TIDMAGR

RNS Number : 1029F

Assura PLC

06 July 2023

6 July 2023

Assura plc

Trading Update

For the first quarter ending 30 June 2023

Assura plc ("Assura"), the leading primary care property

investor and developer, today announces its Trading Update for the

first quarter to 30 June 2023.

Jonathan Murphy, CEO, said:

"Assura has delivered another quarter of strong financial

performance and disciplined activity.

"Our on-site activities progressed well, with two developments

and one asset enhancement project reaching practical completion,

providing high quality premises and enabling an improved range of

health services for patients.

"We made good progress with rent reviews over the period,

settling a further 55 reviews to generate an uplift of GBP0.6

million.

"We continue to see many opportunities to work with the NHS in

providing critical primary care infrastructure. Our leading market

position, strong and sustainable financial position and pipeline of

growth opportunities will allow us to continue to deliver against

our proven strategy."

Continued strong track record of disciplined activity through

first quarter

-- Portfolio of 610 properties with an annualised rent roll of GBP145.3 million

-- Two developments completed; our 100(th) development in

Wolverhampton (as announced 29 June 2023) and our GBP22 million

scheme in Kettering

-- Completed one asset enhancement capital project (total spend

GBP1.1 million); on site with a further nine (total spend GBP8.2

million)

-- 55 rent reviews settled in the quarter, covering GBP5.5

million of existing rent and generating an uplift of GBP0.6

million

-- Quarterly dividend increased by 5% to 0.82 pence per share,

as announced at the full year results, with effect from the July

2023 payment

Development and asset enhancement pipelines provide growth

opportunities

-- Currently on site with nine developments; total cost of

GBP103 million (March 2023: 11, GBP129 million) of which GBP45

million has been spent to date

-- Immediate development pipeline of five schemes, where we

would normally expect to be on site within 12 months; total cost of

GBP35 million (March 2023: 5, GBP37 million). We continue to

experience delays on pipeline schemes as we negotiate to ensure

rents appropriately reflect the current cost of construction.

-- 36 lease re-gears covering GBP8.4 million of existing rent roll in the current pipeline

-- Pipeline of 17 capital asset enhancement projects (projected

spend GBP11 million) over the next two years

Strong and sustainable financial position

-- Weighted average interest rate unchanged at 2.30% (March

2023: 2.30%); all drawn debt on fixed rate basis

-- Weighted average debt maturity of 6.8 years, no refinancing

on drawn debt due until October 2025. Over 50% of drawn debt

matures beyond 2030, with our longest maturity debt at our lowest

rates

-- Net debt of GBP1,144 million on a fully unsecured basis with

cash and undrawn facilities of GBP234 million

- ENDS -

Assura plc Tel: 01925 945354

Jayne Cottam, CFO E mail: Investor@assura.co.uk

David Purcell, Investor Relations

Director

FGS Global Tel: 0207 251 3801

Gordon Simpson Email: Assura@fgsglobal.com

James Thompson

Notes to Editors

Assura plc is a national healthcare premises specialist and UK

REIT based in Altrincham, UK - caring for more than 600 primary

healthcare buildings, from which over six million patients are

served.

A constituent of the FTSE 250 and the EPRA* indices, as at 31

March 2023, Assura's portfolio was valued at GBP2.7 billion.

At Assura, we BUILD for health. Assura builds better spaces for

people and places, invests in skills and inspires new ways of

working, and unlocks the power of design and innovation to deliver

lasting impact for communities - aiming for six million people to

have benefitted from improvements to and through its healthcare

buildings by 2026.

Assura is leading for a sustainable future, targeting net zero

carbon across its portfolio by 2040.

Further information is available at www.assuraplc.com

Assura plc LEI code: 21380026T19N2Y52XF72

*EPRA is a registered trademark of the European Public Real

Estate Association.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIRDTIEIIV

(END) Dow Jones Newswires

July 06, 2023 02:00 ET (06:00 GMT)

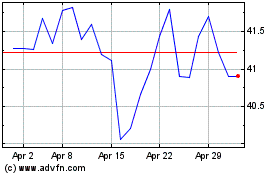

Assura (LSE:AGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Assura (LSE:AGR)

Historical Stock Chart

From Jul 2023 to Jul 2024