TIDMADMR

RNS Number : 1223K

Admiral Acquisition Limited

23 August 2023

FOR IMMEDIATE RELEASE

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION

WHERE TO DO SO WOULD BE IN BREACH OF APPLICABLE LAWS OF THAT

JURISDICTION

Admiral Acquisition Limited

23 August 2023

Interim Report and Financial Statements

Admiral Acquisition Limited (the "Company"), today announced the

publication of its report and unaudited financial statements for

the period from incorporation on 15 December 2022 to 31 May 2023

(the "Interim Report and Financial Statements"). Copies of the

Interim Report and Financial Statements will be available on the

Company's website at www.admiralacquisition.com and are set out in

full below.

For further information please contact:

Oak Fund Services

(Guernsey) Limited,

Company Secretary +44 (0) 1481 723450

James Christie

Hannah Crocker

About Admiral

Admiral (LSE: ADMR) is a British Virgin Islands company founded

by Sir Martin E. Franklin, Ian G.H. Ashken, Desiree DeStefano,

Michael E. Franklin, Robert A.E. Franklin, and James E. Lillie. The

Company was created to pursue its objective of acquiring a target

company or business (the "Acquisition"). There is no specific

expected target value for the Acquisition and the Company expects

that any funds not used for the Acquisition will be used for future

acquisitions, internal or external growth and expansion, purchase

of outstanding debt and/or working capital in relation to the

acquired company or business. The Company's efforts in identifying

a prospective target business will not be limited to a particular

industry or geographic region.

Important Notices

This announcement does not contain or constitute an offer of, or

the solicitation of an offer to buy or subscribe for, securities to

any person in any jurisdiction including the United States,

Australia, Canada, Japan or South Africa. The securities referred

to herein have not been registered under the U.S. Securities Act of

1933, as amended (the "Securities Act") and may not be offered,

sold, transferred or delivered, directly or indirectly, in or into

the United States absent registration under the Securities Act or

an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act. There will be no

public offer of the securities in the United States.

This announcement is an advertisement and not a prospectus and

does not constitute or form part of, and should not be construed

as, an offer to sell or issue, or a solicitation of any offer to

buy or subscribe for, any securities, nor should it or any part of

it form the basis of, or be relied on in connection with, any

contract or commitment whatsoever. Investors should not subscribe

for or purchase any securities referred to in this announcement

except on the basis of information in the Prospectus published by

the Company in connection with such securities. This announcement

is only addressed to, and directed at, persons in member states of

the European Economic Area and the United Kingdom who are

"qualified investors" within the meaning of Article 2(e) of

Regulation (EU) 2017/1129 as amended. In the United Kingdom, this

announcement is directed only at "qualified investors" within the

meaning of Article 2(e) of Regulation (EU) 2017/1129 as it forms

part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 (as amended) who are also (i) persons having

professional experience in matters relating to investments who fall

within the definition of "investment professionals" in Article

19(5) of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005, as amended (the "Order"), or (ii) persons

who are high net worth bodies corporate, unincorporated

associations or partnerships or trustees of high value trusts as

described in Article 49(2) of the Order; or (iii) other persons to

whom it may lawfully be communicated. Under no circumstances should

persons of any other description rely or act upon the contents of

this announcement.

LEI: 213800ZDFRNC8QXEZ48

Chairman's Statement

It is with pleasure that I present to you, the shareholders, the

report and unaudited financial statements of Admiral Acquisition

Limited (the "Company") for the period from incorporation on 15

December 2022 to 31 May 2023.

The Company

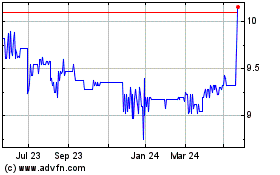

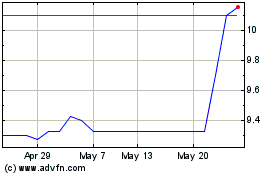

The Company raised gross proceeds of US$539.5 million in its

initial public offering ("IPO"), through the placing of ordinary

shares of no par value in the capital of the Company ("Ordinary

Shares") (with matching (" Warrants") to subscribe for Ordinary

Shares issued at a placing price of US$10.00 per Ordinary Share and

a further US$10.5 million through the subscription of the founder

preferred shares of no par value ("Founder Preferred Shares") (with

Warrants being issued on the basis of one Warrant per Founder

Preferred Share) at a price of US$10.50 per Founder Preferred

Share). The Company was admitted to the Official List of the FCA by

way of a standard listing and to trading on the main market of the

London Stock Exchange on 22 May 2023 ("Admission"). As at 18 August

2023, the Company had 53,975,000 Ordinary Shares and 54,975,000

Warrants in issue. The net proceeds from the IPO are easily

accessible when required.

As set out in the Company's prospectus dated 17 May 2023 (the

"Prospectus"), the Company was formed to undertake an acquisition

of a target company or business. There is no specific expected

target value for the acquisition and the Company expects that funds

not used for the acquisition, if any, will be used for future

acquisitions, internal or external growth and expansion, purchase

of outstanding debt and/or working capital in relation to the

acquired company or business. Following completion of the

acquisition, the objective of the Company is expected to be to

operate the acquired business and implement an operating strategy

with the objective of building and growing the business and

generating value for the Company's shareholders ("Shareholders")

through operational improvements as well as potentially through

additional complementary acquisitions.

The Board of Directors continues to review a number of

acquisition targets and will remain disciplined in only proceeding

with an acquisition that it believes it can produce attractive

returns to its Shareholders.

Financial Results

During the period commenced 15 December 2022 and ended 31 May

2023, the Company has incurred operating costs of US$248,000. These

expenses were offset by investment income totalling approximately

US$659,000. Costs of Admission of US$10.5 million were recorded as

an offset to the gross proceeds from the IPO in the Company's

Balance Sheet.

Principal Risks and Uncertainties

The Company set out in the Prospectus the principal risks and

uncertainties that could impact its performance; the Directors

consider that these principal risks and uncertainties remain

unchanged since that document was published and apply for the

period of the remaining six months of the financial year. Your

attention is drawn to the Principal Risks and Uncertainties section

on page 11 for a summary of these and to the Prospectus for the

detailed assessment. A copy of the Prospectus is available on the

Company's website ( www.admiralacquisition.com ) and was submitted

to the National Storage Mechanism and is available for inspection

at https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Related Parties

Related party disclosures are given in note 7 to these financial

statements.

Rory Cullinan

Chairman

18 August 2023

Report of the Directors

The Directors have pleasure in submitting their Report and the

unaudited financial statements for the period from 15 December 2022

through 31 May 2023.

Status and activities

The Company was incorporated with limited liability under the

laws of the British Virgin Islands under the BVI Business Companies

Act, 2004, on 15 December 2022. The address of the Company's

registered office is Ritter House, Wickhams Cay II, Road Town,

Tortola, VG 1110, British Virgin Islands. The Ordinary Shares and

Warrants were admitted for trading on the main market of the London

Stock Exchange on 22 May 2023. The Company raised gross proceeds of

US $539.5 million in its IPO and a further US$10.5 million through

the subscription of Founder Preferred Shares for a potential

acquisition of a target company or business (which may be in the

form of a merger, capital stock exchange, asset acquisition, stock

purchase, scheme of arrangement, reorganization or similar business

combination) of an interest in an operating company or business (an

" Acquisition " ). Costs of Admission of US$10.5 million were paid

in relation to the IPO, resulting in net proceeds of US$539.5

million.

