 19, 2020, mPhase Technologies, Inc. (the “Company”) entered into a securities purchase agreement (the “Securities

Purchase Agreement”) with an accredited investor pursuant to which the Company issued and sold a convertible promissory

note in the principal amount of $99,225 (including a $4,725 original issuance discount) (the “Note”). The closing

of the transaction contemplated by the Securities Purchase Agreement occurred on August 20, 2020, the date the Company received

net proceeds in the amount of $90,000 as a result of $4,500 being paid to reimburse the accredited investor for legal fees incurred

with respect to the Securities Purchase Agreement and the Note.

The

Note matures on August 19, 2021, bears interest at a rate of 8% per annum (increasing to 24% per annum upon the occurrence of

an Event of Default (as defined in the Note)) and is convertible into shares of the Company’s common stock, par value $0.01

per share, at a conversion price as specified in the Note, subject to adjustment. The Note may be prepaid by the Company at any

time prior to the 180th day after the issuance date of the Note with certain prepayment penalties as set forth therein.

The

foregoing description of the Securities Purchase Agreement and the Note does not purport to be complete and is qualified in its

entirety by reference to the full text of the form of those documents, which are attached as Exhibits 10.1 and 10.2, respectively,

to this Current Report on Form 8-K, and are hereby incorporated herein by reference.

Item

2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Reference

is made to the disclosure under Item 1.01 above which is hereby incorporated in this Item 2.03 by reference.

Item

3.02 Unregistered Sales of Equity Securities.

Reference

is made to the disclosure under Item 1.01 above which is hereby incorporated in this Item 3.02 by reference.

The

Note has not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities

laws of any state, and was offered and issued in reliance on the exemption from the registration requirements under the Securities

Act afforded by Section 4(a)(2) thereof.

Item

4.01 Changes in Registrant’s Certifying Accountant.

On

August 19, 2020, the Board of Directors (the “Board”) of mPhase Technologies, Inc. (the “Company”) approved

the appointment of RBSM, LLP (“RBSM”) as the Company’s independent registered public account firm to audit its

consolidated financial statements for the fiscal year ending June 30, 2020, with such appointment effective as of August 19, 2020.

RBSM replaces Assurance Dimensions, Inc. (“Assurance Dimensions”) who resigned as the Company’s independent

registered public accounting firm effective as of August 19, 2020.

Assurance

Dimensions reported on the Company’s consolidated financial statements for the fiscal years ended June 30, 2019 and June

30, 2018 (collectively, the “Assurance Dimensions Reports”) and such Assurance Dimensions Reports did not contain

an adverse opinion or disclaimer of opinion, nor were the Assurance Dimensions Reports qualified or modified as to uncertainty,

audit scope, or accounting principles, except as modified by the going concern explanatory paragraph.

During

the fiscal year ended June 30, 2018, the fiscal year ended June 30, 2019 and the subsequent interim period from July 1, 2019 through

August 19, 2020, there were no disagreements with Assurance Dimensions on any matters of accounting principles or practices, financial

statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Assurance Dimensions,

would have caused Assurance Dimensions to make reference to the subject matter of the disagreement in connection with the Assurance

Dimensions Reports.

Further,

during the Company’s fiscal year ended June 30, 2018, the fiscal year ended June 30, 2019, and the subsequent interim period

from July 1, 2019 through August 19, 2020, there were no reportable events (as described under Item 304(a)(1)(v)(A)-(D) of Regulation

S-K).

The

Company has provided a copy of the foregoing disclosures to Assurance Dimensions and requested Assurance Dimensions to provide

the Company with a letter indicating whether or not Assurance Dimensions agrees with such disclosures. A copy of the letter, dated

August 19, 2020 is attached hereto as Exhibit 16.1.

During

the fiscal year ended June 30, 2018, the fiscal year ended June 30, 2019, and the subsequent interim period from July 1, 2019

through August 19, 2020, the Company did not consult with RBSM regarding any of the matters set forth in Item 304(a)(2)(i) or

(ii) of Regulation S-K.

Item 8.01. Other Events.

On August 20, 2020, the Company prepaid

a convertible promissory note, including principal, accrued interest, and prepayment amount as set forth within such convertible

promissory note dated February 24, 2020. The convertible promissory note in the principal amount of $53,000 was issued and sold

by the Company to an accredited investor under a securities purchase agreement dated February 24, 2020.

The foregoing description of the securities

purchase agreement and convertible promissory note does not purport to be complete and is qualified in its entirety by reference

to the full text of the form of those documents, which were filed as Exhibits 10.1 and 10.2, respectively, under Form 8-K on February

28, 2020, and are hereby incorporated by reference.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

mPhase

Technologies, Inc.

|

|

|

|

|

Dated:

August 25, 2020

|

/s/

Anshu Bhatnagar

|

|

|

Anshu

Bhatnagar

|

|

|

Chief

Executive Officer

|

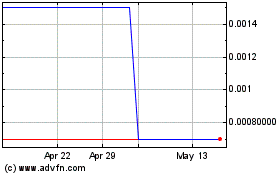

MPhase Technologies (CE) (USOTC:XDSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

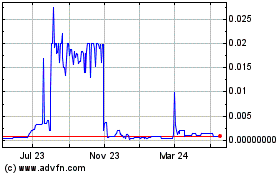

MPhase Technologies (CE) (USOTC:XDSL)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about MPhase Technologies Inc (CE) (OTCMarkets): 0 recent articles

More Mphase Technologies Inc News Articles