There is no specific expected target value for the Acquisition

and the Company expects that funds not used for the Acquisition, if

any, will be used for future acquisitions, internal or external

growth and expansion, purchase of outstanding debt and/or working

capital in relation to the acquired company or business. Following

the completion of any Acquisition, the objective of the Company is

expected to be to operate the acquired business and implement an

operating strategy with the objective of building and growing the

business and generating value for its Shareholders through

operational improvements as well as potentially through additional

complementary acquisitions. Following the Acquisition, the Company

intends to seek re-admission of the enlarged group to such listing

venue as is appropriate for it based on the industry, geographic

focus and track record of the company or business acquired, subject

to fulfilling the relevant eligibility criteria at the time. The

Company expects to acquire a controlling interest in a target

company or business. The Company (or its successor) may consider

acquiring a controlling interest constituting less than the whole

voting control or

less than the entire equity interest in a target company or

business if such opportunity is attractive; provided, the Company

(or its successor) would acquire a sufficient portion of the target

entity such that it could consolidate the operations of such entity

for applicable financial reporting purposes (and, in any event,

would not be required to register as an investment company under

the U.S. Investment Company Act of 1940, as amended). In connection

with an Acquisition, the Company may issue additional Ordinary

Shares which could result in the Company's then existing

Shareholders owning a minority interest in the Company following

the Acquisition.

The Company's efforts in identifying a prospective target

company or business will not be limited to a particular industry or

geographic region. The Company may subsequently seek to raise

further capital for the purposes of the Acquisition.

Unless required by applicable law or other regulatory process,

no Shareholder approval will be sought by the Company in relation

to the Acquisition. The Acquisition will be subject to Board

approval, including by a majority of the Company's Board, including

a majority of those Directors of the Board from time to time

considered by the Board to be independent for the purposes of the

UK Corporate Governance Code issued by the Financial Reporting

Council (the " FRC " ) in the UK from time to time (the " Code " )

(or any other appropriate corporate governance regime complied with

by the Company from time to time) together with the chairman of the

Board provided that such person was considered by the Board to be

independent on appointment for the purposes of the UK Corporate

Governance Code (or any other appropriate corporate governance

regime complied with by the Company from time to time).

The determination of the Company's post-Acquisition strategy and

whether any of the Directors will remain with the combined company

and on what terms will be made at or prior to the time of the

Acquisition.

In the event that the Acquisition has not been announced by the

second anniversary of Admission, the Board will recommend to

Shareholders either that the Company be wound up (in order to

return capital to Shareholders and holders of the Founder Preferred

Shares, to the extent assets are available) or that the Company

continue to pursue the Acquisition for a further 12 months from the

second anniversary of Admission. The Board's recommendation will

then be put to a Shareholder vote (from which the Directors, the

Founders and Mariposa Acquisition IX, LLC (the "Founder Entity")

will abstain).

Report of the Directors (Continued)

The Company has identified the following criteria and guidelines

that it believes are important in evaluating potential acquisition

opportunities. It will generally use these criteria and guidelines

in evaluating acquisition opportunities but the Company may decide

to complete an Acquisition that does not meet these criteria and

guidelines:

-- leading competitive industry position with a defensible moat;

-- a company with strong underlying free cash flow characteristics;

-- an established company or business with a proven track record;

-- experienced management team; and

-- diversified customer and supplier base.

In addition, the Company expects to consider a variety of

factors with respect to potential acquisition opportunities,

including, among others:

-- financial condition and results of operations;

-- growth potential;

-- brand recognition and potential;

-- experience and skill of management and availability of additional personnel;

-- capital requirements;

-- stage of development of the business and its products or services;

-- existing distribution or other sales arrangements and the potential for expansion;

-- degree of current or potential market acceptance of the products or services;

-- proprietary aspects of products and the extent of

intellectual property or other protection for products or

formulas;

-- impact of regulation and potential future regulation on the business;

-- regulatory environment of the industry;

-- seasonal sales fluctuations and the ability to offset these

fluctuations through other acquisitions, introduction of new

products, or product line extensions; and

-- the amount of working capital available.

Results

For the period from incorporation on 15 December 2022 to 31 May

2023, the Company's net income was US$411,000.

Share capital

General:

As at 31 May 2023, the Company had in issue 53,975,000 Ordinary

Shares and 1,000,000 Founder Preferred Shares. In addition, the

Company has 54,975,000 Warrants in issue.

1 Founder Preferred Share was issued on 21 December 2022 with a

further 999,999 Founder Preferred Shares issued on 22 May 2023.

There are no Founder Preferred Shares held in Treasury. Each

Founder Preferred Share was issued at US$10.50 per share with an

associated Warrant as described in note 4.

Report of the Directors (Continued)

Share capital (Continued)

53,975,000 Ordinary Shares were issued on 22 May 2023

(53,950,000 were issued in the IPO at US$10.00 per share and 25,000

were issued, in aggregate, to Rory Cullinan, Melanie Stack and

Thomas V. Milroy (the "Independent Non-Founder Directors") in

connection with the IPO. There are no Ordinary

Shares held in Treasury. Each Ordinary Share was issued with an

associated Warrant as described in note 4.

Founder Preferred Shares:

Details of the Founder Preferred Shares can be found in note 4

to the financial statements and are incorporated into this Report

by reference.

Securities carrying special rights:

Other than as disclosed above in relation to the Founder

Preferred Shares, no person holds securities in the Company

carrying special rights with regard to control of the Company.

Voting rights:

Holders of Ordinary Shares and Founder Preferred Shares have the

right to receive notice of and to attend and vote at any meetings

of members except, in relation to any Resolution of Members that

the Directors, determine is (i) necessary or desirable in

connection with a merger or consolidation in relation to, in

connection with or resulting from the Acquisition (including at any

time after the Acquisition has been made); or (ii) to approve

matters in relation to, in connection with or resulting from the

Acquisition (whether before or after the Acquisition has been

made). Each Shareholder entitled to attend and being present in

person or by proxy at a meeting will, upon a show of hands, have

one vote and upon a poll each such Shareholder present in person or

by proxy will have one vote for each share held by him.

In the case of joint holders of an Ordinary Share, if two or

more persons hold an Ordinary Share jointly, each of them may be

present in person or by proxy at a meeting of members and may speak

as a member, and if one or more joint holders are present at a

meeting of members, in person or by proxy, they must vote as

one.

Restrictions on voting:

No member shall, if the Directors so determine, be entitled in

respect of any share held by him to attend or vote (either

personally or by proxy) at any meeting of members or separate class

meeting of the Company or to exercise any other right conferred by

membership in relation to any such meeting if he or any other

person appearing to be interested in such shares has failed to

comply with a notice requiring the disclosure of shareholder

interests and given in accordance with the Company's articles of

association (the "Articles") within 14 calendar days, in a case

where the shares in question represent at least 0.25 per cent. of

their class, or within seven days, in any other case, from the date

of such notice. These restrictions will continue until the

information required by the notice is supplied to the Company or

until the shares in question are transferred or sold in

circumstances specified for this purpose in the Articles.

Transfer of shares:

Subject to the BVI Business Companies Act, 2004 (as amended)

(the "BVI Companies Act") and the terms of the Articles, any member

may transfer all or any of his certificated shares by an instrument

of transfer in any usual form or in any other form which the

Directors may approve. The Directors may accept such evidence of

title of the transfer of shares (or interests in shares) held in

uncertificated form (including in the form of depositary interests

or similar interests, instruments or securities) as they shall in

their discretion determine. The Directors may permit such shares or

interests in shares held in uncertificated form to be transferred

by means of a relevant system of holding and transferring shares

(or interests in shares) in uncertificated form.

Report of the Directors (Continued)

Transfer of shares (Continued)

No transfer of shares will be registered if, in the reasonable

determination of the Directors, the transferee is or may be a

Prohibited Person (as defined in the Articles) or is or may be

holding such shares on behalf of a beneficial owner who is or may

be a Prohibited Person. The Directors shall have power to implement

and/or approve any arrangements they may, think fit in relation to

the evidencing of title to and transfer of interests in shares in

the Company in uncertificated form (including in the form of

depositary interests or similar interests, instruments or

securities).

Rights to appoint and remove Directors

Subject to the BVI Companies Act and the Articles, the Directors

shall have power from time to time, without sanction of the

members, to appoint any person to be a Director, either to fill a

casual vacancy or as an additional Director. Subject to the BVI

Companies Act and the Articles, the members may by a Resolution of

Members appoint any person as a Director and remove any person from

office as a Director.

For so long as the initial holders of Founder Preferred Shares

(being the Founder Entity together with its affiliates and

permitted transferees) holds 20 per cent. or more of the Founder

Preferred Shares in issue, such holders shall be entitled to

nominate up to three persons as Directors of the Company and the

Directors shall appoint such persons.

In the event such holders notify the Company to remove any

Director nominated by them the other Directors shall remove such

Director, and in the event of such a removal the relevant holders

shall have the right to nominate a Director to fill such

vacancy.

No Director has a service contract with the Company, nor are any

such contracts proposed. There are no pension, retirement, benefits

or other similar arrangements in place with the Directors nor are

any such arrangements proposed.

Powers of the Directors

Subject to the provisions of the BVI Companies Act and the

Articles, the business and affairs of the Company shall be managed

by, or under the direction or supervision of, the Directors. The

Directors have all the powers necessary for managing, and for

directing and supervising, the business and affairs of the Company.

The Directors may exercise all the powers of the Company to borrow

or raise money (including the power to borrow for the purpose of

redeeming shares) and secure any debt or obligation of or binding

on the Company in any manner including by the issue of debentures

(perpetual or otherwise) and to secure the repayment of any money

borrowed, raised, or owing by mortgage, charge, pledge, or lien

upon the whole or any part of the Company's undertaking property or

assets (whether present or future) and also by a similar mortgage,

charge, pledge, or lien to secure and guarantee the performance of

any obligation or liability undertaken by the Company or any third

party.

Directors and their interests

The Directors of the Company who served during the period and

subsequent to the date of this Report are:

Name Position Date of appointment

Sir Martin E. Franklin Founder and Non-Executive 15 December 2022

Director

-------------------------- --------------------

Robert A.E. Franklin Founder and Non-Executive 4 May 2023

Director

-------------------------- --------------------

Melanie Stack Independent Non-Executive 4 May 2023

Director

-------------------------- --------------------

Thomas V. Milroy Independent Non-Executive 4 May 2023

Director

-------------------------- --------------------

Rory Cullinan Chairman and Independent 4 May 2023

Non-Executive Director

-------------------------- --------------------

Report of the Directors (Continued)

Directors and their interests (Continued)

As of 18 August 2023, all of the Directors listed above continue

to serve as Directors of the Company. As at 18 August 2023 (the

latest practicable date prior to the publication of this Report),

the Directors have the following interests in the Company's

securities:

Percentage No. of Warrants

No. of Ordinary of issued Ordinary No. of Founder

Director Shares Shares Preferred Shares

Sir Martin E.

Franklin (1) 8,950,000 16.60 9,950,000 1,000,000

---------------- -------------------- ---------------- ------------------

Robert A.E. Franklin - - - -

---------------- -------------------- ---------------- ------------------

Rory Cullinan 10,000 0.02 10,000 -

---------------- -------------------- ---------------- ------------------

Melanie Stack 7,500 0.01 7,500 -

---------------- -------------------- ---------------- ------------------

Thomas V. Milroy 7,500 0.01 7,500 -

---------------- -------------------- ---------------- ------------------

([1]) Represents an interest held by the Founder Entity. Sir

Martin E. Franklin is the managing member of the Founder Entity and

controls 100 per cent. of the voting and dispositive power of the

Founder Entity. The Founders (as defined below), in aggregate, hold

an indirect pecuniary interest of approximately 69 per cent in the

Founder Entity.

Directors' remuneration

Each of the Directors entered into a Director's letter of

appointment with the Company dated 17 May 2023. Under the

Independent Non-Founder Directors' letters of appointment, Thomas

V. Milroy and Melanie Stack are entitled to a fee of US$75,000 per

annum and Rory Cullinan, as Chairman, is entitled to receive a fee

of US$100,000 per annum. Fees are payable quarterly in arrears.

During the period from 15 December 2022 to 31 May 2023, the Company

issued 25,000 Ordinary Shares, in aggregate, to the Independent

Non-Founder Directors in lieu of their first year's annual cash

remuneration. The Ordinary Shares were valued at US$10.00 per share

and are being expensed over the one-year service period. Sir Martin

E. Franklin and Robert A.E. Franklin do not receive a fee in

connection with their appointment as Non-Executive Directors of the

Company. In addition, all of the Directors are entitled to be

reimbursed by the Company for travel, hotel and other expenses

incurred by them in the course of their directors' duties relating

to the Company.

Substantial shareholdings

As at 18 August 2023 (the latest practicable date prior to the

publication of this Report), the following had disclosed an

interest in the issued Ordinary Share capital of the Company (being

5% or more of the voting rights in the Company) in accordance with

the requirements of the Disclosure and Transparency Rules (the

"DTRs"):

Notified

percentage

Number of Date of disclosure of voting

Shareholder Ordinary Shares to Company rights (2)

Viking Global Investors

LP 10,000,000 23 May 2023 18.53%

----------------- ------------------- ------------------------------

Progeny 3, Inc. 10,000,000 25 May 2023 18.53%

----------------- ------------------- ------------------------------

Mariposa Acquisition

IX, LLC 8,950,000 22 May 2023 16.58%

----------------- ------------------- ------------------------------

(2) Since the date of disclosures to the Company, the interest

of any person listed above in Ordinary Shares may have

increased or decreased without any obligation on the relevant

person to make further notification to the Company

pursuant to the DTRs.

Report of the Directors (Continued)

Change of control

The Company is not party to any significant contracts that are

subject to change of control provisions in the event of a takeover

bid. There are no agreements between the Company and its Directors

or employees providing compensation for loss of office or

employment that occurs because of a takeover bid.

Corporate Governance Statement

The Company is a British Virgin Islands registered company with

a standard listing on the main market of the London Stock Exchange.

For as long as the Company has a standard listing it is not

required to comply or explain non-compliance with the Code.

However, the Company is firmly committed to high standards of

corporate governance and maintaining a sound framework through

which the strategy and objectives of the Company are set and the

means of attaining these objectives and monitoring performance are

determined. At Admission, the Company therefore stated its

intention to voluntarily observe the requirements of the Code. The

Code is available on the FRC's website, www.frc.co.uk . The Company

also complies with the corporate governance regime applicable to

the Company pursuant to the laws of the British Virgin Islands.

As at the date of this Report, the Company is in compliance with

the Code with the exception of the following:

-- Given the wholly non-executive composition of the Board,

certain provisions of the Code (in particular the provisions

relating to the division of responsibilities between the Chairman

and chief executive and executive compensation), are considered by

the Board to be inapplicable to the Company. In addition, the

Company does not comply with the requirements of the Code in

relation to the requirement to have a senior independent

director.

-- The Code also recommends the submission of all directors for

re-election at annual intervals. No Director will be required to

submit for re-election until the first annual general meeting of

the Company following the Company's first acquisition.

-- Until completion of the Company's first acquisition, the

Company will not have nomination, remuneration, audit or risk

committees. The Board as a whole instead reviews its size,

structure and composition, the scale and structure of the

Directors' fees (taking into account the interests of Shareholders

and the performance of the Company), takes responsibility for the

appointment of auditors and payment of their audit fee, monitors

and reviews the integrity of the Company's financial statements,

including the Company's internal control and risk management

arrangements in relation to its financial reporting process, and

takes responsibility for any formal announcements on the Company's

financial performance. Following the Company's first acquisition,

the Board intends to put in place nomination, remuneration, audit

and risk committees.

Share dealing

As at the date of this Report, the Board has voluntarily adopted

a share dealing code which is consistent with the rules of the

Market Abuse Regulation (596/2014/EU) as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

(as amended) (the "Market Abuse Regulation"). The Board is

responsible for taking all proper and reasonable steps to ensure

compliance with the Market Abuse Regulation by the Directors.

Relations with Shareholders

The Directors are always available for communication with

shareholders and all shareholders will have the opportunity, and

are encouraged, to attend and vote at the Annual General Meetings

of the Company during which the Board will be available to discuss

issues affecting the Company.

Statement of going concern

The Directors have considered the financial position of the

Company, taking into account the current cash resources available

and expected run rate expenses and have concluded that it is

appropriate to prepare the financial statements on a going concern

basis.

Report of the Directors (Continued)

Internal control

The Board is responsible for determining the nature and extent

of the significant risks it is willing to take in achieving its

strategic objectives. The Board maintains sound risk management and

internal control systems. The Board has reviewed the Company's risk

management and control systems and believes that the controls are

satisfactory given the nature and size of the Company. Controls

will be reviewed following completion of its first acquisition.

Financial Risk Profile

The Company's financial instruments comprise mainly of cash and

cash equivalents, and various items such as payables and

receivables that arise directly from the Company's operations.

Branches

At the date of this Report, the Company does not have any

branches.

Interim Management Report

For the purposes of compliance with DTR 4.2.3 (2) and DTR 4.2.7

(2), the required content of the "Interim Management Report" can be

found in this Report of Directors and the Principal Risks and

Uncertainties section on page 11.

Directors' Responsibilities

The Directors of the Company (as listed in the Report) are

responsible for preparing the Report and the financial statements

in accordance with applicable law and regulations.

The Directors have prepared the Company's financial statements

in accordance with United States of America generally accepted

accounting principles (U.S. GAAP) and the DTRs . The Directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

company and of the profit or loss of the company for that period.

In preparing these financial statements, the directors are required

to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable and prudent;

-- state whether applicable U.S. GAAP have been followed,

subject to any material departures disclosed and explained in the

financial statements;

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

A copy of the interim financial statements is available on our

website www.admiralacquisition.com . The Directors consider that

the interim report accounts, taken as a whole, are fair, balanced

and understandable and provide the information necessary for

shareholders to assess the Company's performance, business model

and strategy.

Each of the Directors, who are in office and whose names and

functions are listed on page 25, confirms that, to the best of his

or her knowledge:

the Company financial statements, which have been prepared in

accordance with U.S. GAAP, give a true and fair view of the assets,

liabilities, financial position and profit or loss of the Company;

and

the interim management report includes a fair review of the

information required by:

DTR 4.2.7R, being: (i) an indication of important events that

have occurred during the first six months of the financial year,

and their impact on the condensed set of financial statements; and

(ii) a description of the principal risks and uncertainties for the

remaining six months of the financial year; and

DTR 4.2.8R, being: (i) related parties transactions that have

taken place in the first six months of the current financial year

and that have materially affected the financial position or the

performance of the enterprise during that period; and (ii) any

changes in the related parties transactions described in the last

annual report that could have a material effect on the financial

position or performance of the enterprise in the first six months

of the current financial year.

Report of the Directors (Continued)

Directors' indemnities

As at the date of this Report, indemnities granted by the

Company to the Directors are in force to the extent permitted under

BVI law. The Company also maintains Directors' and Officers'

liability insurance, the level of which is reviewed annually.

By order of the Board

Rory Cullinan

Chairman

18 August 2023

Principal Risks and Uncertainties

The Board has identified the following principal risks and

uncertainties facing the Company as set out in the Prospectus. The

risks referred to below do not purport to be exhaustive and are not

set out in any particular order of priority. Additional risks and

uncertainties not currently known to the Board or which the Board

currently deem immaterial may also have an adverse effect on the

Company's business. In particular, the Company's performance may be

affected by changes in the market and/or economic conditions and in

legal, regulatory and tax requirements.

Key information on the key risks that are specific to the issuer

or its industry

Business Strategy

-- The Company is a newly formed entity with no operating

history and has not yet identified any potential target company or

business for the Acquisition.

-- The Company may acquire either less than whole voting control

of, or less than a controlling equity interest in, a target, which

may limit its operational strategies.

-- The Company may be unable to complete the Acquisition in a

timely manner or at all or to fund the operations of the target

business if it does not obtain additional funding.

The Company's relationship with the Directors, the Founders and

the Founder Entity and conflicts of interest

-- The Company is dependent on its Directors and Mariposa

Capital, LLC ("Mariposa Capital") to identify potential acquisition

opportunities and to execute the Acquisition and the loss of the

services of any of them could materially adversely affect it.

-- Sir Martin E. Franklin, Robert A.E. Franklin, Michael E.

Franklin, James E. Lillie, Ian G.H. Ashken and Desiree A. DeStefano

(collectively, the "Founders"), the Founder Entity and Mariposa

Capital are currently affiliated and the Founders, the Founder

Entity, Mariposa Capital and the Directors, may in the future

become affiliated with entities engaged in business activities

similar to those intended to be conducted by the Company and may

have conflicts of interest in allocating their time and business

opportunities.

-- The Directors will allocate a portion of their time to other

businesses leading to the potential for conflicts of interest in

their determination as to how much time to devote to the Company's

affairs, which could have a negative impact on the Company's

ability to complete the Acquisition.

-- The Company may be required to issue additional Ordinary

Shares pursuant to the terms of the Founder Preferred Shares, which

could dilute the value of existing Ordinary Shares.

Taxation

-- The Company may be a "passive foreign investment company" for

U.S. federal income tax purposes and adverse tax consequences could

apply to U.S. investors.

Key information on the key risks that are specific to the

securities

The Ordinary Shares and Warrants

-- The Standard Listing of the Ordinary Shares and Warrants will

not afford Shareholders the opportunity to vote to approve the

Acquisition.

-- The Warrants can only be exercised during the Subscription

Period and to the extent a Warrant holder has not exercised its

Warrants before the end of the Subscription Period, those Warrants

will lapse, resulting in the loss of a holder's entire investment

in those Warrants.

Principal Risks and Uncertainties (Continued)

-- The Warrants are subject to mandatory redemption and

therefore the Company may redeem a Warrantholder's unexpired

Warrants prior to their exercise at a time that is disadvantageous

to a Warrantholder, thereby making those Warrants worthless.

-- The issuance of Ordinary Shares pursuant to the exercise of

the Warrants will dilute the value of a Shareholder's Ordinary

Shares.

Balance Sheet

As of 31 May 2023 (Unaudited)

31 May 2023

---------------------------------

ASSETS US$

(in thousands,

except share

amounts)

Current assets

Cash and cash equivalents 138,018

Marketable securities at fair value 402,204

Prepayments and other assets 410

Total assets 540,632

=================================

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accrued expenses 496

---------------------------------

Total current liabilities 496

Total liabilities 496

---------------------------------

Shareholders' equity

Founder Preferred Shares, no par

value; unlimited authorised shares;

1,000,000 shares issued and outstanding -

as of 31 May 2023

Ordinary Shares, no par value; unlimited

authorised shares; 53,975,000 shares

issued and outstanding as of 31 -

May 2023

54,975,000 Warrants issued and outstanding -

as of 31 May 2023

Additional paid-in capital (Net

of costs) 539,725

Retained earnings 411

Total shareholders' equity 540,136

---------------------------------

Total liabilities and shareholders'

equity 540,632

=================================

The notes on pages 16 to 24 form an integral part of these

unaudited financial statements.

Statement of Income for the period ended from incorporation on

15 December 2022 to 31 May 2023 (Unaudited)

For the period

from

incorporation

on 15 December

2022 to

31 May 2023

US$

(in thousands,

except share and

per share amounts)

Operating expenses:

General and administrative (249)

Loss from operations (249)

-------------------

Other income:

Investment income 660

Total other income 660

-------------------

Net income 411

===================

Basic and diluted income per ordinary share 0.0076

===================

Weighted average Ordinary Shares outstanding,

basic 53,975,000

==========

Weighted average Ordinary Shares outstanding,

diluted 54,975,000

==========

The notes on pages 16 to 24 form an integral part of these

unaudited financial statements.

Statement of Shareholders' Equity for the period from

incorporation on 15 December 2022 to 31 May 2023 (Unaudited)

Preferred Shares Ordinary Shares Warrants

No. of Shares US$ No. of Shares US$ No. of Warrants US$

--------------------- --------------------- -----------------------

Balance as of incorporation, 1 - - -

15 December 2022

Issue of shares 999,999 53,950,000 - - -

Issue of warrants - - - - 54,975,000 -

Issue costs - - - - - -

Share-based compensation - - 25,000 - - -

- directors

Net income - - - - - -

Balance as at 31 May 2023 1,000,000 - 53,975,000 - 54,975,000 -

================ === ================= ================== ===

Additional paid in Retained earnings Total Equity

capital

US$ US$ US$

(in thousands, except (in thousands, except (in thousands, except

share amounts) share amounts) share amounts)

Balance as of incorporation, - - -

15 December 2022

Issue of shares 550,000 - 550,000

Issue of warrants - - -

Issue costs (10,525) - (10,525)

Share-based compensation -

directors 250 - 250

Net income - 411 411

Balance as at 31 May 2023 539,725 411 540,136

====================== ====================== ======================

The notes on pages 16 to 24 form an integral part of these

unaudited financial statements.

Statement of Cash Flows for the period from incorporation on 15

December 2022 to 31 May 2023 (Unaudited)

For the period

from

incorporation

on 15 December

2022 to

31 May 2023

US$

(in thousands)

Net income 411

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Unrealised gain on marketable securities (489)

Changes in operating assets and liabilities:

Prepaids and other assets (410)

Accruals 496

Other 1

Net cash provided by operating activities 9

INVESTING ACTIVITIES:

Purchase of marketable securities - short-term (401,716)

Net cash used in investing activities (401,716)

FINANCING ACTIVITIES:

Proceeds from issuance of Founder Preferred Shares

and Warrants 10,500

Proceeds from issuance of Ordinary Shares and

Warrants, net 529,225

Net cash provided by financing activities 539,725

Net increase in cash and cash equivalents 138,018

Cash and cash equivalents at beginning of -

period

Cash and cash equivalents at end of period 138,018

================

The notes on pages 16 to 24 form an integral part of these

unaudited financial statements.

1. Organisation

The Company was incorporated with limited liability under the

laws of the British Virgin Islands under the BVI Business Companies

Act, 2004, on 15 December 2022. The address of the Company's

registered office is Ritter House, Wickhams Cay II, Road Town,

Tortola, VG 1110, British Virgin Islands. The Ordinary Shares and

Warrants were admitted for trading on the main market of the London

Stock Exchange on 22 May 2023. The Company raised gross proceeds of

US$539.5 million in its initial public offering ("IPO"), through

the placing of ordinary shares of no par value in the capital of

the Company ("Ordinary Shares") (with matching warrants

("Warrants") to subscribe for Ordinary Shares issued) at a placing

price of US$10.00 per Ordinary Share and a further US$10.5 million

through the subscription of the founder preferred shares of no par

value ("Founder Preferred Shares") (with Warrants being issued on

the basis of one Warrant per Founder Preferred Share) at a price of

US$10.50 per Founder Preferred Share for a potential acquisition of

a target company or business (which may be in the form of a merger,

capital stock exchange, asset acquisition, stock purchase, scheme

of arrangement, reorganization or similar business combination) of

an interest in an operating company or business (an "Acquisition"

). The Company was admitted to the Official List of the FCA by way

of a standard listing and to trading on the main market of the

London Stock Exchange on 22 May 2023 ("Admission"). Costs of

Admission of US$10.5 million were paid in relation to the IPO,

resulting in net proceeds of US$539.5 million.

2. Summary of significant Accounting Policies

Basis of preparation

The accompanying financial statements are presented in U.S.

dollars rounded to the nearest thousand and have been prepared in

accordance with accounting principles generally accepted in the

United States of America ("U.S. GAAP"). and pursuant to the

accounting and disclosure rules and regulations of the London Stock

Exchange.

As the Company was incorporated on 15 December 2022, there is no

comparative information.

Going concern

The Directors have, at the time of approving the financial

statements, a reasonable expectation that the Company has adequate

resources to continue in operational existence for the foreseeable

future given the cash funds available and the current forecast cash

outflows. Thus, the Company continues to adopt the going concern

basis of accounting in preparing the financial statements.

Use of Estimates

The preparation of the financial statements in conformity with

U.S. GAAP requires the Company to make estimates and assumptions

that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Actual results could differ

from those estimates.

Cash and Cash Equivalents

While cash held by financial institutions may at times exceed

federally insured limits, the Company believes that no material

credit or market risk exposure exists due to the high quality of

the institutions. The Company has not experienced any losses on

such accounts. The Company considers all highly liquid investments

purchased with a maturity of three months or less from the date of

purchase to be cash equivalents. The Company has US$138.0 million

of cash and cash equivalents as of 31 May 2023.

Investments in Marketable Securities

Marketable securities are stated at fair value as determined by

the most recently traded price of each security at the balance

sheet date. All unrealised gains and losses are reported in

investment income in the statements of income.

Fair Value Measurements

Fair value is determined using the principles of ASC 820, Fair

Value Measurement. Fair value is the price that would be received

to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date.

The fair value hierarchy prioritises and defines the inputs to

valuation techniques as follows:

-- Level 1- Observable quoted prices (unadjusted) for identical assets or liabilities in active

markets.

-- Level 2-Quoted prices for similar assets and liabilities in active markets, quoted prices

in markets that are not active, or inputs which are observable, either directly or indirectly,

for substantially the full term of the asset or liability.

-- Level 3-Unobservable inputs that reflect the Company's own assumptions about the assumptions

market participants would use in pricing the asset or liability in which there is little,

if any, market activity for the asset or liability at the measurement date.

Marketable securities are recorded at fair value. The Company

uses the Level 2 fair value hierarchy assumptions to measure the

marketable securities as of 31 May 2023. The Company's cash and

cash equivalents and accrued expenses are carried at cost, which

approximates fair value due to the short-term nature of these

instruments and are considered level 1 securities.

The inputs used to measure the fair value of an asset or a

liability are categorised within levels of the fair value

hierarchy. The fair value measurement is categorised in its

entirety in the same level of the fair value hierarchy as the

lowest level input that is significant to the measurement. There

have not been any transfers between the levels of the hierarchy for

the period ended 31 May 2023.

Share-based Compensation

The Company expenses share-based compensation over the requisite

service period of the awards (usually the vesting period) based on

the grant date fair value of awards. For share option grants with

performance-based milestones, the expense is recorded over the

service period after the achievement of the milestone is probable

or the performance condition is achieved. The Company estimates the

fair value of share option grants using the Black-Scholes option

pricing model. An offsetting increase to shareholders' equity will

be recorded equal to the amount of the compensation expense charge.

The Company recognises forfeitures as they occur as a reduction of

expense. The Company does not have any forfeitures for the period

ended 31 May 2023. See Note 4.

Founder Preferred Shares

In connection with the IPO, the Company issued 1,000,000 Founder

Preferred Shares at US$10.50 per share to Mariposa Acquisition IX,

LLC (the "Founder Entity"), an entity controlled by Sir Martin E.

Franklin. The Founder Preferred Shares are not mandatorily

redeemable and do not embody an unconditional obligation to settle

in a variable number of equity shares. As such, the Founder

Preferred Shares are classified as permanent equity in the

accompanying balance sheets. The Founder Preferred Shares are not

unconditionally redeemable or conditionally puttable by the Holder

for cash. The Founder Preferred Shares are considered an

equity-like host for purposes of assessing embedded derivative

features for potential bifurcation. The conversion features and

participating dividends of the Founder Preferred Shares

Founder Preferred Shares (Continued)

are not bifurcated and are included in permanent equity as they

are clearly and closely related to the host. The Founder Preferred

Shares do not have a par value or stated value and thus the Founder

Preferred Shares have been recorded in additional paid-in capital.

See Note 4.

Warrants

The Company has Warrants issued with its ordinary shares and

Founder Preferred Shares that were determined to be equity

classified in accordance with ASC 815, Derivatives and Hedging (see

Note 4). The Company also issued Warrants with shares issued to

non-executive directors for compensation that were determined to be

equity classified in accordance with ASC 718 - Compensation - Stock

Compensation. The fair value of the Warrants was recorded as

additional paid-in capital on the issuance date, and no further

adjustments were made.

Earnings per Share

Basic earnings per ordinary share excludes dilution and is

computed by dividing net income by the weighted average number of

ordinary shares outstanding during the period. The Company has

determined that its Founder Preferred Shares are participating

securities as the Founder Preferred Shares participate in

undistributed earnings on an as-if-converted basis. Accordingly,

the Company used the two-class method of computing earnings per

share, for ordinary shares and Founder Preferred Shares according

to participation rights in undistributed earnings. Under this

method, net income applicable to holders of ordinary shares is

allocated on a pro rata basis to the holders of ordinary and

Founder Preferred Shares to the extent that each class may share

income for the period; whereas undistributed net loss is allocated

to ordinary shares because Founder Preferred Shares are not

contractually obligated to share the loss.

Income Taxes

Income taxes are recorded in accordance with ASC 740, Accounting

for Income Taxes (ASC 740), which provides for deferred taxes using

an asset and liability approach. The Company recognises deferred

tax assets and liabilities for the expected future tax consequences

of events that have been included in the financial statements or

tax returns. The Company determines its deferred tax assets and

liabilities based on differences between financial reporting and

tax bases of assets and liabilities, which are measured using the

enacted tax rates and laws that will be in effect when the

differences are expected to reverse. Valuation allowances are

provided if, based upon the weight of available evidence, it is

more likely than not that some or all of the deferred tax assets

will not be realised. The Company does not have any deferred

taxes.

The Company accounts for uncertain tax positions in accordance

with the provisions of ASC 740. When uncertain tax positions exist,

the Company recognises the tax benefit of tax positions to the

extent that the benefit will more likely than not be realised. The

determination as to whether the tax benefit will more likely than

not be realised is based upon the technical merits of the tax

position as well as consideration of the available facts and

circumstances. The Company does not have any significant uncertain

tax positions.

As a British Virgin Islands limited liability company, the

Company is not subject to any income, withholding or capital gains

taxes.

Comprehensive Income

Comprehensive income is the same as net income for all periods

presented.

Segment reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors as it is

the body that makes strategic decisions. The Board is of the

opinion that there is only a single operational segment being the

investment in US Treasury Bills as disclosed in note 3. As a result

no segment

Segment reporting (Continued)

information has been provided as the Company only accumulates

its funds raised for investment in US Treasury Bills.

Recently Adopted Accounting Pronouncements

The Financial Accounting Standards Board (FASB) issued an

Accounting Standards Update: ASU No. 2022-02, Financial

Instruments-Credit Losses (Topic 326): Troubled Debt Restructurings

and Vintage Disclosure (TDRs)s . The amendments in this update

eliminate the accounting guidance for troubled debt restructurings

TDRs by creditors in Subtopic 310-40, Receivables-Troubled Debt

Restructurings by Creditors, while enhancing disclosure

requirements for certain loan refinancings and restructurings by

creditors when a borrower is experiencing financial difficulty.

Specifically, rather than applying the recognition and measurement

guidance for TDRs, an entity must apply the loan refinancing and

restructuring guidance in paragraphs 310-20-35-9 through 35-11 to

determine whether a modification results in a new loan or a

continuation of an existing loan.

For public business entities, the amendments in this Update

require that an entity disclose current-period gross write-offs by

year of origination for financing receivables and net investments

in leases within the scope of Subtopic 326-20, Financial

Instruments-Credit Losses-Measured at Amortised Cost.

Effective Date: Effective for fiscal years beginning after

December 15, 2022, and interim periods within those fiscal years.

The adoption of this update did not impact the Company's financial

statements.

TH other standard update issued in the period by the FASB is:

ASU No. 2022-01, Derivatives and Hedging (Topic 815): Fair Value

Hedging-Portfolio Layer Method : These amendments clarify the

accounting for and promote consistency in the reporting of hedge

basis adjustments applicable to both a single hedged layer and

multiple hedged layers as follows:

1. An entity is required to maintain basis adjustments in an

existing hedge on a closed portfolio basis (that is, not allocated

to individual assets).

2. An entity is required to immediately recognise and present

the basis adjustment associated with the amount of the dedesignated

layer that was breached in interest income. In addition, an entity

is required to disclose that amount and the circumstances that led

to the breach.

3. An entity is required to disclose the total amount of the

basis adjustments in existing hedges as a reconciling amount if

other areas of GAAP require the disaggregated disclosure of the

amortised cost basis of assets included in the closed

portfolio.

4. An entity is prohibited from considering basis adjustments in

an existing hedge when determining credit losses.

Effective Date: effective for fiscal years beginning after

December 15, 2022, and interim periods within those fiscal years.

The adoption of this update did not impact the Company's financial

statements.

Recent Accounting Pronouncements

The following pronouncements were issued by the FASB which are

not yet effective.

ASU 2020-06 - Debt-Debt with Conversion and Other Options and

Derivatives and Hedging-Contracts in Entity's Own Equity:

Accounting for Convertible Instruments and Contracts in an Entity's

Own Equity. Effective Fiscal years beginning after December 15,

2023, and interim periods within those fiscal years.

ASU 2022-03 - Fair Value Measurement (Topic 820): Fair Value

Measurement of Equity Securities Subject to Contractual Sale

Restriction. Effective Fiscal years beginning after December 15,

2023, and interim periods within those fiscal years.

The Company does not expect the adoption of these recent

guidance pronouncements to have a material impact on its financial

statements.

Note 3 - Marketable Securities

The Company's investment in marketable securities consists of

U.S. Treasury Bills. Investment income is recorded as a realised

investment income at the time the investment in U.S. Treasury Bills

matures.

The change in the unrealised gains on these investments are

included in the statements of Income as investment income.

Unrealised gains on the U.S. Treasury Bills are summarised in

thousands as follows:

US$ in thousands

Gross

Gross Unrealised Unrealised Net Unrealised

Cost Gain Loss Gain Fair Value

As of 31 May 2023

U.S. Treasury Bills

owned 535,671 660 - 660 536,331

Less amounts classified

as cash equivalent (133,955) (172) - (172) (134,127)

---------- ----------------- ------------ --------------- -----------

U.S. Treasury Bills

classified as Marketable

Securities 401,716 488 - 488 402,204

========== ================= ============ =============== ===========

US Treasury Bills within the portfolio which have a maturity of

3 months or less from their transaction date or are due to mature

within 3 months of the balance sheet date are classified as being

cash or cash equivalent. At the 31 May 2023 US Treasury Bills of

US$134.0 million were recognised as being cash or cash equivalent

with US$172,000 being considered interest receivable on those US

Treasury Bills. Associated income is reflected as investment income

at the period end. The total investment income of US$660,000 within

the Statement of Income, comprises US$488,000 in respect of fair

value gains and losses and US$172,000 in respect of interest income

on the US Treasury Bills classified within cash and cash

equivalents.

Note 4 - Shareholders' Equity

On 22 May 2023, the Company's IPO raised gross proceeds of

US$550.0 million, consisting of US$539.5 million through the

placement of ordinary shares at US$10.00 per share, and US$10.5

million through the subscription of 1,000,000 Founder Preferred

Shares at US$10.50 per share by the Founders through the Founder

Entity. Costs of Admission of US$10.5 million were paid in relation

to the IPO, resulting in net

Note 4 - Shareholders' Equity (Continued)

proceeds of US$539.5 million. In addition, 25,000 ordinary

shares were issued, in aggregate, to the Independent Non-Founder

Directors in lieu of cash totalling a combined value US$250,000.

Each ordinary share and Founder Preferred Share was issued with a

Warrant as described below.

Founder Preferred Shares

After the closing of an Acquisition, and if the Average Price

(as defined in the Articles) of the ordinary shares is at least

US$11.50 per share for any ten consecutive trading days, the

holders of the Founder Preferred Shares will be entitled to receive

a dividend in the form of ordinary shares or cash, at the option of

the Company, equal to 20 per cent. of the appreciation of the

market price of ordinary shares issued to ordinary shareholders in

the IPO. In the first year an Annual Dividend Amount (as defined in

the Articles) is payable (if any), the Annual Dividend Amount will

be calculated at the end of the calendar year based on the Dividend

Price, (as defined below) compared to the initial ordinary share

offering price of US$10.00 per ordinary share. In subsequent years,

the Annual Dividend Amount will be calculated based on the

appreciated Dividend Price compared to the highest Dividend Price

previously used in calculating the Annual Dividend Amount. For the

purposes of determining the Annual Dividend Amount, the Dividend

Price is the Average Price per ordinary share for the last ten

consecutive trading days in the relevant Dividend Year. Upon the

liquidation of the Company, an Annual Dividend Amount shall be

payable for the shortened Dividend Year and the holders of Founder

Preferred Shares shall have the right to a pro rata share (together

with holders of the ordinary shares) in the distribution of the

surplus assets of the Company.

The Founder Preferred Shares will participate in any dividends

on the ordinary shares on an as converted basis. In addition,

commencing on and after consummation of the Acquisition, where the

Company pays a dividend on its ordinary shares the Founder

Preferred Shares will also receive an amount equal to 20 per cent

of the dividend which would be distributable on such number of

ordinary shares. All such dividends on the Founder Preferred Shares

will be paid at the same time as the dividends on the ordinary

shares. Dividends are paid for the term the Founder Preferred

Shares are outstanding.

The Founder Preferred shares will be automatically converted

into ordinary shares on a one for one basis upon the last day of

the tenth full financial year following an Acquisition (the

Conversion). Each Founder Preferred Share is convertible into one

ordinary share at the option of the holder until the Conversion. If

there is more than one holder of Founder Preferred Shares, a holder

of Founder Preferred Shares may exercise its rights independently

of any other holder of Founder Preferred Shares.

In accordance with ASC 718 - Compensation - Stock Compensation,

the Annual Dividend Amount based on the market price of the

Company's ordinary shares is akin to a market condition award

settled in shares. As the right to the Annual Dividend Amount will

only be triggered upon the Acquisition (which is not considered

probable until consummated). The fair value of the any potential

future Annual Dividend amounts to US$72.8 million, which has been

measured using a Monte Carlo method which takes into consideration

different share price paths. Following are the assumptions used in

calculating the issuance date fair value:

Number of securities issued 1,000,000

Vesting period Immediate

Assumed price upon Acquisition US$10.00

Probability of winding-up 40.50%

Probability of Acquisition 59.50%

Time to Acquisition 1.17 years

Volatility (post-Acquisition) 46.47%

Risk free interest rate 3.54%

Founder Preferred Shares (Continued)

The Founder Preferred Shares carry the same voting rights as are

attached to the Ordinary Shares being one vote per Founder

Preferred Share. Additionally, the Founder Preferred Shares alone

carry the right to vote on any Resolution of Members required,

pursuant to BVI law, to approve any matter in connection with an

Acquisition, or a merger or consolidation in connection with an

Acquisition. Initial Founder Preferred Shareholders, that hold 20

per cent. of the Founder Preferred Shares, can nominate up to three

people as directors of the Company.

Ordinary shares

In connection with the IPO on 22 May 2023, the Company issued

53,950,000 Ordinary Shares for gross proceeds of US$539.5 million.

In conjunction with the IPO, the Company also issued an aggregate

of 25,000 Ordinary Shares to the Independent Non-Founder Directors

for US$10.00 per share in lieu of their cash directors' fees for

one year. Each ordinary share was issued with a Warrant. Ordinary

shares have voting rights and winding-up rights.

Warrants

The Company issued 54,975,000 Warrants to the purchasers of both

Ordinary Shares and Founder Preferred Shares (including the 25,000

Warrants that were issued to the Independent Non-Founder Directors

in connection with their fees). Each Warrant has a term of 3 years

following an Acquisition and entitles a Warrant holder to purchase

one-fourth of an ordinary share upon exercise. Warrants will be

exercisable in multiples of three for one ordinary share at a price

of US$11.50 per whole ordinary share. The Warrants are mandatorily

redeemable by the Company at a price of US$0.01 should the average

market price of an ordinary share exceed US$18.00 for 10

consecutive trading days (subject to any prior adjustment in

accordance with the terms of the Warrants).

Note 5 - Commitments and Contingencies

There were no known or threatened lawsuits or unasserted claims

known at the balance sheet date up to date of singing these interim

unaudited financial statements.

Note 6 - Share-based Compensation

On 17 May 2023, the Company issued its Independent Non-Founder

Directors an aggregate of 125,000 share options (the "Share

Options") to purchase Ordinary Shares of the Company that vest upon

the Acquisition. The Independent Non-Founder Directors are required

to have continued service until the time of the Acquisition to vest

in the Share Options. The options expire on the 5th anniversary

following the Acquisition and have an exercise price of US$11.50

per Ordinary Share (subject to such adjustment as the Directors

consider appropriate in accordance with the terms of the Option

Deeds). The Share Options have a performance condition of vesting

on an Acquisition (which is not considered probable until an

Acquisition). Therefore, in accordance with ASC 718 - Compensation

- Stock Compensation, the fair value of the awards, as determined

on the grant date, will be recognised as an expense and an increase

of additional paid-in capital upon consummation of an

Acquisition.

Note 6 - Share-based Compensation (Continued)

The following table summarises the share option activity:

Weighted

Number Average Exercise Aggregate

of Shares Price Intrinsic Value

------------------------ ------------------ -----------------

Options outstanding -

at inception $ - $ -

Granted 125,000 $ 11.50 $ -

------------------------

Options outstanding at

31 May 2023 125,000 $ 11.50 $ -

------------------------

Options vested and

exercisable - $ - $ -

========================

The fair value of each Share Option was estimated at US$1.647 on

the grant date using the Black-Scholes option pricing model with

the following assumptions for the grant during the period from 17

May 2023 to 31 May 2023:

Share Price $10.00

Exercise Price $11.50

Risk-Free Rate 3.52%

Dividend Yield -

Post-Acquisition

Volatility 46.39%

On 22 May 2023, the Company issued 25,000 Ordinary Shares and

Warrants, in aggregate, to Independent Non-Founder Directors for

their first year's annual fees in lieu of cash. The US$10.00 per

share fair value of the Ordinary Shares and Warrants was based on

the price paid by outside shareholders in the equity offering on 22

May 2023 (see Note 4). In accordance with ASC 718 - Compensation -

Stock Compensation, as the shares and related Warrants were fully

vested and have a non-substantive service period, the fair value of

US$10,000 was recorded as an expense on the grant date.

Note 7 - Related Parties

During the period ended 31 May 2023, 1,000,000 Founder Preferred

Shares, 8,950,000 Ordinary Shares and 9,950,000 Warrants were

issued to the Founder Entity. Sir Martin E. Franklin, a Founder and

Director, is a beneficial owner and the managing member of the

Founder Entity and, as such, may be considered to have beneficial

ownership of all the Founder Entity's interests in the Company. The

Founders, in aggregate, hold an indirect pecuniary interest of

approximately 69 per cent. in the Founder Entity. Other directors

were issued 25,000 Ordinary Shares and 25,000 Warrants along with

125,000 Share Options.

Note 7 - Related Parties (Continued)

Except as set forth herein, there were no other Ordinary Shares,

Warrants and options issued to the directors of the Company for the

period from inception ended 31 May 2023.

An entity owned by Sir Martin E. Franklin, Mariposa Capital,

LLC, earned advisory fees of US$10,000 for the period.

Note 8 - Earnings Per Share

Net income is allocated between the ordinary share and other

participating securities based on their participation rights. The

Founder Preferred Shares (see Note 4), represent participating

securities. Earnings attributable to Founder Preferred Shares are

not included in earnings attributable to Ordinary Shares in

calculating earnings per ordinary share. For the period from 15

December 2022 to 31 May 2023, the Company excluded the Share

Options to purchase 125,000 Ordinary Shares from the diluted

earnings per ordinary share as the performance condition (see Note

6) for these Share Options was not considered probable until the

time of the Acquisition. The Company has also excluded the Warrants

in issue from such earnings on the basis they are non-dilutive.

The following table sets forth (in US$ except share and per

share amounts) the computation of basic and diluted earnings per

ordinary share using the two-class method (see Note 2):

For the

period from

incorporation

on

15 December

2022

through

31 May 2023

----------------

Numerator:

Net income $ 411

Adjustment for vested Founder

Preferred Shares -

----------------

Net income attributable to Ordinary

Shares 411

Denominator:

Weighted average shares outstanding

- basic 53,975,000

----------------

Weighted average shares outstanding

- diluted 54,975,000

----------------

Basic and diluted earnings per

ordinary share $ 0.0076

================

Ordinary Shares issuable upon

conversion of Founder Preferred

Shares 1,000,000

================

Note 9 - Subsequent Events

There were no subsequent events for the period up to the date of

signing the unaudited financial statements.

Directors Legal advisers to the Company

Sir Martin E. Franklin (English and US Law)

Robert A.E. Franklin Greenberg Traurig, LLP

Rory Cullinan (Chairman) 8th Floor

Thomas V. Milroy (Independent) The Shard

Melanie Stack (Independent) 32 London Bridge Street

London

Registered office SE1 9SG

Ritter House

Wickhams Cay II Legal advisers to the Company

Road Town, Tortola (BVI Law)

VG1 110 Carey Olsen

British Virgin Islands Carey House

Les Banques

Administrator and secretary St Peter Port

Oak Fund Services (Guernsey) Guernsey GY1 4BZ

Limited

PO Box 282 Depositary

Oak House Computershare Investor Services

Hirzel St PLC

St Peter Port The Pavilions

Guernsey Bridgewater Road

GY1 3RH Bristol

BS 13 8AE

Registrar

Computershare Investor Services Principal bankers

(BVI) Limited Barclays PLC

Woodbourne Hall 1st Floor

PO Box 3162 Eagle Court

Road Town Circular Road

Tortola Douglas

British Virgin Islands Isle of Man

IM1 1AD

Auditors

Grant Thornton LLP

30 Finsbury Square

London

EC2A 1AG

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.